Case Reports: 2017 Vol: 23 Issue: 1

Case Study : Cj Freshway

Ewha School of Business, Ewha Womans University

Yewon Lee

English Language and Literature, Ewha Womans University

Seungho Choi

Ewha School of Business, Ewha Womans University

Company Overview

CJ Group Overview

CJ Group, a parent company of CJ Freshway, is an influential conglomerate in Korea. The vision of CJ Group is as following: “Create a new culture, for healthy, happy and convenient lifestyles”. It has 14 affiliates with wide coverage from food, media, entertainment sectors, and culture.

CJ, which stands for Cheil-Jedang, was originally a sugar manufacturing company founded by Byungchul Lee as a division of Samsung Trading in 1953. Cheil-Jedang was quite successful by exporting sugar to Okinawa, Japan and successfully launched sugar brand, ‘Baeksul’, which became one of the biggest food brands in Korea. In addition, Cheil-Jedang released beef flavored spices (used in making broth) called Dashida. With its’ success, Cheil- Jedang became a prominent food company in Korea.

There was a turning-point for CJ, when its founder Byungchul Lee passed away in 1993. Cheil-Jedang became independent from Samsung Group. Cheil Jedang entered a restaurant industry, and opened a family restaurant named ‘Skylark’. It also started an entertainment business by establishing Dreamworks SKG. Changing the company’s name to CJ, they focused mainly on four businesses: Food & Food service, Bio & Pharma, Entertainment & Media, and Retail & Logistics. CJ group is the 14th largest company in Korea in terms of total asse

CJ Freshway Overview

Service and Products Overview

CJ Freshway is a food and beverage distributor supplying over 20,000 domestic and international food items. CJ Freshway supplies fishery and livestock products, processed foods, and kitchen appliances to food dealers, food service providers, franchises, and general restaurants. It also provides a contract meal service for hundreds of restaurants. Moreover, it supplies global brand products with competitive price to its clients.

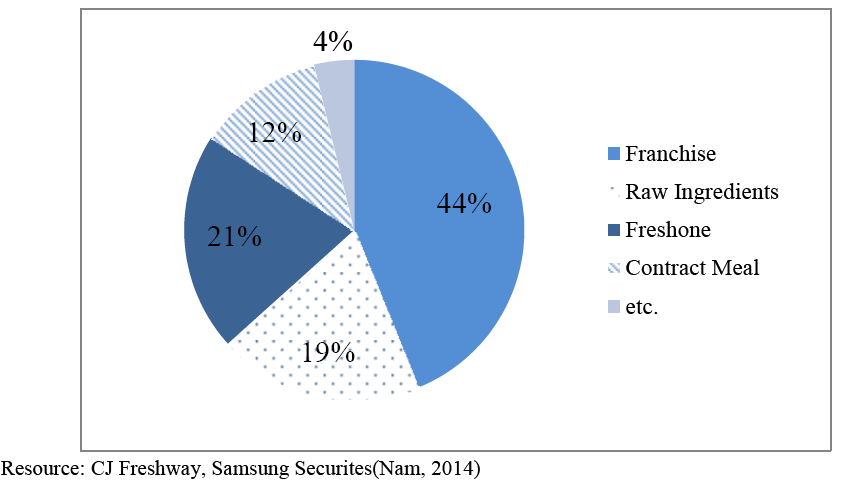

CJ Freshway started its food distribution business in 1999 in Korea and has been leading the domestic market ever since. The Korean food distribution industry, currently worth about 27.3 billion USD (33 trillion won) a year, is expected to further grow in the future. (Oh, 2015)

As the leader in the domestic food distribution industry, CJ Freshway develops wide distribution channels, production development capabilities, and competitive purchasing capability, systematic quality and sanitation management systems (Song, 2015).

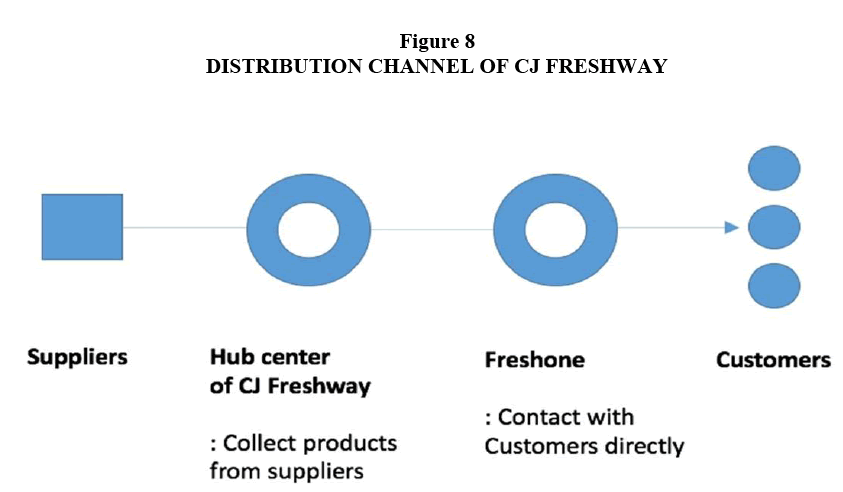

Distribution Channel

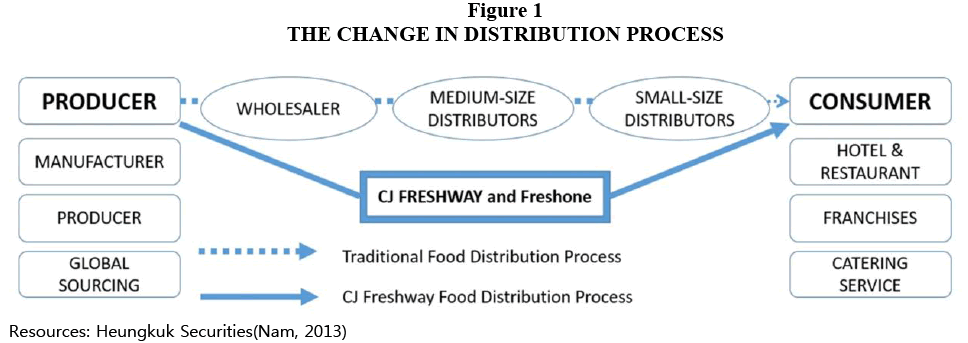

CJ Freshway made a change to deliver the products from producers to customers. In Korea, producers had to go through multiple intermediary distribution channels to sell their products to customers. In this process, shipping cost of the product and profit margin of intermediary distributor were added on the products. Producers can reduce the burden of contacting many distributors and product price decreases as CJ Freshway directly deliver the products of producers to customers (see Figure 1) (Nam, 2013). To achieve this goal, CJ Freshway forms a joint venture with the wholesalers and consumers, called Freshone. In the traditional food distribution process, there were many stages and it caused high price and low quality. However, CJ Freshway integrated the stages and thus shortened the pathway from producer to consumer. Freshone is a center where they cooperate with local small-medium sized distributors in order to shorten the distribution steps and minimize the costs of food distribution (Nam, 2013).

Industry Analysis

Industry Overview

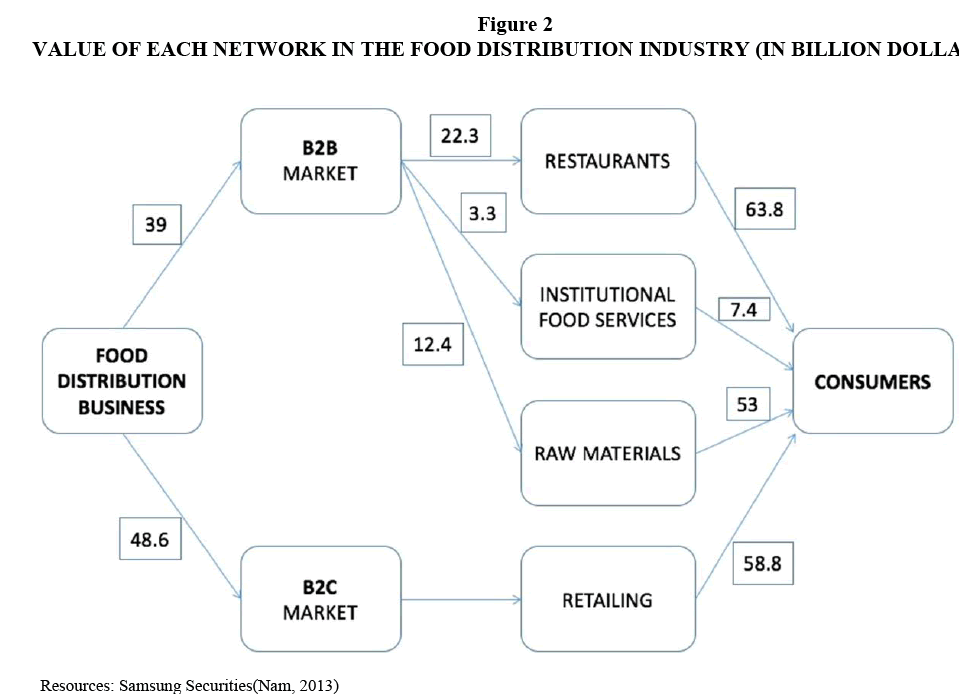

The food distribution industry consists of B2B and B2C markets. The B2B market, worth 39 billion USD (47 trillion won), occupies 45% of the total industry, with the remainder occupied by the B2C market (Nam, 2013) as illustrated in Figure 2.

In these two markets, there are four main networks. For B2C market, the retailer network focuses on distributing products to large retailing stores like Homeplus, E-mart, and Lotte Mart. For B2B market, there are three types of networks. First, the institutional food service sector provides food ingredients to school and company cafeterias. Second, there is the restaurant network that provides food ingredients to franchises or small-medium sized restaurants. Lastly, the raw material network provides food resources to food manufacturing factories, wholesalers, and retailers (Nam, 2013).

CJ Freshway focuses on the B2B market. CJ Freshway focuses on contracts with the big franchises and restaurants section. Consumers tend to expect the same taste of food wherever franchise restaurants they visit. Thus, CJ Freshway enables local restaurants to provide franchise restaurants with consistent food ingredients. Freshone is a joint venture formed with local small- medium sized distributors, who had their own distribution channels with local consumers. Small sized distributors are those directly linked to the local restaurant owners. Medium sized distributors are connected to the small sized distributors.

CJ Freshway does not plan to enter the B2C market in the near future as the market is already very saturated with other firms. In the B2B market, CJ Freshway is the largest domestic player. Its main competitors are as following: Hyundai Ourhome, Daesang Bestco, and Shinsegye Food (Oh, 2015).

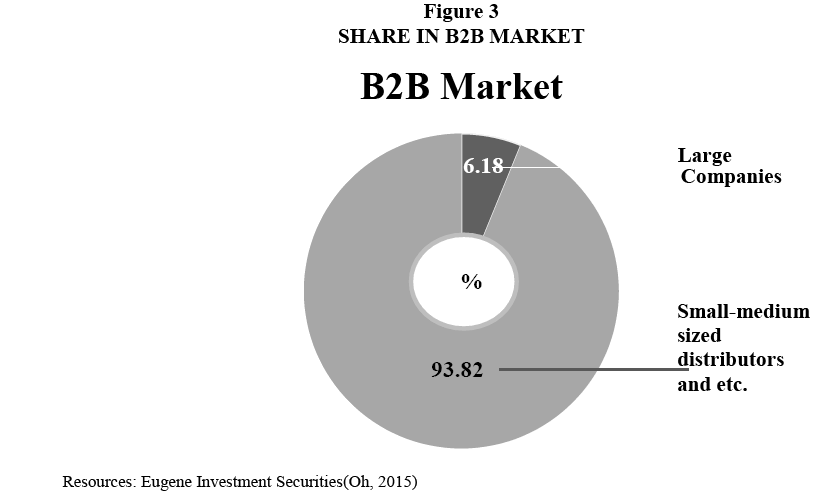

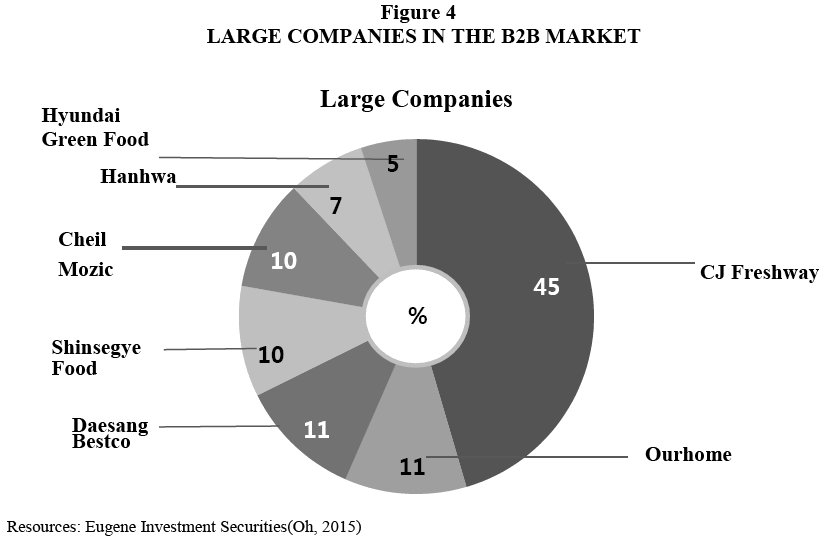

As Figure 3 shows, large companies such as CJ Freshway and Shinsegae Food only occupy about 6% of B2B market share because local restaurants prefer to procure ingredients from small companies (Oh, 2015), and cash transactions in order to avoid paying tax (Koo, 2015).

Although CJ Freshway is the market leader, it only has around 2.5% market shares. Figure 4 depicts the market share in the B2B food distribution market among large companies.

CJ Freshway takes about 45% and other 6 large companies including Ourhome, Daesang Bestco, and Shinsegye Food take the rest.

In the food distribution market, three factors, rivalry, bargaining power of supplier, and bargaining power of buyer are important. Since bargaining power of buyer is very high and industry competition is fierce, they have to fulfill the customers’ needs with competitive price. However, it is hard to cut price when purchasing food ingredients, because the price of food ingredient is decided by auction considering the quality of the product, the supply of that day, and estimated crop of that year.

Achieving economies of scale is crucial in the food distribution industry. According to the interview with internal executive, the average profit rate in food distribution market is 2 to 3%. Since the price of food ingredients is open to the public and it is hard to differentiate the products and services, it is difficult to raise profit rate.

There are two ways to reduce cost; one is increase purchase quantity and the other is contract cultivation. By increasing purchase quantity, CJ Freshway would be able to gain the advantage of economies of scale. The company will get more bargaining power toward suppliers and decrease cost. Contract cultivation means that a company makes a contract about the price and quantity with producers in advance, and then purchases the exact amount of products at the price in the contract. CJ Freshway implements contract cultivation but they cannot make contracts for every product. To manage contract cultivation, merchandisers should be assigned to each product sector or farm. However, CJ Freshway is handling hundreds of products, so it would cost too much for managing each product. Instead, CJ Freshway conducts contract cultivation only when quality and price of products will greatly vary, such as strawberry and potatoes. Thus, in the case of most products, purchasing in large quantity to achieve economies of scale would be the optimal way to cut cost of purchasing.

Competitor analysis

In the food distribution industry, there are four main players, which are CJ Freshway, Ourhome and Daesang Bestco. As a way to create competitive advantage and to keep up with the competition within the industry as it gets fiercer, these four players have entered the industry by adopting different business models and approaches. Among three other players within the industry, Daesang Bestco and Ourhome are considered to be the two direct competitors of CJ Freshway.

Daesang Bestco

Daesang Bestco is regarded as one of the strongest players in the food distribution industry. Its business model is solely focused on providing food distribution service. While other competitors, including Ourhome and Hyundai Green Food both provide services such as restaurants business, school food service, and banquets business, Daesang Bestco positioned mainly provides food materials distribution service. As Daesang Bestco is well-specialized in food material distribution service, it has competitive advantage in outbound logistics, where the food materials are shopped and delivered from its large offline warehouse. As such, its strength and uniqueness come from its operating model that provides two main forms of direct service with its warehouse utilization. The first one is Cash & Carry, which is a form of trade that goods are sold from a wholesale warehouse operated on a self-service basis. The second form is Cash & Delivery, which the company actually delivers the ordered products to the customers outbounded from the warehouse store. To increase its size, Daesang Bestco has acquired 20 small-medium sized distributors through M&A. However, it does not seem to have any positive consequence just yet as it has been suffering loss for five consecutive years since 2011.

Ourhome

Ourhome is the strong player especially in the school food service. However, since it is acting as a fast follower in other business service, it is considered as another direct competitor of CJ Freshway. It was formerly part of LG Food Distribution, but it became independent in the year 2000. Ourhome pursues diversification strategy to enter other services such as food materials processing and food materials manufacturing by introducing several private brands and new types of processed food.

Strengths of Cj Freshway

First-mover advantage as a market leader

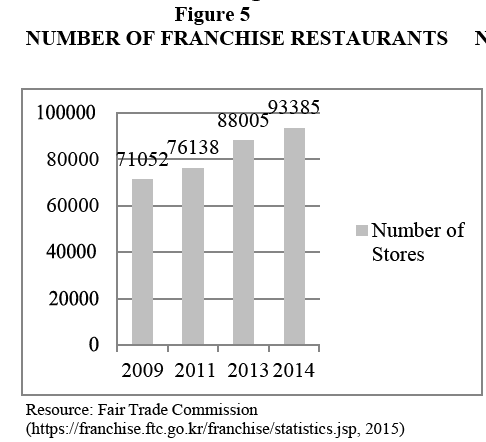

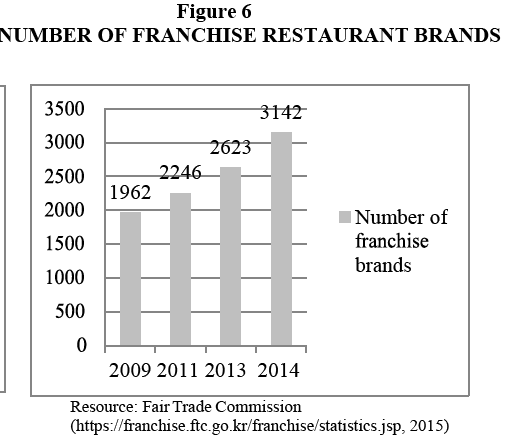

CJ Freshway was the first large company that entered food distribution business in Korea. CJ Freshway attracted many franchise brands as the first mover of the market. As the Figure 6 and Figure 7 show, the number of franchise restaurant brands and franchise stores are increasing over time. Many franchise restaurant brands wanted a stable and punctual supply of high quality food ingredients. Especially for franchise restaurant brands, all branches have to maintain standardized products and service to customers. The leading franchise brands such as, Seoga & Cook, Warawara, and Chilsung-Pocha are the customers of CJ Freshway.

CJ Freshway covers a wide range of the food distribution business and it helps the company to diversify risks and get more chance to grow. The biggest part of revenue comes from distributing food materials for restaurants. CJ Freshway also distributes raw materials to food processing companies, and provides contract meal service. In contrast, its competitors focus only on specific customers or market.

Vertical integration with other CJ firms

As a part of CJ Group, CJ Freshway can enjoy synergy from other CJ businesses such as CJ CheilJedang, CJ Foodvile and CJ Korea Express. First, CJ Freshway can supply food ingredients to CJ CheilJedang and CJ Foodville. CJ CheilJedang is a food company, which has various products, such as sugar, cooked rice, and ham. In addition, CJ Freshway supplies food materials to CJ Foodville, which has 14 restaurant brands and over 2000 stores. According to the interview with an executive of CJ Freshway, the revenue from CJ Group takes up about 20% of CJ Freshway’s revenue.

In addition, CJ Group helps CJ Freshway to develop PB (Private Brand) products. PB product is manufactured by retailers, and it is distributed exclusively via retailer who manufactured it. PB product is the key source of competitiveness of food distribution company. When developing new PB products, it is very important to understand food culture and needs of customers. In this perspective, CJ Cheil-Jedang is perfect partner for CJ Freshway. CJ Cheil Jedang has a capability in developing food products.

PB is one of the critical sources providing the company with competitive advantage. As food distribution businesses is undergoing a long-term recession in the moment, they have turned to develop PB products as a solution. These products are cheaper as it can reduce the cost in distribution process CJ Freshway can attract more customers and increase profit by utilizing its PB products, such as, It’s Well, and Freshway. PB products are expected to have prospective growth in the near future.(Lee, 2012)

Also inbound logistics and logistics between Freshway hub centers and Freshone centers are operated by CJ Korea Express. So CJ Freshway can manage their stocks efficiently with the help of CJ Korea Express, applying up-to-date SCM technology.

Reputation

The reputation of CJ in Korea attracts restaurant owners and franchise restaurant brands as customers due to its history and high quality products. Restaurant owners mainly consider two factors when choosing food material suppliers; price and reliability. In addition, franchise brands aim to expand by drawing more franchisees, and thus these brands collaborate with prominent partners like CJ Freshway. In Korea, people tend to open franchise restaurants after retirement, without any experience and knowledge in food and beverage business. Therefore, in the process of deciding on which franchise restaurant to make contract with, the reputation of CJ may give these potential franchisees a sense of reliability.

Freshone

In the food distribution industry, most competitors, such as Daesang Bestco expanded their businesses through M&A (Mergers and Acquisition) to gain direct control over operations and sales. In contrast, CJ Freshway formed a joint venture with small-medium sized local distributors by obtaining 51% or more of the total shares (See Table 1). This joint venture is called Freshone. The distributors of Freshone receive monthly payments, dividends, and incentives from CJ Freshway. In Freshone, actual sales and delivery of ingredients happen, whereas CJ Freshway provides distribution centers, hygiene system in delivery, and taxation services.

| Table 1 Share Ratio of Cj Freshway on Freshone in 2015 |

||||

| Types | Location | Settled date | Shares | Book value(USD) |

| CJ Freshway Qingdao corporation | China | Dec | 100.00 | 4,104,581.96 |

| Shanghai Blue Wish Catering Service CO,. LTD | China | Dec | 96.87 | 2,752,708.60 |

| CJ Food Service(Shanghai) CO,. LTD | China | Dec | 100.00 | - |

| CJ Freshway (Shenyang) CO,. LTD | China | Dec | 100.00 | 825,285.32 |

| CJ Freshway Vietnam CO.. LTD | Vietnam | Dec | 100.00 | 284,707.08 |

| CJ Freshway America Corporatioon | US | Dec | 100.00 | 422,039.06 |

| Freshone Incheon | Republic of Korea | Dec | 51.00 | 1,314,988.59 |

| Freshone Gwangju | Republic of Korea | Dec | 53.68 | 3,374,388.37 |

| Freshone Jungbu | Republic of Korea | Dec | 61.48 | - |

| Freshone Namseoul | Republic of Korea | Dec | 87.67 | 11,877,283.79 |

| Freshone Gangnam | Republic of Korea | Dec | 51.82 | 7,802,939.39 |

| Freshone Dongseoul | Republic of Korea | Dec | 63.28 | 5,327,331.98 |

| Freshone Daegu | Republic of Korea | Dec | 51.00 | 1,120,109.90 |

| TOTAL | 38,360,984.02 | |||

| Resources: CJ Freshway | ||||

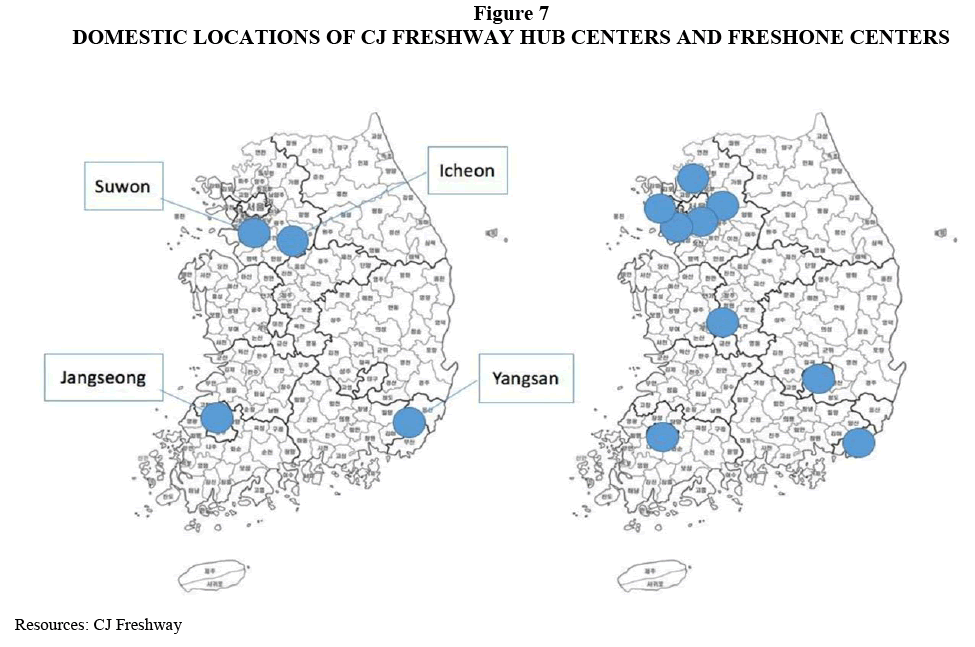

There are four CJ Freshway centers in Icheon, Suwon, Jangseong, Yangsan and nine Freshone centers including Seoul, Jungbu, Namseoul, Gangnam, Daejeon, Gwangju, Incheon, Daegu and Busan (see Figure 7). CJ Freshway centers collect food ingredients from producers and then distribute them to each Freshone center(see Figure 7).

What differentiates CJ Freshway from other food distribution firms is that CJ Freshway expands their business using Freshone centers. While CJ Freshway focuses more on big business partners such as food franchises, Freshone focuses on small- medium sized food distributors. CJ Freshway is aiming to grow rapidly using Freshone. On avera ge, the business owners that joined Freshone were gaining about 70% of their food ingredients fr om CJ Freshway, whereas the business owners that have not joined Freshone buy 10% of their fo od ingredients from CJ Freshway. Thus, CJ Freshway can increase its net sales by attracting mor e small-medium sized distributors to join Freshone.

CJ Freshway sends three employees to each Freshone center to enhance the communication between CJ Freshway headquarter and the local Freshone centers. These three employees belong to the HR department of CJ Freshway. They gather up information from each Freshone center once a month. In the headquarter, then, they hold a meeting and share information.

Benefits of Freshone

CJ Freshway can leverage the local distributors’ know-how and networks by cooperating with the local distributors in Freshone. CJ Freshway makes new customers (e.g. local restaurant owners) by collaborating with the local small-medium sized distributors.

Daesang Bestco pursued M&A to acquire small-medium sized local food distributions and they were harshly criticized in public. There is a great concern in Korea that chaebol destroys the small local businesses. For instance, law forbids the operation of large retailers in certain weekend. Joint venture is more focusing on utilizing and enhancing the current networks of small-medium sized distributors rather than attracting them through acquisitions. Joint venture enables co-evolution between big firms of small-medium sized firms.

The increase in the number of small-medium sized distributors joining Freshone leads the increase of revenue and market share of Freshone. For example, in 2012, the number of small-medium sized distributors in Freshone Nam-Seoul increased from 180 to 230. In the same period, the profit of Freshone Nam-Seoul rose from $780,000 to $1,198,000(CJ, 2012). As more small-medium sized distributors join Freshone, CJ Freshway would be able to achieve economies of scales accordingly in purchasing the food ingredients. As the quantity of food resources increases, CJ Freshway would be able to bargain and negotiate to lower the purchasing prices and this will further result in increasing the profit as a whole (Jang, 2012).

Local distributors can attract more local restaurant owners as customers and hygiene system of CJ Freshway. By working with CJ Freshway, their status and reputation is increased and they gain fixed amount of income securely. In addition, by joining Freshone, they can now get extra incentive from the company based on their ability.

The process of food distribution will be more standardized and shortened when collaborating with CJ Freshway. This makes the local distributors use more advanced equipment and devices provided by CJ Freshway.

Challenges of Freshone

Freshone underwent conflicts with small-medium sized local distributors. The conflict deteriorated the trust relationship between the company and distributors. Also, it gave negative impact on local distributors who consider joining Freshone. In 2011, Freshone Busan tried to draw small-medium sized food distributors, but at the same time, Freshone also attempted to open C&C(Cash and Carry) center (Byun, 2013). C&C is a market type distribution center to sell food ingredients directly to restaurant owners which excludes small medium-sized distributors in the process of food transaction. It caused frustration to local distributors about being excluded from the business by Freshone, while CJ Freshway will take away their know-how and customer network from local distributors.

Local association of small-medium sized distributors in Busan opposed to Freshone, arguing that Freshone threatened their business. The association tried to prevent Freshone drawing small- medium sized distributors, arguing that individual small food distributors would not be able to survive in the market. The association also asked the government to resolve this conflict with CJ Freshway. Finally, in 2014, it came to a settlement that CJ Freshway would try to coexist with small local distributors. Also operating C&C was prevented by the government to protect small- medium sized distributors. Freshone lost trust of local distributors and it made Freshone difficult to attract small-medium sized distributors.

Second, CJ Freshway is aiming to enlarge their shares in Freshone more than 51%. However, this might blur the idea of co-evolution between CJ Freshway and small-medium sized distributors as a form of joint venture. Small-medium distributors who are considering joining Freshone might think that CJ Freshway is not pursuing co-evolution. Also, small-medium sized distributors might assume that they will be eliminated when CJ Freshway acquires Freshone. This leads CJ Freshway to another question, whether they should keep on enlarging their shares in Freshone.

Third, Freshone is going through the difficulty in attracting more local distributors to join Freshone. According to the interview with an executive of CJ Freshway, it is not easy to draw them to Freshone. It is assumed that the benefits the local distributors gain when they join Freshone are not sufficient. When distributors join Freshone, the owners of each business become less in charge compared to being the sole owner of the business. After joining in Freshone, they have to follow the decision of CJ Freshway in the distribution process and share profit with the company. Thus, to increase local distributors joining Freshone, the benefits of joining Freshone must be superior to the losses.

Conclusion

Due to the features of food distribution industry, where margin hardly gets high, the only way to thrive in the fierce environment is to realize economies of scale. As a means to gain economies of scale, it can be said that a firm is given three options: joint venture, M&A, and contacting the local distributors on their own. For CJ Freshway, it is distinguished with other firms as they formed a joint venture with small-medium sized distributors. Small-medium sized distributors can gain the standardized process and revenue increase by participating in Freshone. CJ Freshway can utilize the networks of local distributors. However, Freshone centers are currently still struggling to gain the wholesalers and small-medium sized distributors, although the features of Freshone were expected to be very attractive. Although CJ still stands as the leader in the B2B section of the industry, their market share sums up to only about 2-3 percent. As this percentage refers profits, the actual distributors who have not joined Freshone sum up to more than 97% of the whole market.(Oh, 2015)

Furthermore, CJ Freshway is aiming to enlarge their shares in Freshone starting from 51% at the beginning of contract (See share ratio in Figure 6). However, this might blur the idea of co- evolution between CJ Freshway and small-medium sized distributors as a form of joint venture, Freshone. This leads CJ Freshway to another question, whether they should keep on enlarging their shares in Freshone or maintain their shares as currently done.

Acknowledgement

Seungho Choi is a corresponding author (Tel: +82-2-3277-4138, choise@ewha.ac.kr).

References

- Byun, Hyun Chul, & Park, Jin Kuk (2013). 중소도매상 - CJ 프레시원 갈등 격화. (2013 January 16). Busan Daily. Retrieved from December 29, 2015, from http://m.busan.com/m/News/view.jsp?newsId=20130116000103

- CJ Freshway Financial Statements Annual Report.

- CJ Freshway, Retrieved from http://www.cjfreshway.com/about/food_index.asp

- Lee, Dong-Hyun & Song, Jaeyoul (2012). A Case Study on the Foodservice Distribution Based on Business Model Analysis. Yonsei Business Review, Vol 49(1), 21-53.

- Kim, Hyun Ki & Kim, Pan Jin & Lee, Sang Youn. (2014). A Study on the Globalization Strategies and Business Performance of A Food Service Firm : Focused on the Strategies of Dongwon Homefood. Korea Distribution Science Association, Vol 2014 No.4, 87-93.

- Kim, Jung Wook. (2014). 식자재 유통 산업의 winner 는?. (2014, December 8). BS Investment Securities. Retrieved December 29, 2015, from http://www.bnkfn.co.kr/uploads/13532/1/calibre36_11.pdf

- Lee, Jung Hwan. (2014). 식자재 유통시장 2 만 업체 난립…‘한국의 시스코’ 절실.(2014, December 22). Heralds Economy, Retrieved December 29, 2015, from http://realfoods.co.kr/realfoods/view.php?ud=20141222000181&sec=01-75-04

- Lee, Kye Won.(2015). 식자재유통 1 위 CJ 프레시웨이, 영업이익률 1% 고민. (2015, January 21). Business Post, Retrieved December 29, 2015, fromhttp://www.businesspost.co.kr/news/articleView.html?idxno=8778

- Lee, Se Jung. (2015). 유통업계 경제 불황 속 "PB 상품, 이거 돈 되는데~". (2015 December 16) Global Economics, Retrieved from January 5, 2016, from http://www.g-enews.com/ko- kr/news/article/news_all/201512151719555434117_1/article.html

- Lee, Seung Hyun. (2013). 냉동탑차에 대박 기운 싣고 달려요. (2012 June 1). E-daily. Retrieved from December 29, 2015,from http://www.edaily.co.kr/news/NewsRead.edy?newsid=01446486599557456&SCD=&DCD=A00204

- Nam, Ok Jin. (2013). 식자재 유통 – 마지막 남은 미개척지. (2013, September 30). Samsung Securities, Retrieved December 29, 2015, from https://www.samsungpop.com/index.jsp

- Nam, Sung Hyun. (2013). 식자재 유통산업 Industry Research. (2013 March 11). Heungkuk Securities. Retrieved December 29, 2015, from https://www.google.co.kr/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=0ahUKEwj45YaGsIDK AhWhL6YKHQV4C_wQFggaMAA&url=http%3A%2F%2Fhappystock.tistory.com%2Fattachment%2Fc file26.uf%40013B9545513D1B793EA444.pdf&usg=AFQjCNGNDoTEI2sqh5zI9AhIbpywp4GvHA&sig 2=bJ9LLXKbCKkdeNR9hkTIrw&bvm=bv.110151844,d.dGY&cad=rjt

- News FS Editing Team. (2012). CJ 프레시웨이 최고 안전 식자재 유통기업. (2012 June 14). News FS. Retrieved from December 29, 2015, from http://www.newsfs.com/news/articleView.html?idxno=2949

- Oh, So Min. (2015) CJ Freshway Analysis. (2015 March 13). Eugene Investment Securities. Retrieved from December 29, 2015, from http://file.mk.co.kr/imss/write/20150317134500_mksvc01_00.pdf

- Oh, So Min. (2015). CJ 프레시웨이, 프레시원은 상생할 수 밖에 없는 구조. (2015 April 13). Daily Hankook. Retrieved from January 5,2016, from http://daily.hankooki.com/lpage/economy/201504/dh20150413133659138110.htm

- Park, Mi Ri. (2015). CJ 그룹 계열사, 작년 5 개 줄어 68 개사-게임 부문 독립 영향. (2015 Febryary 4). CEO Score Daily. Retrieved from December 29, 2015, from http://www.ceoscoredaily.com/news/article.html?no=10930

- Song, Chi Ho. (2015). 송셰프의 외식이야기 : CJ 프레시웨이 이해하기. (2015, February 3). E-trade Securities. Retrived December 29, 2015, from http://file.mk.co.kr/imss/write/20150203092303_mksvc01_00.pdf

- Yun, Jin Sub. (2014). CJ 프레시웨이-프레시원, 물류시스템 통합 본격화?. (2014 February 27). SBS CNBC. Retrieved from December 29, 2015, from http://sbscnbc.sbs.co.kr/read.jsp?pmArticleId=10000635557

Appendix

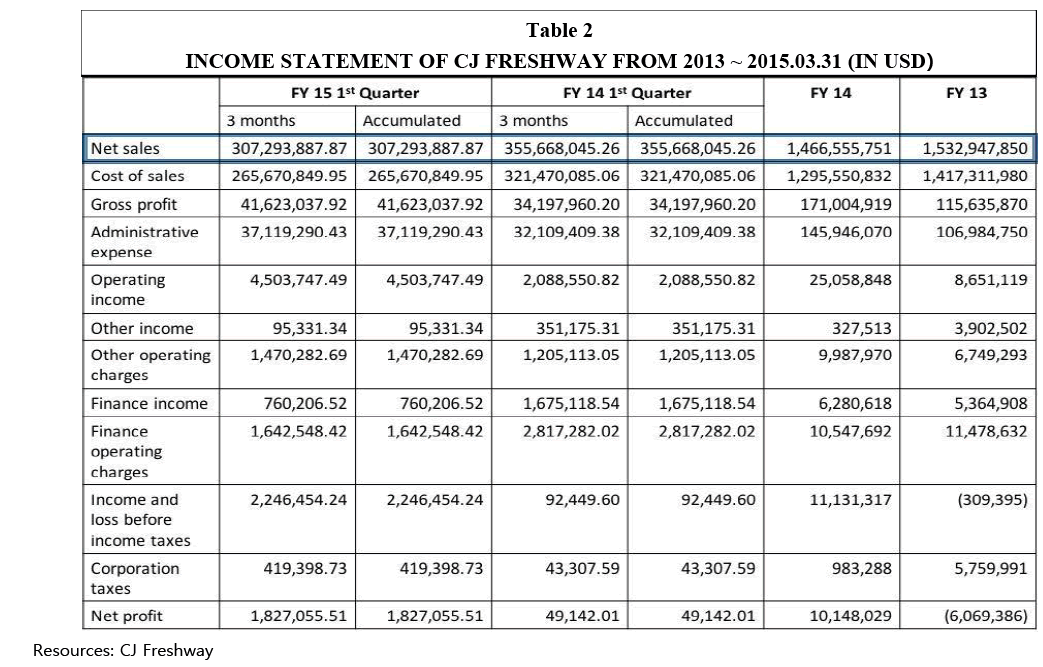

Appendix 1. B2b food ingredient market development and forecast Resources: Yearbook

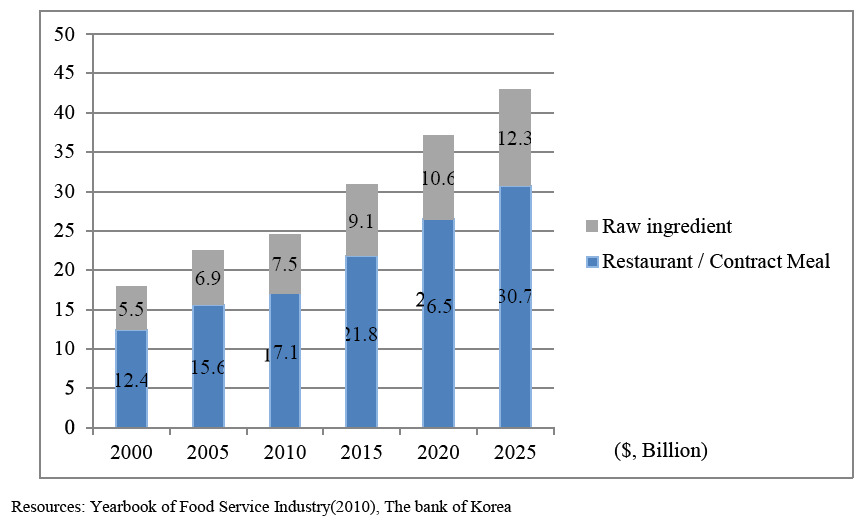

Appendix 2. Sales portion of each business units in cj freshway in 2014

Appendix 3. Benchmarking Model: Sysco

Sysco is a food distribution company that takes up the largest market share with 18% in the US. Many companies in Korea are benchmarking Sysco, since Sysco made success through integrating many small-medium sized distributors with M&A. As there are many small-medium sized distributors in Korean food distribution industry, many companies try to refer to Sysco’s case. Other than their successful M&A, there are also other factors that made them superior than their competitors.

First, by expanding their distribution centers aggressively, Sysco could cut cost by shortening delivery route and attracting new customers. This led to curtailing the total cost of logistics and improvement of quality and stock management. Therefore, this system became one of the main drives of rapid growth.

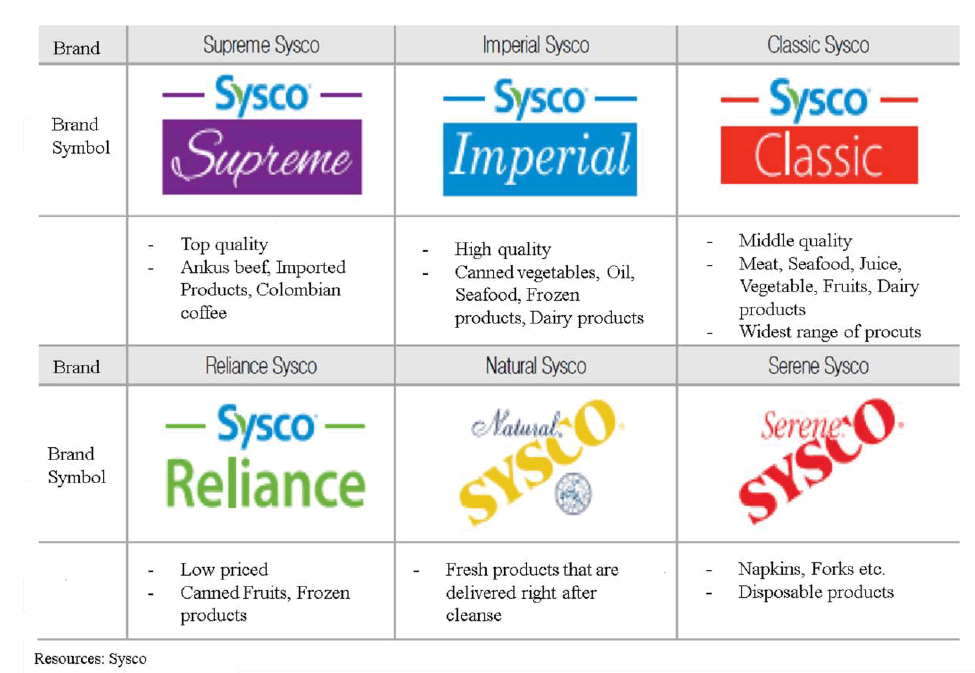

Second, Sysco satisfies various segments of customers with PB (private brand) products appropriate for each segment. As the figure shows, there are four brands of products that are segmented with different quality and price. With segmented products, Sysco could target customers with different needs more efficiently. (Oh, 2015)

Sysco's Private Brands

Appendix 4. CJ Freshway introduction video