Case Reports: 2017 Vol: 23 Issue: 4

Birla Sun Life Asset Management Company - Harting a Unique Success Trajectory

Sougata Ray, Indian Institute of Management Calcutta

Synopsis and Structure of the Case (Summary and Overview)

Mutual Funds are a vehicle for collective investment. Investors pool in their money to be managed collectively by an expert fund manager. Broadly, the mutual fund products are classified under the categories of Debt Funds, Equity Funds, Liquid Fund and Hybrid Mutual Funds.

In India, it was only as late as in 1993 that the market was opened up for private players after the setup of Securities and Exchange Board of India (SEBI). While there are 44 companies that operate in this market, the industry is highly concentrated with the top 8 AMCs generating over 75% of the revenue. Interestingly, those top AMCs (led by HDFC, Reliance Capital, ICICI Prudential, Birla Sun Life and UTI) have differential focus on the different mutual fund categories.

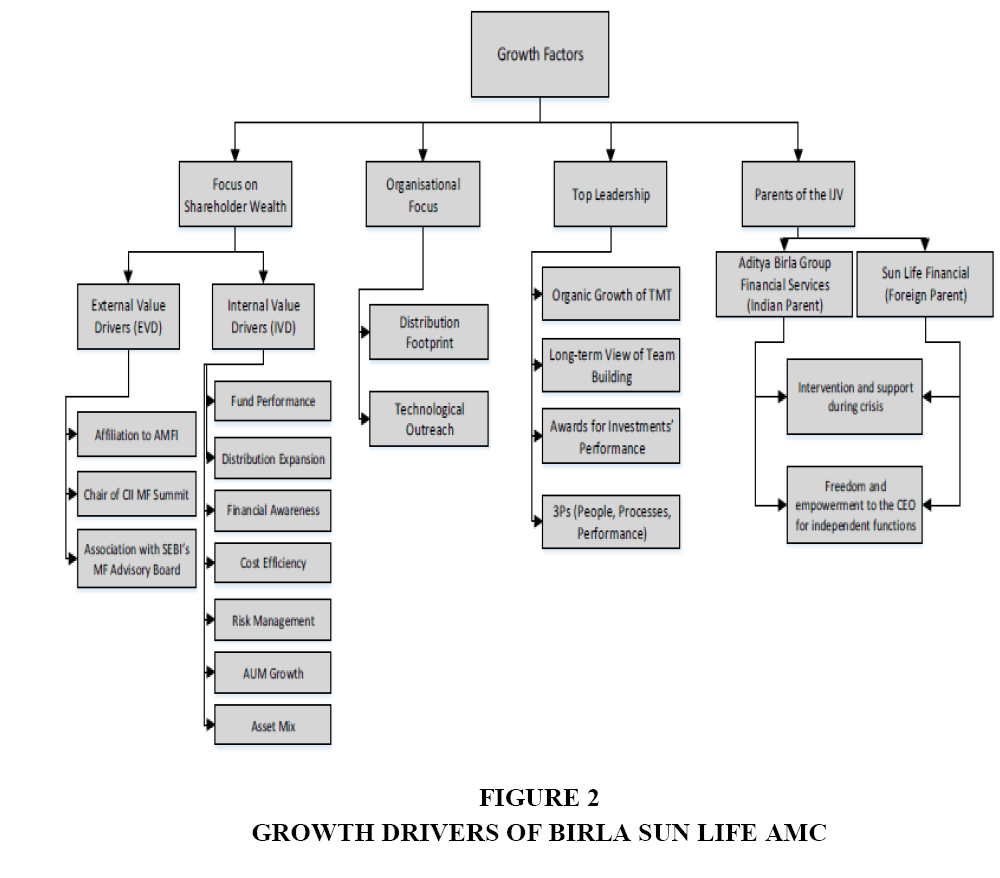

As of FY 2014-2015, Birla Sun Life Asset Management Company is one of the leading mutual funds in India. The company is ably headed by Balasubramanian, who joined the parent company (viz., Aditya Birla Financial Services) as a Group Management Trainee in 1994 and then rose to become the Chief Executive Officer of BSL AMC in August 2009. The company identified two categories of value that drove organisational success– external (regulatory changes, macro-economic developments, competitor moves and changes in the landscape) and internal (fund performance, distribution expansion, financial awareness, cost efficiency, risk management, AUM growth and asset mix). Finally, the case discusses the impact that organisational focus, the leadership and the parents, had on the growth of BSL AMC.

The case ends with a few thought-provoking question – is the growth of BSL AMC sustainable?

As the industry matures, the competition is reaching a new high; will BSL AMC be able to successfully defend its market leadership? Will the company’s current focus on debt products help, in light of the entire industry heavily tilted in favour of equity products?

1. In this teaching note, we examine the company’s success using the theoretical lens of industry attractiveness (Porter, 2008 & 1998) V-R-I-N attribute of resources (Collis & Montgomery, 1998; Kor & Mesko, 2013) and dynamic managerial capability. We also evaluate the ambidextrous capability (O’Reilly & Tushman, 2004; Birkinshaw & Gibson, 2004). and the possibility of focus on equity-based products by straddling (Ghemawat, 2006).We have also prepared a background industry note. Instructors may separately write to us for a copy.

Positioning - Teaching Objectives

This case may best be taught as part of the competitive strategy in the core Strategic management course of the MBA. It is best if this is introduced after the students have a fair understanding of the industry attractiveness and generic strategies and are then embarking on the study of firm resources that lead to sustained competitive advantage. Alternatively, this case may also be used as for participants of executive education, where the agenda is to explain many of the concepts of competitive strategy. For either of the instances, the case is proposed to end with an introduction of the concept of dynamic managerial capability.

When introduced with the note on Indian mutual fund industry, this case beautifully captures the essence of industry attractiveness (Porter, 2008) and resource attributes for sustained competitive advantage (Barney, 1991 & 1995). While undertaking the latter, the case provides sufficient information on BSL AMC to analyse the resources across the different segments of value chain (Porter, 1985; p 37).

The introductory note on the Indian mutual fund industry also aids a discussion on the industry’s core assets and core activities, although by design, falls short of any analysis on the trajectories of industry change. The case teaching is proposed to end with a focussed discussion on characteristics of the top leadership of the company, which shall conclude on the elements of dynamic managerial capability. Instructors also have the liberty of including a discussion on the process of strategy implementation, while examining the practical issues associated with the company’s renewed focus on equity-based products. We propose the theory of ambidextrous organisation and straddling for such an engagement.

Suggested Assignment Questions – Student Assignments

1. Evaluate the attractiveness of the Indian mutual fund industry.

2. What are the factors that led to the growth of Birla Sun Life AMC in this industry?

3. Analyse the sustenance of the growth and related success, of BSL AMC.

4. Analyse the characteristics of the top leadership of BSL AMC and its impact on the company’s success.

Outline of Teaching Plan

Introduction

An effective ice-breaking question is to ask the participants if they have invested in mutual funds and if yes, the difference between mutual funds and direct equity. Invariably, most of the responses would indicate that there is a fair understanding of mutual funds as aggregate funds with a bouquet of equity in it. At this point, it is important to highlight that there is more to mutual funds that only equity and that the Indian context has also witnessed the success of debit and liquid funds.

Our case, namely Birla Sun Life AMC is one such illustration. In recent times, the company’s success is attributed to its focus on debt and fixed-income funds as against the competitors’ focus on equity-based mutual funds.

However, before delving into the success of BSL AMC, it makes sense for us to study the attractiveness of the Indian mutual fund industry. This is based on Porter's (2008) five force framework. In order to understand the structural underpinnings of profitability we focused on analysing industry performance over past 6 years. We focused on this timeframe in order to be able to distinguish any cyclical changes from structural changes. The purpose of industry analysis is not only to evaluate if the industry is profitable or not, but also to understand the competition and root causes of profitability.

Attractiveness of Indian Mutual Fund Industry

The five forces that impact industry attractiveness are threat of new entrants, threat of substitute products and services, bargaining power of buyers and suppliers and the intensity of rivalry amongst existing players (Figure 1).

Threat of New Entry - Medium

Overall the threat of new entry is medium. Following are the factors that affect threat of new entry into asset management business–

• Regulatory requirement by SEBI for entering into asset management business mainly requires of a firm to have - a sound track record and general reputation of fairness, be carrying on business in financial services for a period of not less than five years. Most financial institutions satisfy these requirements and hence we see such a large number of AMCs entering into the business.

• Low start-up costs – start-up costs from the perspective of financials firms are low so we see most financial institutions have their own mutual funds.

• As units of existing financial houses, new entrants are able to sustain losses for long periods. This means that inefficient players would continue to operate in the industry eating a pie of AUM.

• MF benefits from sharing intangible assets like brand names and know-how with parent/JV firms which new entrants can exploit. These economies aid entry of new players into the market.

• As observed during snapshot analysis revenues of AMCs are highly dependent on AUM (Section 2.2.1 of the note on Indian AMC industry). So it is observed that existing firms with high performing funds do not tend retaliate in a way that threatens potential new entrant/s.

Intensity of Rivalry among Existing Competitors – High

For the following reasons intensity among the existing rivals is very high.

• A close observation indicates that there are three classes of AMCs (Table 1) of the note on Indian AMC industry). AMCs holding high, medium and low AUM. Each category of AMC has a few highly competitive firms operating. This equally balanced competition at high, medium and low AUM levels do not allow one or two firms to dominate the market place and ensure high competitive behaviour from each AMC so as to attract higher share of AUM.

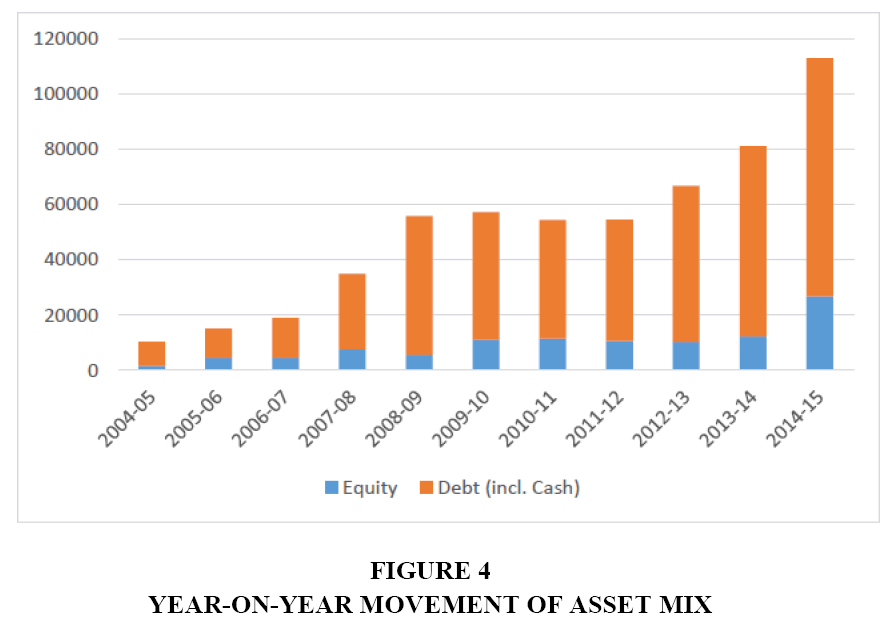

| Table 1 Tabulation of Asset Mix (and Changing Proportion) Across Years (All Figures In rs. Crores) |

|||

| Year | Equity | Debt (incl. Cash) | %Debt |

| 2004-2005 | 1650 | 8723 | 84.1% |

| 2005-2006 | 4684 | 10335 | 68.8% |

| 2006-2007 | 4753 | 14294 | 75.0% |

| 2007-2008 | 7688 | 27175 | 77.9% |

| 2008-2009 | 5656 | 50215 | 89.9% |

| 2009-2010 | 11179 | 46055 | 80.5% |

| 2010-2011 | 11639 | 42710 | 78.6% |

| 2011-2012 | 10553 | 43931 | 80.6% |

| 2012-2013 | 10356 | 56344 | 84.5% |

| 2013-2014 | 12347 | 68725 | 84.8% |

| 2014-2015 | 26880 | 85975 | 76.2% |

• Highly skewed geographic distribution of total AUM in favour of top 5 cities in India, implying that AMCs have to deploy their limited resources in these geographic areas. As all the AMCs are fighting for the same pie of market potential (i.e., AUM), the industry has become highly competitive.

• Lack of differentiation – Regression between Growth to AUM and Growth to total (fixed + current) assets very high (Section 2.2.1 and Section 2.2.3 of the note on Indian AMC industry). This clearly indicates that AMCs with higher AUM have shown profitability indicating the trust that the investors place.

• Investors take more care with making their investments initially than with monitoring subsequently, i.e., the sensitivity of the aggregate performance to outflows due to performance is quite a bit lower than that of inflows. So it becomes very important for AMCs to focus primarily on customer acquisition.

• Diverse competitors – AMCs who are endowed with powerful financial firms as parents are working with different investment strategies which lead to high competitive rivalry at the ground level.

• High Fixed Costs – Costs and time involved in creating fixed assets are high which puts pressure on margins and reduces profitability/increase losses. This creates high rivalry as all the firms try to increase AUM even if it means lower operating efficiency to minimize losses or maximize profitability in future.

• High Strategic Stakes – Since AMCs share brand name with parent companies to sell MF the stakes are very high for AMCs to perform.

• As the information related to fund performance and comparison of performance of various funds is readily available, high performing funds seem to be attracting more AUM over a period of time. This gives competitive advantage to good performing funds. This causes AMCs to invest more towards knowledge management and attract good talent for fund management, putting additional pressure on margins.

• Mutual fund distribution channels create a significant impact on fund performance. Indirect channels distribute underperforming funds and charge a premium on distribution cost. This puts additional pressure on margins. Direct and indirect channels distribute actively managed funds with equal or higher performance than passive funds which have uniform performance across the industry (as they are standard funds like index funds requiring low asset manager intervention).

• Geographic distribution of mutual funds is highly skewed towards to 8 to 10 cities. The cost of creating distribution network and entering other regions for mutual funds are very high. These high costs act as deterrent for one single AMC to strategically enter this region. This means further investment in existing geographic areas and adds further to competitive rivalry.

Buyers Behaviour (Bargaining Power of Buyers) – Moderately

High the end buyers are largely concentrated to the top 8 cities of India. They may be categorised as individual and institutional buyers. There is lack of awareness in the individual buyers and they tend to rely on the advisory services of the distributors. As compared to the fund houses, these buyers intuitively seem to be fragmented and per se, don’t have a significant bargaining power.

A close look, on the other hand, offers a very different picture. Some figures of the note on Indian AMC industry indicates that 73.8% of the retail sales are contributed by corporate houses and the HNIs, making them a concentrated set of buyers. Informed buyers have access to a wealth of information over internet and television that allows them to compare different products and their charges, easily allowing them to take informed decision. So it requires higher costs to push the products that have medium to low performance putting higher pressure on margins.

There is another category of buyer here – the channel partners. Strictly speaking, the channel partners don’t purchase the services before reselling those to the end customers. However, the channel partners have a significant say in the sales choice of the end customers. There are three categories of channel partners – banks, independent financial advisors and national distributors. The banks and national distributors enjoy a captive customer base and tend to push the products of those AMCs that are subsidiaries of their own parents. This thereby increases the bargaining power buyers. Furthermore, 75% of agents are located in 20% of districts (thus not very fragmented) and this contributes to a further increase in their bargaining power.

Threat of Substitutes - High

There are three categories of substitutes for mutual fund products – life insurance (for wealth transfer), bank fixed deposit (for wealth preservation) and self-investment in equity/real estate (for wealth creation). Investment in debt-oriented mutual funds indicates that investors are focussed on wealth preservation. This creates a high threat of substitutes for other categories of mutual funds. Further, bank fixed deposits have always been the flavour of the Indian retail investor thereby increasing the threat of substitution of debt mutual funds as well.

Bargaining Power of Suppliers – Moderately High

The only supplier category that is relevant to the mutual fund industry is trader. Traders/dealers are the actual people who trade in the markets and ensure that the returns of the funds of their companies are higher than that of competitors. In India, qualified finance professionals in this field are in short supply and often demand a premium for retention.

Overviews of these five forces that decide the industry attractiveness are:

• Threat of New Entrants (MEDIUM) – Low entry barriers and strong financial strength allows MFs to survive initial losses and build stronger AUM and a base of fixed asset.

• Intensity of Rivalry (HIGH) – Equally balanced competitor push each other to grab higher share of AUM.

• Bargaining power of Buyers (MODERATELY HIGH) – Buyers weigh safety against returns across different industries based on need for wealth transfer, preservation or distribution.

• Bargaining power of Suppliers (MODERATELY HIGH) – Traders/Dealers put high pressure on MFs by demanding premium compensation terms for retention.

• Threat of Substitutes (HIGH) – Substitutes place higher pressure on MFs by reducing their total AUM.

Growth of Birla Sun Life AMC in this Industry

The discussion here is aimed at meaningful integration of case facts, which shall then be used for assessing the sustenance of BSL AMC’s competitive advantage in the subsequent section.

Students will be inclined to discuss the different growth drivers independently, but the instructor should be able to come up with the following structure at the end of this discussion (Figure 2).

Sustenance of the Growth Trajectory of BSL AMC

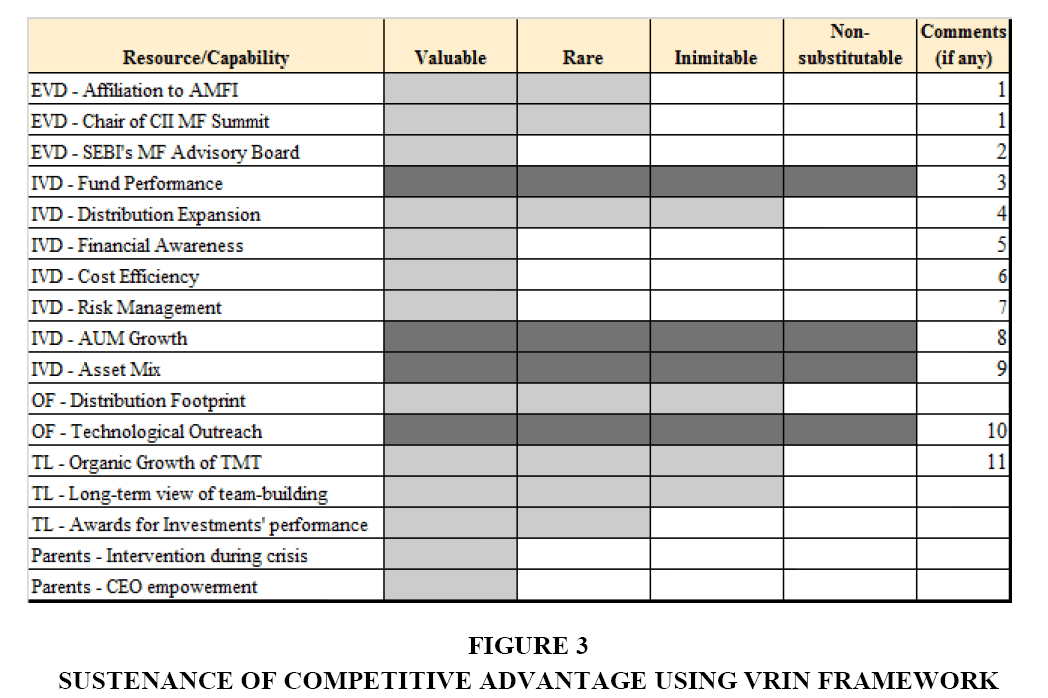

The sustenance of the competitive advantage (or as the students would connect more as the growth trajectory) of BSL AMC is best evaluated along the resource attributes of V-R-I-N (Barney, 1991) or V-R-I-O (Barney, 1995). At times, the students find it easier to understand the idea proposed by Collis & Montgomery (1998). But personally, we have found that it is difficult to test the resource attributes of a) difficulty in copying, b) depreciates slowly c) value controlled by firm, d) difficult in substituting, and e) superior to others (Collis & Montgomery, 1998) on to a case discussion (Figure 3).

We, thus, prefer to use Barney's (1991) valuable–rare–inimitable–non-substitutable attributes of resources to test the sustenance of competitive advantage. It is also worth noting that we underscore the importance of those resources being present across the different activities of the value chain, rather than fragmented resources passing the VRIN acid test.

• The CEO's presence here helped shape policy decisions at the industry-level and is thus valuable; not all MFs have a presence in this top position and consequently the rarity.

• While this membership is valuable, it is not rare as SEBI invites many of the MF players to be members of this Advisory Board.

• The fund performance is the ultimate reason for customers to invest their funds with the MFs; BSLAMC has consistently outperformed its competitors in the category of debt funds.

• May be substituted by online platforms; e.g., fundsindia.com and boxopus.com are already doing brisk business in India.

• This is necessary for BSL AMC to have a disciplined cost structure; however, this is prevalent in other players as well.

• Very similar to Comment 5 above.

• BSL AMC has a particular focus on debt funds; yet, the company has presence in the equity segment as well. Likewise, while the focus is institutional customers, retail channel also significantly contributes to the business, thereby reducing its overall portfolio risk. However, we find this a trend with other mutual fund players as well.

• This is a second-order resource and is contingent on 'Distribution Expansion' and 'Fund Performance'.

• This is a second-order resource and is contingent on 'Distribution Expansion' and 'Financial Awareness'.

• It is not just about the use of different software, but the ability to link different functions and locations seamlessly for customer delivery.

• The entire industry, on the contrary, was finding it difficult to arrest talent attrition.

Characteristics of the Top Leadership

We employ Kor & Mesko (2013)’s framework of the dynamic managerial capability in this section. There are three elements of the dynamic managerial capability – managerial human capital, managerial social capital and managerial cognition.

Managerial human capital includes the skills and knowledge repertoire of managers, which are shaped by their education and personal and professional experiences.

1. To build the knowledge repertoire, the HR practice was designed for high employee motivation, low attrition and high performance. A few illustrations as cited by Singh:

• “Kutumb–our induction programme, through one of its module which enables case studies by employees – has generated key ideas of business and regeneration”

• “By manifesting ‘Saksham’ (competence) as a platform, we have empowered our employees with information about new developments (technological and service innovations and distinct product offerings for our customers) within the organisation”

2. Balasubramanian himself, despite being in Investments all his life, spent about 9 months in Sales in 2006. Only after this successful stint was he brought back to Investments function as the Chief Investment Officer (CIO), the same year. Subsequently, he rose to become the CEO is 2009.

Managerial social capital involves managers’ ability to access resources through relationshipsand connections – both formal and informal network.

1. Balasubramanian joined the company as early as in 1994 as a Group Management Trainee and then rose to become the 9th CEO of BSL AMC in August 2009. A benefit of such association helps the organisation to access resources across the organisation as well as the corporate. E.g. Balasubramanian ensured that there is need-based lateral movement across most of the functions. “I used to have lot of references from the group [about taking people]…So I started taking GMTs and some of them actually, really shined well.”

Managerial cognition consists of belief systems and mental models that managers use for decision making. This is again shaped by personal and professional experiences and manager’s interactions in internal and external networks.

1. Balasubramanian himself having rose in the organisation ladder after joining as a GMT, had a belief in that model being mutually beneficial for the AMC as well as an individual.

2. The top leadership, including the CEO and is EA, believed in people focus and motivation even for core technical roles. It was the TMT’s focus on improving employee motivation that helped rebuilding the capability of equity fund managers, after the incumbent CEO took charge in 2009. A few illustrations:

• “First is the unrelenting focus on developing our people capability and talent. We strengthened our equity research team, where we brought in very capable and experienced analysts with specific skills in areas we thought we had gaps in,” noted Singh.

• Balasubramanian had added, “Employee motivation within the equity was low and we have to kill that. So we started doing the collective programmes on employee side, say let us we sit in a room and discussed actually – And we took a feedback and it was combination of both negative and positive. Every quarter I used to do this exercise so, largely we start focusing on people, overall focusing on strengths rather on focusing on negatives.”

Possibility of Rebalancing Focus on the Asset Mix

This is a classic ambidextrous issue, i.e., the choice and delicate balance between exploitation of existing resources (alignment-focussed activities) and exploration of new/latent opportunities (adaptability-focussed activities). Both the set of activities require very different resource attributes and therefore a trade-off in decisions. The ability of an organisation to simultaneously manage both the exploration and the exploitation activities is termed as ambidexterity capability (O’Reilly & Tushman, 2004; Birkinshaw & Gibson, 2004).

As evident from the case narration, there are broadly two categories of mutual fund products, viz., the equity-based and the debt-based products. For sake of simplicity, cash-based products are being treated as a sub-category of debt products (those are very short term investments and the backend investment is done primarily in government securities). We first converge the data given in Exhibit 9 to understand the trend of asset mix of the company over a span of 10 years (Figure 4).

As evident, debt products have always contributed to 75-90% of the overall business. The company will be able to enhance focus on equity-based products, if relevant capabilities are renewed across the value chain, viz.

a) An investment/dealer team that consistently outperforms the average industry returns from such products

b) A channel that is considered relevant for sales of such products.

An assessment of the former is near impossibility, as the return from investments at the backend of the company is classified information. We shall, therefore, limit our analysis to the latter. A close look at Exhibits 10 and Exhibit 13 (b) of the main case indicates that ‘Corporate’ has always been the dominant channel of sales, followed by ‘HNI”. On percentage basis, the year-on-year channel contribution is calculated in Tables 2 and 3 depicts the relative contribution of each channel to the asset class (year-on-year). We observe that the two major channels, viz., corporates and HNI, have always contributed more to the debt-based products.

| Table 2 Year-On-Year Channel Contribution – Aggregate |

|||||||||

| 2008-2009 | 2009-2010 | 2010-2011 | 2012-2012 | 2012-2013 | 2013-2014 | 2014-2015 | |||

| Channel | Corporate | 67% | 61% | 58% | 50% | 51% | 53% | 51% | |

| HNI | 21% | 21% | 22% | 31% | 32% | 32% | 31% | ||

| Retail | 1% | 2% | 2% | 2% | 2% | 1% | 12% | ||

| Trust | 8% | 13% | 14% | 14% | 12% | 11% | 3% | ||

| Overseas | 2% | 3% | 3% | 3% | 3% | 3% | 3% | ||

| Table 3 Year-On-Year Channel Contribution – Asset Class-Wise |

|||||||||

| 2008-2009 | 2009-2010 | 2010-2011 | 2012-2012 | 2012-2013 | 2013-2014 | 2014-2015 | |||

| Channel | Corporates | Debt | 99% | 97% | 97% | 99% | 98% | 98% | 96% |

| Equity | 1% | 3% | 3% | 1% | 2% | 2% | 4% | ||

| HNI | Debt | 91% | 76% | 75% | 84% | 88% | 86% | 67% | |

| Equity | 9% | 24% | 25% | 16% | 12% | 14% | 33% | ||

| Retail | Debt | 100% | 97% | 71% | 78% | 80% | 66% | 16% | |

| Equity | 0% | 3% | 29% | 22% | 20% | 34% | 84% | ||

| Trust | Debt | 18% | 13% | 13% | 13% | 17% | 19% | 68% | |

| Equity | 82% | 87% | 87% | 87% | 83% | 81% | 32% | ||

On the other hand, the retail channel seems to be bringing more of equity-based business. While this is consistent with the overall industry norms, it also raises question on the ability of the company to rebalance its portfolio. Enhancing the focus on retail channel would require the company to engage in structural ambidexterity (Birkinshaw & Gibson, 2004) to:

a) Avoid any channel conflict, and

b) Ensure that the adaptability-focussed activity (i.e., revamp of the retail channel) is undertaken in a focussed manner.

The structure of the AMC should be such that there is clear segregation of channel roles up to the top management. To elaborate, the entire ‘retail’ channel should report to the Head of Retail, who would himself be a part of the top management. Likewise is proposed for the ‘corporate’ channel. Clearly defined roles of the channel heads, without individual employees dividing their time on different activities, is a prerequisite for success here.

Instructors have the liberty to additionally bring in the concept of ‘straddling’ to explain the merit of the above-mentioned recommendation. Straddling is defined as a response ‘to a substitution threat by establishing a foothold in both camps’ (Ghemawat, 2006; p. 107). For an organisation, this may be either an intermittent arrangement or a long-term strategy itself. Either way, the success of organisations is contingent upon their ability to balance the portfolio between the two substitution forms. In the case of Birla Sun Life, one of the possible routes for the organisation is to balance the focus between its existing strength (i.e., debt-oriented products) and the market trend (i.e., equity-based products). The other nuances converge with the earlier discussion on ambidexterity.

References

- Porter, M.E. (2008). The five competitive forces that shape strategy. Harvard Business Review, 2, 78-94.

- Porter, M.E. (1985). Competitive advantage. New York: The Free Press.

- Barney, J.B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99-120.

- Collis, D. & Montgomery C. (1998). Creating corporate advantage. Harvard Business Review, 76, 70-83.

- Kor, Y.Y. & Mesko, A.(2013). Dynamic managerial capabilities: Configuration and orchestration of top executives’ capabilities and the firm’s dominant logic. Strategic Management Journal, 34, 233-244.

- O’Reilly, C.A. & Tushman, M.L. (2004). The ambidextrous organization. Harvard Business Review, 82, 74-83.

- Birkinshaw, J. & Gibson C. (2004). Building ambidexterity into an organization. MIT Sloan Management Review, 5, 47-55.

- Ghemawat, P. (2006). Strategy and the business landscape. (Second edition). Boston Massachusetts: Pearson Education Limited.

- Barney, J.B. (1995). Looking inside for competitive advantage. The Academy of Management Executive, 9, 49-61.

- McGahan, A.M. & Porter, M.E. (1997). How much does industry matter, really? Strategic Management Journal, 18, 15-30.

- McGahan, AM. ( 2004). How industries change. Harvard Business Review, 82, 86-94.