Case Reports: 2024 Vol: 30 Issue: 1S

Asain gelatin industry: The supply chain team facing key issue

Haseeb Wahid, Superior University Lahore

Muhammad Rafiq, Superior University Lahore

Citation Information: Wahid, H. & Rafiq. M (2024). Asain gelatin industry: The supply chain team facing key issue. Journal of the International Academy for Case Studies, 30(S1), 1-7.

Abstract

Introduction

In 2018, Zohaib Ahmed Managing Director stepped into a company wrestling with formidable challenges in its supply chain. The absence of a senior management-level representative and a dedicated supply chain organization left the team in a perpetual firefighting mode. Compounded by the misconception in Pakistan that the company used forbidden materials, hindering local industry ties, the situation seemed dire. The company's unique strategy targeted only the global market, placing bulk orders with AGI to meet six months' demand, followed by a six-month hiatus leading to substantial losses. Zohaib Ahmed, confronted with staggering daily losses, recognized the need for a trans formative approach. Analyzing the root causes, he pondered the application of the Supply Chain Operations Reference model. Fast forward, after arduous efforts, the company not only achieved global expansion but also bridged gaps with the local industry. Zohaib Ahmed strategically expanded to Gujranwala and is now on the brink of establishing a new industry in Sheikhupura, all while enhancing order fulfillment capabilities. This narrative unfolds a journey from crisis to triumph, where awareness events, supply chain enhancements, and strategic expansions weave a tapestry of success, resilience, and ethical evolution.

Asian Gelatin Industries (AGI)

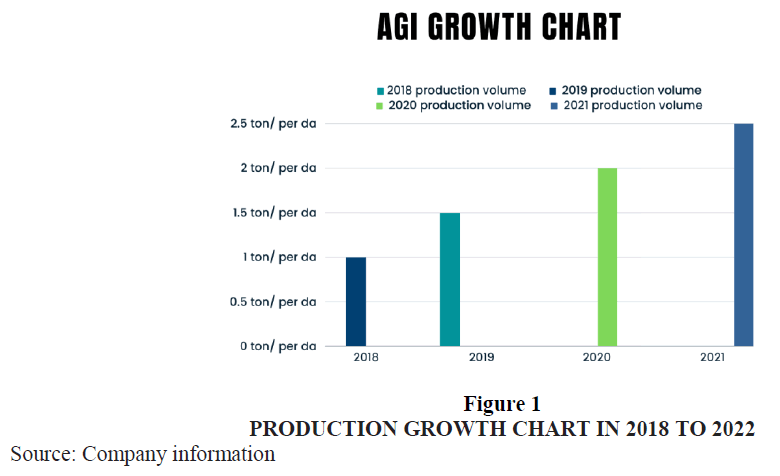

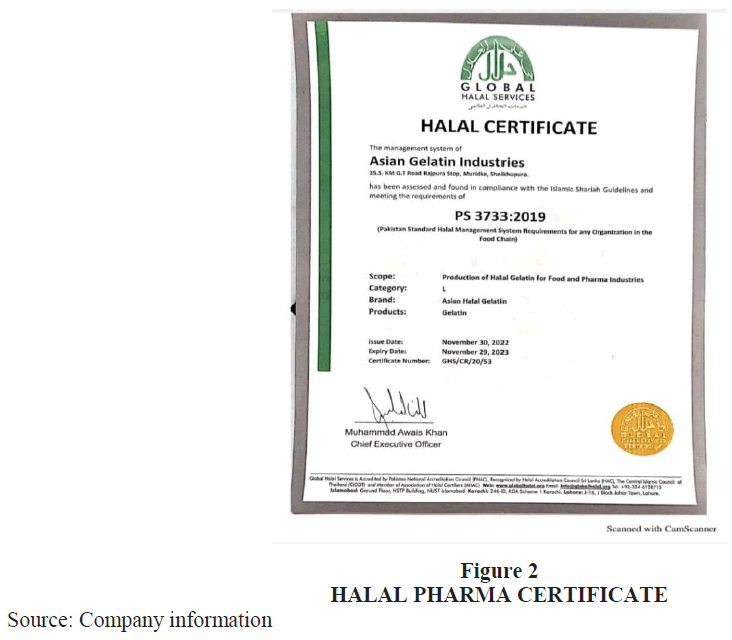

Asian Gelatin Industry, established in 2017 and situated along Sadhokie's main GT Road, specializes in producing gelatin using strictly Halal raw materials such as cow, buffalo, and calve skins. Spanning an expansive land area of 163212 square feet with a built-in space of approximately 18104 square feet, the company operates a singular gelatin production plant. While some components are sourced from Germany (Refer to Exhibit 1, Figure 1) others are locally manufactured in Pakistan and supported by a dedicated maintenance crew.

Gelatin serves as a vital substance employed in pharmaceuticals, cosmetics, and various related products. Derived from cow, buffalo, and calf hides, it is crucial to note that in Pakistan, most industries uphold the use of Halal hides, whereas in Asia, many companies, unfortunately, manufacture from non-Halal sources.

The Asian Gelatin Industry's production is demand-driven and tailored to orders received. They export gelatin to countries like Sri Lanka, Malaysia, and Turkey, while domestically supplying to renowned companies such as Candy Land and Halal. Within Pakistan, there are approximately 6 to 7 other gelatin manufacturing enterprises. At our gelatin factory, Asian Halal Gelatin emphasizes stringent quality control measures to meet global standards. They meticulously select high-quality raw materials for their products, maintaining meticulous records of manufacturing processes. Each finished product undergoes rigorous testing before delivery to ensure optimal quality assurance. Furthermore, to address the company's operational capacity, the maximum production capability stands at 2.5 tons per day (Refer to Exhibit 2, Figure 2) Orders typically commence at a minimum quantity of 25 kg, often utilized by companies as samples before placing larger orders upon satisfaction with the product's quality. Finally, reflecting its success and ethical standards, the Asian Gelatin industry boasts a net worth of $250 million (Refer to Exhibit 3, Figure 3), a testament to its financial stability and adherence to industry standards.

While taking about the success it’s not merely a luck rather conscious and labour Mr Zohaib mark about success and make a three success pillar and here is the company successful pillar.

Quality

Consistently delivering high-quality products or services is a fundamental pillar of success. This not only builds trust and loyalty among customers but also enhances the brand's reputation. Quality assurance and continuous improvement are crucial aspects of maintaining excellence.

Customer Relationship Management

AGI makes it easy for customers to get in touch with them, and they respond quickly to inquiries and complaints. This shows that they value their customers and are committed to providing good customer service.

Innovation

Successful companies often thrive on innovation—whether it's introducing new products, adopting cutting-edge technologies, or finding novel solutions to existing challenges. Staying ahead of the curve and being adaptable to change can set a company apart.

Asain gelatin carried out an inimitable turnaround. After many years of high investment and significant losses, today the company earns an operating profit and achieves record values in virtually all key figures These three pillars—Innovation, Quality, and Customer Relationship management —often form the foundation of successful businesses across various industries. They create a framework for growth, sustainability, and positive engagement with both customers and the broader market.

Supply Chain Team facing Key Issues

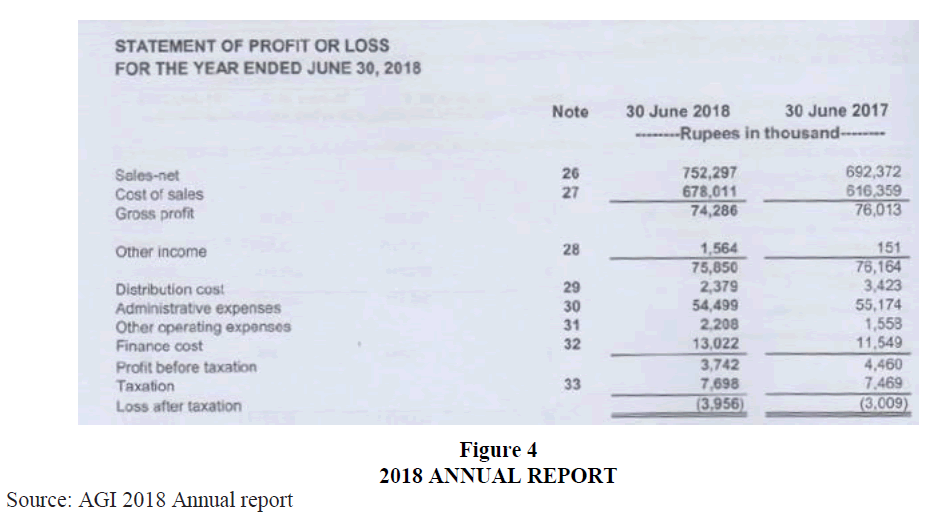

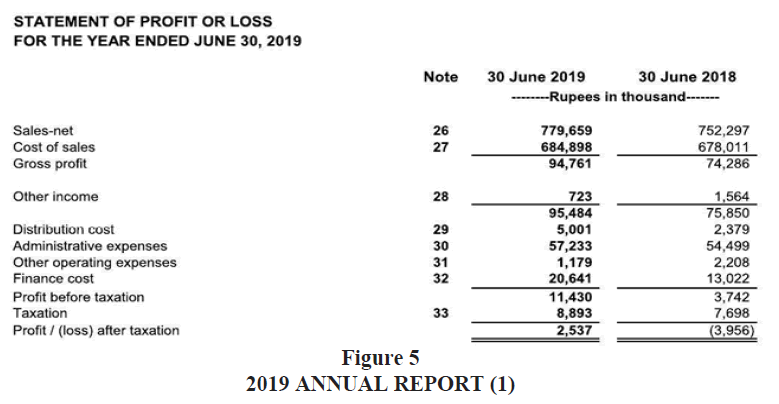

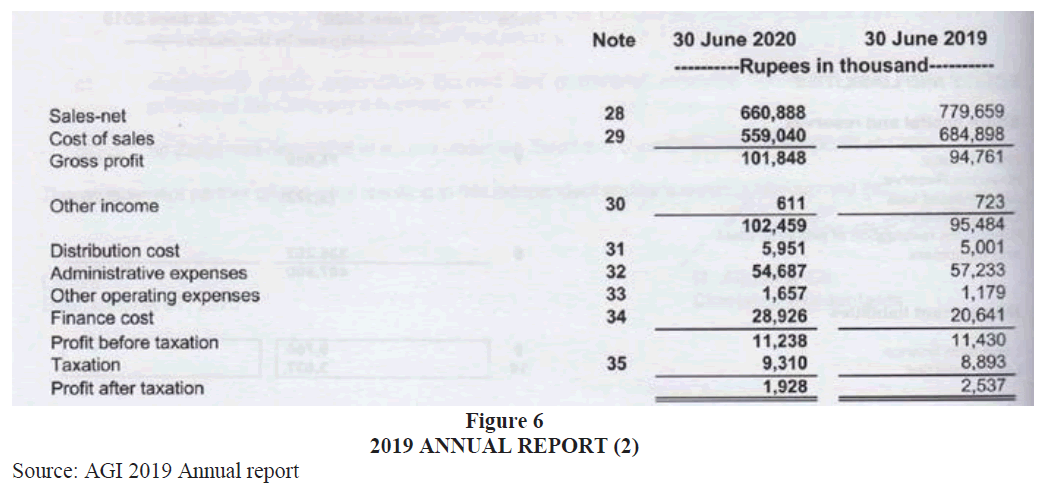

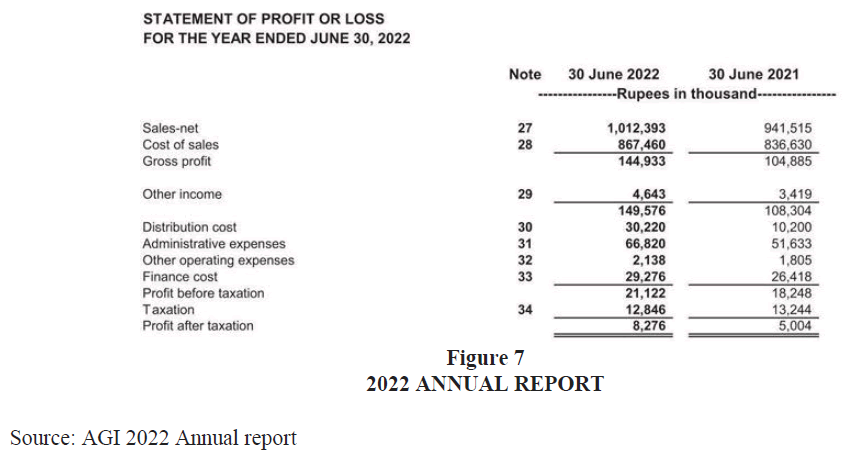

When the Zohaib Ahmed joined the company in the 2018 , there was no supply chain representative at the senior management level and no dedicated supply chain organization and also not any awareness in Pakistan in the Pakistan everyone in the mind being a Muslim this company use the haram cutis (Refer to Exhibit 4, Figure 4 & Figure 5) and they produce the haram gelatin that’s a reason not signal local industry in Pakistan attach with the Asian gelatin industry That’s a reason they just target the Globalization industry not the local industry when they hit the global industry they give a bulk of order and AGI just complete the order in the 6 month and last 6 month they cannot make any one order and the company is completed off and jusy giving the wage of labour or the other expense and the company go the loss and at this time they can’t do nothing. This had to be done in a frugal way given the high losses that the company continued to incur. As Zohaib Ahmed said We were losing more than a million dollar a day. The team was firefighting every day, and there was no focus on operations in the early days – something the new management team wanted to see changed. That said, there was little guidance on what the priorities should be – after all, they brought me in to give that direction. Zohaib Ahmed began analyzing in greater detail the issues that his team was facing. He knew it would be important for long-term success to not only put out the fires but also to address their root causes (Refer to Exhibit 4, Figure 6 & Figure 7).

He was wondering if as a first step it would be useful to apply the Supply Chain Operations Reference model on a high level. SCOR1 was developed in 1996 by the management consulting firm PRTM2 (now part of Price water house Coopers LLP) and AMR Research (now part of Gartner) and endorsed by the Supply-Chain Council. It was a process reference model for supply chain management that enables users to address, improve and communicate supply chain management practices within and between all interested parties in the extended enterprise, from the supplier’s supplier to the customer’s customer.

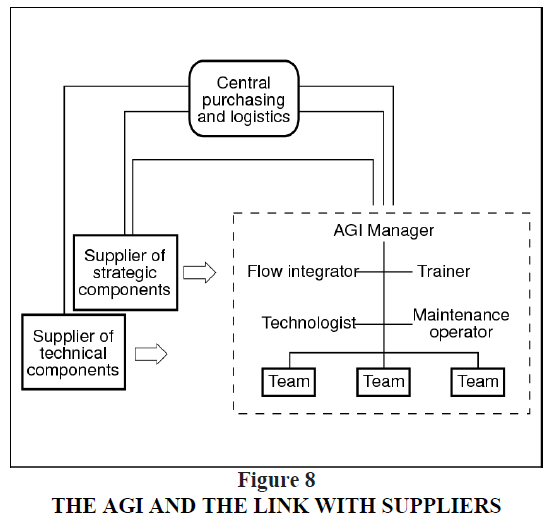

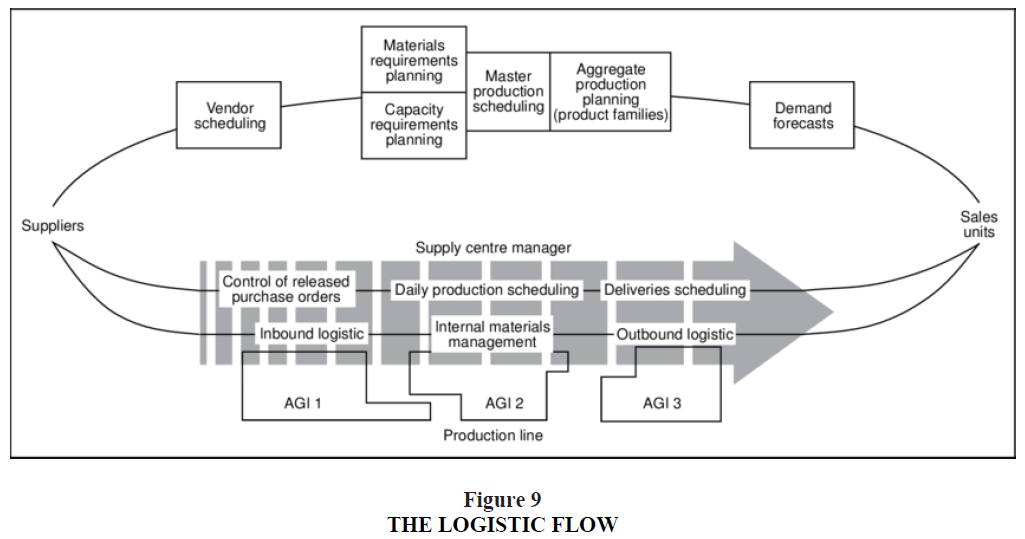

Strategy and Outcomes

The managing director Zohaib Ahmed spearheaded a series of awareness events aimed at highlighting the company's steadfast commitment to ethical sourcing practices. These events emphasized the meticulous avoidance of skins from prohibited animals, (Refer to Exhibit 5, Figure 8) underscoring the organization's dedication to ethical standards. Concurrently, efforts were made to educate stakeholders about the company's values, reinforcing the importance of ethical sourcing in the industry. Recognizing opportunities for enhancement, Zohaib Ahmed led initiatives to fortify the company's supply chain. Measures were implemented to address inefficiencies, focusing on optimizing inventory management and streamlining production processes. These strategic improvements bolstered overall operational efficiency, paving the way for significant advancements in the company's global expansion and local industry integration within Pakistan. The company's global expansion strategy yielded substantial success (Refer to Exhibit 6, Figure 9) penetrating numerous countries and elevating its market presence while garnering widespread recognition. This expansion not only fortified the company's global footprint but also contributed significantly to its overall growth trajectory. Moreover, establishing firm connections within the local industry in Pakistan marked a pivotal milestone, overcoming initial challenges and fostering a more receptive environment within the local business community. This positive shift in perception and increased acceptance highlighted the company's adaptability and resonance within the domestic market.

Subsequently, strategic expansions into Gujranwala and Sheikhupura further underscored the company's trajectory of 400 percent growth and market strategy. Recognizing the potential in Gujranwala and assessing strategic considerations, the company strategically expanded its operations. Additionally, the establishment of a new industry in Sheikhupura signifies the company's dedication to scaling operations and meeting escalating demand. The expansion into Sheikhupura aligns with the objective of enhancing order fulfillment capabilities and ensuring efficiency and timely completion of orders to maintain high customer satisfaction levels. These expansion initiatives are not only indicative of the company's commitment to business continuity and sustainability but also serve to diversify locations, minimize risks, and widen its market reach.

The positive economic impact of these expansions is evident, with the company contributing significantly to the economies of the regions it operates in. The creation of job opportunities and increased economic activity serve as testaments to the company's substantial growth and beneficial contributions to local economies. Overall, these strategic initiatives underscore the successful implementation of the company's plans, leading to robust global and local growth, strengthened industry ties, and an amplified market position, reaffirming its prominence in the industry.

Conclusion

In conclusion, the company's journey from overcoming initial challenges to achieving successful global and local expansion reflects a strategic and adaptable approach. By emphasizing ethical practices and addressing operational inefficiencies, the company not only improved its public image but also strengthened its supply chain, contributing to overall operational efficiency. The strategic expansions into Gujranwala and the ongoing development in Sheikhupura indicate a commitment to meeting market demands and ensuring robust order fulfillment capabilities. The positive economic impact on the regions where the company operates, coupled with its commitment to sustainability, positions it well for long-term success. Moving forward, continuous market analysis, investments in technology, sustainable practices, and community engagement will be key to sustaining growth and staying responsive to evolving market dynamics.

Exhibit - 1

Exhibit - 2

Exhibit - 3

Exhibit - 4

Exhibit - 5

Exhibit - 6

End Notes

1Scor ( supply chain operations reference)

2Prtm( Price water house coopers llp)

Received: 20-Jan-2024, Manuscript No. JIACS-24-14384; Editor assigned: 22-Jan-2024, Pre QC No. JIACS-24-14384 (PQ); Reviewed: 06-Feb-2024, QC No. JIACS-24-14384; Revised: 14-Feb-2024, Manuscript No. JIACS-24-14384 (R); Published: 05-Mar-2024