Research Article: 2019 Vol: 23 Issue: 1

Capacity to Innovate as Driver for Innovation Enhanced Growth

Abstract

The ability of companies to respond rapidly to business and environmental changes is crucially important for their development and sustainable growth. In this study, a time-series analysis is used to investigate the relationship between a firm’s Capacity to Innovate (CTI) and the Innovation Enhanced Growth (IEG) it experiences. The raw data was gathered from several firms independently using one unified assessment tool over a period of five years. This data is then analyzed using inferential statistics through one-way Analysis of Variance (ANOVA) to evaluate and compare the average scores associated with the CTI and IEG variables. Furthermore, the post hoc analysis is applied to assess the extent and direction of variation in scores of the selected variables, and moderated across different years. The results indicate that there is a positive correlation between CTI and IEG for Small to Medium Enterprises (SME), and that both the CTI and IEG vary over time. More specifically, their individual behavior and their interdependent relationships, at least partially, are seen to be influenced by both macroeconomic dynamics and globalization. These relationships are discussed and analyzed in the context of local market growth and suitability. The research aims to assist SME stakeholders and governing bodies, in recognizing the changes in the macroeconomic scales on the economic throughput from innovation, growth, and sustainability perspectives.

Keywords

Capacity to Innovate, Innovation-Enhanced Growth, Small to Medium Enterprises, Sustainable Growth, ANOVA.

Introduction

Regardless of the field of work, demography, or economic environments, all modern businesses need to grow to compete in globally competitive markets (Porter, 1985). Such growth requires both robust strategic planning and a focus on the firm’s strengths within the context of local and global markets. Failing to do so may result in firms ceasing to exist (Johnson et al., 1997). Furthermore, to be competitive, the firm’s strategic planning needs to address business performance matters from different possible perspectives. For example, firms may need to focus on developing their human capital (Lau & Ngo, 2004; Li et al., 2006; Shipton et al., 2005); developing their technological advancement (Bond & Houston, 2003, Amore et al., 2013); investing in operational streamlining and effectiveness (Deshpande et al., 1993; Yamin et al., 1997; Gaur et al., 2005); and even possibly strengthening their knowledge flow through corporate and regional segmentations (Cooke et al., 2011). In undertaking these activities, many firms have turned to innovation as the practical vehicle to achieve their business targets. In this respect, innovation is a critical factor in the improvement of the business’ economic efficiency, where working effectively can assist firms targeting these areas in advancing their strategic objectives and staying competitive in ever-expanding markets (Casadesus-Masanell & Zhu 2013). This is particularly evident in highly competitive markets, in which the emphasis has gradually shifted from production-to knowledge-based economies and from producing a high number of tangible products to producing greater-value products with a high level of customer satisfaction (Vargo et al., 2008). As businesses mature and endeavor to remain competitive, they exert pressure on themselves to find even more innovative business management approaches (Hsin-Min et al., 2008) to improve their operations, reduce costs and boost revenues. It is worth stating that some of these innovative ideas and approaches do not need to be totally radical or imported; firms can still utilize the knowledge-based approach to innovate by leveraging their existing knowledge assets and inter[business or personal]-relationships (Pennings & Harianto, 1992). In other words, the management style of many firms relies on internal resource, which is a type of incremental innovation rather than a radical or disruptive innovation. This leads to the core elements of this research paper: a discussion of Capacity to Innovate (CTI) and Innovation- Enhanced Growth (IEG), which highlights the importance of evaluating and utilizing the firm’s internal innovative capacities as well as external innovative ideas in order to grow and achieve competitive advantage (Burns & Stalker 1961).

Before discussing the meaning and background of CTI and IEG, let us first discuss the meaning of innovation in the context of this research. The concept of innovation has evolved over time, and the word itself has many uses. Let’s begin with the classic definition, in which innovation is defined as the generation, acceptance and implementation of new ideas, processes, products or services (Thompson’s 1965). In this context, innovation can be seen as a process to add value to a firm’s business operations and performance and increase the economic value of the firm. However, we must also note that innovation needs antecedents to be realized and implemented. These antecedents vary depending on factors such as the organizational learning (Keskin, 2006; Jiménez-Jiménez & Sanz-Valle, 2011), organizational culture (Lee & Tsai, 2005) and market orientation (Jaworski & Kohli, 1993) of a firm. For a firm to utilize and implement innovation as a tool for improved performance, it must first appreciate the value of innovation (Hult et al., 2004); such appreciation corresponds with the firm’s capacity to innovate, and is the most important method of achieving competitiveness (Feldman & Florida, 1994). In other words, whether or not the firm has the required resource and drivers to improve business performance and productivity is fundamental to its success. One method of ensuring that a firm does have the necessary resource is based on the concept of open innovation, in which knowledge is leveraged across firms to achieve competitive advantage at a reduced cost (Chesbrough & Appleyard, 2007; Chesbrough & Garman, 2009). Such leverage does not necessary translate into tangible technological- or produce-related results; it may be expressed in terms of an improved business or operational model (Chesbrough & Schwartz, 2007).

The second concept introduced and discussed in this research is the IEG and its relation to the firm’s capacity to innovate. The IEG is typically manifested in a firm’s ability to successfully introduce new products and services or to process leads to growth (Audretch et al., 2014). IEG can therefore be understood as the practical translation of the firm’s capacity to innovate when economic values are added to the firm (Foster & Kaplan, 2001). Such a concept is not new; in fact, it dates to as early as 1912 and Joseph Schumpeter’s book “The Theory of Economic Development”, in which innovation is treated as the heart of economic development that facilitates growth. The relationship between CTI and the IEG can be expressed in several different measures, such as number of products or patents (Acs et al., 2002). However, it should be emphasized that measuring the innovation of a firm is not a straightforward matter and can pose serious challenges because of its multifaceted and interconnected factors (Wang & Ahmed 2004; Gault, 2018). This study aims to answer the following research questions:

1. To what extent does the capacity to innovate DRIVE the innovation enhanced growth?

2. Does such innovation enhanced growth ENABLE business strategic objectives?

In the following section, we will discuss the conceptual model and backgrounds for this study, and then set out methodologies and approaches used for data gathering and analysis. The end of the paper will evaluate the implication of the results and analysis on business management and growth.

Methods

Proposed Conceptual Model

The research began with the development of a conceptual model of the research problem based on the assessment of published hypothesis and literature review. The literature shows several diverse approaches when examining capacity to innovate in terms of business performance and subsequent growth. But the literature does consistently suggest that innovativeness is a positive driver of business performance, which is a prerequisite for growth. In this context, the innovativeness can be considered to be related to either the capacity to innovate or to the firm’s capability to introduce new processes, products or ideas (Hult et al., 2004; Damanpour, 1991; Hurley & Hult, 1998).

Figure 1 shows the relationship between a firms’s CTI with its strategic objective of achieving IEG. To simplify matters and focus on the relationship between these two concepts, the model considers a business to be a combination of two sub-systems: the driving strategic sub-system and the enabling growth subsystem. It goes without saying that, in reality, a typical firm is more complicated, and multiple internal facilitating and governing factors would be used to manage and make such relationships. In this study, the proposed model bundles these internal characteristics through a set of Critical Success Factors (CSFs), which are managed through a set of Key Performance Indicators (KPIs). As stated earlier, the scope of this research will only cover the CTI and how it is related to IEG.

Figure 1:Conceptual Model Relating Capacity To Innovate (Cti) With The Innovation Enhanced Growth (Ieg) Through A Set If Built-In Critical Success Factors (Csfs) And Key Performance Indicators (kpis).

Research Approach

The project began with a longitudinal study to gather the required data. In this approach, the sample frame is identified and the respondents are selected within the scope and research problem of the project. However, frequent changes in the sample frame lead to logistical difficulties in gathering the same data from the same subjects over a period of five years. Therefore, the methodology was changed to be a cross-sectional study, using the same population and the same gathering tool over different years. This relies on the sample population staying roughly the same over the five years of study, and so the same population was used throughout the five years. The data was gathered from three major cities in the kingdom of Saudi Arabia, and the questions used in the survey are based on the assessment of competitive advantages that is published annually in the World Economic Forum’s Global Competitive Report (www.weforum.org). To ensure consistency in the data gathered, and thus validate the research method, the same tool and approach were used throughout the five year period. The two variables selected for this study are presented in the following sections.

Capacity to Innovate

This CTI is not a new concept. It was first introduced by Bums & Stalker (1961) as a means of defining the successful adoption or implementation of new ideas, processes, or products. Such a definition overlaps with the currently adopted general definition of innovation (Thompson’s 1965). The CTI concept was subsequently adopted and researched by many groups (Hurley et al., 1998; Hult et al., 2004), where it was considered to be the most important antecedent for firms aiming to improve their performance and operations (Feldman & Florida, 1994). Using this definition, this research uses CTI as a means of assessing the firm’s ability and effectiveness in producing innovation. Such a definition is consistent with the definition used at the beginning of this paper (Hurley & Hult, 1998; Sanchez-Perez & Iniesta-Bonillo, 2004).

The main research question that arises when considering CTI is whether or not the CTI of a firm varies across time. The associated null hypotheses to be tested are:

H1: There are no differences in the average scores of capacity to innovate for firms across five years.

H2: There are no differences in the average score for innovation-enhanced growth across five years.

Innovation Enhanced Growth

Firms with a high degree of innovation are estimated be 62% likely to grow (PricewaterhouseCoopers, 2013); in other words, innovation can be considered to be a driving factor for growth. Since, from economic perspective, companies with high growth directly contribute to economic growth (Du & Temouri, 2015), it is not surprising that there is much interest in assessing and qualifying growth. In particular, many research groups have examined innovation as an antecedent to growth, their results agreeing on a positive correlation between the two (Li et al., 2007). This study focuses on the relationship between the CTI and the innovation driven growth. Such a relationship has been confirmed in several industries and economies (Gabriele, 2002), and therefore it is not surprising to see that many firms with high levels of investment in the research and development of productivity experience high levels of growth (Hu, 2001).

The associated hypotheses to be tested are then:

H3: Innovation has no impact on the firm’s growth.

H4: New innovative ideas positively impact the firm’s growth.

In summary, the variables used in this research are:

Population and Samples

Several independent groups from a single population were surveyed repeatedly over five years between 2013 and 2017. For the purpose of this research, more than 500 surveys were distributed to various firms, which were carefully selected to reflect industry and sector diversities. The selected sectors include industry, agriculture, construction and services. One of the top five executive managers were requested to answer the questions of the research (Table 1), which are used to analyze and measure the dependent variables of the proposed model. These questions are designed to reflect the objectives and hypotheses of the research and are listed above. The questions are answered by respondents in a seven-point Likert scale, with the statement “Extremely Low” inserted on the left-hand side of the scale and “High Extent” inserted on the right-hand side. Therefore, selection of 1 means the respondent strongly disagrees with statement while selection of 7 means the respondent strongly agrees with the statement on the right-hand side. Other answers can range from 2 to 5.

| Table 1: Variables Used For Study | ||

| Variable | Abbreviation | Assessment Survey Question |

|---|---|---|

| Capacity to Innovation | CTI | To what extent do companies have the capacity to innovate? |

| Innovation Enhanced Growth | IEG | To what extent do new companies with innovative ideas grow rapidly? |

The method of selection was thoroughly explained and communicated to the respondents prior to the selection being made. Furthermore, the respondents were consulted before administering the surveys and they expressed willingness to take part in this study.

Results And Analysis

Gathered data was entered into the standard SPSS v.24 statistical package and analyzed using multiple modules within SPSS. The first stage in such analysis is to perform descriptive statistics, and the results are shown in Table 2.

| Table 2: Descriptive Statistics Of The Innovation Enhanced Growth (Ieg) And The Capacity To Innovation (Cti) Variables | ||||||||||||

| Year | N | Mean | Std. Deviation | Std. Error | 95% Confidence Interval for Mean | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IEG | CTI | |||||||||||

| IEG | CTI | IEG | CTI | IEG | CTI | IEG | CTI | Lower Bound | Upper Bound | Lower Bound | Upper Bound | |

| 2014 | 36 | 36 | 5.19 | 3.86 | 1.091 | 1.533 | 0.182 | 0.256 | 4.83 | 5.56 | 3.34 | 4.38 |

| 2015 | 55 | 55 | 4 | 3.67 | 1.563 | 1.375 | 0.211 | 0.185 | 3.58 | 4.42 | 3.3 | 4.04 |

| 2016 | 101 | 101 | 4.4 | 3.88 | 1.386 | 1.344 | 0.138 | 0.134 | 4.12 | 4.67 | 3.62 | 4.15 |

| 2017 | 87 | 87 | 4.66 | 4.57 | 1.328 | 1.411 | 0.142 | 0.151 | 4.37 | 4.94 | 4.27 | 4.88 |

| 2018 | 54 | 54 | 4.94 | 4.59 | 1.522 | 1.421 | 0.207 | 0.193 | 4.53 | 5.36 | 4.2 | 4.98 |

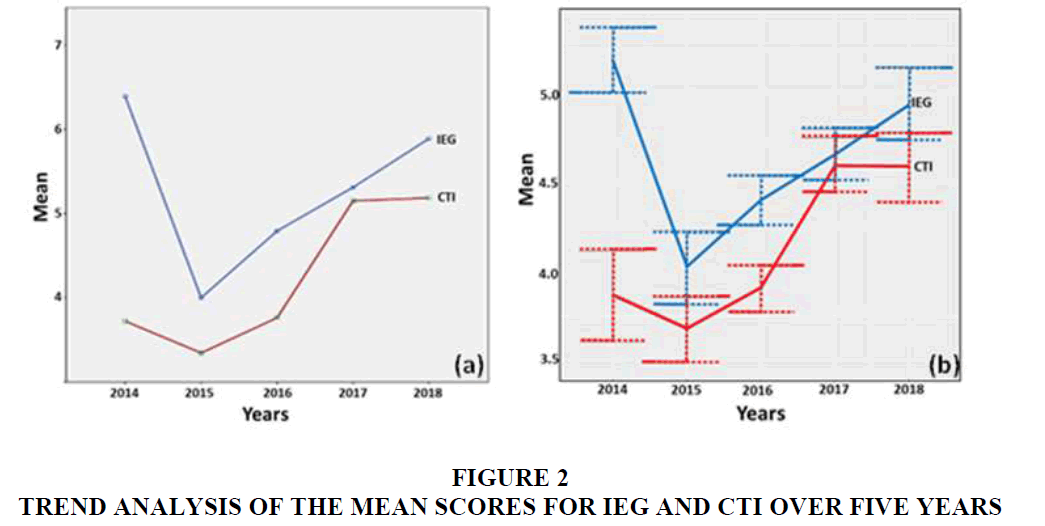

The data shows a high degree of variability in the higher values of the standard deviation. This information is used to generate the trend lines of the means shown in Figure 2.

In (a) only the score are shown and in (b) the error bar are added. The error bars are added for each point to show the associated bounds of the confidence intervals. Such information is useful to assess the spread of the data from the mean for each year for both the CTI and IEG. Some of the error bars are clearly overlapping, indicating a non-significant difference in variances, but other bars clearly do not overlap, which indicates a significant difference in the variances. In order to quantify these differences, the indicators were also subject to inferential statistical analysis, which was applied through the application of the Analysis of Variance (ANOVA) test, as will be shown in the following sections

A prerequisite of applying the ANOVA test is the homogeneity test. The homogeneity test of the selected samples was performed using the Levenen’s test to assess whether or not the variances of the data sets for both the CTI and IEG are significantly different. The results are shown in Table 3, and indicate non-significant results, with F(4, 328)=1.31; p=0.26 for the IEG and F(4, 328)=0.41; p=0.80 for the CTI variable. These results indicate that the homogeneity conditions are preserved (Field 2013), and we are therefore ready to perform the ANOVA.

| Table 3: Test Of Homogeneity Of Variances Using Levene’s Test Procedure | ||||

| Variable | Levene Statistic | df1 | df2 | Sig. |

|---|---|---|---|---|

| Innovation Enhanced Growth (IEG) | 1.309 | 4 | 328 | 0.266 |

| Capacity to Innovation (CTI) | 0.411 | 4 | 328 | 0.801 |

Table 4 shows the results of the ANOVA test for both IEG and CTI. This table indicates that the variances of the datasets in different groups from different years are different with F(4, 328)=5.53; p=0.000 for the IEG and F(4, 328)=6.26; p=0.000 for the CTI. These results show that different years have different effects on the perceived IEG and CTI. Such effects can be attributed to several factors, which are discussed in the later sections of this paper.

| Table 4: Anova Analysis Of The Ieg And Cti For The Groups Across The Five-Year Period | ||||||

| Variables | df | F | Sig. | η² | r | |

|---|---|---|---|---|---|---|

| Between Groups | Within Groups | |||||

| Innovation Enhanced Growth (IEG) | 4 | 328 | 5.53 | 0 | 0.1 | 0.25 |

| Capacity to Innovation (CTI) | 4 | 328 | 6.26 | 0 | 0.1 | 0.27 |

The effect size of the two variables (η²) is 0.1, indicating a moderate effect (Cohen’s 1988). This shows that variances in the both IEG and CTI can be partially explained by variances in different years. Having established that the CTI and IEG are significantly different over the five-year period, and that the CTI has at least a moderate effect on the IEG, a pairwise comparison is now required to examine the groups individually. For this purpose, the post hoc analysis of Tukey HSD was used due to its commonality (Pallant 2016), and the results are shown in Table 5.

| Table 5: Post Hoc Analysis Using Tukey’s Hsd Test For The Clusters Of Capacity To Innovate (Cti) And Innovation Enhanced Growth (Ieg) Over Five Years | |||||||||

| Capacity to Innovate (CTI) | Innovation Enhanced Growth (IEG) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Year (I) | Year (J) | Mean Diff (I-J) | Sig. | 95% Confidence Interval | Mean Diff (I-J) | Sig. | 95% Confidence Interval | ||

| Lower Bound | Upper Bound | Lower Bound | Upper Bound | ||||||

| 2014 | 2015 | 0.188 | 0.97 | -0.64 | 1.01 | 1.194 | 0.001 | 0.37 | 2.02 |

| 2016 | -0.02 | 1 | -0.77 | 0.73 | 0.798 | 0.028 | 0.05 | 1.54 | |

| 2017 | -0.714 | 0.08 | -1.47 | 0.05 | 0.539 | 0.294 | -0.22 | 1.3 | |

| 2018 | -0.731 | 0.11 | -1.56 | 0.1 | 0.25 | 0.921 | -0.57 | 1.07 | |

| 2015 | 2014 | -0.188 | 0.97 | -1.01 | 0.64 | -1.194 | 0.001 | -2.02 | -0.37 |

| 2016 | -0.208 | 0.9 | -0.85 | 0.44 | -0.396 | 0.441 | -1.04 | 0.25 | |

| 2017 | -0.902 | 0.002 | -1.56 | -0.24 | -0.655 | 0.053 | -1.32 | 0.01 | |

| 2018 | -0.92 | 0.006 | -1.66 | -0.18 | -0.944 | 0.004 | -1.68 | -0.21 | |

| 2016 | 2014 | 0.02 | 1 | -0.73 | 0.77 | -0.798 | 0.028 | -1.54 | -0.05 |

| 2015 | 0.208 | 0.901 | -0.44 | 0.85 | 0.396 | 0.441 | -0.25 | 1.04 | |

| 2017 | -0.694 | 0.007 | -1.26 | -0.13 | -0.259 | 0.711 | -0.82 | 0.3 | |

| 2018 | -0.711 | 0.023 | -1.36 | -0.06 | -0.548 | 0.139 | -1.19 | 0.1 | |

| 2017 | 2014 | 0.714 | 0.078 | -0.05 | 1.47 | -0.539 | 0.294 | -1.3 | 0.22 |

| 2015 | 0.902 | 0.002 | 0.24 | 1.56 | 0.655 | 0.053 | -0.01 | 1.32 | |

| 2016 | 0.694 | 0.007 | 0.13 | 1.26 | 0.259 | 0.711 | -0.3 | 0.82 | |

| 2018 | -0.018 | 1 | -0.68 | 0.65 | -0.289 | 0.754 | -0.95 | 0.37 | |

| 2018 | 2014 | 0.731 | 0.111 | -0.1 | 1.56 | -0.25 | 0.921 | -1.07 | 0.57 |

| 2015 | 0.92 | 0.006 | 0.18 | 1.66 | 0.944 | 0.004 | 0.21 | 1.68 | |

| 2016 | 0.711 | 0.023 | 0.06 | 1.36 | 0.548 | 0.139 | -0.1 | 1.19 | |

| 2017 | 0.018 | 1 | -0.65 | 0.68 | 0.289 | 0.754 | -0.37 | 0.95 | |

The results in Table 5 show that the average scores for the CTI in 2014 are substantially lower and significantly different compared to the scores of 2017, and the scores for 2015 are substantially lower and significantly different compared to those for 2017 and 2018. The analysis of mean scores from all years shows the existence of two bands: a lower band, that comprises of the years 2014, 2015, and 2016; and an upper band, comprised of the years 2017 and 2018. The differences in scores between these bands are substantial and significant. The same analysis was repeated for the IEG and, again, 2014 scores much higher than, and is significantly different to, 2015 and 2016, while the average score for 2015 is lower and significantly different to those of 2014, 2017, and 2018. The same analysis was repeated on the remaining years, and indicated that, overall, the positive mean differences for the CTI and IEG of 2014 are relatively higher than that of the years 2015 and 2016. Therefore, there seems to have been a dip for both CTI and IEG in 2015, although performance has been recovering consistently since then. This will be analyzed in relation to macroeconomic changes at a country level later. However, such observations do indicate a level of correlation between CTI and IEG: correlation analysis showed that the variables are indeed correlated, with a Pearson coefficient of 0.44, which is considered to be moderate. However, the analysis also showed the relationship between the variables to be insignificant. As the two sets of data for CTI and IEG appear to correlate “visually”, the insignificance of the correlation can most likely be attributed to the low sample size (only five years).

Discussion

In order to answer the first research problem, “to what extent does the cti drive the IEG?”, we have taken the following steps: (1) assess whether the average score of these variables vary in different years, i.e. whether or not businesses relate their performance to the actual capacity for innovation; (2) evaluate the significance of such variations; (3) determine the details of the variation; and (4) assess the driver-enabler relationship. These steps were undertaken in the sections above, and the results show that year-to-year variations of CTI and IEG are significant, but that there was a dip in 2015.

In order to answer the second research problem on causality and direction, it is important to note that modern strategic thinking considers innovation as something that will drive beyond the short-term financial benefits. Businesses focus more on a system view, and examine the related interdepended factors that affect long-term social, economic, and sustainable growth. Key factors that influence such a drive include the agility of a business’s internal absorptive capacity (Greenwood, 2010). From this perspective, innovation is considered to be a primary tool needed to drive growth (Bullinger et al., 2004; Gault, 2018). This study investigated such fundamental relationships and the interdependency between capacity to innovate and business growth. The relationship was first studied by assessing the correlation between CTI and IEG. The results indicated that the two variables are positively correlated, with a Pearson coefficient of 0.44. Although such correlation value is considered moderate, it clearly indicates that, when the firm’s CTI increases, the IEG also increase. This result is informative, but it does not show causality i.e. we cannot deduct which of the two variables drives the other. In practical terms, this study suggests that businesses interested in achieving competitive advantage and leading the market at sustainable growth must have the CTI embedded within their business strategy as a driver, or at least as a “critical success factor”. Correct adoption and enrolment of such strategies will ultimately lead to the development of a business environment that supports and encourages innovation-based thinking and operations. For example, incorporating CTI into business culture should ultimately lead to the creation of an “innovative-supporting” environment that encourages employees to think outside of the box in everything they do. These findings seem to be consistent with those of Bullinger et al. (2004) and Gault, (2018). However, the details of which critical success factor can help to achieve such targets are disputable. Staying within the key research problems of this study, and with due consideration to above arguments, CTI seems to drive IEG. Heaving said this, it is not strictly a black and white case; it is possible to have a hybrid approach that comprises of both top-down and bottom-up mechanisms. For example, a firm may start with CTI as a top-down driver of the IEG, but may iteratively use a bottom-up approach to adjust the business strategy through the development of new relevant critical success factors as conceptualized in Figure 1. Along these lines, some firms can potentially consider absorptive capacity, for example, as a prerequisite critical success factor to activating the CTI through the leveraging of internal knowledge-based capabilities (Zahra & George, 2002)

Conclusions

The analysis of the data gathered from selected firms in different sectors and geographical locations across Saudi Arabia showed that CTI and IEG are time-dependent and subject to business, market, and environmental dynamics. The research demonstrated that the two variables are directly and positively correlated. These findings suggest that, within the current climate of increasing globalization and mobility, firms are required to develop internal innovation capabilities to further support their business growth and suitability. In terms of causality analysis, i.e. which of these variable causes or “drives” the other, the literature reviews support the view that capacity to innovate is the driver, at least initially, for the innovation enhanced growth.

Acknowledgments

This research project is supported by the King Abdulaziz City for Science and Technology (KACST), with the grant number 2 for 2017-2018.

References

- Acs, Z.J., Anseli, L., & Varga, A. (2002). Patent and in novation count as measures of regional production of new knowledge. Research Policy, 31(7), 1069-1085.

- Amore, M., Schneider, C., & Zaldokas, A. (2013). Credit supply and corporate innovation. Journal of Financial Economics, 109(3), 835-855.

- Bond, E.U., & Houston, M.B. (2003). Barriers to matching new technologies and market opportunities in established firms. Journal of Product Innovation Management, 20, 120-135.

- Bullinger, H.J., Auernhammer, K., & Gomeringer, A. (2004). Managing innovation networks in the knowledge-driven economy. International Journal of Production Research, 42(17), 3337-3353.

- Bums, T., & Stalker, G.M. (1961). The management of innovation. London: Tavistock Publishing.

- Casadesus-Masanell, R., & Zhu, F. (2013). Business model design and competitive imitation: The case of sponsor-based business models. Strategic Management Journal, 34(4), 464-482.

- Chesbrough, H., & Appleyard, M.M. (2007). Open innovation and strategy. California Management Review, 50(1), 57-76.

- Chesbrough, H., & Schwartz, K. (2007). Innovating business models with co-development partnerships. Research Technology Management, 50(1), 5-16.

- Chesbrough, H.W., & Garman, A.R. (2009). How open innovation can help you cope in lean times. Harvard Business Review, 87(12), 68-76.

- Cooke, P., Asheim, B., Boschma, R., Martin, R., Schwartz, D., & Tödtling, F. (2011). Handbook of regional innovation and growth. Cheltenham: Edward Elgar.

- Damanpour, F. (1991). Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34(3), 555-590.

- Deshpande, R., Farley, J.U., & Webster, F.E. Jr. (1993). Corporate culture, customer orientation, and innovativeness in Japanese firms: A quadrad analysis. Journal of Marketing, 57(1), 23-37.

- Dorothea, G.G. (2010). Collaborate to innovate innovative capacity index for effective open innovation. Thesis.

- Du, J., & Temouri, Y. (2015). High-growth firms and productivity: Evidence from the United Kingdom. Small Business Economics, 44(1), 123-143.

- Feldman, M.P., & Florida, R. (1994). The geographic sources of innovation: Technological infrastructure and product innovation in the United States. Annals of the Association of American Geographers, 84(2), 210-229.

- Field. (2013). Discovering statistics using SPSS. London, England: SAGE.

- Foster, R., & Kaplan, S. (2001). Creative destruction. McKinsey Quarterly, 3, 41-51.

- Gabriele, A. (2002). S&T policies and technical progress in China’s industry. Review of International Political Economy, 9, 333-373.

- Gault, F. (2018). Defining and measuring innovation in all sectors of the economy. Research Policy, 47(3), 617-622.

- Gaur, V., Fisher, M.L., & Raman, A. (2005). An econometric analysis of inventory turnover performance in retail services. Management Science, 51(2), 181-194.

- Grenwood, D.G. (2010). The innovation imperative the relationships between team climate, innovation, and performance in research and development teams. Phd Thesis, University of Maryland University College.

- Hsin-Min, H., Se-Hwa, W., Chao-Tung, W., & Feng-Shang, W. (2008). Competitive advantages of managing an effective social network structure to stimulate innovation from a knowledge management perspective. International Journal of Technology Management, 43(4), 363-382.

- Hu, G.Z. (2001). Ownership, government R&D, private R&D, and productivity in Chinese industry. Journal of Comparative Economics, 29, 136-157.

- Hult, G.T.M., Hurley, R.F., & Knight, G.A. (2004). Innovativeness: Its antecedents and impact on business performance. Industrial Marketing Management, 33(5), 429-438.

- Hurley, R.F., & Hult, G.T.M. (1998). Innovation, market orientation, and organizational learning: An integration and empirical examination. Journal of Marketing, 62(3), 42-54.

- Jaworski, B., & Kohli, A. (1993). Market orientation: Antecedents and consequences. Journal of Marketing, 57, 53-70.

- Jiménez-Jiménez, D., & Sanz-Valle, R. (2011). Innovation, organizational learning and performance. Journal of Business Research, 64, 408-417.

- Johnson, J.D., Meyer, M.E., Berkowitz, J.M., Ethington, C.T., & Miller, V.D. (1997). Testing two contrasting structural models of innovativeness in a contractual network. Human Communication Research, 24(2), 320-348.

- Keskin, H. (2006). Market orientation, learning orientation, and innovation capabilities in SMEs. European Journal of Innovation Management, 9(4), 396-417.

- Lau, C., & Ngo, H. (2004). The HR system, organizational culture, and product innovation. International Business Review, 13, 685-703.

- Li, K., Hu, Y., & Chi, J. (2007). Major sources of production improvement and innovation growth in Chinese enterprises. Pacific Economic Review, 12(5), 683-710.

- Li, Y., Zhao, Y., & Liu, Y. (2006). The relationship between HRM, technology innovation and performance in China. International Journal of Manpower, 27(7), 679-697.

- Midgley, D.F., & Dowling, G.R. (1978). Innovativeness: The concept and its measurement. Journal of Consumer Research, 4, 229–42.

- Pennings, J.M., & Harianto, F. (1992). Technological networking and innovation management. California Management Review, 30(1), 356-382.

- Porter, M.E. (1985). Competitive advantage: Creating and sustaining superior performance. The Free Press, New York, NY.

- PricewaterhouseCoopers. (2013). Breakthrough innovation and growth.

- Sanchez-Perez, M., & Iniesta-Bonillo, M.A. (2004). Consumers felt commitment towards retailers: Index development and validation. Journal of Business and Psychology, 19(2), 141-159.

- Shipton, H., Fay, D., West, M., Patterson, M., & Birdi, K. (2005). Managing people to promote innovation. Creativity and Innovation Management, 14(2), 118-128.

- Thompson, V.A. (1965). Bureaucracy and innovation. Administrative Science Quarterly, 10, 1-20.

- Vargo, S.L., & Lusch, R.F. (2008). Service-dominant logic: Continuing the evolution. Journal of the Academy of Marketing Science, 36(1), 1-10.

- Wang, C.L., & Ahmed, P.K. (2004). The development and validation of the organizational innovativeness construct using confirmatory factor analysis. European Journal of Innovation Management, 7(4), 303-313.

- Yamin, S., Mavondo, F., Gunasekaran, A., & Sarros, J. (1997). A study of competitive strategy, organizational innovation and organizational performance among Australian manufacturing companies. International Journal of Production Economics, 52(1), 161-172.

- Zahra, S.A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185-203.