Research Article: 2022 Vol: 26 Issue: 5

Corporate social responsibility and tax avoidance focusing on the moderating effect of Korean Chaebol

Aeja Park, Hansung University

Kyunbeom Jeong, Hansung University

Citation Information: Park A., & Jeong K. (2022). Corporate social responsibility and tax avoidance – focusing on the moderating effect of korean "chaebol”. International Journal of Entrepreneurship, 26(5), 1-9

Abstract

This study analyzes the relationship between corporate social responsibility (CSR) activities and tax avoidance for companies listed on the Korea Stock Exchange, and examines whether this relationship differs depending on whether they belong to a large-scale business group, that is, a "chaebol" in Korea. As a result of the empirical analysis of this study, the measure of corporate social responsibility activity shows a significant positive (+) effect on the tax avoidance. Also, it is found that whether they belong to a “Chaebol” has negative (-) moderating effect on the relationship between the level of CSR activity and tax avoidance. These results suggest a paradigm that companies that are active in social responsibility activities also have a high level of tax avoidance because they need to raise funds for social responsibility activities or companies recognize social responsibility and tax payment as substitutes. In addition, it is found that the relationship between these CSR activities and tax avoidance may vary depending on the special corporate type ("chaebol") in Korea. In other words, unlike other general companies, Korean "chaebol" companies have sufficient funds without any reason to avoid tax for CSR activities. The results of this study are expected to provide timely and useful information to corporate decision-makers, shareholders or creditors investing in companies, evaluation institutions that evaluate social responsibility activities, tax authorities that enforce tax laws, and related institutions that enforce finances.

Introduction

In recent years, interest in "Corporate Social Responsibility (CSR)" is increasing, in which companies create economic benefits while simultaneously contributing to society through environmental, ethical, and social contributions. In terms of demand, consumers also value corporate performance on CSR, especially transparency and honest corporate culture as important factors in CSR. Basically, CSR reflects the value and culture of the organization, which also affects the behavior of managers (Trevino, 1986; Aguilera et al. 2007). It is a general idea that managers of companies engaged in CSR activities make decisions for the values and beliefs of the organization that pursues accounting transparency rather than pursuing private interests. However, there is also an aspect that if companies engage in CSR activities to avoid monitoring stakeholders and report the performance of CSR through the media, stakeholders can be satisfied with managers and lower the level of monitoring of managers (Castelo & Lima, 2006).

On the other hand, tax is an inevitable expenditure in business activities. Tax avoidance behavior to lower tax costs is also a decision making activity of managers and affects other management decisions. One of them can be the CSR activities mentioned above, and previous studies have been conducted on this, but the results are mixed, so it was not consistent. Studies have shown that if CSR activities reflect desirable organizational values and cultures as intended, or companies active in CSR activities may have higher non tax costs to pay when tax evasion is revealed (Hasseldine & Morris 2013), the more CSR activities, the less tax avoidance behavior can be predicted. However, CSR activities may be aimed at lowering the level of monitoring of stakeholders (Castelo & Lima, 2006) or it may be aimed at raising expenditure itself from CSR activities (Davis et al. 2016), there were also research results that the more CSR activities, the more tax avoidance can be.

Therefore, this study aims to contribute to organize the inconsistent research results on corporate social responsibility and tax avoidance using Korean data. In addition, we would like to examine in depth the moderating effect of the special corporate structure by looking at what discriminatory results in "chaebol" companies, which are special types of companies in Korea, show on the relationship between corporate social responsibility and tax avoidance.

As a result of the analysis, it was confirmed that the more CSR activities, the more tax avoidance, that is positive relationship between CSR activities and tax avoidance. Through this, it can be interpreted as a result of supporting the existing studies that suggested that companies active in CSR activities do more tax avoidance activities to make up for their expenditure due to CSR activities. In addition, this positive relationship is discriminatorily very weak or rather negative relationships in Korean "chaebol" companies. These results can be interpreted as meaning that even if there is an expenditure by CSR activities, "chaebol" companies rarely need to make up for it through tax avoidance, or rather, less tax avoidance to revive the purpose of CSR activities. The biggest contribution of this study can be that these results provide an opportunity to more clearly interpret the mixed results of existing previous studies.

Literature Review and Hypotheses

Corporate Social Responsibility and Tax Avoidance

The results of previous studies on the relationship between CSR and tax avoidance are inconsistent. Some of the existing studies said that if tax avoidance is revealed, companies active in CSR activities will have higher non tax costs than companies indifferent to CSR activities, so companies active in CSR activities have lower level of tax avoidance (Hasseldine & Morris 2013).

Even if a company is passive in CSR activities, it is likely to maximize corporate value by reducing corporate tax costs that are cash outflows through tax avoidance, and even if a company is active in CSR activities, there is sufficient incentive to avoid tax avoidance. Watson (2015) reported that when a company's income level is predicted to be low or actually low, CSR activities and tax avoidance show a positive relationship. Watson said that tax is important because it is one of the largest costs in most companies, and tax avoidance is necessary if financial resources are insufficient due to poor performance. Poor companies are relatively far from the interest of the tax authorities compared to high profit companies, so tax avoidance is freer, and unlike taxes, CSR requires long term commitments and is generally not linked to income, so expenditures related to CSR are more strictly executed than taxes.

Davis et al.(2016) suggested that CSR and taxes are not complementary and act as substitute goods, providing evidence that socially responsible companies spend more money on tax related lobbying and that high CSR companies are avoiding more taxes.

If a company considers tax related activities as part of CSR activities, or a company that has actively engaged in CSR activities is expected to suffer more damage such as a loss of corporate image and a decline in external credibility, CSR and tax avoidance will have negative relationship. On the other hand, if a company needs to raise funds for CSR activities or if the company recognizes CSR and tax payment as alternatives, the company's CSR and tax avoidance will appear in a positive relationship.

Based on the results of inconsistent previous studies, this study set Hypothesis 1 in the form of the following null hypothesis because it is difficult to predict the relationship between CSR and tax avoidance in one direction.

H1: The degree of CSR activity will not affect the level of tax avoidance.

The Differential Effect of a Large Scale Business Group (“chaebol” of Korea)

A Large scale business group is a special form of enterprise called “chaebol” in Korea. Various studies related to these “chaebol” have been conducted in several previous studies. While studies highlighting the positive aspects of “chaebol” exist (Shin & Park, 1999; Khanna & Palepu, 2000; Khanna & Yafeh, 2005), there are also a number of studies highlighting the negative aspects of “chaebol” (Johnson et al., 2000; Bertrand et al., 2002; Baek et al., 2006). Studies looking into the positive aspects of “chaebol” mainly note that “chaebol” companies have more internal funds than “non chaebol” companies. For example, it is argued that it is helpful for corporate development because it can afford funds and invest when necessary (Khanna & Palepu, 2000), or because internal funds can be used in emerging markets where external financing is difficult (Shin & Park, 1999; Khanna & Yafeh, 2005). On the contrary, studies claiming the negative effects of “chaebol” mainly focus on the agency problem arising from conflicts between major shareholders and minority shareholders. For example, in the case of Baek et al. (2006), it was mentioned that major shareholders are bringing the interests of minority shareholders through stock issuance.

Based on these previous studies, the relationship between CSR and tax avoidance, which is mainly sought in this study, is likely to appear in different aspects in “chaebol” companies. If tax avoidance is done more to cover the funds used for CSR activities, as seen in previous studies, “chaebol” companies will not need to avoid tax because they have sufficient funds for CSR. If the purpose of CSR activities disappears due to tax avoidance, there is a possibility that “chaebol” companies will avoid tax less because their image decline can be a greater blow. For these reasons, the relationship between CSR activities and tax avoidance is likely to appear differentially in “chaebol” companies, so the hypothesis is established as follows.

H2: The effect of CSR activities on tax avoidance will be differentiated in “chaebol” companies.

Research Design

Research Model

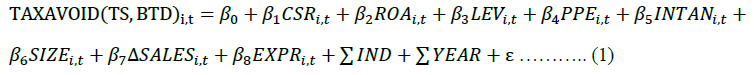

In this study, first, the method proposed by Desai and Dharmapala (2006) and the difference between financial reporting income and tax reporting income (BTD) are used as the dependent variable TAXAVOID to verify the relationship between CSR activities and tax avoidance for H1.

As a measure of the degree of CSR activity, an independent variable, the total values of E, S, and G scores calculated by the Korea Corporate Governance Service are used. Based on these dependent variables and independent variables, the following equation (1) is established. We also use variables known to affect corporate tax avoidance tendencies used in Watson (2011) as control variables.

<Dependent variables>

TAXAVOID: Proxies of tax avoidance

TS: proxy of tax avoidance proposed by Desai and Dharmapala (2006)

BTD: book tax difference (difference between book income and taxable income)

<Independent variable>

CSR: total ESG evaluation score of Korea Corporate Governance Service

<Control variables>

ROA: total return on assets (net income / total assets at the beginning of the year)

LEV: debt ratio (total liabilities / total assets)

PPE: depreciable assets ratio ((tangible assets land construction in progress) / total assets at the beginning of the year)

INTAN: intangible asset ratio (intangible asset / total assets at the beginning of the year)

SIZE: size of the company (natural logarithm of total assets)

?

SALES: rate of change in sales (? sales / sales in previous year)

EXPR: export ratio (export amount / sales)

IND: industry dummy

YEAR: year dummy

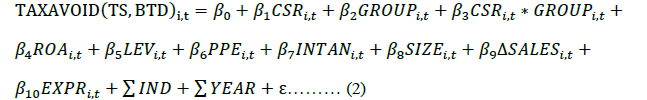

In addition, to verify Hypothesis 2, the following research model is established by adding a dummy variable (GROUP) indicating whether it is a large business group to the model and adding an interaction variable between this variable and CSR variable.

Sample and Data

To verify the hypothesis of this study, a study was conducted on companies that meet the following conditions among companies listed on the securities market of the Korea Exchange during the period from 2013 to 2015.

1) Companies not in the financial industry

2) Companies with a settlement month in December

3) Companies that are not the capital impairment companies and that are non negative taxable income companies

4) Companies that can obtain data from the Financial Supervisory Service's electronic disclosure system (DART)

5) Companies with ESG scores from Korea Corporate Governance Service

6) Companies that do not fall under capital overstated (accounting fraud)

The firms in financial industry are excluded because the form of financial statements and the nature of accounting subjects are different from that of general manufacturing firms, making it difficult to compare and analyse with firms in other industries. In addition, the sample is limited to the December settlement firms to control the impact of the difference in settlement. Capital impairment companies or companies with negative taxable income are excluded from the sample because of their low motivation for tax avoidance (Desai & Dharmapala, 2006). Among the 2,320 samples of listed companies, 689 samples are selected for the final sample satisfying the above conditions. The values of the variables corresponding to 1% of the upper and lower levels are winsorized in order to remove the effect of outliers.

Of the 689 samples in this study, 290 samples (42.09%) belonged to the large scale business group, and 399 samples (57.91%) do not belong to the large scale business group. There are 109 more samples that do not belong to the large scale business group. It is expected that there will be some differences in the relationship between CSR and tax avoidance between companies in a large scale business group called “chaebol” and companies that do not.

Results

Descriptive Statistics

Table 1 is the descriptive statistics of the sample used in this study. First, the average of the dependent variable, the tax avoidance measure TS, is 0.0041 and the average of BTD is

0.0187. The mean and median of CSR, which are independent variables, are 37.0816 and 33.9367, and the standard deviation is 12.3663. The maximum value is 77.6467 and the minimum value is 16.3967. The difference between the maximum and minimum values is 61.2500. It can be seen that there is a significant difference in the level of CSR activities among companies.

| Table 1 Descriptive Statistics |

||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | N | Mean | Median | Std. Dev. | Min. | 25% | 75% | Max. |

| TS | 689 | 0.0041 | 0.0110 | 0.0489 | -0.1849 | -0.0159 | 0.0338 | 0.1068 |

| BTD | 689 | -0.0187 | -0.0078 | 0.0517 | -0.2754 | -0.0319 | 0.0078 | 0.0855 |

| CSR | 689 | 37.0816 | 33.9367 | 12.3663 | 16.3967 | 28.5342 | 41.3867 | 77.6467 |

| ROA | 689 | 0.0379 | 0.0351 | 0.0603 | -0.1616 | 0.0099 | 0.0662 | 0.2217 |

| LEV | 689 | 0.4029 | 0.4047 | 0.1866 | 0.0199 | 0.2534 | 0.5403 | 0.8514 |

| PPE | 689 | 0.1955 | 0.1774 | 0.1335 | 0.002 | 0.0852 | 0.2882 | 0.5349 |

| INTAN | 689 | 0.0233 | 0.0096 | 0.0348 | 0.0000 | 0.0038 | 0.0280 | 0.1899 |

| SIZE | 689 | 20.7856 | 20.502 | 1.3989 | 18.0285 | 19.8428 | 21.5464 | 24.7788 |

| ?SALES | 689 | 0.0070 | 0.0078 | 0.1279 | -0.3502 | -0.0572 | 0.0710 | 0.4152 |

| EXPR | 689 | 0.0973 | 0.0000 | 0.2218 | 0.0000 | 0.0000 | 0.0210 | 0.9678 |

Univariate Analysis

Table 2 presents the Pearson correlation coefficients among the dependent and independent variables in the final sample of 689 firm year observations. Tax avoidance measure TS has a positive (+) correlation with BTD, CSR, ROA, PPE, INTAN, and ?SALES, but it was found that LEV and EXPR had a negative (--) correlation with TS. It was found that there was a significant correlation with BTD, CSR, ROA, LEV, PPE, and SIZE at the 1% level, but there was no significant correlation with INTAN, ?SALES, and EXPR. Another tax avoidance measure BTD also had a positive (+) correlation with CSR, ROA, PPE, INTAN, and ?SALES, but LEV and EXPR were found to have a negative (--) correlation with BTD. It was found that ROA, LEV, PPE, and ?SALES showed significant correlation at 1% level and significant correlation at 5% level with SIZE, but no correlation with CSR, INTAN, and EXPR was found.

| Table 2 Pearson Correlations |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variable | TS | BTD | CSR | ROA | LEV | PPE | INTAN | SIZE | ?SALES | EXPR |

| TS | 1 | - | - | - | - | - | - | - | - | - |

| - | - | - | - | - | - | - | - | - | ||

| BTD | 0.889*** | 1 | - | - | - | - | - | - | - | - |

| (0.000) | - | - | - | - | - | - | - | - | ||

| CSR | 0.137*** | 0.043 | 1 | - | - | - | - | - | - | - |

| (0.000) | (0.264) | - | - | - | - | - | - | - | ||

| ROA | 0.470*** | 0.598*** | 0.063 | 1 | - | - | - | - | - | - |

| (0.000) | (0.000) | (0.097) | - | - | - | - | - | - | ||

| LEV | -0.184*** | -0.242*** | 0.109*** | -0.449*** | 1 | - | - | - | - | - |

| (0.000) | (0.000) | (0.004) | (0.000) | - | - | - | - | - | ||

| PPE | 0.239*** | 0.120*** | 0.205*** | 0.071* | 0.068* | 1 | - | - | - | - |

| (0.000) | (0.002) | (0.000) | (0.064) | (0.073) | - | - | - | - | ||

| INTAN | 0.051 | 0.004 | 0.054 | -0.002 | 0.081** | 0.024 | 1 | - | - | - |

| (0.183) | (0.916) | (0.155) | (0.965) | (0.034) | (0.534) | - | - | - | ||

| SIZE | 0.144*** | 0.082** | 0.656*** | 0.021 | 0.223*** | 0.164*** | 0.091** | 1 | - | - |

| (0.000) | (0.032) | (0.000) | (0.591) | (0.000) | (0.000) | (0.017) | - | - | ||

| ?SALES | 0.027 | 0.101*** | -0.040 | 0.313*** | -0.059 | -0.019 | 0.168*** | 0.002 | 1 | - |

| (0.481) | (0.008) | (0.298) | (0.000) | (0.123) | (0.616) | (0.000) | (0.957) | - | ||

| EXPR | -0.059 | -0.029 | 0.072* | 0.056 | -0.016 | 0.043 | -0.098** | 0.003 | -0.048 | 1 |

| (0.120) | (0.440) | (0.058) | (0.141) | (0.676) | (0.258) | (0.010) | (0.930) | (0.212) | ||

Regression Analysis

In order to analyse the effect of CSR on tax avoidance, multiple regression analysis is conducted using ROA, LEV, PPE, INTAN, SIZE, ? SALES, EXPR, IND, and YEAR as control variables. Table 3 presents the results of empirical analysis through regression analysis. Model 1 is a model in which the dependent variable is TS and Model 2 is BTD. To conduct regression analysis, the Durbin Watson index and the VIF index are used to examine the autocorrelation and multicollinearity. As a result of examining the Durbin Watson index to examine the autocorrelation of the dependent variable, it is found that 2.011 in Model 1 and 2.065 in Model 2, both are close to 2, so they are independent regardless of autocorrelation. In addition, as a result of examining the VIF index to review the multicollinearity between independent variables, it is found that there is no multicolleinearity because all of them are less than 10. Therefore, this model can be said to be suitable for regression analysis.

| Table 3 Regression Result For Hypothesis 1 |

||||

|---|---|---|---|---|

| Variable | Model 1 (Dependent variable : TS) |

Model 2 (Dependent variable : BTD) |

||

| Coefficient | t-value | Coefficient | t-value | |

| (Constant) | -0.075** | -2.180 | -0.090** | -2.407 |

| CSR | 0.110** | 2.004 | 0.022 | 0.393 |

| ROA | -0.052 | -1.154 | -0.068 | -1.492 |

| LEV | 0.000 | 0.002 | 0.003 | 0.067 |

| PPE | -0.125** | -2.943 | -0.097** | -2.215 |

| INTAN | -0.053 | -1.240 | -0.068 | -1.551 |

| SIZE | 0.098* | 1.809 | 0.099* | 1.794 |

| ?SALES | 0.030 | 0.744 | 0.128** | 3.113 |

| EXPR | -0.059 | -1.531 | -0.019 | -0.495 |

| Year Dummy | Included | Included | Included | Included |

| Industry Dummy | Included | Included | Included | Included |

| F-value | 3.625*** | 2.293*** | ||

| R2 | 0.111 | 0.073 | ||

| N | 689 | 689 | ||

As a result of the analysis, in Model 1 and Model 2, the regression coefficient of CSR is found to have positive (+) values of 0.110 and 0.022, but it is significant at the 5% level of statistical probability only in Model 1. Through this, it can be seen that CSR activities and tax avoidance are in a positive (+) relationship. Looking at the control variables, in both Model 1 and Model 2, the coefficients of ROA, INTAN, and EXPR are negative (--) and the coefficients of LEV are positive (+), but they are not statistically significant. In both Model 1 and Model 2, the coefficient of PPE showed a significant negative (--) value at the statistical probability 5% level, and the coefficient of SIZE showed a significant positive (+) value at the statistical probability 10% level. This can be interpreted as being active in tax avoidance because the Korean tax law grants tax benefits such as investment tax deductions to assets subject to depreciation, and the coefficient of ? SALES is positive (+) in Model 1 and Model 2, but it is found to be significant at the 5% level of statistical probability only in Model 2. If a company has high growth potential, it is interpreted as being active in tax avoidance. Although the explanatory power R2 of Model 1 and Model 2 is slightly lower at 11.15% (p<0.001) and 7.3% (p<0.001), respectively, it is difficult to deny its academic value because it is significant at the 1% level of statistical probability.

Hypothesis 1's verification results are generally positive relationship because companies avoid taxes to finance CSR activities, or do not accept tax payments as part of CSR activities and CSR chooses to replace taxes. In Model 1, the null hypothesis of Hypothesis 1 is rejected.

A regression analysis is conducted to verify the moderating effect of a large scale business group on the relationship between CSR and tax avoidance. As a result of examining the mean centered independent variable CSR, the multicollinearity problem did not appear because VIF index is all less than 10 at 1.073 to 6.009. Table 4 presents the results of regression analysis. Looking at the coefficient of the interaction term, in Model 1 and Model 2, the regression coefficient of the interaction term CSR×GROUP is 0.229 and 0.215, which are found to have a negative (--) value, and is significant at the 1% level of statistical probability. In the relationship between CSR activities and tax avoidance, a large scale business group significantly adjusted in the negative (--) direction, and a large scale business group are found to alleviate the positive (+) relationship between CSR and tax avoidance.

| Table 4 Regression Result For Hypothesis 2 |

||||

|---|---|---|---|---|

| Variable | Model 1 (Dependent variable : TS) |

Model 2 (Dependent variable : BTD) |

||

| Coefficient | t-value | Coefficient | t-value | |

| (Constant) | -0.120*** | -2.867 | -0.136*** | -3.002 |

| CSR | 0.306*** | 3.429 | 0.207** | 2.259 |

| GROUP | -0.014 | -0.265 | -0.017 | -0.328 |

| CSR*GROUP | -0.229*** | -2.838 | -0.215*** | -2.600 |

| ROA | -0.050 | -1.125 | -0.064 | -1.412 |

| LEV | -0.002 | -0.054 | 0.001 | 0.019 |

| PPE | -0.137*** | -3.224 | -0.110** | -2.497 |

| INTAN | -0.047 | -1.093 | -0.061 | -1.407 |

| SIZE | 0.127** | 2.119 | 0.129** | 2.105 |

| ?SALES | 0.030 | 0.734 | 0.126*** | 3.087 |

| EXPR | -0.069** | -1.793 | -0.029 | -0.742 |

| Year Dummy | Included | Included | Included | Included |

| Industry Dummy | Included | Included | Included | Included |

| F-value | 3.693*** | 2.397*** | ||

| R2 | 0.122 | 0.083 | ||

| N | 689 | 689 | ||

Conclusion

In this study, the relationship between corporate social responsibility activities and tax avoidance was confirmed, and an empirical analysis was conducted on whether belonging to a large corporate group plays a moderating role in the relationship between these variables. As a proxy for corporate social responsibility activities, ESG scores calculated by the Korea Governance Agency were used, and tax avoidance used the method proposed by Desai and Dharmapala (2006) and the difference between financial and tax reporting profits (BTD). For hypothesis verification, an empirical analysis was conducted as a study sample of 689 companies listed on the securities exchange during the period from 2013 to 2015.

As a result of the verification of Hypothesis 1, CSR, a measure of corporate social responsibility activity, generally showed a positive (+) value for the dependent variable, the tax avoidance measure. Although it was not significant in BTD, a tax avoidance measure, it was significant at the 5% level for TS. This can be attributed to the perception that CSR replaces taxes without companies avoiding taxes or accepting tax payments as part of social responsibility activities to finance CSR activities. As a result of additional verification of hypothesis 2 to verify the moderating effect of belonging to a large business group, it was confirmed that companies belonging to a large business group had a strongly moderating effect of easing the positive relationship between social responsibility activities and tax avoidance or changing it to a negative direction. This provides a basis for reasoning that companies belonging to large business groups do not need to finance CSR activities through tax avoidance, but rather, there are cases where the effect of CSR activities is less likely to be diluted.

This study empirically analyzed the relationship with tax avoidance using the corporate governance agency's ESG score as a proxy variable for CSR. Among the mixed results of corporate social responsibility activities and tax avoidance, this study supports the argument that tax avoidance is more active as CSR activities are active, and it can be said that this relationship has been mitigated or reversed in Korea's special corporate type.

Acknowledgement

This research was financially supported by Hansung University. The corresponding author is Kyunbeom Jeong.

References

Aguilera, R.V., Rupp, D.E., Williams, C.A., & Ganapathi, J. (2007). Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Academy of management review,32(3), 836-863.

Indexed at, Google Scholar, Cross Ref

Bertrand, M., Mehta, P., & Mullainathan, S. (2002). Ferreting out tunneling: An application to Indian business groups.The Quarterly Journal of Economics,117(1), 121-148.

Indexed at, Google Scholar, Cross Ref

Baek, J.S., Kang, J.K., & Lee, I. (2006). Business groups and tunneling: Evidence from private securities offerings by Korean chaebols.The Journal of Finance,61(5), 2415-2449.

Indexed at, Google Scholar, Cross Ref

Branco, M.C., & Rodrigues, L.L. (2006). Corporate social responsibility and resource-based perspectives.Journal of business Ethics,69(2), 111-132.

Indexed at, Google Scholar, Cross Ref

Desai, M.A., & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives.Journal of financial Economics,79(1), 145-179.

Indexed at, Google Scholar, Cross Ref

Davis, A.K., Guenther, D.A., Krull, L.K., & Williams, B.M. (2016). Do socially responsible firms pay more taxes?.The accounting review,91(1), 47-68.

Hasseldine, J., & Morris, G. (2013, March). Corporate social responsibility and tax avoidance: A comment and reflection. InAccounting Forum(Vol. 37, No. 1, pp. 1-14). Taylor & Francis.

Indexed at, Google Scholar, Cross Ref

Johnson, S., Boone, P., Breach, A., & Friedman, E. (2000). Corporate governance in the Asian financial crisis.Journal of financial Economics,58(1-2), 141-186.

Indexed at, Google Scholar, Cross Ref

Khanna, T., & Palepu, K. (2000). Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups.The journal of finance,55(2), 867-891.

Indexed at, Google Scholar, Cross Ref

Khanna, T., & Yafeh, Y. (2007). Business groups in emerging markets: Paragons or parasites?.Journal of Economic literature,45(2), 331-372.

Shin, H.H., & Park, Y.S. (1999). Financing constraints and internal capital markets: Evidence from Koreanchaebols'.Journal of corporate finance,5(2), 169-191.

Trevino, L.K. (1986). Ethical decision making in organizations: A person-situation interactionist model.Academy of management Review,11(3), 601-617.

Indexed at, Google Scholar, Cross Ref

Watson, L. (2011). Corporate social responsibility and tax aggressiveness: An examination of unrecognized tax benefits.The Pennsylvania State University working paper.

Watson, L. (2015). Corporate social responsibility, tax avoidance, and earnings performance.The Journal of the American Taxation Association,37(2), 1-21.

Indexed at, Google Scholar, Cross Ref

Received: 23-May-2022, Manuscript No. IJE-22-12054; Editor assigned: 25-May-2022, Pre QC No. IJE-22-12054 (PQ); Reviewed: 08 -Jun- 2022, QC No. IJE-22-12054; Revised: 10-Jun-2022, Manuscript No. IJE-22-12054 (R); Published: 17-Jun-2022