Research Article: 2021 Vol: 25 Issue: 4S

Do Business Model Practices Predict Microenterprise Performance?

Noor Azam Samsudin, Universiti Selangor (UNISEL) Malaysia

Zuraini Alias, Universiti Selangor (UNISEL) Malaysia

Noor Ullah Khan, Universiti Malaysia Kelantan (UMK) Malaysia

Hanieh Alipour Bazkiaei, Universiti Malaysia Kelantan (UMK) Malaysia

Keywords

Business Model Practices, Business Coaching, Microenterprises Performance

Abstract

Microenterprises (MEs) are considered the backbone of the economy and a vital source of job creation, poverty alleviation through business development. In academic research, studies on MEs are relatively less recognized than large, medium, and small-scale enterprises. Indeed, research on MEs is a relatively novel field of study. Low ME performance in Malaysia is due incompatibility of business model practices. The data is collected via survey questionnaires from microenterprises. The 348 microenterprises were targeted. However, only 199 questionnaires were received. Finally, the clean data of 175 were analyzed using the structural equation modeling technique via smart PLS 3.3.3. The findings revealed that business model practices, i.e., product value, customer interface, infrastructure management, and financial aspects, positively impact microenterprise performance. This research provides a comprehensive insight into Malaysian microenterprise owners, and other relevant government regulatory agencies on the role of BMP, business coaching, and microenterprise performance.

Introduction

Microenterprises (MEs) are considered the backbone of the economy for most countries worldwide and an important area for research (Kim & Sherraden, 2014; Jamak, Ghazali & Sharif, 2017). Similarly, in Malaysia (Ekpe, Mat, Al Mamun & Mahdi, 2015; Jamak et al., 2017). MEs are a vital source of job creation, poverty alleviation through business development (Oyekunle & Fillis, 2017). In academic research, studies on MEs are relatively less recognized than large, medium, and small-scale enterprises. Indeed, research on MEs is a relatively novel field of study (Thapa, 2015). In developing economies, MEs also contribute to the economy in terms of employment and GDP more than other larger medium and large size organizations (Chao et al., 2007). Similarly, there is a growing tendency of microenterprises in ASEAN member counties, e.g., Malaysia, Indonesia (Jamak et al., 2017).

Research on business model practices (BMP) has gained importance in the academic world (Zott, Amit & Massa, 2010). BMP refers to conceptualizing elements, relationships, vocabulary, and semantics in formalized patterns (Osterwalder, 2004; Osterwalder & Pigneur, 2010). GBMP is a blueprint for strategy implementation and describes the rationale of how an enterprise creates, delivers, and captures value (Osterwalder & Pigneur, 2010). Low ME performance in Malaysia is due to lack of managerial capabilities (Munoz, Welsh, Chan & Raven, 2015; Pillai & Dam, 2017), incompatibility business model practices (Aziz & Mahmood, 2011), lack of proper training and motivation of owner and microentrepreneur to continue their business (Jamak et al., 2017). Based on previous literature, this study is proposed that Business Model Practices (BMP) will positively impact MEs performance.

Challenges for Malaysian Microenterprises

Microenterprise (MEs) performance is vital for the economic growth and development of the country (Munoz, Welsh, Chan & Raven, 2015; Jamak et al., 2017). Likewise, Malaysian ME have created greater performances by contributing around 35% to (GDP) still need improvement, compared to developed countries to share of enterprises, are above 50%, e.g., Italy with 70% in terms of contribution to GDP. Previous studies have mainly focused on SME’s performance, while the main contribution to GDP comes from MEs in Malaysia. MEs establishments make up around 77% of the total SME establishments. In the service sector, 79.6% of the total establishments are microenterprises (Department of Statistics, 2015). It is pretty encouraging to see an increase in MEs start-ups, but the main challenge is to sustain their performance in the long run (Boey, 2009). However, MEs face significant problems and challenges in Malaysia. The failure rate of new enterprises is almost 90% within five years of their operations (Munoz et al., 2015; Jamak et al., 2017).

Similarly, most Malaysian MEs are experiencing stagnation, which results in low performance (Jamak et al., 2017). The Malaysian government has helped more than 2,000 MEs through mentoring programs to upgrade these enterprises by performance improvement and increase the capabilities of entrepreneurs. National SME Development Council of Malaysia (NSDC) in 2004 a particular program on how to grow and improve microenterprise performance in terms of microenterprises annual sales. Out of 2,000 microenterprises, only 10% had successfully achieved the yearly sales of RM250,000 and hence upgraded to SMEs (Department of Statistics, 2015).

MEs performance. To address the problems of Malaysian MEs experiencing stagnation and low performance (Bakar et al., 2006). Microentrepreneurs need to upgrade their micro-business to a higher business echelon of SMEs (Jamak et al., 2017). Therefore, microentrepreneurs and owners need to enhance their skills through training and awareness programs, i.e., applying business model practices (Aziz & Mahmood, 2011). The current study bridges identified gaps in the literature and examine the relationship between key Business Model Practices (BMP) (product, customer interface, infrastructure management, and financial factors) and MEs performance.

Theoretical foundation and Research Model

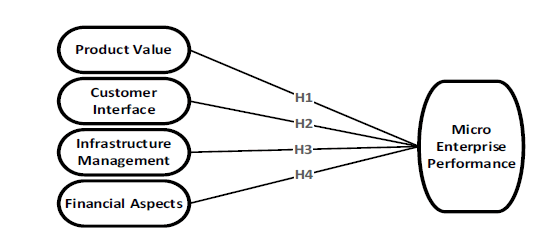

This research study uses the Resource-Based View (RBV) of the firm. RBV was subsequently reformulated by (Barney, 1986). Barney’s (1991) main contribution to the RBV has been to characterize the attributes that make a resource a source of competitive advantage. According to (Wernerfelt, 1984), a resource can be anything that could be thought of as a strength or a weakness of a given enterprise. Consequently, resources can be categorized as tangible resources, such as plant and machinery, or intangible such as tacit knowledge, organizational models and structures, and financial resources (Barney, 1991). Resources can provide a competitive advantage to an enterprise via capabilities, strategic assets, and core competencies (Ambrosini, 2003). Distinctions have sometimes been made between resources and capabilities (e.g., Amit & Schoemaker, 1993; Grant, 1991) and used as synonymous (e.g., Peteraf, 1993). Grant (1991) specifically made the distinction between resources and capabilities. According to this author, resources include tangible resources, such as financial capital and physical assets; intangible resources, reputation, image, product quality; and human resources, such as technical know-how and knowledge. On the other hand, capabilities refer to the enterprise ability to assemble, integrate and deploy valued resources. This section discusses the conceptual model to support the critical objective of the research, which is to identify the impact of business model practices (BMP) on ME performance (Figure 1).

Figure 1 illustrates the current study proposed conceptual model based on RBV of the firm, and the model establishes the relationship between Business Model Practices (BMP) and ME performance. BMP are including product (value proposition), customer interface (customer relationship, distribution channel, and target customer), infrastructure management (core capabilities, partner network, and value configuration), and financial aspects consist of cost structure and revenue streams (Osterwalder, 2004; Osterwalder & Pigneur, 2010).

Research Questions

This research attempts to answer the following four major objectives.

1) To investigate the relationship between product value proposition and ME performance

2) To investigate the relationship between customer interface and ME performance

3) To investigate the relationship between infra-structure management and ME performance

4) To investigate the relationship between financial aspects and ME performance

2.0 Literature Review on Business Model Practices and Microenterprise (ME) Performance

Microenterprise (ME) performance is vital for a firm's survival and is considered a central variable of interest in business management (Richard et al., 2009). ME performance focuses on profitability and long-term survival (Bititci et al., 2012) in a broader context, including financial and non-financial indicators. Previous research examined causes and variations in enterprise performance. Most research studies were conducted at large companies (Senff et al., 2016), leaving a gap for research on microenterprises. Analysis on ME id differentiated from large firms based on factors, e.g., fewer employees, the centralization of decisions, technological limitations, scarcity of resources that impact performance. Thus, sometimes qualitative indicators are also added to measuring performance (Oyemomi et al., 2016).

Research literature discussed the topic of ME performance (Kim & Sherraden, 2014; Khan et al., 2013) and specifically in Malaysia (Abdul Aziz et al., 2012; Paul et al., 2014; Ekpe, Mat, Al Mamun & Mahdi, 2015). In academic research, studies on ME are relatively less recognized than large, medium, and small-scale enterprises (Thapa, 2015). In both developing such as African nations (Chao et al., 2007) and emerging economies like China (Eversole, 2004). ME contributes to the economy in terms of employment and GDP more than other larger medium and large size organizations. In recent years there is a growing tendency of ME in different regions worldwide, such as ASEAN (Malaysia, Indonesia) (Tambunan, 2007). Previous studies have reported various benefits of ME, such as job creation, financial betterment, poverty alleviation (economic improvements, community, and socio-political development (Tamilmani, 2009). All these benefits contribute to economic growth in transforming societies and creating jobs and revenue creation. This implies that the importance of ME performance should be reconsidered (Munoz, 2010). Previous research has ignored to study of structure, organization, and essential factors that impact the performance of ME in entrepreneurship literature (Berrone et al., 2014). Despite there is lack of studies analyzing the performance of ME where enterprises owners make major decisions (Kovaleva & de Vries, 2016). Previous research has revealed that ME performance is affected negatively by lack of managerial skills, financial resources credits, unfavourable taxation procedures, inconsistent policies, and compliance costs. Similarly, introducing support programs such as training, consultancy services, and counselling of employees can enhance ME performance (Moses, 2015).

Business Models Practices

Research on business models have gained significant attention from scholars. The current study adopts the seminal framework proposed by Osterwalder intends to investigate the impact of Business Model Practices (BMP) such as (product, customer interface, infrastructure management, and financial aspects) on microenterprise performance. The main four components are further grouped into nine subcomponents that integrate BMP (Osterwalder & Pigneur, 2013). Table 1 presented these components and their sub-elements.

| Table 1 Business Model Practices |

||

|---|---|---|

| Pillars | Components | Description |

| Product | Value proposition | The overall portfolio of enterprise or firm products provides a better value proposition (product) to customers. |

| Customer interface | Target Customer | Represent the customers' segment where the enterprise offers value to their costumer. |

| Distribution Channel | The medium which connects enterprise with their customer. | |

| Relationship | The link keeps the enterprise and customer in connection. | |

| Infrastructure | Value Configuration | Refers to the logistic support in terms of activities and resources to offer customer value (products). |

| Capability | The ability and execution of actions in a consistent pattern to create value for customer. | |

| Management | Partnership | The mutual agreement among two or more enterprises to develop a better value for the customer. |

| Financial Aspects | Cost Structure | The overall cost which has employed in the business model. |

| Revenue Model | Represent the various streams through which the enterprise generates revenue. | |

GBMP sub-elements as highlighted in Table 1. Product value component refers to what the enterprise offers as value propositions (product) to the customer. The customer interface component focuses on delivering enterprise products and services to the target market (customer) and maintaining a meaningful relationship, infrastructure management component related to the enterprise's logistics, infrastructure, and network management. Financial aspects refer to cost and revenue structure to ensure the economic sustainability of the enterprise (Osterwalder & Pigneur, 2010).

Product Value Proposition

Product is an integral component of BMP. The value proposition is a subpart of the product (Osterwalder & Pigneur, 2010). A value proposition is essential for customers and the firm itself, and its value chain partners. Correspondingly, Belz and Bieger differentiate benefit advantages of value for customers in the broader sense (Belz & Bieger, 2006). The value proposition can be decomposed into single offerings to explore how value is proposed and created (Osterwalder, 2004). Value Propositions should be aligned with customer needs to satisfy customers and develop synergies between products and services to build a strong network effect (Osterwalder & Pigneur, 2010). Offering value can be a product or service which is offered by the enterprise (Osterwalder & Pigneur, 2002). Other business model elements such as target customer, value proposition, capabilities are associated with product innovation (Osterwalder & Pigneur, 2002). The offering value (product or service) should be designed from a specific segment of the customer (Afuah et al., 2001) with a range that contributes to value proposition (Osterwalder & Pigneur, 2002; Lagha et al., 2001). The enterprise should have the capability to create a better value proposition (product) to meet its customer demands via cost-effective manner and build sustainable infrastructure to deliver the value in mentioning relationship management (Osterwalder 2004). However, Van Leuven (2013), emphasized that firm, although a firm should distinctively value its offering (product or service) but should consider other components which customer values.

H1: There is a positive relationship between product value and ME performance.

Customer Interface

The customer interface is another essential component of BMP. They are further subdivided into three elements, i.e., target customer, distribution channel, and relationships. In a broader view, the customer interface is directly related to strategic and operational marketing issues. Looking closer at the pillars elements reveals this connection target customers and their specific characteristics; distribution channels, links, strategies, and conflicts; and finally, customer relationships and the mechanisms to create and maintain them (Freund, 2009). The firm customer base should segment efficiently and effectively acquire new customers using integrated customer channels and relationships (Osterwalder & Pigneur, 2010). The customer interface is the mechanism through which enterprises stay connected with their customers and collect valuable information about the target customers to offer them better value. The information strategy, which is part of the customer interface, increases customer satisfaction (Fuller & Mangematin, 2013).

H2: There is a positive relationship between customer Interface and ME performance.

Infrastructure Management

Infrastructure Management is a crucial component of BMP. Further consisted of three sub-elements, e.g., value configuration, capability, and partnership. All these subcomponents contribute to infra-structure management (Osterwalder, 2004; Osterwalder & Pigneur, 2010). Value system configuration linked with the value proposition and customer interfaces. Value configurations are based on internal and external resources and activities and can be represented by value-creation chain frameworks (Freund, 2009). Essential resources should be inimitable, efficient, and easily deployable. The firm should work with key partners when necessary (Osterwalder & Pigneur, 2010). Infrastructure management is related to value offer (product) and customer relationships (customer interface) to deliver a better value (Osterwalder & Pigneur, 2013). This element uses product innovation and customer relationships to provide logistic support, enhance the capability, and create partnerships. Value configurations impact firm performance (Aversa et al., 2015).

H3: There is a positive relationship between infrastructure management and ME performance.

Financials Aspects

Financial aspects of the business model refer to a firm cost and revenue structure (Osterwalder & Pigneur, 2010). This is one of the critical components of which impact all other dimensions of BMP. Cost and revenue streams enable the rest of the components, including product, customer interface, and ‘infrastructure management providing the financial resource. Revenue streams should be predictable, diversified, cost-efficient, and sustainable to bring more profits for the firm (Osterwalder & Pigneur, 2010). The revenue structure refers to the ability of the enterprise to generate profit. In contrast, cost structure refers to the cost incurred in value costs, marketing costs, and delivery costs (Osterwalder & Pigneur, 2013). The difference between the cost and revenue components results in net profit. This component of a business model (Financial aspects) is critical for the enterprise's survival and sustainability because all the other components are based on it. It is impossible to underestimate the vital role of cost and revenue structure in a business model making higher profits with low cost (Stampfl et al., 2013). The research studies have revealed that business models and changes in the environment include lasting or eternal effects on enterprise performance (Afuah &Tucci, 2001).

H4: There is a positive relationship between financial Aspects and ME performance.

Research Methodology

The current study examines the impact of business models on enterprise performance in the context of Malaysian service sector microenterprises. Previous research studies have been used various quantitative methods such as field experiments, surveys, and experimental research in laboratory settings (Sajons, 2020). This research study used a quantitative research design. Therefore, the research design adopts a random stratified probability sampling technique. The unit of analysis for the current research is service sector microenterprises. The key respondents for this research study were managers. Under their various hierarchical positions within enterprises, they are the most relevant and well-informed respondents.

Population and Sample

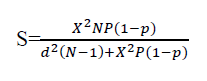

SME Corp. Malaysia promotes the development of Micro Enterprises through various programs to improve productivity and growth. According to available data, a total of 649,186 micro-enterprises in the service sector. The following formula has used to determine the sample size by (Krejcie & Morgan, 1970). Based on Morgan Table, the required sample is 384. This is a study target sample of 384. However, only 199 responded with a 52% response rate, after normality and unusable cases clen data of 175 used for further analysis.

Survey Measures

Business model practices: Business Model (BM) practices provide a rationale for the conceptualization of elements, relationships, vocabulary, and semantics in a formalized pattern composed of four components, i.e., (product, customer interface, infrastructure management, and financial aspects) (Osterwalder & Pigneur, 2010). Product Value (PV): This research measured product value with four items scale adopted from (Osterwalder & Pigneur, 2010; Abd Aziz et al., 2008). Customer Interface (CI): This study measured CI using six items scale adopted from previous researchers, e.g., (Osterwalder & Pigneur, 2010; Abd Aziz et al., 2008; Osterwalder & Pigneur, 2010; Anjorin & Ravi, 2012). Infrastructure Management: This study measured IM using five items scale adopted from (Osterwalder & Pigneur, 2009; Osterwalder & Pigneur, 2010). Financial Aspects: This study measured FA using a four-item scale (Osterwalder & Pigneur, 2009; Osterwalder & Pigneur, 2010). Microenterprise Performance (MP) was measured by 11 items scale-based subjective measures proposed by (Vij & Bedi, 2016).

Data Analysis and Result Interpretation

The descriptive statistics show that total eleven various types of service sector participated in the study. E.g., (1) Wholesale & retail trade of vehicles (2)Food & beverages services (3) Transportation and storage (4) Professional services (5) Administrative and support service (6) Human health and social work (7) Real Estate activities (8) Education (9) Financial service (10) Information & communication services (11)Waste management services. Table 2 presents details of frequency and percentages of each stratum.

| Table 2 Demographic Information |

||

|---|---|---|

| Micro Enterprises Stratum | Frequency | Percent |

| Wholesale & retail trade of vehicle | 42 | % 24.0 |

| Food & beverages service | 33 | 18.9 |

| Transportation and storage | 24 | 13.7 |

| Professional services | 11 | 6.3 |

| Administrative and support service | 05 | 2.9 |

| Human health and social work | 07 | 4.0 |

| Real Estate activities | 15 | 8.6 |

| Education | 06 | 3.4 |

| Financial services | 08 | 4.5 |

| Information & communication service | 10 | 5.7 |

| Waste management service | 14 | 8.0 |

| 175 | %100 | |

Measurement Model

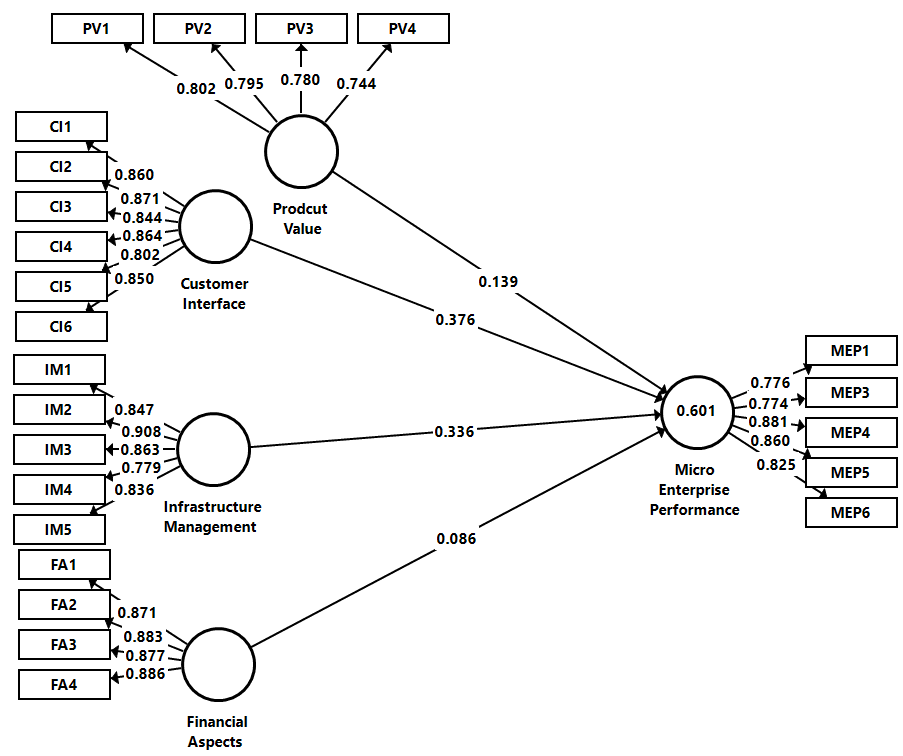

In Smart PLS, the estimation of the research model is based on convergent and discriminant validity. To establish convergent validity, three criteria were used (i) loading of items should be more than 0.70, (ii) Composite Reliability (CR) should be greater than 0.50, and (iii) Average Variance Extracted (AVE) should be also greater than 0.50. Table 3 presented the details of all the three criteria met, and all values fall in the threshold. (Figure 2)

| Table 3 Convergent Validity |

|||

|---|---|---|---|

| Items Loading | CR | AVE | |

| CI | CI 1 0.86 | 0.94 | 0.72 |

| CI 2 0.87 | |||

| CI 3 0.84 | |||

| CI 4 0.86 | |||

| CI 5 0.80 | |||

| CI 6 0.85 | |||

| FA | FA 1 0.87 | 0.93 | 0.77 |

| FA 2 0.88 | |||

| FA 3 0.88 | |||

| FA 4 0.89 | |||

| IM | IM 1 0.85 | 0.93 | 0.72 |

| IM 2 0.91 | |||

| IM 3 0.86 | |||

| IM 4 0.78 | |||

| IM 5 0.84 | |||

| MEP | MEP 1 0.78 | 0.91 | 0.68 |

| MEP 3 0.77 | |||

| MEP 4 0.88 | |||

| MEP 5 0.86 | |||

| MEP 6 0.83 | |||

| PV | PV 1 0.80 | 0.86 | 0.61 |

| PV 2 0.79 | |||

| PV 3 0.78 | |||

| PV 4 0.74 | |||

The discriminant validity was assessed using three criteria (i) inter-correlation matrix of constructs, (ii) heterotrait-monotrait ratio (HTMT), and (iii) cross-loadings. All the values were within the required threshold. So, the discriminant validly threshold was not violated. See Table 4, 5, and 6.

| Table 4 Fornell and Lacker Criterion Using Inter Correlation Matrix of Constructs |

|||||

|---|---|---|---|---|---|

| CI | FA | IM | MEP | PV | |

| CI | 0.85 | ||||

| FA | 0.48 | 0.88 | |||

| IM | 0.56 | 0.51 | 0.85 | ||

| MEP | 0.67 | 0.51 | 0.67 | 0.82 | |

| PV | 0.47 | 0.50 | 0.60 | 0.56 | 0.78 |

| Table 5 HTMT |

|||||

|---|---|---|---|---|---|

| CI | FA | IM | MEP | PV | |

| CI | |||||

| FA | 0.52 | ||||

| IM | 0.61 | 0.57 | |||

| MEP | 0.74 | 0.56 | 0.75 | ||

| PV | 0.55 | 0.60 | 0.72 | 0.67 | |

| Table 6 Cross-Loadings |

|||||

|---|---|---|---|---|---|

| CI | FA | IM | MEP | PV | |

| CI1 | 0.86 | 0.38 | 0.49 | 0.58 | 0.39 |

| CI2 | 0.87 | 0.50 | 0.51 | 0.60 | 0.40 |

| CI3 | 0.84 | 0.35 | 0.45 | 0.53 | 0.43 |

| CI4 | 0.86 | 0.38 | 0.51 | 0.56 | 0.40 |

| CI5 | 0.80 | 0.42 | 0.43 | 0.52 | 0.38 |

| CI6 | 0.85 | 0.39 | 0.47 | 0.61 | 0.39 |

| FA1 | 0.39 | 0.87 | 0.41 | 0.42 | 0.40 |

| FA2 | 0.46 | 0.88 | 0.46 | 0.47 | 0.46 |

| FA3 | 0.45 | 0.88 | 0.46 | 0.46 | 0.49 |

| FA4 | 0.37 | 0.89 | 0.46 | 0.43 | 0.41 |

| IM1 | 0.47 | 0.42 | 0.85 | 0.59 | 0.55 |

| IM2 | 0.50 | 0.44 | 0.91 | 0.59 | 0.56 |

| IM3 | 0.48 | 0.46 | 0.86 | 0.59 | 0.50 |

| IM4 | 0.44 | 0.38 | 0.78 | 0.53 | 0.46 |

| IM5 | 0.48 | 0.47 | 0.84 | 0.56 | 0.48 |

| MEP1 | 0.62 | 0.52 | 0.58 | 0.78 | 0.53 |

| MEP3 | 0.51 | 0.39 | 0.47 | 0.77 | 0.37 |

| MEP4 | 0.56 | 0.39 | 0.53 | 0.88 | 0.45 |

| MEP5 | 0.55 | 0.38 | 0.59 | 0.86 | 0.44 |

| MEP6 | 0.51 | 0.39 | 0.58 | 0.83 | 0.51 |

| PV1 | 0.30 | 0.46 | 0.47 | 0.42 | 0.80 |

| PV2 | 0.34 | 0.34 | 0.42 | 0.45 | 0.79 |

| PV3 | 0.45 | 0.30 | 0.49 | 0.47 | 0.78 |

| PV4 | 0.36 | 0.48 | 0.49 | 0.41 | 0.74 |

Structural Model

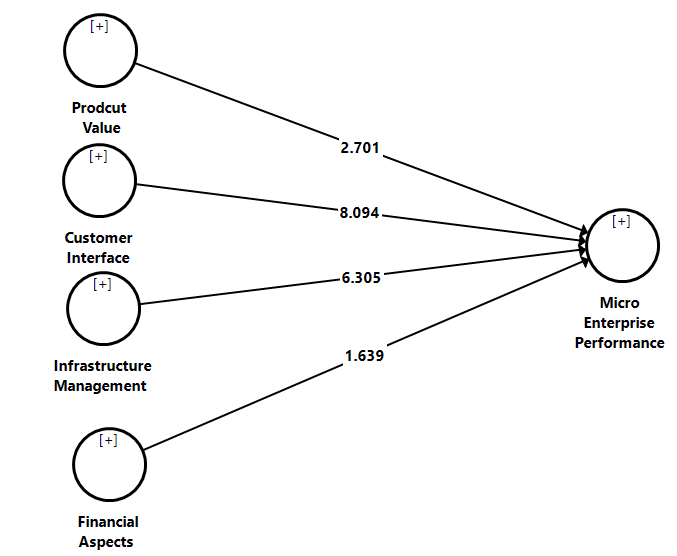

Once the measurement model was assessed using CV and DV, the next step is to validate the structural model. To evaluate the structural model, the four hypotheses (H1, H2, H3, and H4). The path coefficient (β) and t-values and P values using bootstrapping was employed SEM using Smart PLS with 2000 iterations as highlighted in Figure 3

Table 7 H1: PV is positively related with MEP (β 0.140; t 2.701, p-value 0.001) H2: CI positively related with MEP (β 0.370; t 8.094, with p-value 0.000 was also supported. H3: IM is positively related with MEP (β 0.340; t 6.305, p-value 0.000. H4: FA is positively related with MEP (β 0.090; t 1.369, p-value 0.004.

| Table 7 Results of Structural Model and Direct- Hypotheses Testing |

|||||

|---|---|---|---|---|---|

| S.NO | Hypothesis | β | t-value | p-value | Decision |

| H1 | PV→MEP | 0.140 | 2.701 | 0.001 | Accepted |

| H2 | CI → MEP | 0.370 | 8.094 | 0.000 | Accepted |

| H3 | IM→MEP | 0.340 | 6.305 | 0.000 | Accepted |

| H4 | FA→ MEP | 0.090 | 1.369 | 0.004 | Accepted |

Discussion and Findings and Implications

The purpose of this study was to investigate the impact of critical business model practices (BMP), including product value, customer interface, infrastructure management, and financial aspects, on microenterprise performance within the service sector. The findings confirmed the positive relationship between the key BMP, e.g., PV, CI, IM, and FA, with MEP. The literature also provides supportive evidence to establish these relationships, e.g., (Osterwalder & Pigneur, 2010). A previous study revealed that the business model is a key predictor of firm performance (Zott et al., 2011). Literature has highlighted the importance of business models in improving performance (Zott et al., 2011; Wu, Ma & Shi, 2010) and enterprise success (Baden-Fuller et al., 2013). Similarly, the business model has a potential source of competitive edge (Markides & Charitou, 2004). But in contrast, few studies have revealed no significant relationships between the business model and organizational performance of Spanish industrial firms (Camiso´n & Villar-Lo Pez, 2010). Few studies examined the relationship between business model and firm performance (Zott & Amit, 2007).

Product value can play a central role in improving ME performance. The firm builds and uses its resources to offer its customers better value (product) and make money. According to (Zott & Amit, 2013), product value should not be created only but enable the business model to enhance the total and share of the value created. He implies the view that BM is a source of value creation (Osterwalder & Pigneur, 2010; Afuah, 2014). A customer interface system can create the element of trust and loyalty among enterprise and their customers. The enterprise should target customers after collecting valuable information about them through distribution channels to better value and mention meaningful relationships. Customer interface should create positive outcomes trust, loyalty, feel, and serve to offer better value to target customers. Infrastructure management provides logistic support in terms of resources to enable and enhance capability and build partnerships with other enterprises to create and deliver better value (product) to customers through customer interface within GMBP (Osterwalder, 2004). Cost and revenue streams enable the rest of the components, including, PV, CI, IM providing the financial resource. Revenue streams should be predictable, diversified, cost-efficient, and sustainable to bring more profits for the firm (Osterwalder & Pigneur, 2010). This study also has some limitations, e.g., using relatively small sample size and cross-sectional nature. Future studies should use business coaching, and the type of firm can be used as a moderator.

Conclusion

The key objective of this study is to propose an integrative model based on antecedences of ME performance. Findings conclude that business model practices (BMP) incudes product (product value, target customer interface, infrastructure management, and financial aspects positively impact ME performance based on the Resource-Based View (RBV). This theory justifies the empirical relationship between BMP and ME performance. These research findings encourage entrepreneurs and owners to employ business model practices and improve ME performance through business coaching. Future research studies can empirically test this model in various contexts.

References

- Abd Aziz, S., Fitzsimmons, J.R., & Douglas, E.J. (2008). Clarifying the business model construct.

- Abdul Aziz, Y., Awang, K.W., & Samdin, Z. (2012). Challenges faced by micro, small, and medium lodgings in Kelantan, Malaysia. International Journal of Economics and Management, 6(1), 167-190.

- Rashid, A.M. (1992). Management practices, motivations and problems of male and female entrepreneurs in Malaysia. Malaysian, J. Small Med. Ent, 3, 35-46.

- Oyekunle, O.A., & Fillis, I.R. (2017). The role of handicraft micro-enterprises as a catalyst for youth employment. Creative Industries Journal, 10(1), 59-74.

- Abu Bakar, J., Mad, C., & Latif, R. (2006). Liberalization and globalization: A case of Naza and a lesson to SME. Proceedings of Persidangan Kebangsaan IKS 2006.

- Afuah, A. (2004). Business models: A strategic management approach: McGraw-Hill/Irwin.

- Afuah, A. (2013). The theoretical rationale for a framework for appraising the profitability potential of a business model innovation. Browser Download This Paper.

- Afuah, A. (2014). Business model innovation: Concepts, analysis, and cases. Routledge.

- Afuah, A., & Tucci, C.L. (2001). Internet business models and strategies. McGraw-Hill New York.

- Alam, S.S. (2010). Assessing barriers of growth of food processing SMIs in Malaysia: A factor analysis. International Business Research, 4(1), 252.

- Amit, R., & Schoemaker, P.J. (1993). Strategic assets and organizational rent. Strategic management journal, 14(1), 33-46.

- Amit, R., & Zott, C. (2001). Value creation in e?business. Strategic management journal, 22(6?7), 493-520.

- Amit, R., & Zott, C. (2010). Business model innovation: Creating value in times of change.

- Amit, R., & Zott, C. (2012). Creating value through business model innovation. MIT Sloan Management Review, 53(3), 41.

- Andersen, P.H., & Kragh, H. (2010). Sense and sensibility: Two approaches for using existing theory in theory-building qualitative research. Industrial marketing management, 39(1), 49-55.

- Ang, E. (2010). Taxing time for traders: More needs to be done-by both Businesses and the Government-to ease the cost of doing business, especially in the current economic environment. The Star, 28.

- Apollo, B. (2014). An introduction to the Business Scalability Matrix for companies with high-value, complex B2B sales environments.

- Aversa, P., Furnari, S., & Haefliger, S. (2015). Business model configurations and performance: A qualitative comparative analysis in Formula One racing, 2005?2013. Industrial and Corporate Change, 24(3), 655-676.

- Aziz, S.A., & Mahmood, R. (2011). The relationship between business model and performance of manufacturing small and medium enterprises in Malaysia. African Journal of Business Management, 5(22), 8918.

- Aziz, Y.A., Awang, K., & Zaiton, S. (2012). Challenges faced by micro, small, and medium lodgings in Kelantan, Malaysia. International Journal of Economics and Management, 6(1), 167-190.

- Fuller, B.C., & Mangematin, V. (2013). Business models: A challenging agenda. Strategic Organization, 11(4), 418-427.

- Baker, T.M. (2014). Family coaching: An exploratory study of parental perceptions.

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of management, 17(1), 99-120.

- Barney, J.B. (1986). Organizational culture: Can it be a source of sustained competitive advantage? Academy of management review, 11(3), 656-665.

- Bashir, M., & Verma, R. (2016). Business model innovation: Past, present, and the future. Prabandhan: Indian Journal of Management, 9(1), 8-20.

- Bashir, M., Yousaf, A., & Verma, R. (2016). Disruptive business model innovation: How a tech firm is changing the traditional taxi service industry. Indian Journal of Marketing, 46(4), 49-59.

- Bataineh, M., & Al Zoabi, M. (2011). The effect of intellectual capital on organizational competitive advantage: Jordanian Commercial Banks (Irbid District) An empirical study. International Bulletin of Business Administration, 10, 15-24.

- Beattie, R.S., Kim, S., Hagen, M.S., Egan, T.M., Ellinger, A.D., & Hamlin, R.G. (2014). Managerial coaching: A review of the empirical literature and development of a model to guide future practice. Advances in Developing Human Resources, 16(2), 184-201.

- Belz, C., & Bieger, T. (2006). Customer-value: Customer benefits create company benefits: MI Wirtschaftsbuch.

- Bennis, W.G., & O'toole, J. (2005). How business schools lost their way. Harvard business review, 83(5), 96-104, 154.

- Berrone, P., Gertel, H., Giuliodori, R., Bernard, L., & Meiners, E. (2014). Determinants of performance in microenterprises: Preliminary evidence from Argentina. Journal of Small Business Management, 52(3), 477-500.

- Bititci, U., Garengo, P., D