Research Article: 2018 Vol: 22 Issue: 3

Entrepreneurial Innovativeness and Its Impact on SMEs Performances

Mohammad Falahat, University Tunku Abdul Rahman (UTAR)

Shehnaz Tehseen, Sunway University

Constance Van Horne, University of New Brunswick Saint John

Abstract

Grounded in the innovation literature and the composition-based view (CBV), this paper develops a framework for assessing the impact of entrepreneurial innovativeness on SME’s performances. Specifically, this paper investigates the impact of entrepreneurial innovativeness on the four types of firm performance. We employed structural equation modeling partial least square (SEM-PLS) to test our proposed theoretical framework on a dataset of 450 SMEs in the wholesale and retail industry in Malaysia. Our findings revealed that there was a significant positive impact of entrepreneurial innovativeness on three types of business performances namely perceived non-financial, perceived business growth and perceived performance relative to competitors. However, based on our findings, increased financial performance was not derived from entrepreneurial innovativeness. This study contributes to the existing literature on innovation by assessing the impact of the most influential innovative practices on the four aspects of SME’s performances in the context of wholesalers and retailers.

Keywords

Innovation; SME Performance; Composition-Based View (CBV); Wholesale and Retail Industry.

Introduction

A vast literature is evident on the significant positive relationship between innovation and a firm’s success (Naranjo et al., 2016). Studies also find that innovation strategies increase the scope of firm success in today’s competitive world (Taghizadeh et al., 2016). Moreover, recently it was concluded that a firm innovativeness leads to the superior firm performance in turbulent business environments (Zawawi et al., 2016). Similarly, other studies have also demonstrated the positive impact of innovation on firm performance (Bartoloni & Baussola, 2018; Ribau et al., 2017; Gërguri et al., 2017; Tajuddin et al., 2015). Evidently innovation is believed to be one of the key drivers for the long-term success of a firm in the competitive markets (Naranjo et al., 2016). Relatedly, by realizing the importance of innovation for the success of businesses, this study attempts to investigate the influence of innovation on the four types of firm’s performances among Malaysian SME’s. Therefore, this study seeks to answer the question “what is the impact of entrepreneurial innovativeness on a firm’s performances namely, perceived financial performance, perceived non-financial performance, perceived business growth, and perceived performance relative to its competitors”? The next section of this paper deals with the review of the relevant literature.

Literature Review

Underlying Theory and Hypothesis Development

This study uses the CBV to describe the concept of innovation for wholesalers and retailers. The CBV explains that firm can be developed, compete and achieve growth without the assistance of core technology, resource advantages, or market power (Luo & Child, 2015). The CBV focuses on how ordinary firms with common resources may attain superior business growth by effectively and creatively using the available open resources and distinct integrating capabilities that lead to enhancing the speed and a price-value ratio for large numbers of mass-market consumers. Therefore, the main idea of CBV is that firms can successfully compete and develop without the “benefit of resource advantages, proprietary technology, or market power” (Luo & Child, 2015) in today’s marketplace. Consequently, CBV can be considered as a theory of survivability.

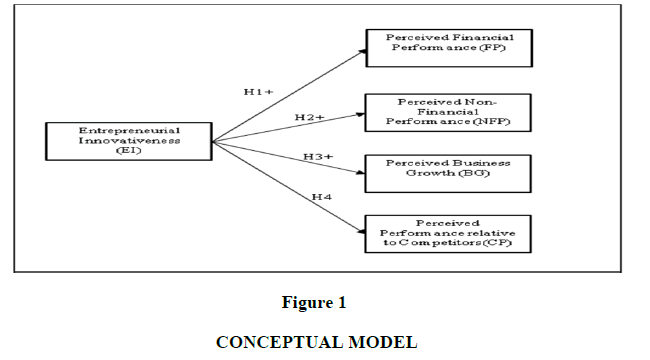

Wholesale and retail SMEs operate in turbulent business environments where they face the critical issue of survivability because of intense competition within the industry. Therefore, it is very essential for managers and entrepreneurs to know how to survive in such a dynamic business environment. We feel that CBV can be very helpful to assist SMEs in their survival through existing resources. For instance, innovativeness has been considered as the key resource of SMEs, however, innovative practices in wholesale and retailing context, such as changes in packaging or appearance of existing products, improvement in quality for the existing products, introduction of the new products and services, and engaging new suppliers etc., are neither rare nor unique practices or resources and are easy to copy or are even substitutable by the rivals. Therefore, these types of common innovative practices that exist in almost all SMEs are easily accessible within the business environment. Thus, based on CBV, innovation is considered as an ordinary resource and as an independent variable of our research framework. Additionally, four types of firm performances, including perceived financial performance, perceived non-financial performance, perceived business growth, and perceived performance relative to competitors have been used as the dependent variables in this study’s conceptual model. The conceptual model is illustrated in Figure 1.

Innovativeness and Perceived Financial Performance

It has been widely acknowledged that innovation is a key source for achieving a competitive edge for all firms (Bilton & Cummings, 2009; Weerawardena, 2003; Bharadwaj et al., 1993). A number of studies have empirically found the positive impact of innovation on financial performance of firms under various contexts (Wang, 2014; Bigliardi, 2013; Laforet, 2011). For instance, it was found that financial performance of firms increased with the increase in innovation level in the context of the food machinery industry (Bigliardi, 2013). Innovations result in positive outcomes such as the good image and reputation of SME’s, as well as an increase in cost benefits and operational efficiency leading towards superior financial performance (Laforet, 2011). Likewise, a longitudinal survey of 607 high-technology firms also indicated innovation as the key driver of firm performance (Wang, 2014). Moreover, innovativeness aids firms in developing new capabilities that allow them to attain superior profitability (Hogan & Coote, 2014; Calantone et al., 2002; Sadikoglu & Zehir, 2010). Although the impact of innovation on firm performances has been studied in various contexts, studies on innovation in the retail context are lacking (Djellal & Miles, 2013; Drejer, 2004). Nonetheless, firms that are involved in various innovative behaviours can realize positive performance outcomes (Hogan & Coote, 2014). Consistent with the above arguments, the following hypothesis on the direct and positive influence of innovativeness on perceived financial performance is articulated:

H1: Innovativeness has a positive impact on perceived financial performance.

Innovativeness and Perceived Non-Financial Performance

Firms practicing innovativeness are able to respond to the needs of their customers (Sadikoglu & Zehir, 2010; Calantone et al., 2002). Thus, only satisfied customers will again purchase the products and services from the firm whose innovative practices have satisfied their expectations and needs. Therefore, it can be said that innovation leads to customer satisfaction and retention. Moreover, when the organisation is successful in satisfying and retaining their customers for the long term due to their innovative practices, this results in superior financial performance. This superior performance could then lead to managers and owners achieving increased work-life balance. However, the link has still not been fully studied in the retail sector. However, there is evidence in existing studies that innovation has a positive influence on customer satisfaction and retention. Thus, based on the above discussion, the associated hypothesis is as follows:

H2: Innovativeness has a positive impact on perceived non-financial performance.

Innovativeness and Perceived Business Growth

There is limited evidence available regarding the impact of innovation on performance in the context of the service sector. Research suggests there is positive impact of innovation on growth (Mansury & Love, 2008). Several studies have found positive impact of innovation on business growth under various contexts. For instance, the assessment of a firm’s innovation capability determines that the innovation capability of a firm is related to the long-term growth of businesses in the context of China (Yang, 2012). Similarly, by studying a sample of 113 Andalusian firms in the construction industry, Martínez et al. (2017) found a positive impact of innovation on firm growth. The foregoing argument leads to the development of the following hypothesis:

H3: Innovativeness has a positive impact on perceived growth performance.

Innovativeness and Perceived Performance Relative to Competitors

Currently, firms are operating in environments that are characterized by changing customer demands, ever increasing global competition, uncertainty and rapid technical changes (Droge et al., 2008). Therefore, it is critical for firms to achieve success and competitive advantage in through innovation (Prajogo & Ahmed 2006). This is because innovative firms are more flexible and can quickly respond to change (Drucker, 1998). Dynamism or dynamic environments demonstrate the uncertainty in customer demands and the unpredictable actions of competitors. Therefore, firms in turbulent business environments usually strive to innovate their products by various means in order to meet the unexpected demands of customers and to compete successfully within their respective industry (Prajogo, 2016; Lumpkin & Dess, 2001). Many studies have highlighted that dynamic and competitive business environments create a driving force on the innovative practices of firms (Baron & Tang, 2011; Wang & Chen, 2010; Freel, 2005). This is due to the ever-changing tastes and preferences of customers and the actions of competitors which require firms to use innovative practices to respond to such threats (Prajogo, 2016; Tripsas, 2008; Tidd, 2001). Thus, the innovative practices used by the firms may actually impact firm performance relative to their competitors in uncertain business environments. In light of the above arguments, the following hypothesis was developed:

H4: Innovativeness has a positive impact on perceived performance relative to competitors.

Methodology

Primary data were collected using quota sampling via a survey in 13 states of Peninsular Malaysia including Malacca, Johor, Kuala Lumpur, Negeri Sembilan, Putrajaya, Selangor, Perlis, Kedah, Pahang, Terengganu, Perak, Penang and Kelantan. We have determined the sample size using G*Power 3. We received 450 usable questionnaires. The seven items used to measure entrepreneurial innovativeness were adapted from the local studies of Idris (2010) and Juri (2009). The present study adapts a scale from the study of Ahmad et al. (2011) which constitutes four types of perceived firm performances. The four performances measures namely (a) perceived satisfaction with financial performance; (b) perceived satisfaction with non-financial performance; (c) perceived satisfaction with business growth; (d) perceived performance relative to competitors.

Data Analysis

We used Structural Equation Modeling Partial Least Square (SEM-PLS) using Smart PLS 3.0 software to analyze the data. Following the two-stage approach recommended by Hair et al. (2017), we examined the measurement model (validity and reliability of the measures) and structural model (hypothesis testing).

Measurement Model

For reliability, we examined each item’s loadings and composite reliability. For validity, we examined average variance extracted (AVE) for convergent validity (AVE>0.5) and the heterotrait-monotrait ratio of correlations (HTMT) for discriminant validity (HTMT<0.90) based on the recommended value by Henseler et al. (2015) accordingly. The satisfactory result for the measurement model was found due to its adequate reliability, convergent validity and discriminant validity. The following section presents the structural model analysis and hypotheses testing.

Assessment of the Structural Model

Table 1 illustrates the result of hypotheses testing. Direct positive and significant impact of innovativeness was found on perceived business growth, perceived performance relative to competitors and on perceived non-financial performance. On the other hand, we found that innovativeness has no impact on perceived financial performance.

| Table 1 HYPOTHESES TESTING STRUCTURAL MODEL |

||||

| Hypothesis | Std. Beta | Std. Error | P-values | Result |

| H1: Entrepreneurial Innovativeness->Financial Performance. | 0.104 | 0.072 | 0.152 | Not Supported |

| H2: Entrepreneurial Innovativeness->Non-Financial Performance. | 0.188 | 0.044 | ***0.000 | Supported |

| H3: Entrepreneurial Innovativeness->Growth Performance. | 0.178 | 0.057 | ***0.002 | Supported |

| H4: Entrepreneurial Innovativeness->Performance Relative to Competitors. | 0.107 | 0.063 | *0.089 | Supported |

The coefficients of determination (R<sup>2</sup>) was 0.011 for perceived financial performance (FP), 0.035 for perceived non-financial performance (NFP), 0.032 for perceived growth performance (GP), and 0.012 for perceived performance relative to competitors. Thus, based on Cohen’s (1988) guidelines for assessing the value of R<sup>2</sup>, the R<sup>2</sup> values are considered weak as they are less than 0.13. As for the Q2 values of the dependent variables, including perceived financial performance, perceived non-financial performance, perceived growth performance, and perceived performance relative to competitors is above 0. Thus, our proposed model has an adequate predictive relevance.

Conclusion

This study aimed to assess the impact of innovativeness on four measures of business performances including perceived financial performance, perceived non-financial performance, perceived growth performance, and perceived performance relative to competitors. The results revealed the positive and significant impact of innovativeness on all three perceived performance measures, except for perceived financial performance. This indicates that the existing innovative practices in wholesalers and retailers do not have a perceptible effect on financial performance. Hereinafter, with innovative practices, SMEs in the wholesale and retail industry are not able to generate superior financial performance. This may be due to little and ineffective innovative practices in Malaysian SMEs businesses and the huge dynamism faced by Malaysian SMEs. Moreover, the weak and non-significant impact of innovativeness on perceived financial performance is consistent with many other studies that also found negative or weak influence of innovativeness on a firm’s financial performances (Gunday et al., 2011; Zhang, 2011). Consequently, the findings reveal that innovativeness as an ordinary resource is not a strong predictor of perceived financial performance. However, the results regarding the positive influence of innovativeness on the remaining three perceived measures of firm performance, including perceived non-financial performance, perceived business growth, and perceived performance relative to competitors, are consistent with many other studies that already provided empirical evidence regarding the positive influence of entrepreneurial innovativeness on SMEs performances (Tajuddin et al., 2015; De-Clercq et al., 2011; Chen & Huang, 2009; Droge et al., 2008; Prajogo, 2006).

References

- Ahmad, N.H., Wilson, C., & Kummerow, L. (2011). Assessing the dimensionality of business success: The perspectives of Malaysian SME owner-managers. Journal of Asia-Pacific Business, 12(3), 207-224.

- Baron, R., & Tang, J. (2011). The Role of entrepreneurs in firm-level innovation: Joint effects of positive affect creativity and environmental dynamism. Journal of Business Venturing, 26(1), 49-60.

- Bartoloni, E., & Baussola, M. (2018). Driving business performance: Innovation complementarities and persistence patterns. Industry and Innovation, 25(5), 505-525.

- Bharadwaj, S., Varadarajan, P.R., & Fahy, J. (1993). Sustainable competitive advantage in service industries: A conceptual model and research propositions. Journal of Marketing, 57(4), 83-99.

- Bigliardi, B. (2013). The effect of innovation on financial performance: A research study involving SMEs. Innovation, 15(2), 245-255.

- Bilton, C., & Cummings, S. (2009). Creative strategy: From innovation to sustainable advantage. John Wiley & Sons Ltd.

- Calantone, R.J., Cavusgil, S.T., & Zhao, Y. (2002). Learning orientation, firm innovation capability and firm performance. Industrial Marketing Management, 31(6), 515-524.

- Chen, C.J., & Huang, J.W. (2009). Strategic human resource practices and innovation performance-the mediating role of knowledge management capacity. Journal of Business Research, 62(1), 104-114.

- De-Clercq, D., Thongpapanl, N., & Dimov, D. (2011). The moderating role of organizational context on the relationship between innovation and firm performance. IEEE Transactions on Engineering Management, 58(3), 431-444.

- Djellal, F., & Gallouj, F. (2013). Two decades of research on innovation in services: Which place for public services? Structural Change and Economic Dynamics, 27(1), 98-117.

- Drejer, I. (2004). Identifying innovation in surveys of services: A Schumpeterian perspective. Research Policy, 33(3), 551-562.

- Droge, C., Calantone, R., & Harmancioglu, N. (2008). New product success: Is it really controllable by managers in highly turbulent environments? Journal of Product Innovation Management, 25(3), 272-286.

- Drucker, P.F. (1998). The discipline of innovation. Harvard Business Review, 76(6), 149-157.

- Freel, M.S. (2005). Perceived environmental uncertainty and innovation in small firms. Small Business Economics, 25(1), 49-64.

- Gërguri-Rashiti, S., Ramadani, V., Abazi?Alili, H., Dana, L.P., & Ratten, V. (2017). ICT, innovation and firm performance: The transition economies context. Thunderbird International Business Review, 59(1), 93-102.

- Gunday, G., Ulusoy, G., Kilic, K., & Alpkan, L. (2011). Effects of innovation types on firm performance. International Journal of Production Economics, 133(2), 662-676.

- Hair, J.F., Hult, G.T.M., Ringle, C.M., & Sarstedt, M. (2017). A primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Thousand Oaks, CA: Sage.

- Henseler, J., Ringle, C.M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115-135.

- Hogan, S.J., & Coote, L.V. (2014). Organizational culture, innovation and performance: A test of Schein's model. Journal of Business Research, 67(8), 1609-1621.

- Hristov, L., & Reynolds, J. (2015). Perceptions and practices of innovation in retailing: Challenges of definition and measurement. International Journal of Retail & Distribution Management, 43(2), 126-147.

- Hughes, A. (2007). Innovation policy as cargo cult: Myth and reality in knowledge-led productivity growth. Centre for Business Research, University of Cambridge, Cambridge.

- Idris, A. (2010). An Inter-Ethnic study of gender differentiation and innovativeness among women entrepreneurs in Malaysia. South African Journal of Business Management, 41(4), 35-46.

- Juri, K.A.M. (2009). The relationship between cultural values and innovativeness: A study of malay and chinese entrepreneurs in Malaysia (master’s thesis). University of Malaya, Malaysia.

- Laforet, S. (2011). A framework of organisational innovation and outcomes in SMEs. International Journal of Entrepreneurial Behavior & Research, 17(4), 380-408.

- Lumpkin, G.T., & Dess, G.G. (1996). Clarifying the entrepreneurial orientation construct and linking it to performance. Academy of Management Review, 21(1), 135-172.

- Lumpkin, G.T., & Dess, G.G. (2001). Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle. Journal of Business Venturing, 16(5), 429-451.

- Luo, Y., & Child, J. (2015). A composition-based view of firm growth. Management and Organization Review, 11(3), 379-411.

- Mansury, M.A., & Love, J. (2008). Innovation, productivity and growth in US business services: A firm-level analysis. Technovation, 28(1), 52-62.

- Martínez, R.J.A., Tamayo, J.A., & Gamero, J. (2017). Innovativeness and its influence on growth and market extension in construction firms in the Andalusian region. Journal of Engineering and Technology Management, 43(3), 19-33.

- Naranjo-Valencia, C., Jiménez-Jimenez, D., & Sanz-Valle, R. (2016). Studying the links between organizational culture, innovation and performance in Spanish companies. Revista Latinoamericana De Psicología, 48(1), 30-41.

- Prajogo, D.I. (2006). The relationship between innovation and business performance a comparative study between manufacturing and service firms. Knowledge and Process Management, 13(3), 218-225.

- Prajogo, D.I. (2016). The strategic fit between innovation strategies and business environment in delivering business performance. International Journal of Production Economics, 171(2), 241-249.

- Prajogo, D.I., & Ahmed, P.K. (2006). Relationships between innovation stimulus, innovation capacity and innovation performance. R&D Management, 36(5), 499-515.

- Ribau, C.P., Moreira, A.C., & Raposo, M. (2017). SMEs innovation capabilities and export performance: An entrepreneurial orientation view. Journal of Business Economics and Management, 18(5), 920-934.

- Sadikoglu, E., & Zehir, C. (2010). Investigating the effects of innovation and employee performance on the relationship between total quality management practices and firm performance: An empirical study of Turkish firms. International Journal of Production Economics, 127(1), 13-26.

- Taghizadeh, S.K., Jayaraman, K., Ismail, I., & Rahman, S.A. (2016). Scale development and validation for DART model of value co-creation process on innovation strategy. Journal of Business & Industrial Marketing, 31(1), 24-35.

- Tajuddin, M.Z.M., Iberahim, H., & Ismail, N. (2015). Relationship between innovation and organisational performance in construction industry in Malaysia. Universal Journal of Industrial and Business Management, 3(4), 87-99.

- Tidd, J. (2001). Innovation management in context: Environment, organisation and performance. International Journal of Management Reviews, 3(3), 169-183.

- Wang, C.H. (2014). A longitudinal study of innovation competence and quality management on firm performance. Innovation, 16(3), 392-403.

- Wang, C.L., & Ahmed, P.K. (2004). The development and validation of the organisational innovativeness construct using confirmatory factor analysis. European Journal of Innovation Management, 7(4), 303-313.

- Wang, H., & Chen, W.R. (2010). Is Firm-specific innovation associated with greater value appropriation? The roles of environmental dynamism and technological diversity. Research Policy, 39(1), 141-154.

- Weerawardena, J. (2003). The role of marketing capability in innovation-based competitive strategy. Journal of Strategic Marketing, 11(1), 15-35.

- Yang, J. (2012). Innovation capability and corporate growth: An empirical investigation in China. Journal of Engineering and Technology Management, 29(1), 34-46.

- Zawawi, N.M., Wahab, S.A., Al-Mamun, A., Yaacob, A.S., Al-Samy, N.K., & Fazal, S.A. (2016). Defining the concept of innovation and firm innovativeness: A critical analysis from resorce-based view perspective. International Journal of Business and Management, 11(6), 87-94.

- Zhang, M.J. (2011). Firm-level performance impact of is support for product innovation. European Journal of Innovation Management, 14(1), 118-132.