Research Article: 2022 Vol: 26 Issue: 1

A bibliometric review of the Pakistan stock exchange literature

Ishtiaq Ahmad Bajwa, Beaconhouse National University

Ali Murad Syed, University of Bahrain

Shabir Ahmad, Imam Abdulrahman Bin Faisal University

Chaudhry Kashif Mahmood, Imam Abdulrahman Bin Faisal University

Tarig Eltayeb, Imam Abdulrahman Bin Faisal University

Citation Information: Bajwa I. S., Syed A. M., Ahmad S., Mahmood C. K., Eltayeb T. (2022). A bibliometric review of the Pakistan stock exchange literature. International Journal of Entrepreneurship, 26(1), 1-10.

Abstract

The stock market is one of the most dynamic financial markets, contributing actively to economic development. The Pakistan stock market (PSX) is a fast-growing emerging stock market. In recent years, it has witnessed growth both in terms of no of participants and market capitalization. Due to its emerging nature, researchers are also actively exploring various aspects of PSX. This study uses bibliometric analysis techniques to review the existing literature on PSX. We used 101 articles from the Web of Science database and found that most of the research is carried on in Pakistani institutions. Whereas the institutions from China and Lithuania are the main collaborators in this research. Moreover, journals like the International transaction journal of engineering management & applied sciences & technologies, African journal of business management, and Cogent economics & finance mainly publish these researches.

Keywords

Pakistan Stock Exchange, Bibliometric Review, Structural Changes, Research Trends

Introduction

The stock markets occupy a central role in the financial sector of an economy. The market covers all industries in almost all segments of the economy; that is why it is referred to as the barometer of the economy. In recent times, the stock markets worldwide are expanding, which has compelled researchers to initiate research on the relationship between the stock market and economic development (Salameh & Ahmad 2020). Apart from this, there are many other aspects of stock markets that researchers explore. For instance, the determinants of stock market performance (Maku & Atanda, 2010, Rakhal 2018), stock market volatility (Mahmud & Mirza 2011, Akhtar & Khan 2016), and stock market efficiency (Shah et al. 2018, Zafar & Siddiqui 2020) etc.

As the overall research on the stock market witnessed growth in different dimensions, many researchers attempted to capture this research output through various review papers. For instance, Bala (2013) reviewed Indian stock market literature, Lu and Fu (2014) examined the empirical literature discussing structural changes in the Chinese stock market. Ma et al. (2016) reviewed the literature on liquidity in international stock markets. We attempt to extend this literature by adding a bibliometric review study covering the Pakistan Stock Market (PSX) literature. PSX being one of the emerging markets has undergone various structural changes and mergers in recent times. The market has witnessed immense growth in size and volume since its inception. The overall number of participants has increased to 540 (2020) compared to 81 in 1960. Moreover, the market capitalization has also expanded to PKR 8.4 trillion (US$52 billion) in 2018 compared to 1,8 billion in 1960.

We applied the bibliometric analysis on 101 articles extracted from the Web of Science (WOS) database. The Web of Science is a comprehensive and popular database covering 12000 12000 multidisciplinary high-impact factor journals, including 55 social science disciplines (Analytics). We attempted to answer the following questions: What are the leading journals, countries, and institutions involved in PSX research? Who are the most influential authors and co-author networks? What are the most cited studies in PSX literature? What are the most repeated keywords in the domain? Following Bahoo et al. (2020), we also applied the citation analysis technique, a burgeoning technique used mainly by the review papers in management and social sciences. We found that the International transaction journal of engineering management & applied sciences & technologies remained on the top with seven publications. Whereas naturally, Pakistan was the top country, with Comsats University Islamabad, the main research contributor. The study by Majeed et al. (2015) published in the International Journal of financial studies achieved the highest 45 total global citations.

The structure of the rest of the study is as under; the next section discusses the data collection and methodology. In section 3, the influential aspects of PSX literature are discussed. Finally, in section 4, the conclusion and implications are given.

Data and Methodology

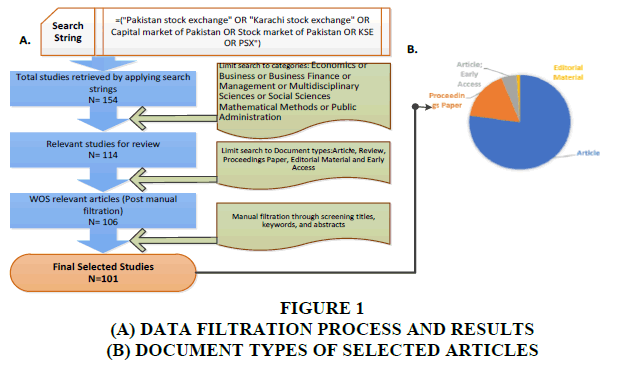

This study attempts to conduct a bibliometric analysis of Pakistan Stock Market (PSX) research. We used the Web of Science database to gather all relevant articles on the topic. Web of Science is one of the primary databases covering good-quality studies in social sciences like many other disciplines; this database choice is consistent with other studies like Apriliyanti and Alon (2017); Naatu and Alon (2019). Figure 1 provides a brief overview of the data collection and filtration process. We used the Pakistan stock market-related keywords to collect the relevant articles. In the first round, 154 articles were extracted. These articles were further filtered in the database based on disciplines. We selected articles only for Economics, Business, Finance, Management, Multidisciplinary Sciences, and Public Administration. Finally, the area experts applied the manual filtration process to exclude the irrelevant and incomplete research articles to arrive at a final number of 101 articles for analysis.

Our methodology is in line with the standard approaches of bibliometric analysis in socio-economic fields (Lensink et al. 2018). We conducted an in-depth analysis by carefully examining the published articles to capture the most relevant information. It covers bibliometric citations, which is the quantitative perspective of PSX literature. Following the contemporary techniques for the bibliometric citation analysis, we performed checks on the influential aspects of the subject area, journals' profile, and country of origin, institutional affiliations, and authors' eminence in the research area (Paltrinieri et al. 2019, Bahoo et al. 2020). We highlighted the influential aspects of existing literature: it includes the number of research articles produced each year, the most influential journals, top countries producing the research, and institutions contributing the most within those countries. We further focused on the most productive authors, and finally, the most prominent and trending publications. For this study, we used various bibliometric software to analyze the citation trend and explore relevant networks and clusters among countries and institutions and their preferred research fields. We also conducted co-citation, co-authorships, and cartographic analysis using the software HistCite, VOS viewer, and Biblioshiny. This software’s are very commonly used in this type of analysis.

Influential Aspects of Pakistan Capital Market Research

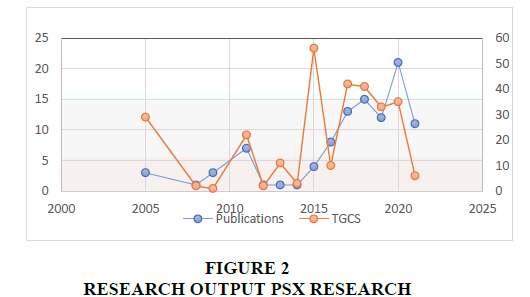

The research trends on the Pakistan capital market are indicated in figure 2. The research has an upward trend both in terms of the number of publications and global citations score. The overall data represents 101 articles published in the journals available in the web of science database. The growing trend in capital market research is basically because of rapid regulatory and structural changes in PSX. A total of 101 articles were contributed by 256 authors and are published in 66 different journals. There are 71 articles, 17 proceeding papers, five early access articles, and one editorial.

We selected top sources/journals based on two different criteria. First, the journals were selected based on the higher number of publications in the selected sample. Under this category, we selected all journals with three or more publications (PPSX ≥ 3) on the Pakistani capital market. Under this criterion, the International transaction journal of engineering management & applied sciences & technologies remained at the top of the list with seven publications. The African journal of business management, with six publications, secured second-ranking in the list. Cogent economics & finance is third on the list with five publications. The second criterion is total annual global citation per year; Histcite gives this citation criterion. As per this criterion, the International Journal of financial studies with 6.4 TGS/t, Cogent economics & finance with 4.9 TGS/t, and Qualitative research in financial markets with 4.3 TGS/t remained the top three journals Table 1.

| Table 1 Most Influential Journals In Psx Research |

||||

|---|---|---|---|---|

| Rank | Journal 1 | PPSX | Journal 2 | TGC/t |

| 1 | International transaction journal of engineering management & applied sciences & technologies | 7 | International journal of financial studies | 6.4 |

| 2 | African journal of business management | 6 | Cogent economics & finance | 4.9 |

| 3 | Cogent economics & finance | 5 | Qualitative research in financial markets | 4.3 |

| 4 | Economic research-ekonomska istrazivanja | 4 | Journal of Asian finance economics and business | 4 |

| 5 | Journal of Asian finance economics and business | 4 | Economic research-ekonomska istrazivanja | 3.9 |

| 6 | Global business review | 3 | Pacific accounting review | 3.5 |

| 7 | Pacific business review international | 3 | South Asian journal of business studies | 3.3 |

| 8 | Technological and economic development of economy | 3 | Research in international business and finance | 2.7 |

| Note: Influential journals classification based on; 1. the number of published papers in the period selected (PPSX), 2. Total Global Citations per year (TGC/t). | ||||

As the research relates to the Pakistani capital market, it is not surprising that most of the publications appeared from Pakistan in terms of the number of studies (PPSX). The country is at the top of the list, with 84 publications. China, Malaysia, Lithuania, UK, and UAE follow with eight, seven, six, and three publications respectively. On the other hand, table 2 also indicates the top countries in terms of total global citations score (TGC). Pakistan, with 239 citations, remained on the top of the list. Malaysia follows it with 35 and China with 22 citations.

| Table 2 Most Influential Countries In Psx Research |

||||

|---|---|---|---|---|

| Rank | Country 1 | PPSX | Country 2 | TGC |

| 1 | Pakistan | 84 | Pakistan | 239 |

| 2 | China | 8 | Malaysia | 35 |

| 3 | Malaysia | 7 | China | 22 |

| 4 | Lithuania | 6 | Lithuania | 16 |

| 5 | UAE | 3 | Brunei | 12 |

| 6 | UK | 3 | UAE | 9 |

| Note: Influential countries classifications based on; 1. the number of published papers in the selected data PPSX, 2. Total Global Citations (TGC). | ||||

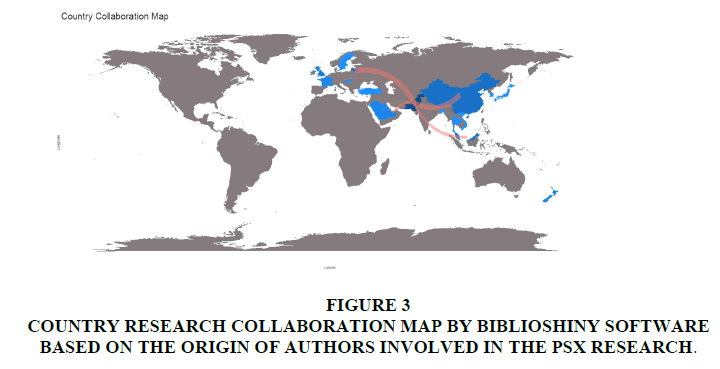

The country research collaboration map is given in figure 3 below. The map is produced through Biblioshiny software; the minimum edge parameter is taken as 2. It means the countries with a minimum of two collaborations will be counted. The pairs of Pakistan-China and Pakistan-Lithuania emerged as top collaborators sharing six researches each. It is followed by the pairs of Pakistan-Malaysia and Pakistan-UAE sharing three researches each.

Figure 3:Country Research Collaboration Map By Biblioshiny Software Based On The Origin Of Authors Involved In The Psx Research.

Likewise, different institutes from Pakistan are leading in PSX research. Comsats University Islamabad, Iqra University, Lithuanian Sports University, Shaheed Z.A. Bhutto Institute of Science & Technology, and the University of Sargodha are top in the list with five publications each. However, in terms of global citation scores, the situation is relatively different. The Islamic University Bahawalpur, with 49 citations, ranked first in the list. International Islamic University with 31 citations occupied the second position. The University of Karachi follows with 19, University Utara Malaysia with 18, and Lithuanian Sports University with 15 citations Table 3.

| Table 3 Most Influential Institutions In Psx Research |

||||

|---|---|---|---|---|

| Rank | Institution1 | PPSX | Institution2 | TGC |

| 1 | COMSATS University Islamabad | 5 | Islamia University Bahawalpur | 49 |

| 2 | Iqra University | 5 | International Islamic University | 31 |

| 3 | Lithuanian Sports University | 5 | University of Karachi | 19 |

| 4 | Shaheed Z. A. Bhutto Institute of Science & Technology | 5 | University Utara Malaysia | 18 |

| 5 | University of Sargodha | 5 | Lithuanian Sports University | 15 |

| Note: Influential institutions classification based on; 1. the number of published papers in the period selected (PPSX), 2. Total Global Citations (TGC). | ||||

In this study, the top authors have been categorized based on total global citations per year. Sadia Majeed from Islamia University Bahawalpur, with a total citation score of 45 and an annual score of 6.4, is top in the list. Syed Zulfiqar Ali follows her from International Islamic University with a total global citation score of 23 and the yearly score of 5.4. Waqas Mehmood from University Utara Malaysia is third on the list with 18 and 4 global and local citation scores, respectively. The other top authors are listed in table 4 below.

| Table 4 Most Influential Authors In Psx Research |

|||||

|---|---|---|---|---|---|

| Rank | Name of author* | Name of university/institution** | PPSX | TGC | TGC/t |

| 1 | Sadia Majeed | Islamia University of Bahawalpur | 2 | 45 | 6.4 |

| 2 | Syed Zulfiqar Ali | International Islamic University | 3 | 23 | 5.4 |

| 3 | Waqas Mehmood | University Utara Malaysia | 4 | 18 | 4 |

| 4 | Suleman Sarwar | University of Jeddah | 2 | 8 | 4 |

| 5 | Bisharat Hussain Chang | Shaheed Z.A. Bhutto Institute of Science & Technology | 1 | 10 | 3.33 |

| Note: * Extracted using HistCite software while considering the first author only. ** Institutions' ranking is based on Total Global Citations per year (TGC/t) | |||||

Research does not prosper in silos; it is an outcome of academic discourse on unknown factors in real-life situations. In this study, the co-authors' networks are also identified. We used Vosviewer employing a criterion of a minimum of 4 co-authored publications. The most knitted group of authors includes Jolita Vveinhardt, Dalia Streimikiene, Rizwan Ahmed, and Ahmad Nawaz for instance, (Vveinhardt et al., 2016, Ahmed et al., 2017, Ahmed & Vveinhardt, 2018, Palwasha et al., 2018).

Table 5 lists the articles with a higher impact in terms of total global citation per year in the available data. The study conducted by Majeed et al. (2015) published in the International Journal of financial studies is the most cited article per year, on average. The study examined the relationship between corporate governance and corporate social responsibility of firms in PSX. Further, Shah et al. (2018), the second study in the list, empirically explore the relationship of heuristic biases, investment decisions, and perceived market efficiency with reference to the Pakistan stock exchange. The factors like overconfidence, representativeness and anchoring have a markedly negative impact on investment decisions made by individual investors.

The third study on the list, Mehmood et al. (2020), explores the effects of pricing mechanism on initial public offerings (IPOs) oversubscription in Pakistan; the study concluded that the pricing mechanism is negatively significant with an oversubscription of IPOs. The study received 3.5 citations per year. The fourth study on the list is Chang et al. (2019), which received 3.33 citations per year. The study examined the relationship between equity prices and macroeconomic variables like industrial production, foreign direct investment (FDI), trade balance (TB), exchange rate.

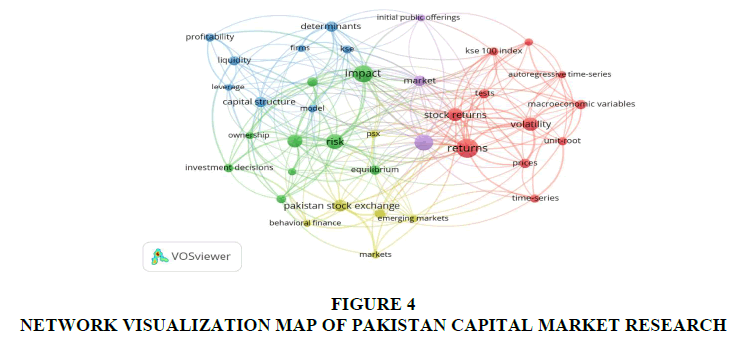

In addition, we employed a thematic clustering analysis to assess the research growth and clusters of studies in the given dataset, as suggested by Bahoo et al. (2020). A thematic analysis includes an assessment of keyword co-occurrence through a network visualization map and an overlay visualization map.

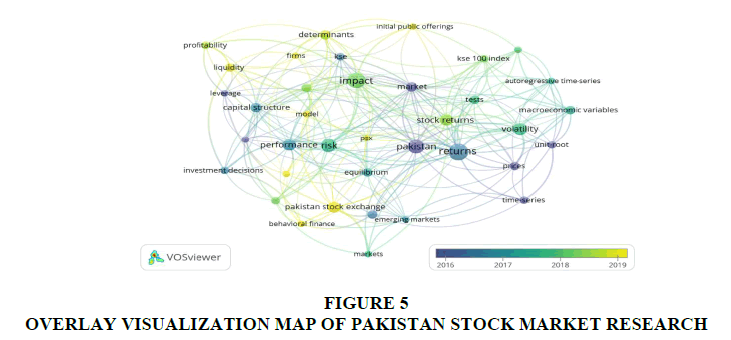

In contrast, keyword analysis is utilized to identify the research knowledge composition and areas of concentration in the given field of study (Deng et al. 2020); an overlay visualization map groups the selected studies into clusters based on time frame (with the help of various colors). In both maps (Figure 4 and Figure 5), the size of the bubble indicates the frequency of the occurrence of the keyword, the connecting lines represent the co-occurrence link, and the thickness of the lines shows the total strength of the link. Both analyses were performed in VOS viewer software using a cartography analysis technique. A total of 321 keywords were used in the selected article. Considering the relatively smaller dataset, we set a criterion of a minimum number of 2 keywords co-occurrences, and 48 articles out of 61 met the criterion.

The cartography or keyword analysis indicated five main clusters represented by different colors. The largest cluster represented through red color covers the keywords like stock returns, volatility, time series, unit root, etc. The other cluster represented by green color covers the keywords like risk, equilibrium, ownership, and corporate governance. The third-largest cluster represented by blue color encompasses the keywords like capital structure, profitability, liquidity, and leverage. The fourth cluster in yellow color covers keywords like behavioral finance, emerging markets, and the Pakistan stock exchange. The main keyword appearing in the fifth cluster (purple color) is the initial public offer.

The overlay visualization map is given below; this map groups the authors' keywords for their average publication years with the help of various colors shown in the color bar at the bottom left of the figure. As indicated by the figure, we may divide Pakistan capital market research into three main groups. The first cluster from 2005-2016 representing dark purple color. In this period, the research was mainly focusing on time-series, unit root, prices and leverage. The second period from 2017-2018 witnessed a research focus like stock returns, risk, volatility, and macroeconomic variables. Thereafter till 2021, the main focus of research changed to behavioral finance, liquidity, profitability, and IPO-related aspects.

This study conducted a bibliometric review of PSX literature using the Web of Science database. We used the related keywords in the search query in the WOS database and yielded 154 research articles. After applying the necessary filters, 101 most relevant papers were retained for further analysis. The study used biometric software like HistCite, Biblioshiny, and VOS viewer to conduct the analysis. For the Meta literature review, we conducted the following types of analysis (i) the influential aspects of PSX literature, (ii) co-authorship analysis, and (iii) keyword analysis. There is no previous study available on PSX literature, so we expect this study will add value to existing literature. Moreover, this study may be helpful for future researchers since it provides an overview of the main contributors, institutions, primary sources, and influential and trending articles related to PSX.

We found that, there are many studies on PSX covering different valuable aspects like volatility, price return, profitability, and its relationship with other macroeconomic variables. Pakistan is the leading country researching in the domain. The institutions like Comsats Institute Islamabad, Iqra University are the leading institutions. Whereas International transaction journal of engineering management & applied sciences & technologies and the African Journal of Business Management are the main sources publishing on the topic.

Regarding the utility of the study, the updated information about various researchers and institutions is useful for PSX investors and related institutions for future collaboration, testing, and upgrading of ideas relating to various aspects of this emerging capital market. For young academic researchers, information about the prominent and influential elements of PSX is vital. Furthermore, such type of information is helpful for future networking for researchers and other interested stakeholders.

This study possesses certain limitations in its scope. We have only used Web of Science as a database to extract the studies because the leading software used, i.e., HistCite, which only processes WOS data. PSX is an emerging stock market, and many good pieces of research are available in other databases like Scopus and google scholar. So future research may combine the data from all these databases to conduct a more comprehensive study.

References

Analytics, C. "Web of Science information." Retrived from: https://web.archive.org/web/20170224013916/http://wokinfo.com/citationconnection/realfacts.

Bala, A. (2013). "Indian stock market-review of literature." TRANS Asian Journal of Marketing & Management Research (TAJMMR) 2(7): 67-79.

Chang, B.H.M.S. Meo, Q.R. Syed and Z. Abro (2019). "Dynamic analysis of the relationship between stock prices and macroeconomic variables An empirical study of Pakistan stock exchange." South Asian Journal of Business Studies 8(3): 229-245.

Maku, O.E. and A.A. Atanda (2010). "Determinants of stock market performance in Nigeria: Long-run analysis."

Rakhal, R. (2018). "Determinants of stock market performance." NCC Journal 3(1): 134-142.

Vveinhardt, J.D. Streimikiene, A.R. Rizwan, A. Nawaz and A. Rehman (2016). "Mean reversion: an investigation from karachi stock exchange sectors." Technological and Economic Development of Economy 22(4): 493-511.