Research Article: 2021 Vol: 25 Issue: 4S

Development of accounting information systems according to the accounting variances and the requirements of International Accounting Standard (IAS) no. 1

Atala Alqtish, Al-Zaytoonah University of Jordan

Adel Qatawneh, Al-Zaytoonah University of Jordan

Dina Alhaj, Income Tax Department

Abstract

This study aims developing accounting information systems according to the accounting variances and the requirements of international accounting standard No. (1) in Jordanian telecommunications companies. Thus, the researchers has prepared special questionnaire to gather necessary data and information. The questionnaire has been addressed to the accountants, heads of accounting departments, financial managers and internal auditors at the Jordanian telecommunications companies. Whereas 70 questionnaires have been distributed, 64 of which have been recovered and 4 questionnaires have been excluded due to their invalidity. Questionnaire's data have been analyzed using (SPSS) through the descriptive statistics such as, arithmetic averages, standard deviations and (T) One Sample T-Test. A set of results has been concluded, the most important of which are: 1. Developing the accounting information systems can provide timely accounting information in order to make the decisions. 2. Focusing on providing accounting information at the lowest cost when developing accounting information systems. 3. Providing accounting information having predictive capability when developing accounting information system is taken into account. In the light of the foregoing results, a set of recommendations has been concluded. The most important of which: 1. Shaping the accounting information systems with appropriate flexibility when their updating and developing are required in order to be matched with the new conditions occurred in the establishment. 2. Determining subsystems in accounting information systems that require special attention and concern, upon which the development process to be carried out. 3. Determining data and facts in connection with accounting information systems and establishing the logical relationships connecting them in order to determine the specifications and dimensions of the new system.

Keywords

Accounting Information, Information Systems, Telecommunications, Jordan

Introduction

Information Systems (IS) currently depict an important facet of our modern life, in particular, the several and expanded uses of these systems to include various fields ranging from the Universal sciences through social, economic and administrative sciences. Concepts of Information systems are considered the pillar of information systems, the assimilation of these systems' concepts helps in understanding concepts related to information development, the accounting information system is the backbone of the company. Accordingly, it must be fortified to significantly contribute more effectively to the growth of the company (Hanan, 2006).

Technology can be planned and managed using information systems techniques. An effective technological strategy should analyze and assess the relative importance of these factors in terms of the overall strategy of the organization. Information has become the most important element distinguishing successful organizations from the unsuccessful ones. Without information, decision making becomes random and economically costly. Hence, we need to find an information administration/ management that undertakes providing the necessary information with speed, accuracy, cost and appropriate time (Hussein, 2006).

Statement of the Problem and its Elements

Due to the progress and widespread use of accounting information systems on one hand and its high costs on the other hand, it is necessary to consider the tendency of these systems to provide information on the grounds that this information is a valuable product. In addition, it is of a high priority to develop Information Production and Deployment Systems for the purpose of imposing systems to adequate measurement, monitoring and control in such a way that ensures maximum benefit.

The excess of information is much better than the lack of it, but the problem is not the augmentation of information, but the problem arises from the costs of spending on its inquiry. The cost-benefit of acquiring Information may be in the undesired side as the problem of developing and applying information systems currently is no longer resembled in the production of information, but extends to the assessment of systems productive outputs of information that has to be properly classified, archived, retrieved, disseminated and used, all of which have costs. Accounting information systems must be developed to provide appropriate output (information) suitable for decision-making (Schroeder et al., 2005).

Therefore, the purpose of this study is to develop accounting information systems in the light of the accounting variables and the requirements of International Accounting Standard (IAS # 1).

This can be Achieved by Answering the Following Questions:

1. Are the accounting information systems in Jordanian telecom companies developed on the basis of providing information that is consistent with the objectives?

2. Are the accounting information systems in Jordanian Telecom companies developed on the basis of providing verifiable information?

3. Are the accounting information systems in Jordanian telecom companies developed on the basis of providing unbiased information?

4. Are accounting information systems developed in Jordanian telecom companies based on the providing quantifiable information?

Study Hypotheses

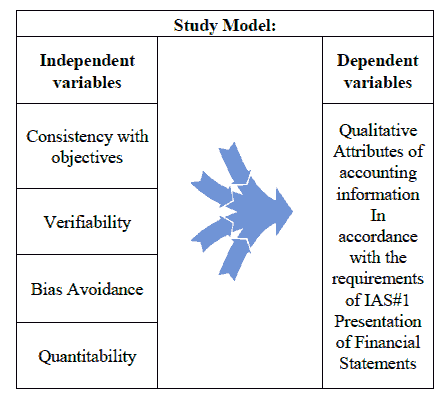

1. There is no statistically significant impact of providing information consistent with the objectives on the development of accounting information systems in Jordanian telecom companies.

2. There is no statistically significant impact of providing verifiable information on the development of accounting information systems in Jordanian telecom companies.

3. There is no statistically significant impact of providing unbiased information on the development of accounting information systems in Jordanian telecom companies.

4. There is no statistically significant impact of providing quantifiable information on the development of accounting information systems in Jordanian telecom companies.

The Development of accounting information systems according to the cost/ benefit standard

The Significance of the Study

The importance of the development of accounting information systems is due to the importance of information and it's evaluation as one of the elements of production because it has a framework that surrounds the cycle of the physical flow of the factors of production, expresses them, connects them, measures their outputs and then measures the basis for their planning and control. Information is also the element that ensures the interaction of other elements. Hence, it is imperative to provide accounting information that is appropriate, unbiased, verifiable and quantifiable.

Defining Procedural Terms

Accounting Information System: A set of components and procedures that include the collection, operation, storage, distribution, dissemination and retrieval of information in order to strengthen decision-making processes and control within the organization.

Bias Avoidance: The importance of this standard is due to the potential conflicts between the needs of the user groups of the financial statements, especially the potential conflicts between the interests of the administration in contrast with the interests of other groups. Therefore, accounting information should be objective and unbiased.

Quantitative Measurability: Means non-adherence to absolute measurements, but can be based on the idea of the Range in measurement and the possibility of multiple disclosures in the same lists using more than one assessment methodology.

Verifiability: The measurement is intended to be of a low level of variation/ deviation.Timeliness means that the information is available for the user when it is actually needed in order to make a particular decision, and that the information is not obsolete when consumed or when it is used, that is, to make the information available quickly enough.

Economy: A measure of the amount of resources to be allocated in order to obtain the required information.

Relevance: This means that there are evidences to enhance the user's confidence in this information, and it's reliability (free from bias) and represents the reality it expresses.

Study Population and Sample

In light of the study problem and its objectives, the study population will consist of:

Accountants, heads of accounting departments, financial managers and internal auditors of the three companies in the Jordanian telecom sector (Orange, Zain, Umniah).

As these categories represent the most capable categories for answering the study questions as practitioners of the accounting profession and familiar with process mechanism of accounting information systems.

The sample of the study was randomly selected from the study population. The sample of the study was 70. Seventy questionnaires were distributed to the study population. Sixty-four of these questionnaires were retrieved and four of which were excluded.

Study Tools

The data and information collection needed to prepare this study was based on two sources:

Secondary sources: Reference was made to IAS#1, Books, Periodicals, Articles, Research, and unpublished studies that examined the subject of the study in order to serve this study in the preparation of the Literature Review part.

Preliminary sources: The data and information needed to test the hypotheses were obtained through a questionnaire prepared by the researcher to serve this study in preparing the practical part.

Study Procedures

The questionnaire was used in collecting data and information needed for the study and then to analyze the data using the SPSS program in order to test the hypotheses of the study.

Methodology and Procedures

Study Sample and Population

In light of the study problem and its objectives, the study population will consist of:

Accountants, heads of accounting departments, financial managers and internal auditors of the three companies in the Jordanian telecom sector (Orange, Zain, Umniah).

As these categories represent the best categories capable of answering the study questions as accountants of the accounting profession and familiar with the mechanism of accounting information systems.

The sample of the study was randomly selected from the study population. The number of individuals in the study sample was 70. Seventy questionnaires were distributed to the study sample members. Sixty-four questionnaires were retrieved and four of which were excluded.

Study Tools

The needed data /information collection for preparation of this study were based on two sources:

Secondary sources: Reference was made to IAS # 1, Books, Periodicals, Articles, Research, and unpublished studies that examined the subject of the study in order to serve the preparation of the theoretical part of this study.

Preliminary sources: The data and information needed for the purpose of testing the hypotheses were obtained through a questionnaire prepared by the researcher to serve the preparation of the practical part of this study.

Study Procedures

The questionnaire (mentioned previously) was used to collect the data and information needed for the study and then to analyze the data using the SPSS program in order to test the hypotheses of the study.

The Design of the Study and its Statistical Processing

The descriptive analytical approach is manifested, where the theoretical part was covered in regard to accounting information systems and IAS # 1. The data on the elements in the hypotheses of the study were collected through the questionnaire in order to describe it and then to analyze it using appropriate statistical tests. In order to test the hypothesis of the study and to reach the appropriate results and recommendations, all of which was based on the following statistical methods:

- Test of credibility/Trustworthiness (Kronbach-alpha).

- Mathematical averages.

- Standard Deviations.

- One Sample T-Test.

Stability of the Study Instrument

To confirm the stability of the tool, the internal consistency was calculated on an additional external sample in addition and outside of the study sample (30) according to the Kronbach Alpha equation. The table (1) below shows these coefficients:

| Table 1 Coefficient of Internal Consistency Kronbach Alpha |

|

|---|---|

| Field/ Area | Internal Consistency |

| Providing information that is consistent with objectives | 75% |

| Provide verifiable information | 79% |

| Providing unbiased information | 71% |

| Provide quantifiable information | 76% |

| Tool as a whole | 84% |

The coefficient of consistency/reliability (Kronbach Alpha) was used to measure the degree of reliability of the responses to the statements of the questionnaire. The coefficient is based on measuring the internal stability of the questionnaire statements to be able to provide consistent results for the responses of the sample members in response to the questionnaire statements. The coefficient of kronbach alpha is in the range between 0-1 and it is statistically accepted if it was above (80%). Thus, the credibility of the tool is good and we can generalize the results. The result of Kronbach Alpha test for the tool as a whole is 84%. This means that there is a high degree of credibility in the answers and that we may generalize the results.

The Personal Characteristics of the Study Sample are as Follows

First: Distribution of the Study Sample by Gender

| Table 2 Distribution of The Study Sample By Gender |

|||

|---|---|---|---|

| Category | Frequency | Percentage | |

| Gender | Male | 42 | 70% |

| Female | 18 | 30% | |

| Total | 60 | 100% | |

Table (2) shows that the percentage of males was (70%) and females were (30%). This means that the number of males who hold the accounting and auditing positions exceeds the number of females who hold the same positions.

Second: Distribution of the Sample of the Study According to the Functional Level

| Table 3 Distribution of The Study Sample By Position Title |

|||

|---|---|---|---|

| Category | Frequency | Percentage | |

| Position Title | Financial Manager | 4 | 6.70% |

| Head of Accounting Section | 3 | 5.00% | |

| Internal Auditor | 4 | 6.70% | |

| Accountant | 49 | 81.60% | |

| Total | 60 | 100% | |

Table (3) indicates the distribution of the study sample according to the position title/ level. It is noted that most of the respondents are employed as accountants (81.6%). The percentage of those with the position of internal auditor or financial manager (6.7%), Accounting department manager (5%).

Third: Distribution of the Study Sample according to Academic Qualification

| Table 4 Distribution of The Study Sample of The According To Academic Qualification |

|||

|---|---|---|---|

| Categories | Frequency | Percentage | |

| Academic Qualification | Bachelor | 42 | 70% |

| Masters | 18 | 30% | |

| Total | 60 | 100% | |

Table (4) illustrates that (70%) of the study sample members are bachelor's degree holders, while (30%) of the sample members are master's degree holders which exemplifies that telecommunications companies have employees with higher degrees.

Fourth: Distribution of the Study Sample by Academic Major

| Table 5 Distribution of The Study Sample of The By Academic Major |

|||

|---|---|---|---|

| Categories | Frequency | Percentage | |

| Academic Major | Accounting | 51 | 85.00% |

| Business Administration | 2 | 3.30% | |

| Economy | 3 | 5.00% | |

| Banking and Financial Sciences | 4 | 6.70% | |

| Total | 60 | 100% | |

Data presented in Table (5), as related to academic major indicate that most of the study sample members are Accounting certificate holders, which constitutes (85%). Finance and Banking certificate holders constitute (6.7%), (5%). Business Administration certificate holders constitute (3.3%); this is due to the aptness of the accounting major to occupy such accounting functions.

Fifth: Distribution of the Study Sample by Years of Experience

| Table 6 Distribution of The Study Sample Members By Years of Experience |

|||

|---|---|---|---|

| Categories | Frequency | Percentage | |

| years of experience | Less than 3 Years | 4 | 6.70% |

| 3 to less than 6 Years | 19 | 31.70% | |

| 6 to less than 10 years | 22 | 36.60% | |

| 10 Years or over | 15 | 25.00% | |

| Total | 60 | 100% | |

Data shown in Table (6), as related to the distribution of the study sample based on years of experience, indicates that the percentages reached were:

36.6% (for those with 6 years to less than 10 years of experience),

31.7% (for those with 3 years to less than 6 years of experience),

25% (for those with 10 years of experience or over), and

6.7% (for those with less than 3 years of experience).

This indicates that the members of the study sample have a sufficient experience to understand the contents of the questionnaire and subsequently, answer it with awareness and understanding. This in return, increases the truthiness of the study results.

Sixth: Distribution of the Sample of the Study by Age Groups.

| Table 7 Distribution of Study Sample Members By Age Groups |

|||

|---|---|---|---|

| Categories | Frequency | Percentage | |

| Age Groups | 30 Years old or Less | 16 | 26.70% |

| 31 Years old to less than 40 Years old | 35 | 58.30% | |

| 40 Years old to less than 50 Years old | 9 | 15.00% | |

| Total | 60 | 100% | |

Table (7) shows the distribution of the study sample by age groups. It is noted that their ages are distributed variably among categories. Most of the answers are in the age group (31 - less than 40 years) by 58.3%, followed by the age groups (30 years or less) And (40 - less than 50 years), where their proportion of the total number of the sample members counted to 26.7% and 15% respectively, and this distribution shows that most of the respondents are of the younger age group.

Results and Recommendations

Data Analysis

In order to develop accounting information systems in light of the accounting changes and the requirements of IAS # 1, the study relied on the preliminary data collected using the questionnaire designed for this purpose. The questionnaire was used to facilitate the description of data attributes as well as the illustration of sample member responses. The (Lickert - five answers/points) scale has been instrumented in order to measure the opinions of the study sample members on each of the statements (or arguments) of the questionnaire, and for the purposes of data analysis, each of the five answers/points was weighted to commensurate with the importance of each answer, the five answers were allocated as follows:

- Strongly Agree: Weight given (5)

- Agree: Weight given is (4)

- Neutral: Weight given is (3)

- Disagree: Weight given is (2)

- Strongly disagree: Weight given is (1)

Due to the absence of a reliable normal distribution, the average of the questionnaire responses was classified as follows:

- 1 to less than 2.5 resembles a weak level.

- 2.5 to less than 3.5 resemble an average level.

- 3.5 to less than 5 resemble a high level.

Hypotheses Testing

The Main Hypothesis: There is no statistically significant impact of providing information consistent with the objectives on the development of accounting information systems in Jordanian telecom companies.

In order to evaluate the correctness of this hypothesis, averages and standard deviations of the statements were calculated regarding the extent to which information consistent with the objectives would have an impact on the development of accounting information systems. The table (8) below illustrates this.

| Table 8 Averages And Standard Deviations of Statements/Expressions Related to Providing Information Consistent With The Objectives And Its Impact on The Development of Accounting Information Systems in Descending Order By Calculated Averages |

|||||

|---|---|---|---|---|---|

| Rank | No. | Statement/Expression | Average | Standard Deviation | Importance |

| 1 | 1 | Accounting information systems are developed based on providing accounting information in a timely manner | 4.57 | 0.5 | High |

| 2 | 3 | Accounting information systems are developed based on considering feedback | 4.55 | 0.5 | High |

| 3 | 5 | Accounting information systems are developed based on providing accounting information at the lowest cost | 4.5 | 0.54 | High |

| 4 | 9 | Accounting information systems are developed based on providing the appropriate information to complete the control process | 4.5 | 0.54 | High |

| 5 | 7 | Accounting information systems are developed based on providing appropriate accounting information for planning decisions | 4.47 | 0.54 | High |

| 6 | 6 | Accounting information systems are developed based on providing accounting information based on relative importance | 4.4 | 0.49 | High |

| 7 | 4 | Accounting information systems are developed based on providing information about their users' needs | 4.38 | 0.49 | High |

| 7 | 8 | Accounting information systems are developed based on providing appropriate accounting information for making investment decisions | 4.38 | 0.49 | High |

| 9 | 2 | Accounting information systems are developed based on providing accounting information with a high forecasting capacity | 4.37 | 0.49 | High |

| Field | Development of accounting information systems based on providing appropriate accounting information | 4.46 | 0.26 | High | |

Table (8) shows that the averages calculated ranged between (4.37 - 4.57), where statement/expression (1), that "the accounting information systems are developed by providing accounting information in a timely manner" ranked first with an average of (4.57), followed by statement/expression # 3, that "Accounting information systems are developed based on considering feedback" with an average of (4.55), followed with an average of (4.5) by the statement/expression (5), "Accounting information systems are developed by providing Accounting information at the lowest cost ", and statement/expression (9), that " Accounting information systems are developed based on providing the appropriate information to complete the control process." then with an average of (4.47), " Accounting information systems are developed based on providing appropriate accounting information for planning decisions", followed with an average (4.40), by statement/expression (6), that " Accounting information systems are developed based on providing accounting information based on relative importance.", then two statements/expressions with an average of (4.38) each, statement/expression (4), that " Accounting information systems are developed based on providing information about their users' needs", and statement/expression # 8, that " Accounting information systems are developed based on providing appropriate accounting information for making investment decisions", and finally, ranking last, with an average of (5.37), statement # 2, that " Accounting information systems are developed based on providing accounting information with a high forecasting capacity".

The First Sub-Hypothesis: Providing information consistent with the objectives has no significant impact on the development of accounting information systems in Jordanian telecom companies.

Testing the First Hypothesis

The average of the acceptance or rejection of the hypothesis was also compared to the average (3) using T test and the table below shows this.

The calculated averages were compared to the acceptance/rejection ratios of the hypothesis using the T-Test (3, as illustrated in the table below:

| Table 9 Test The First Hypothesis Using T-Test |

||||

|---|---|---|---|---|

| Average | Standard Deviation | "t" Value | Statistical Significance | |

| Develop accounting information systems by providing accounting information that is consistent with objectives | 4.46 | -0.26 | 43.079 | 0 |

Table (9) shows the result of the statistical analysis of the T-test. The result of the statistical analysis was that the average was 4.46, which is greater than the standard mean (3) and by a standard deviation of (0.26), the value of a=0.000, and that the value of T is (43.079), which is a value with s statistical significance at the level of significance (a< 0.05), which means the rejecting the null hypothesis and accepting the alternative hypothesis, that states: "Providing information consistent with the objectives has an impact on the development of accounting information systems in Jordanian telecom companies."

The Second Hypothesis: There is no statistically significant effect of providing verifiable information on the development of accounting information systems in Jordanian telecom companies.

To validate this hypothesis, the averages and standard deviations of the expressions related to the extent to which verifiable information affect the development of accounting information systems have been extracted. The table 10 below illustrates this.

| Table 10 The Arithmetical Averages and Standard Deviations of Terms Relating to The Provision of Verifiable Information on The Development of Accounting Information Systems Are Arranged in Descending Order By Arithmetical Averages |

|||||

|---|---|---|---|---|---|

| Rank | No. | Statement/Expression | Average | Standard Deviation | Importance |

| 1 | 1 | Accounting information systems are developed based on providing reliable accounting information | 4.53 | 0.54 | High |

| 2 | 3 | Accounting information systems are developed based on providing accounting information that can be understood | 4.5 | 0.5 | High |

| 3 | 2 | Accounting information systems are developed based on providing accounting information that can be verified with a high accuracy | 4.48 | 0.5 | High |

| 4 | 4 | Accounting information systems are developed through the provision of comprehensive accounting information | 4.43 | 0.5 | High |

| 5 | 6 | Accounting information systems are developed based on providing clear and unambiguous accounting information | 4.42 | 0.5 | High |

| 6 | 5 | Accounting information systems are developed based on providing accurate accounting information | 4.4 | 0.53 | High |

| Field | Accounting information systems are developed based on providing verifiable accounting information | 4.46 | 0.32 | High | |

Table (10) shows that the calculated averages ranged between (4.40 - 4.53), where the phrase (1), which states that " Accounting information systems are developed based on providing reliable accounting information" in the first place with an average of (4.53), Followed by phrase (3) " Accounting information systems are developed based on providing accounting information that can be understood " with an average of (4.50). Followed by phrase (2), which reads: " Accounting information systems are developed based on providing accounting information that can be verified with high accuracy" with an average of 4.48, while the statement No. 5 reads: " Accounting information systems are developed based on providing clear and unambiguous accounting information “at the last rank with an average of (4.40). The field “Development of accounting information systems by providing verifiable accounting information" averaged as a whole (4.46).

Testing the Second Sub-Hypothesis

The average of acceptance/rejection of the hypothesis was also compared to the hypothetical mean (3) using T-test and the table below illustrates this.

| Table 11 Testing The Second Hypothesis Using T-Test |

||||

|---|---|---|---|---|

| Average | Standard Deviation | "t" Value | Statistical Significance | |

| Development of accounting information systems by providing verifiable accounting information | 4.46 | 0.32 | 35.108 | 0 |

Table (11) shows the result of the statistical analysis of the T-test. The result of the statistical analysis was that the calculated average was 4.46, which is greater than the standard average (3) and by a standard deviation of (0.32), and that the value of α=0.000, and T value of (35.108), which is statistically significant at the level of significance (α<0.05), which means rejecting the null hypothesis and accepting the alternative hypothesis which states: "There is no statistically significant effect of providing verifiable information on the development of accounting information systems in Jordanian telecom companies."

The Third Sub-Hypothesis: There is no statistically significant effect by providing unbiased information on the development of accounting information systems in Jordanian telecom companies.

In order to validate this hypothesis, the averages and standard deviations of the expressions related to the extent to which biased information may affect the development of accounting information systems were provided. The table 12 below illustrates this.

| Table 12 Accounting Averages and Standard Deviations For Expressions of Providing Unbiased Information in Relevance To The Development of Accounting Information Systems Are Arranged in Descending Order By Averages |

|||||

|---|---|---|---|---|---|

| Rank | No. | Statement/Expression | Average | Standard Deviation | Importance |

| 1 | 6 | Accounting information systems are developed based on providing accounting information that meets disclosure requirements | 4.57 | 0.5 | High |

| 2 | 5 | Accounting information systems are developed based on the provision of accounting information free from distortion | 4.5 | 0.5 | High |

| 3 | 3 | Accounting information systems are developed based on providing accounting information that presents undisputed facts | 4.47 | 0.5 | High |

| 4 | 2 | Accounting information systems are developed based on providing unbiased accounting information | 4.43 | 0.53 | High |

| 5 | 4 | Accounting information systems are developed based on providing reliable accounting information | 4.42 | 0.5 | High |

| 6 | 1 | Accounting information systems are developed based on providing unbiased accounting information | 4.37 | 0.52 | High |

| Field | Accounting information systems are developed based on providing unbiased accounting information | 4.46 | 0.3 | High | |

Table (12) shows that the calculated averages ranged between (4.37- 4.57). Phrase (6) which states that "Accounting Information Systems are developed based on providing accounting information that meets disclosure requirements" ranked first with an average of 4.57 ), Followed by the phrase (5) which reads: "Accounting information systems are developed based on the provision of accounting information free from distortion" with an average of (4.50), Phrase (3) came next, which reads: "Accounting information systems are developed based on providing accounting information that presents the facts in an undisputed manner" with an average of (4.47), while phrase (1) that reads: "Accounting information systems are developed based on Providing unbiased accounting information "at the last rank with an average of 4.37. The field average as a whole as related to providing unbiased accounting information accounted for (4.46).

Testing the Third Sub-Hypothesis

The average for acceptance/rejection of the hypothesis was also compared to the mean (3) using T-test and the table below illustrates this.

| Table 13 Testing Hypothesis 3 Using T-Test |

||||

|---|---|---|---|---|

| Average | Standard Deviation | "t" Value | Statistical Significance | |

| Development of accounting information systems through the provision of unbiased accounting information | 4.46 | 0.3 | 37.844 | 0 |

Table (13) shows the result of the statistical analysis of the T test. The result of the statistical analysis was that the average was 4.46, which is greater than the standard average (3) and with a standard deviation of (0.30) and that the value of α=0.000 and T value of (37.844), A value with a statistical significance at the level of significance (α< 0.05), which means the rejection of the null hypothesis and acceptance of the alternative hypothesis which states: There is a statistically significant effect by providing unbiased information on the development of accounting information systems in Jordanian telecom companies.

The Fourth Sub-Hypothesis: There is no statistically significant effect by providing quantifiable information on the development of accounting information systems in Jordanian telecom companies.

To validate this hypothesis, averages and standard deviations of the statements regarding the extent to which quantifiable information provided affects the development of accounting information systems have been extracted. The table below illustrates this.

| Table 14 Averages And Standard Deviations of Statements Related to The Effect of Providing Quantifiable Information on The Development of Accounting Information Systems Are Arranged in Descending Order By Averages |

|||||

|---|---|---|---|---|---|

| Rank | No. | Statement/Expression | Average | Standard Deviation | Importance |

| 1 | 2 | Accounting information systems are developed by providing accounting information free from bias in measurement | 4.5 | 0.5 | High |

| 1 | 4 | Accounting information systems are developed by providing accurate accounting information that precisely reflects the reality | 4.5 | 0.54 | High |

| 3 | 3 | Accounting information systems are developed by providing accounting information on available alternatives | 4.47 | 0.54 | High |

| 4 | 1 | Accounting information systems are developed by providing accounting information that can be quantitatively measured | 4.43 | 0.5 | High |

| 4 | 7 | Accounting information systems are developed by providing accounting information valid for accounting measurement | 4.43 | 0.5 | High |

| 6 | 5 | Accounting information systems are developed by providing full accounting information about the company's resources | 4.27 | 0.55 | High |

| 7 | 6 | Accounting information systems are developed by providing customer satisfaction information | 4.08 | 0.5 | High |

| Field | Development of accounting information systems through the provision of quantifiable accounting information | 4.38 | 0.27 | High | |

Table (14) shows that the calculated averages ranged from 4.08 to 4.50, where the two phrases (2 and 4), "Accounting information systems are developed through the provision of accounting information free from bias in measurement" and " Through the provision of accounting information which precisely expresses the reality “in the first place with an average of (4.50), Followed by the third paragraph (3), "Accounting information systems are developed by providing accounting information on available alternatives" with an average of (4.47), while the phrase "Accounting information systems are developed by providing information about customer satisfaction" at the last rank with an average of (4.08). The average was to provide quantifiable accounting information as a whole (4.38).

Testing the Fourth Sub-Hypothesis

The average acceptance/rejection of the hypothesis was also compared to the mean (3) using T-test and the table below illustrates this.

| Table 15 Test The Fourth Hypothesis Using The Test (T) |

||||

|---|---|---|---|---|

| Average | Standard Deviation | "t" Value | Statistical Significance | |

| Development of accounting information systems through the provision of quantifiable accounting information | 4.38 | 0.27 | 39.478 | 0 |

Table (15) shows the result of the statistical analysis of the T-test. The result of the statistical analysis is that the average was 4.38, which is greater than the standard mean (3) and with a standard deviation of (0.27) and that the value of a=0.000 and T value of (39.478), which is statistically significant at the level of significance (a< 0.05), which means rejecting the null hypothesis and accepting the alternative hypothesis which states: There is a statistically significant effect by providing quantifiable information on the development of accounting information systems in Jordanian telecom companies.

Results

By reviewing the study’s literature (or theoretical) part as well as the field study, the researcher has reached a set of results in regard to the development of accounting information systems in the light of the accounting variables and the requirements of IAS#1:

1. The development of accounting information systems arranges for timely accounting information for decision making.

2. The focus is on providing accounting information at the lowest cost in the process of developing accounting information systems.

3. Accounting information that has a predictive capacity in the future is taken into consideration when developing accounting information systems.

4. When developing an accounting information system, accounting information that can be demonstrated and understood would be facilitated.

5. Throughout the development of accounting information systems, emphasis is given for providing accounting information that is verified and integrated.

6. Accurate and unambiguous accounting information is obtained through the development of accounting information systems.

7. Accounting information is obtained to meet the disclosure requirements for the development of accounting information systems.

8. The development of accounting information systems provides reliable accounting information and presents ample facts.

9. The development of accounting information systems provides neutral and unbiased accounting information.

10. The development of accounting information systems provides accounting information free from bias in measurement and reflects reality.

11. The development of accounting information systems provides accounting information that can be measured quantitatively about available alternatives.

12. The development of accounting information systems provides valid and complete accounting information about the company's resources.

Recommendations

In the light of the findings of the study, the researchers recommend a set of recommendations:

1. Accounting information systems should be flexible enough when it is necessary to be updated and developed as to adapt to the contingencies of the enterprise.

2. Identification of subsystems in accounting information systems needs special care and attention to conduct information systems development processes.

3. Data and facts determination as related to the accounting information systems in addition to articulating logical relationships between them should be championed for determining the specifications and dimensions of the new system.

4. When developing accounting information systems, it is crucial to take into account the cost of obtaining accounting information and comparing it with the expected benefit of accounting information.

5. When developing accounting information systems, it is critical to provide accounting information that is consistent with the objectives and meet the needs of all users of accounting information.

6. When developing accounting information systems, it is important to provide accounting information that has the essence above the form (its economic reality above the legal form).

7. The necessity to train and the employees involved in accounting information systems and to indulge them in its’ development in order to let them adapt on using such systems.

8. Further studies should be carried out on the development of accounting information systems due to its’ importance in achieving value added for the company.

References

- Alfred-son, A. (2005). Applying International accounting standards. John Willy & Sons, Inc.

- George, H.B., & Williams, H. (2004). Accounting Information Systems (9th edition), New Jersey, Pearson Prentice Hall.

- Jeffrey, A.H., George, J.F,. & Josephs, S.V. (2005). Modern systems analysis and design (4th edition). New Jersey, Pearson Prentice Hall.

- IASB, (2007). International financial reporting standards. IASCF, London, UK.

- Kenneth, E.K., & Julie, E.K. (2005). Systems analysis and design (4th edition). New Jersey, Pearson Prentice Hall.

- Donalad, E.K., Jerry, J.W., Terry, D.W., & Warfield, W. (2006). Intermediate accounting, (14th Edition). John Willy & Sons, Inc, 44.

- Richard, G., Schroeder., & Myrtle, W.C. (2005). Accounting theory, (4th edition). New York: John Wiley & Sons University of Calgary, Canada, Inc., 18

- Asta, R., & Linas, S. (2003). Development of a model for evaluation of effectiveness of accounting information systems. EFITA, 59.

- Ismail, N.A., & King-Malcolm. (2007). Factors influencing the alignment of accounting information systems in small and medium sized Malaysian manufacturing firms. Journal of Information System & Small Business, 1(2), 1-20.

- Mashhour, A., & Zaatreh, Z. (2008). Framework for evaluating the effectiveness of information systems at Jordan banks: An empirical study. Journal of Internet Banking and Commerce, 13, 1-14.