Case Reports: 2024 Vol: 30 Issue: 1

Case study Pakistan Aluminium Beverage Cans Ltd: End Of Rivals Monopoly Through Strategic Management

Farhan Hussain Mirza, Superior University, Lahore

Muhammad Rafiq, Superior University, Lahore

Citation Information: Mirza, F.H. & Rafiq. M (2024). Case study Pakistan aluminium beverage cans ltd: End of rivals monopoly through strategic management. Journal of the International Academy for Case Studies, 30(1), 1-6.

Summary

Pakistan Aluminium Beverage Cans Limited (PABCL)1, encountered initial growth challenges, including production-related issues resulting in decreased sales, and market competition from established finished can exporters further impacting the company's profitability. To address these challenges, the company underwent a significant restructuring of its leadership team. The CEO, Mr. Mustansar Ali Khan, was initially succeeded by Mr. Erik Hoggardh, who, in turn, was later replaced by Mr. Azam Sakrani. Holding multiple top management positions across various Liberty Group companies. This change in leadership not only resolved the production issues but also enhanced the operational efficiency of the plant, reducing overall overhead and administrative expenses. The strategic management shifts successfully disrupted the monopoly of competitors, paving the way for sustained growth and improved financial performance for PABCL.

Introduction and Corporate Background

Established in December 2014, Pakistan Aluminium Beverage Cans Limited (PABCL) stands as a testament to the strategic vision of M/s Ashmore Investment Group UK. In 2013, M/s Ashmore embarked on a comprehensive global research initiative to identify lucrative investment opportunities in the aluminum-based beverage can sector. The meticulous findings of this research positioned Pakistan among the top three most attractive markets for such a venture. The market assessment indicated a robust demand, with beverage cans witnessing a consistent annual growth rate exceeding 15% since 2010 in both Pakistan and Afghanistan. The compelling market dynamics prompted the establishment of a state-of-the-art manufacturing facility, aligning with the escalating demand from beverage manufacturers and bottlers.

As part of its global expansion strategy, M/s Ashmore initiated projects worldwide, including several can be manufacturing plants. The Aluminium Beverage Cans Manufacturing Plant in Pakistan, operational since May 22, 2017, boasts a production capacity of 700 million cans annually, expandable to an impressive 1,200 million cans per year. Representing the inaugural investment of M/s Ashmore in Pakistan, the project required a substantial investment of approximately $78 million. The ownership structure comprises 51% shares held by M/s Ashmore Group UK (via Ashmore Mauritius PABC Limited) and 49% shares by M/s Liberty Group Pakistan (through sponsors’ shares). The plant, situated in the M-3 Industrial City within the FIEDMC Special Economic Zone in Faisalabad, achieved its Certificate of Occupancy (COD) seamlessly, meeting all deadlines and adhering to the budgeted costs.

In the fiscal year 2021, M/s Ashmore Mauritius PABC Limited strategically decided to divest a significant portion of its shares in PABCL. This divestment comprised the transfer of 90,274,625 shares to Mrs. Hamida Salim Mukaty & M/s. Soorty Enterprises through a private placement, and a further 93,888,000 shares offered for sale to the public on the Pakistan Stock Exchange. Following the successful listing on the exchange and subsequent alterations in the shareholding structure, Liberty Group's2 ownership stake increased from 49% to 54%. The remaining 20% is now held by M/s. Soorty Enterprises Pvt Limited, while 26.0% is distributed among public investors, reflecting the evolution of PABCL's corporate landscape.

Primary Challenges and Implemented Strategies by CEO and his Team for Mitigation

PABCL started its first commercial production in end quarter 2017, and based on successful production run, PABC’s commercial team started procuring orders for the year 2018. As per the beverage industry trend, sales ramp up March onwards and then peak from May till September, since it was the first year of commercial operations, PABC started facing production related issues during the start of second quarter.

From April 2018 onwards, the company started having dent in its produced cans. The dent increased in size as rate of production increased. Dents were observed in range of 8% to 15% of total produced cans at 60% of machine rated speed (and above). The PABCL was therefore forced to run its plant at lower capacity at which the dent size was at acceptable level. The CEO Mr. Azam and his professional team were found out that the problem lied with the functioning of decorator/printing machine because at this step dent was being created on the cans. The management had to obtain services from engineers of both Roeslein (EPC contractor)3 and Original Equipment Manufacturers (OEM) of the decorator machine to get the issue resolved. The said issue was eventually resolved by August 2018 by replacing few parts of the said machine and the company was able to avail maximum production without any product defect however, by that time, peak demand season had already passed.

Though PABC was successful in connecting with the PABCLs and generating demand for the product, but due to production related issues, PABC wasn’t successful in utilizing the available production capacity, hence the company lost the opportunity to fulfill demand of PABCLs. It was able to sell 199 Mln cans in CY18 as against target of 300 Mln cans. Lower sales adversely impacted profitability of the company during CY18. The company was able to cover its variable cost and earn some margin on it as well however, it could not fully cover its fixed cost component resulting in gross loss of PKR 219 Mln and posted net loss of PKR 799 Mln.

In addition to lower sales/production related issues, market competition from existing finished Cans exporter also played role in hampering profitability of the company. Main existing player (exporter) in the industry is Crown group which has been supplying finished cans in Pakistan for years. Similarly, Ceylon Beverages from Sri Lanka, has been dumping its product (finished cans) in Pakistan. As per CEO upon supply of PABCL product in market, Crown Group owing to its strong financial backing started decreasing price of its product beyond its cost (selling cans at price of as low as 73$ /1000 cans) to deter PABCL from capturing local market share (previously with Crown). Similarly owing to dumping of cans by Ceylon beverages (owing to FTA concessions provided to Siri Lanka by Pakistan) overall market prices remained quite low and PABCL also had to sell its product at lower than expected price. Thus opportunity to subside impact of lower volumetric sales by keeping product prices higher (being sole local player in the industry) could also not be materialized.

The company has gone through a major rationalization in leadership team, the CEO of the company Mr. Mustansar Ali Khan was initially replaced by Mr Erik Hoggardh who was himself later replaced by Mr. Azam Sakrani. The newly appointed CEO and his highly skilled team not only arrested the production issue faced by the company, but has also been effective in improving operational efficiency of the plant and bringing down overall overhead/administrative expenses of the company.

As mentioned earlier, owing to production issues during the peak season, PABCL lost opportunity of higher production/sales however being cognizant of the entire situation, sponsors of PABCL took various timely decisions including change in both technical and senior management of the company to get it back on track. Similarly, both previous sponsors of the company i.e., Ashmore group and Liberty group had practically shown their faith and confidence in the project by injecting PKR 668 Mln fresh equity in the company in March 2019 in the then ownership proportion (i.e., 51:49). They initially planned on injecting further equity of PKR 200 Mln however owing to significant improvement in financial position/performance of CY19, further equity injection was not needed. This also reflected capability and willingness of both the sponsors to support PABCL in time of need.

During CY19, with great effort of PABCL professional management anti-dumping duties were provisionally imposed on both Crown and Ceylon which increased their price. Strategy of Crown was unsustainable as it could not go on selling cans at prices lower than its cost for indefinite period of time. Imposition of anti-dumping duties further increased Crown’s cost. Additionally, the PABCL has been able to get the base price (assessed value) of imported finished cans (on which duties are imposed) increased by 10% (details ahead) which further increased cost of imported finished cans. Thus, price cutting owing to competition from foreign finished can exporters tapered off in CY19 creating room for PABCL to increase sales. In order to benefit local industry, through effective lobbying, PABCL was able to persuade the government to increase custom duty on import of Aluminium Cans from 11% to 20% in May 2017 (in line with achieving COD). The same shows, that the government is also supporting local manufacturing of Cans.

Following steps were taken to further reduce cost of manufacturing Aluminium Cans and increase cost of imported finished aluminum cans:

a) Primary raw material for Aluminium Can manufacturing is Aluminium Coil (Aluminium tin sheet with 0.25 mm thickness). Previously, there was 11% duty on Aluminium Coil sheet, however through PABCL’s efforts, the said were reduced to 8% in Sep 18 and then reduced further to 5% in 2019-20 budget. The same has reduced cost of production and in turn cost at which the PABCL can provide the end product to final consumers. It should be noted that historically PABCL primarily procured Coils from Novelis South Korea, however, it also imported some coil from Nanshan China (largest supplier in the world of Coil). This is because Under FTA (free trade agreement) with China duty is limited to 5%. The said supplier was tested and in 2018 and the PABCL started importing Coil from Nanshan to reduce its cost further. However, the company was not satisfied with quality of supply from Nanshan China and has reverted back to Novelis South Korea for import of aluminum coil. Through budget 2020-21, import duty on coil was further reduced to nil which has further reduced cost of the company. With regards to ends, the PABCL paid Custom duty of 5% which has been decreased from 11% in 3QCYCY18. The same has also been reduced to 0% in 2019-20 budget owing to PABCL’s continuous follow up with the concerned government departments. It is pertinent to mention that the above custom duties (along with 2% Additional Duty, 5.5% Income tax and 17% sales tax) is levied only on imported coils/ends which are eventually used for manufacturing of cans sold in local market. Entire import (coil/ends) of PABCL for manufacturing of cans which are eventually exported is completely duty/tax free. Thus if the PABCL exports 50% of its production, it does not pay any duty/tax on 50% of its total imports.

Over the course of time, PABCL has been lobbying for imposition of Regulatory duty on import of Aluminium Cans. It was eventually successful in getting 5% Regulatory Duty imposed on direct import of finished Aluminium Cans in FY18 thereby increasing final cost of imported cans and making locally manufactured Aluminium Cans of PABCL more feasible. The company continued its efforts to increase regulatory duty on imported finished cans to 10%. In this regard, it has written letter to ministry of commerce relaying its concerns and requesting increase in regulatory duty for imported finished cans. The PABCL was confident that duty will be increased during CY20 and the same was increased in budget of 2020-21.

b) Through continuous effort and follow-up by CEO moreover PABCL top management, it has been successful in getting the custom value (base price) of imported finished Aluminum cans (on which various import duties are imposed) reassessed at higher level. Through notification dated 14th May 2019, Directorate General of Custom Valuation has increased the custom values (base price) of both 250 ml and 300 ml aluminum cans by 10%. As per estimates of PABCL, its net impact is increase in cost of imported finished cans by 2$ per 1000 cans. As a result of above changes, current duty structure on import of can parts for PABCL and importer of finished cans (Refer to Exhibit 1, Table 1 and Table 2)

c) Under Free Trade Agreement (FTA) with Sri Lanka, Ceylon Beverages of Sri Lanka dumps Aluminium Cans in Pakistan. Under Anti-dumping agreement, if the share of Ceylon Beverages increases beyond 3% (as per PABCL the said is already near 3% and they are effectively trying to prove that the said has exceeded 3%), Ceylon Beverages product will be subject to 17.14% duty under anti-dumping policy (details below) and the same will not be able to dump further Cans in Pakistan, thereby ensuring lower cost Aluminium Cans are not available to undermine PABCL product. Similarly, Crown Group has also been dumping its Aluminium cans to some extent from Jordan and UAE (these countries however do not have FTA agreement with Pakistan). After a lot of effort, the PABCL was finally able to get provisional anti-dumping duty imposed on import of Aluminium Beverage cans from Jordan, Sri Lanka and UAE on 3rd May 2019.

d) As per the notice of National Tariff Commission provisional duties were initially imposed for a period of 4 months. During the provisional period of 4 months, National tariff Commission (NTC) received and evaluated objections from exporters on which anti-dumping duties have been levied. The impact of imposition of above anti-dumping duties was significant as import of finished cans had already become very costly (owing to aforementioned other duties) and therefore the same saw dramatic decline in CY19. In March 20, final decision of NTC was announced which lifted the above imposed anti-dumping duties. The company filed objection to above decision of NTC in NTC tribunal which ultimately ordered in favor of the company with final imposition of anti-dumping duties till Feb 2025 (Refer to Exhibit 2, Table 3)

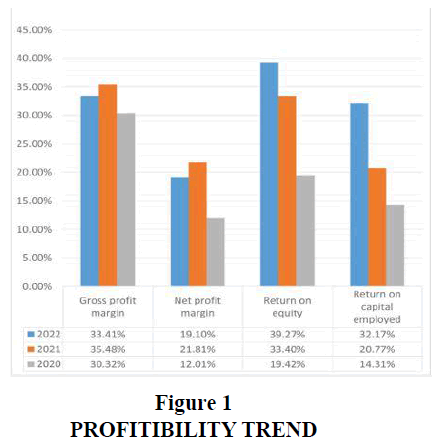

Meanwhile, owing to overall increase in imported cost of finished cans through imposition of various duties, exporters of finished cans have to cut their prices significantly below their costs to become locally competitive. Similarly, PABCL has established strong business ties with its main PABCLs i.e., Coke, Pepsi etc. which have not shifted their orders or asked for any price cut. Thus, even if the anti-dumping duties were not imposed, the PABCL was in comfortable position to retain its market share (Figure 1 and Figure 2).

Mr. Azam (CEO) and his professional team along PABCL sponsors timely decisions, have collectively resulted in turnaround of the company which has sold 728 Mln cans in CY22 despite country wide prevailing economic challenges against 521 Mln cans in CY21. Sales of the company have closed at PKR 14,153 Mln against PKR 7,230 Mln in CY21(Refer to Exhibit 3, Table 4)

Conclusion

Pakistan Aluminium Beverage Cans Limited's journey exemplifies a remarkable turnaround in the face of early production challenges and market competition. Led by CEO Mr. Azam Sakrani, the company's strategic responses, including resolving manufacturing issues, lobbying for regulatory changes, and fortifying PABCL relationships, have yielded substantial sales growth and profitability. The commitment of sponsors, evident through equity injections, coupled with a dynamic and adaptive leadership approach, underscores PABCL's resilience in navigating a complex industry landscape. The case of PABCL stands as a testament to effective management, strategic foresight, and the capacity to overcome adversities, positioning the company as a noteworthy success in the aluminum can manufacturing sector.

Exhibit 1

| Table 1 Applicable Duty Structure for PABCL | ||

| Applicable Duty Structure for PABCL | Coil | ENDs |

| Custom Duty | 0% | 0% |

| Additional Duty | 2.0% | 2.0% |

| WHT | 5.50% | 5.50% |

| Cess | 0.58% | 0.58% |

| Clearance & Freight | 2.0% | 2.0% |

| Sales Tax | 17.34% | 17.34% |

| Additional Sales Tax | 0 | 0 |

| Regulatory Duty | 0 | 0 |

| Total Tax & Duties | 27.42% | 27.42% |

| Adjustable Component | 22.84% | 22.84% |

| Non Adjustable Component | 4.58% | 4.58% |

| For Export | 2.58% | 2.58% |

| Table 2 Applicable Duty Structure Import | |||

| Applicable Duty Structure Import | Sri Lanka | China | All Origins |

| Custom Duty | 0% | 20% | 20% |

| Additional Custom Duty | 7.0% | 6% | 6% |

| WHT | 5.50% | 5.50% | 5.50% |

| Regulatory Duty | 10% | 10% | 10% |

| Cess | 0% | 0% | 0% |

| Clearance & Freight | 0% | 0% | 0% |

| Sales Tax | 17% | 18% | 18% |

| Additional Sales Tax* | 3% | 3% | 3% |

| Total Tax & Duties | 42.50% | 62.50% | 62.50% |

| Adjustable Component | 25.50% | 26.50% | 26.50% |

| Non Adjustable Component | 17% | 36% | 36% |

Exhibit 2

| Table 3 Anti-Dumping Duty Rates | |||

| Country | Exporters | Provisional Anti-Dumping Duty rates | Finalized Anti-Dumping Rates |

| Sri Lanka | Ceylon Beverage Cans and All Others | 17.14% | 23.24% |

| Jordan | All exporters | 21.86% | 26.54% |

| UAE | All exporters | 18.26% | 22.06% |

Exhibit 3

| Table 4 Balance Sheet | |||||||

| Balance Sheet | CY20 | CY21 | CY22 | Profit & Loss | CY20 | CY21 | CY22 |

| Audited | Audited | Audited | Audited | Audited | Audited | ||

| Total Assets | 8,805 | 12,167 | 15,358 | Sales | 5,084 | 7,230 | 14,153 |

| Net Worth | 3,144 | 4,721 | 6,882 | EBITDA | 1,368 | 2,085 | 3,826 |

| Total Debt | 4,558 | 5,458 | 4,951 | Financial Charges | 423 | 277 | 409 |

| Leverage | 1.45 | 1.16 | 0.72 | Net Profit | 611 | 1,577 | 2,703 |

| Current Ratio | 1.18 | 1.29 | 1.73 | ICR | 2.65 | 6.66 | 8.66 |

| Net Worth / T.A. | 0.36 | 0.39 | 0.45 | DSCR | 1.47 | 2.83 | 3.92 |

End Notes

1PABCL is listed company in Pakistan Stock exchange and engage in the business of manufacturing beverages cans and sales both locally and internationally.

2https://dps.psx.com.pk/company/PABC

3EPC stands for Engineering, Procurement and construction.

References

Received: 17-Jan-2024, Manuscript No. JIACS-24-14402; Editor assigned: 18-Jan-2024, Pre QC No. JIACS-24-14402 (PQ); Reviewed: 23-Jan-2024, QC No. JIACS-24-14402; Revised: 29-Jan-2024, Manuscript No. JIACS-24-14402 (R); Published: 31-Jan-2024