Case Reports: 2018 Vol: 24 Issue: 4

A Holdings Company and Its Synergy Korea Kolmar Case

Kyung-Hee Park, Ewha Womans University

Jinho Byun, Ewha Womans University

Jungsoon Shin, Ewha Womans University

Case Description

The present case study examines the advantages that were gained as Kolmar Korea, a cosmetics manufacturer, transformed into a holding company and the strategies it used to maximize the synergy between its subsidiary companies. The case is designed to be taught in three class hours and is expected to require approximately six hrs. of outside preparation by students.

Case Synopsis

In 2012, Kolmar Korea decided to become a holding company, the first holding company in the Korean cosmetics industry. The market welcomed their restructuring and it was considered to be quite exceptional. Kolmar Korea’s decision to change its corporate structure into that of a holding company increased its market capital by 50%, from 42 billion KRW to 63 billion KRW. The present case study examines the holding company system, the advantages that a manufacturer can gain as a holding company and the effect that this restructuring had on Kolmar Korea’s shareholders.

Korea Kolmar Holdings began its life as a cosmetics company but expanded into the pharmaceuticals and functional health foods industries through its subsidiaries. Thus, the present case study also examines how Korea Kolmar Holdings maximized the synergy arising from the relationships between its diverse holdings.

Case Body

Beginnings as a Cosmetics Company

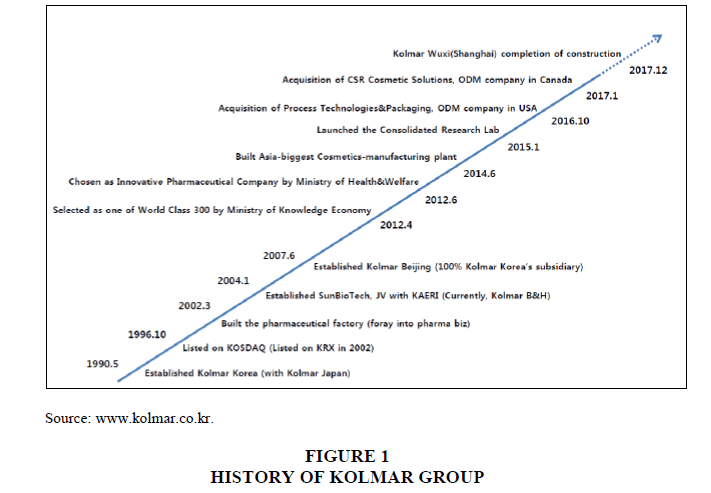

Kolmar Korea was founded as a cosmetic Original Equipment Manufacturer (OEM) (Kim and Ryou, 2016; Figure 1). At the time, the cosmetics market in Korea was relatively small and undeveloped. As the Korean economy developed, Chairman Yoon was convinced that the cosmetics industry would grow. At the time of its establishment, Chairman Yoon visited Kolmar America in order to establish a joint venture because it had many advantages including the world-wide network of Kolmar companies such as Kolmar America, Kolmar Japan and Kolmar Canada, etc. The Kolmar America recommended the Kolmar Japan which was looking for a business partner.

After the negotiations with Kolmar Japan, he established the joint venture successfully. Kolmar Japan had 51% share, while Yoon owned only 49% share. The minor shareholding of Yoon was a necessary choice for transferring cosmetics manufacturing technology and raising the funds as a subsidiary of Kolmar Japan. And Kolmar Japan had a typical Japanese company structure. It used to be the top manufacturer of Japanese cosmetics and continues to produce steady sellers like SK2 and other high quality brands.

Cosmetics OEMs typically only manufacture what cosmetics companies order and thus do not need to develop new products. Thus, the limits of this type of company were clear. After benchmarking the corporate practices of cosmetics companies in developed nations, Chairman Yoon decided to introduce the Original Design and development Manufacturing (ODM) business model to the Korean market. The ODM model requires the manufacturer to independently develop products and manufacturing methods to produce those products based on customer orders (Kim and Ryou, 2016).

At the end of the 1990s, South Korea went through the IMF crisis and the economy suddenly shrunk. Consumers greatly decreased their spending on cosmetics, which led to difficult situations for cosmetics companies. As a response to this crisis, cosmetics companies began to outsource manufacturing. In the early 2000s, cosmetics companies that solely focused on distribution and marketing without doing any manufacturing began to appear, starting a new trend. It was in this socioeconomic context that Kolmar Korea was able to grow as an ODM company. Kolmar Korea grew to be the number one company in the ODM industry with 40 billion KRW in annual sales and with a market share of 49%.

Expansion into the Pharmaceuticals Sector

In 2002, Kolmar Korea decided to expand into the pharmaceuticals sector where ODMs are known as Contract Manufacturing Organizations (CMO, Figure 1). Unlike the cosmetics industry, the pharmaceutical industry is focused on the development of new medicines. The development of new medicines requires large concentrations of capital and long development timelines. Therefore, CMOs mostly produce generic pharmaceuticals, which are pharmaceuticals that have been somehow changed relative to their original patent or that are produced in different doses or forms after the original patent has expired. Kolmar Korea first began by producing ointments made with similar manufacturing methods as cosmetic creams used in dermatologist’s offices. Kolmar Korea was initially a cosmetics company, so its generic ointments were quickly adopted.

Companies in the pharmaceuticals sector have to have significant manufacturing capacity. However, equipping factories requires a lot of capital, so Kolmar Korea had to determine how build a new plant. At about this time, BRN Science, a KOSDAQ-listed company, went bankrupt as it was unable to finance the construction of a cutting-edge pharmaceuticals factory. Upon hearing the news, Kolmar Korea representatives visited the factory and discovered that it met Kolmar Korea’s needs. Such a factory would have cost Kolmar Korea at least 3.2 billion KRW to build, but Kolmar Korea was able to purchase it for 2.2 billion KRW. Kolmar Korea seized the opportunity and bought out BRN Science and changed its name to Kolmar Pharma. Kolmar Pharma began to receive orders that could be filled by the new factory beginning in 2013 and has grown by over 10% every year since then. It quickly became the top pharmaceutical CMO. Based on such outstanding growth, Korea Kolmar Holdings is considering conducting an Initial Public Offering (IPO) for Kolmar Pharma.

Holding Company Restructuring

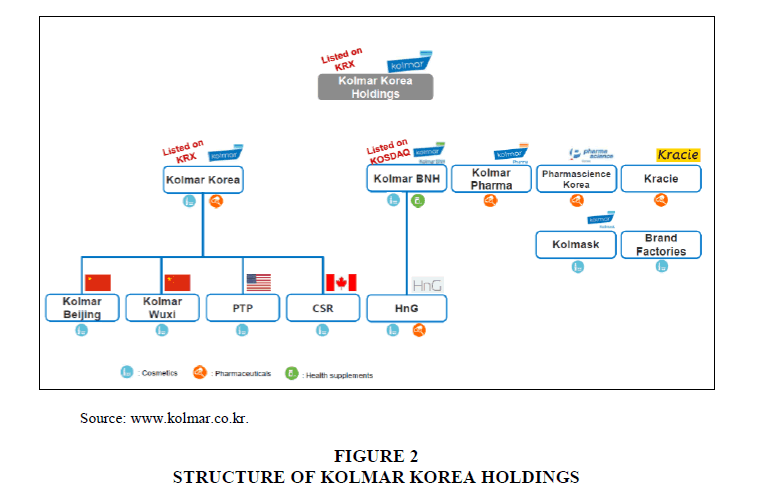

As Kolmar Korea founded subsidiary companies such as Kolmar Pharma and Kolmar BNH, its corporate size grew tremendously. Kolmar Korea decided to convert its corporate structure into that of a holding company. After converting Kolmar Korea into the holding company named Korea Kolmar Holdings and the manufacturing company Kolmar Korea, Kolmar Korea was relisted on the KOSPI market. Through this process, in 2012 Korea Kolmar Holdings became a holding company with four subsidiaries. It became the first holding company in the Korean cosmetics industry. Then the company is reorganized as shown in Figure 2.

At that time, conversion to holding company was strongly encouraged by Korean government in order to enhance the transparency of corporate governance after promulgating relative laws on holding companies. By doing so, companies were eligible for a large amount of tax credits. One of the advantages was, the major shareholder’s share can also be increased. As Yoon had started his business in the form of a joint venture, he did not have a strong controlling power compared to other CEOs of family-owned firms. Therefore, the conversion to a holding company was a good opportunity for him.

Kolmar Korea’s conversion into a holding company caused its stock price to increase rapidly. Its pre-announcement price was around 7,000 KRW but between the announcement of the conversion and the actual conversion, it increased by about 100%. This phenomenon occurred because investors saw the restructuring as a positive change.

The Main Products Produced By the Kolmar Korea Group

It is difficult to think of the pharmaceutical and cosmetics industries as being similar. However, their manufacturing practices are similar in many ways. Chairman Yoon understood these similarities because he had worked at a pharmaceutical company before he founded Kolmar Korea.

For example, liquefaction is the process of chemically mixing oil and water and is used to manufacture cosmetic lotions and creams and dermatological ointments. There are other shared processes as well, like that of manufacturing fine powder. Such techniques and manufacturing processes were applicable in the manufacture of both cosmetics and pharmaceuticals. Thus, the Kolmar Group mostly produces dermatological medicines, including ointment to treat atopy and medicine to treat athlete’s foot. Many consumers have now come to think of Kolmar Korea as a pharmaceutical company that mostly produces dermatology products.

Kolmar Korea produced many dermatological medicines which were considered to be effective. A researcher who had worked in a cosmetics research lab for 20 years was appointed to Kolmar Korea’s pharmaceutical research center and developed a medicine to treat athlete’s foot that could be applied to the skin like nail polish. This product was the first Korean product to be granted permission to be developed as a generic pharmaceutical. This product is currently being sold by nine pharmaceutical companies and Kolmar Korea is the only company in Korea that can manufacture this product.

Establishment of Research Centers and Investment in Research and Development

The most important factor in the survival of ODMs and CMOs is maintaining a high level of technical capability because they must develop and manufacture products that their customers request. Korea Kolmar Holdings has continued to increase its technical capabilities by developing new technologies and products which it presents at regular meetings of all of its subsidiary’s research centers. In these meetings, which are presided over by Korea Kolmar Holdings, many new ideas regarding the development of new products are discussed.

Korea Kolmar Holdings has tended to move staff between cosmetics and pharmaceutical positions. Chiefs, department heads and senior researchers from the cosmetics research center have been transferred to the pharmaceutical research center and those who have worked at the pharmaceutical research center for a long time have been transitioned to the cosmetics research center. The fruition of this strategy was the Fulcare generic fingernail and toenail medicine for treating athlete’s foot. Despite such strategies, each research center is located in a different region and is affiliated with a different subsidiary company. In order to deal with the difficulties arising from this arrangement, Korea Kolmar Holdings created an integrated technology institute in order to facilitate and vitalize the networks between the research centers. It is hoped that this decision will produce a synergetic effect on the research of shared technologies and increase research efficiency by integrating the cosmetics, pharmaceuticals and health functional foods research centers. Furthermore, the new integrated technology institute will be located in Seoul, so customer accessibility and sales capacity will increase.

Overseas Expansion

Once Kolmar Korea had reached a certain domestic market share, they found overseas expansion critical to further growth. If they focus on the domestic market share, it would result in a sharp increase in marginal costs such as marketing and negotiation costs with retailers. In addition, when the Chinese government opens its market to foreign companies, the establishing cost of Chinese factories was relatively low. Moreover the Chinese cosmetic market has been growing rapidly due to the increased consumption of cosmetics.

In 2004, Kolmar Korea decided to expand into the Chinese cosmetics industry. Beijing Kolmar (Figure 2), a subsidiary of Kolmar Korea, has been doing well in the ODM business through its technical competence and Kolmar Korea’s client management experience. In 2010, Beijing Kolmar built a factory which finally turned profitable in 2013 because of steady sales. Much of these sales were from Proya, Beijing Kolmar’s major client, accounting for 300 billion KRW, making Beijing Kolmar the second-highest grossing company in the Chinese cosmetics market.

Now Kolmar Korea has set its sights beyond China. It is currently attempting to expand into the bigger North American market. North America is a leading global cosmetics market and its entry into the market as a cosmetic company highlights its identity as a leading global company. In 2016, Kolmar Korea entered an agreement to take over Process Technologies and Packaging (PTP, Figure 2), a United States ODM, in conjunction with Wormser, a specialized sourcing company, in order to expand into the United States cosmetics market. As a joint company, Kolmar Korea is in charge of research and development and manufacturing while Wormser is in charge of sales and marketing.

Instructor’s Notes

This case study analyzes what Kolmar Korea gained by restructuring itself from a cosmetics manufacturing company into a holding company. Furthermore, it examines what kind of synergetic effect that the holding company system was able to produce from a manufacturing perspective. It explores the advantages of the holding company system in expanding into new industries. It also examines the influence that subsidiarie’s various business strategies, such as IPOs and overseas expansion, had on the holding company.

Learning Objectives

1. Review and examine the functions and advantages and disadvantages of holding companies.

2. Examine the influence that conversion to a holding company has on stockholders.

3. Analyze the strategies used by Korea Kolmar Holdings to maximize the synergetic effect between its subsidiaries.

4. Understand IPOs and examine the effect that the subsidiaries’ IPOs have on the parent company.

5. Examine the profits gained by the holding company when the subsidiaries expand overseas.

Discussion Question

1. What is a holding company? How do profits increase when a company restructures as a holding company?

A holding company is a company that holds stock of other companies in order to govern them. Holding companies are categorized as either pure or operating holding companies depending on how business decisions are made and as either general or financial holding companies depending on their subsidiary’s industries. A pure holding company governs the business activities of other companies and does not conduct any other business while an operating holding company governs other companies and engages in its own business activities, like manufacturing and sales.

Bonbright et al. (1932) proposed four types of holding company goals. First, holding companies aim to be conservative independent businesses through singular control or combining into the rights of management. Second, independent businesses can engage in combined financial operations. It is possible to make the decisions that optimize outcomes for the group by setting goals for subsidiaries, such as reaching particular sales targets and evaluating whether those goals were reached or not. Third, financial restructuring is possible. Fourth, holding companies have vertical structures, so companies can be governed by adjusting which company owns which shares within the holding company family.

2. What would a stockholder say about the restructuring into a holding company?

General investors can look forward to an increase in company value from the improved corporate governance as a result of restructuring into a holding company. However, there is a complicated evaluation process for becoming a listed company and to produce various commissions. There is the further cost of founding the holding company, which itself must be managed. Korean law requires that holding companies must own a certain minimum percentage of their subsidiaries. Holding companies require a large sum of capital when they want to increase the percentage of their subsidiaries that they own. If the increased company value that occurs as a result of the transformation does not offset these costs, then restructuring is not appealing to minority shareholders.

If shareholders do not participate in the Seasoned Equity Offerings (SEO) during the holding company transformation, their shares might be diluted. Furthermore, the holding company has governance rights even though they only own a part of their subsidiary’s issued stocks, so there may be a conflict of interest between the holding company and minority shareholders when decisions are made to benefit the holding company or another subsidiary. The holding company seeks to maximize the group’s profits while minority shareholders seek to maximize the value of the specific subsidiary company for which they own shares. Such a situation can cause conflicts.

3. Analyze the strategies used by Korea Kolmar Holdings to maximize the synergetic effect between its subsidiaries.

Kolmar Korea’s value increased due to knowledge- and information-sharing between the cosmetics and pharmaceutical businesses. These two businesses shared not only how to apply liquefaction and powder technology, but also technical knowledge and advancements in research and development. There are currently three pharmaceutical research centers and three cosmetics research centers, including the Beijing research center. Researchers rotate between each center. In order to maximize the synergetic effect of this knowledge-sharing, all 14 research centers affiliated with Kolmar Korea were planned to be consolidated into a single integrated research center in 2017.

1. Technology transfer

a. Kolmar Korea, which was founded as a cosmetics company, was able to break into the pharmaceuticals industry by producing ointment by leveraging its cream manufacturing expertise. The lotion cosmetics and ointment pharmaceuticals manufacturing processes are almost exactly the same, so Kolmar Korea faced little risk in expanding into the pharmaceuticals industry despite the differences between the cosmetics and pharmaceuticals industries.

b. Furthermore, Kolmar Korea became the only company in the Korean market with the right to manufacture the generic Fulcare athlete’s foot treatment because of its nail lacquer composite international patent on the product, which was produced based on its nail polish production expertise. Kolmar Korea was able to stably enter the pharmaceutical industry by producing the generic Fulcare.

2. The establishment of an integrated research center

a. Korea Kolmar Holdings is building an integrated research center in order to maximize the synergy of technology transfers between its subsidiaries. The cosmetics, pharmaceuticals and health functional foods research that was being conducted separately at each subsidiary’s research center can be jointly conducted and shared through such an integrated research center. It is expected that the shared exploration of new materials and manufacturing methods in each of these sectors will produce significant results. This type of integrated research center is only possible because Korea Kolmar Holdings manages the system through its control over the entire corporation.

3. Rotating human resources assignment system

As a holding company, Korea Kolmar Holdings can assign researchers in its subsidiaries to any other subsidiary. When a pharmaceutical researcher is assigned to a cosmetics research position, they can bring their technical skills developed in the pharmaceutical industry to the cosmetics industry, creating products that competitors cannot. Health functional foods researchers can create innovative products by analyzing the efficacy of new inputs.

4. Discuss the effect that subsidiary IPOs have on Korea Kolmar Holdings.

IPOs are when companies first publicly issue stock. IPOs give companies many advantages. After IPOs, company stock can be traded on the open market, which helps companies to raise money and increase the liquidity of their shares. Furthermore, in order to be listed on stock exchanges after an IPO, companies must be examined by financial authorities, so being listed on stock exchanges signals to investors and creditors that listed companies are more likely to be stable. Therefore, company’s credit ratings often increase, reducing the cost of capital (Pagano et al., 1998) and increasing the value of company’s names.

When a subsidiary makes an IPO its holding company gets an evaluation of the subsidiary’s market value, which increases the holding company’s value. This phenomenon occurs because, generally, when a subsidiary’s value is evaluated, this updated value is reflected in the holding company’s book value. Sometimes competitive companies are undervalued but then become appropriately evaluated following an IPO. The well-known investor Peter Lynch calls these companies “asset players”. An asset player is a company that owns valuable assets such as real estate, oil, or metal but which the market has undervalued (Lynch et al., 2000).

5. What are the profits gained by a holding company when a subsidiary expands overseas?

When a subsidiary expands overseas, it can increase its holding company’s value by leveraging the tax systems of the countries where it operates. Each country has a different tax system and so offers different tax deductions or different costs and benefits of tax treaties. Therefore, a holding company can establish an integrated financial strategy to reduce its tax burden.

When a holding company exchanges goods with its subsidiary, the price for that good is known as the transfer price. The holding company can set the transfer price in such a way that it can move profits from a high-tax country to a low-tax country. The transfer price can also be set to collect capital from a country that is expected to experience currency devaluation. For example, when tariffs are collected based on a product’s value, the price of that product can be estimated to be lower in order to reduce the company’s tax burden.

Well-known medicines and medical supplies made by the Kolmar Group:

1. Fulcare generic: Medicine for treating athlete’s foot in fingernails and toenails.

2. Lidomex: Ointment for treating atopy.

3. Antiphlamine: Anti-inflammatory lotion with 81 years of history.

4. Hiforge: A generic version of exforge, a medicine used for treating high blood pressure created by Novatis, Manufactured for 26 Korean companies.

References

- Bonbright, J.C., Means, G.C., & Mound, M. (1932). The holding company: Its public significance and its regulation. McGraw-Hill Book Company.

- Pagano, M., Panetta, F., & Zingales, L. (1998). Why do companies go public? An empirical analysis. The Journal of Finance, 53(1), 27-64.

- Lynch, P.S., Lynch, P., & Rothchild, J. (2000). One up on wall Street: How to use what you already know to make money in the market, (First Edition). Simon and Schuster.

- Kim, H.E., & Ryou, H.S. (2016). A case study on Kolmar Korea Inc. in cosmetic OEM/ODM industry. Korean Business Education Review, 31(2), 279-310.

- Yoon, D.H. (2016). Humanities came into management. Freeeconomicbooks

- Kolmar Korea pharmaceutical division homepage (1990). Retrived from: http://www.kolmarpharm.co.kr

- Kolmar Pharma homepage (2016). Retrived from: http://www.kolmarpharma.com

- Kolmar Korea homepage (2016). Retrived from: http://www.kolmar.co.kr/