Research Article: 2022 Vol: 26 Issue: 1

Company value factor analysis through earnings quality as an intervening variable

Hendi Prihanto, Universitas Prof. Dr. Moestopo (Beragama) Jakarta

Usmar, Universitas Prof. Dr. Moestopo (Beragama) Jakarta

Citation Information: Prihanto H., & Usmar. (2022). Company value factor analysis through earnings quality as an intervening variable. International Journal of Entrepreneurship, 26(1), 1-14.

Abstract

The study aims to analyze and explain the direct and indirect effects of firm value through capital structure, working capital, RoR, NPM and earnings quality, which act as intervening variables in predicting substantial weight and using control variables Gross Profit RoA, RoE and earnings persistence. The research population is comprised of all manufacturing enterprises that were listed on the IDX from 2016 to 2018, and were chosen through a purposive selection technique. Multiple linear regression hypothesis testing and path analysis modeling on intervening factors were used to evaluate the data, and robustness tests on firm value using a series of control variables. The findings indicated that the indirect influence of capital structure and NPM had a considerable effect on earnings quality, while working capital and ROR had no significant impact. Then a substantial direct effect on firm value is obtained from working capital, ROR and NPM, while earnings quality and capital structure are unnecessary. In the control variables, gross profit margin, RoE, RoA and earnings persistence significantly affect firm value. The research implications can be a reference in developing optimal models through testing schemes with a more modern research paradigm following market phenomena, in maximizing company value that prevents and avoids agency conflicts, by preventing information asymmetry as much as possible and determining investments for relevant companies in making decisions. Future strategic decisions.

Keywords

Firm Value, Earnings Quality, Capital Structure, Working Capital, Rate of Return, Net Profit Margin, Roa, Roe and Earnings Persistence.

Introduction

Every company wants quality profits because profit is one indicator of making decisions. Earnings quality Dechow and Dichev (2002) as earnings ability reflects the truth of future earnings including paying dividends including cash flow because Liu & Skerratt, 2014 earnings quality is one of the essential factors to determine the value of a company. Management has a role in earnings management arrangements with the form of earnings presentation aimed at maximizing market value through selecting accounting policies. Earnings quality significantly affects firm value. Management's freedom to choose accounting policies and a set of rules often trigger a command to select approaches that can maximize their interests or stock market value and cause agency conflicts. Jensen and Meckling (1976); financial accounting measurement involves freedom, which impacts increasing the economic value of accounting numbers. Enron, Petrobas, Ponzi, Ringing, Olympus, WorldCom, Volkswagen Pratiwi (2015), Xerox, Toshiba, Tisiphone Mobile Indonesia have problems with the quality of accounting information that makes them slump. Because one indicator of the company's profitability and honesty is in its profits when disclosing the amount of tax Prihanto and Damayanti (2020).

The decline of several large companies when the profits they engineered turned out to impact their declining company value; thus, non-actual profits caused a significant influence on the sale of company shares which in turn became a measure of success in company performance. Several studies that discuss earnings quality and firm value have different results; this is an attraction to obtain certainty of the actual results where researchers have the initiative to prove it with various techniques. Earnings quality in Indonesia is still low (Boulton et al., 2017) compared to developed countries such as America and Australia. So that by doing this research aims to analyze the quality of earnings, It then has an effect on the company's worth in terms of capital structure, working capital, rate of return, and net profit margin, in addition to the influence of control variables gross profit margin, RoA, RoE and earnings persistence. The research contribution is used to develop theoretical aspects related to determining factors on earnings quality and firm value that are practically capable of considering financial management in making strategic decisions in business. However, it is essential from the point of view of investors and management in making decisions with caution.

Literature Review

Theories Supporting the Development of Hypotheses

The agency relationship is described as a contract between one or more owners and another individual for the performance of services on their behalf, is described as the delegation of decision-making authority to agents in order to minimize costs due to knowledge asymmetry Jensen and Meckling (1976), as a result of received is different and binding under conditions of uncertainty. There will be agency conflict defines information asymmetry as a condition in which one of the parties involved in the transaction has the advantage and excess of information, adverse selection and moral hazard. The signaling theory explains why businesses feel compelled to communicate financial statement information to external parties via a signal or signal that contains information for the owner, that the recipient can utilize. The manner in which the company's management communicates to investors its thoughts about the company's future prospects through minimizing information asymmetry by sending positive signals to outsiders. Financial information that is both cheerful and trustworthy will reduce uncertainty about the company's prospects, said earnings announcements and their impact on stock prices is an indicator for firm value. However, the potential for fraud in companies in disclosing earnings can also be caused by organizational leadership that does not work well (Prihanto et al., 2020), which tends to occur due to conflicts of interest.

Hypothesis and Variable Measurement

The value of the company:

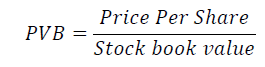

Define firm value as the discounted present value of future free cash flows determined using stock market indices; high stock prices result in a high firm value. Management's objective is to improve the company's worth by enhancing the prosperity of its owners and shareholders, which is shown in the share price (PBV) comparison between the share price and the book value of the shares:

Structure of capital:

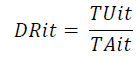

Is indeed a combination of long-term sources of funding employed by the business that enables the company to optimize the risk-reward ratio in order to maximize the stock price as measured by leverage, the percentage of the company's assets financed by debt, which is calculated by the formula as follows?

Notes: Dirt; debt ratio of the company I in year t, TUit: total debt of company i in year t, TAit: total assets of the company i in year t.

Research states that earnings quality harms firm value, and affects the cost of debt then Yung et al. (2013) states that short-term accruals are significant on short-term earnings quality. But it can be considered the existence of a control variable. Furthermore, capital ownership, governance and other variables predict various measures of earnings quality Ji et al. (2015), Ojo, (2014) Alzoubi, 2016 that governance has a material effect on the quality of financial statements and on the quality of profits, and profit erosion Ismail (2015). It is concluded that discretionary accruals provide an overview of the company's financial well-being therefore, earnings management is recognized as an effort to manipulate profits and short-term capital (Omeye & Erika, 2014) (Lemma & Minga, 2014), but more profitable companies tend to be better. Quickly adjust their capital structure. Madhumathi (2015) noted that multinational corporations and companies with diverse product lines have less leverage than organizations with a concentration on capital structure. Then Wang and Zhu (2013) noted that the value of the company would decrease with the uncertainty of financing to the equity that influences the optimal capital structure, while (Cheng et al., 2013); Banerjee and De (2016) stated a positive and robust relationship between capital structure and firm value, then Chipeta (2016) said that developed companies tend to have debt ratios lower average and extraordinary faster capital structure adjustment, thus the research hypothesis:

“H1: Capital structure has a positive effect on earnings quality

H1a: Capital structure has a positive impact on firm value through earnings quality”

Working capital:

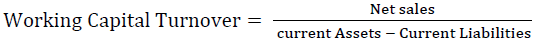

According to Kasmir's (2014) opinion, A working capital investment is one made in short-term assets such as cash, bank accounts, securities, receivables, inventory, and other current assets. A business's working capital is the amount invested in short-term or existing assets, which is calculated by the following formula:

Then Cheng et al. (2013) noted that working capital management has an effect on firm profits since low-quality revenue results in lower-quality revenue (Zadeh Darjezi et al., 2015). Lyngstadaas and Berg (2016) companies, must be aware of working capital. They must carry out management on long-term, short-term funding, and assets that predict future viability because earnings management through accruals is not significant and earnings quality information is low (Liu & Skerratt, 2014). The positive relationship between current assets and profitability, working capital & earnings affects the quality of the company's earnings value Gama, 2015; (Singh & Kumar, 2014). When utilizing the DD and modified models, investors may overlook information contained in the cash flow and working capital accrual components of current and future earnings. A high and positive correlation was established between EQ and managerial access to external (bank) debt financing Salehi et al. (2018). The capital structure is therefore determined by the nature and distinctive characteristics of the business, the probability of bankruptcy, agency costs, transaction costs, taxes, and information asymmetry (Lemma & Minga, 2014). There is a strong negative link between operational working capital and investment returns, and improving operational working capital efficiency results in improved firm value Wasiuzzaman (2016), hence the following study hypothesis is advanced:

“H2: Working capital has a positive effect on earnings quality

H2a: Capital structure harms firm value through earnings quality”

Rate of return (RoR):

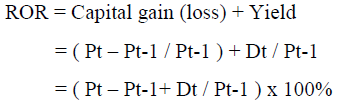

Stock returns into two types, namely realized returns and expected returns. A realized return is one that has already occurred and is determined using historical data. RoR, also known as Return on Investment (RoI), is a discount rate that gives the NPV = 0. ROR is the annual gain from the investment of a project. The ROR or ROI formula can be calculated in the following way:

Note: Pt: Current share price, Pt–1: Previous period share price, Dt-1: Dividend paid now

High earnings quality is defined as a high rate of return Perotti and Wagenhofer (2014) on enhanced earnings persistence, accrual quality, and decreased income smoothing, as reflected in the financial strength grade (Ames et al., 2014). As a result of their ERR flexibility, enterprises with ambiguous asset allocation have an ambiguous asset allocation Hwang and Sarath (2017). Salehi et al. (2018) observed a strong positive correlation between EQ and internal debt financing, as well as a negative correlation between EQ and the quality of financial information provided to creditors in investment returns. As a result, high-income managers are more likely to report high-quality results and earnings quality has a negative association with income, debt cost, firm size control, and debt levels. Additionally, Cahyanto (2013) notes that when RoI or RoR are evaluated concurrently with DER, LDER, DAR, ROE, and EPS, they have a substantial effect. Nonetheless, when examined on an individual basis, the product is not necessary. Baker et al. (2017) claimed that the accounting rate of return and manner of return are more significant for the firm than the current net value because Sabrina et al. (2018) investment decisions affect the company's value; hence the research hypothesis is as follows:

“H3: Rate of Return (RoR) harms earnings quality

H3a: There is a positive influence between RoR on firm value through earnings quality”

Net profit margin:

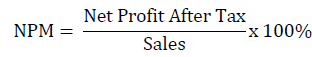

The opinion of Gumanti (2011) and Gitman (2012) states that NPM is calculated as the percentage of each dollar of sales that remains after all costs and expenses, including as interest, taxes, and preferred stock dividends, are deducted, after deducting which can be obtained by the following formula:

Then, Sayed, 2015 when a positive (negative) change in gross margin is followed by a positive (negative) change in income, earnings management is carried out Goel, 2014 because the NPM that did not perform as planned has an effect on low earnings quality. Then, Halimahton Borhan et al. (2014) established a negative association between returns and rises in net profit margins and ATO, which culminated in a negative relationship. Borhan et al. (2014) noted that NPM was positively related to the company's financial performance. Furthermore, Majanga (2018) also says that ROCE, NPM, ATO have a positive effect on stock prices and earnings, then Reeve and Warren (2010) state that NPM is a profitability measure that shows the effectiveness of company assets, while Murniati, 2017 net profit margin has a positive effect. And significant to book value. Bougatef (2018) NPM can be explained in large part by risk aversion, inefficiency, diversification and economic conditions, thus;

“H4: NPM has a positive effect on earnings quality

H4a : NPM has a positive impact on firm value through earnings quality”

Earnings Quality

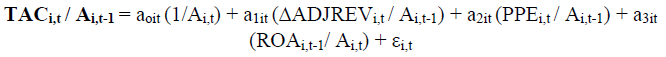

The managerial skill of a business has a favorable and considerable effect on the quality of its earnings Setin and Murwaningsari (2018). Then, Bellovary et al. (2005) stated that earnings quality should reflect the company's actual earnings and forecast future earnings, taking into account earnings stability and persistence. According to Abedini et al. (2014), the quality of profits has an effect on the capital market's attitude, and it is then added Perotti and Wagenhofer (2014) that a high earnings quality implies a high smooth rate of return. Zadeh Darjezi et al. (2016) discovered that information about the quality of earnings has an effect on the stock returns in the capital market. The residual value of total accruals or the gap between profits and cash flows is used to indicate the earnings quality Valipour and Moradbeygi (2011); the formula is calculated with total accruals using the following measurement model:

Note TAC i,t; total accruals of the company i year t, Ai,t-1; company assets i year t-1, ADJREV i,t; sales – accounts receivable company i year t, PPE i,t; net property, plant, and equipment company i year t, ROA i,t-1: net income total assets of the company i year t-1, €i,t: Residual errors company i year t. AC i,t is derived by subtracting non-cash current assets from short-term debt, omitting maturing long-term debt, less depreciation and amortization, and scaling by lagged total assets (Kothari et al., 2005).

Earnings quality is one of the essential factors to determine the value of a company; (Perotti & Wagenhofer, 2014) that using accrual measurement techniques (accrual measures) as a measure. Then, according to Gamayuni (2012), while variations in earnings quality have no significant positive or negative influence on company value (Lestari 2013; Zhou, 2016; Koubaa and Jarboui (2017), book-tax differences contribute positively to the major growth in earnings quality and firm value. Earnings quality has an effect on the capital market's stock returns, according to Li (2014) (Zadeh Darjezi et al., 2015). According to Yung et al. (2013) and Egbunike et al. (2018), governance has an effect on profits quality. The following summarizes this research hypothesis:

“H5: Earnings quality has a positive effect on firm value”

Control variable firm value:

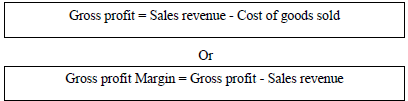

Gross profit, according to Sawir (2009), is a ratio that indicates a company's ability to produce efficiently by comparing the cost of items and production costs:

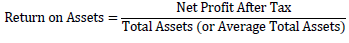

Return of assets (ROA):

As according Kasmir (2008), is a ratio that demonstrates the results (return) on the number of assets employed in the business to deliver results or returns on the total assets utilized in the business, which is then used to determine management effectiveness. When it comes to investment management which is calculated by:

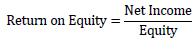

Return of equity (ROE):

According to Weston and Copeland (2002), business profitability which is the result of the return on equity, measures the return of book value to company owners; the formula that can be used is as follows:

Investors and creditors use profit persistence:

Schipper and Vincent (2003) earnings as the basis for making economic decisions, especially those related to making investment decisions and making legal decisions. Penman (2003) classifies earnings into two categories: sustainable earnings (permanent or core earnings) and odd or transient earnings:

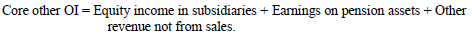

(COI from sales before tax – a tax on COI from sales) + Core other OI

(Core GM – COExp – a tax on COI from sales) + Core other OI

(Core SR–Core CS – COExp – a tax on COI from sales) + Core other OI

Note: GM: Gross Margin, COExp: Core Operating Expenses, SR: Sales revenue, CS: Cost of Sales.

Method

This study employs a quantitative technique in which the causal link is the primary emphasis in order to forecast company value using numerous variables that have a significant impact. The research population consists of businesses that are listed on the IDX, while the sample is companies registered in the 2016-2018 era obtained by purposive sampling technique with the following criteria: 1) Group of manufacturing companies listed on the IDX; 2) Complete financial reports for 2016-2018; 3) Have complete data for the variables needed in this research; 4) Companies that use Rupiah in their financial reporting. The unit of analysis of this study is the company's financial statements listed on the IDX during the study period Asir (2021). SPSS tools were used to determine the processing media, which included descriptive statistics, classical assumption tests, multiple regression, coefficient of determination, and F tests. After verifying the data, the total final sample that is suitable for use is 357 companies, so that annually 119 companies are the sample with the following data description(Table 1):

| Table 1 Descriptive Test Results and Classical Assumptions |

||||||

|---|---|---|---|---|---|---|

| NP | KL | SM | MK | ROR | NPM | |

| Minimum | -4.412 | -4.605 | -2.649 | 5.670 | -6.040 | -4.811 |

| Maximum | 8.584 | .920 | 1.624 | 33.378 | 3.291 | 12.056 |

| Mean | .494 | -.339 | -.824 | 22.611 | -1.494 | 1.141 |

| Std. Devices | 1.876 | 1.008 | .605 | 5.513 | 1.404 | 1.550 |

| Skewness | 1.485 | -.744 | -.002 | -.721 | -.322 | 2.779 |

| Kurtosis | 3.437 | .613 | 2.223 | -.573 | 1.219 | 15.197 |

| N | 357 | |||||

| Kolmogorov. | 0.05 | |||||

| Multikol. (Tol.-VIF) | .968-1.033 | .824-1.208 | .933-1.072 | .484-2.065 | .230-4.344 | |

| Source: processed data | ||||||

Before the regression and other tests, descriptive identification of the variables: NP, KL, SM, MK, ROR, and NPM has the smallest minimum value of -6.040 on the ROR variable, the maximum 33,378 on the MK, the standard deviation of values far from the mean is NP, KL and MK while SM, ROR and NPM are close to the norm. Kurtosis data is in the category of Platikurtic, Mesokurtic and Leptokurtic. Kolmogorovskmirnov's value is at the average value of 0.05. Variable multicollinearity is at VIF < 10, so the level of collinearity can still be tolerated. The heteroscedasticity test of the points in the image does not form a specific pattern and spreads between (above and below 0). It can be concluded that there is no heteroscedasticity in the data. It is supposed that all the results of the classical assumption test have normality accompanied by a statistical descriptive data description and are feasible to be used to predict the regression model at a later stage in the regression test between variables Asir, 2011.

Regression Analysis

The purpose of this study is to analyze the effect of intervening variables on the following equation: Capital Structure, Working Capital, ROR, and NPM, which are made into the following equation(Table 2):

| Table 2 Pathway Analysis Regression Results |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Model | Indirect influence | Direct influence | Control variable | Overall variable | ||||||||

| ß | T | sig | ß | t | sig | ß | t | Sig | ß | t | Sig | |

| SM | .285 | 3.118 | .001 | -.156 | -.941 | 0.173 | - | - | - | -.064 | -.392 | .347 |

| MK | .002 | .249 | .402 | -.102 | -5.757 | .000 | - | - | - | -.254 | -3.441 | .000 |

| ROR | .038 | .723 | .235 | .321 | 3.388 | .000 | - | - | - | .598 | 2.891 | .002 |

| NPM | .067 | 1.352 | .088 | .252 | 2.825 | .002 | - | - | - | .163 | 1.818 | .035 |

| KL | - | - | - | -.077 | -.802 | .211 | - | - | -- | -.120 | 2.147 | .092 |

| GP | - | - | - | - | - | .140 | 2.726 | .000 | .276 | 2.653 | .004 | |

| ROA | - | - | - | - | - | - | .337 | 6.224 | .000 | .266 | 3.003 | .001 |

| ROE | - | - | - | - | - | - | .071 | 1.394 | ,082 | -6.819 | -1.891 | .029 |

| PL | - | - | - | - | - | - | -.379 | -6.618 | .000 | .159 | 2.147 | .016 |

| const | -1.180 | 2.771 | 5.353 | 4.260 | ||||||||

| F | - | - | .038 | - | - | .000 | - | .000 | - | - | .000 | |

| R2 | .017 | .093 | .145 | .196 | ||||||||

| Source: SPSS 22 processed | ||||||||||||

Note: the significance level of hypothesis testing is divided into 3, namely: * = 0.10 or 10 %, ** = 0.05 or 0.5 %, *** = 0.01 or 1 %, **** = 0.001 or 0.01 % and *** ** = 0.000 or one hundred percent.

Direct regression : the model's direct effect on company value

Indirect degeneration : the impact of the model on firm value through earnings quality

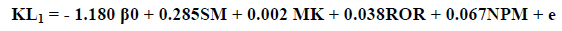

Structural Equation 1

The indirect effect on Earning quality on firm value has a value for each variable with a beta value of -1180, Capital Structure 0.285, Working Capital 0.002, RoR 0.038 and Net Profit Margin 0.067, which means that each unit changes every one unit to Earnings Quality variable assuming the other independent variables from the fixed regression model (caterius paribus). In the regression analysis model 1, all variables have positive values; capital structure and NPM are significant variables because they have sig values of 0.001 (at sig. 0.001) and 0.008 (at sig. 0.10). In contrast, other variables only have a positive effect. Thus the hypothesis that states H1, H2 and H4 is positive can be accepted, while H3 fails to be taken.

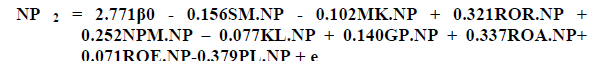

Structural Equation 2

Note: NP = Firm value, KL= Earnings Quality, SM= Capital Structure, MK= Working Capital, ROR= Rate of Return, NPM= Net profit margin, GP= Gross Profit, ROA= Return of Assets, ROE = Return of Equity, PL=Earnings Resistance, e = error

The direct effect on firm value has on each of its variables with a beta value of zero of -2.771, Capital Structure -0.156, -0.102 in working capital, 0.321 in rate of return, 0.252 in net present value, -0.077 in earning quality, 0.140 in gross profit, 0.337 in return on assets, 0.071 in return on equity, and 0.379 in earnings persistence, which means that each unit changes each unit on the Firm Value variable assuming the other independent variables from the fixed regression model (cateius paribus). Thus the research hypothesis H1a fails to be accepted, H2a is acceptable, H3a can be accepted, H4a can be accepted, while H5 fails to be taken. Overall testing is carried out to obtain comparisons and confidence in the results obtained from data processing carried out differently through various models.

The test results through the Anova F test obtained the significance level of each model used with the earnings quality intervening variable of 0.038, the firm value of 0.00, as well as the control variables and the overall test; it can be said that the comprehensive data used has reasonably good feasibility measured by the significance (Asir & Pasok, 2018). The value of the coefficient of determination (R2) indicates that the most muscular model is obtained when the researcher performs a regression on all variables predicted to explain the firm value of 0.146 or 14.6%(Table 3).

| Table 3 Comparison Of Regression Tests Between Variables On Firm Value |

|||||

|---|---|---|---|---|---|

| Variable | Path analysis | Direct regression | Information | ||

| T value | sig. | t value | sig | ||

| KL | -0.802 | 0.211 | -1.330 | 0.092* | Be significant (remain negative) |

| SM | -0.941 | 0.173 | -0.392 | 0.347 | Not significant |

| MK | -5.759 | 0.000**** | -3.441 | 0.000**** | Not significant |

| ROR | 3.388 | 0.000**** | 2.891 | 0.002**** | Not significant |

| NPM | 2.825 | 0.002**** | 1.818 | 0.035** | Not significant |

| PL | -6.618 | 0.000**** | 2.147 | 0.016*** | Stay significant (be positive) |

| GP | 2.726 | 0.003**** | 2.653 | 0.004**** | Stay significant |

| ROA | 6.224 | 0.000**** | 3.003 | 0.001**** | Stay significant |

| ROE | 1.394 | 0.0828 | -1.891 | 0.029** | Remains significant (goes negative) |

| Source: Data processed | |||||

Note: this test is carried out to obtain confidence in the influence between variables on firm value by changing the combination of various models used. (in using the intervening/indirect variable model and using the direct regression model)

Significance level : * = 0.10, 0.05**, 0.01***, 0.00****

Result and Discussion

Indirect Influence

The study results stated that the significant direct effect was on the variable: capital structure on earnings quality, which had a value of 3.118 and a significance level of 0.001 which means the research hypothesis H1 is acceptable. These results are in line with the opinions of Ojo (2010), Yung et al. (2013), (Omoye & Eriki, 2014), Lemma (2014), Alzoubi (2016) & Salehi et al. (2018) there is a correlation and positive influence between the structure the company's capital on the quality of company earnings, this is because a reasonable capital structure means the company does not require accruals that are too high and away from the reality, so the quality of company profits is getting better The influence of NPM on earnings quality with a t value of 1,352 and a significance of 0.088 has a significant positive level of significance of 0.10. Thus, the research hypothesis H4 is acceptable if the result corroborates the work of Lento and Nasyed (2015), (Burhan et al., 2014) and Majanga (2018) they prove a significant influence between the net profit margin on the quality of the company's earnings with the more critical the net profit margin balanced by healthy debt quality, the company can be said to be more beneficial.

If the net profit margin is small, the profit will be smaller if there is a price decrease. The company can be predicted to lead to a loss, encouraging earnings management which worsens earnings quality. Meanwhile, the hypothesis (H2) failed to be accepted with a t value of 0.249 with a significance of 0.402. At the same time, this study's theory states that working capital has a positive effect on earnings quality, albeit a small one, which contradicts (Singh & Kumar 2014, who state that working capital has a positive effect and determines the quality of company earnings Berg (2016) and profitability (Pais & Gama, 2015). Thus, H3 is rejected because the direction is negative and the t value is insignificant (0.723 with a significance of 0.235); however, these findings are consistent with those of (Perotti & Wagenhofer, 2014) and Carmo, 2016, which found a negative relationship between earnings quality and high returns. , this research contradicts Cahyanto et al. (2014), which state positive and significant results between RoR and returns on earnings quality. Working capital and RoR are not substantial and are not accepted in the hypothesis because working capital is not the main thing used in predicting company profits; this is because working capital comes from various aspects of financing current assets, which are used as production processes from companies with different risks, so it is less able to explain the actual state of profit Asir, 2021. Whereas in RoR, earnings quality is not significant because RoR is an annual gain from investment in a project that has accumulated in that year and working capital, which is an investment in short-term assets. Companies in Indonesia tend to have shortcomings and weaknesses in working capital used and obtained by way of debt so that they are less able to maximize company profits because they have to pay interest on their debts.

Direct Influence

The impact of working capital on firm value, which has a t value of -5,759 and a significance level of 0.000 (H2a is acceptable) (Singh & Kumar, 2014); Wasiuzzaman, 2015; Lyngstadaas & Berg, 2016, demonstrates that working capital has a negative effect on firm value. While H3a is an accepted research hypothesis, it has a value of 3.388 and a significance level of 0.000. This is consistent with the researcher's presentation of the hypothesis that RoR has a positive effect on company value. Additionally, report positive and substantial correlations between ROR and returns on earnings quality. According to Garcia-Teruel et al. (2014), managers with high wages are more likely to report high-quality earnings than managers with low incomes, which provides owners and investors with misleading information. This is a sort of conflict of interest Jensen and Meckling (1976), which might manifest itself in the form of fraud committed by company leaders (Prihanto et al., 2020). Statistical analysis of data acquired at a value of 2.825 with a significance level of 0.002 reveals that NPM has a significant positive effect on firm value at the 0.00 level of significance. As a result, one may accept research hypothesis H4a, found a favorable and statistically significant association between the earnings quality of NPMs. The net profit obtained by the company tends to encourage companies to report their earnings, thereby attracting the attention of investors to buy their shares with a positive response.

Meanwhile, the inconsequential result results in the capital structure having a negative effect on business value. H1a is not accepted since it has a value of -0.941 and a significance level of 0.173, which contradicts findings that firm value decreases as financing uncertainty toward equity affects the optimal capital structure. They suggest a strong and positive relationship between capital structure and corporate value (Cheng et al., 2013). These findings, however, are similar with those of Gracia and Meca (2011), who all concluded that capital structure had a detrimental effect on and relationship with firm value. The negative impact of capital structure can be attributed to the fact that enterprises with debt will prioritize debt repayment and interest, eroding the quality of net income. Earnings quality does not contribute positively to company value as indicated in the hypothesis, and thus H5 study fails to accept it. The quality of earnings has no significant effect on firm value. Boulton et al. (2011) also stated that the quality of earnings in Indonesia is still inadequate in comparison to developed countries such as the United States and Australia, owing to the fact that on average, Indonesian businesses begin operations with debt. Thus, if there is a severe crisis that results in inflation, the business will have difficulty repaying debts and interest.

Additionally, robustness tests were conducted on the control variables to determine whether they adequately explained the influence on firm value predicted by gross profit with a t value of 2.726 and a significance level of 0.003, which is equal to 0.00. RoA has a t value of 6224 with a significance level of 0.000, and RoE has a t value of 1.394 with a significance level of 0.082, indicating that it has a deal with a group of 0.10. Earnings persistence, with a t value of 6618 and a significance level of 0.000, is a well-established fundamental factor affecting business value. A weak capital structure affects the company's profits generated to impact the low quality of company profits. Companies in Indonesia have an inadequate ability in terms of yield because their capital structure is obtained mainly by way of debt, so this feels heavy when companies have to return interest charges to their creditors. The existence of a weak capital structure and tends to be in debt is not attractive to investors; they will think in investing because of concerns about debt, as stated in the Pecking Order theory (Myers & Majluf, 1984).

Comparison Between Statistical Tests

The comparison between the tests aims to make the researcher obtain confidence in the results obtained from data processing with various model developments made; besides that, it is also necessary to get information on the appropriate model in testing the variables of firm value and earnings quality. Comparing test results when carried out using earnings quality path analysis becomes an insignificant variable, but when a direct regression is carried out, all models become significant. This explains that if the company displays all financial information wholly and comprehensively, then the quality of earnings will be dominant and become a parameter that has a strong influence on other economic variables; the lower the accrual, the higher the quality of the company's earnings. The earnings persistence variable initially regressed with its role as a control variable, had a significant negative effect. Still, after the regression, the overall direction changed to positive and remained substantial.

This explains that earnings persistence has a reasonably positive contribution and is very much needed by investors as information to invest in the company; persistent profit is a picture of data on the stability of the company in managing its business; therefore, the more constant the company's earnings, the better the quality. While the initial ROE had a positive and statistically significant effect, when regression was conducted, the entire model became negative but still statistically significant. The size of the company's debt has an effect on ROE, and if the company's debt is more extraordinary, this ratio will be more significant. It demonstrates that investors prefer companies that do not have a high level of debt and have bad performance. As a result, investors tend to invest, which enhances the company's worth; therefore, by regressing the total model, more thorough analysis results can be obtained, as well as other perspectives on the information provided. The approach will result in a shift in perceptions regarding earnings quality research and business value. Additionally, the value of the regression model's coefficient of determination (R2) with the comparison test, the maximum value obtained when all models are integrated directly, which is 19.6% of the firm value, can be explained by the research model.

Conclusion

The significant effect is reflected in the capital structure and NPM on earnings quality. In contrast, the non-significant effect is found in working capital and ROR on earnings quality, which is in line with and not in line with previous researchers. A significant impact was obtained between working capital, ROR, NPM and PL on firm value directly, while earnings quality and capital structure were not substantial. Control variables (Gross profit, ROA, ROE and earnings persistence) have a considerable effect on firm value. Comparison of tests obtained that there is a change in the significance and direction of the hypothesis of the earnings quality model, which has initially been insignificant to be significant with the demand from being positive to negative; ii) earnings persistence was initially damaging and then became positive but remained in a powerful position; iii) RoA which was initially positive then becomes negative. Tests on other variables tend not to change in direction and significance; the purpose of this is a modification of the model's ability that affects the problems in the study so that the ability to explain the research variables can be obtained. Based on the process and results obtained from the research, the researcher concludes that the state of the financial statements published by companies in Indonesia has not met the reporting criteria with accounting standards and internationally; this is evident due to the difficulty of data obtained by researchers when conducting data inventory.

References

Asir, M. (2021). Rantai Pasok Kakao: Karakteristik & Peran Stakeholder. Pekalongan: NEM.

Asir, M., & Pasok, S.P.R.R. (2018). Revitalisasi Peran Pemangku Kepentingan dan Strategi Pengendalian Risiko Rantai Pasok Komoditas Kakao. (Disertasi. SekolahPascasarjana. UniversitasHasanuddin. Makassar)

Liu, S.D., & Skerratt, L. (2014). Earnings quality across listed, medium-sized, and small companies in the UK. Brunel Univ. West London, Brunel Business School.

Omoye, A.S., & Eriki, P.O. (2014). Corporate governance determinants of earnings management: Evidence from Nigerian quoted companies. Mediterranean Journal of Social Sciences, 5(23), 553.

Pratiwi, D.A. (2015). Tujuh Perusahaan dengan Skandal Terbesar di Dunia. Artikel economy Oke-zone. com.

Prihanto, H., & Damayanti, P. (2020). Disclosure Information on Indonesian UMKM Taxes. Jurnal Riset Akuntansi Dan Keuangan, 8(3), 447-454.

Prihanto, H., Murwaningsari, E., Umar, H., & Mayangsari, S. (2020). How Indonesia Attempts to Prevent Corruption!. Oceanside, 12(2).

SeTin, S., & Murwaningsari, E. (2018). The effect of managerial ability towards earning quality with audit committee as moderating variable. Journal of Business and Retail Management Research, 12(3).

Valipour, H., & Moradbeygi, M. (2011). Corporate debt financing and earnings quality. Journal of applied finance and banking, 1(3), 139.