Research Article: 2022 Vol: 14 Issue: 4S

An analysis of problems and consequences of price rises in petroleum products in India

Gopalasundar R, Madurai Kamaraj University

Chithra N, Bharathidasan University

Citation Information: Gopalasundar, R., & Chithra, N. (2022). An analysis of problems and consequences of price rises in petroleum products in india. Business Studies Journal, 14(S4), 1-5.

Abstract

Petroleum products are materials derived from crude oil (petroleum) as it is processed in oil refineries. Unlike petrochemicals, which are a collection of well-defined usually pure organic compounds, petroleum products are complex mixtures. The majority of petroleum is converted to petroleum products, which includes several classes of fuels. Petrol and diesel pricing depends on several factors. Final retail price = crude oil price (international price of crude oil) + refinery charges + transport charges + dealers’ commission + Central Excise Duty (Imposed by Central government) + Value Added Tax (VAT) & surcharges (Imposed by state government).

Keywords

Petroleum, Crude Oil, Gasoline, Asphalt, Lubricants, Excise Duty.

Introduction

Petroleum products are materials derived from crude oil (petroleum) as it is processed in oil refineries. Unlike petrochemicals, which are a collection of well-defined usually pure organic compounds, petroleum products are complex mixtures. The majority of petroleum is converted to petroleum products, which includes several classes of fuels.

Petrol and diesel pricing depends on several factors. Final retail price=crude oil price (international price of crude oil) + refinery charges + transport charges + dealers’ commission + Central Excise Duty (Imposed by Central government) + Value Added Tax (VAT) & surcharges (Imposed by state government).

Objectives

1. To analyze the price fixation pattern of petroleum products in India

2. To Discuss the reasons for the rise in prices of petroleum products

3. To Investigate the problems of increase in the price of petroleum products in India

4. To Find the ways the price reduction of petroleum products in India

The First Objective is to analyze the Price Fixation Pattern of Petroleum Products in India

How the price of petroleum products is determined in India: Just as we buy milk in liters, so do we buy crude oil in barrels? Brent crude is currently trading at $ 107.9 a barrel. Taking it into Indian terms, the price of a barrel of crude oil is around Rs 8,185.

A barrel of crude oil contains a total of 159 liters. This 159 liter will not change if it turns into petrol. Imported crude oil is refined in India. Public sector companies including Bharat Petroleum, Indian Oil Corporation and private companies including Reliance Industries are working to refine it. This is where crude oil is refined (Coker, 2018).

Petroleum, diesel and jet gas are produced during refining. About 73 liters of petrol, 36 liters of diesel, 20 liters of jet fuel and more are produced from one barrel of crude oil.

To go with these, tar and naphtha are available in quantities of 34 liters. Assuming an average price of Rs 50, these are available for up to Rs 1,700 only through tar and naphtha.

The actual price of a liter of petrol.

The price of 1 barrel (159 liters) of crude oil is 8,185. Then the price of a liter of petrol is 51 rupees 47 paise. It costs around Rs 2 per liter to convert crude oil into petrol. In that sense, the actual price of a liter of petrol today is up to 54 rupees. It costs from Rs 2 to Rs 4 to convert to diesel. In that sense, the basic price of diesel is 56 rupees.

A liter of petrol before taxes by the central and state governments ranges from Rs 53 to Rs 54. This is followed by taxes levied by the Central Government including excise tax and chess tax. This tax is levied at almost 52 per cent of the base price of petrol. In that case, the federal tax on a liter of petrol is 28 rupees (Worrell & Galitsky, 2004; Raseev, 2003; Park et al., 2010).

After that, the state government's VAT, including the fixed price, is almost 41 per cent of the base price of petrol. State Government Taxation Rs.22.14. If we look at the bulk now (Table 1 & 2).

| Table 1 Price of Petroleum Products is Determined in India | |

| Rupees | |

| Base Price | 54 |

| Central Government Tax | 28 |

| State Government Tax | 23 |

| Dealer commission | 5 |

| Table 2 Total of 1 Liter of Petrol Sells for 110 Rupees | ||

| Rupees | Percentage | |

| Diesel base price | 56 | 56 |

| Central Government Tax | 22 | 22 |

| State Government Tax | 19 | 19 |

| Distributors | 3 | 3 |

| Diesel Price | 100 | 100% |

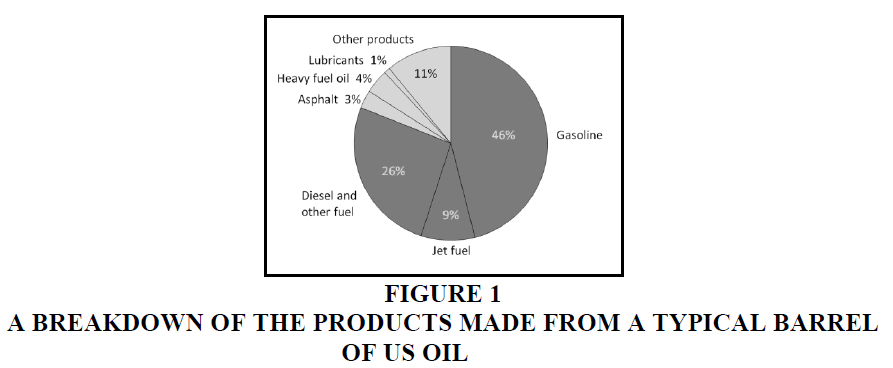

In a barrel of crude oil the diagram above shows that 46% of petrol, 26% of diesel, 9% of jet fuel, 4% of heavy fuel oil, 3%of asphalt, 1% of lubricants and 11% of others are produced (Figure 1).

In the above list, the price of 1 liter of petrol in Venezuela, which is the lowest in the world, is 1.93 (first place). It is 28.78 rupees in Russia, 64.84 rupees in Pakistan and 157.19 rupees in Europe. India ranks 3rd in this list (Table 3).

| Table 3 The Price of Petrol Between India and other Countries | ||||||

| Petrol prices in USD, EURO and INR | ||||||

| Rank | Country | Gasoline/Petrol Prices per liter | Continent | |||

| USD ($) | EURO (€) | INR (₹) | Name | Rank | ||

| 1. | Venezuela | 0.03 | 0.02 | 1.93 | South America | 1 |

| 2. | Libya | 0.03 | 0.03 | 2.48 | Africa | 1 |

| 3. | Iran | 0.05 | 0.05 | 3.95 | Asia | 1 |

| 4. | Kuwait | 0.35 | 0.32 | 26.64 | Asia | 3 |

| 5. | Russia | 0.37 | 0.34 | 28.78 | Europe | 1 |

| 6. | Iraq | 0.51 | 0.47 | 39.58 | Asia | 7 |

| 7. | Saudi Arabia | 0.62 | 0.57 | 47.87 | Asia | 11 |

| 8. | Pakistan | 0.84 | 0.78 | 64.84 | Asia | 14 |

| 9. | United Arab Emirates | 0.85 | 0.78 | 65.47 | Asia | 15 |

| 10. | Sri Lanka | 1.03 | 0.95 | 79.16 | Asia | 22 |

| 11. | USA | 1.18 | 1.09 | 90.82 | North America | 8 |

| 12. | India | 1.34 | 1.23 | 102.87 | Asia | 31 |

| 13. | China | 1.37 | 1.26 | 105.42 | Asia | 32 |

| 14. | Japan | 1.48 | 1.36 | 114.03 | Asia | 34 |

| 15. | United Kingdom | 2.04 | 1.88 | 157.19 | Europe | 33 |

The Second Objective is to discuss the Reasons for the Rise in Prices of Petroleum Products

Factors affecting fuel prices in India: The rising prices of petrol and diesel have been a major concern for the citizens of the country (Degnan, 2007; Gary & Handwerk, 1975; Moro, 2003). There are a number of factors that affect the fuel prices in India. Some of the most important factors that affect the prices of fossil fuels in India can be summed up as follows:

Cost of crude oil: Crude oil or unrefined oil is a commodity of the international market. The changes in the price of this commodity directly affect the price of petrol and diesel in our country. Whenever there is a change in the demand and supply of crude oil, the prices vary. In addition to that, international political relations and future reserves and supplies also have direct effects on the price of crude oil.

Price charged to dealers: The crude oil is acquired and distributed by the Oil Marketing Companies (OMCs). The price charged by the OMCs to the dealers is an important deciding factor of the price of the fossil fuels. This price is also based on a number of factors which include the freight charges, the refining cost, and so on (Degnan, 2000).

Commission for dealers: The Oil Marketing Companies or OMCs pay a commission to the fuel dealers. The petrol pump owners have their earnings, cost, and profit covered in this commission. This is one of the components which make up the price of the fuel.

Central excise duty: The central government levies the excise duty on petrol and diesel. It should be kept in mind that the central excise duty is a pre-defined amount of money and not a percentage. Thus, the duty does not fluctuate with the price of the fuels. Over the past few years, the Government of India has increased the excise duty manifold. The current duty charged on petrol is Rs.32.98 per liter and that for diesel is Rs.31.83 per litre. This amount is constant irrespective of the rise or fall in the price of the crude oil.

Sales Tax or Value Added Tax (VAT): This tax is imposed by the respective state governments. The VAT or sales tax is calculated after taking a few other factors into consideration such as the excise duty charged by the center, the commission of the dealers, and so on.

Taxes imposed by the government: The Government of India imposes a tax on both petrol and diesel. There are certain policies on the basis of which, the centre might change the tax structure. The change in this structure is mainly base on the marginal returns from the fossil fuels and the recovery of losses. The price of the fuels also changes on the basis of these taxes.

Demand for fuel: With the number of two-wheelers and four-wheelers steadily increasing on the Indian roads, the demand for both petrol and diesel has been increasing as well. As the oil refinery companies in India have to acquire crude oil from the international market in order to process the same into petrol and diesel, the supply cannot be always fulfilled. When the supply is less and the demand is more, as per the laws of economics, the price of both the fuel is bound to increase (Dadong, 2013; Fahim et al., 2009).

The Third Objective is to investigate the Problems of Increase in the Price of Petroleum Products in India

Consumption ratio of refineries: The crude oil imported to India is sent across to the refineries for processing. If the number of refineries is lower, then the overall quantity of petrol or diesel which will be available for sale will also be lower. This would also mean that the supply will be lower, which in turn, will make the price of the fuel higher.

Valuation of INR against USD: One major factor that is responsible for the alteration of prices of petrol and diesel in India is the value of the Indian Rupee against the American Dollar. The crude oil which is refined for petrol and diesel is bought from the international market and the transaction is done in dollars. Thus, the strength of the USD against INR is a direct factor. If the American Dollar is stronger, the cost of purchasing crude oil will be higher. This will mean that the price of the finished products will also be higher (Dadashev & Stepanov, 2000).

Consequences of high fuel prices: High petrol and diesel prices contribute to higher transportation costs and hence increases in the prices of essential commodities such as vegetables, rice, pulses etc.

High fuel prices increase the prices of commodities and thereby can cause inflation: As people pay more for essential commodities, they may not easily buy other non-essential goods. So, that results in fewer sales for many businesses and that leads to an economic slowdown.

The Fourth Objective is to find the Ways the Price Reduction of Petroleum Products in India

What needs to be done: Reducing taxes on petroleum products will result in a reduction in costs of transport and thereby reduces the price of many consumer goods? This will help markets and the economy and also reduces the burden on common people (Bridjanian & Samimi, 2011).

Instead of depending on these taxes on petrol & diesel, the Indian government needs to create more revenue sources such as increasing the number of people that pay income tax, recovering bad loans of public sector banks etc.

More and more people are buying their own vehicles, especially after witnessing the pandemic and hence the demand for petrol and diesel is increasing and thereby the pressure on foreign exchange reserves and “Trade deficit” are increasing. This will further lower the value of the rupee (Gary et al., 2007; Meyers, 2016). To reduce the dependence on crude oil imports, there is a need to invest in the exploration of crude oil reserves in the country. Moreover, alternative energy resources such as solar energy, wind energy should be encouraged and promoted.

There is a dire need to encourage people to use electric vehicles and to use renewable energy resources. This will reduce the burden on foreign exchange reserves as well as leads us towards eco-friendly living.

Conclusion

Due to the high fuel prices, there will be a huge burden on people whether they own a vehicle or not. Because high fuel prices increase the cost of transport and thereby increases the prices of consumer goods. To avoid that situation, the government needs to work on reforms in petroleum pricing.

References

Bridjanian, H., & Samimi, A.K. (2011). Bottom of the barrel, an important challenge of the petroleum refining industry. Petroleum & Coal, 53(1).

Coker, A.K. (2018). Petroleum Refining Design and Applications Handbook, Volume 1. John Wiley & Sons.

Indexed at, Google Scholar, Cross Ref

Dadashev, M.N., & Stepanov, G.V. (2000). Supercritical extraction in petroleum refining and petrochemistry. Chemistry and technology of fuels and oils, 36(1), 8-13.

Indexed at, Google Scholar, Cross Ref

Dadong, L.I. (2013). Crucial technologies supporting future development of petroleum refining industry. Chinese Journal of Catalysis, 34(1), 48-60.

Indexed at, Google Scholar, Cross Ref

Degnan Jr, T.F. (2007). Recent progress in the development of zeolitic catalysts for the petroleum refining and petrochemical manufacturing industries. Studies in surface science and catalysis, 170, 54-65.

Indexed at, Google Scholar, Cross Ref

Degnan, T.F. (2000). Applications of zeolites in petroleum refining. Topics in Catalysis, 13(4), 349-356.

Indexed at, Google Scholar, Cross Ref

Fahim, M.A., Al-Sahhaf, T.A., & Elkilani, A. (2009). Fundamentals of petroleum refining. Elsevier.

Indexed at, Google Scholar, Cross Ref

Gary, J.H., & Handwerk, G.E. (1975). Petroleum refining. Technology and economics. Volume 5.

Indexed at, Google Scholar, Cross Ref

Gary, J.H., Handwerk, J.H., Kaiser, M.J., & Geddes, D. (2007). Petroleum refining: technology and economics. CRC press.

Indexed at, Google Scholar, Cross Ref

Meyers, R.A. (2016). Handbook of petroleum refining processes. McGraw-Hill Education.

Moro, L.F.L. (2003). Process technology in the petroleum refining industry—current situation and future trends. Computers & Chemical Engineering, 27(8-9), 1303-1305.

Indexed at, Google Scholar, Cross Ref

Park, S., Lee, S., Jeong, S.J., Song, H.J., & Park, J.W. (2010). Assessment of CO2 emissions and its reduction potential in the Korean petroleum refining industry using energy-environment models. Energy, 35(6), 2419-2429.

Indexed at, Google Scholar, Cross Ref

Raseev, S. (2003). Thermal and catalytic processes in petroleum refining. CRC Press.

Indexed at, Google Scholar, Cross Ref

Worrell, E., & Galitsky, C. (2004). Profile of the petroleum refining industry in California. Lab Report LBNL-55450, Lawrence Berkeley National Laboratory, Berkeley, Calif.

Received: 08-Jul-2022, Manuscript No. BSJ-22-12311; Editor assigned: 11-Jul-2022, PreQC No. BSJ-22-12311(PQ); Reviewed: 25-Jul-2022, QC No. BSJ-22-12311; Revised: 30-Jul-2022, Manuscript No. BSJ-22-12311(R); Published: 12-Aug-2022