Research Article: 2019 Vol: 18 Issue: 6

Relationship Marketing and Deposit Mobilization in Five Deposit Money Banks in Nigeria

Ochei Ailemen Ikpefan, Covenant University

Harry Ibinabo, Covenant University

Godswill Osagie Osuma, Covenant University

Oladokun Omojola, Covenant University

Abstract

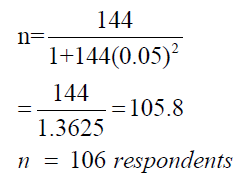

This study was carried out to examine how relationship marketing strategies influence the deposit mobilization of deposit money banks in Nigeria. This study investigated five (5) deposit money banks which were chosen at random: United Bank for Africa plc. Ecobank, Heritage Bank, Guarantee Trust Bank and Access Bank plc. This study aims to accomplish the purpose of the developed objectives, research questions, research hypotheses and the stated problems in the study. Existing literature was expansively reviewed and relationships between the dimensions of the independent variables and the measures of the dependent variables were purposefully established. The study employed primary data collected in ensuring that valuable data were obtained for the data analysis. A total number of one hundred and six (106) copies of questionnaire were administered to staff of the selected banks. After cleaning and sorting the copies of the accepted questionnaire they were fed into the statistical package for social science (SPSS, 23). To determine the strength and direction between the variables, the linear regression model was used to test the hypotheses. The study found that relationship marketing strategy has a significant effect on the deposit mobilization of deposit money banks. The study concluded that, banks’ most important assets are the customers and as such, they need to be managed in a manner that will ensure that their expectations are met. The study also recommended that deposit money banks should develop sustainable relationship marketing strategies that guarantee long-lasting business interaction with customers.

Keywords

Deposit Mobilization; Relationship Marketing; Deposit Money Banks.

JEL Code

M31, G21.

Introduction

Relationship marketing is a concept that has its main focal point on not just improving the transaction volume in relations with the marketing exercise but it focuses more on ensuring that customers gain maximum satisfaction which would metamorphose to customers retention. It can simply be written as a practice that can enhance transaction volume and transform customers’ satisfaction to retention. Professional and scholars have made numerous write-ups with regards to deposits money banks role in deposit mobilization in the Nigerian banking sector. This is why deposit mobilization is playing a key in maintaining an optimum working capital that would be used in running the daily affairs of deposit money banks. Thus, making working capital management germane for the success of the banking industry (Godswill et al., 2018). The heightened interest amongst scholars and professionals is however not far-fetched, this is because of the central role deposit money banks play in the economic development and general wellbeing of nations. The performance of deposit money banks depends on their various strategies employed in ensuring that they attract huge volumes of cash deposits from its potential and prospecting customers. This is in a bid to balance their roles of financial intermediation in the Nigerian economy. The most essential role of deposit money banks in any economy is to source funds from those in the economy that has excess and then makes it available as credit to those in the economy in need of funds to enable them to fulfill their desired financial goals. Deposit money banks in carrying out its function as enumerated above, create wealth and enhance the economic development of nations across the globe. This simply put, means that for deposit money banks to achieve their goal of financial intermediation, takes deposits from those who have idle funds through deposit mobilization and lend it to individuals/corporate entrepreneurs through loans and advances for profits in a bid to create a balance towards building the economic fortunes of any nation.

A very valuable strategy that most deposit money banks and business organizations employ in their operations in other to enhance performance, growth, profitability and sustainability is relationship marketing. The notion of relationship marketing was first presented in the business and marketing management literature by Berry (1983), as a valuable plan of action to draw, sustain and perk up business relationships with customers. Akinyele (2011) posited that strategic marketing enhances a firm position in its vibrant business domain and the capacity of firms to craft new products and services in an existing market. Murdy & Pike (2012) advanced that relationship marketing is now being employed by many firms in their bid to develop new relationships as well as sustain existing ones. By employing relationship marketing strategies, deposit money banks seek ways to attract new customers, sustain existing ones and also increase their drive to enhance the achievement of their goals to increase the volume of funds they mobilize in other to remain competitive. This is evident to the fact that when lasting relationships are fostered between deposit money banks and their customers it helps to create more businesses between the parties.

In most cases, relationships are bilateral, joint or mutual. It takes two individuals for any relationship to be effective and should be reciprocated in other words there should be a relationship-based approach in the marketing practices of organizations (Grönroos & Helle, 2012). A valuable element of relationship marketing is reciprocity which refers to the act of appreciating one’s responsibility as a result of earlier actions and dedications. It is noteworthy, to say the fact that before the entrance of the “new generation banks” in the Nigerian banking sector around 1989-1995, that we had only four major deposit money banks namely: First Bank plc, Union Bank plc, UBA plc and Afribank. These banks were not in any way interested in marketing, most of their branches where located in major cities except a few thereby making it inaccessible by a teeming majority of potential customers who are left as part of the unbanked public. The old generation banks at the same time practiced what was largely termed “sit tight or arm chair” banking practices. Rather than seeking customers, identify their needs and ways to improve their business relationship with its customers, these banks allow customers to search for them as the need arises. This led to a general perception of poor quality service delivery and the relationship between the banks and their customers. However, the entrance of banks like Zenith Bank, GTB, Diamond bank now Access bank etc., heralded the proliferation of banks in the banking sector in the late 1980s and early 1990s did not come without a price. They came with a variety of technologies that transformed the banking business landscape into a global village. The impact of the competition and the entrance of some multinational financial corporations cannot be overemphasized largely because they raised the bar of banking operations in the sector.

This heightened competition led to the search for new ways of satisfying customers’ needs and strategies to outcompete customers by establishing long term relationships. To this effect, deposit money banks employed distinctive strategies in other to attract, sustain and enhance the relationship with customers (Law et al., 2003). Some of the identifiable and acknowledged relationship efforts made by banks in recent times where thus: branch expansion, employment of forward-looking and competent personnel, computerization and linking up of branches for online-real time banking operations, assigning of customer relationship/account officers to clients, marketing segmentation to identify niches, mobile banking, ATM, and negative interest rates for customers with certain minimum deposit. Moreover, deposit money banks are yet to attain the goals of effectively and efficiently satisfying the ever-increasing needs of its customers, led to failures and winding up of some banks in the sector in Nigeria over time, thus resulting in the recapitalization exercise carried out by CBN in 2004. The underlying reason here is that deposit money banks have not been able to make good use of the relationship marketing techniques in their operations, largely because they mainly focus on their side of the bargain thereby ignoring the aspect of mutuality towards the customers. To achieve the desired result, deposit money banks ought to show a good understanding of the essential part and process of relationship marketing that is necessary to enhance its performance. Relationship marketing is an area of practice highly renowned for re-inventing it and its language in line with times and culture (Oke, 2012).

Statement of Problem

Over time, deposit money banks’ inability to attain desired height has been linked to their failure to initiate and implement the desired relationship marketing action plans that will readily stimulate enhanced growth in deposit mobilization. Typically, the banking sector in Nigeria, the focus has been to employ prospective staff based on “Nepotism” syndrome. This has been used to counteract the benefits of competence. Ulrich et al. (2012) described competence as the capability to add value to organizations’ business, thus, it must be concerned with the process that guides workers towards altering business circumstances while achieving sustainable competitive advantage. Building a workforce with a superior level of competence enhances the ability to add value especially in deposit mobilization as such staff will be able to identify the expectations of customers and match it with quality service. When customer’s expectations are met it spurs them to deepen their business relationship with the existing firm thereby enabling them to attain goals. It has been observed that relationship marketing strategy is used in winning customer loyalty, but the real application of relationship marketing is confronted with many challenges in Nigeria such as poor relationship marketing practice by the deposit money banks, lack of commitment from the bank employees and over-concentration on service marketing. The use of marketing for banking activities in the early days was not as intense as what we see now because of the height of competition that existed in the banking industry. Pan et al. (2012) describes customer focus as a tactical purpose with a lifelong interest which usually presents appropriate outcomes within short term applications.

The execution of customer focus practices entails, the investment of huge capital; but expected outcomes is more favorable at long periods (Verhoef & Lemon 2013). On the other hand, if deposit money banks pay less attention to relationships it could easily result in a significant reduction in the number of customers and market share. Marketing of bank products and services is to attract new customers and maintain old ones but now the role of relationship marketing strategy is being hindered by the fact that relationship marketing is mostly done in the urban areas to the disadvantage of the underbanked rural community. i.e. the rural area is most time neglected when it comes to marketing of products and this leads to the decrease in the bank’s market share due to inadequate infrastructural facilities that would facilitate the relationship between bank staff and customers. Past research works in service marketing have not attained a compromise in recognizing the most important determinants of maintaining quality customer relations by evolving good strategies. (Palmatier et al., 2006) found that history on relationship marketing has coverage of obtaining strong and long-lasting relationships with customers; the most effective relationship building strategy is communication. Communication aids in the satisfaction of customers by being aware of their expectations. Poor communication has a more negative effect on deposit mobilization in deposit money banks than its positive effect. Therefore, if all poor customer communication is left unattended to all positive relationship marketing efforts may be wasted or rendered futile.

Objective of the study

The purpose of this research is to determine the level to which relationship marketing strategies impacts on deposit mobilization in deposit money banks. Therefore, the objectives are broken down into two specific objectives as follows:

(a) To examine how competence impacts the profitability of deposit money banks in Nigeria.

(b) To determine how customer focus impacts the market share of deposit money banks in Nigeria.

H1 Competence has no significant impact on the profitability of deposit money banks.

H2 Customer focus has no significant impact on the market share of deposit money banks in Nigeria.

Literature Review

Conceptual Review

Relationship marketing has evolved as a valuable tool that every business development personnel and manager should employ in search of creation of value (Morgan & Hunt, 1994). Nonetheless in the banking sector nowadays, the intermediating practices are speedily altering marketing strategies and making marketing relationships more acceptable. Most importantly, in this time of hyper-competition among various firms, marketing efforts now appear to align more and more towards customer retention and loyalty (Ngambi & Ndifor, 2015). Some organizations are pursuing the strategy aggressively, using persuasive words and graphics to exhibit what they have to offer to their customers (Omojola et al., 2018). Therefore, it is very essential to underscore the fact that crafting long term relationships with customers is more profitable than only engaging in a one-off sales transaction it has become expedient to disclose that relationship marketing helps firms to develop an essential mechanism that enables them to create value for their clients. The vital elements in firms’ value creation process entail identifying what values a firm can provide for its clients, the value the firm will gain in return and the effective management of the value interactions.

Ikpefan et al. (2018b) averred that marketing of the deposit money banks services helps to attract its target customers thereby creating a relationship where exchange can be made possible. Relationship marketing is, therefore, a very crucial marketing strategy, it is most often crafted to assist business organizations to identify and meet the expectations of their immediate customers as well as prospective clients and develop a superior business relationship with them as time evolves. Bradford et al. (2010) opined that relationship marketing has attracted a lot of attention because relational based marketing evolved as a very essential methodology to engender customer loyalty. In the words of Peng & Wang (2006) relationship marketing is a very vital instrument used in modifying diverse prospect groups into loyal clients, thereby establishing, creating and maintaining long-lasting relationships with clients. However, in the study of Jamil et al. (2012), they opined that the fundamental target of relationship-driven marketing action plans is basically to identify and develop loyalty within its customers’ base and build a formidable long-run relationship with them. Relationship marketing enhances the ability of marketing personnel to differentiate their firms from that of rivals in their market domain (Malik et al., 2017).

Empirical Review

Mordi (2004) posited that the deposit money banks play the essential role of mobilizing deposits from the surplus sector in the economy and facilitates the loaning of these deposits to the deficit sector intended for investments. In doing this effectively and efficiently, deposit money banks enhance the volume of a nation’s savings and investment potentials. Mobilization of deposits have been acknowledged in the financial literature as one of the most valuable functions of deposit money banks, this is largely because it is one of the easiest and most efficient sources of accumulating working capital and funds for loans to customers. In the financial sector, the mobilization of deposits plays an essential role in ensuring that satisfactory services are rendered to the diverse sectors of the economy because it boosts the deposit money bank’s performance ability, as well as provides funds that enable them to meet the demands of its customers thereby stabilizing the economy at large. Sylvester (2011) argues that in other to enhance profitability, the money banks should focus their strategies on minimizing its expenditures by mobilizing cheap funds as deposits. Hence, it can be said that deposit money banks in their bid to enhance the volume of its deposit mobilization and achieve competitive advantage in this incumbent globally induced competitive business environment, banks formulate and implement a variety of business strategies as an enticement to outcompete its close rivals.

Oke (2012) examined marketing strategies and bank performance in Nigeria: A Post-Consolidation Analysis; his findings reveal that one of the most important aspects or functions in the banking industry is marketing because of the high rate of competition in the banking industry. Deposit money banks and other players who are in the financial sector carry out the task of providing financial intermediation services to the public and the economy at large. According to Bauer & Dorn (2017), the services undertaken by deposit money banks entails the relationship between a client and an organization referred to as a service provider. In today’s business and organizational context, workers play middlemen’s role between organizations, clients and prospects. In the marketing literature, scholars have acknowledged that service is about being effective in matching the expectations of the customers and the quality of the service can only be viewed from the perspective of how good the employees conduct themselves while providing required services to clients (Bauer & Dorn, 2017). According to these authors, the customers’ perception of service is stemmed from the verifiable diverse realty of the services offered such as tangible facilities, technology (equipment) communication mechanisms, objects, employees, other customers and cost of services. Relationship marketing evolved in the strategic marketing management in the early 1980s as a fundamental change from traditional marketing ideology to a more relational and long-lasting marketing concept. This was stemmed from the increasing interest of firms to the realization of the essential role of organizational-customers’ interaction and the benefits that accrued from it which needs to be developed and sustained for the core purpose of competitive advantage. The main idea of relationship marketing studies is rooted in evaluating trust in corporate interaction in diverse relationship stages such as exploration, growth and sustainability. However, Kordnaeij et al. (2013), are of the view that relationship marketing strategies is the numerous approaches aimed at discovering, generating, maintaining, improving and, if needed, come to an end of business relationships with clients and others in mutual profit venture in order to meet up with stakeholders’ objectives.

Kordnaeij et al. (2013) posited that relationship marketing comprises of six (6) components among them are “trust, link, communication, shared value, empathy and mutual relations”. Gedefaw (2014) posits that relationship marketing is essential and mostly applicable in the service sector especially in deposit money banks. The building of relationships entails how effective interaction and communicates with other people have been employed in different ways in the past to help in eliminating the difficulties encountered in our everyday life especially in the business environment that is affected by dynamic environmental factors. Dushyenthan (2012), in his study, employed six (6) dimensions of relationship marketing thus: commitment, trust, quality of the workforce, complaint handling, familiarity and personalization of service. His findings revealed that trust and commitment play the most essential role in attracting customers’ loyalty. On the other hand, Velnampy & Sivesan (2012) stated that relationship marketing is a very valuable marketing technique to gain the loyalty of customers and aid in enhancing the growth of the organization in the long term.

Ogbadu & Usman (2012) opined that relationship marketing entails the conjecture of integrating the customer into all aspects of business transactions. Chary & Ramesh (2012) developed the distinctive elements of relationship marketing strategies as customer focus, value creation, customer services, commitment and closeness with a customer and quality delivery. It has been acknowledged that clients are daily becoming very individualistic, quality-minded and impulsive in their purchase conducts and demand behaviors that require a variety of goods and services to maximize their utility. Oogarah-Hanuman et al. (2011) viewed customer satisfaction and loyalty as the most essential elements for success and profitability of organization in every sector of business enterprise, hence, the more a firm satisfies its clients, the likelihood of them developing increased loyalty and the tendency of evolving durable relationships. However, it is important to note that with the swelling growth in the number of banks and its resultant hyper-competitive outlook, managers of most banks will have to persistently struggle in search of alternative action plans that will not only enhance the drive to attract new customers but also build a long-term friendly business relationship in order to grow shareholder fund and become profitable.

Relationship Marketing Strategy and Deposit Mobilization in Deposit Money Banks

Presently in the banking sector, the intermediating practices are speedily altering marketing strategies and making marketing relationships more acceptable. Therefore, it is very essential to underscore the fact that establishing lifelong or lasting relationships with customers is more lucrative than only engaging in a one-off sales transaction. It is also, expedient to disclose that relationship marketing strategies help banks to develop an essential mechanism that enables them to create value for their clients. The vital elements of firms’ value creation process entail identifying what values a firm can provide for its clients, identifying the value the firm will gain in return and effective management of the value interactions. Thus, in today’s banking environment, the more technologically inclined a bank is the larger its customer base which would increase its deposit mobilization in the long-run (Ikpefan et al., 2018a).

Kordnaeij et al. (2013), viewed relationship marketing strategies as action plans that enhance the process of spotting, generating, sustaining and enhancing or if essential, bringing to an end relationship with customers and others in a mutual benefit for all the group members are met. The authors further highlighted that, relationship marketing strategies entail six mechanisms such as trust, link, communication, shared value, empathy and mutual relations. All the same, these components are focused on building long relationships with customers and if sustained will engender greater performance as it relates to increased deposit mobilization drive and competitive advantage. However, Ogbadu & Usman (2012) advanced that relationship marketing entails the conjecture of integrating the customer into all aspects of business transactions. Chary & Ramesh (2012) developed the distinctive elements of relationship marketing as customer focus, value creation, improved customer services, commitment, and closeness with customers and quality delivery. It has been acknowledged that clients are daily becoming very individualistic, quality-minded and impulsive in their purchase conducts that requires a variety of goods and services to maximize their utility.

Deposit mobilization is the major foundation of funds on credit operations by banks, as deposit is the solution to effective credit transaction and such facilitates profitable intermediary role. The banks usually introduce some mouth-watering promotional strategies in their bid to sway the banking public to deposit funds with them. According to Gockel and Brow (2007), bank deposits are money placed or deposited with banks for safe-keeping, they are in the form of savings account, current account, time deposit, call deposit (fixed) and money market accounts cited in Tuyishime et al. (2015). According to Thanban (2013), the purpose of customer relationship marketing is to build customer loyalty by building and sustaining an upbeat attitude of customers towards an organization. Therefore, when a bank asserts that it is enthusiastic in relationship marketing, it signifies that it has embarked on an organization-wide strategic approach to administer and take care of its relationship with clients and prospects.

Commitment-Trust theory of Relationship Marketing

This theory of relationship marketing was posited by Morgan & Hunt in (1994), they noted that commitment and trust are vital for any successful relationship. They further posited that relationship marketing involves creating a unique tie with your customers by ensuring their needs are met, honoring commitments other than focusing on short term profits. Thus, in ensuring customers’ loyalty is achieved, there would be repeated patronage and referrals which would beef-up the profits of the company. Product innovation has the potential of opening new markets if a particular brand has proven to be of high quality. When customers retain the new innovated products, it has the potential to protect the firm from market threats and competitors. (Hult et al., 2004) as cited in (Centobelli et al., 2019).

Methodology

This section includes the procedures and steps involved in analyzing and obtaining the data used in this study. It describes the methodological framework used in attaining the stated objective of the study. It discusses and analyses the research methodology, research design, Population of the study, sample frame, sampling technique, sample size, source of data collection and the various methods used in the collection of relevant information, the validity and the reliability of the used instrument required for this study.

Population of the Study

The population for this research work was drawn from the twenty-two (22) deposit money banks in Nigeria in which amongst these banks five (5) deposit money banks were selected for this research. These banks where selected because they are the new generation banks and they focus more on relationship marketing in carrying out their banking business. The banks selected include: United Bank for Africa (UBA), Guaranty Trust Bank Plc (GTB), Heritage Bank (HB), Eco Bank and Access Bank.

Sample Size Determination

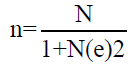

The Yamane’s formula was used for this particular study and it is calculated with the formula as follows; Taro Yamane’s formula (1967)

Where: n = Sample size

N = Population

e = Sampling error; (0.05)

Therefore, N = 144; a = 5% or 0.05; n =?

Source of Data Collection

For this study, the researcher made use of primary data. The primary data were collected through the use of questionnaire distributed to the respondents selected in the population in the course of the research. Data was generated as well as results by processing the data obtained.

Reliability of the Research Instruments

The Cronbach alpha test was used for this research study. It associates each measurement item to every other measurement item and finds the average. Cronbach alpha is used to test the reliability of a multi-item scale in which the coefficient is either 0.07 or higher, it is regarded “acceptable” in most social science research studies.

From the Table 1, the reliability coefficient is 0.902 thus, it is above 0.7. Therefore, the research work or study is good and reliable. The Cronbach alpha test measures the internal consistency and reliability of the scale used in the analysis. From the Cronbach alpha (α) result, 0.902 is acceptable meaning that there exist internal consistency and reliability of the scale used for the analysis.

| Table 1 Reliability Statistics | ||

| Cronbach’s Alpha | Cronbach’s Alpha Based on Standardized Items | N of Items |

| 0.902 | 0.923 | 35 |

Data Presentation

This section centers on the analysis, interpretation, and presentation of the primary data collected. The responses from various respondents to the questions outlined in the questionnaire were collated. All questions were analyzed and reported with the help of the statistical package for social science (SPSS) version 23, while the hypotheses were analyzed, reported and interpreted with the same SPSS before our decisions were taken as to either accept or reject the hypothesis. Regression analysis was used to test hypothesis two (2) to determine the cause and effects between the dependent and independent variables, while correlation analysis was used to test hypothesis one (1) to determine the relationship between the dependent and independent variables. A total of 106 questionnaires were administered for this research work, and out of which 101 were returned but 20 copies were found incomplete giving a response rate of 76% (Table 2). These questionnaires were administered to the five deposit money banks which were chosen at random, United Bank for Africa, Heritage bank, Access bank, Eco bank and Guarantee trust bank.

| Table 2 Distributed and Retrieved Questionnaires from Respondent | |||

| Questionnaire Distributed | Received Questionnaire | Incomplete questionnaire | Response rate |

| 106 | 101 | 20 | 76% ( 81/106*100) |

Note: 101-20= 81 represents the total questionnaire received that was completely filled.

Hypotheses Testing and Interpretation

Correlation would be used to test hypothesis one to determine the relationship between the dependent and independent variables while regression analysis would be used to test hypothesis two to determine the cause and effects between the dependent and independent variables. The two hypotheses are stated in the null form which are thus:

H0 Competence has no significant relationship with profitability of deposit money banks.

H1 Customer focus has no significant impact on the market share of deposit money banks in Nigeria.

Interpretation

From the correlation Table 3, it can be deduced that there is a positive weak correlation of 34.8% and it is significant at 0.01 (1%) level of significance. Meaning that there exists a significant relationship between competence and the profitability of deposit money banks to the level of 34.8%.

| Table 3 Correlations | |||

| Competence of the staff has improved the banks’ profits | We have valuable and high-quality products and services that enhance our profitability | ||

| Competence of the staff has improved the banks’ profits. | Pearson Correlation | 1 | 0.348** |

| Sig. (2-tailed) | 0.000 | ||

| N | 194 | 194 | |

| We have valuable and high-quality products and services that enhance our profitability. | Pearson Correlation | 0.348** | 1 |

| Sig. (2-tailed) | 0.000 | ||

| N | 194 | 194 | |

Note: **. Correlation is significant at the 0.01 level (2-tailed).

Decision

The alternative hypothesis should be accepted which states that competence has a significant relationship with the profitability of deposit money banks and the null hypothesis should be rejected.

Interpretation

From the regression result in Table 4, the coefficient of the independent variable (customer focus) is 0.73 which is positive. This implies that there is a positive relationship between market share and customer focus. The R square shows that customers’ focus explains about 28.1% variation in market share (Table 5). Therefore, a unit increase in customers’ focus would lead to a 5% increase in market share while a unit change in the market share would lead to a 0.73% increase in customers’ focus.

| Table 4 Coefficientsa | |||||

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | |

| B | Std. Error | Beta | |||

| (Constant) | 5.195 | 2.985 | 1.740 | 0.086 | |

| Customer focus | 0.735 | 0.133 | 0.530 | 5.517 | 0.000 |

| a. Dependent Variable: market share | |||||

| Table 5 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.530a | 0.281 | 0.271 | 2.35856 |

| Predictors: (Constant), customer focus | ||||

Also, the analysis of variance (ANOVA) in Table 6 shows the speed of rectification of customer focus is significant at Probability value=0.000 because the level of significance is less than 0.05 (0.00<0.05).

| Table 6 Anovaa | |||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | ||

| Regression | 169.300 | 1 | 169.300 | 30.434 | 0.000b | ||

| Residual | 433.900 | 78 | 5.563 | ||||

| Total | 603.200 | 79 | |||||

| a. Dependent Variable: market share | |||||||

| b. Predictors: (Constant), customer focus | |||||||

Decision

Therefore, the rule of thumb states that we should reject the null hypothesis (H0) and accept the alternative hypothesis (H1) if the probability value is less than 5%; it also states that if the probability value is more than 5% we should accept the null hypothesis (H0) and reject the alternative hypothesis (H1). Therefore, from the afore-stated analysis, we would accept the alternative hypothesis (H1) and reject the null hypothesis (H0). The alternative hypothesis (H1) to be accepted states that customer focus has a significant impact on the market share of deposit money banks in Nigeria.

Conclusion and Recommendations

From the presentation and analysis of data received from the questionnaire that where administered for the research work, the following are some of the empirical findings:

Conclusion

1. Based on the researchers’ study and findings it shows that the competence of the bank staff has effectively helped to improve the banks’ profitability status.

2. The study showed that customer focus or orientation has helped the deposit money banks to improve its market share.

3. Based on this study it shows that deposit money banks’ work teams, groups and individuals are highly skillful and they are competent enough to carry out assigned task.

4. Deposit money Banks create new products and services in other to attract new customers and maintain existing once

5. Adoption of marketing communication has led to an improved customer service in the banks.

6. The study also shows that the information given to the customers by the banks are accurate and appropriate.

7. The research study shows that the banks have high quality products and services that enhance their profitability.

Recommendations

1. The Deposit money banks should train and retrain their staff regularly so that they can be up to date with the current trends affecting the industry and for them to transform their knowledge into valuable service to customers.

2. Deposit Money Banks should continuously produce products and services that will enhance sufficient delivery of customer-centric product line and also be more competitive.

3. Decision makers in the banking industry should positively utilize the potentials of marketing communication as an important tool to improve the innovative capacity of their employees in their effort to transform prospective customers into loyal customers.

4. To improve the competence of employees the banks should focus more on technology as it grows because it holds the power required for competition and utilizing cutting edge technology that is technology with the most recent and advanced IT developments which helps to motivate employees in working better.

Acknowledgement

The authors use this medium to appreciate Covenant University management for providing the article processing charge of this article.

Appendix

Questionnaire (Survey Indicators)

Section A

Topic: Relationship Marketing and Deposit Mobilization in Deposit Money Banks.

Please tick (√) appropriately that which best fits your position in relation to the raised question.

1. Position in the firm: Regional manager ( ) Regional Operations manager ( ) Regional HR mangers ( ) Branch manager ( ) Branch operations manager ( ) Cash officer ( ) Team leads ( )

2. Gender: Male ( ) Female ( )

3. Educational qualification: HND/B.SC/B.ED/B.T( ) MSC/MBA( ) PhD ( ) Others ( )

4. Name of the Bank: UBA Bank ( ) Heritage Bank ( ) ECO Bank ( ) Access Bank ( ) GT Bank ( )

5. Number of years in Service: 0-5 years ( ) 6-10 years ( ) 11-15 years ( ) 16 and above ( )

Section B

The statements below represent possible opinions that you may have about relationship marketing and deposit mobilization in deposit money banks.

1. Strongly agree (SA) = 5

2. Agree (A) = 4

3. Neutral (N) = 3

4. Disagree (D) = 2

5. Strongly disagree (SD) = 1

Dimensions of Relationship Marketing

| S/No | Competence | (SA) | (A) | (N) | (D) | (SD) |

|---|---|---|---|---|---|---|

| 5 | 4 | 3 | 2 | 1 | ||

| 1 | We have highly skilled staff in our work team | |||||

| 2 | Our Staff are highly innovative, knowledgeable and experienced. | |||||

| 3 | There is uniqueness in our finance product that distinguishes us. | |||||

| 4 | Our staff is competent in handling issues, queries and complaints from customers. | |||||

| 5 | Competence of the staff has improved the banks’ profits. |

| S/No | Customer Focus | (SA) 5 | (A) 4 | (N) 3 | (D) 2 | (SD) 1 |

|---|---|---|---|---|---|---|

| 1. | We create new products and services because we think they will attract more customers and maintain existing ones. | |||||

| 2. | Digital marketing skill is expedient in improving our customers’ base. | |||||

| 3. | Customer focus has improved the market share of the bank. | |||||

| 4. | Our organizational culture enhances timely service delivery to our customers. | |||||

| 5. | We are keen towards meeting customer’s expectation. |

| S/No | Marketing Communication | (SA) 5 | (A) 4 | (N) 3 | (D) 2 | (SD) 1 |

|---|---|---|---|---|---|---|

| 1. | We are responsible to provide timely and trustworthy information to our customers. | |||||

| 2. | The adoption of marketing communication has led to an improved customer service in the bank. | |||||

| 3. | The information that we provide to our customers are accurate and appropriate. | |||||

| 4. | The introduction of public relations as a marketing technique helps us in building and sustaining customer’s confidence and satisfaction. | |||||

| 5. | We have motivated teams that effectively communicate with our customers. |

Measures of Deposit Mobilization

| S/No | Profitability | (SA) 5 | (A) 4 | (N) 3 | (D) 2 | (SD) 1 |

|---|---|---|---|---|---|---|

| 1. | Our organization has strong core values that enhance our corporate performance. | |||||

| 2. | Employee’s productivity is one of the core objectives of our organization management. | |||||

| 3. | Our strong customer relationship leads to improved profitability in both short and long run. | |||||

| 4. | We have valuable and high-quality products and services that enhance our profitability. | |||||

| 5. | Our CSR helps improve our organizational goals. |

| S/No | Market share | (SA) 5 | (A) 4 | (N) 3 | (D) 2 | (SD) 1 |

|---|---|---|---|---|---|---|

| 1. | Our organization aims at providing services and products that would outsmart those of our competitors. | |||||

| 2. | There is always anticipation of the dynamic market nature, thus fostering our different market strategies. | |||||

| 3. | We are good at product innovative before it is being implemented by our competitors. | |||||

| 4 | We pay attention to customer’s complaints which makes us serve them better. | |||||

| 5. | Customers are usually attracted to our innovative products and services. |

| S/No | Improved customer service | (SA) 5 | (A) 4 | (N) 3 | (D) 2 | (SD) 1 |

|---|---|---|---|---|---|---|

| 1. | We are very swift with attending to customers complaints. | |||||

| 2. | We have a thorough recruitment process that helps us to employ the best of staff. | |||||

| 3. | By meet-up the expectations of customers in terms of timely delivery of our services. | |||||

| 4. | We continuously improve our quality management approach to ensure enhancement of customer satisfaction. | |||||

| 5. | The technical competence of our workforce and their response time makes us very competitive. |

References

- Akinyele, S.T. (2011). Strategic marketing and firms performance: A study of Nigerian oil and gas industry. Business Intelligence Journal, 4(2), 303-311.

- Bauer, W., & Dorn, J. (2017). System design of e-markets for IPSS purchasing. Procedia Cirp, 64, 211-216.

- Berry, L.L. (1983). Relationship marketing. Emerging perspectives on services marketing, 66(3), 33-47.

- Bradford, K., Brown, S., Ganesan, S., Hunter, G., Onyemah, V., Palmatier, R., Rouziès, D., Spiro, R., Sujan, H. & Weitz, B. (2010). The embedded sales force: Connecting buying and selling organizations. Marketing Letters, 21(3), 239-253.

- Centobelli, P., Cerchione, R., & Singh, R. (2019). The impact of leanness and innovativeness on environmental and financial performance: Insights from Indian SMEs. International Journal of Production Economics, 212, 111-124.

- Chary, T.N., & Ramesh, R. (2012). Customer relationship management in banking sector-A. International Journal of Human Resource Mangement, 1(2).

- Gedefaw, A. (2014). Determinants of relationship marketing: The case of Ethiopian airlines. Global Journal of Management and Business Research.

- Godswill, O., Ailemen, I., & Osabohien, R. (2018). Working capital management and bank performance: Empirical research of ten deposit money banks in Nigeria. Banks and Bank Systems, 13(2), 49-61.

- Grönroos, C., & Helle, P. (2012). Return on relationships: conceptual understanding and measurement of mutual gains from relational business engagements. Journal of Business & Industrial Marketing, 27(5), 344-359.

- Hult, G.T.M., Hurley, R.F., & Knight, G.A. (2004). Innovativeness: Its antecedents and impact on business performance. Industrial marketing management, 33(5), 429-438.

- Ikpefan, O.A., Enobong, A., Osuma, G., Evbuomwan, G.O., & Ndigwe, C. (2018a). Electronic banking and cashless policy in Nigeria. International Journal of Civil Engineering and Technology (IJCIET), 9(10), 718-731.

- Ikpefan, O.A., Olaolu, R., Omankhanlen, A.E., Osuma, G., & Evbuomwan, G.O. (2018b). Impact of marketing of deposit money bank services on customers’ patronage and loyalty. Empirical study of five deposit money banks in Nigeria. Journal of Applied Economic Sciences, 8(62), 2446-2458.

- Jamil, G., Furbino, L., Santos, L., Alves, M., Santiago, R., & Loyola, S. (2013). A design framework for a market intelligence system for healthcare sector: a support decision tool in an emergent economy. In Handbook of Research on ICTs and Management Systems for Improving Efficiency in Healthcare and Social Care.

- Kordnaeij, A., Bakhshizadeh, A., & Shabany, R. (2013). The outcomes of relationship marketing strategy in banking industry by emphasizing on word of mouth. International Research Journal of Applied and Basic Sciences, 4(7), 1837-1845.

- Law, M., Lau, T., & Wong, Y.H. (2003). From customer relationship management to customer-managed relationship: Unraveling the paradox with a co-creative perspective. Marketing Intelligence & Planning, 21(1), 51-60.

- Malik, M.S., Ali, H., & Ibraheem, T. (2017). Consequences of relationship marketing on customer loyalty. International Journal of Research–Granthaalayah, 5(2), 180-190.

- Mordi, C.N.O. (2004). Institutional framework for the regulation and supervision of the financial sector. Central Bank of Nigeria Bullion, 28(1), 25-30.

- Morgan, R.M., & Hunt, S.D. (1994). The commitment-trust theory of relationship marketing. Journal of Marketing, 58(3), 20-38.

- Murdy, S., & Pike, S. (2012). Perceptions of visitor relationship marketing opportunities by destination marketers: An importance-performance analysis. Tourism Management, 33(5), 1281-1285.

- Ngambi, M.T., & Ndifor, P.S. (2015). Customer relationship management and firm performance: Revisiting the case of the Camccul Microfinance Institutions. International Journal of Information Technology and Business Management, 6, 77-126.

- Ogbadu, E.E., & Usman, A. (2012). Imperatives of customer relationship management in Nigeria banking industry. Kuwait Chapter of Arabian Journal of Business and Management Review, 33(849), 1-14.

- Oke, M.O. (2012). Marketing strategies and bank performance in Nigeria: A post-consolidation analysis. Global Journal of Management and Business Research, 12(12).

- Omojola, O. (2016). Using symbols and shapes for analysis in small focus group research. The Qualitative Report, 21(5), 834-847.

- Oogarah-Hanuman, V., Pudaruth, S., Kumar, V., & Anandkumar, V. (2011). A study of customer perception of CRM initiatives in the Indian banking sector. Research Journal of Social Science and Management, 1(04).

- Palmatier, R.W., Dant, R.P., Grewal, D., & Evans, K.R. (2006). Factors influencing the effectiveness of relationship marketing: a meta-analysis. Journal of Marketing, 70(4), 136-153.

- Pan, Y., Sheng, S., & Xie, F.T. (2012). Antecedents of customer loyalty: An empirical synthesis and reexamination. Journal of Retailing and Consumer Services, 19(1), 150-158.

- Peng, L.Y., & Wang, Q. (2006). Impact of relationship marketing tactics (RMTs) on switchers and stayers in a competitive service industry. Journal of Marketing Management, 22(1-2), 25-59.

- Thanban, L. (2013). The role of customer trust and commitment as mediator for the relation between customer satisfaction and loyalty at central African banks. International Journal of Business and Management Invention.

- Tuyishime, R., Memba, F., & Mbera, Z. (2015). The effects of deposits mobilization on financial performance in commercial banks in Rwanda. A case of equity bank Rwanda limited. International Journal of Small Business and Entrepreneurship Research, 3(6), 44-71.

- Ulrich, D., Younger, J., Brockbank, W., & Ulrich, M. (2012). HR talent and the new HR competencies. Strategic HR Review, 11(4), 217-222.

- Velnampy, T., & Sivesan, S. (2012). Customer relationship marketing and customer satisfaction: A study on mobile service providing companies in Srilanka. Global Journal of Management and Business Research, 12(18), 318-324.

- Verhoef, P.C., & Lemon, K.N. (2013). Successful customer value management: Key lessons and emerging trends. European Management Journal, 31(1), 1-15.