Research Article: 2021 Vol: 27 Issue: 3

A First Assessment of Covid-19 Pandemic in Financial Markets

Costas Siriopoulos, Zayed University

Citation Information: Siriopoulos, C. (2021). A First Assessment of Covid-19 Pandemic in Financial Markets. Journal of the International Academy for Case Studies, 27(S3), 1-8

Abstract

The paper summarizes some interesting results about financial markets and the covid-19 pandemic from recently published papers. I especially focus on risk/volatility and the contagion effects/spillovers in the financial markets due to covid-19 pandemic. Most literature primarily focused on government responses towards the pandemic, supply chain management, financial market’s reaction, and tourism management, and few if any in financial markets. This short paper aims to fill this gap providing a first assessment of the covid-19 pandemic and its impact in the financial markets.

Keywords

Covid-19, Financial Markets, Bibliometric Analysis, Risk, Contagion, Staple Food Soft Commodities, Islamic Finance, Volatility.

Introduction

In the preface of a recent document published by FSF-IIF-ISDA (2021) it is argued that “the COVID-19 pandemic arrived suddenly in a world that was unprepared for such an event and impacted the global economy”. However, the reality is totally different Mellish et al. (2020), among others, provide ample evidence that many governmental and international institutions preventing pandemics, and has highlighted the inability of governments to handle both local and global epidemics. The paper concludes that excess neoliberalism, which negatively impacted investment in healthcare national systems is the cause of the huge effect of covid-19.

Despite this, covid-19 pandemic has been seen as an extreme and unexpected event and almost all countries, imposed restrictions on good and mobility that affected the demand and supply to the commodities market. For others (Ahmed et al., 2021) covid-19 is certainly the first sustainability crisis of the 21st century. The first concerns of governments, analysts and researchers were focused on the economy and the government support to very small and small firms, as SMEs are main generators of employment and economic development in all economies. The restrictions imposed to prevent the spread of the covid-19 outbreak have had more severe effects on SMEs than on larger and multinational firms because they have lower capital reserves, fewer assets, lower levels of productivity, and limited access to credit markets (Siriopoulos, 2020; Dyduch, 2021; Jelacic, 2021). The ample evidence though is that covid-19 pandemic has brought uncertainty to all sectors in the globalized economies, including the financial sector.

The fact is that many countries have experienced a two-wave pattern in reported cases of coronavirus disease-19 during the 2020 pandemic, and empirical data show that the characteristics of the effects of the virus do vary between the two periods. Those differences refer to number of hospitalized patients, the symptoms, the age of patients and the duration of hospitalization, among others. Although symptoms were very similar, patients in the second wave were younger and the duration of hospitalization and case fatality rate were lower than those in the first wave (Iftimie et al., 2021).

In the first wave of the pandemic financial markets increased price volatility and its persistence might generate a new episode of international financial stress. Hence, the uncertainty due to the covid-19 may contribute to higher stock market volatility but also an indirect channel of uncertainty may well be created via significant stock markets drop. Also, the governance measures aimed at reducing the spread of covid-19 can significantly increase equity market volatility and this effect is clearly independent from the influence of the coronavirus pandemic itself. The recent empirical research detects negative effects not only on the stock markets, but also on oil prices, on commodities markets and on the cryptocurrency market, which are considered as a hedging instrument by investors (Ghulame et al., 2020; Ahmed et al., 2021). The synchronous developments of the stock markets during the outbreak of covid-19 confirms the familiar hypothesis of the interdependence of stocks markets and reinforces the view that the cost of risk diversification is the contagion effect due to the complex network of the financial markets and the interdependence between the financial institutions. It also indicates that the healthcare sector price is an important indicator that can assist policymakers in developing early economic and healthcare policy responses, especially during this unprecedented pandemic (Nammouri et al., 2021).

Numerous research papers have been already published and the general conclusion is that covid-19 had a negative impact on financial markets. In a recent bibliometric paper (Alshater et al., 2021) the authors examined 477 Scopus-indexed business-related articles to covid-19 and economy. Most literature primarily focused on government responses towards the pandemic, supply chain management, financial market’s reaction, real estate, aviation, and tourism management. The authors show that China, USA, India, and the United Kingdom produced the highest number of documents and citations in the field of covid-19 research in business. However, those and other bibliometric analyses do not conclude about the impact of covid-19 to the financial markets and the mechanisms of transmission. Indeed, Mahi et al. (2021) in a bibliometric analysis of pandemic studies in economics since 1974 reported that “the publications historically focus on the general issues related to economics” Liu et al. (2021) observed that the main themes of the existing studies are segmented to four parts, namely, the economic impacts of covid-19, the issues on measures, the influences of economy and measures on covid-19, the economic development in post-covid-19 era. Hence, while in accounting there are some references (Sarea, 2020), finance, amongst other fields, is not extensively represented. In this paper, I focus on the later issue, and especially on risk/volatility and the contagion effects/spillovers in the financial markets due to covid-19 pandemic. This short paper provides a first assessment of the covid-19 pandemic and its impact in the financial markets.

Evidence and Facts

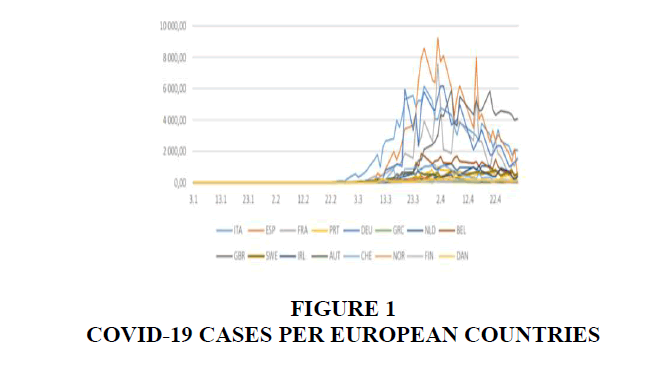

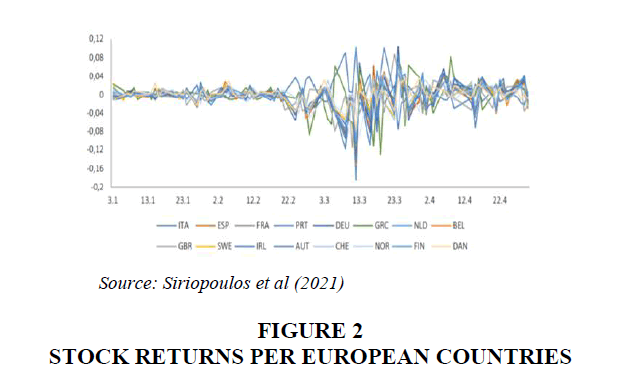

Ahmed et al. (2021) present evidence that the impact on the stock market performances “was only for a short period and it diminished in the second wave of covid-19 spread” in financial markets. Some interesting observations were published during the first wave of the pandemic (January 2020-April 2020). For instance, simple standard deviation calculations show that the volatility levels of all the European countries have increased from January 2020 to March 2020, while the peak was during March 2020 and decreased afterwards.

Second, there is evidence of divergences; although European capital market seems to calm down during April 2020, covid-19 cases and deaths were still increasing. It was observed that the peak in both Chinese market volatility and Chinese covid-19 cases happened during February 2020; afterwards an essentially decreasing trend is observed in china. Third, the most volatile European market was Greece, while in the first wave had the fewest covid-19 cases (Siriopoulos et al., 2021). Indeed, as reported in Georgeou and Hawksley (2020).

“Greece was one of the few countries that successfully managed to prevent the first wave of covid-19 pandemic from spreading in its territory. The infection numbers and fatalities were notably lower compared to other European countries”

Another fact is the non-synchronicity of cases and volatility of returns. From Figure 1 and Figure 2 it is observed the volatility of stock returns of European stock exchanges along with the number of cases due to covid-19. It is clear that in the European stock markets, investors priced the pandemic before it spreads (Siriopoulos et al., 2021). This is evidence that volatility in the European market is not a consequence of the pandemic.

Mensi et al. (2021) examined price-switching spillovers between the US and Chinese stock, crude oil, and gold futures markets before and during the first wave of covid-19 pandemic. The authors show that “stock markets were mainly influenced by their own shocks”, which is similar to the finding provided by another study (Siriopoulos et al., 2021), which shows “that shocks derived from the European stock markets have impact on their own volatility” Li (2021) found that during the coronavirus recession, “The total degree of volatility spillover is staying at an extremely high level, and emerging markets are the main risk receivers in the 2020 stock markets crash”. There is also reported evidence that covid-19 cases and deaths have no impact on the European stock returns. VIX, which is the standard measure accounting the market volatility and investors’ sentiments, show that the overall uncertainty in international markets negatively affects European stock markets, but its impact is smaller as compared as to the Chinese shock. In fact, Siriopoulos et al. (2021) estimated that the volatility of European stock returns is due to approximately 34% on Chinese returns and only the 7% of volatility is anticipated by VIX. The authors state that “The variables of covid-19 do not essentially affect the European returns, although some limited effects are detected in the short term”. The effect of VIX indicates that investors view the European financial market as an integrated market, and this prospect inevitably makes Europe vulnerable to worldwide risks indicating the cost of contagion effect.

One more fact is the economic power of China, which is increasing last decades. Siriopoulos et al. (2021) provide evidence, that China’s influence is greater on the stock returns of countries with the highest value in the index number of deaths per million. This result is an additional indication of the transmission capacity of China and reflects concerns about the developments of the Chinese stock market and international uncertainty.

Crises seem to be a part of modern capitalism and increased interdependence between financial markets and institutions has led to more financial fragility. When studying capital markets, we are using models based on the notion of the risk diversification claiming that if we distribute the risk among different assets, then investors’ portfolio would exhibit less risk/volatility. In that sense, the benefits of integration of capital markets are gained by diversification. Yet, in interdependent markets there is no diminution of risk through diversification, but rather amplification, through contagion. Hence, the cost of interdependence and financial interlinkages between financial markets and financial institutions is measured by contagion effects (Stiglitz, 2011).

However, there is evidence that crises affect evolution and connection of capital markets and emphasize the advantages of the sectoral contagion phenomenon that provides some benefits of international diversification during crises (Nammouri et al., 2021; Nammouri et al., 2021).

Study sectoral co-movements by focusing specifically on the healthcare sector as the source of sectoral contagion during the covid-19 outbreak. They are using healthcare index as the benchmark index to evaluate sectoral contagion before and during the covid-19 period. The healthcare sector is found to be correlated with other sectors during the covid-19 period and accelerated in the post-covid first period confirming the varying and volatile interdependencies between the sectors. The authors observe low volatility values for all sectors in US capital market (except in the energy sector) during the first wave of covid-19 pandemic. The authors reveal a new relationship with the healthcare industry in response to the covid-19 crisis. This finding also reflects the contagion's occurrence from the healthcare sector to other sectors and indicates the importance of the healthcare sector's impact to other sectors but also highlights the role of healthcare stock in forecasting stock prices in the short and long run. As for the last observation, additional evidence is provided by Gkillas et al. (2021) revealing that “an uncertainty-due-to-infectious disease has significant predictive value on the changes of the stock-bond relation”. In another paper, Nugroho (2021) shows that the outbreak of covid-19 increases the dynamic connectedness of gold and gold-backed cryptocurrencies, which also indicates a contagion effect Yousfi et al. (2021) also supports the presence of volatility spillovers (contagion effects) between the US and the Chinese stock markets, especially during the rapid spread phase of COVID-19 in the US, but asymmetric effects on the correlation between the two markets have been observed.

A clear fact is that government measures caused demand and supply shocks to the commodity markets as well, which are differentiated between hard commodities (such as energy and metal commodities) where their prices were reduced during covid-19 pandemic (Ghulame et al., 2020; Ahmed, 2021). On the contrary, it is reported that the panic of buying behavior increased the demand for soft commodities (such as grains, cereals, live stocks etc.). Their results show that staple food soft commodities (wheat, corn, and cocoa) and the futures on corn, cotton and cocoa possess strong positive co-movement with global covid-19 fear index and can be used as safe-haven assets due to their price resilience during the times of covid-19 pandemic. However, the non-staple soft commodities do not exhibit this behavior as their consumption is not persistent and consumers switch to healthy foods during the covid-19 outbreak to boost their immunity against the covid-19. As reported by the authors during the covid-19 outbreak investors search for alternative asset classes to invest in order to hedge the risk of their portfolios, and the commodity asset class is one option. The authors examined the behavior of commodities during covid-19 to investigate the safe-haven properties of soft commodities and commodities futures and concluded on investment strategies that investors could adopt during covid-19 pandemic.

Recently, there is a growing literature investigating whether Islamic financial markets outperform conventional markets, but few studies have examined the reaction of Islamic markets to the covid-19 pandemic. As a general critic, various authors have argued that faith-based investments diverge from the definition of the efficient portfolio principles, and hence only in the short run faith-structured portfolios are sustainable. Recent studies have examined the performance of Sharia-compliant markets compared with that of conventional markets during the covid-19 pandemic (Adekoya et al., 2021). The authors findings provide evidence of a strong integration and competition between conventional and Islamic stock markets given the high total connectedness index of 93.7%. They also found that “both the covid-19 incidences of all the countries considered in the paper (United States, China, Saudi Arabia, and Nigeria), and the speculative and sentiment factors are found to strongly affect the volatility connectedness across the sectors”. An interesting result for investors is that during extreme market risks induced by health contagions, “investment in conventional and Islamic firms dealing in technology and utilities would provide greater hedging advantage than in other financial sectors”.

The last decade financial literacy has received great attention by investors, markets, policy makers and regulators (Lusardi & Mitchell, 2014). It is argued that investor education may be “considered as a systemic risk management tool for future financial crises and, especially, financial literacy can drive a wedge between the regulation and the prevention of severe financial crises based on expected benefits versus losses” (Siriopoulos, 2021; Chhatwani & Mishra, 2021) investigated financial literacy and its implications during covid-19 and found that financial literacy reduces the odds of being financially fragile by 9.1%. On April 2020, OECD observed that covid-19 has accelerated the need to promote financial literacy as an essential tool for individuals and investors to manage their financial affairs and build greater resilience. OECD (2020) issued several reports supporting the financial resilience of citizens throughout the covid-19 pandemic.

However, for a comprehensive assessment more papers should be analyzed including all scientific fields. Durieux and Gevenois (2010) argue that bibliometric analysis is an objective evaluation of scientific research, presenting the main and most important findings of current research on a topic, along with future research and development trends. For instance, in a recent bibliometric paper, Fan et al. (2020), explored the differences between English language and Chinese language Medical/Scientific journals publications, particularly aiming to explore the efficacy/contents of the literature published in English and Chinese in relation to the outcomes of management and characterization of covid-19 during the early stage of covid-19 pandemic. They found that “more studies have been published in Chinese journals than in English, due to the epicenter being located in Wuhan” Wand and Tian (2020) in a similar study show that the United States has contributed the most published literature, followed by China. According to that study.

“The United States has published the most reports included in the Web of Science in the categories of non-pharmaceutical interventions, treatment, and vaccine-related reports, while China has published the most literature in the categories of clinical features and complications, epidemiology, and detection and diagnosis”

In a bibliometric analysis of pandemic and epidemic studies in economics 1974-2020, Mahi et al. (2021) show that the most productive countries in terms of total publications are USA, UK, China, although it first was China in 2002 that spurred the increased interest in this research area.

In a related study, regarding finance, most papers are published in English, even in Chinese journals, although Chinese financial markets are included in many papers. As an example, China Finance Review International (2021) only recently dedicated a special issue on covid-19 and financial market stability. This is also due to the fact that researchers would prefer to be published in high-quality journals ranked in reputable lists.

Conclusion

The importance of the rapid spread of the covid-19 virus has caused people, governments, and investors around the world to panic since January 2020. Subsequently, considerable attention has been focused on covid-19 from academics to examine the characteristics of the pandemic and evaluate practical guidelines to investors and policy makers. However, as provided by different bibliometric analyses, finance is not well represented in the related research with covid-19 and its impact (Liu, 2021; Mahi et al., 2021, amongst others). In this short paper I have assessed the impact of covid-19 pandemic to the financial markets provided by some interesting, published works. Covid-19 impacted the whole economic sectors, and the reported evidence is clear.

Considering that the knowledge about the findings of the existing studies about covid -19 and the financial markets is not only helpful to understand the research progress and the connections between covid-19 and financial markets’ reaction, but also provides effective suggestions for fighting against covid-19 and protecting investors. It also offers a guide to policy makers and financial regulators. Finally, it reveals the agenda for future research and collaborations.

References

- Adekoya, O.B., Oliyide, J.A., & Tiwari, A.K. (2021). Risk transmissions between sectoral Islamic and conventional stock markets during COVID-19 pandemic: What matters more between actual COVID-19 occurrence and speculative and sentiment factors? Borsa Istanbul Review.

- Alshater, M.M., Atayah, O.F., & Khan, A. (2021). What do we know about business and economics research during COVID-19: a bibliometric review. Economic Research-Ekonomska Istraživanja, Pp.1-29.

- Ahmed, F., Syed, A.A., Kamal, M.A., de las Nieves López-García, M., Ramos-Requena, J.P., & Gupta, S. (2021). Assessing the Impact of COVID-19 Pandemic on the Stock and Commodity Markets Performance and Sustainability: A Comparative Analysis of South Asian Countries. Sustainability, 13(10), Pp. 5669.

- Chhatwani, M., & Mishra, S.K. (2021). Does financial literacy reduce financial fragility during COVID-19? The moderation effect of psychological, economic and social factors. International Journal of Bank Marketing.

- China Finance Review International (2021).

- Durieux, V., & Gevenois, P.A. (2010). Bibliometric Indicators: Quality measurements of scientific publication, Radiology, 255(2), 342-351.

- Dyduch, W., Chudziński, P., Cyfert, S., & Zastempowski, M. (2021). Dynamic capabilities, value creation and value capture: Evidence from SMEs under Covid-19 lockdown in Poland. Plos One, 16(6), e0252423.

- Fan, J., Gao, Y., Zhao, N., Dai, R., Zhang, H., Feng, X., Shi, G., Tian, J., Chen, C., Hambly, B.D., & Bao S (2020). Bibliometric Analysis on COVID-19: A Comparison of research between English and Chinese studies. Front. Public Health 8, Pp. 477.

- FSF-IIF-ISDA (2021). The role of financial markets and institutions in supporting the global economy during the COVID-19 pandemic. Retrieved from https://www.isda.org/a/zZzTE/The-Role-of-Financial-Markets-and-Institutions-in-Supporting-the-Global-Economy-During-the-COVID-19-Pandemic.pdf

- Georgeou, N., & Hawksley (2020). State responses to Covid-19: A global snapshot at 1 June 2020, HARDI, Western Sydney University. Retrieved from https://researchdirect.westernsydney.edu.au/islandora/object/uws:56288

- Ghulame, R., Ali Awais, K., Siriopoulos, C., & Samitas, A. (2020). Safe-Haven properties of soft commodities during times of COVID-19. Retrieved from SSRN: https://ssrn.com/abstract=3740588

- Gkillas, K., Konstantatos, C., & Siriopoulos, C. (2021). Uncertainty due to infectious diseases and Stock-Bond correlation. Econometrics, 9(17).

- Iftimie, S., López-Azcona, A.F., Vallverdú, I., Hernández-Flix, S., de Febrer, G., & Parra, S. (2021). First and second waves of coronavirus disease-19: A comparative study in hospitalized patients in Reus, Spain. Plos One, 16(3), e0248029.

- Jelacic, D., Pirc Barcic, A., Oblak, L., Motik, D., Groselj, P., & Jost, M. (2021). Sustainable Production Management Model for Small and Medium Enterprises in Some South-Central EU Countries. Sustainability, 13, 6220.

- Liu, N., Xu, Z., & Skare, M. (2021). The research on COVID-19 and economy from 2019 to 2020: analysis from the perspective of bibliometrics. Oeconomia Copernicana, 12(2), 217-268.

- Lusardi, A., & Mitchell, O.S. (2014). The Economic Importance of Financial Literacy: Theory and Evidence, Journal of Economic Literature, 52(1), 5-44.

- Mahi, M., Mobin, M.A., Habib, M., & Akter, S. (2021). A bibliometric analysis of pandemic and epidemic studies in economics: future agenda for COVID-19 research. Social Sciences & Humanities Open, 4(1), 100165.

- Mellish, T.I., Luzmore, N.J., & Shahbaz, A.A. (2020). Why were the UK and USA unprepared for the COVID-19 pandemic? The systemic weaknesses of neoliberalism: a comparison between the UK, USA, Germany, and South Korea. Journal of Global Faultlines, 7(1), 9-45.

- Mensi, W., Reboredo, J.C., & Ugolini, A. (2021). Price-switching spillovers between gold, oil, and stock markets: Evidence from the USA and China during the COVID-19 pandemic. Recourses Policy, 73.

- Nammouri, H., Chlibi, S., & Labidi, O. (2021). Co-movements in sector price indexes during the COVID-19 crisis: Evidence from the US. Finance Research Letters.

- Nugroho, B.A. (2021). Spillovers and bivariate portfolios of Gold-Backed cryptocurrencies and gold during the COVID-19 outbreak. Journal of Islamic Accounting and Business Research.

- OECD (2020). Retrieved from https://www.oecd.org/financial/education/financial-education-responses-to-covid-19.html

- Sarea, A. (2020). A bibliometric review on COVID-19 and accounting research. Journal of Investment Compliance, 21(4), 203-207.

- Siriopoulos, C. (2020). The impact of covid-19 on entrepreneurship and SMEs. Journal of the International Academy for Case Studies, 26(2), 1-2.

- Siriopoulos, C. (2021). Financial markets are not efficient: Financial literacy as an effective risk management tool. International Journal of Business and Management Research, 9(1), 65-73.

- Siriopoulos, C., Svingou, A., & Dandu, J. (2021). Lessons for Euro markets from the first wave of COVID-19. Investment Management and Financial Innovations, 18(1), 285-298.

- Stiglitz, J. (2011). Rethinking macroeconomics: What failed and how to repair it. Journal of the European Economic Association, 9(4), 591-645.

- Yousfi, M., Zaied, Y.B., Cheikh, N.B., Lahouel, B.B., & Bouzgarrou, H. (2021). Effects of the COVID-19 pandemic on the US stock market and uncertainty: A comparative assessment between the first and second waves. Technological Forecasting and Social Change, 167, 120710.