Research Article: 2021 Vol: 25 Issue: 5S

Does the management control system have an effect on the financial performance of village-owned enterprises (BUMDes) ?

Udin Suadma, University of Bina Bangsa

Anita Ardiyanti, University of Muhammadiyah Tangerang

Tata Rustandi, University of Bina Bangsa

Dirvi Surya Abbas, University of Muhammadiyah Tangerang

Abstract

In Banten Province, the presence of dormant Village-Owned Enterprises (BUMDes) has an influence on BUMDes' ability to build the community's economy and explore local potential. The goal of this study was to see how the management control system affected financial performance. This study takes an explanatory and descriptive approach, employing data analysis techniques such as the Partial Least Squares Structural Equation Model (PLS-SEM). The following criteria were used to collect data from 80 BUMDes as a sample: (1) registered BUMDes, (2) active BUMDes, and (3) active BUMDes having a capital of Rp. 30,000,000. Return on Investment (ROI) of BUMDes is used to measure success in this study. Management Control Systems have a positive influence on financial performance, according to research findings. The findings of the management control system assessment show a positive influence on financial performance, with t count=2.764 and p-value=0.000 0.05 which indicates that the Ha data is not sufficient to accept Ho and the data supports then Ho is rejected. Management control system efforts that have an impact on financial performance include budgeting for all functional sections, establishing new program concepts, and developing finances. All functioning parts must adhere to the stated standards and conduct assessments and approvals.

Keywords

Management Control System, Financial Performance, Village-Owned Enterprises

Introduction

Village Owned Enterprises (BUMDes) did not receive optimal benefits along the way, and as a result, many BUMDes went "out of business," and the potential of existing villages was not explored, making the hope of becoming an independent village through BUMDes as an effort to improve the economy of rural communities difficult. must be done, but improvements and responses are required Rusito (2018); Rahmawati (2018) cite various aspects in their research that lead to the majority of BUMDes enterprises that are not yet formed. For example, in the agriculture business, from the perspective of entrepreneurs and farmers. There are no buyers when farmers wish to plant. When the farm is already producing and the farmers have partnered, prices fall. Meanwhile, from the standpoint of the entrepreneur, among other things, production cannot meet the demands of the industry, production terms and quality are not in line with its designation, and production quality is acceptable but the price is high. The hope to become an independent village, of course, BUMDes which is the reference for village income must be able to take advantage of the potential that exists in the village, determine the appropriate business unit with capable human resources. In addition, the application of business management management patterns greatly influences the profits generated by BUMDes.

The importance of a company's management system cannot be overstated. This is due to the fact that it is tied to the overall design of a company/business entity. A competent managerial system may stimulate the existence of high financial performance, ensuring the sustainability of a company entity to continue functioning. According to Sudarmakiyanto, et al., (2013), the best financial performance of a company entity is the application of the financial management function in order to fulfill its objectives, because one financial choice will effect other financial decisions. The analysis of financial statements as a follow-up to the assessment of financial performance is carried out not only by big commercial organizations, but also by all company sizes, including small and medium businesses and BUMDes. According to Fahmi (2014), financial performance is an examination performed to determine the extent to which current financial rules are followed appropriately and accurately. Meanwhile, financial performance, according to Marinda (2014), is a comparison of the degree of attainment of work outcomes with the operating period, including standards, objectives, and performance that have been defined.

Several financial ratios can be used to assess financial performance. Profitability is the ratio that will be employed in this study. The profitability ratio is a ratio that serves to determine a business entity's ability to earn a profit during a specific period and provides an overview of the implementation of operating activities and its relationship to management effectiveness, as stated by Said & Ali (2016) in their research that profitability is a company's ability to generate profits over time. a specific period of time, which is commonly assessed by the profitability ratio. Then it is reinforced by Lima & Juju (2008)'s assertion that profitability also has an essential importance in the long term survival of the firm, because profitability tells whether the company has strong prospects in the future. As a result, every firm will continually want to grow profitability, because the greater a company's degree of profitability, the better the company's capacity to communicate profitability.

Return on Investment is the profitability ratio employed in this study (ROI). Return on Investment, also known as Return on Assets (Harjito, 2014; Abbas, et al., 2021), is a metric used to assess a company's efficiency in generating profits via the utilization of its assets. According to Darmadji & Fakhrudin (2012), ROI is a ratio used to assess a company's capacity to make returns on its assets. One method for calculating ROI is to compare net income after taxes to total assets. This ratio is frequently highlighted in financial statement analysis since it can demonstrate the performance of a company organization in producing profits. ROI also measures how effective a corporate organization is in generating profits via the use of its assets. Yusuf's (2018). Then, according to Kasmir (2012), ROI may be used to measure management's capacity to achieve total profitability and managerial efficiency.

ROI measures a company entity's ability to create profits, allowing previous gains to be projected into the future. The assets in question are all assets of a business entity gained from other capital or from own capital and turned into assets of a business entity used for the business entity's existence. Management accounting is a management control system that will be employed in this study. Management control is concerned with giving financial and non-financial information to managers to guarantee the efficacy and efficiency of an organization's performance in management accounting (Horngren, 2014). Management control systems are often linked to the planning process, supporting in decision making, managing, and giving feedback to the planning unit (Anthony & Govindarajan, 2007). Depending on the objectives of the business entity, business entities should have realistic policies and clear plans in place to establish an effective management control system.

Management control system concepts that have been applied by corporate organizations often benefit from a variety of instruments in order to achieve their objectives. The instruments are classified into two types: time-oriented instruments and goal-oriented instruments (Byrne & Pierce, 2007; Wiedemann, 2014). Goal-oriented instruments are strategic instruments that consider the company's and market's competitive positions and seek improvement opportunities. Meanwhile, operational instruments that aim to define operating objectives such as profitability, liquidity, and efficiency are referred to as time-oriented instruments or long-term strategic instruments. Meanwhile, instruments with a shorter time range, less than a year, are referred to as operational instruments (Byrne & Pierce, 2007). Vision and strategy formulation, strategic planning, scenario analysis, SWOT analysis, shareholder value analysis, competitor analysis, balanced scorecard, benchmarking, product life cycle analysis, gap analysis, investment control, portfolio analysis, and so on are examples of strategic instruments (Byrne & Pierce, 2007; Wiedemann, 2014). In this study, the management control system will employ strategic instruments to determine the extent to which BUMDes managers or administrators are aware of the variables in the management control system, which include Strategic Planning and Budgeting.

Research Method

In this study, the model employs quantitative methodologies in the form of non-experimental research. The descriptive method will be used in this research, so the researcher will try to obtain actual and valuable information related to the Financial Performance of BUM Desa in Banten Province, which is influenced by the management control system with data processing using structural methods of explanation and descriptive methods.

The researcher concludes that the targeted BUMDes are all active and stable BUMDes in Banten Province, hence the target population is based on geographical limits. So, during the 2019 term, this study population consists of all BUMDes in Banten Province, with a total of 688 BUMDes. The BUMDes in this study were chosen using the Purposive Sampling technique, with the following criteria:

(1) Registered BUMDes as evidenced by the existence of a Village Government Decree.

(2) Active BUMDes as evidenced by the 2019 financial statements

(3) Active BUMDes with a capital of Rp. 30,000,000. (Thirty Million Rupiah).

As a result, 80 samples were acquired and distributed throughout four districts in Banten Province. When the researcher divides by the proportion of 80% in each BUMDes in each district, the total sample size in the district is 70. Pandeglang has six, Kab. Lebak has three, and Tangerang has one.

PLS-SEM is the analytical method used to find and define a link between latent variables. The data utilized does not have to have a multivariate normal distribution, nor does the sample size have to be huge. Researchers may use this PLS analysis tool to calculate the value of the latent variable, making it easier to explain whether or not there is a link between latent variables.

Results

The study findings are separated into three levels of analysis: outside model evaluation, inner model evaluation, and hypothesis testing.

Evaluation of the Outer Model

The first stage is to evaluate the outer model by considering all variables' loading factors. The results of the Loading Factor test on indicators of BUMDes financial performance factors based on route coefficient output are as follows:

| Table 1 Load Factor Test Outcomes |

||

|---|---|---|

| Statement Item Number | Loading Factor(LF) | Conclusion |

| SP1 | 0.434 | Valid |

| SP2 | 0.847 | Valid |

| SP3 | 0.773 | Valid |

| SP4 | 0.755 | Valid |

| SP5 | 0.645 | Valid |

| SP6 | 0.744 | Valid |

| SP7 | 0.612 | Valid |

| SP8 | 0.847 | Valid |

| SP9 | 0.651 | Valid |

| SP10 | 0.846 | Valid |

| SP11 | 0.779 | Valid |

| SP12 | 0.765 | Valid |

| SP13 | 0.770 | Valid |

| SP14 | 0.709 | Valid |

| SP15 | 0.588 | Valid |

| ROI | 1.000 | Valid |

Resource: Smart PLS 3.0 report 2020 output

Based on the data from the LF test findings, it is clear that the existence of each variable indicator in this study has numerous outer loading values more than 0.4. As a result, it can be demonstrated that the indicators in this study variable are legitimate data that may be directly evaluated further. In addition, the discriminant validity test is performed by comparing the AVE roots with the connection between constructs.

| Table 2 AVE vs. Root AVE Comparison |

||

|---|---|---|

| Variable | Average Variance Extracted (AVE) | Root AVE |

| Monetary performance | 1.000 | 1.000 |

| System of Management Control | 0.527 | 0.725 |

Resource: Smart PLS 3.0 report 2020 output

According to the AVE comparison table with the AVE root, the AVE value of the AVE Financial Performance of BUMDes is 1,000 with the AVE root of 1,000. The AVE value of the Management Control System is 0.527, with an AVE root of 0.725. So, if the measure of convergent validity is excellent because it can explain numerous variations of the indicators on the final variable based on data and data analysis findings, then the value of discriminant validity in this dissertation research results indicates a good value. The reliability value of each indication is then tested using composite reliability.

| Table 3 Composite Reliability |

|

|---|---|

| Variable | Composite Reliability |

| Monetary performance | 1.000 |

| System of Management Control | 0.942 |

Resource: Smart PLS 3.0 report 2020 output

As the table above demonstrates, all research variables in this study had a value greater than 0.6. As a result, each indicator on the variables used in this study has satisfied composite reliability, resulting in a high reliability value for each indication on the variables utilized in this study. Then, move on to the Cronbach Alpha notion, which may be utilized to improve the process of assessing the dependability value of research variables.

| Table 4 Cronbach Alpha |

|

|---|---|

| Variable | Cronbach's Alpha |

| Monetary performance | 1.000 |

| System of Management Control | 0.933 |

Resource: Smart PLS 3.0 report 2020 output

Each variable in this study has a Cronbach Alpha value greater than 0.7. All variables in this study have a high level of dependability since they meet the Cronch Alpha value standards.

Evaluation of the Inner Model

The Path Coefficient is used by the researcher to examine the influence of the independent variable on the dependent variable. Researchers may gain a broad picture of the effect of the independent variable on the dependent variable in this dissertation research using the idea of Path coefficient test. According to the graph above, the path coefficient value on the variable of the effect of financial performance on BUMDes investment diversification is 4.527. Based on the Path Coefficient Test, the variable in this study has a positive numerical value since it has a big value on the independent variable utilized for the dependent variable.

Validation of Hypotheses

The following findings were obtained through hypothesis testing using t-statistical measurements:

| Table 5 The Results of T-Statistical Measures the Link Between Variables in the Model Structure |

||||

|---|---|---|---|---|

| Variables' Interrelationship | The value t is counted | PValue | Ha | Conclusion |

| Monetary performance → System of Management Control | 2,764 | 0,000 | Accepted | There is a Beneficial Influence |

Resource: Smart PLS 3.0 report 2020 output

The findings of the management control system test have a positive influence on financial performance, with a t-count=2.764 and a p-value=0.000 0.05, indicating that Ha is insufficient data to accept Ho and the data supports Ho being rejected. As a result, the management control system has a considerable and favorable impact on financial performance. So the management control system has a coefficient value of 0.455 with a financial performance value of 0.455, indicating that if all other variables remain constant, the financial performance will rise by 0.455 and the management control system will increase by 1 unit.

Discussion

The Management Control System (MSS) has a favorable impact on BUMDes' financial performance (there is an effect of SPM on ROI). Management control efforts are done by doing budget calculations and recording budget calculation findings so that BUMDes finances may be planned, directed, and recorded for the review and audit of BUMDes enterprises.

Several other activities in the management control system that have an impact on financial performance include incorporating all functional elements in budget preparation, developing new program proposals that correspond to current criteria, and evaluation and approval by all functional components. In practice, the management control system process may be divided into two primary schemes, namely Strategic Planning and Budgeting. Strategic planning can be the initial step in implementing management control. BUMDes can formulate the determination of the program, corporate activity, or business sector to be picked during the strategic planning stage. The purpose is to ensure that BUMDes do not select the incorrect business sector. This promotes the achievement of goal congruence.

According to the responses, up to 78.75 percent of BUMDes in Banten Province execute a SWOT analysis on each program design that will be implemented by BUMDes. The planning technique implemented by BUMDes in Banten Province has significantly improved financial performance. The planning approach itself is supposed to be capable of regulating BUMDes expense management. According to Don Kor, et al., (2018), strategic planning contributes to the growth of small and medium-sized businesses by describing the internal and external business contexts that form the basis of company operations, which are prepared and implemented by business managers and communicated to all company employees. from the lower to the higher level Then, Hervani, et al., (2005) claimed that when a company expands, the requirement for strategic planning rises as well. Floyd & Lane (2006) advocate that businesses develop reasonably consistent strategic conduct in response to external variables.

The attainment of goals is inextricably linked to strategic planning in the management control system. That is, the managerial process will be goal-oriented and directly proportionate to financial performance. So, the financial performance of the firm may be used to determine whether or not the benchmark is effective in managing the company. The budgeting process in management control then plays a strategic function since it automatically balances each program (ballancing activity and balancing process to target). According to the responses, 90% of BUMDes in Banten Province do budget calculations for each BUMDes activity..

Furthermore, Hakim, et al., (2000) said that the company's budget is the most crucial aspect. This is due to the fact that the planning and control procedures of a company-run program are budget-dependent. Thus, competent management will have a positive impact on financial performance by carrying out management control activities in order to accomplish goals (the aim of a corporate organization is profit). As a logical account of the major influence of the management control system on financial performance, the researcher offers a schematic of how the process between management control systems impacts financial performance.

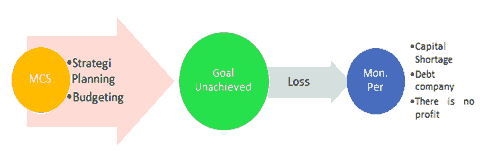

Figure 1: Diagram Illustrating the Beneficial Effect of a Management Control System on Financial Performance (Qualitative Analysis)

Figure 2: The Effect of the Management Control System on Financial Performance is Depicted in a Diagram that Does not Work (Qualitative Analysis)

The two images above depict a logic scheme for the management control system's effect on financial performance. The researcher depicts two steps in Figure 1, namely strategic planning with budgeting if done correctly and fulfilling the goals that were declared at the start so that they can have an impact on the attainment of strong financial performance. This approach is implemented in the administration of BUMDes in Banten Province. Meanwhile, in Figure 2, it is comparable that if the management control system fails (does not meet the target), it will be directly proportionate to the financial performance, which will also be poor and have an influence on the company's financial state, which is deteriorating. Profit is the goal of a corporation, and a metric for assessing financial success is the extent to which a company's financial state is.

Based on the premise, it is possible to conclude that MSS has an impact on financial performance. In this situation, financial success as measured by ROI was able to generate a positive future return. As a result, the more successful the SPM function is, the greater its ability to earn a favorable return on investment in the future. The findings of this study are consistent with the findings of Senduk, et al., (2016), who found that by applying excellent management controls, the company's financial management process will improve.

According to empirical research, SPM has a major influence on financial performance, with evidence of conclusions showing the more effective SPM in a firm, the more effective the organization's financial performance. According to the findings of the research, the management performed by BUMDes in Banten Province in connection to financial performance is to create a comprehensive preparation of all supporting components such as Human Resources, finances, procedures, materials, and markets.

The managerial process is not only used in strategic planning but also in budgeting by calculating profits and allocating BUMDes funds that are known to all functional units. Furthermore, not only is the policy-making process coordinated, but the disposal of BUMDes spending is coordinated as well, such that the budget review process includes all operating BUMDes. The managerial process has had a good influence on financial report preparation, delivering BUMDes financial reports that operate smoothly, and the usage of targeted money.

Management control systems and financial performance are two very different ideas, although they work in tandem. The management control system process, which includes planning, will plan the organization of all corporate operations, whilst the budget may be used to regulate a corporation. As a result, the management control system will have a significant impact on financial performance. This is consistent with Eko Sudarmakiyanto, et al., (2013), who explain that when a corporation or business entity has optimal financial performance, the objective process carried out is also ideal. This occurs because financial management in one business unit has an influence on other units, including the firm or the business entity that operates it.

The control system used by BUMDes in the Banten Province has a good impact on the company's financial performance. Profits have been generated for the Business Entity's business. Furthermore, the data findings highlight where BUMDes in Banten have demonstrated asset utilization or maximizing. This is an example, such as the utilization of assets by BUMDes Karya Cimanuk Mandiri, Cimanuk Village, which uses a central government waste processing equipment grant to operate as a business unit and has succeeded in creating profits for the BUMDes.

Conclusion

The control system has the potential to improve BUMDes' financial performance. The budgeting process in management control plays a strategic function since it automatically balances each program (Balancing activity and balancing process to target). The findings revealed that BUMDes who performed budget planning and financial filing had a positive ROI. The size of the management control system's effect on financial performance demonstrates that there is conceptual relation between the management control system and financial performance. This is due to the planning stage's ability to identify numerous business circumstances that will be carried out, such as weaknesses, opportunities, and threats, as well as strategic variables and dangers encountered. Thus, by identifying and analyzing the planning that has been completed, a corporation will be able to avoid policymaking blunders. Furthermore, the discovered strategic elements may be used to produce high profitability.

References

- Abbas. (2013). Impact of unrelated diversification on financial performance of the firms: evidence from Pakistan. Management and Administrative Sciences Review, 1(2), 23-32.

- Abbas, D.S., Ismail, T., Taqi, M., & Yazid, H. (2021). Does company's source of capital signal increasing company value: A case study of basic industrial and chemical companies. Academy of Accounting and Financial Studies Journal, 25(S5), 1-10.

- Adamu, N.D.k. (2011). Evaluating the impact of product diversification on financial performance of selected nigerian construction firms. Journal of Construction in Developing Countries, 16(2), 91–114.

- Afriyanti, M. (2011). Analysis of the effect of current ratio, total asset turnover, debt to equity ratio, sales and size on ROA (Return on Assets) in manufacturing companies listed on the Stock Exchange in 2006 – 2009. Undergraduate thesis. Diponegoro University.

- Ali, E.M. (2012). Transformational leadership in government Bureaucracy. Jakarta: Multi Smart Publishing.

- Anthony, R.N., & Govindarajan, V. (2007). Management Control Systems, (12th Edition). Boston: McGraw Hill.

- Byrne, S., & Pierce, B. (2007). Towards a more comprehensive understanding of the roles of management accountants. European Accounting Review, 16(3), 469-498.

- Capar, N., & Kotabe, M. (2003). The relationship between international diversification and performance in service firms. Journal of International Business Studies, 34, 345-355.

- Fakhrudin, D.D. (2012). IT and business process performance management: Case study of ITIL implementation in finance service industry, July 2008.,

- Fahmi, I. (2014). Analisis Laporan Keuangan. Bandung: Alfabeta.

- Harmiati, & Zulhakim, A.A. (2017). The existence of village-owned enterprises (bum desa) in developing business and economics of competitive village communities in the era of Asean economic community. Journal of Chemical Information and Modelling, 53(9), 1689–1699.

- Harto, P. (2005). “Corporate diversification policy and its impact on performance: Empirical study on public companies in Indonesia”. SNA VIII Solo. 15-16 September 2005.

- Horngren, C.T. (2014). Introduction to Management Accounting, (16thEdition). USA: Pearson.

- Hsu, W.T., Chen, H.L., & Cheng, C.Y. (2013). Internationalization and firm performance of SMEs: The moderating effects of CEO attributes. Journal of World Business, 48(1), 1–12.

- Jayeola, D., & Ismail, Z. (2016). Effects of correlation on diversification of precious metals and oil. Applied Mathematics and Information Sciences,10(27), 1343-1352.

- Jayeola, D., & Dkk, S.F. (2018). Optimal risk of computation on Precious metal’s assets diversification. International Journal of Engineering and Technology, 7(2), 526-5287.

- Jayeola, D., Ismail, Z., & Sufahani, S.F. (2017). Effects of diversification of assets inoptimizing risk of the portfolio. Malaysian Journal of Fundamental and Applied Science, 13(4), 584-587.

- Jayeola, D., Ismail, Z., Sufahani, S.F., & Manliura, D.P. (2017). Optimal method for investing on assets using black-litter man model. Far East Journal of Mathematical Sciences, 101(5), 1123-1131.

- Jumingan. (2006). Financial statement analysis. Jakarta: PT. Bumi Aksara

- Kahloul, Ines, dan Slaheddine Hallara (2010). The impact of diversification on firm performance and risk: An empirical evidence. International Research Journal of Finance and Economics,2(35), 150-162.

- Kasmir. (2012). Financial statement analysis. Jakarta: Rajagrafindo Persada.

- Krivokapic., & Ranka. (2017). All effects of corporate diversification on firm performance: evidence from the Serbian insurance industry. Economic Research.

- Limakrisna, N., & Juju, U. (2008). The influence of synergy, credibility, new ownership, culture, corporate governance on post-privatization bank performance. Trichonomics, 7(2), 97-105.

- Martono, & Harjito, D.A. (2014). Financial management. Yogyakarta: Ekonisia.

- Mashiri, E., Sebele, F. (2014). Diversification as a corporate strategy and it’s effect on firm performance: A study of zimbabwean listed conglomerates in the food and beverages sector. International Journal of Economics and Finance, 6(1), 182- 195.

- Ranka, K., Vladimir, N. & Dragan, S. (2017). Effects of corporate diversification on firm performance: Evidence from the Serbian insurance industry. Economic Research-Ekonomska Istra?ivanja, 30(1), 1224-1236.

- Raza. (2015). Managing catastrophic risks in agriculture: Simultaneous adoption of diversification and precautionary savings. 12, 268-277.

- Rahmawati, R.D. (2018). Analysis of the formation and development of business entities owned by roti gulacir village in sukabares village, Waringin Kurung District, Serang Regency, Banten Province. Journal of Public Administration, 9(2).

- Said, M., & Ali, H. (2016). An analysis on the factors affecting pro tability level of sharia banking in Indonesia. Banks and Bank Systems, 11(3), 28-36.

- Satoto, & Shinta, H. (2009). Diversification strategy on company performance. Journal of Finance and Banking, 13(2), 280-287.

- Satoto, & Sintaheru. (2007). Diversification strategy on company performance. Financial Journal and Banking, 13(2).

- Shen, H., Dong, W., & Zhongfeng, S. (2011). Diversification and firm performance in China. African Journal of Business Management, 5(27), 10999-11004.

- Sudarmakiyanto, & Eko. D.K.K. (2013). The effect of financial decisions on financial performance. Journal of Business and Economics. 9(2), 149-163.

- Sujadi, & Firman. (2015). General guidelines for the implementation of village government: supplementary book of the latest regulations on villages. Jakarta: Bee Media Pustaka

- Suqaier & Ziyud. 2011. The effect of diversification on achieving optimal portfolio. Eurojournals, 32, ISSN 1450-2275

- Teece, D.J. (2007). Explicating dynamic capabilities: The nature and micro foundations of (sustainable) enterprise performance. Strategic management journal, 28(13).

- Wiedemann, D. (2014). Characteristics of management accounting in small and medium-sized enterprises case RantalinnaOy. (Tesis). Faculty of Business Administration, Saimaa Universityof Applied Sciences, Finlandia.

- Yuliani., Djumilah, Z., Sudarma, M., & Solimun. (2012). Diversification, investment opportunity set, envinronmental dynamics and firm value (empirical study of manufacturing sectors in indonesia stock exchange). IOSR Journal of Business and Management (IOSR-JBM), 6(4), 01-15.

- Yuliani, Z., Djumilah, S., Made, & Solimun, D. (2012). “Diversification, investment opportunity set, environmental dynamics and firm value (empirical study of manufacturing sectors in Indonesia Stock Exchange)”. IOSR Journal of Business and Management, 6(4), 01-15,

- Yusuf. (2018). Analysis of financial performance on pro tability withnonperformancefinancing as variable moderation (Study at Sharia Commercial Bank in Indonesia Period 2012–2016). International Journal of Economics and Financial Issues, 8(4), 126-132.

- Yusuf. (2018). Effect of return on equity, net profit margin and firm size on underpricing. Journal of Accounting Studies, 2(1), 41-53.