Research Article: 2021 Vol: 27 Issue: 1

Capital Flows Response to U.S. Quantitative Easing and Capital Market Frictions: The Case of Emerging Countries

Labidi Moez, University of Monastir

Nadia Mansour, University of Sousse

Abstract

This paper explores empirically the effect of US unconventional monetary policy on capital flows into emergent countries between 2000 and 2016. Also, the important factors which influence the international portfolio after the financial instability and with the presence of capital market frictions. Using exogenous and endogenous variables as determinants of capital flows, we tested a series of dynamic panel regression models that includes treasuries purchases and long interest rate as explanatory variables. The estimation of equations was done with the general method of moments (GMM), a technic that allows controlling the problem of endogeneity using several variables as instruments. The dynamic panel estimation results show that external factors had an important impact on capital inflows to EMEs. The degree of capital frictions between these economies and the United States is significant in explaining capital flows and heterogeneity across countries following unconventional asset purchases by advanced economies. This study was only focused on five emerging economies which are characterized all by fragile fundamentals and a reliance on foreign investment as one of the representative groups that capture the capital flows dynamically to this country destination. This highlights that the US unconventional monetary policy plays an important role in the fluctuation of the international flows, particularly in emerging economies but with substantial heterogeneity. The degree of capital market frictions between the two economies is statistically significant in explaining this observed heterogeneity. This paper contributes soo to knowledge in this field. Future Frameworks of capital market frictions in association with quantitative easing on EME currency, equity prices, and long-term sovereign bond market are worth doing to identify the heterogeneous implications in macroeconomic level.

Keywords

Unconventional Monetary Policy, Capital Flow, Quantitative Easing, Shadow Rate, Capital Market Frictions.

JEL Classifications

E52, E58, E65, F42.

Introduction

To support financial stability and economic growth, central banks of Advanced Economies implemented unconventional monetary policies (UMP), after the global financial crisis (GFC). Above all, the Federal Reserve announced three programs of large-scale asset purchases (LSAP), commonly Known as "Quantitative Easing" (QE) with a lower interest rate. Faced of the Zero interest rate in the United states and other advanced countries–many of which were adopting unconventional monetary instruments of their own–financial capital began to search other sources of yields.

Emerging economies appeared to be an ideal choice for investment during the last decade, which had enjoyed by stable economic environments and strong growth rate1. The practice of accommodative monetary policies by the Federal Reserve have had substantial international spillover to emerging market economies (EMEs) and the rest of the world.

During the last episode, the expand of capital flows to Emerging Market Economies (EMEs) has increased substantially and with strength volatility. In fact, compared to earlier periods, capital flows have marked not only by the change in size but also in the composition of such assets. Bartkiewicz (2018) suggested that there is a consensus of the empirical literature about the destination of the implication of (QE) but for its size and durability have not yet been confirmed with sufficient precision. Policy makers in Emerging Economies expressed concerns about capital inflows due to the complex reactions that took and the challenges that faced to trade-off between the potential benefits and the risks of this wave of flows. On the one side, the rise of emergent capital flows influence positively the economic growth through an increase of investment, the drop of the cost of capital and the development of the financial markets. On the other side, the size and the volatility of capital movement can threat the financial stability by a sudden outflows capital and a bubble in equity prices. In this vein, a number of studies have found a destabilized impact of QE on emerging economies. Lim & Mohapatra (2016) for example document that unconventional monetary policy by developed countries could threat emerging markets stability due to the excessive financial flows, transmitted through many of channels. Also, Tillmann (2016) provides evidence that the implementation of the US quantitative easing generate an appreciation on asset price and capital flows in EMEs.

Given the positive and negative implications mentioned above, it’s crucial to understand the determinants of capital flows specifically after the recent financial turmoil. The recent episode of capital inflows was marked by the implementation of unconventional monetary policies in advanced economies and a surge in capital flows coupled by excessive volatility, has taken an important place in a context of heterogeneity and with presence of capital market frictions. The central objective of this paper is to empirically investigate issue by (1) analyzing the different factors which influence the size and the volatility of capital inflows before and after a financial instability and (2) examining the effect of "QE" on capital flows into emerging countries in order to show the most significant factors. To examine the relationship between U.S. unconventional asset purchases and capital flows, we study the spillover effect directly through treasuries purchases and indirectly with long-term interest rate to five of emerging market economies (EMEs): Brazil, India, Indonesia, South Africa and Turkey. We compare two periods of time before and after the financial crisis to focus on the composition of capital flows and capture how drivers respond with types of each asset. Finally, we measure the same issue with the presence of capital market frictions by multiplying each variable with the treasuries purchases. All the equations are estimated by panel regression model and GMM method. Our results suggest that external factors played an important role on capital flows to Emerging Markets Economies, after the Fed’s quantitative easing programs implemented in the current period. In this line of the existing studies on this topic, the paper finds evidence those episodes of US quantitative easing marked by the resurgence of capital flows. Also, we show that the degree of capital market frictions between EMEs and advanced countries is significant in explaining such inflows. Furthermore, risk aversion seems to be an important driver, particularly on portfolio investment. Finally, we find the heterogeneous impact with regard to types of investment, specifically, the incentive portfolio flows and FDI with "QE" policy.

Among many papers suggested that US unconventional asset purchases had a positive and significant effect on capital flows to emerging economies.

This paper contributes that there is a substantial heterogeneity in the way these monetary policies affected EMEs. Also, the degree of capital market frictions between the two economies is significant in explaining in how the capital flows were affected. Also, its focus on the relationship between the U.S. and this group of emerging countries which characterized by reliance on foreign investment. How these countries react to U.S. monetary policy could have a large influence on their growth and could have feed back into the U.S.

The rest of the paper is organized as follows: section 2 presents a brief review of literature on the international spillover of unconventional monetary policy and the determinants of capital flows. Section 3 describes the evolution of capital flows to Emerging Countries during the three rounds of quantitative easing programs. Section 4 and 5 discuss the empirical strategy and summarize the main results. Section 6 concludes the paper by pointing out other areas of research.

A Review of the Literature

We hypothesize that U.S. unconventional monetary shocks have significant spillover effects on emerging capital flows, with heterogenous effects occurring when we add the capital market frictions. Following the implementation of unconventional monetary policies by several advanced economies, many studies analyzed the effectiveness of these unprecedented measures on the economic fundamentals and the financial indicators. Since last years, the expansion in capital flows to Emerging Economies has provided an extensive debate in the literature of the international spillover effects of the quantitative easing. Many authors attributed the resurgence of capital flows to this accommodative policy, others researchers attributed this change to many factors such as growth in the economic fundamentals, capital market development, integration, and the modification of the global financial conditions, that emerged to explain the heterogenous impact between countries. With reference to previous researches, the transmission channels of accommodative measures are more different to traditional monetary policies. The US quantitative easing influence the EMEs through five main routes: the portfolio rebalancing, liquidity, confidence, signaling, and bank-lending channels. Lim, et al. (2014) examined the capital flow to emerging countries between 2000 and 2013 and during the "QE" period. They found that unconventional monetary policy acts through three main transmission channels (liquidity channel, portfolio rebalancing and the signal channel). Bowman et al. (2015) emphasize a high responsiveness of EMEs to portfolio rebalancing shocks. Also, Duca et al. (2016) provided evidence that portfolio rebalancing was the main mechanism to transmit a flow effects in developed economies and a stock effects to Emerging countries. However, Papadamou et al. (2019) suggested that the effect of portfolio rebalancing transmitted via the "credit easing" policy due to the imperfect substitutability of asset and through local supply effects. Notably, the signaling channel operates through anticipation of the short-term rates. In addition, the liquidity channel works by increasing the liquidity to investors and the reductions of the liquidity premium. The confidence channel acts by increasing confidence in economic perspectives and aggregate demand. But the bank lending channel operates by lowering the lending rates. In the same direction, Fofak et al. (2020) presented evidence that the quantitative easing policy caused a surge on capital flow in the form of equity portfolios, foreign direct investment and bank loans. Also, they suggested that such monetary policy was transferred to EMEs through the portfolio rebalancing, liquidity and confidence channels.

There has been significant academic work focusing on the Heterogeneous effects in the international transmission of the US monetary policy to emerging countries and the rest of the world. Some studies have attributed this heterogeneity to many factors as the "QE" policy, the financial integration, the exchange rate regime or the capital market frictions and the operations of the carry trade. Due to increased globalization, Galstyan & Lane (2013) found that the size of bilateral holdings, common language, the degree of trade, geographical distance and common institutional links help to determine international portfolio rebalancing during and after the crisis. Authors like Georgiadis, (2016) suggested that the spillover impacts of emerging economies are greater than those in the United States. They associated the size of these implications to specific characteristics of the country, including financial integration, the degree of openness, exchange rate controls, the rigidity of labor market and the evolution of financial market. Anaya et al. (2017) showed that during US extraordinary periods, the portfolio flows towards EMEs was increased and last for about half a year. Moreover, they suggested in response to US lax policies, the EMEs conduct easing measures.

A very large number of studies have been investigating that unconventional monetary policy trigger the impact on capital flows by the main portfolio rebalancing channel and some financial indicators. Using fixed-effects panel regressions, Liu et al. (2019) provided evidence that US QE has affected powerfully foreign exchange and stock markets in EMEs, particularly in the beginning of non-conventional measures. The appreciations in the domestic currencies of China, Singapore, Indonesia, Hong Kong, Taiwan, Russia and Brazil are detected during the first round of QE, whereas much lower effects on real economies are observed in the rest of rounds. In their reasearch, Belke & Dubova (2018) argued that unconventional monetary policies by developed countries generate informational spillover that is different across literature. Papadamou et al. (2019) associated these differences to the variety of the transmission channels and the determinants of the QE spillover among alternative academic papers. They emphasize the heterogenous impact in results of ECB to different specifications of monetary shocks and the application of alternative modeling frameworks.

Employing a time-varying factor-augmented VAR framework, Evgenidis et al. (2019) examined the international transmission of US monetary shocks to the South East Asian and European Union economies. They found that in the South East Asian countries, the income absorption channel is the pronounced one which reflected the fragile of the trade balance and consequently on production. But, the wealth and the balance sheet channel have an important role in the transmission of the shock to these economies. In the EU, the observed rise on production resulted by the shock is more operate by exchange rate than the trade balance. In terms of changes in the magnitude of the shock over time, they concluded that the high degree of global integration trigger the effect of the shock in macroeconomic and financial variables of foreign countries. Furthermore, the international impact has increased in these destinations during the post-crisis period.

Evolution of Capital Flows to Emerging Countries

Role of U.S. Monetary Policy

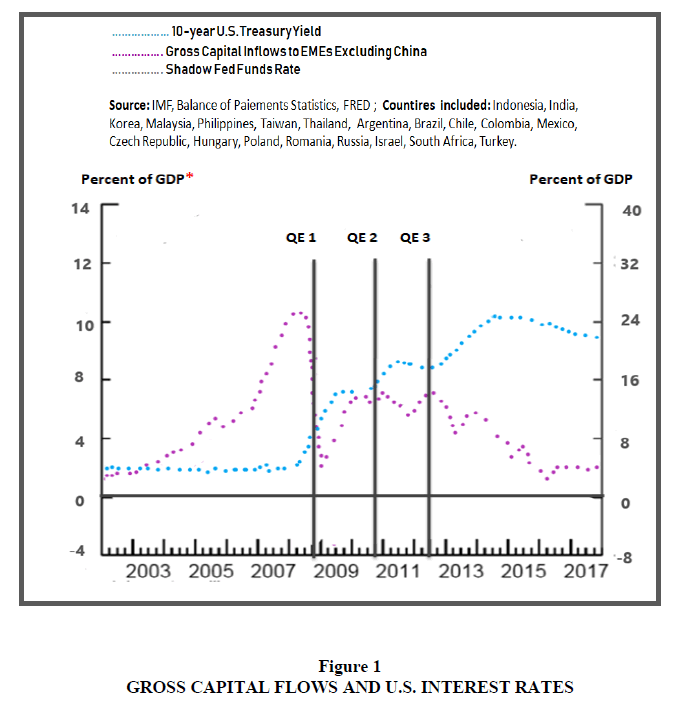

Before the financial crisis, capital flows to EMEs remained stable, but since 2004, they have started to increase and continued with strength trend. Using gross flows shown in Figure 1, the peak of capital flows to EMEs can be observed more clearly in 2006 before the loosening of monetary instruments in advanced economies.

The upwards was temporarily interrupted by the collapse referred to the global financial crisis (GFC) and recovered to their level in 2007. After the GFC, with the zero lower bound rates, Federal Reserve implemented unconventional monetary policies through large-scale asset purchases known as quantitative easing and forward guidance channels rather than traditional policy rate change. Figure 1 plots the expansion of the Fed’s balance sheet and the volatility of gross capital flows to EMEs after each program of quantitative easing (vertical line). The surge in capital flows in 2009 reflects largely the crucial role of the accommodative monetary policies propounded by United States in this flow.Some economists have found that the quantitative easing policy by the Fed and other advanced economies, central banks have resulted in large capital inflows to emerging market economies2. Bahattarai et al. (2015) estimated the impact of quantitative easing on capital flows to EMEs at abaut 2%. After 2011, capital flows to emerging countries began to moderate by an increase of the Federal Reserve’s balance sheet under QE2 and QE3, a period in which the United States continued to apply exceptional instruments to reduce long-term interest rate.

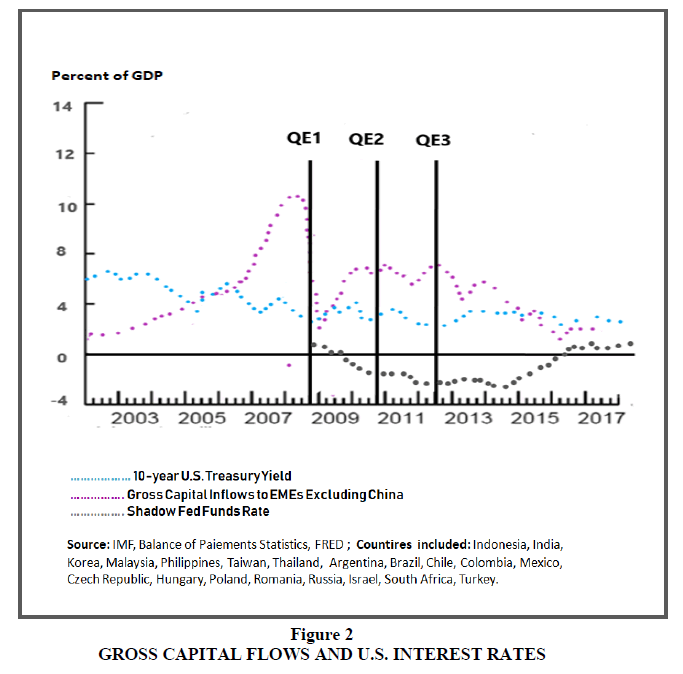

Figure 2 plots the gross capital flows and the Fed’s interest rates. This graph compares the capital flows to EMEs to 10 years treasury yields of the Federal Reserve instead of the balance sheet. This rate includes many factors, not only specific to monetary policy, but also indicators related to financial conditions. It’s clear that the curve of capital flows continued to decrease even as the finding conditions were released by the U.S. financial markets Khatiwada (2017) found three principal findings: First, the quantitative easing programs have coupled with a surge in capital flows. Second, the size of spillover change with the different episodes of QE and the types of assets (bond or equity). Finally, the important role of the pull factors and the specific characteristics of country on capital inflows. Clark et al. (2020) conducted a similar study to that of Khatiwada (2017) and showed an increase in capital flows to emerging economies reflecting a loosing of Fed’s policy rate. While, the slowdown of flows between 2010 and 2015 continued even during the accommodating monetary policy. Also, the authors found evidence that capital inflows and their decline are clearly explained by the volatility in commodity price and EMEs output growth.

Also, Figure 2 presents “shadow rate”of the United States has been estimated by Krippner (2013); Wu & Xia (2016).These interest rates highlighted the effect of unconventional monetary policy during the period when the fed funds rate hit the zero lower bound. However, the two rates differ considerably. Wu & Xia (2016)’s shadow rate is less negative and volatile than the one calculated by Krippner (2013), because they based on different models. The continued implementation of the accommodative policy in late 2014 by this measure shows that the decline in capital inflows not attributed to unconventional approach. This does not mean that monetary policy in advanced economies had no spillover on emerging capital movement and finding conditions. Many studies have confirmed significant effect of unconventional monetary policy on EMEs. Conversely, others research confirmed that advanced economy monetary policies are not the only factor which affecting capital flows to EMEs. As shown in Figure 2, the shadow rate started to rise and left the negative levels in December 2015, this evolution has explained by outflows in this year.

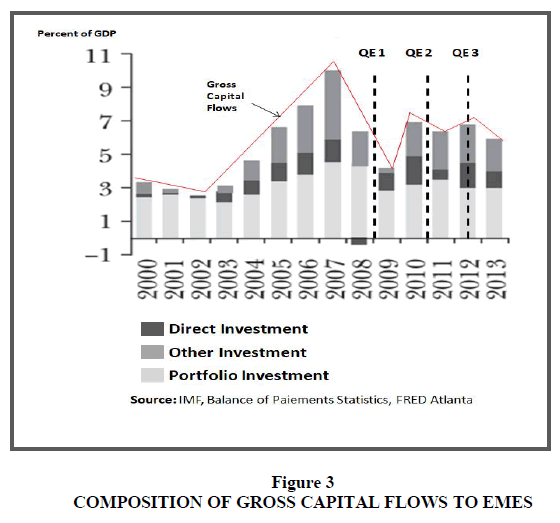

The Composition of Gross Capital Flows to Emes

The recent episode in capital flows was characterized by an increase in all types of investment: direct investment (FDI), portfolio flow and other investment Figure 3. However, after the financial crisis, the composition of capital flows has been more oriented towards portfolio investments, comprising debt securities and liquid equities. On the one hand, portfolio flows and debt securities in particular made it possible to benefit from a lower global interest rate by issuing debt at a lower cost. But, on the other hand, the increasing share of this type of investment has been a source of concern for policymakers due to their volatility.

Their trading allows investors too easily with draw their investments, further increasing the risk of a sudden outflow of capital. For this reason, it represents a major challenge for policymakers in all countries.

Some studies revealed that portfolio investment started to take place before the crisis attributed to the evolution of the local currency bonds markets in EMEs, specifically in government bonds. This trend has increased and with some volatility in the post crisis period. Ramirez & Gonzalez (2017) noted in a recent study that Latin America has been the main beneficiary of this type of investment.While we can attribute the increase in capital flows to external factors common to all countries, it is difficult to understand why the composition of portfolio flows has varied from region to region, requiring that we must also take into account other factors such as country specific variables to try to explain the increase in capital flows over the last decade.

Research Methodology

Data Description

This framework studies the determinants of capital flows to emerging countries on a sample comprising 5 major emerging economies: Brazil, India, Indonesia, South Africa, and Turkey. For the dependent variables, we use quarterly gross capital flows collected from the site of the international monetary funds over a period from the first quarter of 2000 to the first quarter of 2016. Specifically, we choose foreign direct investment, portfolio investment, and other investment, and we estimate the total flow3 as the sum of these three components. Data are in current US dollars and refer to the nominal GDP of each country. It is important to emphasize that in this analysis, we try to explain the factors of foreign capital using gross capital flows instead of net flows4. The 10-year US real interest rate is obtained from the Federal Reserve. The quarterly change in the VIX index was available on the Bloomberg site.

We define the interest rate differential as the difference between the negative real interest rate calculated by Wu & Xia (2016)5 and the real effective US rate. We use quarterly data of two different periods: 2000Q4-2006Q1 and 2008Q4-2016Q1. The policy rate data is collected from the Federal Reserve of St. Louis and the last variables from the Federal Reserve of Atlanta. The growth rate differential is present as the difference between the growth rate of each emerging country and the United States. The announced programs of "QE" are obtained from FOMC6 press releases available on the Federal Reserve website.

The Econometric Model

We estimate a dynamic panel with 5 emerging economies to analyze gross capital inflows using “pull” and “push” factors as explanatory variables. For "pull" factors, we include the real negative interest rate and the economic growth rate differential relative to the United States. The "push" factors introduced in this model are the following: the US 10-year interest rate, the treasuries purchases, and the VIX index7, the last one is an indicator of risk aversion in international markets. It is important to note that the differential policy rate is used with reference to the study findings of Ahmed & Zlate (2014), according to which it affects yield differentials and therefore investor decisions. It is also crucial to note that we select real interest rates to control domestic monetary policy evolution.

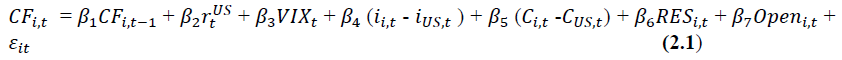

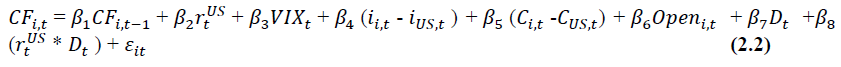

To measure the effect of Quantitative Easing on capital flows, we executed three exercises. In the first one, the aim is to determine how capital flows have been affected by internal and external factors during the pre-crisis and post-crisis period. We analyze this impact of US monetary policy by comparing two different periods. The equation that present the pre-crisis period is as follows:

Where:

Capital flow of country i at time t.

Capital flow of country i at time t.

USA 10-year real interest rate.

USA 10-year real interest rate.

The VIX index at time t.

The VIX index at time t.

Real policy rate of country i at time t.

Real policy rate of country i at time t.

Real US policy rate "Shadow Rate" at time t

Real US policy rate "Shadow Rate" at time t

Economic growth rate of country i at time t.

Economic growth rate of country i at time t.

United States economic growth rate at time t.

United States economic growth rate at time t.

The foreign exchange reserves of country i at time t.

The foreign exchange reserves of country i at time t.

The degree of openness of each country i.

The degree of openness of each country i.

is a stochastic error term capturing other factors that influence capital flows into emerging countries.

is a stochastic error term capturing other factors that influence capital flows into emerging countries.

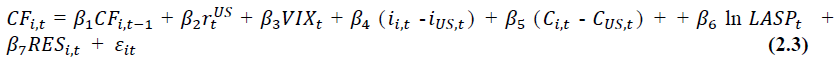

In the second case, we examine directly the effect of securities purchases on capital inflows. Since the implementation of the Fed’s first round of "QE" program, many studies have been analyzed the impact of such an expansionary policy on US interest rates. Although the size of this shock change from one study to another, all found that, in the context of the zero lower bound rate, "QE" programs generated further reductions in the US 10 year interest rate. We want also to know whether the effect of this yield on capital flows has changed with the quantitative easing policy during the post-crisis period. To this end, we include a dummy variable equal to 1 from the fourth quarter of 2008, the first quantitative easing program until the last phase of this expansionary policy. Even though the last program ended in October 2014, the Federal Reserve continued to purchase agency debt and mortgage-backed securities, so we set the dummy variable equal to 1 until the first quarter of 2015. Also, the variable that helps us to show how capital flows have been varied is the 10-year bond rate and his interaction with a dummy variable. This coefficient gives us an idea of the indirect effect of long-term interest rates. Based on the specifications that we mentioned above, the regression equation presented as follows:

Where:

Capital flow to country i at time t.

Capital flow to country i at time t.

USA 10-year real interest rate

USA 10-year real interest rate

The VIX index at time t.

The VIX index at time t.

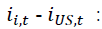

the real interest rate differential between the United States and country i at time t.

the real interest rate differential between the United States and country i at time t.

The differential in the rate of economic growth in country i and the United States.

The differential in the rate of economic growth in country i and the United States.

A dummy variable for the post-crisisperiod.

A dummy variable for the post-crisisperiod.

is a stochastic error term capturing other factors that influence capital flows into emerging countries.

is a stochastic error term capturing other factors that influence capital flows into emerging countries.

We hypothesize that the policy rate differential, the growth rate differential, large-scale asset purchases (LASP) and reserve will have a positive effect on capital flows while USA 10-year real interest rate and VIX will have a negative effect. These hypotheses are supported by the reviewed literature, specifically (Ahmed & Zlate 2014; Bowman et al. 2015; McKinnon 2013; Chen et al. 2014; Sarno 2016). The expected sign of the coefficients β1, β4, β5, β6, β7 will be positive and negative for β2, β3, β8.

β1 Expected to be positive, reflecting the persistence of capital flows, which could show that investors are more likely to invest new resources in countries where they already have capital. β4 will be positive, it must reflect particularly the search for alternative sources of yield.

β5 predicted to be also positive since it projects well the growth in advanced economies, the United States in this case tends to support capital flows to EMEs

In the second exercise, we use the log8 of treasuries purchases to explain whether the impact of the post-crisis period, was specifically affected by the expansionary monetary policy of the Federal Reserve. We would expect a positive sign for the LASP variable and the reserves in equation (2.3).

Where:

Treasuries purchases of the FED at time t.

Treasuries purchases of the FED at time t.

Looking at the behavior of capital flows in the second excercise, β6 will be estimated as positive, since the increase in global liquidity has been a positive impact on capital flows to emerging countries. Consistent with previous research, β2 will be negative9, indicating that the decrease in interest rate tends to push capital flows to emerging countries and vice versa. For the same reason, we expect β7 to be positive.

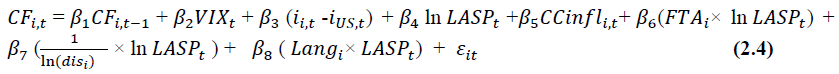

The third exercise aims to determine the implications of US unconventional monetary policy on capital flows in emerging countries by adding some frictions in the capital market10. The equation is as follows:

Where:

Control of capital inflows11 from country i at time

Control of capital inflows11 from country i at time  is equal to one if there is a free trade agreement between the United States and each country for at least one year of the reporting period, or one free trade agreement under negotiation, otherwise zero ;

is equal to one if there is a free trade agreement between the United States and each country for at least one year of the reporting period, or one free trade agreement under negotiation, otherwise zero ;  Measures the physical distance between the two countries ;

Measures the physical distance between the two countries ;  Is a dummy variable equal to one for English speaking countries.

Is a dummy variable equal to one for English speaking countries.

We hypothesize that the large-scale asset purchases (LASP) and reserve will have a positive effect on capital flows. This variable with the interaction with the frictions on the capital market will be negative. These hypotheses are supported by the reasearch of (Mcdonald 2017; Georgiadis; Grab 2016; Evgenidis et al. 2019). As mentioned above, the coefficient of Treasuries purchases β4 in equations (2.3) and (2.4) will be positive. For the other coefficients of the frictions β6, β7 and β8, we show if quantitative easing (LASP) has a significant effect on capital movements with the presence of these frictions or if the latter has a more important role in the determination of flows. All regressions estimated using the general method of generalized moments (GMM)12 which allows us to control the problem of endogeneity using several variables as instruments.

The results obtained by Sargan’s test don’t reject the null hypothesis of over-identification of the model which confirms the quality of the instruments. The second one is the autocorrelation error test. The results lead us to accept the null hypothesis, which indicates that there is no correlation between second-order errors. All values of the probability are greater than 0.05.

Results and Discussion

The Capital Flows of the Five Fragile13 Emerging Countries during the Pre-Crisis Period (2000Q1-2006Q4)

According to the results presented in Table 1, the total of capital flows and FDI are explained positively by their past values (0.977 and 1.219). We start with the rate of 10-year bonds of the United States, we observe a positive and significant coefficient equal to 0.071, and this indicates tha the capital inflows in EMEs have increased by this yield. About the differential of interest rate, which corresponds to the difference between the interest rate of emerging countries (Brazil, India, Indonesia, Korea, South Africa, and Turkey) and the negative one of the United States calculated by Wu & Xia (2016), the coefficients are insignificant for the three measures (capital flow, portfolio investment, and FDI). Jerome (2013) suggested that if interest rates have been the main driver of capital movements, LT government bond yield and the differential rate should move in the same direction. Furthermore, they added that the lack of a close relationship between capital flows and interest rates showed that other factors played an important role with reference to previous studies; we show that the risk aversion VIX14 has a negative coefficient equal to -0.0007, particularly on portfolio investment. This suggests that in times of increased risk aversion, there was a capital outflow from all emerging countries. when we focus on the economic growth differential, we see a positive sign of the coefficient, but not statistically significant (total of capital flow and FDI). The reason is simple and complicated at the same time because according to academic papers this group of emerging countries is characterized by weak economic fundamentals and its reliance to foreign investment to finance their growth.

| Table1 Capital Flows to Emerging Economies During the Pre-Crisis Period (2000Q1-2006Q4) | |||

| Total flowsModel 1 | Portfolio Investment Model 1 |

FDI Model 1 |

|

| L (-1) (P-value) |

0.9775249 (0.018)*** |

-0.1145032 ( 0.467) |

1.219412 (0.001)*** |

| US_10Y interest rate (P-value) |

0.0712984 (0.062)** |

-0.0032265 (0.201) |

0.0505034 (0.228) |

| VIX (P-value) |

0.0107590 (0.173) |

-0.0007093 (0.096)* |

0.0083968 (0.458) |

| Diff_interest rate (P-value) |

-0.0069401 (0.347) |

-0.0000457 (0.941) |

-0.0016225 (0.892) |

| Diff_growth (P-value) |

0.02438120 (0.526) |

0.0046801 (0.095)* |

0.0481184 (0.282) |

| D_openness (P-value) |

0.01728150 (0.001)*** |

0.0000802 (0.542) |

0.015884 (0.025)** |

| Reserve (P-value) |

4.79e-06 (0.015)*** |

-9.55e-08 (0.202) |

4.15e-06 (0.011)*** |

| Constant (P-value) |

-1.431014 (0.000)*** |

0.0334196 (0.019)*** |

-1.310473 (0.017) *** |

| Wald P-value |

0.000*** | 0.001*** | 0.000*** |

A high degree of openness in emerging marke teconomies with relation to the United States and other countries generated an increase in capital inflows. As a result, an upward in these flows leads to high reserves. The coefficients of these two variables are then significant and positive in only two measures (the total flow of capital and FDI). When the monetary authorities record a very large accumulation of reserves, they intervene to control these inflows. After the recent financial crisis and sovereign debt crisis, other factors affected the movement of capital not only Emerging countries, especially the Five Fragile but also the international flows.

The Capital Flows of the Five Fragile Emerging Countries during the Post-Crisis Period (2008Q4-2016Q1)

In this subsection, we analyze the determinants of capital flows after the financial crisis by testing two exercises. The first one, measures the effect of the Fed’s unconventional monetary policy and its implications on EMEs capital movements, indirectly with US 10 year interest rate and directly with treasuries purchase.The second exercise focuses on the impact of such a policy with the presence of some frictions in the capital market.

The Determinants of Capital Flow In the Presence of Quantitative Easing

Firstly, the objective of this part is to determine indirectly the effect of unconventional monetary policy by measuring the long term interest rate on capital inflows. The estimation results show positive coefficients for the portfolio investment and FDI.Then, we notice a positive differential rate policy which we explained by the research of the highest returns on the other markets, when the US interest rate hit the lower bound. Many empirical studies have verified that even the interest rate differential and capital inflows didn’t go always in the same direction, this relationship stay available when other determinants of these flows are taken into account. Byrne & Fiess (2011) assessed US interest rates as a common determinant of global capital flows to emerging economies among others. Our results suggest that for the "pull" factors, the growth differential is slightly significant. As soon as each percentage point of the growth of the Five Fragile exceeds the growth rate of the United States, capital flows to the GDP increase on average by 0.02 points of percentage Table 2. Moreover, the IMF report (2011) suggested that improving fundamentals and the growth prospects of emerging economies are important components of global capital flows.Some researchers have pointed out that given their stage of development and demographic profile, emerging economies are expected to grow faster than advanced economies. So, an increase in the growth rate tends to stimulate capital flows to these countries.According to the positive sign of the dummy variable, the unconventional monetary policy of the United States has a considerable impact on emerging capital inflows.In terms of total flow and portfolio investment, we notice that the risk aversion is significantly negative and we also found that an increase in risk aversion in the financial markets is associated with the outflows of capital from emerging countries.

| Table2 Capital Flows to Emerging Economies During the Post-Crisis Period (2008Q4-2016Q1) | |||

| Total flows Model 1 |

Portfolio Investment Model 1 |

FDI Model 1 |

|

| L (-1) (P-value) |

-0.1733615 (0.702) |

0.5129188 (0.097)* |

0.9816391 (0.056)** |

| US_10Y interest rate (P-value) |

0.0327278 (0.146) |

-0.0133312 (0.214) |

-0.0310660 (0.099)* |

| VIX (P-value) |

-0.0051577 (0.001)*** |

-0.0006829 (0.085)* |

-0.0003830 (0.245) |

| Diff_interest rate (P-value) |

0.025505 (0.008)*** |

-0.000945 (0.671) |

-0.0027562 (0.469) |

| Diff_growth (P-value) |

0.0231621 (0.053)** | -0.0048072 (0.220) |

-0.0016345 (0.832) |

| Dummy (P-value) |

0.0649053 (0.089)* | 0.0030837 (0.820) |

-0.0024361 (0.276) |

| Tx 10 ans *dummy (P-value) |

-0.0291416 (0.123) |

0.0075068 (0.395) |

-0.0274627 (0.158) |

| D_openness (P-value) |

-0.0016938 (0.394) 0.022528 (0.394) |

-0.0044467 (0.004)*** |

0.0225289 (0.115) |

| Constant (P-value) |

-0.0748321 (0.587) |

0.2528044 (0.001)*** |

0.1987025 (0.142) |

| Wald P-value |

0.036*** | 0.000*** | 0.003*** |

Coefficients are estimated with GMM.

Secondly, we seek to determine directly the effect of unconventional monetary policy through the purchase of long-term securities on capital inflows. The results in Table 3 detected an increase in portfolio investment, FDI, and total flows, which represents a significant change. As expected, the effect is positive, which means that during the post-crisis period, particularly after the implementation of an expansionary policy, capital inflows into emerging economies have increased. The values of the coefficients are respectively equal to 0.0285, 00189, and 0.0090. An annual report to the IMF (2011) noted that the use of unconventional monetary policies in advanced economies such as the United States can have a strong impact on international capital flows. Also, several empirical studies have confirmed the idea that episodes of "QE" were coupled by large waves of capital inflows into emerging countries.However, the size of these flows could change over time. These results were presented by the IMF report in 2013 which detected a brief capital outflow from emerging countries and then a rapid return of flows to emerging markets, supported by growth and interest rate differentials. With the presence of unconventional monetary policies, the US 10-year interest rate experienced a negative coefficient for both, total flow and portfolio investment. This result is explained by the fall in this interest rate since the financial crisis, which generates a flight of capital to emerging economies.

| Table 3 US "Quantitative Easing" and Capital Flows to Emerging Countries During The Post-Crisis Period (2008Q4-2016Q1) | |||

| Total flows Model 1 |

Portfolio Investment Model 1 |

FDI Model 1 |

|

| L (-1) (P-value) |

0.0369246 (0.854) |

0.3158554 (0.237) |

0.5146769 (0.000)*** |

| lnLASP (P-value) |

0.0285363 (0.109)* |

0.0189177 (0.018)*** |

0.0090681 (0.033)** |

| US_10Y interest rate (P-value) |

-0.0146672 (0.054)** |

-0.0057678 (0.016)*** |

-0.001749 (0.290) |

| VIX (P-value) |

-0.001275 (0.022)** |

-0.0004859 (0.116) |

0.0002182 (0.124) |

| Diff_ interest rate (P-value) |

0.0027361 (0.509) |

-0.002837 (0.104)* |

-0.0020527 (0.294) |

| Diff_growth (P-value) |

0.0060941 (0.287) |

-0.001821 (0.376) |

0.0032619 (0.340) |

| Reserve (P-value) |

-5.57e-07 (0.087)* |

-3.40e-07 (0.002)*** |

3 .76e-08 (0.167) |

| Constant (P-value) |

-0.2426658 (0.221) |

-0.1578829 (0.099)* |

-0.115295 (0.041)** |

| Wald P-value |

0.002*** | 0.000*** | 0.000*** |

Coefficients are estimated with GMM.

As for portfolio investment, we show that the differential bore a negative sign Powell (2013) argued that from mid-2009 until early 2011, this differential rate and capital flows (inflows) to EMEs increased simultaneously. Although, the overall relationship doesn’t particularly strict. In fact, in early 2007, capital flows to emerging markets have been quite strong, even with a low differential rate. However, in mid-2011, capital inflows decreased despite the significance of this differential.

The overall attitude towards risk is another driver of capital flows in emerging countries. The VIX is negative only for the first indicator. This measure is strongly correlated with net inflows into EMEs. While the reasons of this fluctuating risk are globally uncertain. Table 3 also presents a negative response for reserves to the first two models, this is justified as follows: the flight of capital to emerging countries can stimulate reserves. An excessive increase in these reserves prompts the emerging monetary authorities to control the movement of capital. As conclusion, our results find support from the existing literature that the episodes of "QE" by the FED led to significant inflows. Furthermore, external factors played an important role in capital flows to EMEs. Finally, we find evidence of heterogeneous effects, especially about types of flow. In the panel estimation, portfolio investment appears the main driver of our finding and FDI is a globally incentive to "QE" policy. In this sense, Mohapatra et al. (2016) found evidence of heterogeneity with the types of flows, portfolio bond flows tend to be more vulnerable than FDI to the accommodative monetary policy.

Determinants of Capital Flow with the Presence of Frictions in the Capital Market

Looking at Table 4, we find a positive relationship between the purchase of long-term securities by the FED and the movement of capital to emerging countries. The values of the coefficients are positive and equal to (0.1064) and (0.0268) respectively. So, this result joins those of the literature where the use of unconventional measures by the United States stimulates capital outflows to other countries, more particularly the EMEs.

| Table 4 US "Quantitative Easing" and Capital Flows to Emerging Countries in the Presence of Capital Market Frictions | |||

| Total flows Model 1 |

Portfolio Investment Model 1 |

FDI Model 1 |

|

| L (-1) (P-value) |

0.208476 (0.103)* |

0.4945634 (0.000)*** |

0.1931428 (0.376) |

| lnLASP (P-value) |

0.1064033 (0.057)** |

0.0268308 (0.038)** |

0.1450454 (0.115) |

| VIX (P-value) |

-0.0005741 (0.336) |

-0.0001374 (0.580) |

0.0001001 (0.907) |

| Diff_ interest rate (P-value) |

0.0003079 (0.945) |

0.0005836 (0.816) |

-0.001202 (0.755) |

| CCinflow (P-value) |

0.6382797 (0.748) |

0.0200549 (0.966) |

3.157101 (0.059)** |

| Distance (P-value) |

-0.1758737 (0.172) |

-0.0562849 (0.013)*** |

-0.3584316 (0.101)* |

| FTA*lnLASP (P-value) |

-0.0315237 (0.002)*** |

-0.0022437 (0.009)*** |

-0.0055947 (0.075)* |

| Lang*lnLASP (P-value) |

-0.0143733 (0.037)** |

-0.003523 (0.002)*** |

0.0251925 (0.247) |

| Constant (P-value) |

-0.3394312 (0.658) |

-0.0052169 (0.981) |

-1.375867 (0.059)** |

| Wald P-value |

0.000 | 0.000 | 0.000 |

Coefficients are estimated with GMM.

The main goal of this last exercise is to detect firstly the other determinants that can stimulate the movement of capital in emerging countries and the rest of the world. Secondly, we try to understand if the presence of unconventional monetary policy remains effective in the presence of capital market frictions such as physical distance between countries, common language, free trade agreements if it exists, and capital market controls.

The result in Table 4 below shows a negative sign of each friction multiplied by the variable of quantitative easing. Without the presence of frictions, a positive relationship exists between capital flows and expansionary monetary policy. But, when we add distance, language, and FTA, a negative relationship is built between these variables, and capital movements. So, we notice that the more the friction decreases in the capital market, the more there is an increase in investments. Also, the effect of "QE" weakens in the presence of the latter. In this sense, Fratzcher et al. (2013) found that the repercussions of "QE" were not significantly relevant in explaining variations in capital flows in "EMEs". The degree of capital market frictions between EMEs and the United States can explain so why certain countries are more affected by foreign monetary policy than others and these latter has been transmitted mostly through the international capital flow. MacDonald (2017) suggested that monetary authorities in EMEs can better estimate and plan for the repercussions of QE from advanced economies if they know in advance their degree of capital market frictions relative to these countries and the types of assets purchased by the Federal Reserve. Finally, we conclude that the inflows and outflows of capital do not depend on the exceptional instruments of the FED only, but there are other factors such as improving fundamentals, differences in growth prospects, the difference in the rate of overall interest and appetite for risk VIX.

Conclusion

During the global financial crisis, advanced economies engaged in unconventional monetary policy to support economic growth and financial stability. The U.S. Federal Reserve launched three separate "QE" episodes that involved massive purchases of U.S. government bonds. Recent research has shown that the Fed's implementation of such programs had an international spillover impact on Emerging Market Economies (EMEs), specifically volatile capital flows. Going forward, policymakers in emerging countries expressed widespread concerns over the U.S. "QE" effect on their financial stability and global liquidity. The potential destabilizing capital flows can have unprecedented consequences in these economies as increasing inflation, currency appreciations, decreases in long-term local-currency sovereign yields, and the drop in equity prices (Ahmed & Zlate, 2014; Chen et al. 2014; Margaux, 2017). The main purpose of the research is to assess the connexion of the US quantitative easing monetary policy and capital flows with the presence of capital market frictions for five emerging countries for the period 2000 to 2016. The purpose has been attained using a dynamic panel model with the general method of moments (GMM).

Our results yielded several interesting finds. We found that US unconventional monetary policy, measured by the long term interest rate and the purchase of treasuries had a spillover effect on capital flows and during the post-crisis episode, there was an increase in capital inflows to EMEs also before the crisis but with the deepening of this trend. While the impact was different depending on the types of investment. The result obtained for portfolio investment confirms that this type of capital flows took center stage after the financial turmoil. When we measured the effect of "QE" through treasury purchases, we show that the impact was significant for the three types of investment.

Previous studies show that risk aversion affected capital flows to EMEs, particularly the portfolio investment. This is true, our result suggest that capital outflows from emerging economies are associated with an increase in risk aversion. Using the pull versus push framework, we concluded that external factors remained the main determinants of capital flows. Within pull factors, we found that the differential rate and economic growth are significant when we measured indirectly the spillover of "QE" programs on capital flows through the long-term interest rate. However, there is no evidence to confirm that these two variables are an important driver of capital flows when we used treasuries purchases. Finally, we presented evidence that when capital market frictions are present; the effect of "QE" begins to weaken. Furthermore, when the degree of friction decreases, the level of investment increases Clark et al. (2020) deduced that the role of the Fed’s monetary policy in EMEs capital flows has been smaller than what popularly believed.

The "QE" programs have ended in December 2015 and the Federal Reserve started the normalization of its monetary policy by increasing the fund's rate. This action generated a reversal of capital flows in the United States and substantial volatility outflows from EMEs. A crucial policy lesson emerges from my empirical findings. Policymakers in EME can better predict and plan for the spillover impact of unconventional monetary policy by advanced economies if they know their degree of capital market frictions on each country. This leads to expect the potential benefits and risks of distress episodes (financial crisis, health crisis, and covid-19).

Limitation and Study Forward

This study is a major novelty since we applied the degree of capital market frictions to identify the heterogenous spillover of the US monetary policy on capital flows to emerging economies (differently to previous researches). Nevertheless, this study can be riched with other countries and in particular a comparative study with different groups of emerging countries like the BRICS one, which are the largest developing economies in the world. It would be interesting to see how capital flows to these economies behave since the US unconventional asset purchases and how to respond with capital market frictions in these destinations. Another area where the paper could be extended is by adding other variables to show the connexion with capital flows as the foreign exchange rate and inflation measure of a country. The analysis could be expanded by focusing on capital market frictions in association with the quantitative easing of other advanced country central banks on capital movement to identify the heterogeneous effects. All these topics can be enriched by applying the threshold cointegration approach and time varying Granger causality test Evgenidis et al. (2017).

End Notes

1IMF (2017) report that emerging countries GDP present 58% in 2016 compared to 36% in 1990.

2Bernanke, (2016); Bowman, Londono & Sapriza, (2014); Chen, Mancini-Griffoli & Sahay, (2014); Georgiadis, (2016), (McKinnon, 2013).

3Measured as a share of GDP and presented as a function of monetary policy indicators, domestic growth prospects and the behavior of investor towards or perceptions of the country’sriskiness.

4The choice between gross and net flows can be important, in that factors such as US monetary policy, particularly affects only gross inflows into EMEs, rather than net.

5Wu and Xia (2015) estimated the shadow interest rate to accommodate unconventional monetary policy with a latent factor extracted from a large panel of monetary and financial data. Other authors calculated this rate as Krippner (2013); Lombardi & Zhu (2014).

6Federal Open Market Committee.

7Is a benchmark symbol for the Chicago Board Options Exchange Volatility Index and a popular measure of the degree of the volatility of Standard &Poor's 500 index options.

8Transformed LASP in (Ln) to ensure stationarity.

9See Calvo et al. (1993), IMF (2011) & IMF (2013).

11Uribe et al. (2015) calculated capital controls by codifying the IMF’sAnnual Report on Exchange Rate Arrangements and Restrictions. The integrated 55 different categories of restrictions, ranging from equity and bond restrictions to real estate restrictions.

12We used the Arellano-Bond dynamic panel generalized method of moments (GMM) to avoid the bias of the standard dynamic panel estimation.

13is a term coined by a Morgan and Stanley financial analyst in 2013 to represent emerging countries that rely too heavily on foreign investment to finance their growth.

14Recent researchs have shown that an upward of capital flows is associated to a lower VIX (see Bruno and Shin (2014)). Also, Rey(2015) found that during the boom period, a low value of VIX is associated with higher capital inflows and outflows, more leverage and high inflation.

Appendix

| Table A1 Capital Market Frictions | ||||

| COUNTRY | Code | Distance | FTA | LANG |

| Brazil | BRA | 7.69 | 1 | 0 |

| Indonesia | IDN | 16.18 | 1 | 0 |

| India | IND | 11.76 | 0 | 1 |

| South Africa | ZAF | 12.58 | 1 | 1 |

| Turkey | TUR | 8.07 | 0 | 0 |

References

- Ahmed, S., & Zlate, A. (2014). Capital flows to emerging market economies: A brave new world?. Journal of International Money and Finance, 48, 221-248.

- Anaya, P., Hachula, M., & Offermanns, C.J. (2017). Spillovers of US unconventional monetary policy to emerging markets: The role of capital flows. Journal of International Money and Finance, 73, 275-295.

- Bartkiewicz, P. (2018). The Impact of Quantitative Easing on Emerging Markets–Literature Review. Financial Internet Quarterly, 14(4), 67-76.

- Belke, A., & Dubova, I. (2018). On the role of international spillovers from the European Central Bank’s unconventional monetary policy. Credit and Capital Markets, 51(1), 151-170.

- Bowman, D., Londono, J.M., & Sapriza, H. (2015). US unconventional monetary policy and transmission to emerging market economies. Journal of International Money and Finance, 55, 27-59.

- Byrne, J. P., & Fiess, N. (2016). International capital flows to emerging markets: National and global determinants. Journal of International Money and Finance, 61, 82-100.

- Byrne, J.P., & Fiess, N. (2016). International capital flows to emerging markets: National and global determinants. Journal of International Money and Finance, 61, 82-100.

- Calvo, G.A., Leiderman, L., & Reinhart, C.M. (1993). Capital inflows and real exchange rate appreciation in Latin America: the role of external factors. Staff Papers, 40(1), 108-151.

- Chen, M.J., Griffoli, M.T.M., & Sahay, M.R. (2014). Spillovers from United States monetary policy on emerging markets: different this time?. International Monetary Fund.

- Clark, J., Converse, N., Coulibaly, B., & Kamin, S.B. (2020). Emerging market capital flows and US monetary policy. International Finance, 23(1), 2-17.

- Duca, M.L., Nicoletti, G., & Martinez, A.V. (2016). Global corporate bond issuance: what role for US quantitative easing?. Journal of International Money and Finance, 60, 114-150.

- Evgenidis, A., Philippas, D., & Siriopoulos, C. (2019). Heterogeneous effects in the international transmission of the US monetary policy: a factor-augmented VAR perspective. Empirical Economics, 56(5), 1549-1579.

- Galstyan, V., & Lane, P.R. (2013). Bilateral portfolio dynamics during the global financial crisis. European Economic Review, 57, 63-74.

- Georgiadis, G. (2016). Determinants of global spillovers from US monetary policy. Journal of international Money and Finance, 67, 41-61.

- IMF (2011), Recent Experiences in Managing Capital Inflows-cross Cutting Themes and Possible Framework, IMF, February.

- IMF (2013), “Global Capital Flows,” at Spillover Report-Analytical Underpinnings and Other Backgrounds, Chapter 3, IMF Policy Paper, August.

- IMF (2017). Balance of Payments: Portfolio Investment | Countries:Brazil, Russia, India, China, and South Africa, 2000-2014 | International Monetary Fund Subject: Portfolio investment | Code 3B9AA, 1990-2015. Data-PlanetTM Statistical Datasets by Conquest Systems, Inc. [Data-file]. Dataset-ID: 056-006-010.

- Khatiwada, S. (2017). Quantitative easing by the fed and international capital flows (No. 02-2017). Graduate Institute of International and Development Studies Working Paper.

- Krippner, L. (2013). Measuring the stance of monetary policy in zero lower bound environments. Economics Letters, 118(1), 135-138.

- Lim, J., Mohapatra, S., & Stocker, M. (2014). The Effect of Quantitative Easing on Financial Flows to Developing Countries. Global Economic Prospects H, 1.

- Lim, J.J., & Mohapatra, S. (2016). Quantitative easing and the post-crisis surge in financial flows to developing countries. Journal of International Money and Finance, 68, 331-357.

- Lim, J.J., & Mohapatra, S. (2016). Quantitative easing and the post-crisis surge in financial flows to developing countries. Journal of International Money and Finance, 68, 331-357.

- Liu, P., Theodoridis, K., Mumtaz, H., & Zanetti, F. (2019). Changing macroeconomic dynamics at the zero lower bound. Journal of Business & Economic Statistics, 37(3), 391-404.

- Margaux MacDonald. (2017). International capital market frictions and spillovers from Quantitative easing. Journal of International Money and Finance, 70 (2017) 135–156.

- Papadamou, S., Siriopoulos, C., & Kyriazis, N.A. (2020). A survey of empirical findings on unconventional central bank policies. Journal of Economic Studies.

- Powell, J.H. (2013). Advanced economy monetary policy and emerging market economies. In Speech at the Federal Reserve Bank of San Francisco 2013 Asia Economic Policy Conference, San Francisco, CA (Vol. 4).

- Ramirez, C., & González, M. (2017). Have QE programs affected capital flows to emerging markets?: A Regional Analysis. Investigación conjunta-joint research, 155-188.

- Sarno, L., Tsiakas, I., & Ulloa, B. (2016). What drives international portfolio flows? Journal of International Money and Finance, 60, 53-72.

- Tillmann, P. (2016). Unconventional monetary policy and the spillovers to emerging markets. Journal of International Money and Finance, 66, 136-156.

- Wu, J.C., & Xia, F.D. (2016). Measuring the macroeconomic impact of monetary policy at the zero lower bound. Journal of Money, Credit and Banking, 48(2-3), 253-291.