Research Article: 2019 Vol: 23 Issue: 1

Barriers and Public Policies Impeding SMEs International Market Expansion: A South African Perspective

Veli Sibiya, University of Pretoria’s Gordon Institute of Business Science

Tumo Kele, University of Pretoria’s Gordon Institute of Business Science

Abstract

In this study, researchers sought to evaluate the influence of four variables (access to procurement contracts, access to funding, regulatory frameworks, and access to market information) that are important for the market expansion of Small and Medium Enterprises (SMEs) in both their local and international markets. The Resource-Based View (RBV) and institutional theories were used as theoretical underpinnings of the study based on the knowledge that SMEs are limited in internal resources and SMEs’ successes depend on institutions. Researchers used a survey method with a structured questionnaire administered through a web-based platform. A total of 178 questionnaires were obtained and after data screening and cleaning, the sample size was reduced to 119. A multiple linear regression test was conducted, and the results suggested that SMEs are experiencing challenges in gaining access to funding, access to market information, and an unfavourable regulatory environment. The study recommended that the South African government must design and implement a policy aimed at facilitating the creation of business networks between SMEs and large private corporates to ensure that SMEs have access to enough private funding and market information. Also, favourable regulatory environment is essential to drive SME expansions and successes.

Keywords

Institutional Theory, SMEs’ Expansion Barriers, SMEs’ Market Expansion, Resource-Based View of a Firm Theory, Public Policy.

Introduction

It is common practice for governments in various countries to develop and implement policy programmes aimed at alleviating entrepreneurship barriers. These include support in terms of funding, market access, market information, managerial capability as well as regulatory environments impeding on the market expansion of Small and Medium Enterprises’ (SMEs’) (Doh & Kim, 2014; Gilmore et al., 2013). One major reason for government participation in developing and implementing policies is that SMEs’ market expansion might effectively contribute to addressing a country’s socioeconomic challenges. In the South African context, building strong SMEs cannot be overemphasised. Thus, the optimal performance of SMEs should not be impeded by lack of resources and institutional factors that could be eliminated by governments (Beck, 2013; Castaño et al., 2016; Castillo et al., 2013; Heinonen & Hytti, 2014). Like other countries, South Africa has implemented policies aimed at addressing institutional and regulatory bottlenecks.

Despite much research on barriers hampering the global and international expansion of SMEs (Doh & Kim, 2014; Gilmore et al., 2013), employment and economic growth figures indicate that South Africa is still not leveraging on SMEs for the country’s economic growth and employment. Arguably, some researchers attribute the country’s failure to better use the capabilities of SMEs to the government’s inefficient institutions tasked with the responsibility to develop SMEs (Ibeh & Crone, 2015). Not surprisingly, most public policies thus emphasise the role of public institutions in eliminating or limiting barriers affecting the market expansion of SMEs (Cardoza et al., 2015; Dickson & Weaver, 2011; Hessels & Terjesen, 2010; Makhmadshoev et al., 2015; Oparaocha, 2015). Authors such as Cardoza et al. (2015) however argue that the business environment of SMEs in developing countries is often involve complex problems and challenges such as corruption and flouting of policies.

Given that research mainly points to regulatory problems regarding SME expansion, this study focused on a resource-based view and institutional theories where the premise is that SMEs are resource constrained and not well supported on regulatory matters (Viljamaa, 2011; Bhamra et al., 2010). Also, the perspective of resource dependency and network theories were considered since SMEs depend on key role players in the institutional environment to acquire essential resources for their market expansion plans (Ciravegna et al., 2013; Hessels & Terjesen, 2010).

Literature Review

It is common practice for governments in different countries to develop and implement policy programmes aimed at alleviating barriers such as funding, market access, market information, managerial capability as well as regulatory environment impeding SMEs’ market expansion (Doh & Kim, 2014; Gilmore et al., 2013). The motive for government’s participation in developing and implementing policies that support SMEs’ market expansion performance stems from the fact that SMEs address the country’s socioeconomic challenges, and their performance is impeded by the lack of resources and institutional factors (Beck, 2013; Castaño et al., 2016; Castillo et al., 2013; Heinonen & Hytti, 2014). As a result, this chapter delved deeper into SMEs’ policy programmes implemented in South Africa and around the world.

The study built on resource-based view of a firm theory on the premise that SMEs are resource constrained (Viljamaa, 2011). Furthermore, the study built on institutional theory on the premise that SMEs’ market expansion is not only impeded by lack of internal resources but by the unfavourable institutional environment where they conducting business (Bhamra et al., 2010). Also, the perspective of resource dependency and network theories was considered and discussed in this chapter due to the fact that SMEs depend on key role players in the institutional environment to acquire essential resources for their market expansion plans (Ciravegna et al., 2013; Hessels & Terjesen, 2010).

Theory Development

Institutional theory has three pillars, which are regulatory, social, and cultural influences. These pillars are imperative in promoting the survival and legitimacy of organisations (Scott, 2007). Of the three pillars of institutional theory, research has indicated that the regulatory institutional pillar is more imperative since government(s), through public polices, should create a favourable institutional environment for SMEs to expand their markets (Cardoza et al., 2015; Nasra & Dacin, 2010). Moreover, SMEs in developing countries are more concerned about implemented regulations and policies (Peng, 2003) that often create an unfavourable institutional environment for market expansion (Cardoza et al., 2015).

Barney (1991) reported that scholars drawing from RBV theory argue that SMEs in possession of non-substitutable, inimitable, rare and valuable resources have a sustainable competitive advantage that is often used to enhance market expansion. In advancing the perspective of RBV theory, entrepreneurship scholars argue that Entrepreneurial Orientation (EO) is a rare and valuable intangible resource that SMEs must possess to substitute for scarce tangible resources (Lafuente et al., 2013; Lonial & Carter, 2015; Shirokova et al., 2016). Rosenbusch et al. (2010) added that SMEs also need substantial funding to fund their entrepreneurial and innovation activities.

Building on resource dependency and network theories, the research sought to determine whether public policy could be used to curb barriers impeding SMEs’ market expansion through the facilitation of formal business networks in a value chain between large firms and SMEs in a home country. Currently, SMEs depend on various role players, through informal and formal networks, to compensate for institutional void (Ciravegna et al., 2013; Xheneti & Bartlett, 2012; Zhou, 2012), and to acquire scarce resources (Ciravegna et al., 2013; Hessels & Terjesen, 2010) necessary to enhance market expansion. Makhmadshoev et al. (2015) argue that dependence on informal networks is as a result of weak formal institutions, and has adversarial effect on SMEs’ market expansion.

Public Policy and Regulatory Environment

Governments in different countries use policies and regulatory frameworks as instruments to create a favourable environment for SMEs to grow and expand their markets (Halabí & Lussier, 2014; Nițescu, 2015). Most public policies and regulatory frameworks are intended to equip SMEs to deal with traditional barriers such as regulatory barriers, market access, funding, managerial capability and market information among others (Doh & Kim, 2014; Gilmore et al., 2013). Given all the correct intentions, developed and implemented policies and regulatory frameworks can either enhance or impede SMEs’ market expansion (Castaño et al., 2016). In the case of Latin America, the implemented policies to enhance the market expansion of SMEs have not produced intended results for various reasons ranging from corruption, ineffectiveness of public institutions and poor implementation among others (Cardoza et al., 2015). To that end, regulatory frameworks and policy programmes must be developed and implemented to accommodate the dynamics of the specific institutional environment (Arshed et al., 2014).

Following the adoption of the regulatory policy framework termed “The white paper on national strategy for the development and promotion of small business in South Africa” aimed at addressing the barriers faced by South African SMEs (Department of Trade & Industry, 1995), the South African institutional environment was considered ideal for the research. In accordance with the global community, the policy programmes outlined in the South African White Paper are intended to promote SMEs’ market expansion in order to address the challenges of economic growth, employment and poverty (Department of Trade & Industry, 1995). The socioeconomic challenges of 0.5% economic growth (South African Government News Agency, 2016) and the record high unemployment rate of 26.6% (Statistics South Africa, 2016d) informed the decision to research about barriers and public policies impeding South African SMEs’ market expansion.

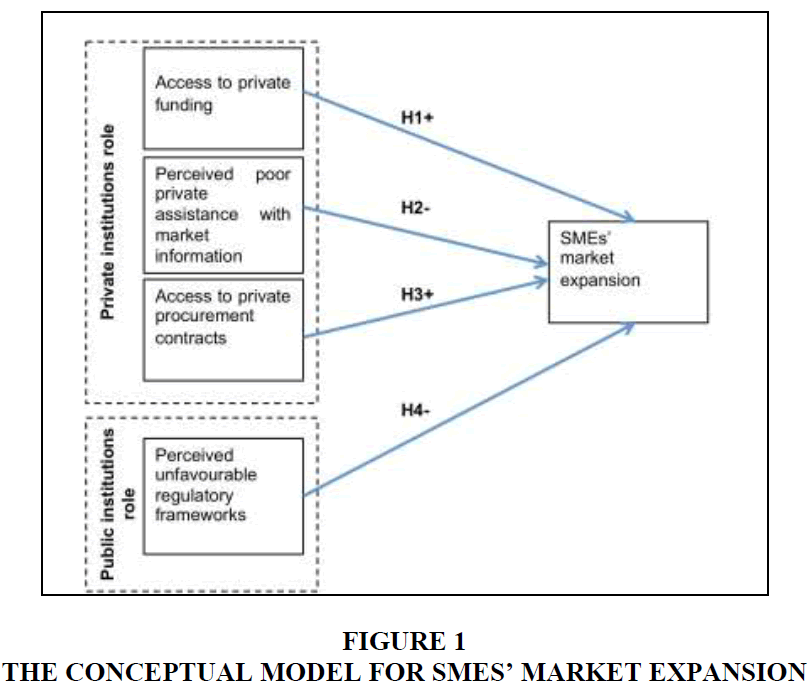

Despite the implementation of the White Paper policy programmes aimed at curbing barriers impeding SMEs’ market expansion such as tax burdens, lack of market access, lack of market information, lack of access to funding and unfavourable regulatory environment among others, South African SMEs are still struggling to expand their markets (Department of Trade & Industry, 2005). With that in mind, one of the main objectives of this research was to determine whether policy programmes that enable access to private procurement contracts, access to market information provided by private institutions, access to private funding as well as a creation of favourable regulatory environment by government could enhance SMEs’ market expansion. Thus, leading to Hypothesis 1.

H1: South African SMEs perceiving unfavourable regulatory frameworks are less likely to expand.

Market Expansion of SMEs

Naldi & Davidsson (2013) assert that SMEs’ market expansion occurs when SMEs expand into new geographic markets at home and abroad. Furthermore, some scholars measure expansion in terms of sales (Bianchi & Wickramasekera, 2016; Cardoza et al., 2015) and others measure expansion in terms of both employment and sales (Hessels & Parker, 2013). For this study, expansion meant expansion into new geographic markets at home (i.e. South Africa) and abroad, and was measured in terms of sales as sales is the most common measure of market expansion (Uhlaner et al., 2012).

Research suggests that the most sustainable expansion strategy for SMEs is the one that considers expansion into international markets to avoid limitations and saturation of home markets brought by international firms (Bianchi & Wickramasekera, 2016; Dikova et al., 2015). Therefore, domestic orientated SMEs and exporting SMEs must expand or further expand to international markets. However, international market expansion proves to be almost impossible for these SMEs because of barriers and unfriendly policies impeding their determination (Bianchi & Wickramasekera, 2016; Dikova et al., 2015). As a result, the study sought to determine favourable policies that would support international market expansion of SMEs.

SMEs’ Access to Private Funding

Leonidou (2004) affirms that SMEs often lack funding to invest in much needed resources and capacity to enhance market expansion performance. Similarly, Lee et al. (2014) assert that SMEs’ balance sheets are relatively poor to finance expansion investments. Given these facts, SMEs are in desperate need of external finance to fund expansion investments (Lee et al., 2014). However, the current capital market structure is not making it any easier for SMEs to acquire the much-needed funding for expansion investment. Firstly, SMEs are sceptical of acquiring funding from business angels and venture capitalists, although proven to have a good track record (Alperovych et al., 2014), because of fears of losing control of their business (Daskalakis et al., 2013). Secondly, the reliance on hard information as a transactional lending technique by large banks to assess the risk of lending to SMEs (Bartoli et al., 2013; Yaldız Hanedar et al., 2013), make it more difficult for SMEs to acquire long-term debt with acceptable payment conditions (Canton et al., 2012; Daskalakis et al., 2013).

To assist in easing challenges of SMEs’ external funding, different governments have implemented grant financing policies (Daskalakis et al., 2013), which could be in the form of tax incentives, loans and subsidies (Busom et al., 2014). Despite numerous efforts by governments to provide funding solutions, SMEs, particularly in developing economies, remain financially constrained (Beck, 2013; Lee & Drever, 2014; Yaldız Hanedar et al., 2013).

Research by different scholars affirm that the challenges of access to external funding could be resolved through the diversification of the types of lending such that SMEs are afforded with access to numerous choices to choose from (Lee et al., 2014; Ryan et al., 2014). Notwithstanding government’s effort in resolving SMEs’ access to external funding through grant financing, this study sought to determine the role that can be played by private institutions in providing SMEs with access to external funding following the view that SMEs having access to private funding seem very likely to expand their markets (Cardoza et al., 2015). Thus, leading to research Hypothesis 2.

H2: South African SMEs benefiting from private funding are more likely to expand.

SMEs’ Access to Market Information Provided by Private Institutions

Child & Hsieh (2014) define information “as data that are structured and understood in a way so as to become a useful input into knowledge”. According to Child & Hsieh (2014), lack of access to market information is one of the main barriers impeding SMEs’ market expansion. The most cited market information barriers impeding SMEs’ market expansion, particularly international expansion, include: “locating/analysing foreign markets, finding international market data, identifying foreign business opportunities, and contacting overseas customers” (Leonidou, 2004). Moreover, Jin et al. (2016) categorise these market information barriers into institutional knowledge, i.e. information about the new markets’ institutional environment, and business knowledge, i.e. information about competitors, markets and customers in new markets. Given these facts, this study focused on SMEs’ access to both institutional and business knowledge.

Different authors affirm that the impact of market information on market expansion performance is reliant on the quality of information sources (De Clercq et al., 2011; Mogos et al.,, 2011). Henceforth, governments in Latin America were not effective in providing SMEs with market information necessary to expand their markets, whereas information obtained from private firms through formal and informal networks (Mogos et al., 2011); through export intermediaries (Hessels & Terjesen, 2010); and through alliance with international firms (Milanov & Fernhaber, 2013) assisted with market expansion performance.

Thus, leading to research Hypothesis 3.

H3: South African SMEs perceiving poor private institutions assistance on market information are less likely to expand their market.

SMEs’ Access to Private Procurement Contracts

Following the acknowledgement by government that South African SMEs lack access to markets, government has since implemented supplier development and procurement policies (Department of Trade & Industry, 1995). The results of such policies in enhancing the market expansion of SMEs remain varied (Cardoza et al., 2014; De Falco & Simoni, 2014). For example, government procurement contracts failed to promote SMEs’ market expansion in Latin America (Cardoza et al., 2015) and China (Cardoza et al., 2014). In contrast, the supplier development policies in Chile that encouraged business relationships between SMEs as suppliers and large private firms as customers assisted both SMEs and large private firms with improved sales and expansion performance (Arráiz et al., 2012).

Hsu et al. (2011) assert that policies that promote SMEs as suppliers of large firms ensure that SMEs have access to the large firm’s technology, finance, market information and human resources. On the other hand, large firms as customers benefit from the flexibility and competencies of SMEs as suppliers. Overall, the trust relationship built over time between the SME supplier and large firm customer reduce the cost and the risk of doing business with each other (Hsu et al., 2011). However, policies giving preference to SMEs in the supply chain might impede the entrepreneurial orientation of SMEs (Arráiz et al., 2012), which is a rare, valuable and non-substitutable intangible resource necessary for market expansion (Lafuente et al., 2013; Lonial & Carter, 2015; Shirokova et al., 2016). Thus, leading to research Hypothesis 4.

H4: South African SMEs having access to private procurement contracts are more likely to expand.

The Conceptual Model for SMEs’ Market Expansion

Following government failure, particularly in developing economies, to enhance SMEs’ market expansion for various reasons (Cardoza et al., 2015), this research tested the conceptual model in Figure 1 indicating that private institutions can play a major role in providing access to funding, access to market information and access to procurement contracts. Also indicated in Figure 1 is the importance of public institutions in creating a favourable environment for SMEs to expand their markets.

Methodology

For this study, the research design adopted was quantitative and the research type was explanatory. The main objective of the study was to gain more understanding on barriers impeding South African SMEs’ market expansion as these barriers vary between countries (Williams & Horodnic, 2015). Cahen et al. (2015) assert that more insight on barriers impeding SMEs’ market expansion already exists for developed countries. In contrast, only few scholars (Cahen et al., 2015; Cardoza et al., 2014:2015; Uner et al., 2012; Zhu et al., 2011) have recently started gaining further insight on barriers impeding SMEs’ market expansion from the context of developing economies.

Population and Sample

The target population was all South African formal manufacturing SMEs that were in operation during the time of the research formed part of the study universe. Given the time frame and the nature of the study, the selected universe was considered appropriate. Firstly, the manufacturing sector was selected based on the fact that the South African manufacturing sector is facing negative growth challenges, and most SMEs in the sector are struggling to survive (Manufacturing Bulletin, 2012). Secondly, the researcher’s resources could not allow for the study to be extended to informal manufacturing SMEs in the study because they do not exist in any database. Questionnaires were distributed to managers who manage SMEs in the manufacturing sector. A non-probability purposive sampling method was used to select SMEs’ managers as suitable sampling members.

A sample size of 119 managers from formal manufacturing SMEs was received through electronically distributed questionnaires. At first, researchers received a sample of 178 and cleaned the data, resulting in the reduction of the sample to 119. Researchers used a government agency, with a database for SMEs in the manufacturing sector to distribute questionnaires.

The Influence of Funding On SMES’ Total Market Expansion

Researchers conducted the multiple linear regression models on three independent variables, i.e. public funding, local government funding and private funding, as well as one dependent variable being total sales measured on a continuous scale. Table 1 below depicts that the significance value of 0.034 indicating that private funding is a significant independent variable in explaining the variation in SMEs’ total sales at the confidence interval of 95 percent.

| Table 1 Coefficienta For funding vs. Total expansion |

||||||||||

| Model | Unstandardised Coefficients | Standardised Coefficients | t | Sig. | 95.0% Confidence Interval for B | Collinearity Statistics | ||||

| B | Std. Error | Beta | Lower Bound | Upper Bound | Tolerance | VIF | ||||

| 1 | (Constant) | 34348117.04 | 12741475.7 | 2.696 | 0.009 | 8960172.427 | 59736061.7 | |||

| Personal funding | -1434510.59 | 1889023.58 | -0.086 | -0.759 | 0.45 | -5198472.24 | 2329451.06 | 0.963 | 1.038 | |

| Private funding | 4348704.626 | 2011466.24 | 0.247 | 2.162 | 0.034 | 340770.654 | 8356638.6 | 0.956 | 1.046 | |

| Public funding | 549622.429 | 3148570.99 | 0.02 | 0.175 | 0.862 | -5724042.22 | 6823287.08 | 0.989 | 1.011 | |

a. Dependent Variable: Total sales.

Findings

To answer the research questions and meet the research objectives, multiple linear regression tests and paired samples t-tests were conducted using IBM SPSS statistical analysis software. Given that the researchers did not have access to the total population, that includes SMEs not registered, a confidence interval of 95 percent was deemed appropriate for statistical.

Given that the results indicate private funding as the only significant variable in predicting SMEs’ total sales, research Hypothesis 1 was accepted. Thus, researchers concluded that private funding does influence the total market expansion of South African SMEs.

The Influence of Funding On SMEs’ International Market Expansion

Regarding the international market expansion variable, the multiple linear regression model fitted also had public funding, private funding and local government funding as independent variables. However, the dependent variable termed international expansion is a ratio of export sales to total sales.

Researchers calculated the significance value of 0.789 using ANOVA and the results indicated that funding as not explaining the international expansion of South African SMEs. Furthermore, none of the independent variables, as depicted in Table 2, explain international expansion of South African SMEs at 95% confidence interval. Therefore, research Hypothesis 2 is rejected for the international market expansion of SMEs.

| Table 2 Coefficienta For funding vs. International expansion |

|||||||||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | Collinearity Statistics | |||||||||||||

| B | Std. Error | Beta | Lower Bound | Upper Bound | Tolerance | VIF | |||||||||||||

| 1 | (Constant) | 0.180 | 0.092 | 1.96 | 0.054 | -0.003 | 0.363 | ||||||||||||

| Personal funding | 0.011 | 0.014 | 0.092 | 0.79 | 0.435 | -0.016 | 0.038 | 0.963 | 1.04 | ||||||||||

| Private funding | -0.004 | 0.015 | -0.034 | -0.29 | 0.772 | -0.033 | 0.025 | 0.956 | 1.05 | ||||||||||

| Public funding | -0.009 | 0.023 | -0.048 | -0.42 | 0.679 | -0.055 | 0.036 | 0.989 | 1.01 | ||||||||||

a. Dependent Variable: Total sales.

The Influence of Market Information on SMEs’ Total Market Expansion

With other variables included in the calculations, the significance value of 0.006 for host regulations in Table 3 indicated that South African SMEs have challenges in accessing information related to regulations in foreign markets. The researchers thus rejected Hypothesis 3. Therefore, one can infer that South African SMEs are still able to expand their total markets despite lack of assistance on information about host regulations.

| Table 3 Coefficientsa For market information vs. Total market expansion |

||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | Collinearity Statistics | ||||

| B | Std. Error | Beta | Lower Bound | Upper Bound | Tolerance | VIF | ||||

| 1 | (Constant) | -9666536.5 | 29739198 | -0.33 | 0.746 | -69026224 | 49693151 | |||

| Host regulations | 18443906 | 6469262.9 | 0.396 | 2.85 | 0.006 | 5531203.4 | 31356609 | 0.611 | 1.637 | |

a. Dependent Variable: Total sales.

The Influence of Market Information on SMEs’ International Market Expansion

With regards to familiarity, researchers found the significance value of 0.038, as depicted in Table 4. Which suggests that South African SMEs are not familiar with commercial practices in foreign or international markets. Furthermore, the significance value of 0.008 for government assistance in Table 4 depicts that government does not offer assistance with regards to market information. Thus, researchers rejected Hypothesis 4.

| Table 4 Coefficienta For market information vs. International market expansion |

||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | Collinearity Statistics | ||||

| B | Std. Error | Beta | Lower Bound | Upper Bound | Tolerance | VIF | ||||

| 1 | (Constant) | -0.132 | 0.198 | -0.67 | 0.508 | -0.527 | 0.263 | |||

| Gov assistance | 0.100 | 0.037 | 0.336 | 2.73 | 0.008 | 0.027 | 0.174 | 0.793 | 1.261 | |

| Familiarity | -0.084 | 0.040 | -0.294 | -2.12 | 0.038 | -0.162 | -0.005 | 0.624 | 1.602 | |

a. Dependent Variable: Total sales.

Public versus Private Institutions in Providing Market Information

Table 5 shows a significance value of 0.032 with the mean difference of 0.256 between private and government assistance at a confidence interval of 95%. Thus, researchers deduced that private institutions are better prepared in providing market information when compared to public or government institutions in South Africa.

| Table 5: Paired sample test for public vs. Private assistance on market information | ||||||||

| Paired Differences | t | Sig. (2-tailed) | ||||||

| Mean | Std. Deviation | Std. Error Mean | 95% Confidence Interval of the Difference | |||||

| Lower | Upper | |||||||

| Pair1 | Gov assistance– Pvt assistance | 0.256 | 1.037 | 0.117 | 0.023 | 0.490 | 2.183 | 0.032 |

As Table 6 depicts, none of the procurement contract types are significant in explaining the total market expansion of South African SMEs. Thus, research Hypothesis 3 is rejected for total market expansion of South African SMEs.

| Table 6 Coefficienta For procurement contracts vs. Total expansion |

||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | Collinearity Statistics | ||||

| B | Std. Error | Beta | Lower Bound | Upper Bound | Tolerance | VIF | ||||

| 1 | (Constant) | 39341005 | 11842001 | 3.322 | 0.001 | 15745304 | 62936706 | |||

| Pvt procurement | 74834.507 | 149338.19 | 0.06 | 0.501 | 0.618 | -222728.34 | 372397.36 | 0.943 | 1.061 | |

| Nat gov procurement | -186473.81 | 390717.76 | -0.058 | -0.477 | 0.635 | -964995.94 | 592048.32 | 0.902 | 1.109 | |

| Loc gov procurement | -95836.411 | 388281.44 | -0.029 | -0.247 | 0.806 | -869504.07 | 677831.25 | 0.955 | 1.047 | |

a. Dependent Variable: Total sales.

The Influence of Procurement Contracts on SMEs’ International Market Expansion

Regarding the international market expansion, researchers found the significance value 0.037, as depicted in Table 7, which indicates that private procurement contracts are significant in explaining the international expansion of South African SMEs. Therefore, research Hypothesis 3 is accepted for international market expansion of South African SMEs.

| Table 7 Coefficienta for procurement contracts vs. International expansion |

||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | Collinearity Statistics | ||||

| B | Std. Error | Beta | Lower Bound | Upper Bound | Tolerance | VIF | ||||

| 1 | (Constant) | 0.363 | 0.080 | 4.55 | 0.000 | 0.204 | 0.522 | |||

| Pvt procurement | -0.002 | 0.001 | -0.244 | -2.13 | 0.037 | -0.004 | 0.000 | 0.943 | 1.06 | |

| Nat gov procurement | -0.004 | 0.003 | -0.158 | -1.34 | 0.183 | -0.009 | 0.002 | 0.902 | 1.11 | |

| Loc gov procurement | -0.002 | 0.003 | -0.102 | -0.9 | 0.372 | -0.008 | 0.003 | 0.955 | 1.05 | |

a. Dependent Variable: Total sales.

The Influence of Regulatory Frameworks on SMEs’ Total Market Expansion

Table 8 shows the significance value of 0.025, which shows that the currency exchange rate is a significant barrier in total market expansion of South African SMEs. Thus, researchers rejected Hypothesis 4 for the total market expansion.

| Table 8 Coefficienta for regulatory frameworks vs. Total expansion |

||||||||

| Model | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | Collinearity Statistics | |||

| Beta | Lower Bound | Upper Bound | Tolerance | VIF | ||||

| 1 | (Constant) | -0.562 | 0.576 | -76540371.4 | 42868485.9 | |||

| Exch rate | 0.26 | 2.285 | 0.025 | 1567477.145 | 22919822.3 | 0.943 | 1.061 | |

| Payment | 0.169 | 1.507 | 0.136 | -2189781.41 | 15776545.5 | 0.972 | 1.029 | |

| Dom regulations | -0.045 | -0.389 | 0.699 | -14802518 | 9969794.16 | 0.924 | 1.082 | |

a. Dependent Variable: Total sales.

Regarding regulatory barriers, in Table 9 shows that none of the regulatory barriers were significant. Thus, research is Hypothesis 4 is accepted.

The Influence of Regulatory Frameworks on SMEs’ International Market Expansion

| Table 9 Coefficientsa for regulatory frameworks vs. International expansion |

||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | Collinearity Statistics | ||||

| B | Std. Error | Beta | Lower Bound | Upper Bound | Tolerance | VIF | ||||

| 1 | (Constant) | 0.094 | 0.24 | 0.393 | 0.696 | -0.384 | 0.573 | |||

| Paperwork | -0.04 | 0.039 | -0.143 | -1.029 | 0.307 | -0.117 | 0.038 | 0.722 | 1.385 | |

| Exchrate | 0.013 | 0.048 | 0.039 | 0.263 | 0.793 | -0.083 | 0.109 | 0.65 | 1.538 | |

| Domregulation | -0.031 | 0.041 | -0.093 | -0.758 | 0.451 | -0.113 | 0.051 | 0.929 | 1.077 | |

| Payment | 0.052 | 0.039 | 0.184 | 1.328 | 0.189 | -0.026 | 0.129 | 0.729 | 1.372 | |

| Econenvironment | 0.04 | 0.037 | 0.153 | 1.082 | 0.283 | -0.034 | 0.115 | 0.693 | 1.442 | |

Discussion

As discussed earlier, market expansion in this study meant the expansion into new geographic markets abroad and at home (Naldi & Davidsson, 2013). To that end, the ratio of annual export sales to annual total sales was used as a proxy for international market expansion, and annual total sales as a proxy for total market expansion.

The Influence of Funding On SMEs’ Market Expansion

Research Hypothesis 1 stating that South African SMEs benefiting from private funding are more likely to expand was aimed at corroborating the perspective by Cardoza et al. (2015) affirming that SMEs with access to private finance seem to expand their markets. The fact that private funding (Sig. 0.034) was found to be the only funding type influencing the total market expansion of South African SMEs validated the view by Cardoza et al. (2015).

However, this view did not hold true for the international market expansion since none of the funding types (Sig>0.4) influence the international market expansion of South African SMEs. In support of these interesting findings, Huett et al. (2014) affirm that resources creating value in a certain geographic market would not necessarily create value in a new geographic market because of institutional differences. Furthermore, Lonial & Carter (2015) assert that SMEs must have the ability to effectively deploy their resources when expanding into new markets. Therefore, it could be deduced that South African SMEs effectively deploy private funding to create value in home markets, and not in international markets.

In contrast, entrepreneurship scholars could argue that lack of entrepreneurial orientation is one of the reasons SMEs do not expand into competitive foreign markets even though they have access to private funding (Lafuente et al., 2013; Lonial & Carter, 2015; Shirokova et al., 2016). In addition, De Falco & Simoni (2014) assert that certain prerequisites must be met before expanding into foreign markets.

Unsurprisingly, the results for public funding (Sig. 0.862) suggested that South African government funding policy programmes aimed at enhancing SMEs’ market expansion are not effective. These results validated the findings by the Department of Trade and Industry (2005) stating that the market expansion of South African SMEs is still impeded by various barriers, including lack of access to funding, despite the implementation of policy programmes outlined in the White Paper.

The Influence of Market Information on SMEs’ Market Expansion

Even though South African SMEs still lack access to certain information regarding commercial practices (Sig. 0.038) and regulations (Sig. 0.006) in international markets, it could be deduced from a paired sample t-test that private institutions provide most of the market information (Sig. 0.032 for the mean difference). Similarly, the multiple linear regression test results indicated that government does not assist with foreign market information (Sig. 0.008). The failure of South African government policy to provide assistance on market information corroborates the findings on the failure of Latin American policy programmes to provide information about potential markets (Cardoza et al., 2015). Consequently, the lack of access to this crucial foreign market information, i.e. regulations and commercial practices, could justify the failure of SMEs to seize opportunities offered by international markets (Bianchi & Wickramasekera, 2016; Dikova et al., 2015).

In conclusion, South African SMEs could perform even better in terms of market expansion, particularly foreign market expansion, if they could be provided with all the muchneeded market information. Moreover, private institutions are in a better position to provide market information to SMEs when compared to public institutions.

The Influence of Procurement Contracts on SMEs’ Market Expansion

The current research on the effectiveness of supplier development and procurement policies aimed at enhancing the market expansion of SMEs shows varied results (Cardoza et al., 2014; De Falco & Simoni, 2014). As a result, research hypothesis 3 sought to determine the influence of procurement contracts on SMEs’ market expansion.

There are a number of reasons for SMEs to prefer foreign markets instead of home markets. Firstly, Williams & Horodnic (2015) affirm that the market expansion performance of SMEs is influenced by SMEs’ resource capacity and the institutional environment. According to Bruton et al. (2010), building internal resource capacity, e.g. through access to private procurement contracts and private funding, is not sufficient to enhance SMEs’ market expansion performance if the institutional environment is unfavourable. As a result of high risk and cost of doing business in home markets with unfavourable institutional environment (Manufacturing Bulletin, 2012), SMEs tend to prefer foreign markets instead home markets.

Secondly, another reason for preferring foreign markets over home markets has to do with the fact that home markets are saturated by international firms (Bianchi & Wickramasekera, 2016; Dikova et al., 2015). In this context, South Africa imports about 50% of the manufactured goods at the relatively cheaper price (Manufacturing Bulletin, 2012). These findings complement the earlier funding findings in a sense that SMEs with access to private procurement contracts generate sufficient funding to fund international expansion.

In conclusion, South African SMEs with access to private procurement contracts tend to invest in foreign markets instead of home markets due to unfavourable institutional environment and competitive environment in home markets. Also, the procurement or supplier development policies implemented by South African government are not assisting SMEs with market expansion.

The Influence of Regulatory Frameworks on SMEs’ Market Expansion

Most governments around the world have implemented various policy and regulatory frameworks to remedy resource gaps and unfavourable institutional environment so that SMEs can thrive (Munari & Toschi, 2014). To that end, research hypothesis 4 sought to determine the state of the regulatory or macroeconomic environment for South African SMEs.

The regression test results indicate that the exchange rate (Sig. 0.025) is the significant barrier for the total market expansion of South African SMEs. On the other hand, there are no significant regulatory or macroeconomic barriers (Sig>0.1) impeding the international market expansion of South African SMEs. Therefore, it could be deduced that the exchange rate influences the domestic market expansion performance and not the international market expansion performance.

These results make perfect sense for two basic economic reasons. Firstly, exchange rate is not a significant barrier for international expansion performance because export sales are generally in US dollars and input costs are a combination of South African Rands and US dollars (import material), assuming manufacturing occurs in South Africa. Hence, the high US dollar/SA Rand exchange rate often experienced by the South African market is in favour of the international market expansion performance. In contrast, sales in domestic markets are conducted in South African Rands resulting to squeezed margins when exchange rate is high. Moreover, competition in the domestic market is high because 50% of manufactured goods consumed in South Africa are imported at a relatively cheaper price (Manufacturing Bulletin, 2012). Given these facts, the high US dollar/SA Rand exchange rate often experienced by the South African market makes the regulatory or macroeconomic environment unfavourable for the domestic markets.

Critical Barriers Impeding SMEs’ Market Expansion

Although the expansion barriers of today are still similar to the expansion barriers found by scholars in earlier years, SMEs in different countries perceive or experience these barriers differently (Uner et al., 2012). Furthermore, most countries cite barriers such funding (Beck, 2013; Daskalakis et al., 2013; Lee et al., 2014; Yaldız Hanedar et al., 2013), market information (Child & Hsieh, 2014; Huett et al., 2014; Naldi & Davidsson, 2013; Oura et al., 2015) and unfavourable regulatory environment (Bruton et al., 2010; Mogos Descotes et al., 2010; Williams & Horodnic, 2015) as being critical in the expansion performance of SMEs.

To begin with, the findings suggest that South African government policy programmes designed to alleviate external funding barriers are not effective, i.e. public funding does not influence the expansion performance of SMEs (Sig. 0.862 and Sig. 0.679). As a result, South African SMEs rely on private funding to fund their expansion investments. However, the private funds received are only sufficient to fund home market expansion, and not international market expansion. Therefore, funding is still a critical barrier on the expansion performance of South African SMEs.

Secondly, South African SMEs still lack access to market information regarding regulations (Sig. 0.006) and commercial practices (Sig. 0.038) in foreign markets. Even more concerning is the fact that the results indicate that SMEs do not get support from government on foreign market information.

Thirdly, the domestic market expansion of South African SMEs is negatively influenced by the exchange rate (Sig. 0.025) even though this is not the case for international market expansion (Sig>0.1, Table 5). The high US dollar/SA Rand exchange rate often experienced by the South African market is in favour of the international market expansion performance because sales in these markets are generally in US dollars

Finally, following the fact that the South African White Paper identified lack of access to markets as a significant barrier to the growth of SMEs (Department of Trade and Industry, 1995), the effectiveness of whatever procurement policy programmes that have since been put in place was also tested. The results indicate that South African government procurement contracts are not effective at all in enhancing the market expansion of SMEs (Sig. 0.037). On the other hand, access to private procurement contracts influence the international market expansion of SMEs (Sig. 0.037) and not the domestic market expansion (Sig>0.6) for various reasons.

Conclusions And Recommendations

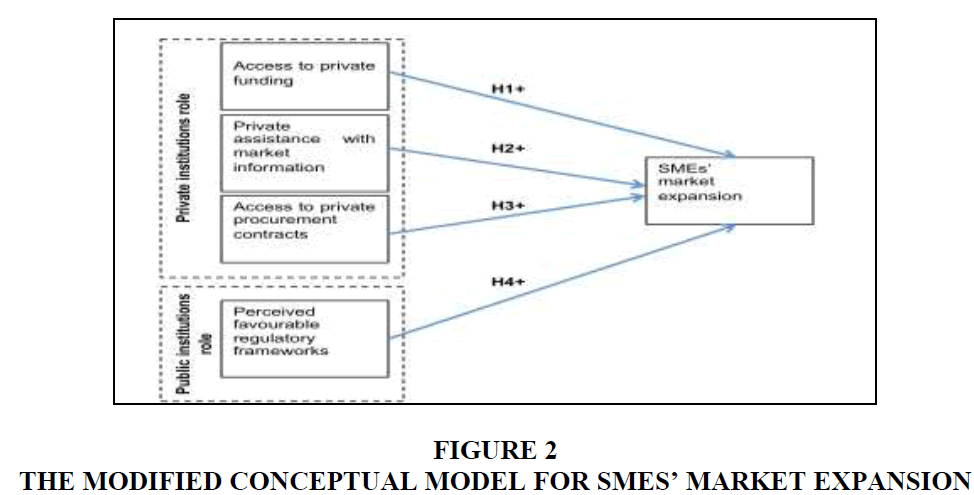

Notwithstanding other objectives, the main objective of the study as adopted from Cardoza and modified was to determine the influence of four critical barriers (access to procurement contracts, access to funding, regulatory frameworks, and access to market information) on SMEs’ market expansion in a setting that included both private and public institutions instead of only public institutions. In addition, the roles to be played by both private and public institutions in curbing expansion barriers were also determined.

Unsurprisingly, the study revealed that South African SMEs are still experiencing challenges regarding access to markets or procurement contracts, access to funding, access to market information, and an unfavourable regulatory environment. It is unfortunate that this is still the case following the adoption of White Paper centred on curbing these barriers about 20 years ago.

Also, the study revealed that public institutions lack capacity and are ineffective in playing the main role in curbing these sets of barriers. The results suggest that the market expansion of South African SMEs is to a certain extent enhanced by access to private procurement contracts, access to private funding, and access to market information provided by the private sector. In addition, SMEs are still able to expand their markets despite the unfavourable regulatory environment.

The Modified Conceptual Model for SMEs’ Market Expansion

Following the research findings, the conceptual model by Cardoza for the market expansion of SMEs was modified to reflect the conditions necessary to enhance the market expansion of South African SMEs. In this model, it is a responsibility of both public and private institutions, instead of only public institutions, to enhance the market expansion of SMEs (Figure 2).

Recommendations For Policy Makers

Government must design and implement a public policy to facilitate the creation of business networks in a value chain between SMEs and large private firms with the aim of ensuring that SMEs have access to sufficient private funding, access to all necessary market information, and access to private procurement contracts. Furthermore, government together with relevant stakeholders must create a favourable regulatory environment, through policies and regulations, where large private firms would be encouraged to develop SMEs through supply chain or procurement development initiatives. In this case, government must provide incentives and/or funding to large private firms for their participation in supply chain or procurement development initiatives.

Given these facts, public policy must satisfy certain conditions if it were to be successful. Firstly, despite the success of formal business relationships between large private firms and SMEs in enhancing the market expansion of SMEs in Chile in South and in the United State of America, public policy must ensure that the independence and flexibility of SMEs are protected. Secondly, SMEs must command full control or ownership of resources acquired during the relationship. Thirdly, the policy must be designed in such a way that the risk of unintended flow of information from small firms to large firms because of asymmetrical power is safeguarded. Lastly, the policy must be designed in such a way that it does not inhibit innovation due to the fact that SMEs are given preference in a value chain.

References

- Alperovych, Y., Hübner, G., & Lobet, F. (2014). How does governmental versus private venture capital backing affect a firm’s efficiency? Evidence from Belgium. Journal of Business Venturing, 30(4), 508-525.

- Arráiz, I., Henríquez, F., & Stucchi, R. (2012). Supplier development programs and firm performance: Evidence from Chile. Small Business Economics, 41(1), 277-293.

- Arshed, N., Carter, S., & Mason, C. (2014). The ineffectiveness of entrepreneurship policy: Is policy formulation to blame? Small Business Economics, 43(3), 639-659.

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

- Bartoli, F., Ferri, G., Murro, P., & Rotondi, Z. (2013). SME financing and the choice of lending technology in Italy: Complementarity or substitutability? Journal of Banking & Finance, 37(12), 5476-5485.

- Beck, T. (2013). Bank financing for SMEs-lessons from the literature. National Institute Economic Review, 225(1), R23-R38.

- Bhamra, R., Dani, S., & Bhamra, T. (2010). Competence understanding and use in SMEs: A UK manufacturing perspective. International Journal of Production Research, 49(10), 2729-2743.

- Bianchi, C., & Wickramasekera, R. (2016). Antecedents of SME export intensity in a Latin American market. Journal of Business Research, 69(10), 4368-4376.

- Bruton, G.D., Ahlstrom, D., & Li, H.L. (2010). Institutional theory and entrepreneurship: Where are we now and where do we need to move in the future? Entrepreneurship Theory and Practice, 34(3), 421-440.

- Busom, I., Corchuelo, B., & Martínez-Ros, E. (2014). Tax incentive or subsidies for business R&D? Small Business Economics, 43(3), 571-596.

- Cahen, F.R., Lahiri, S., & Borini, F.M. (2015). Managerial perceptions of barriers to internationalization: An examination of Brazil’s new technology-based firms. Journal of Business Research, 69(6), 1973-1979.

- Canton, E., Grilo, I., Monteagudo, J., & van der Zwan, P. (2012). Perceived credit constraints in the European Union. Small Business Economics, 41(3), 701-715.

- Cardoza, G., Fornes, G., Farber, V., Gonzalez Duarte, R., & Ruiz Gutierrez, J. (2015). Barriers and public policies affecting the international expansion of Latin American SMEs: Evidence from Brazil, Colombia, and Peru. Journal of Business Research, 69(6), 2030-2039.

- Castaño, M.S., Méndez, M.T. & Galindo, M.Á. (2016). The effect of public policies on entrepreneurial activity and economic growth. Journal of Business Research, 68(7), 1496-1500.

- Castillo, V., Maffioli, A., Rojo, S., & Stucchi, R. (2013). The effect of innovation policy on SMEs’ employment and wages in Argentina. Small Business Economics, 42(2), 387-406.

- Child, J., & Hsieh, L.H.Y. (2014). Decision mode, information and network attachment in the internationalization of SMEs: A configurational and contingency analysis. Journal of World Business, 49(4), 598-610.

- Ciravegna, L., Lopez, L., & Kundu, S. (2013). Country of origin and network effects on internationalization: A comparative study of SMEs from an emerging and developed economy. Journal of Business Research, 67(5), 916-923.

- Daskalakis, N., Jarvis, R., & Schizas, E. (2013). Financing practices and preferences for micro and small firms. Journal of Small Business and Enterprise Development, 20(1), 80-101.

- De Clercq, D., Sapienza, H. J., Yavuz, R. I., & Zhou, L. (2011). Learning and knowledge in early internationalization research: Past accomplishments and future directions. Journal of Business Venturing, 27(1), 143-165.

- De Falco, S.E., & Simoni, M. (2014). The effect of public export incentives on Italian textile and fashion SMEs. International Studies of Management and Organization, 44(1), 70-83.

- Department of Trade and Industry. (1995). The White Paper on national strategy for the development and promotion of small business in South Africa.

- Department of Trade and Industry. (2005). Integrated strategy on the promotion of entrepreneurship and small business development.

- Dickson, P.H., & Weaver, K.M. (2011). Institutional readiness and small to medium-sized enterprise alliance formation. Journal of Small Business Management, 49(1), 126-148.

- Dikova, D., Jaklič, A., Burger, A., & Kunčič, A. (2015). What is beneficial for first-time SME-exporters from a transition economy: A diversified or a focused export-strategy? Journal of World Business, 51(2), 185-199.

- Doh, S., & Kim, B. (2014). Government support for SME innovations in the regional industries: The case of government financial support program in South Korea. Research Policy, 43(9), 1557-1569.

- Gilmore, A., Galbraith, B., & Mulvenna, M. (2013). Perceived barriers to participation in R&D programmes for SMEs within the European Union. Technology Analysis & Strategic Management, 25(3), 329-339.

- Halabí, C.E., & Lussier, R.N. (2014). A model for predicting small firm performance: Increasing the probability of entrepreneurial success in Chile. Journal of Small Business and Enterprise Development, 21(1), 4-25.

- Heinonen, J., & Hytti, U. (2014). Entrepreneurship mission and content in finish policy programmes. Journal of Small Business and Enterprise Development, 23(1), 149-162.

- Hessels, J., & Parker, S.C. (2013). Constraints, internationalization and growth: A cross-country analysis of European SMEs. Journal of World Business, 48(1), 137-148.

- Hessels, J., & Terjesen, S. (2010). Resource dependency and institutional theory perspectives on direct and indirect export choices. Small Business Economics, 34(2), 203-220.

- Hsu, C.C., Tan, K.C., Laosirihongthong, T., & Leong, G.K. (2011). Entrepreneurial SCM competence and performance of manufacturing SMEs. International Journal of Production Research, 49(22), 6629-6649.

- Huett, P., Baum, M., Schwens, C., & Kabst, R. (2014). Foreign direct investment location choice of small- and medium-sized enterprises: The risk of value erosion of firm-specific resources. International Business Review, 23(5), 952-965.

- Jin, B., Jung, S., & Matlay, H. (2016). Toward a deeper understanding of the roles of personal and business networks and market knowledge in SMEs’ international performance. Journal of Small Business and Enterprise Development, 23(3).

- Kim, J., & Hemmert, M. (2015). What drives the export performance of small and medium-sized subcontracting firms? A study of Korean manufacturers. International Business Review, 25(2), 511-521.

- Lafuente, E., Stoian, M.C., & Rialp, J. (2013). From export entry to de-internationalisation through entrepreneurial attributes. Journal of Small Business and Enterprise Development, 22(1), 21-37.

- Lee, N., & Drever, E. (2014). Do SMEs in deprived areas find it harder to access finance? Evidence from the UK small business survey. Entrepreneurship & Regional Development, 26(4), 337-356.

- Lee, N., Sameen, H., & Cowling, M. (2014). Access to finance for innovative SMEs since the financial crisis. Research Policy, 44(2), 370-380.

- Leonidou, L.C. (2004). An analysis of the barriers hindering small business export development. Journal of Small Business Management, 42(3), 279-302.

- Lonial, S.C., & Carter, R.E. (2015). The impact of organizational orientations on medium and small firm performance: A resource-based perspective. Journal of Small Business Management, 53(1), 94-113.

- Makhmadshoev, D., Ibeh, K., & Crone, M. (2015). Institutional influences on SME exporters under divergent transition paths: Comparative insights from Tajikistan and Kyrgyzstan. International Business Review, 24(6), 1025-1038.

- Manufacturing Bulletin. (2012). Retrieved from http://www.plasticsinfo.co.za/wp-content/uploads/2015/08/Manufacturing-Circle-Bulletin-Sept-2015.pdf

- Milanov, H., & Fernhaber, S.A. (2013). When do domestic alliances help ventures abroad? Direct and moderating effects from a learning perspective. Journal of Business Venturing, 29(3), 377-391.

- Mogos Descotes, R., & Walliser, B. (2011). The process of export information exploitation in French and Romanian SMEs. Journal of Small Business and Enterprise Development, 18(2), 311-330.

- Mogos Descotes, R., Walliser, B., Holzmüller, H., & Guo, X. (2010). Capturing institutional home country conditions for exporting SMEs. Journal of Business Research, 64(12), 1303-1310.

- Munari, F., & Toschi, L. (2014). Assessing the impact of public venture capital programmes in the United Kingdom: Do regional characteristics matter? Journal of Business Venturing, 30(2), 205-226.

- Naldi, L., & Davidsson, P. (2013). Entrepreneurial growth: The role of international knowledge acquisition as moderated by firm age. Journal of Business Venturing, 29(5), 687-703.

- Nasra, R., & Dacin, M.T. (2010). Institutional arrangements and international entrepreneurship: The state as institutional entrepreneur. Entrepreneurship Theory and Practice, 34(3), 583-609.

- National Development Plan. (2012). National development plan: Vision 2030.

- Nițescu, D.C. (2015). A new beginning for SMEs development? Theoretical and Applied Economics, 22(3), 39-52.

- Oparaocha, G.O. (2015). SMEs and international entrepreneurship: An institutional network perspective. International Business Review, 24(5), 861-873.

- Oura, M.M., Zilber, S.N., & Lopes, E.L. (2015). Innovation capacity, international experience and export performance of SMEs in Brazil. International Business Review, 25(4), 921-932.

- Republic of South Africa. (2003). National small business amendment act no 26 of 2003.

- Ryan, R.M., O’Toole, C.M., & McCann, F. (2014). Does bank market power affect SME financing constraints? Journal of Banking & Finance, 49, 495-505.

- SBP Alert. (2014). Examining the challenges facing small businesses in SA.

- Scott, W.R. (2007). Institutions and organizations: Ideas and interests. Thousand Oaks, CA: Sage Publications.

- Shirokova, G., Bogatyreva, K., Beliaeva, T., Puffer, S., & Matlay, H. (2016). Entrepreneurial orientation and firm performance in different environmental settings: contingency and configurational approaches. Journal of Small Business and Enterprise Development, 23(3), 9-18.

- South African Government News Agency. (2016). South Africa’s economic growth revised. Enterprise Development, 23(1), 105-121.

- Uhlaner, L.M., van Stel, A., Duplat, V., & Zhou, H. (2012). Disentangling the effects of organizational capabilities, innovation and firm size on SME sales growth. Small Business Economics, 41(3), 581-607.

- Uner, M.M., Kocak, A., Cavusgil, E., & Cavusgil, S.T. (2012). Do barriers to export vary for born globals and across stages of internationalization? An empirical inquiry in the emerging market of Turkey. International Business Review, 22(5), 800-813.

- Viljamaa, A. (2011). Exploring small manufacturing firms’ process of accessing external expertise. International Small Business Journal, 29(5), 472-488.

- Williams, C.C., & Horodnic, I.A. (2015). Cross-country variations in the participation of small businesses in the informal economy: An institutional asymmetry explanation. Journal of Small Business and Enterprise Development, 23(1), 3-24.

- Xheneti, M., & Bartlett, W. (2012). Institutional constraints and SME growth in post‐communist Albania. Journal of Small Business and Enterprise Development, 19(4), 607-626.

- Yaldız Hanedar, E., Broccardo, E., & Bazzana, F. (2013). Collateral requirements of SMEs: The evidence from less-developed countries. Journal of Banking & Finance, 38, 106-121.

- Zhu, Y., Wittmann, X., & Peng, M.W. (2011). Institution-based barriers to innovation in SMEs in China. Asia Pacific Journal of Management, 29(4), 1131-1142.