Research Article: 2019 Vol: 23 Issue: 1S

Analyzing the Commercial Capacity of Agribusiness Enterprises in Dien Bien Province

Pham Minh Dat, Thuong Mai University

Nguyen Van Tuong, Market Management in Dien Bien province

Dinh Tran Ngoc Huy, Banking University HCM city Vietnam

Nguyen Hoang, Thuong Mai University

Nguyen Duy Dat, Thuong Mai University

Abstract

It is highly essential to analyze the commercial capacity of companies that produces and trade in Agricultural products, which propose aid policies with the aim of supporting the development of firms in the future. The author’s established a research model, evaluates the competitive ability of operations trading agricultural products in Dien Bien province within an article. Thus, thanks to data of sociological investigation, the author carries out analyzing and accrediting to confirm the practicability of the model in Dien Bien province.

Keywords

Commercial Capacity, Agribusiness, Enterprises.

Introduction

Concepts and Hypotheses in Researching the Commercial and Trade Capacity of Agribusiness Companies

Basing on features of agribusiness operations such as small scale, households and identifying the commerce and production business in the integration of enterprise, the article provides a concept: The commercial and trade capacity is a component of creating market orientation capacity in an agribusiness company and is understood as a collection of knowledgeable assets in the compatible relationship with resources that are created and developed as integrating them to commercial marketing process and supply chains so as to maximize the utility of the valuable supply process. It aims to meet the demand of market and achieves the goals of business strategies in the long run.

From the above concept, firstly, the general business capacity and the commercial capacity often associate with a process or definite activity. Secondly, because of the small business, taking into account commercial capacity is extremely hard to define three structures of resources, dynamic capability and display capability as a perfect enterprise, medium and large scale, are often considered the integration of these 3 structures in one collective commerce capacity. Thirdly, the measurement of an agribusiness company is showed in terms of its performance. The capacity of commercial business is established by 2 groups:

The level of response to the target market through value indexes that the commercial business provides to the market, that reflects the quality of the business system through 5 elements: customer philosophy, information, organization of trade and business department, general business strategy orientation, performance of commercial business system. By this approach, the factors affecting the commercial capacity of the agribusiness company depend on different perceptions and approaches about commercial processes to diversely format.

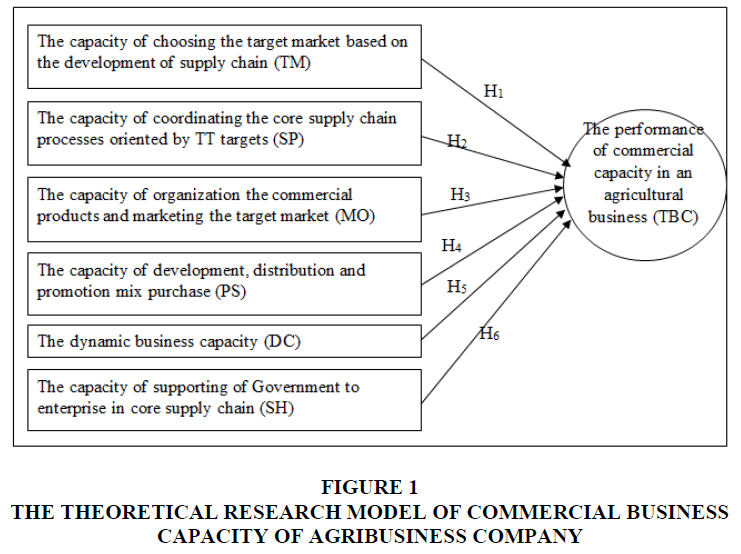

In this study, basing on the selection of the concept of commercial business in marketing, commercial business based on the value supply process, commercial business is the integration and continuation of the supply chain and marketing commerce, commercial business in small enterprise requires the collective capacity and the elements of capacity have a huge impact on the performance of commercial capacity in an agribusiness company including:

The capacity of choosing target market based on the development of supply chain. The market often becomes the goal and orientation of commerce, choosing the target market would be always a global and long-term strategy directly for commercial business and it would dominate the whole business of an enterprise. Choosing an attractive target market based on developing the supply chain market would be the feature of commercial capacity of Agribusiness Company. Because of its position, a company only resonate with the capacity of choosing the target market when it becomes a participant and concludes to create horizontal configuration, then it can empower the development of the supply chain market vertically to key markets, attractive and lead to increase performance of the business strategy of the company. So this is considered a strategic capacity. Then, it is possible to establish a research hypothesis (H1). The ability to select target markets based on the development of supply chain market development has a direct, positive impact on the unit's commercial business performance.

The capacity of coordinating main supply chain processes to orient to the target market

The specialist who managed supply chain suggested five supply chain processes of a member firm such as: operational planning, purchase, production, delivery, and return. These processes are largely internal and operational. However, the ability of coordinating these processes is orienting the target market and, accordingly, the type of commercial business (retail, manufacturing, wholesale, trade wholesale and export) becomes an element into the commercial business capacity of an enterprise, an agribusiness company, because these processes are essentially the quality and cost of two core and existing of the final product. These are also two factors that create the value of customer in commercial business, if these processes are oriented by the target market that means that the SF basically guaranteed the criteria of participating the target market, the criteria of value consumer and, enhance business performance of business. Then, it is possible to establish a research hypothesis (H2). The ability to coordinate the target market-oriented core supply chain processes has a direct, positive impact on commercial business performance of company.

The capacity to develop target market (CHTT)

The sales of target market are essentially sales leads with target customers being an important component of a commercial business. The formula - Quality - Service - Price (QSP) are the nucleus of CHTT (Kotler, 2000, 2008; Katnriratne & Paole, 2006; Simchi, 2003) with the aim of transforming the manufactured SF into a commercial product that meets the barrier of entering the target market, demands and needs in the target market, creating the basis for other commercial marketing activities. That allows for a hypothetical study (H3). The capacity of developing a target brand has a direct and positive impact on the commercial performance of company.

The capacity of distribution development - promotion and mixed sales

Being different from the commercial business of medium and large enterprises, there is a clear differentiation of the mixture of marketing and marketing tools. In the small agribusiness company, It had the high integration of distribution and promotion contents trade and sales in a scheme carried out by a group of people, so in this study, it is integrated into a kind of commercial business capacity and a specific type of trade business competency.

This capacity is related to the development of channels, transactions, and distribution and trade channels; marketing communications and practicing appropriate trade promotion tools; the organization and administration of sales and customer service are all essential elements of a commercial business. Then, that allows the hypothesis to be studied (H4). The capacity of developing distribution - promotion - mixed sales has a direct, positive impact on the commercial business performance of the unit.

The dynamic commercial capacity

The dynamic commercial capacity is the collection of energy using commercial business resources in combination with knowledge creation process (SECI) to create the effect of soon, fast, unique, unexpected first Changes from environment, market and competitors. If the above commercial business capacities can be reproduced, imitated and/or can yield a business capacity performance in a defined market and environment context, then the context may change.; Such capacity to adapt often has a certain lag, especially for large and medium-sized enterprises, in these situations, the dynamic trading capacity will ensure a commercial business performance. Overall stability, sustainability. We have a hypothesis (H5). The dynamic trading capacity has a direct and coherent effect on the commercial business performance of a company.

Support of state policy and support of businesses in the supply chain. Due to the common attribute of production and business units of original agricultural products (OPM - Original Product Manufacturer) in our country is small scale, odd, scattered, low resource assets, so if self-improvement commercial business force is very difficult, very long-term, so the support of policies, the support of businesses, especially the focal enterprise (Focal Company) is necessary objectively and has a crucial role. in improving the commercial business performance of the unit in overcoming price pressures, buying down prices or "rescuing". We have a hypothesis (H6): The level of state policy support and support of businesses in the supply chain has a direct, positive impact on the commercial capacity of company.

Research Model, Scale and Design

Models and Scales of Theoretical Research

Based on the six research hypotheses above, it is possible to establish a theoretical research model of the commercial business power of the following agro-product production and trading units: (Figure 1) (Source: Nguyen Bach Khoa (2008, 2011, 2015); Việt (2012, 2014); Thành (2010) and team for researching the development of commerce).

Quantitative Research Design

Quantitative research to test scales, models and official research hypotheses has been established above through the market data and commercial business of production units specializing in agribusiness company in Dien Bien province. To collect this data set, sociological survey method was implemented.

The object of the investigation consists mainly of two groups, one of them is the production and business units - the manufacturers of original products - Original Product Manufacturer - (hereinafter referred to as OPMs) are production facilities. agricultural farming on households and farms, agricultural cooperatives, state-owned enterprises that cultivate agricultural specialties as attached in the previous sections; The second group is the business units - the suppliers and direct customers of the above OPMs - that are the input suppliers of agricultural production, collectors, processing enterprises, retailer purchases and / or purchases of specialty products produced by OPMs; The third group is, state regulators with local specialty agricultural production and business, experts, customers, local trade promotion, specialty agricultural supply chain service providers of third party businesses (banking, logistics, communication). The following two groups are both objects of in-depth understanding and both business customers of OPMs.

In addition, in order to ensure greater reliability, analysis of customer performance data on the commercial capabilities of OPMs, this study also directly investigates agricultural specialties of OPMs to a group of end-consumer retail customers separately with 4 observed variables (from TBC1 to TBC4) of TBC dependent variable (Table 1).

| Table 1 Description of Sample Features | |||

| No | Features | Quantity | Percentage % |

| 1 | Total samples including: Male Female |

305 196 109 |

100 64,26 35,74 |

| 2 | Age: < aged 25 Aged 25-35 Aged 35-45 Aged from 45 to 60 > Aged 60 |

12 67 89 119 18 |

3,93 21,97 29,18 39,02 5,90 |

| 3 | Education Qualification Secondary school High school Bachelor’s or Master’s Degree Including Agricultural Production Agricultural business and commerce Others |

28 134 143 61 12 70 |

9,18 43,93 64,89 42,66 8,39 48,95 |

| 4 | Occupation Owner of an agricultural specialty production establishment (Household, Farm - OPM) CEOs of businesses, agricultural and commercial cooperatives Traders buy and sell agricultural specialties CEOs purchasing management of agricultural enterprises CEOs managing purchases of retail establishments - customers of OPM Local state management experts on production and trade of agricultural specialties Officers of local agriculture promotion, trade promotion, 3rd party service provision |

118 43 22 36 38 34 14 |

38,69 14,10 7,21 11,80 12,46 11,15 4,59 |

Research Results

Testing Scales

Explore Factor Analysis (EFA)

The EFA analysis is used to verify the convergence of the observed variables according to each component of the research model, the extracted method selected is the principal Component method with verimax rotation.

With 5 independent variables for the following EFA results: KMO test result = 0.809 (>0.5) with significance level Sig = 0.000 (<0.05) shows that EFA analysis is appropriate. At Eigenralue> 1, good kernel analysis has extracted 6 good cores, 38 observed variables and with variance extracted 75.738% (>0.5), so good kernel analysis was satisfactory.

Based on the analysis of the Rotated Component Matrix table, the four observed variables MO3, DC4, TM1, Sh6 have a load factor of 0,401; 0,403; 0.388; 0.462 (<0.5) should be excluded from further analysis. The second EFA analysis after the EFA type 4 observed above has the following results (Table 2).

| Table 2 KMO and Bartlette Testing Results | ||

| KMO | 0.828 | |

| Testing Bartlette | Square Df Sig |

646.985 415 0000 |

From Table 3 shows: KMO coefficient =0.828 (> 0.5) and Sig=0.000 significance level, so factor analysis is appropriate. At Eigenvalue>1 with Principal Component’s extraction method and Verimax rotation, multi-extract factor analysis was analyzed as required.

| Table 3 EFA (Rotated Component Matrix) Results for Independent Variables in the Second Time | ||||||

| Components | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | |

| MO1 | 0.677 | |||||

| MO2 | 0.689 | |||||

| MO4 | 0.686 | |||||

| MO5 | 0.693 | |||||

| MO6 | 0.716 | |||||

| MO7 | 0.697 | |||||

| PS1 | 0.715 | |||||

| PS2 | 0.708 | |||||

| PS3 | 0.693 | |||||

| PS4 | 0.728 | |||||

| PS5 | 0.701 | |||||

| PS6 | 0.697 | |||||

| PS7 | 0.712 | |||||

| DC1 | 0.728 | |||||

| DC2 | 0.719 | |||||

| DC3 | 0.721 | |||||

| DC5 | 0.716 | |||||

| DC6 | 0.727 | |||||

| TM2 | 0.673 | |||||

| TM3 | 0.691 | |||||

| TM4 | 0.682 | |||||

| TM5 | 0.696 | |||||

| TM6 | 0.679 | |||||

| SH1 | 0.713 | |||||

| SH2 | 0.697 | |||||

| SH3 | 0.706 | |||||

| SH4 | 0.701 | |||||

| SH5 | 0.718 | |||||

| SC1 | 0.664 | |||||

| SC2 | 0.692 | |||||

| SC3 | 0.558 | |||||

| SC4 | 0.707 | |||||

| SC5 | 0.698 | |||||

| SC6 | 0.705 | |||||

| Eigenvalue | 9.658 | 7.219 | 5.381 | 3.169 | 2.823 | 1.572 |

| Variance of extract |

20.375 | 17.288 | 12.719 | 10.938 | 9.366 | 8.875 |

| Alpha | 0.7918 | 0.8273 | 0.8038 | 0.7892 | 0.8163 | 0.8056 |

For variables dependent on the following EFA analysis results: KMO and Bartlette test results are shown in Table 4

| Table 4 Bartlette's Test Results of Dependent Variable | ||

| KMO | 0.814 | |

| Testing Bartlette’s | Square Df Sig |

131,508 18 0.000 |

From Table 5 shows KMO = 0.722 (> 5) and significance level Sig = 0.000 (<0.05), so this factor analysis is appropriate.

| Table 5 EFA Results Depending on TBC | ||||

| Observed variables | Factor loading element | Eigenvalue | Variance of extract | Alpha |

| Performance of commercial capacity of company |

1.853 | 82.387 | 0.8436 | |

| TBC1 TBC2 TBC3 TBC4 TBC5 TBC6 TBC7 TBC8 |

0.784 0.756 0.802 0.766 0.831 0.819 0.794 0.798 |

|||

At each good kernel, there is Eigenvalue> 1, the result of analysis of good kernel factor is greater than 0.5, the variance extracted = 82,387% and from 8 observed variables, 1 good kernel has been extracted named Performance Business capacity of the company.

Analysis of Cronbach Alpha Reliability Coefficient

On the Cronbach test standard, the total correlation coefficient is> 0.3, the alpha value if the variable type <synthetic alpha coefficient (Alan et al., 1993; Arstinder, 2011; Beamon & Benita, 1998). Cronbach alpha analysis results are summarized in Table 6.

| Table 6 Results of Gonbach's Analysis of Alpha Variables Model | ||||

| Observed variables | Average scale if the variable type | Variance of scales if variable type | Correlate variable sum | Alpha if the variable type |

| Capacity in choosing the target market (MT), Alpha = 0,8219 | ||||

| TM2 | 1,63,468 | 68,175 | 0,5674 | 0,8032 |

| TM3 | 1,65,724 | 61,168 | 0,5138 | 0,7968 |

| TM4 | 1,64,584 | 62,521 | 0,6013 | 0,8091 |

| TM5 | 1,68,266 | 68,937 | 0,5927 | 0,8103 |

| TM6 | 1,68,456 | 67,515 | 0,5776 | 0,7911 |

| Capacity in operating the process core CCU (SC), Alpha = 0,8163 | ||||

| SC1 | 1,91,710 | 64,183 | 0,4991 | 0,7885 |

| SC2 | 1,91,259 | 63,817 | 0,4686 | 0,7968 |

| SC3 | 1,94,964 | 60,411 | 0,2816 | 0,5876 |

| SC4 | 1,93,705 | 60,147 | 0,4894 | 0,7933 |

| SC5 | 1,90,475 | 62,835 | 0,5008 | 0,7987 |

| SC6 | 1,87,536 | 69,324 | 0,4887 | 0,7882 |

| Capacity in developing the target market (MO), Alpha = 0,8097 | ||||

| MO1 | 1,95,848 | 62,184 | 0,6106 | 0,7628 |

| MO2 | 1,96,037 | 64,375 | 0,5982 | 0,7848 |

| MO4 | 1,96,218 | 63,386 | 0,6031 | 0,7694 |

| MO5 | 1,95,973 | 65,628 | 0,6086 | 0,7782 |

| MO6 | 1,96,011 | 64,184 | 0,6113 | 0,7814 |

| MO7 | 1,96,206 | 60,211 | 0,5998 | 0,7991 |

| Capacity in developing promotion distribution services and mixed sales (PS), Alpha = 0,8273 | ||||

| PS1 | 2,36,881 | 70,289 | 0,5673 | 0,8022 |

| PS2 | 2,35,169 | 71,174 | 0,5718 | 0,7859 |

| PS3 | 2,40,238 | 68,329 | 0,5561 | 0,7966 |

| PS4 | 2,37,291 | 69,037 | 0,5944 | 0,8007 |

| PS5 | 2,34,156 | 70,413 | 0,5944 | 0,8097 |

| PS6 | 2,36,217 | 71,286 | 0,5828 | 0,8007 |

| PS7 | 2,33,781 | 69,882 | 0,5436 | 0,7918 |

| Capacity in dynamic commercial business (DC), Alpha = 0,8103 | ||||

| DC1 | 1,64,788 | 61,271 | 0,6126 | 0,7944 |

| DC2 | 1,63,271 | 60,732 | 0,5977 | 0,7815 |

| DC3 | 1,65,182 | 60,366 | 0,6006 | 0,8066 |

| DC5 | 1,64,613 | 59,784 | 0,6133 | 0,8818 |

| DC6 | 1,63,188 | 61,358 | 0,6079 | 0,7859 |

| Capacity of the governmental assistance and supporting enterprise CCU (SH) central assistance,, Alpha = 0,8286 | ||||

| SH1 | 166036 | 62389 | 6618 | 8123 |

| SH2 | 165872 | 63158 | 7029 | 8059 |

| SH3 | 162188 | 60677 | 6966 | 8028 |

| SH4 | 165214 | 64115 | 6672 | 7967 |

| SH5 | 166237 | 62699 | 6751 | 8033 |

| Capacity of commercial performance of company (TBC), Alpha = 0,8436 | ||||

| TBC1 | 2,67,214 | 1,62,543 | 0,6415 | 0,8158 |

| TBC2 | 2,69,639 | 1,67,659 | 0,6528 | 0,8215 |

| TBC3 | 2,70,812 | 1,59,219 | 0,6192 | 0,8206 |

| TBC4 | 2,70,919 | 1,68,770 | 0,6227 | 0,8173 |

| TBC5 | 2,65,291 | 1,73,183 | 0,5993 | 0,7938 |

| TBC6 | 2,69,043 | 1,62,629 | 0,6031 | 0,7909 |

| TBC7 | 2,72,154 | 1,59,980 | 0,5818 | 0,8021 |

| TBC8 | 2,68,995 | 1,65,744 | 0,5934 | 0,8108 |

From Table 6 shows that, except for the two observed variables SC3 and PS5, the overall variable ratio is 0.2816; 0.22913 (<0.3) and 0.5876 respectively; 0.5738 (<0.6) should be excluded from subsequent analysis, leaving the 32 observed variables to meet the testing criteria. The alpha coefficient of the model variables whose observed variables are excluded is recalculated and summed to 0.8296 (SC), respectively; 0.8425 (PS).

Thus, the verification of the scale by EFA analysis and Gonbach alpha reliability coefficient showed that 32 observed variables of 6 independent variables and 8 observed variables of the dependent model of the research model have ensured the coherence and intrinsic consistency.

Research Model Testing

Correlation Analysis

The results of correlation analysis among the research model variables are summarized in Table 7.

| Table 7 Correlation Analysis Results Between Model Variables | |||||||

| TM | SC | MO | DS | DC | SH | TBC | |

| TM | 1 | 0,325* | 0,349* | 0,309* | 0,382* | 0,346* | 0,513* |

| SC | 1 | 0,527* | 0,513* | 0,544* | 0,506* | 0,585* | |

| MO | 1 | 0,523* | 0,561* | 0,439* | 0,607* | ||

| PS | 1 | 0,506 | 0,483* | 0,591* | |||

| DC | 1 | 0,503* | 0,616* | ||||

| SH | 1 | 0,578* | |||||

| TBC | 1 | ||||||

Source: Processing survey data with SPSS 20.0.

From Table 7 shows that all pairs of variables of the research model have Spearman correlation coefficients for the range from 0.309 to 0.616 (<0.85), that means, the value distinguishes between research concepts which achieved with 95% confidence. All 6 independent variables have a positive relationship with the dependent variable TBC (Table 8).

| Table 8 Summary of CFA analysis of model variables | |||||

| Variables model | CMIN/df | TLI | CFI | RMSEA | Conclusion |

| TM | 0,650 | 1,002 | 0,995 | 0,077 | Approved |

| SC | 1,698 | 0,986 | 0,998 | 0,056 | Approved |

| MO | 0,856 | 0,993 | 1,000 | 0,019 | Approved |

| PS | 1,081 | 0,999 | 1,000 | 0,010 | Approved |

| DC | 0,758 | 1,001 | 0,994 | 0,069 | Approved |

| SH | 1,269 | 0,970 | 0,990 | 0,079 | Approved |

| TCB | 0,648 | 1,004 | 1,000 | 0,022 | Approved |

Regression Multiple Regression Analysis

The results of multiple regression analysis according to Stepwise method are summarized in Table 9.

| Table 9 Forecast Results of TBC Multiple Regression Model | |||||||||

| Variables | Unstandardized coefficients | Standardized coefficients | R partial |

t | Sig | Evaluating multi- collinear phenomena | |||

| Dependent | Independent | β | ĐLC | β* | Tolerance | VIF | |||

| TBC | Const | 0,184 | 0,098 | 2,358** | 0,025 | ||||

| TM | 0,14 | 0,025 | 0,149 | 0,183 | 6,305 | 0,013 | 0,175 | 5,726 | |

| SC | 0,134 | 0,041 | 0,145 | 0,131 | 4,138 | 0,000 | 0,287 | 3,482 | |

| MO | 0,182 | 0,058 | 0,202 | 0,213 | 2,374 | 0,000 | 0,349 | 2,861 | |

| PS | 0,193 | 0,061 | 0,211 | 0,208 | 4,051 | 0,000 | 0,358 | 2,796 | |

| DC | 0,138 | 0,049 | 0,141 | 0,142 | 3,613 | 0,016 | 0,258 | 3,874 | |

| SH | 0,145 | 0,066 | 0,147 | 0,164 | 5,819 | 0,008 | 0,185 | 5,413 | |

Note: * - The statistical significance level <0,001, ** The statistical significance level <0,05

Source: Processing survey data with SPSS 20.0.

From Table 9, it is allowed to address some conclusions:

VIF coefficients are <5 if there is no multicollinearity phenomenon between the independent variables in the multiple regression model and they do not significantly affect the results between the explanation and prediction of the regression model.

The coefficient R2 = 84.76% means that about 85% of the variation of TBC is explained by 6 independent variables of the regression model. That means this regression model is consistent with the data collected.

The statistical quantity F = 223,406 with Sig = 0,000 shows that the regression model is suitable for the overall trade of agricultural specialty market in Dien Bien province and can be used to explain and forecast.

Regression multiple regression models following TBC = 0.144 + 0.154 SC + 0.202 MO + 0.211 PS + 0.141 DC + 0.147 SH.

The above results show that 6 good independent variables have significant values of β * and are all statistically significant indicators to predict the business performance of a unit in which* are positive, meaning that all 6 independent variables have a positive effect on TBC. However, these variables have different impacts on TBC, can be divided into 2 groups: group 1 including PS (capacity of developing distribution services, promoting mixed sales) and MO (Development capacity target market offers) the most significant contribution. Next group 2 is TM (Capacity to select target markets based on supply chain market development) and SH (Beneficiaries benefiting from agricultural support and focus on CCU; DC (business capacity) Dynamic Trade) and SC (NL coordinates target market-oriented core supply chain processes).

Discussion and Conclusion

Firstly, the qualitative and quantitative research method considers the variables related to the overall commercial business capacity of a production unit specializing in agricultural production and business in Dien Bien province. Data collected through 2 steps: In the first step, group discussions of experts (n = 16), combined interviews of socialization surveys (n = 305) of which 161 OPMs of all kinds, 96 CCU clients of all types of OPMz; 48 state management, agricultural extension, special trade promotion with agricultural specialties in the Delta; thereby creating market and trade data sets. The second step is, through EFA and reliability analysis, a set of 40 measurement indicators and evaluation of 7 research concepts ensure convergence, internal consistency and no collinear phenomenon.

Secondly, through the overview analysis, CFA has established a research model to ensure a discriminatory value including 6 component trade capacities and overall commercial business capability or commercial business capacity. Actual sale of the unit.

Thirdly, through multiple regression analysis, the reliability of the research model is consistent with the data collection and the overall market and trade of agricultural specialties in Dien Bien province. At the same time, quantify the effect and contribution of each component capacity to the overall commercial business capacity. The multiple regression analysis also indicates that nearly 85% of the variation in the overall commercial business capacities of OPMs is provided by the other 6 competencies and is formed by the number β0 = 0.184 in the nonstandardized regression model.

Fourthly, the component capacities have unevenly contributed to the overall commercial business capacity, of which group 2 component competencies include: Capacity of developing distribution services, promotion and mixed sales and The capacity to develop target market supply chains is the most effective (β *, respectively, 0.211 and 0.202), group 2 includes the following components in the following order: Developing the supply chain market application; exploiting agriculture and helping businesses focus on the supply chain; Coordinate core supply chain processes oriented to the target market; Dynamic commercial trading capacity. (Yes β * are: 0.149; 0.147; 0.145 and 0.141 respectively. This is explained in the following basic way:

The two components PS and MD are the main connotations of commercial business and therefore it contributes the largest to the overall commercial business capacity. And because MQ, PS are within the meaning of commercial marketing, it can be said that commercial marketing is the most important content of commercial business. Unlike business enterprises, most OPMs with social labor division and specialized business trade are very primitive and preliminary, so the target market problem is safe and effective towards the market strategy, which is the supply chain market and OPMs' strategic marketing capacity is the ability to select target markets based on supply chain market development. OPM has the capacity to develop the supply chain market, its MLM market reaches that, in other words, the capacity to develop the target supply chain market is the resonant factor OPM's commercial business Takeoff.

Also according to this argument, it is difficult for agricultural specialty OPMs to upgrade commercial business by themselves without the banks to exploit state support and the support of the focal point of the supply chain that OPM. This is the main reason that these 2 component energy have the next important order (β * respectively 1.49 and 1.47 - ranked 3rd and 4th among the 6 component energy). This is also a specific feature of the development of network marketing of OPMs, agricultural specialties in the Delta and the Tb region of Vietnam in particular.

The core CCU processes and coordinating them is one of the basic contents of CCU governance, however, the overall coordination capability of the new target center has the meaning of commercial business and the secondary component in the 5th of the overall commercial business capacity of 1 OPM. The results of Gonbach Alpha's reliability coefficient analysis have removed an important indicator that the production process and the organization of specialty production have the meaning of production rather than commercial business, mentioned in independent variables: NL develops distribution services, promotion and mixed sales when building and practicing lean and customized sales distribution system (Agile). A key feature of OPM's commercial business capacity is shifting production planning independently from sales planning products, which means not only maximizing revenue, the total output of a product, which is more important than taking the sales (content of commercial business) as a goal and the business as the goal to achieve the goal, which is the essence of the Coordination Capacity - target market orientation of commercial business. This proves that the integration of commercial marketing and supply chain processes will determine the actual commercial business capacity, although in terms of the effect on the overall commercial business capacity, it is weak. This factor is not high position (β * = 0.1145).

In principle, the more intense and complex the market is and the more complex and the more volatile changes and uncertainties the greater the role and dynamic commercial trading capacity contributes to whole trade business capacity. With the advantage of small and micro businesses in terms of flexibility and ability to respond to change, avoid direct competition pressure, OPMs when entering the market of high altitude and high quality also require dynamic trading business capacity to exploit this advantage (expressed in value (β * = 1.41). But, because OPMs are still small in scale, mainly entering the market. with low and average qualifications, the position and role that contributes to the overall trade business capacity is still low - ranked last in the β * value of the model.

References

- Alan, J.R., Richard, O.M., Karl, E.D., Richard, B.M., & Robert, J.M. (1993). Strategic Manag. Sddison Wesley, NY.

- Arstinder, K. (2011). A Review of SC Cordination: Cordination Mechaniem. Int. Handbook on Informaiton Systems, Sidney.

- Beamon, J., & Benita, M. (1998). SC Design and Anlysis: Medels and Methods. International Journal of Production Economics, 55(3).

- Katnriratne, D., & Paole, N. (2006). Geating Value for Comprtifive Advantage in SC Relattion ship: The Case of the Srilanca Tea Industry. International Journal of Logistic Management, 34(2).

- Khoa, N.B. (2015). Building research model and analytical framework of specialties N, forestry areas in Vietnam, branch projects, agricultural level. MS Science and Technology. 06X - 01 / 13-18.

- Khoa, N.B., & Long, N.H. (2008). Commercial marketing - BXB Statistics, HN.

- Khoa, N.B., & Việt, N.H. (2011). Model and scale frame to measure the quality and value of services in Vietnam ”- TC KHTM No. 72.

- Kotler, P.S. (2000). Marketing. Manag - Prentice Hall.

- Kotler, P., & Amstrong, G. (2008). Principles of MKT, Prentice Hall - NY.

- Simchi, L.D. (2003). Designing and Managing the SC Concepts, Strategies and Case studies, Mc. Graw Hill - NY.

- Thành, Đ.V. (2010). Strengthening Participation Capacity of Agricultural Products in Global Value Chain in Current Vietnam Conditions - Industry and Trade Publishing House, Hanoi.

- Việt, N.H. (2012). Development of commercial business strategy for Vietnamese garment enterprises, Statistical Publishing House, Hanoi

- Việt, N.H. (2014). Developing e-commerce strategies of Vietnamese businesses. Information & Communication Publishing House, Hanoi