Case Reports: 2017 Vol: 23 Issue: 1

Case Study : Capital Budgeting In The Federal Government: The Case Of A Marine Corps Exercise Support Detachment In Yuma, Arizona

Mitch A. Bruce

Headquarters Marine Corps, Combat Development & Integration

Steven P. Landry

Naval Postgraduate School

Donald E. Summers

Naval Postgraduate School

Case Description

This case requires the use of capital budgeting techniques to compare two competing alternatives to carry out a particular required Marine Corps training exercise. Training outcomes are assumed to be the same under each alternative with the focus on lowering costs as the primary objective. The core activities in this case involve the analysis of cost and discount rate inputs to measure the present value of the costs and the evaluation of the two options.. The backdrop for these two competing alternatives is a federal government attempting to inculcate fiscal constraints and cost cutting within the military. While this case is based on an actual, real set of facts, people, and organizations, some specific data have been changed for proprietary or educational reasons.

The case lends itself to student group project assignments with respect to developing a capital budgeting analysis for the “Marine Corps Exercise Support Detachment.” Proposed solution(s) should determine the costs of both the “status quo” (current situation) and the proposed “alternative,” and, subsequently, which alternative to accept. Furthermore, students should give consideration to the various inputs of their prospective capital budgeting models as well as consider factors other than costs that may affect the decision.

The case has a difficulty level appropriate for a senior course at the undergraduate level or an MBA graduate-level course. The case is designated to be taught in 1.5 class hours, assuming students have put in at least one hour of preparation outside the classroom either individually or in groups.

Case Synopsis

This case explores the potential cost savings of establishing a Marine Corps Exercise Support Detachment (ESD) in Yuma, AZ. It requires comparing the costs of a current operational mode (status quo) to those associated with an ESD (proposed alternative). Historical data are provided to calculate the costs of the status quo. A large input cost of the status quo is the personnel cost associated with equipment preparation and embarkation, and post-exercise maintenance. The costs of the proposed alternative may be calculated using historical data from similar projects and operations—which can either be provided to students, or which students can be asked to research—as well as Department of Defense (DoD) and U.S. government regulations regarding cost estimation. The annual costs of the alternative can then be compared to the annual costs of the status quo to quantify potential annual savings at each level of involvement. The time value effect of any annual savings will then need to be analyzed using capital budgeting techniques such as the net present value (NPV) method to show the total cost and/or benefit of the ESD over a range of extended periods.

Introduction

Captain Mitch Bruce sits at his computer pondering how to respond to an upper level request to resolve some potentially contradictory objectives. On the one hand, the Marine Corps needs to continue to maintain readiness via specified required training in order to meet current and possible unknown mission requirements. On the other hand, the Marine Corps, like the rest of the Department of Defense (DoD), is facing current and looming budget cuts. Captain Bruce has been asked to analyze and make recommendations on how to accomplish both of these objectives.

Background

The Weapons and Tactics Instructors Course (WTI) is an integral part of Marine aviation training. WTI provides pilots, weapon systems operations, and ground combat support service personnel an opportunity to hone their battlefield knowledge and expertise. Students are taught tactics and uses for a variety of weapons, including how to best utilize them together with other Marine aviation units and command and control systems. Students are taught about a variety of weapons, Marine Aviation Weapons and Tactics Squadron One (MAWTS-1) conducts this training (two courses per year) at the Marine Corps Air Station in Yuma, Arizona (AZ). These two courses produce more than 300 graduates annually. WTI provides the Marine Corps with highly trained officers in the aviation community.

A key component of the WTI course is the fully integrated combined arms exercise. A combined arms exercise involves several hundred Marines playing a war game against a fictitious enemy in which ground troops, armor, artillery (Ground Combat Element), and aircraft (Air Combat Element) engage enemy movements simultaneously. This exercise requires significant support from the operating forces. Operating forces deploy detachments to Yuma, AZ, for six to eight weeks in support of the exercise. These detachments provide MAWTS-1 with field units to use during the WTI course. To adequately support the exercise, the detachments require large amounts of equipment (armored vehicles, artillery, trucks, etc.) from the home bases or stations. The transportation costs associated with the detachments’ equipment amount to several millions of dollars per year for the Marine Corps.

The Marine Corps Air Ground Combat Center in Twentynine Palms, CA, had a similar issue but found a different approach to conduct operations. An Exercise Support Detachment (ESD) was established in Twentynine Palms, CA, to provide and maintain equipment in support of exercises and to eliminate the need for units to ship equipment, thus reducing the cost of transportation. Instead of transporting equipment to Twentynine Palms, units now “borrow” equipment from the ESD for the exercise and return it at the end of the exercise.

Marine Corps Air Station Yuma

The history of Marine Corps Air Station (MCAS) Yuma goes back to 1928, when Colonel Benjamin F. Fly persuaded the U.S. government to lease land from Yuma County and establish an airfield (MCAS Yuma, 1997). The airfield was used occasionally until 1941, when the federal government approved the construction of permanent runways. During World War II, the government authorized the construction of an air base, which became one of the most active military pilot training centers in the country. Following World War II, the air base ceased flight operations, and other government agencies used the base for a headquarters to direct irrigation projects in the area.

The U.S. Air Force reactivated the base on July 7, 1951, as a training facility for elements of the Western Air Defense Forces. On January 1, 1959, the Air Force transferred the facility to the Navy, which then designated it as the Marine Corps Auxiliary Air Station. It became Marine Corps Air Station Yuma on July 20, 1962. Since then, it has served as a training facility for Marine Corps aviation units.

Marine Aviation Weapons and Tactics Instructor Squadron One

Commissioned on June 1, 1978, by the Commandant of the Marine Corps, Marine Aviation Weapons and Tactics Instructor Squadron One (MAWTS-1) is “staffed by individuals of superior aeronautical and tactical expertise, instructional abilities, and professionalism” (MAWTS-1, 1995). MAWTS-1 provides graduate-level instruction through its WTI course. The graduates serve in “training billets in every tactical unit in Marine Corps aviation” (MAWTS-1, 1995) and provide these units with “tactical and weapons systems employment” (MAWTS-1, 1995) expertise.

Weapons and Tactics Instructors Course (Wti)

WTI is an integral part of Marine aviation training. According to the WTI 2–13 Planning Guide, “The purpose of WTI is to produce Weapons and Tactics Instructors from qualified candidates from the various Marine Corps communities” (MAWTS-1, 2012, p. 3-1). WTI provides the Marine Corps with highly trained officers in the aviation community.

WTI courses began in 1976, originally conducted separately by Marine Air Weapons Training Unit Pacific (MAWTUPac) and Marine Air Weapons Training Unit Atlantic (MAWTUAnt). In 1977, the Marine Corps combined the courses at MCAS Yuma, where instructors and staff from both MAWTUPac and MAWTULant combined to offer instruction to students. Due to the success of the combined courses, the Commandant of the Marine Corps commissioned MAWTS-1 and thus began the WTI course we know today. Components of the course changed over the years, but the fundamental elements remained consistent. According to MAWTS-1 (1995),

The WTI Course is a fully integrated course of instruction for highly experienced and fully qualified officers from all aviation communities. Officers from ground combat, combat support, and combat service support also attend the course to ensure appropriate air-ground interface. The WTI course academic syllabus allows the WTI candidate to put classroom lessons to work in the air. Briefing and debriefing techniques and airborne instructional skills are reviewed and tactics and weapons systems employment are evaluated. The course culminates in a fully integrated combined arms exercise encompassing all functions of Marine Corps aviation in support of a national Marine Air Ground Task Force. (para. 4)

The fully integrated, combined-arms exercise involving a ground combat element, an air combat element, and a logistics element is a key component to the WTI course. This combined-arms exercise provides hands-on, realistic training for the students, which cannot be reproduced through simulation. “This complex exercise requires significant support and staff augmentation from the operating forces” (MAWTS-1, 2012, p. 3-1). Operating forces deploy to Yuma, AZ, for six to eight weeks in support of the exercise and provide MAWTS-1 with field units to use during the WTI course.

WTI also serves a purpose for the supporting units as well. The WTI 2–13 Planning Guide (2012) states that “WTI can serve as a venue for the conduct of a Mission Rehearsal Exercise (MRX) for MACG and VMAQ units scheduled to deploy” (p. 3-3). The MRX is an important part of Marine Corps pre-deployment training because it helps ensure units are combat proficient and ready to perform during deployment.

Department of Defense Budget

The fiscal environment in which the Department of Defense (DoD) operates is challenging. Many congressional leaders are looking to save money by making cuts in the DoD budget even including budget sequestration.

According to the White House website, “In 2011, Congress passed a law saying that if they couldn’t agree on a plan to reduce our deficit by $4 trillion—including the $2.5 trillion in deficit reduction lawmakers in both parties have already accomplished over the last few years—about $1 trillion in automatic, arbitrary and across the board budget cuts would start to take effect in 2013.” Sequestration began on March 1, 2013, due to lack of congressional action. The automatic cuts mean that the DoD will be trying to maintain its current capabilities on a reduced budget.

Due to sequestration and the lack of adequate funding, the DoD began looking to reduce costs in every facet of its operations. Inefficient programs and wasteful spending were two areas high on the list for reduction or elimination. According to the Fiscal Year 2012 Department of Defense Efficiency Initiatives, the DoD found ways to trim $10,741,000,000 from the 2012 budget and $100,173,000,000 over a five-year period (FY2012–FY2017). All departments of the DoD had to analyze their programs and operations in order to identify ways to decrease cost and improve efficiency. Analyzing current operations and developing strategies to reduce costs could allow leaders to increase the sustainability of the programs in austere fiscal environments.

Task at Hand

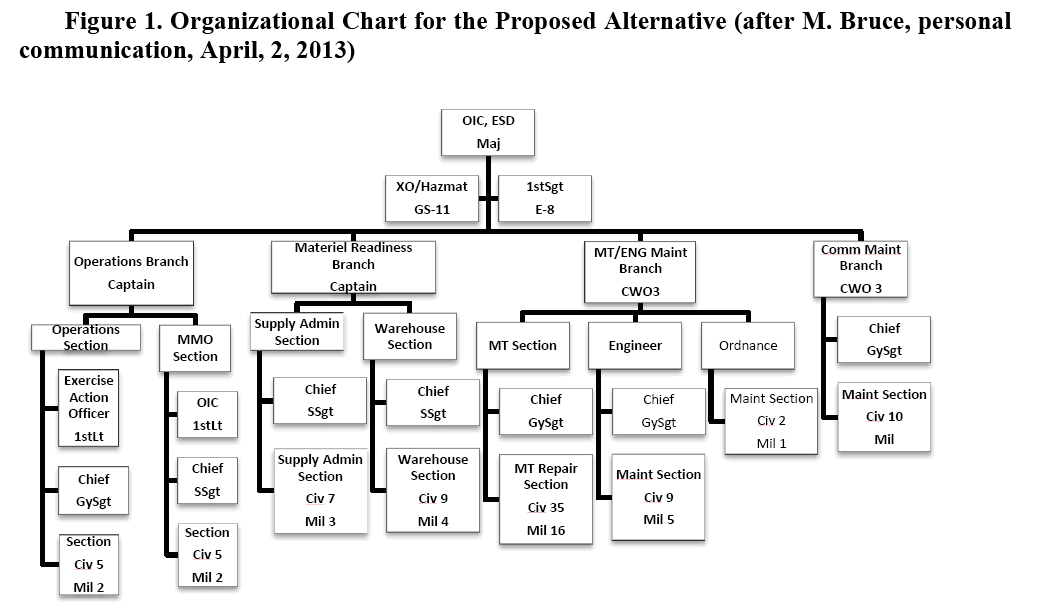

Captain Bruce’s task is to examine the potential cost savings associated with establishing a permanent Exercise Support Detachment (ESD) in Yuma, AZ. He thinks that an appropriate approach would be to flesh out this new option, then compare its potential costs to the current modus operandi (status quo) approach. Captain Bruce obtains a significant amount of data and organizes that data as shown in Tables 1 through 5, Figure 1, and Appendix A.

| Table 1 Sample Wti Exercise Support over a Two-Year Period |

|

| Exercise | Percent of Support Provided |

| Year 1,WTI Exercise # 1 | 100% East Coast, 0% West Coast |

| Year 1,WTI Exercise # 2 | 50% East Coast, 50% West Coast |

| Year 2,WTI Exercise # 1 | 0% East Coast, 100% West Coast |

| Year 2,WTI Exercise # 2 | 50% East Coast, 50% West Coast |

Figure 1: Organizational Chart for the Proposed Alternative (after M. Bruce, personal communication, April, 2, 2013)

Important to the analysis is an understanding of the annual costs due to the cyclical nature of operations in Yuma. Costs differ from year to year depending on which units support the WTI exercises. When units from the East Coast support the exercise, the costs increase compared to when units from the West Coast support the exercises. Over a two-year period, the cycle appears as depicted in Table 1.

The exact percentages might change slightly depending on the year. However, this is the general cycle of WTI exercises, which have significant and varying impacts on transportation costs. Therefore, it is important to evaluate the average annual costs to accurately analyze the alternatives and to determine the savings.

Additional Information

U.S. Government Economic Guidelines

Government agencies follow guidance from the Office of Management and Budget (OMB) set forth in Circular No. A-94. The OMB published the revised edition in 2013. The document states,

The standard criterion for deciding whether a government program can be justified on economic principles is net present value—the discounted monetized value of expected net benefits (i.e., benefits minus costs). Net present value is computed by assigning monetary values to benefits and costs, discounting future benefits and costs using an appropriate discount rate, and subtracting the sum total of discounted costs from the sum total of discounted benefits. Discounting benefits and costs transforms gains and losses occurring in different time periods to a common unit of measurement. Programs with positive net present value increase social resources and are generally preferred. Programs with negative net present value should generally be avoided. (OMB, 2013, p. 4)

Appendix C of the circular, updated annually by the OMB, identifies the discount rates government agencies use when conducting a net present value (NPV) analysis regarding cost-effectiveness, lease purchase, and related analyses. The OMB assigns rates for different periods of time (3-year, 5-year, 7-year, 10-year, 20-year, and 30-year). The rate used in the NPV calculation depends on the expected duration of the investment. For investment periods that do not match the periods outlined by the OMB, a “linear interpolation” should be used: “For example, a four-year project can be evaluated with a rate equal to the average of the three-year and five-year rates” (OMB, 2013). The OMB directs that “programs with durations longer than 30 years may use the 30-year interest rate” (OMB, 2013).

Net Present Value Analysis

The Marine Corps uses a 50-year lifespan estimate for buildings. Therefore, the NPV analysis using OMB (2013) assumes a discount rate of 3.0 percent based on the guidance set forth in OMB Circular 94. The biennial savings calculated for each of the three levels of participation are discounted over a 50-year period and provide the total savings over the estimated life of the alternative.

Sensitivity Analysis

A sensitivity analysis analyzes different assumptions for the lifespan of a building and the assumptions effects on the NPV. Sensitivity analysis might consider, for instance, changing the lifespan assumptions to 10 years, 15 years, and 20 years to provide an idea of the cost savings that may be realized over shorter time spans. Changing the lifespan assumption changes, assuming OMB (2013), the discount factors are 2.0, 2.4, and 2.7 percent, respectively. The discount factor for 15 years is not specified by the OMB, but is derived from the average of the 10-year and 20-year discount rates per the guidance of the OMB (2013).

Transportation Costs

For the WTI exercise, the Marine Corps sends equipment from both coasts to support the exercise. The Marine Corps employs contracted tractor-trailers to transport the equipment across the country. The prices for each contractor differ depending on the location and the contract used to hire the contractor. These costs make up a large portion of the expenses associated with the current operations held in Yuma, AZ.

Major Subordinate Commands (MSCs) pay for the transportation using their operation and maintenance (O&M) funds, an annual appropriation from Congress. The MSCs track these costs. The most recent two years of available historical data are provided in Table 2 to quantify the costs associated with the transportation of equipment to Yuma, AZ.

| Table 2 Transportation Costs Associated With the Status Quo |

||||||

| FY11 | FY12 | Total | ||||

| Air Combat Element | $ | 2,319,656 | $ | 2,727,055 | $ | 5,046,711 |

| Ground Combat Element | $ | 214,034 | $ | 965,764 | $ | 1,179,798 |

| Logistics Combat Element | $ | 23,117 | $ | - | $ | 23,117 |

| Total | $ | 2,556,807 | $ | 3,692,819 | $ | 6,249,626 |

| Average Annual Cost | $ | 3,124,813 | ||||

Cost of Time—Equipment Preparation and Embarkation Phase

Marines spend a great deal of time prior to an exercise preparing equipment for embarkation. The time spent and the personnel involved vary greatly depending on the unit and the leadership of the unit. For the purposes of this analysis, the Marine Corps assumes that 14 days will be required for this phase.

The other key to calculating the cost of time associated with equipment preparation and embarkation is the number of personnel involved. Personnel involved vary from unit to unit and situation to situation. The typical manning levels, by units, are shown in Table 3. The units involved are a Marine Air Control Group (MACG), an Infantry Battalion (Inf Bn), an Artillery Battalion (Arty Bn), and a Marine Wing Support Squadron (MWSS).

| Table 3 Number of Military Personnel Involved In Wti Operations |

|||||

| Pay Grade/Rank | MACGMWSSTotalInf BnArty Bn |

||||

| O - 4 (Major) | 6 | 0 | 0 | 0 | 6 |

| O - 3 (Captain) | 14 | 3 | 0 | 2 | 19 |

| O - 2 (1st Lieutenant) | 11 | 5 | 2 | 1 | 19 |

| O - 1 (2nd Lieutenant | 0 | 0 | 0 | 0 | 0 |

| W - 5 (Chief Warrant Officer 5) | 0 | 0 | 0 | 0 | 0 |

| W- 4 (Chief Warrant Officer 4) | 0 | 0 | 0 | 0 | 0 |

| W- 3 (Chief Warrant Officer 3) | 1 | 0 | 0 | 0 | 1 |

| W - 2 (Chief Warrant Officer 2) | 2 | 0 | 0 | 1 | 3 |

| W - 1 (Chief Warrant Officer) | 0 | 0 | 0 | 0 | 0 |

| E - 9 (Sergeant Major) | 3 | 0 | 0 | 0 | 3 |

| E - 8 (First Sergeant) | 7 | 1 | 0 | 2 | 10 |

| E - 7 (Gunnery Sergeant) | 21 | 3 | 0 | 4 | 28 |

| E - 6 (Staff Sergeant) | 27 | 7 | 2 | 8 | 44 |

| E - 5 (Sergeant) | 72 | 20 | 8 | 23 | 123 |

| E - 4 (Corporal) | 97 | 45 | 17 | 33 | 192 |

| E - 3 (Lance Corporal) | 124 | 65 | 9 | 32 | 230 |

| E - 2 (Private First Class) | 1 | 2 | 0 | 1 | 4 |

| E - 1 (Private) | 0 | 36 | 13 | 0 | 49 |

| Totals | 386 | 187 | 51 | 107 | 731 |

The DoD defined the military standard pay and reimbursement rates for FY2013 for each rank in the FY2013 (DoD) military personnel composite standard pay and reimbursement rates memorandum. This cost was then multiplied by the daily rate of 0.00439, per the deputy comptroller (2012). Table 4 shows the annual and daily compensation rates of military personnel by pay grade.

| Table 4 Annual and Daily Compensation Rates for Military Personnel |

||||

| Pay Grade | Annual Compensation | Daily Compensation | ||

| O - 4 | $ | 164,812 | $ | 723 |

| O - 3 | $ | 138,563 | $ | 608 |

| O - 2 | $ | 109,828 | $ | 482 |

| O - 1 | $ | 82,056 | $ | 360 |

| W - 3 | $ | 137,667 | $ | 604 |

| W - 2 | $ | 121,662 | $ | 534 |

| W - 1 | $ | 110,497 | $ | 485 |

| E - 9 | $ | 140,827 | $ | 618 |

| E - 8 | $ | 115,976 | $ | 509 |

| E - 7 | $ | 103,983 | $ | 456 |

| E - 6 | $ | 90,139 | $ | 395 |

| E - 5 | $ | 73,307 | $ | 321 |

| E - 4 | $ | 60,214 | $ | 264 |

| E - 3 | $ | 51,069 | $ | 224 |

| E - 2 | $ | 45,373 | $ | 199 |

| E - 1 | $ | 41,804 | $ | 183 |

| Note 1: Pay grades O-5 through O-10, WO-4 and WO-5, and E-9 assumed by this case will not participate in the equipment preparation and embarkation phase. | ||||

Maintenance, Cost of Repair, and Replacement Parts

The actual operations conducted are the same in both alternatives; therefore, one can expect the same wear and tear on the equipment. Given this, the maintenance cost of repair and replacement parts were assumed to be the same in both situations/alternatives. The consolidation of maintenance activities in the alternative may actually reduce the cost of repair and replacement parts. However, to be conservative, assume the costs are the same between the two alternatives.

Temporary Additional Duty (Tad) Costs

Temporary additional duty (TAD) orders encompass a broad range of operations and training events. Commands assign Marines TAD orders when Marines are assigned to another unit for a temporary period and are expected to return to the original unit. While under TAD orders, Marines are authorized a certain amount of additional money for traveling expenses such as lodging and food. These expenses are considered TAD costs.

TAD costs associated with supporting units for WTI are usually for the advance party (ADVON) and the rear party. The ADVON is a small number of personnel that deploy to Yuma before the rest of the unit arrives. The ADVON is responsible for coordinating all activities for the arrival of the rest of the unit and receiving all equipment shipped from the unit’s home station. The ADVON usually deploys at least 10 days prior to the rest of the unit arriving, and receives TAD authorizations for those 10 days.

The rear party is responsible for ensuring that all personnel and equipment depart Yuma successfully. The rear party usually remains in Yuma for three days after the rest of the unit departs and is authorized TAD money for those three days.

The personnel in the ADVON and rear parties are usually the same and vary from unit to unit. This case study assumes the ADVON and rear parties consist of a captain (03), a lieutenant (02), a gunnery sergeant (E-7), a staff sergeant (E-6), two sergeants (E-5), four corporals (E-4), and 12 lance corporals (E-3). The money authorized for each rank differs and is based on DoD orders and regulations. The TAD cost calculation uses the maximum per diem rate, per the Defense Travel Management Office, for Yuma County, AZ, which is $124 per day per person. Given the schedule above, every Marine receives per diem for thirteen days. Table 5 shows the TAD costs associated with the status quo.

| Table 5 Tad Costs Associated With Status Quo |

||||||||

| Grade | Number of Given Grade |

Days ADVON |

Days Rear |

TotalDays TAD |

TAD Cost/Day |

TAD Cost | ||

| O - 3 | 1 | 10 | 3 | 13 | $ | 124 | $ | 1,612 |

| O - 2 | 1 | 10 | 3 | 13 | $ | 124 | $ | 1,612 |

| E - 7 | 1 | 10 | 3 | 13 | $ | 124 | $ | 1,612 |

| E - 6 | 1 | 10 | 3 | 13 | $ | 124 | $ | 1,612 |

| E - 5 | 2 | 10 | 3 | 13 | $ | 124 | $ | 3,224 |

| E - 4 | 4 | 10 | 3 | 13 | $ | 124 | $ | 6,448 |

| E - 3 | 8 | 10 | 3 | 13 | $ | 124 | $ | 12,896 |

| Total | 18 | Total | $ | 29,016 | ||||

Generally, nine different units will provide various support functions for the exercises. Assuming each unit has the same personnel requirements, each unit will require $29,016 in TAD costs per exercise, and there are two exercises per year.

Permanent Personnel (Military And Civilian)

To calculate the cost of permanent personnel for the ESD in Yuma, a proposed organization and staffing level was created, as shown in Figure 1. The number of personnel derived from the proposed organization was then multiplied by the annual cost of military (Table 4) and civilian personnel, as shown in Table 6, to derive the permanent personnel costs shown in Appendix A.

| Table 6 Annual Salaries of Gs Employees in The Phoenix–Mesa–Scottsdale, Az, Locality Pay Area |

|

| Grade | Step 10 |

| 1 | $ 26,001 |

| 2 | $ 29,413 |

| 3 | $ 33,150 |

| 4 | $ 37,213 |

| 5 | $ 41,633 |

| 6 | $ 46,410 |

| 7 | $ 51,580 |

| 8 | $ 57,115 |

| 9 | $ 63,083 |

| 10 | $ 69,478 |

| 11 | $ 76,327 |

| 12 | $ 91,487 |

| 13 | $ 108,791 |

| 14 | $ 128,557 |

| 15 | $ 151,224 |

The staffing was derived using information received from the Exercise Support Division, Marine Air Ground Task Force Training Command (MAGTFTC), Marine Corps Air Ground Combat Center (MCAGCC). Based on the information, a ratio of three Marines to seven civilians (3:7) was used to establish the proper staffing of the Exercise Support Detachment in Yuma. Assume “Step 10” is the average for each civilian grade.

Facilities’ Costs (Construction and Annual Operating Costs)

The proposed establishment of the ESD would require a large, initial investment in facilities as well as recurring, annual maintenance costs for the facilities. Military construction (MILCON) funding will pay for the initial construction costs, and O&M funding will pay for the annual maintenance costs. This is important because MILCON and O&M stem from two different congressional appropriations, and the funding cannot be redistributed between the categories without congressional approval.

Using the cost of the Exercise Support Division, MAGTFTC, and MCAGCC buildings in Twenty-nine Palms, CA, as a base comparison, the Consumer Price Index (Bureau of Labor Statistics, 2013) was used to convert the original costs to 2013 dollars, which would allow for comparative analysis between the status quo and the alternative. According to the Federal Real Property Council’s 2012 Guidance for Real Property Inventory Reporting, operating costs include “recurring maintenance and repair costs, utilities (includes plant operation and purchase of energy), cleaning and/or janitorial costs (includes pest control, refuse collection, and disposal to include recycling operations), and roads/grounds expenses (includes grounds maintenance, landscaping, and snow and ice removal from roads, piers, and airfields)” (p. 11). According to the most current Federal Real Property Report, published in FY2010, the operating cost per square foot of owned federal buildings was $5.30 (Federal Real Property Council, 2010). Adjusting for inflation, the estimated annual operating cost per square foot would be $5.68.The total square footage of the proposed ESD facility would then be multiplied by $5.68 to estimate the annual operating expenses of the alternative. O&M funds pay for the annual operating costs.

These calculations resulted in an initial investment of $30,000,000 and annual operating costs of $420,320, as detailed in Appendix B.

Equipment Procurement

The Marine Corps has the equipment assets available to reallocate to different areas due to the current downsizing of the Marine Corps and the returning of equipment from Afghanistan. This means that new equipment would not have to be procured. However, the equipment would still need to be maintained using O&M funding. Therefore, the cost of maintaining the equipment is the same for both alternatives; it is not avoidable.

If the Marine Corps wants to forego the impacts to procurement funds, it can source equipment internally, without facing new procurement costs. This may mean that other units would not maintain their full equipment allowances, but the Marine Corps would not spend additional money on the assets. Therefore, the assumption of no procurement costs is a reasonable assumption.

Temporary Additional Duty Costs

Although temporary additional duty (TAD) costs exist in both situations, the TAD costs differ between the status quo and the alternative, and thus are relevant costs. The organization of the ADVON and rear party remains the same as the status quo. For the alternative, the ADVON’s responsibilities include inspecting and checking out equipment from the ESD, which should take seven days instead of 10 days (status quo). This decreases ADVON time by an estimated three days, resulting in a cost savings. The rear party will still need to stay three days in order to ensure proper return of the equipment to the ESD and ensure all personnel depart from Yuma.

Appendix A

| Permanent Personnel Cost Calculations | |||||||

| Type | Paygrade | Mil | Civ | Individual | Military | Civilian | |

| Salaries | Salaries | Salaries | |||||

| HQ | |||||||

| OIC | Mil | 0-4 | 1 | $164,812 | $164,812 | ||

| XO/Hazmat | Civ | GS-10 | 1 | 69,478 | 69,478 | ||

| 1st Sgt | Mil | E-8 | 1 | 115,976 | 115,976 | ||

| Ops Branch | |||||||

| OIC | Mil | O-3 | 1 | 138,563 | 138,563 | ||

| Ops Section | |||||||

| 2nd Lt | Mil | O-1 | 1 | 82,056 | 82,056 | ||

| Ops Chief | Mil | E-7 | 1 | 103,983 | 103,983 | ||

| Section | Mil | E-4 | 2 | 60,214 | 120,428 | ||

| Civ | GS-4 | 5 | 37,123 | 186,065 | |||

| MMO Section | |||||||

| OIC | Mil | O-2 | 1 | 109,828 | 109,828 | ||

| Chief | Mil | E-6 | 1 | 90,139 | 90,139 | ||

| Section | Mil | E-4 | 2 | 60,214 | 120,428 | ||

| Civ | GS-4 | 3 | 37,213 | 111,639 | |||

| Material Readiness Branch | |||||||

| OIC | Mil | O-3 | 1 | 138,563 | 138,563 | ||

| Supply | |||||||

| Supply Chief | Mil | E-6 | 1 | 90,139 | 90,139 | ||

| Admin Sect | Civ | GS-4 | 7 | 37,213 | 260,491 | ||

| Warehouse | |||||||

| Chief | Mil | E-6 | 1 | 90,139 | 90,139 | ||

| Section | Mil | E-4 | 4 | 60,214 | 240,856 | ||

| Civ | GS-4 | 9 | 37,213 | 334,917 | |||

| MT/Eng Maint Branch | |||||||

| OIC | Mil | W-3 | 1 | 137,667 | 137,667 | ||

| MT Section | |||||||

| Chief | Mil | E-7 | 1 | 103,983 | 103,983 | ||

| Maint Section | Mil | E-4 | 16 | 60,214 | 963,424 | ||

| Civ | GS-4 | 35 | 37,213 | 1,302,455 | |||

| Eng Section | |||||||

| Chief | Mil | E-7 | 1 | 103,983 | 103,983 | ||

| Maint Section | Mil | E-4 | 5 | 60,214 | 301,070 | ||

| Civ | GS-4 | 9 | 37,213 | 334,917 | |||

| Ordnance Maintenance Section | |||||||

| Mil | E-4 | 1 | 60,214 | 60,214 | |||

| Civ | GS-4 | 2 | 37,213 | 74,426 | |||

| Comm Maint Branch | |||||||

| OIC | Mil | W-3 | 1 | 137,667 | 137,667 | ||

| Chief | Mil | E-7 | 1 | 103,983 | 103,983 | ||

| Maint Section | |||||||

| Mil | E-4 | 5 | 60,214 | 301,070 | |||

| Civ | GS-4 | 10 | 37,213 | 372,130 | |||

| Total | Military | Civilian | |||||

| Total Annual Salaries | $6,848,099 | $3,801,581 | $3,046,518 | ||||

Appendix B

| APPENDIX B Milcon Cost Calculations | ||||||||

| BLDG1 | Year Built1 | SqFt1 | Cost2 | Cost in 2013 Dollars (BLS Website3) |

2013 Rounded4 | |||

| 2044 | 1986 | 25,000 | $ 5,500,000 | $ 11,770,000 | $ 11,800,000 | |||

| 2054 | 1986 | 30,000 | $ 5,250,000 | $ 11,235,000 | $ 11,200,000 | |||

| 2061 | 2002 | 19,000 | $ 5,400,000 | $ 7,020,000 | $ 7,000,000 | |||

| Total Initial Investment | $ 30,000,000 | |||||||

| 2010 Operating Costs/SqFt5 | Estimated 2013 Annual Operating Costs/SqFt (BLS Website3) | Estimated Total Annual Operating Costs of Facilities | ||||||

| $ 5.30 | $ 5.68 | $ 142,000 | ||||||

| $ 5.30 | $ 5.68 | $ 170,400 | ||||||

| $ 5.30 | $ 5.68 | $ 107,920 | ||||||

| Total Estimated Annual Operating Cost | $ 420,320 | |||||||

List of Acronyms and Abbreviations

References

- Bureau of Labor Statistics. (2013). CPI inflation calculator. Retrieved from http://www.bls.gov/data/inflation_calculator.htm

- Department of Energy (2013). Buildings energy data book. Retrieved from http://buildingsdatabook.eren.doe.gov/CBECS.aspx

- Department of the Treasury (2013, January 16). Historical debt outstanding-Annual 2000–2012 [Table]. Retrieved from http://www.treasurydirect.gov/govt/reports/pd/histdebt/histdebt_histo5.htm

- Deputy Comptroller. (2012, April 9). FY 2013 Department of Defense (DoD) military personnel composite standard pay and reimbursement rates [Memorandum]. Washington, DC: Office of the Under Secretary of Defense(Comptroller).

- Federal Real Property Council. (2010). FY 2010 Federal real property report: An overview of the U.S. federal government’s real property assets. Washington, DC: General Services Administration. Retrieved fromhttp://www.gsa.gov/graphics/ogp/FY_2010_FRPP_Report_Final.pdf

- Federal Real Property Council.(2012, October 25). 2012 guidance for real property inventory reporting. Washington, DC: General Services Administration. Retrieved from http://www.gsa.gov/portal/content/103101

- Marine Corps Air Station (MCAS) Yuma. (1997). The history of MCAS Yuma. Retrieved from http://www.mcasyuma.marines.mil/About/History.aspx

- Marine Aviation Weapons and Tactics Squadron One (MAWTS-1). (1995). History of MAWTS-1. Retrieved from https://www.trngcmd.usmc.mil/mawts1/Web%20Pages/Suqadron-History.aspx

- Marine Aviation Weapons and Tactics Squadron 1 (MAWTS-1). (2012, December 14). WTI 2-13 planning guide: Conference results and course requirements. Retrieved fromhttps://vcepub.tecom.usmc.mil/sites/msc/magtftc/mawts1/WTI/default.aspx

- Office of Management and Budget. (2013). Circular A-94 Appendix C. Retrieved from http://www.whitehouse.gov/omb/circulars_a094/a94_appx-c

- Office of Personnel Management (OPM). (2013). Salary table 2013-PX incorporating a locality payment of 16.67% for the locality pay area of Phoenix-Mesa-Scottsdale, AZ rates frozen at 2010 levels [Table]. Retrieved from http://www.opm.gov/policy-data-oversight/pay-leave/salaries-wages/2013/general-schedule/

- United States Navy. (2013). Comparison of military and civilian equivalent grades.

- The White House. (2013). What you need to know about the sequester. Retrieved from http://www.whitehouse.gov/issues/sequester