Case Reports: 2018 Vol: 24 Issue: 4

Equity Valuation of Infosys Ltd. (2017)

Uday K Jagannathan, Ramaiah University of Applied Sciences

Case Description

This case is an introductory case in Corporate Finance and can be taught in the first year MBA students. The main focus areas are: Intrinsic Value of the firm, Cost of Equity Calculation using various estimates, Discounted Cash flow valuation of the firm, Impact of Corporate Governance on firm value. Students will be exposed to an array of analytical methods useful in estimating the intrinsic value of the Assets of the firm.

Case Synopsis

In the early February of 2017, the famed Information Technology Company of India, Infosys Ltd. was in the news not necessarily for the right reasons. The Corporate Governance of the firm was being called into question.

A few questions are along the intrinsic valuation of Infosys Ltd equity. Is the company’s stock properly valued at Rs. 967 at the present time? What should the appropriate discount rate be? What should the present value of the company be? Is the stock vulnerable to changes in growth rate and risk levels?

Case Body

Company Background of Infosys Ltd.

As they gazed out of their giant 20th floor office window on the Worli sea face in Mumbai, owners of mutual fund management firm Upside, Suri and Jagan wondered if Infosys Ltd. should be part of their current portfolio of large cap Indian stocks or should be replaced.

In the late winter of 2017, the famed Information Technology Company of India (Infosys Ltd.) was in the news not necessarily for the right reasons. The Corporate Governance of the firm was being called into question by the founder. Although none of the founders remained in the company, they still owned 12.75 percent of the firm’s equity. Among the important holders of Infosys equity were Foreign portfolio investors, Insurance companies in India, Retail investors amounted to about 30 percent of the company’s equity (Table 1).

| Table 1 Ownership structure of infosys ltd. Equity |

||

| Type of Investor | Percent Owned | |

| Foreign Portfolio investors | 39.02 | |

| Indian Insurance companies | 11.26 | |

| Mutual funds | 7.42 | |

| Promoter and promoter group | 12.75 | |

| Others (including individuals) | 29.55 | |

| Total | 100.0 | |

Source: Infosys Annual Reports as of 31st December 2016.

Infosys was founded in 1981 by N.R.Narayanamurthy and 6 software professionals with a capital of Rs 10,000 in the city of Pune, India. The company relocated headquarters to Bengaluru in 1983, and in 1987 opened its first US office in Boston, MA, USA. With an emphasis to develop high quality software, Infosys obtained ISO 9001 certification in the year 1993. With the opening up of financial markets in 1991 by then Finance minister Dr. Manmohan Singh in the P.V. Narasimha Rao government, Infosys also went public with an IPO trading at Rs 145 per share. Infosys experienced rapid growth and moved to a larger campus in Electronics city, Bengaluru. The company also opened an offshore development center in 1994 in Fremont, CA, USA. With “Year 2000-Y2k” projects driving demand for software solution companies, Indian Information Technology (IT) companies experienced a boom like never before.

Abetted by low land and labour prices in India, a strong global demand environment, Infosys revenue touched $500 million in 2002 and $1 billion in 2004. The first billion $ in revenue took 23 years but the time taken to reach $2 billion in revenue only took 23 months more, according to company information. Several subsidiaries and offshore development centers emerged in countries like China and Australia and multiple time zones of clients were managed with the concept of the Global delivery model. In 2014 upon exit from the firm of all founders, Dr. Vishal Sikka was selected to run Infosys and with his rich technology expertise from SAP AG, was able to articulate a vision for one of the leading IT services firm of India.

Industry Structure

The revenue of the Indian IT industry was over $140 billion dollars per year. The revenues largely came from the U.S. and Europe. Infosys had clients in the other continents Africa, Asia, Australia and South America as well. Services were delivered using the famed IT outsourcing methodology under the premise of reduced organizational operating cost of the client. One of the reasons why IT service firms saw a high return on equity was labour arbitrage. Assuming the average wage of a programmer in the U.S. was more than $45 per hr, the same labour could be obtained in India at a fraction of that amount (Bruner, 1998). Therefore in simple economic terms, Indian offshore IT labour was an appealing substitute for on-site programming services. The largest four in the Indian IT sector were Tata Consultancy Services (TCS), Infosys Ltd, Wipro Ltd, and Cognizant Technology solutions (Table 2). The four companies had a combined market capitalization of Rs. 10,45,941 Crore (USD 156 billion) and a combined revenue of Rs. 3,16,895 Crore (USD 46.6 billion) as on fiscal year end 2016.The IT sector itself was growing at a rate of over10% per year. NASSCOMM (National Association of Software Services Companies) projected the growth rate of the IT sector at 10-12%.

| Table 2 The Big Four Of Indian It Services |

|||||

| Company name | Share price on FY end 2016 | Market Cap in Rs. Cr. | Revenue Fiscal year ending 2016 in Rs. Cr. | Operating profit in Rs. Cr. | PE Ratio |

| Tata Consultancy Services | 2,362 | 4,72,252 | 1,08,646 | 31,676 | 19.1 |

| Infosys Ltd | 1,011 | 2,22,356 | 62,441 | 15,620 | 18.7 |

| Cognizant Technology solutions+ | 3,823* | 2,37,811* | 91,712* | 15,565* | 22.0 |

| Wipro Ltd | 564 | 1,13,522 | 54,096 | 11,543 | 15.5 |

Source: Company annual reports for fiscal year ending 2016.

Note: *Converted from USD at the prevailing rate as @ Rs. 68 per USD.

The New Infosys Management and Board of Directors

The founders of Infosys welcomed Dr. Vishal Sikka to Infosys in 2014. The founders always said that at the right time, they would gladly give up the reins of the company to professional management and they did. Dr. Sikka joined the company after 12 years at SAP AG where he was a member of the executive board and led all product development initiatives. He was credited with the development of HANA, a high tech solution which became the fastest growing product in SAP AG’s history. The timing of Dr. Sikka’s joining Infosys was marked by high pressure on cost concomitant with rapid changes in technology (Goedhart et al., 2010).

In February 2017, the board of directors at Infosys comprised ten seasoned technology and management professionals and Dr. Sikka enjoyed support of the Board members. Neither any of the founders nor past management personnel of Infosys were in the present board of the company. The structure of the Board included two Executive members (including Dr. Sikka), one non-executive Chairman of the board and seven independent directors. Infosys was always known for its superior quality of Corporate Governance, transparency in operations and information to shareholders at large. Infosys had won several awards related to Corporate Governance since the company went public in 1993. These were indeed big shoes to fill for Dr. Sikka, and in the meanwhile the competitive nature of the industry had become far more intense.

Margins were always under pressure for each firm in the industry. Further, client could always find substitutes easily, and too much price flexibility was not possible. There was this general question as to whether the standard of Corporate Governance alone was an important determinant of increased shareholder value.

Dissatisfaction with Corporate Governance at Infosys

It was a well-known fact that Infosys created very high amount of shareholder value from the time of the Initial Public Offering (IPO) until the time that the last founder exited the company, in 2014. Therefore it is possible for the founders to speak from high ground, share their achievements with the general public and create a similar expectation in the minds of the investor. In February 2017, media reported the general impression that while there was no problem with the management, certain issues were raised regarding the governance at Infosys specifically on the severance package made to Rajiv Bansal, CFO who resigned in October 2015. The contention was that the level of the severance package was unprecedented and that good governance standards should call for consistency in the level of severance for executives. Further, the contention was that excessive severance packages could damage firm value and financial well-being of the company.

Reaction from the Investor Community

Several executives who had resigned from Infosys expressed grievance and commented on the nature in the manner the severance was paid. An ex-CFO of Infosys suggested that the Infosys board needed strengthening and that the Infosys business model was not robust enough to withstand the wave of automation. Further, he suggested that there was leadership flux in the company. Also on his list was lack of capital efficiency and allocation. Another an ex-CFO of the company in an interview to economic times, a leading business daily of India said that the variable pay hike given to Dr. Sikka seemed non-transparent in that it was unclear what target it was linked to (Jensen, 1976).

An open letter, from Oppenheimer Funds, a large foreign institutional investor to the Infosys Board of directors stated.

“The bottom line is that, in our opinion, Dr. Sikka has achieved much in his tenure as the first non-founder Chief Executive Officer. After many years of internal volatility and competitive underperformance, it is encouraging to see that Vishal has stabilized the core and articulated a clear and appropriate long-term strategy to help Infosys thrive amidst industry disruption. We would strongly encourage the Board of Directors to restrain divisions in the firm and contain interventions by non-executive founders. Let Vishal do what he was hired to do, without distractions. And appraise him on his efforts.”

The Intrinsic Price of Infosys Ltd.

Suri and Jagan were owners of a small mutual fund company management firm Upside which held Rs. 1,000 Crore (Rs. 10 billion or USD 147 million) of large cap equity stocks. The share of Infosys in the portfolio was 4 percent which amounted to Rs. 40 Crore or USD 5.8 million. While this was a small amount when compared to the overall market capitalization of Infosys in early February 2017, it was still important for the two to consider the valuation of the company under the present circumstances.

Infosys stock price adjusted for dividends and stock splits in the last 60 months was publicly available information. In addition, the level of the BSE 500 in the same time frame was available as a reference for estimating the performance of Infosys’ shares versus the market. This data was available to them in (Table 3). It is useful to note that shareholders were given both cash dividends and stock dividends (through stock splits, equivalent to cash dividends) in both 2014 and 2015.

| Table 3 Infosys ltd. And bse 500 monthly closing levels for 60 months starting january 2012 |

||||||||

| Month- Year |

Infosys Ltd. Adjusted Closing Price | BSE 500 Closing Level | Month-Year | Infosys Ltd. Adjusted Closing Price | BSE 500 500 Closing Level |

Month-Year | Infosys Ltd. Adjusted Closing Price | BSE 500 Closing Level |

| Dec-16 | 1,010.7 | 11,036.4 | Mar-15 | 1,022.1 | 11,048.8 | Jun-13 | 514.4 | 7,164.1 |

| Nov-16 | 975.5 | 11,195.1 | Feb-15 | 1,045.1 | 11,405.3 | May-13 | 496.8 | 7,441.9 |

| Oct-16 | 997.5 | 11,853.4 | Jan-15 | 988.1 | 11,346.2 | Apr-13 | 439.9 | 7,385.3 |

| Sep-16 | 1,038.1 | 11,700.7 | Dec-14 | 909.0 | 11,341.0 | Mar-13 | 568.9 | 7,085.0 |

| Aug-16 | 1,036.8 | 11,834.9 | Nov-14 | 502.5 | 10,956.2 | Feb-13 | 572.0 | 7,163.7 |

| Jul-16 | 1,073.9 | 11,586.0 | Oct-14 | 934.1 | 10,594.9 | Jan-13 | 549.0 | 7,665.7 |

| Jun-16 | 1,170.8 | 11,029.5 | Sep-14 | 837.6 | 10,173.3 | Dec-12 | 456.4 | 7,581.6 |

| May-16 | 1,235.5 | 10,761.5 | Aug-14 | 803.3 | 10,096.1 | Nov-12 | 479.6 | 7,472.5 |

| Apr-16 | 1,196.9 | 10,406.1 | Jul-14 | 752.2 | 9,831.5 | Oct-12 | 465.3 | 7,118.8 |

| Mar-16 | 1,203.9 | 10,185.1 | Jun-14 | 725.6 | 9,791.3 | Sep-12 | 486.2 | 7,206.5 |

| Feb-16 | 1,071.3 | 9,206.0 | May-14 | 657.4 | 9,206.0 | Aug-12 | 455.3 | 6,616.4 |

| Jan-16 | 1,151.4 | 10,014.0 | Apr-14 | 671.6 | 8,342.2 | Jul-12 | 427.4 | 6,605.7 |

| Dec-15 | 1,091.8 | 10,634.2 | Mar-14 | 693.1 | 8,295.3 | Jun-12 | 480.1 | 6,682.5 |

| Nov-15 | 1,075.9 | 10,580.9 | Feb-14 | 807.5 | 7,709.8 | May-12 | 468.1 | 6,280.0 |

| Oct-15 | 1,123.0 | 10,671.6 | Jan-14 | 782.0 | 7,499.0 | Apr-12 | 454.8 | 6,698.5 |

| Sep-15 | 1,136.6 | 10,498.3 | Dec-13 | 736.8 | 7,828.3 | Mar-12 | 529.1 | 6,759.6 |

| Aug-15 | 1,072.7 | 10,536.4 | Nov-13 | 708.9 | 7,598.2 | Feb-12 | 531.0 | 6,857.3 |

| Jul-15 | 1,055.9 | 11,233.4 | Oct-13 | 699.4 | 7,656.6 | Jan-12 | 506.6 | 6,549.3 |

| Jun-15 | 965.1 | 10,903.5 | Sep-13 | 622.2 | 7,020.0 | |||

| May-15 | 932.6 | 11,023.8 | Aug-13 | 639.7 | 6,674.0 | |||

| Apr-15 | 895.7 | 10,696.8 | Jul-13 | 612.2 | 6,985.6 | |||

Infosys had always made dividend payments regularly to the investors. The dividend information was available to them in (Table 4).The stock split in 2014 as well as in 2015 these were same as dividends. The owners of Upside noted that there was no debt in the capital structure but did not question it at the present moment.

| Table 4 Infosys ltd. Dividends and stock splits for 60 months starting january 2012 |

|||||

| Date | Rs. | Dividend | |||

| 9-Jun-16 | 14.25 | Dividened | |||

| 16-Oct-15 | 10 | Dividened | |||

| 15-Jun-15 | 29.5 | Dividened | |||

| 12-Jun-15 | 29.5 | Dividened | |||

| 16-Oct-14 | 30 | Dividened | |||

| 29-May-14 | 43 | Dividened | |||

| 17-Oct-13 | 20 | Dividened | |||

| 30-May-13 | 27 | Dividened | |||

| 18-Oct-12 | 15 | Dividened | |||

| 24-May-12 | 22 | Dividened | |||

| Date | Ration | Type | |||

| 15-Jun-15 | 2:1 | Stock split | |||

| 2-Dec-14 | 2:1 | Stock split | |||

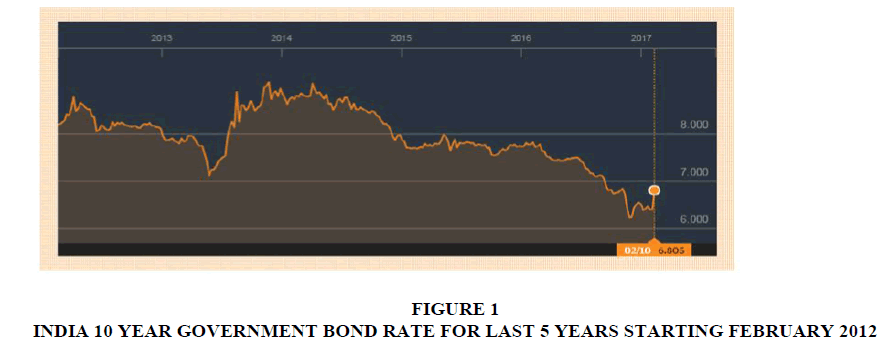

The risk free rate was the return any investor desired for making a risk less return. In the Indian context, the yield on a 10 year government bond was considered as an appropriate measure of the risk free rate (Van, 2009). This data was available to them in (Figure 1). Add the risk premium of Infosys and one could arrive at the appropriate discount rate for Infosys. Selected data from Infosys Profit and Loss statement (Table 5) as well as Balance Sheet were available in (Table 6)

| Table 5 Infosys ltd. Selected data from profit and loss and balance sheet FY15-FY16 |

|||||

| 2015 | 2016 | ||||

| Income from Software Services and Products | 47,300 | 53,983 | |||

| Other Income | 3,337 | 3,009 | |||

| Total Revenue | 50,637 | 56,992 | |||

| Expenses | |||||

| Employee benefit expense | 25,115 | 28,206 | |||

| Deferred Consideration pertaining to Acquisition | 219 | 110 | |||

| Cost of Technical Subcontractors | 2,909 | 4,417 | |||

| Travel Expenses | 1,360 | 1,655 | |||

| Cost of Software Packages and others | 979 | 1,049 | |||

| Communication Expenses | 384 | 311 | |||

| Consultancy and professional charges | 396 | 563 | |||

| Depreciation and amortization expense | 913 | 1,115 | |||

| Other Expenses | 1,976 | 1,909 | |||

| Total Expense | 34,251 | 39,335 | |||

| Tax Expense | |||||

| Profit Before Exceptional Item and Tax | 16,386 | 17,657 | |||

| Profit on Transfer of Business | 412 | 3036 | |||

| Profit Before Tax | 16,798 | 20,693 | |||

| Current Tax | 4537 | 4898 | |||

| Deferred Tax | 97 | 9 | |||

| Profit for the Period | 12,164 | 15,786 | |||

| Year | 2015 | 2016 | |||

| Share Capital | 574 | 1,148 | |||

| Reserves and Surplus | 47,494 | 56,009 | |||

| Total Shareholder funds | 48,068 | 57,157 | |||

| Liabilities | |||||

| Long Term Liabilities | 30 | 73 | |||

| Current Liabilities | 13,715 | 15,537 | |||

| Total Liabilities | 13,745 | 15,610 | |||

| Equity + Liabilities | 61,813 | 72,767 | |||

| Year | 2015 | 2016 | |||

| Fixed Assets | 8,116 | 9,182 | |||

| Investments | 6,108 | 11,111 | |||

| Deferred Tax | 433 | 405 | |||

| Long Term Advances | 4,378 | 5,970 | |||

| Other Non-Current Assets | 26 | 2 | |||

| Total Non-Current Assets | 19,061 | 26,670 | |||

| Current Investments | 749 | 2 | |||

| Trade Receivables | 8,627 | 9,798 | |||

| Cash and Cash Equivalent | 27,722 | 29,176 | |||

| Short Term Advances | 5,654 | 7,121 | |||

| Total Current Assets | 42,752 | 46,097 | |||

| Table 6 Beta Calculation |

|||||||

| Date | Pit | Pmt | Dividend | Rit | Rmt | ||

| January-12 | 506.6 | 6,549.3 | 0 | 0.05 | 0.05 | ||

| February-12 | 531.0 | 6,857.3 | 0 | 0.00 | -0.01 | ||

| March-12 | 529.1 | 6,759.6 | 0 | -0.14 | -0.01 | ||

| Apnl-12 | 454.8 | 6,698.5 | 0 | 0.03 | -0.06 | ||

| May-12 | 468.1 | 6,280.0 | 22 | 0.07 | 0.06 | ||

| Jwte-12 | 480.1 | 6,682.5 | 0 | -0.11 | -0.01 | ||

| July-12 | 427.4 | 6,605.7 | 0 | 0.07 | 0.00 | ||

| August-12 | 455.3 | 6616.4 | 0 | 0.07 | 0.09 | ||

| September-12 | 486.2 | 7,206.5 | 0 | -0.04 | -0.01 | ||

| October-12 | 465.3 | 7,118.8 | l5 | 0.06 | 0.05 | ||

| November-12 | 479.6 | 7,472.5 | 0 | -0.05 | 0.01 | ||

| December-12 | 456.4 | 7,581.6 | 0 | 0.20 | 0.01 | ||

| January-13 | 549.0 | 7,665.7 | 0 | 0.04 | -0.07 | ||

| February-13 | 572.0 | 7,163.7 | 0 | -0.01 | -0.01 | ||

| March-13 | 568.9 | 7,085.0 | 0 | -0.23 | 0.04 | ||

| Apnl-13 | 439.9 | 7,385.3 | 0 | 0.13 | 0.01 | ||

| May-13 | 496.8 | 7,441.9 | 27 | 0.09 | -0.04 | ||

| Jwte-13 | 5l4.4 | 7,164.1 | 0 | 0.19 | -0.02 | ||

| July-13 | 612.2 | 6,985.6 | 0 | 0.04 | -0.04 | ||

| August-13 | 639.7 | 6,674.0 | 0 | -0.03 | 0.05 | ||

| September-13 | 622.2 | 7,020.0 | 0 | 0.12 | 0.09 | ||

| October-13 | 699.4 | 7,656.6 | 20 | 0.04 | -0.01 | ||

| November-13 | 708.9 | 7,598.2 | 0 | 0.04 | 0.03 | ||

| December-13 | 736.8 | 7,828.3 | 0 | 0.06 | -0.04 | ||

| January-14 | 782.0 | 7,499.0 | 0 | 0.03 | 0.03 | ||

| February-14 | 807.5 | 7,709.80 | 0 | -0.14 | 0.08 | ||

| March-14 | 693.1 | 8,295.3 | 0 | -0.03 | 0.01 | ||

| Apnl-14 | 671.6 | 8,342.20 | 0 | -0.02 | 0.10 | ||

| May-14 | 657.4 | 9,206.0 | 43 | 0.17 | 0.06 | ||

| Jwte-14 | 725.6 | 9,791.3 | 0 | 0.04 | 0.00 | ||

| July-14 | 752.2 | 9,831.5 | 0 | 0.07 | 0.03 | ||

| August-14 | 803.3 | 10,096.1 | 0 | 0.04 | 0.01 | ||

| September-14 | 837.6 | 10,173.3 | 0 | 0.12 | 0.04 | ||

| October-14 | 934.1 | 10,594.9 | 30 | -0.43 | 0.03 | ||

| November-14 | 502.5 | 10,956.20 | 0 | 0.81 | 0.04 | ||

| December-14 | 909.0 | 11,341.0 | 0 | 0.09 | 0.00 | ||

| January-I S | 988.1 | 11,346.2 | 0 | 0.06 | 0.01 | ||

| February-1S | l,045.l | ll,405.3 | 0 | -0.02 | -0.03 | ||

| March-IS | 1,022.1 | 11,048.8 | 0 | -0.12 | -0.03 | ||

| Apnl-IS | 895.7 | 10,696.8 | 0 | 0.04 | 0.03 | ||

| May-IS | 932.6 | 11,023.8 | 0 | 0.03 | -0.01 | ||

| Jwte-IS | 965.l | 10,903.5 | 59 | 0.16 | 0.03 | ||

| July-IS | l,055.9 | 11,233.4 | 0 | 0.02 | -0.06 | ||

| August-I S | 1,072.7 | 10,536.4 | 0 | 0.06 | 0.00 | ||

| September-I S | 1,136.6 | 10,498.3 | 0 | -0.01 | 0.02 | ||

| October-I S | 1,123.0 | 10,671.6 | 10.00 | -0.03 | -0.01 | ||

| November-IS | l,075.9 | 10,580.9 | 0 | 0.01 | 0.01 | ||

| December-IS | 1,091.8 | 10,634.2 | 0 | 0.05 | -0.06 | ||

| January-16 | l,I5l.4 | 10,014.0 | 0 | -0.07 | -0.08 | ||

| February-16 | 1,071.3 | 9,206.0 | 0 | 0.12 | 0.11 | ||

| March-16 | 1,203.9 | 10,185.l | 0 | -0.01 | 0.02 | ||

| Apnl-16 | 1,196.9 | 10,406.1 | 0 | 0.03 | 0.03 | ||

| May-16 | l,235.5 | 10,761.5 | 0 | -0.05 | 0.02 | ||

| Jwte-16 | 1,170.8 | 11,029.50 | 14.25 | -0.07 | 0.05 | ||

| July-16 | 1,073.9 | ll,586.0 | 0 | -0.03 | 0.02 | ||

| August-16 | 1,036.8 | 11,834.9 | 0 | 0.00 | -0.01 | ||

| September-16 | 1,038.1 | 11,700.7 | 0 | -0.04 | 0.01 | ||

| October-16 | 997.5 | ll,853.4 | 0 | -0.02 | -0.06 | ||

| November-16 | 975.5 | ll,195.l | 0 | 0.04 | -0.01 | ||

| December-16 | 1,010.7 | 11,036.4 | 0 | - | - | ||

| Average | 2.69% | 0.98% | Covariance | 0.0005 | |||

| Annualized | 32% | 11.7% | Var (Market) | 0.0018 | |||

| ß Value | 0.29 | ||||||

| Risk Free Rate | - | 6.80% | |||||

| Beta | - | 0.29 | |||||

| Rm-Rf | - | 4.9% | |||||

| ke | - | 8.2% | |||||

Questions to be assigned to Students:

Question 1: What is the role of Corporate Governance in firm profitability and firm value creation?

Question 2: What are value drivers in Corporate Valuation? How do they impact firm value?

Question 3: What is the value of Infosys Ltd using Discounted Cash Flow Valuation? Using Relative Valuation?

Instructor Notes

This case is based entirely on secondary data which is publicly available and can be used as an introductory case to teach basic principles of Valuation to Finance students.

Teaching Objectives

This case aims to teach the student two types of valuation–Discounted Cash flow valuation and Relative Valuation.

Teaching Methods

Discussion Questions

Question 1: What is the role of Corporate Governance in firm profitability and firm value creation?

1. Founders own a large portion of Infosys Ltd. Equity (12.75%) in Table 1. Does this entail them to discuss matters with media? Or should it be part of Shareholder meetings?

2. There is always an Agency cost–refer Jensen and Meckling.

3. The stakeholders should aim at lowering the total agency cost of the firm. Agents may take decisions which are risky and or not in line with overall risk level of firm.

4. A discussion on “does good Governance increase the firm value (Share price) or are several other factors responsible for determination of share price?”

5. Professor should gather ideas on what constitutes good governance practices–transparency, staggered board, track record of directors, prevention of hostile takeover, honesty and integrity

6. Agency problem can be solved by: A) Market Forces; i) hostile takeover, ii) shareholder meetings and B) Incurring Agency Costs; i) monitoring cost i.e., audit and control, ii) bonding cost to ensure integrity of managers, iii) opportunity cost because controlling agents results in hierarchy, bureaucracy, iv) structuring cost i.e., incentive and performance plans.

Question 2: What are value drivers in Corporate Valuation? How do they impact firm value?

A discussion on what constitutes value drivers:

1.

2. Discussion on FCF1.

3. Discussion on WACC (Introduce the concept of Cost of Capital and how purely equity firms Cost of Equity can be calculated).

4. How is the growth rate of Earnings of the firm?

Calculations

Weighted Average Cost of capital (WACC) is a complex entity and it is hoped that the students have done some basic reading on the topic (Brealey and Myers or other text will be useful). For the usefulness of discussion, the risk level of the firm concept can be introduced. The cash flows of the firm are being discounted at the WACC and the current value of the firm is thus arrived at.

Where, wd is the market value of Debt and we is the market value of equity.

In order to calculate the cost of capital for a purely equity financed firm, the first part of the above equation is zero (wd*kd) and only we*ke remains. Since we is 100% or 1.0 therefore the problem boils down to calculate the value of ke. This can be estimated using the Capital Asset Pricing Model (CAPM) or the Dividend Discount Model (DDM).

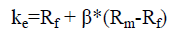

The CAPM states that:

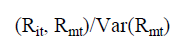

Where, Rf is the risk free rate, β is the covariance of the equity with the market divided by the market variance. The last 5 years data of Infosys stock price along with the benchmark index BSE500 is given in electronic format. The students should have calculated the stock’s beta using the theory instruction given by the professor prior to the discussion of this case. The specific formula for the Covariance (β):

Where, Rit is the return on the stock in time t and Rmt is the return on the market portfolio in time t.

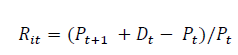

Where, Pt is the price of the share in time t and Dt is the dividend paid in time t.

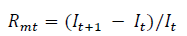

Where, It is the value of the BSE 500 Index in time t.

Table 6 details how to do the beta calculation for Infosys Stock.

Note: Although Betas are available on the internet, the students should be encouraged to calculate it for themselves.

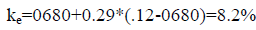

The value of Rf can be read from the graph as in Figure 1 6.80% (for February 10th 2017). This value can be used in the CAPM. The value of Rm is 11.7% from Table 6 (remember to take the annualized value) and the Beta value is 0.29. Therefore the cost of equity for the firm is:

Since the firm is growing EPS at about 9%, and exceeds the value of 8.2% the value of ke does not seem appropriate to use in the formula related to free cash flow. Therefore the dividend discount model (DDM) can be used for calculation of ke.

The DDM states that:

Where,

From Table 4 it is clear that the value of D2016 is 14.25.

And the value of D0 in 2017 is 15.53 showing below:

14.25 x (1+g)=14.25 x 1.09=15.53

Since, the 2016 value of Dividend is 14.25 and the stock is being valued in 2017. Therefore it can be deduced that:

D1=D2018=15.53 x (1.09)=16.92

The above is done assuming a growth rate of 9% (EPS of 59.02 in 2016 and EPS of 53.93 in 2015) and P0=1,010.7 we can obtain the value of ke as (16.92/1010.7)+0.09=10.67%.

All data is available in Table 5 pertaining to Sales, Current Assets, Current Liabilities for years 2015 and 2016

Question 3: What is the value of Infosys Ltd Using Relative Valuation? Using Discounted Cash Flow Valuation?

1. valuation Industry Average PE Ratio x Infosys FY 2016 Earnings per Share = 15.02 X 59.02 = Rs. 886 (Table 7).

valuation Industry Average PE Ratio x Infosys FY 2016 Earnings per Share = 15.02 X 59.02 = Rs. 886 (Table 7).

| Table 7 Relative Valuation |

|||||

| Company name | Share price on FY end 2016 | Market Capitalization in Rs. Cr. |

Revene in Rs. Cr | Operating profit in Rs. Cr | PE Ratio |

| Tata Consultancy Services | 2,362 | 4,72,252 | 1,08,646 | 31,676 | 19.1 |

| Infosys Ltd | 1,011 | 2,22,356 | 62,441 | 15,620 | 18.7 |

| Cognizant Technology solutions | 3,823 | 2,37,811 | 91,712 | 15,565 | 22 |

| Wipro Ltd | 564 | 1,13,522 | 54,096 | 11,543 | 15.5 |

| Average | 18.825 | ||||

| EPS of Infosys | 59.02 | ||||

| Share Price of Infosys | 1,111 | ||||

2. Discuss on what the limitations of the PE model for Valuation are (companies with high growth and or high Return on Equity (ROE) can have a high PE Ratio at the same time poorly performing companies can have low PE Ratio).

3. Finally approach the Discounted Cash Flow model (DCF).

4. Discuss the Assumptions of the DCF (Percent of Sales Approach can be used to estimate the Free Cash Flows).

5. Assume horizon value is reached in 5 years (2021) and arrive at a growth rate of about 3% to 5% (Sensitivity Analysis to be performed).

6. Assume the ke does not change in 5 years and the value of the ke is 8.2%.

7. Define FCFt and find what constitutes FCFt in any given time period.

8. FCF is defined as the free cash flow available to investors. It is the Operating Cash Flow after Tax minus any Cash flow made into investments.

9. FCFt=(EBITt(1-T)+CLt-CLt-1-CAt+CAt-1-FAt+FAt-1+Deprt) where, EBIT stands for Earnings before Interest and Tax, T for Tax Rate, CL stands for current liabilities, CA for current assets, FA for fixed assets, Depr for Depreciation.t is a variable and goes from 2017 to 2021.

10. Salest can be estimated as Salest-1*(1+gs) where gs=growth rate in Sales between 2015 and 2016.

11. EBIT(1-T)t can be estimated as EBIT(1-T)/Sales in 2016 and multiplying by Salest.

12. CAt can be obtained by taking the CA/Sales Ratio for 2016 and multiplying by Salest.

13. CLt can be obtained by taking the CL/Sales Ratio for 2016 and multiplying by Salest.

14. FAt can be obtained by taking the FA/Sales Ratio for 2016 and multiplying by Salest.

15. Deprt can be obtained by taking the Depreciation/Sales Ratio for 2016 and multiplying by Salest.

16. The discount rate to be used is the cost of Capital already calculated as 8.2%. We are using the CAPM value, but the sensitivity Analysis Table (Table 8) shows the impact of increased cost of Capital as calculated by DDM.

| Table 8 Free Cash Flow Analysis |

|||||||||||||||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | Growth Rate% |

|||||||||||||

| Sales | 56,992 | 64,145 | 72,195 | 81,255 | 91,453 | 102,930 | 12.55% | ||||||||||||

| EBIT*(l-t) | 15,786 | 17,767 | 19,997 | 22,507 | 25,331 | 28,510 | 27.70% | ||||||||||||

| Current Operating Assets | 9,798 | 11,028 | 12,412 | 13,969 | 15,722 | 17,696 | 17.19% | ||||||||||||

| Current Liabilities | 15,537 | 17,487 | 19,682 | 22,152 | 24,932 | 28,061 | 27.26% | ||||||||||||

| Fixed Assets | 9,182 | 10,334 | 11,631 | 13,091 | 14,734 | 16,583 | 16.11% | ||||||||||||

| Depreciation | 1,115 | 1,137 | 1,159 | 1,182 | 1,205 | 1,228 | 1.96% | ||||||||||||

| Free Cash Flow | - | 18,450 | 20,647 | 23,118 | 25,897 | 29,022 | - | ||||||||||||

| Non-Operating Assets | 53,783 | - | - | - | - | - | - | ||||||||||||

| Discounted at WACC @ 8.20% | 8.20% | 17,052 | 19,083 | 21,366 | 23,934 | 26,822 | - | ||||||||||||

| Terminal Growth Rate % | 3.0% | - | - | - | - | - | - | ||||||||||||

| Terminal Value of Operating Cash Flows | 387,634 | - | - | - | - | - | - | ||||||||||||

| Total Value of the Operations | 495,891 | - | - | - | - | - | - | ||||||||||||

| Total Value of Non-Operating Assests | 53,783 | - | - | - | - | - | - | ||||||||||||

| Total Value of the Company | 549,674 | - | - | - | - | - | - | ||||||||||||

| Number of shares in Crores | 228.572 | - | - | - | - | - | - | ||||||||||||

| Share Price in Rupees | 2,405 | - | - | - | - | - | - | ||||||||||||

| SENSITIVITY OF SHARE PRICE TO VARIOUS PARAMETERS | |||||||||||||||||||

| Sensitivity to EBIT*(1-t) growth rate | Sensitivity to terminal growth rate % | Sensitivity to WACC % | |||||||||||||||||

| - | 2,405 | - | 2,405 | - | 2,405 | - | - | ||||||||||||

| 2.00% | 431 | 0.00% | 1,753 | 5.00% | 5,847 | - | - | ||||||||||||

| 4.00% | 585 | 1.00% | 1,910 | 6.00% | 3,976 | - | - | ||||||||||||

| 6.00% | 738 | 2.00% | 2,117 | 7.00% | 3,045 | - | - | ||||||||||||

| 8.00% | 892 | 3.00% | 2,405 | 8.00% | 2,490 | - | - | ||||||||||||

| 10.00% | 1,045 | 4.00% | 2,829 | 9.00% | 2,122 | - | - | ||||||||||||

| 12.00% | 1,199 | 5.00% | 3,518 | 10.00% | 1,861 | - | - | ||||||||||||

| 14.00% | 1,353 | 6.00% | 4,834 | 11.00% | 1,667 | - | - | ||||||||||||

| 15.00% | 1,429 | 7.00% | 8,343 | 12.00% | 1,517 | - | - | ||||||||||||

| 16.00% | 1,506 | 7.50% | 13,857 | 13.00% | 1,399 | - | - | ||||||||||||

| 17.00% | 1,583 | 8.00% | 46,943 | 14.00% | 1,302 | - | - | ||||||||||||

| 18.00% | 1,660 | 8.50% | - | 15.00% | 1,223 | - | - | ||||||||||||

| Sensitivity to CAPEX to Sales % | Sensitivity to CA/Sales % and CL/Sales % CL/SALES% -> | ||||||||||||||||||

| - | 2,405 | CA/ Sales % | 2,405 | 15% | 20% | 25% | 30% | ||||||||||||

| 1.00% | 2,569 | 5% | 2404 | 2458 | 2513 | 2567 | |||||||||||||

| 2.00% | 2,558 | 7% | 2382 | 2437 | 2491 | 2545 | |||||||||||||

| 3.00% | 2,547 | 9% | 2361 | 2415 | 2469 | 2524 | |||||||||||||

| 4.00% | 2,536 | 11% | 2339 | 2393 | 2448 | 2502 | |||||||||||||

| 5.00% | 2,526 | 13% | 2317 | 2371 | 2426 | 2480 | |||||||||||||

| 6.00% | 2,515 | 15% | 2295 | 2350 | 2404 | 2458 | |||||||||||||

| 7.00% | 2,504 | 17% | 2274 | 2328 | 2382 | 2437 | |||||||||||||

| 8.00% | 2,493 | 19% | 2252 | 2306 | 2361 | 2415 | |||||||||||||

| 9.00% | 2,482 | 21% | 2230 | 2285 | 2339 | 2393 | |||||||||||||

| 10.00% | 2,471 | 23% | 2208 | 2263 | 2317 | 2371 | |||||||||||||

| 11.00% | 2,460 | 25% | 2187 | 2241 | 2295 | 2350 | |||||||||||||

17. Finally, sensitivity analysis should be done so that the impact of variables like EBIT growth rate %, terminal growth rate % and WACC % on Intrinsic Value of Share Price should be analysed.

18. The MS Excel Spread sheet accompanying the Teaching Note should be helpful for the Professor to use as a Teaching Aid. The professor should discuss the variables and the valuation technique in class and ask students to take the raw work sheet and arrive at the valuation themselves if they have not done so.

1This case study was developed for use in a classroom setting by Mr. Uday kumar Jagannathan, Assistant Professor at Ramaiah University of Applied Sciences, Bengaluru, India. The case is not intended to demonstrate proper or improper handling of a business situation.

References

- Bloomberg, India Risk Free Rate. (2017). Retrieve from http://www.bloomberg. com/ quote/GIND10YR:IND

- Bruner, R.F., Eades, K.M., Harris, R.S., & Higgins, R.C. (1998). Best practices in estimating the cost of capital: Survey and synthesis. Financial Practice and Education, 8(1), 13-28.

- Business Standard, NASCOMM. (2017). Retrieve from <http://www.business -standard.com/article/companies/a-first-in-25-years-nasscom-defers-it-growth-forecast-for-fy18-117021501053_1.html>

- Cognizant Annual Report. (2017). Retrieved from <http://investors.cognizant.com/annual-report>

- Economic Times. (2015). Statement of Dr. Vishal Sikka. Retrieve from <http://economictimes.indiatimes.com/tech/ites/infosys-ceo-vishal-sikka-says-hitting-20-billion-revenue-by-2020-feasible-and-viable/articleshow/47043314.cms>

- Economic Times. (2017). Statement of Mr. N.R. Narayana Murthy. Retrieve from <http://economictimes.indiatimes.com/opinion/interviews/no-talks-on-strategy-with-vishal-sikka-infosys-founder-nr-narayana-murthy/articleshow/57070727.cms>

- Economic Times. (2017). Statement of Mr. Mohandas Pai. Retrieve from <http://economictimes.indiatimes.com/tech/ites/mohandas-pai-urges-investors-to-question-infosyss-capital-allocation-policy/articleshow/57108118.cms>

- Economic Times. (2017). Statement of Mr. V. Balakrishnan. Retrieve from <http://economictimes.indiatimes.com/tech/ites/mohandas-pai-urges-investors-to-question-infosyss-capital-allocation-policy/articleshow/57108118.cms>

- Goedhart, M., Koller T., Wessels, D., McKinsey., & Company (2010). Valuation: Measuring and managing the value of companies. Wiley Finance.

- Infosys Annual Report. (2017) Retrieve from http://www.infosys.com/about/Pages/history.aspx

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Tata Consultancy Services Annual Report. (2017). Retrieve from <investors.tcs. com/ investors/financial_info/Pages/default.aspx

- Van, H., James, C., Wachowicz, J.M. (2009). Fundamentals of financial management, (13th ed.). FT Prentice Hall, Harlow

- Wipro Annual Report. (2017). Retrieve from http://www.wipro.com/investors/financial-information/annual-reports

- Yahoo finance for Infosys Stock Price. (2017). Retrieve from https://finance.Yahoo.com/quote/INFY.BO/history?p=INFY.BO

- Yahoo finance for BSE-500 Index Value. (2017). Retrieve from https://finance. yahoo. com/quote/BSE-500/history?p=BSE-500.BO