Research Article: 2017 Vol: 21 Issue: 3

Access to Financing and Regional Entrepreneurship in Ecuador: An Approach Using Spatial Methods

Rafael Alvarado, Universidad Nacional de Loja

Abstract

Entrepreneurship is one of the most effective ways to generate employment and income and to strengthen an economy. In this process, access to financing is key to the birth of new companies and remains over time. The objective of this research is to examine the relationship between access to financing and regional entrepreneurship in Ecuador. We estimate this relationship in a country with a strong economic, population and institutional concentration in Quito and Guayaquil. Using spatial econometric techniques with data for the 221 cantons of this country, we find that access to finance is a key factor for the emergence of new companies. However, there are other factors that also contribute to the birth of new businesses. The main ones are the human capital and the specialization in the services. A public policy implication derived from the present research is that monetary and financial regulation should promote the deconcentration of financial services to take advantage of the development potential of less developed regions.

Keywords

Access to Financing, Entrepreneurship, SMEs, Ecuador.

Introduction

Small and medium enterprises (SMEs) are organizations of great importance in the economic dynamics of nations because of the role they play in generating employment and income. They also link producers and consumers, generating forward and backward linkages with a positive multiplier effect on the national productive structure. Recent empirical evidence has shown the interest of researchers and development agencies and economic cooperation to study their performance and the factors that slow the growth of SMEs (Ayyagari, Demirgüç-Kunt y Maksimovic, 2008).

In practice, a serious constraint to the growth and emergence of new SMEs is the lack of financing, particularly in developing countries, where financial capital is concentrated in large cities and it is easier for large companies to access a credit than for the small ones. There is ample empirical evidence regarding the positive relationship between SMEs and access to financing. The results show that the main obstacles to achieving growth and sustainability of a SMEs is access to credit in the formal banking system (Ayyagari, Demirgüç-Kunt and Maksimovic, 2008; Ferraro and Goldstein, 2011; Moritz, Block and Heinz, 2016; Norden, 2015). Unlike large companies and business consortiums, whose business dynamics allow them to develop efficient sources of financing in traditional and non-traditional financial markets, small businesses have several limitations at the time of accessing a loan. The financing of large companies represents an excellent business for the formal financial system due to the portfolio of financial products and services that they demand and which are traditionally concentrated in the areas of greatest economic development. On the contrary, SMEs have greater credit risk and therefore, the cost of financing is higher.

In this context, the objective of this research is to examine the relationship between access to financing and regional entrepreneurship in Ecuador using data from the 221 cantons of this country. We hypothesize that access to financing is a relevant factor for the emergence of new companies as indicated by the results of several applied researches (Abdulsaleh and Worthington, 2013; Hommes, Khan, Gerber, Kipnis and Hamm, 2014; Inklaar, Koetter and Noth, 2015; Kim, Lin and Chen, 2016). Our dependent variable is the logarithm of the number of companies per capita of each canton between 2005 and 2010, while the independent variable is the logarithm of the number of financial establishments per canton. In practice, a company can be expected to have more credit facilities as there is a greater offer of credit from the formal financial system. However, there are no institutional limitations for a company located in a canton to manage a loan in neighbouring cantons. It is possible for a company to request and obtain a loan in the financial institutions of the neighbouring cities. In this sense, it is necessary to estimate an econometric model of spatial data that allows capturing the effect of the financial establishments of a canton and the neighbouring cantons in the birth of new companies in a canton. In addition, in order to capture the regional heterogeneity of the country, we include a set of control variables related to the productive characteristics of the cantons. The results show that the birth of companies is determined positively by the offer of formal credit with spill over effects of access to financing and entrepreneurship. This result has been largely ignored in the previous literature on the relationship between access to credit and entrepreneurship. A possible policy implication derived from this research is that to encourage the birth of new companies in less developed regions, the regulation of the financial system should favour the deconcentration of the financial system of large cities and offer incentives for establishments that offer credit are located in the less developed regions.

The document is structured in four additional sections to the introduction. The second section contains the review of the most relevant previous literature on the subject. The third section describes the data and proposes the econometric methodology. In the fourth section we analyse and discuss the results found with the previous empirical evidence. Finally, in the fifth section we propose the conclusions of the article and the possible implications of economic policy.

Literature Review

Access to financing for micro, small medium enterprises (SMEs) is important for them to carry out their activities. The financing allows the sustainability of the businesses over time and at the same time that favours the birth of new companies. The literature that examines the nexus between the two variables is broad. Some research focuses on examining the relationship between the survival of new businesses and access to credit from formal banks (Alessandrini, Presbitero & Zazzaro, 2010; Baas & Schrooten, 2006). Other studies determine the impact of non-traditional funding sources on the permanence and growth of SMEs (Lee & Drever, 2014; Ryan, O'toole & McCann, 2014). Recent studies also determine how competition in banking activity and the agglomeration of large industrial parks in satellite cities concentrate financial products and services in deterioration of less developed areas (Kim, Lin & Chen, 2016; Klagge & Martin, 2005). In addition, banks argue that they incur diseconomies of scale in the credit assessments of SMEs, since they are numerous operations of small amounts. As a result of insufficient information and the risks attributed to these loans, banking institutions increase the number of requirements or guarantees to cover the risk and raise interest rates (Ferraro & Goldstein, 2011). The bank loan may improve the survival conditions of SMEs for several reasons. One of them is that the survival of the new companies concluded that having a bank loan is a positive variable with predictive significance of the survival of the SMEs (Åstebro & Bernhardt, 2003). Access to a formal bank loan improves the reputation with suppliers and other actors in the SME value chain (Beck & Demirguc-Kunt, 2006; Beck, Demirguc-Kunt, Laeven & Levine, 2008; Elsas, 2005).

In the formal financial system, the decisions to grant loans are given by their specialty to analyse the financial evidence of credibility (Åstebro & Bernhardt, 2003; Hommes, Khan, Gerber, Kipnis & Hamm, 2014; Kim, Lin & Chen, 2016). Some experiences in the European and Asian context of the relationship between banking system and SMEs have shown that state regulation can facilitate access to financing, increase the competitiveness of credit directed to this type of companies and make more active the use of co-financed funds (Daskalakis, Jarvis, Schizas, 2013; Norden, 2015; Petersen & Rajan, 2002), although commercial banking focuses its business routines usually on large companies and business consortiums. This type of company has the necessary and clear information for the bank analyst, unlike the SMEs. In the context of Latin America, the limited availability of information and its asymmetric distribution converge in two problems. The first associated with adverse selection, which means having limitations to identify good projects (with an acceptable profitability/risk ratio) and bad ones (excessively risky) and the moral risk associated with the difficulty to provide incentives in an appropriate manner and an efficient distribution of risk.

In the Latin American context, SMEs are located regionally in different areas, but not the credit offer of the financial system, which limits their financial inclusion. One of the policies to correct this problem is the application of specific regulation that generates a synergy between the SMEs and the financial system. For example, the promotion of regional banking by facilitating access to financial products, mainly credit and generating significant financial intermediation between the deficit sector and the surplus resource sector have been some of the great achievements in banking and SMEs. It strengthens the placement of long-term funds with lower costs (Hommes, Khan, Gerber, Kipnis & Hamm, 2014). The financial system can generate coverage in the territories to the extent that it is able to access information that mitigates risks in the concession and administration of risk, due to the influence of the market power of its competitors in the field of microfinance or by agents of control and regulation. This latter measure could promote the deconcentration of financial services to take advantage of the development potential of less developed regions (Beck, Demirguc-Kunt, Laeven & Levine, 2008; Beck, Lu & Yang, 2015; Carbo-Valverde, Rodriguez-Fernandez & Udell, 2009; Wang, 2016). This policy can be beneficial in developing countries because they have a high economic, population and institutional concentration in large cities. In the case of Ecuador, financial services are concentrated in Quito, Guayaquil and Cuenca and an important part of the institutions that offer credit in small cities are branches of large financial institutions or, in effect, small institutions that offer microcredit. This research contributes to the debate between the relationship between access to financing and SMEs with empirical evidence on the effect of the offer of formal credit in the birth of new companies in a developing country with a strong economic concentration.

Data and Methodology

Statistical Sources

The database used in the present investigation is obtained from the National Economic Census (CNE) of the National Institute of Statistics and Censuses of Ecuador (INEC). The dependent variable is the logarithm of the companies that were born between 2005 and 2010 and the independent variable is the logarithm of the number of financial establishments in each canton. In addition, since the birth of the companies does not only depend on the formal credit offer, we include some additional covariates. These variables seek to capture the structure of local productive dynamics and the existing heterogeneity among the cantons. In the country it clearly has three poles of development (Quito, Guayaquil and Cuenca). Therefore, we include dummy variables that capture this productive heterogeneity (Figure 1).

Econometric Strategy

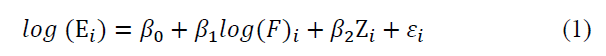

In order to examine the effect of the offer of financing in the birth of new companies, we estimate a model with cross-sectional data for the 221 cantons of Ecuador. The initial model to estimate is the following:

Where  represents the number of companies that were born between 2005 and 2010 as a proxy for entrepreneurship,

represents the number of companies that were born between 2005 and 2010 as a proxy for entrepreneurship,  is the number of formal financial establishments and

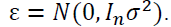

is the number of formal financial establishments and  the term of perturbations of the model. Both variables are measured in logarithms scale. Finally, we include the variables related to the average human capital of the canton and the productive specialization. Given that there is a high economic concentration in the country, in particular the financial system is concentrated in large cities where they find a greater number of customers to both capture and place savings. At the other extreme, there are several cantons where the presence of the financial system is very scarce, which makes it difficult to start new ventures due to lack of financing. So the new companies should seek financing in the neighbouring cantons. In this sense, ignoring the spatial dimension leads to obtain unbiased estimators for the omission of relevant variables. This leads to the need to propose an econometric model with spatial data. A spatial econometric model follows the underlying logic that what happens in a canton, ends up affecting the neighbouring cantons and that effect decreases as the cantons are further away. In this context, we propose three basic spatial models (SAR, SEM and SARMA) as proposed by LeSage and Pace (2009).

the term of perturbations of the model. Both variables are measured in logarithms scale. Finally, we include the variables related to the average human capital of the canton and the productive specialization. Given that there is a high economic concentration in the country, in particular the financial system is concentrated in large cities where they find a greater number of customers to both capture and place savings. At the other extreme, there are several cantons where the presence of the financial system is very scarce, which makes it difficult to start new ventures due to lack of financing. So the new companies should seek financing in the neighbouring cantons. In this sense, ignoring the spatial dimension leads to obtain unbiased estimators for the omission of relevant variables. This leads to the need to propose an econometric model with spatial data. A spatial econometric model follows the underlying logic that what happens in a canton, ends up affecting the neighbouring cantons and that effect decreases as the cantons are further away. In this context, we propose three basic spatial models (SAR, SEM and SARMA) as proposed by LeSage and Pace (2009).

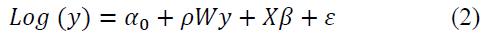

In the Spatial Autoregressive model (SAR), expressed in equation (2),W is the spatial weights matrix,β measures the effect of access to financing in entrepreneurship and the autoregressive spatial parameter ρ determines the spatial dependence between the cantons. When formalizing equation (1) in matrix terms, if Y represents the dependent variable and X the independent variables, the SAR model to estimate is the following:

The term WY is a vector of N by 1 of spatial delays and is a vector of N by 1 of random error terms normally distributed with means 0 and variance constant (σ2 ). In this context, the parameters to be estimated are βand ρ . The scalar parameter takes a value of zero when there don’t have spatial dependence.

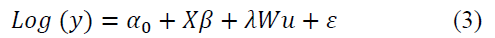

We assume that the vector elements of the error term,  . This model reflects the dependence on the error term. Finally, the SARMA model combines the two previous models. In practice, the choice of the MCO model or the SAR, SEM and SARMA models is based on the spatial dependence test (LeSage and Pace, 2009). The results obtained from this formalization are included in the following section.

. This model reflects the dependence on the error term. Finally, the SARMA model combines the two previous models. In practice, the choice of the MCO model or the SAR, SEM and SARMA models is based on the spatial dependence test (LeSage and Pace, 2009). The results obtained from this formalization are included in the following section.

Discussion Of Results

The results show that there is a spatial dependence on entrepreneurship measured by the birth of new companies in the 2005-2010 periods. The spatial dependency test indicates that there is autocorrelation between the cantons of Ecuador with respect to the dependent variable. The results are reported in Table 1. The results of the I-Moran test suggest that there is spatial dependence, while the tests for model selection indicate that SAR is not significant, but the SEM and SARMA are statistically significant. The results of both models are compared with the OLS.

| Table 1: Results Of Spatial Dependence Test | |||

| TEST | MI/DF | VALUE | PROB |

|---|---|---|---|

| Moran's I (error) | 0.18 | 4.38 | 0.000 |

| Lagrange Multiplier (lag) | 1 | 8.19 | 0.004 |

| Robust LM (lag) | 1 | 0.15 | 0.693 |

| Lagrange Multiplier (error) | 1 | 1 | 0.000 |

| Robust LM (error) | 1 | 1 | 0.000 |

| Lagrange Multiplier (SARMA) | 2 | 1 | 0.000 |

Table 2 shows the results of the OLS regressions and the spatial models SEM and SARMA. On the one hand, the results of the MCO model indicate that the change in entrepreneurship is significant when access to financing changes. The empirical evidence highlights the importance of access to formal credit and the success of new ventures (Alessandrini, Presbitero & Zazzaro, 2010; Lee & Drever, 2014; Ryan, O'toole & McCann, 2014). This result does not change significantly when estimating the spatial error model and the combined model of spatial and autoregressive error, the coefficients are practically maintained. The statistical significance of the spatial parametersρ in the error model and ρand λ in the SARMA indicate the importance of the inclusion of spatial models to capture the effect of access to financing in the enterprise. The stability of the parameter associated with access to financing, despite the different models, guarantees that the venture is positively affected by the offer of formal credit. This result is consistent with the results of previous empirical research (Kipnis & Hamm, 2014). This implies that if the regulation of the national financial system orients financial institutions to offer loans in less developed regions, the growth of new companies can be encouraged and, therefore, accelerate the development of the less dynamic regions as suggests Beck Lu & Yang (2015), Carbo-Valverde, Rodriguez-Fernandez & Udell (2009) and Wang (2016).

When we include the control variables, the results have practically no variations; the positive effect of financing on the enterprise is maintained. With respect to the control variables, the results show that the average regional human capital has a positive and significant effect on regional entrepreneurship, as would be expected a priori. This result can be explained because it is possible that the most capable people could be more enterprising (Jiménez, Sánchez, Alvarado and Ponce, 2017; Jiménez and Alvarado, 2017; Cueva and Alvarado, 2017). The rate of participation of manufacturing is not significant; the result may be due to the fact that the manufacturing activity in the country is low. Finally, the specialization in services is significant, which shows the importance of specialization in this sector to increase the birth of new companies and therefore, economic development (Jiménez and Alvarado, 2017).

| Table 2: Results Of The Mco, Sem And Sarma Models | |||

| MCO | SEM | SARMA | |

|---|---|---|---|

| Ln (Access to financing) | 0.964*** | 0.976*** | 0.965** |

| (20.09) | (21.69) | -19.565 | |

| Human capital | 0.880* | 0.765* | |

| (2.67) | (3.04) | ||

| Manufacture | -0.034 | -0.078 | |

| (1.31) | (1.31) | ||

| Services | 0.548** | 0.658** | |

| (12.23) | (13.76) | ||

| Rho | 0.365** | -0.029 | |

| (4.30) | (-0.356) | ||

| Lambda | 0.365** | ||

| -3.584 | |||

| Constant | 1.952*** | 1.929*** | 2.015*** |

| (20.36) | (41.76) | -8.842 | |

| Observations | 221 | 221 | 221 |

| Pseudo R2 | 0.643 | 0.678 | 0.640 |

| Spatial Pseudo R2 | 0.644 | ||

Notes: t statistical t in parentheses and * p<0.05, ** p<0.01, *** p<0.001

Conclusion

This research examined the nexus between the offer of access to formal financing and the birth of new companies in Ecuador, a country with a strong economic and institutional concentration. The results suggest the importance of the offer of financial services to favour the increase in the number of companies that are born. In addition, there is a spill over effect of the venture and access to financing. This result has been largely omitted from the empirical literature that relates the two variables. It is logical to expect that the behaviour of the enterprise will have effects in the neighbouring cantons. Therefore, future research could focus on analysing the spatial interaction of entrepreneurship, in particular the relationship between the birth of new companies and the distance of financial supply. The investment in human capital and the productive specialization are relevant to favour the birth of new companies. Finally, the possible implications of this research is that to encourage the birth of companies should consider the existence of spatial effects of entrepreneurship and access to financing to improve the design of policies aimed at accelerating the development of less developed regions.

References

- Abdulsaleh, A.M. & Worthington A.C. (2013). Small and medium-sized enterprises financing: A review of literature. International Journal of Business and Management, 8, 14-36.

- Alessandrini, P., Presbitero, A.F. & Zazzaro, A. (2010). Bank size or distance: What hampers innovation adoption by SMEs? Journal of Economic Geography, 10(6), 845-881.

- ?stebro, T. & Bernhardt, I. (2003). Start-up financing, owner characteristics and survival. Journal of Economics and Business, 55, 303-319.

- Ayyagari, M., Demirg??-Kunt, A. & Maksimovic, V. (2008). How important are financing constraints? The role of finance in the business environment. The World Bank Economic Review, 22(3), 483-516.

- Baas, T. & Schrooten, M. (2006). Relationship banking and SMEs: A theoretical analysis. Small Business Economics, 27(2), 127-137.

- Beck, T. & Demirguc-Kunt, A. (2006). Small and medium-size enterprises: Access to finance as a growth constraint. Journal of Banking & Finance, 30(11), 2931-2943.

- Beck, T., Demirguc-Kunt, A., Laeven, L. & Levine, R. (2008). Finance, firm size and growth. Journal of Money, Credit and Banking, 40(7), 1379-1405.

- Beck, T., Lu, L. & Yang, R. (2015). Finance and growth for microenterprises: Evidence from rural China. World Development, 67, 38-56.

- Carbo-Valverde, S., Rodriguez-Fernandez, F. & Udell, G.F. (2009). Bank market power and SME financing constraints. Review of Finance, 13(2), 309-340.

- Cueva, K. & Alvarado, R. (2017). Spatial concentration of qualified human capital and regional income inequality in Ecuador. Paradigma Econ?mico, 9(1), 5-26.

- Daskalakis, N., Jarvis, R. & Schizas, E. (2013). Financing practices and preferences for micro and small firms. Journal of Small Business and Enterprise Development, 20(1), 80-101.

- Elsas, R. (2005). Empirical determinants of relationship lending. Journal of Financial Intermediation. 2005, 32-55.

- Ferraro, C.A. & Goldstein, E. (2011). Pol?ticas De Acceso Al Financiamiento Para Las Peque?as Y Medianas Empresas En Am?rica Latina. Comisi?n Econ?mica para Am?rica Latina y el Caribe. Santiago.

- Hommes, M., Khan, A., Gerber, C., Kipnis, H. & Hamm, K. (2014). Out of the shadows and into the banks: Financing very small and informal enterprises. Enterprise Development and Microfinance, 25(3), 211-225.

- Inklaar, R., Koetter, M. & Noth, F. (2015). Bank market power, factor reallocation and aggregate growth. Journal of Financial Stability, 19, 31-44.

- Jim?nez, S. & Alvarado. R. (2017). Sectorial specialization, human capital and regional incomes in Ecuador. Journal of Regional Research.

- Jim?nez, C., S?nchez, B., Alvarado, R. & Ponce, P. (2017). El Rol Del Capital Humano En El Emprendimiento Regional En Ecuador: Un Enfoque Usando M?todos Espaciales. Revista Paradigma Econ?mico.

- Kim, D.H., Lin, S.C. & Chen, T.C. (2016). Financial structure, firm size and industry growth. International Review of Economics & Finance, 41, 23-39.

- Klagge, B. & Martin, R. (2005). Decentralized versus centralized financial systems: Is there a case for local capital markets. Journal of Economic Geography, 5(4), 387-421.

- Lee, N. & Drever, E. (2014). Do SMEs in deprived areas find it harder to access finance? Evidence from the UK small business survey. Entrepreneurship & Regional Development, 26(3-4), 337-356.

- LeSage, J.P. & Pace, R.K. (2009). Introduction to spatial econometrics. Statistics, textbooks and monographs.

- Moritz, A., Block, J.H. & Heinz, A. (2016). Financing patterns of European SMEs - An empirical taxonomy. Venture Capital, 18(2), 115-148.

- Petersen, M.A. & Rajan, R.G. (2002). Does distance still matter? The information revolution in small business lending. The Journal of Finance, 57(6), 2533-2570.

- Ryan, R.M., O?toole, C.M. & Mccann, F. (2014). Does Bank Market Power Affect SME Financing Constraints? Journal of Banking & Finance, 49, 495-505.

- ?eba, M.G. (2016). Financing preferences of European SMEs. In economic development and entrepreneurship in transition economies. Springer International Publishing, 185-204.

- Wang, Y. (2016). What are the biggest obstacles to growth of SMEs in developing countries?-An empirical evidence from an enterprise survey. Borsa Istanbul Review, 16(3), 167-176.