Research Article: 2021 Vol: 25 Issue: 1S

Ethical Compliance to the Anti-Financial Crime Regulations

Haitham Nobanee, Abu Dhabi University, University of Liverpool, University of Oxford

Noura Ahmed Al-Suwaidi, Abu Dhabi University

Keywords

Business Ethics, Corporate Governance Disclosure, CSR Disclosure, Sustainability Disclosure, Share Price Volatility, Financial Market Performance

JEL Classifications

C33, G32, G34

Abstract

Purpose: This paper aims to explore several issues related to financial market that come under the umbrella of financial ethics in association with the influence of Corporate Governance (CG), Corporate Social Responsibility (CSR) and sustainability disclosures on organizational performance. Design/Methodology/Approach: A survey was developed to collect the required information on specific ethical related practices that include corporate governance, CSR and Sustainability in the UAE stock market listed corporations. Findings: The findings of our study show significant impact of corporate governance and CSR on organizational performance. On the other hand, sustainability has neutral effect on performance. The findings of our study will contribute in preparing a guide for regulators to properly govern the listed corporation, limit the volatility of share prices and enhancing the stability of financial markets by developing a valid model in which the policy implications are fully covered through ethical practice. Research limitations: This study is limited, as the sample represented does not cover all the required listed corporations. Further analysis should be conducted to better understand the factors that affect the UAE stock market and build upon it a better working model. Practical implications: This study may be useful to academics, governments and authority seeking to improve the state of the financial market through better legislation and law enforcement. Also, this study is useful to capture the other factors related to compliance and may be useful for FATF (Financial Action Task Force) as it can be used to re-evaluate its’ recommendations related to the use of stock markets to launder money and to inject more ethical practices related to compliance instead of targeting technical compliance alone. Originality/value: This paper is an attempt to fully examine the corporate practices that govern the UAE listed corporations in an ethical point of view.

Introduction

Business Ethics, by the very nature of its’ subject can never be investigated by itself, for that reason we intended to examine different variables alongside the road with it, to reach out a possible pivot pointin the financial market. Corporate governance its’ code and disclosures, corporate social responsibility and corporate sustainability reporting. A novel and innovative way to almost perfectly govern the financial market pitfalls and volatility while bringing possible changes that might be helpful to all regulators involving in the financial market legitimacy.

Ethics is a valuable tool in todays’ business world. Issues evolving around ethics are widely common in different areas of business. The fundamental concepts of ethics are represented by simple phrases or words such as ‘good’, ‘ought to’ and ‘socially responsible’. Other researches consider ethics as a waste of time and unscientific. But questions are raised about un-ethical behavior as they bubble to surface when the concern grows bigger as lots of traders and participants are willing to break the rules if they think that they can make big money and returns and just get away with it (Chang, 2004). Observation of such un-ethical behavior proved their huge effect on the health of stock exchange in the market. According to unspoken media reports the incident of the stock decline in the UAE market during Jun 2014 was a proof of such effect. The decline was mainly related to the change in ownership and resignation of one of the management at "Arabtic Holding" (Bloomberg news). Which caused a decline in the company’s share prices and affected the market accordingly (Al-Suwaidi et al., 2018). Another incident was reported by Chang, 2004, as he documented the un-ethical financial behavior of Ivan Boesky, the Wall Street financier-turned-criminal, incidents like the one that involved large corporations such as Enron, Arthur Andersen, WorldCom and Global Crossing illustrates quit well the importance of ethics and how seriously un-ethical managerial behaviors could impact the economy.

Ethics in financial market is viewed differently than usual. It is often characterized as a matter of law rather than ethics (Jamnik, 2011), laws concerning banks and financial institutions, securities transactions and supervision and market organization and regulation (Chang, 2004). Jamnik also emphasized on the different unwritten ethics involving in financial markets, financial services and financial management. However, Law by itself is not enough to regulate the overall system of the financial market, as Chang (2004) argued that law is not enough without perceiving ethical issues, dilemmas and corporate scandals, commitment to high ethical standards is indeed essential for financial integrity not just the legal compliance (Boatright, 1999).

Under the umbrella of ethics comes different concepts of huge importance, corporate governance; which was perceived as a guideline toward “good” governance practice (Othman & Rahman, 2011). However, Inadequacy has been presented in the structure of corporate governance (Arjoon, 2005) because of the lack of ethical standards and obligations, the “good” governance practice was focused more on the side of doing well economically rather than doing good morally. This was observed through the examination of the code of corporate governance, which was issued by the Security & Commodity Authority in the UAE during the year of 2007 that means prior to the crises year (Nobanee, 2018).

While conducting the research for this paper, we run through another concept that caught our interest and we thought it held in between an important impact that may give more sustainability over the long run to the financial market. Enquiries from empirical studies found that ethics and CSR do intersect (Stanwick & Stanwick, 1998). Vitelll, et al., (2009) revealed the impact of ethics on CSR, Jin & Drozdenko (2009) “found that managers in both mechanistic and organic organizations which were perceived as more socially responsible were also perceived as more ethical; and that perceived ethical attitudes and social responsibility were significantly correlated with organizational performance outcomes” (Luu, 2012, P.547).

Another important set of relationship is the inter-relationship between CSR and CG. Gill, 2008 illustrated on the interplay between the two concepts, there is an increasing overlap between both CG and CSR (Jamali et al., 2008). Corporate governance has been considered as a driving vehicle for enhancing “social and environmental concerns in to the business decision-making process, benefiting not purely financial investors but employees, customers, and communities as well” (Luu, 2012, P.548). However, these two concepts have been highlighted together with another concept. Sharma & Khanna (2014) emphasized on the complexity and significant relationship between CG, CSR and sustainability that need to be impeded in to corporate codes. Also, Betts (2009) argued about the interdependence between sustainability and business ethics. Moore & Wen (2008) documented that “a global survey of 160 annual company reports has revealed that public companies are emphasizing non-financial reporting, including more information on ethics and corporate sustainability reporting” (Nobanee & Ellili, 2018).

In the context of this study, the main focus will be on business ethics and their interrelation with corporate governance, Corporate Social Responsibility (CSR) and sustainability and how they affect both the share price volatility and financial market performance. As such, this paper makes several contributions to address the issue of the UAE stock market, which started on June (2014). Thus, the study will consist of developing and constructing innovative synergetic model, by compiling ethics, corporate governance, CSR and sustainability. Analyzing the qualitative results collected by the use of questionnaire, to evaluate the overall condition of the UAE financial market. Conducting quantitative analysis to evaluate and measure the degree of the share price volatility and firms’ performance. Compare and relate the results to the listed firm’s performance and share price volatility. Finally, examining the impact of leadership, size of firm and industry as mediators.

The vivid incident in the UAE stock market (Jun 2014) razed random gossips and information that took the uppermost of the investors’ minds and impacted most of their decisions regarding the trade in the stock market. Which makes us think; how effective is the current code of corporate governance? And, what is the amount of fluctuation that can be caused by disclosure on the financial market performance? And what are the other reasons behind the continuous fluctuated state? Could it be a whole system deficit, which includes not only corporate governance but also CSR and ethical issues related to unknown events, which happens behind the scenes (corruption)? Lastly, how sustainable disclosures transparency impact the financial market?

Several other reasons for choosing UAE, which were backed up by (Mostafa Kamal Hassan, 2012), who aimed to study the extent of corporate governance by UAE listed corporations. Ever since the month of June (2014), the UAE stock prices have been fluctuating and strongly dominated by Real-Estate sector with “Arabtic Holdings” as a leading stock. Afterwards “Emaar” came to sight with it Initial Public Offering (IPO) of “Emmar Malls”. Even though all stock analyst mentioned that the reason behind the decline was a normal turnover of what previously happened on June, and as a result of the Morgan Stanley index, plus the correlated relationship among the world’s stock markets, the decline in crude oil prices with no change in supply and the continuous change in other commodities such gold prices. Nevertheless, they were not fully aware of what might be the real reason behind it. We are still facing the same fatal financial errors in the stock market, which were not of much significant during the good times, but their effect is very visible indeed during the bad ones. Lots of scholars have been pinpointing this fact since the crises, besides Mostafa (2012) findings, which were quite interesting, as he found three policy implications. Obay (2009) added that, there has been no attempt to fully examine the corporate governance practices that were abided by the UAE listed corporations, nor an ethical examination of corporate governance, CSR or sustainability disclosures.

Research Questions

This paper will attempt to examine and investigate two major questions; in order to investigate the state of the UAE stock market. First, what is the level of significance impact does Business Ethics, corporate governance, CSR and sustainability have on organizational performance (share price volatility & financial Performance)? Second, how to incorporate business ethics with corporate governance, CSR and sustainability to maximize the UAE financial market performance and reduce the volatility amount?

Literature Review& Background

Ethics & Financial Market

While reviewing literature, we found that finance includes some basic and fundamental ethical aspects, such as fairnessin the financial market –either substantively or procedurally- and fiduciary’s duties (Jamnik, 2011). Hence, we need to understand every aspect of the different areas in finance as it held different ethical practices and issues. As Jamnik (2011) indicated that ethical finance comes under three major subjects: (1) Financial market and its’ vulnerability to unethical trading, conditions, contractual difficulties and fraud. (2)Financial intermediaries providing services to delusive corporations trading in the stock market. (3) Duty violation from financial management and fabrication of disclosures such as financial audit, press release, false statements, misleading facts and online reporting. A comprehensive ethics program goes well beyond the provision to merely combat fraud or comply with the law, it rather, covers the economic, legal, ethical, and discretionary expectations that society has of organizations at a given time (Carroll, 1979; Abdolmohammadi & Owhoso, 2000). Also, Jamnik (2011) documented his use to two theories to support his study: the financial theory of the firm and the stakeholder theory. As the financial theory supports and argues about the need for protection seeking from regulators, while the stakeholder theory describes the list of corporate constituencies as it includes all persons of interest in the firm’s activities. He also mentioned the problematic fact held behind the concept of shareholder wealth. Most likely because of the fact of their actual seeking of wealth, which might lead to unethical business practice and end up with fraud and money laundering that hugely impact the country’s economy in many ways (Zghal et al., 2020).

As fairness related to disclosure in many means of actions and practices it certainly has an effect on both share price volatility and market performance. Upon examination of literature, we came across the study of Jo & Kim (2008) who examined the association between business ethics and corporate social responsibility disclosures and their impact on performance and seasoned equity offering in the US stock market as he found two evidences: one is the negative association between disclosure and the unethical earnings manipulation, the second is the positive association of the long term post-issue performance of the seasoned equity performance. They literarily stated “long-term, post-issue seasoned equity offering underperformance is significantly less for firms with extensive disclosure and conservative earnings management than firms with less disclosure and aggressive earnings management”. Which lead them to the fact that incorporating ethics in to financial reporting with corporate social responsibility decision-making process by enhancing transparency through voluntary disclosure will help the overall firm’s performance. They based their research on the assumption of the endogenous nature between business ethics and disclosure and conducted a partial qualitative analysis –observation- to measure disclosures over a certain period of time. Moreover, the factual relation between unethical reporting and firm’s stock price, as unethical reporting of a firm shows lower stock price over the long run (Jo & Kim, 2008). Thus, it affects the share price volatility.

Corporate Social Responsibility & Financial Market

Corporate social responsibility has an impact on investors and firm’s performance in different ways; hence impact the stock return. It also goes beyond that to reach profit maximization (Wang et al., 2011). However, scholars like McWilliams & Siegel (1997) reported mixed results on the effect of CSR on the listed corporations in the financial market. Tsoutsoura (2004) reported that a possible reason for such different results is the time frame of the activities related to CSR, such that the cost of CSR is immediate while its’ benefit is not fully realized by investors. When thinking about our case there could be different reasons depending on the nature of the investors and the different origin of the listed corporations without neglecting the market nature, which held unique characteristics. For that reason, it is very important to understand the relationship between CSR, investors and firm’s performance and how they are related to share price volatility in order to formulate our ethical model.

We further examine the corporate social responsibility to see how it actually affect the financial market performance and its’ share price volatility. Nelling & Webb (2009) studied the causal relationship between corporate social responsibility and financial performance. They actually found a very interesting result of weak relation between the two variables when conducting a time series fixed effects approach, they also found very small evidence of causality held between financial performance and social performance, which focus on stakeholder’s management. Nevertheless, these results differ based on the studied market environment and time spam used as this article was published during the crises period we will certainly find different results governing the UAE stock market. Researchers such: Bello (2005), Statman (2000), examined these two variables came across almost the same ending. Even though corporate social responsibility is usually used as a way to select investments, there are no gains or returns investors can derive from including it into their portfolios (Nelling& Webb, 2009). Nelling & Webb (2009) mentioned a very important tool that helps to determine wither doing good socially will lead to doing well financially that is “virtuous circle”, as they declared its proof of empirically existence. Other scholars such Saleh, et al., (2011) indicated a different finding of positive and significant effect of corporate social responsibility on corporate financial performance, as they found that “employee relations” and “community involvement” were positively related to financial performance. They used annual reports as a way of presenting corporate social responsibility and based their measurement of its’ practice on a disclosure-scoring methodology that is based on content analysis, as they classified the disclosures qualitatively to refer to the highest weighted and lowest weighted value of CSR practice.

On the other hand, researches to examine and study the impact of CSR on share price volatility were found to be less and the gab has to be fulfilled. Maggina, et al., (2012) one of the few who studies such a relationship on the case of china during the melamine contamination incident in China, and found that “neither the individual investors’ nor the institutional investors’ behaviors are influenced by firms’ CSR performance before the incident. However, in the post-event period, institutional investors’ behaviors are significantly influenced by firms’ CSR performance that exceeds a certain threshold (Maggina et al., 2012, p.127). Such finding explains how investors’ behavior plays hugely on their decision making while dealing and trading in the stock market, hence, affect the volatile and fluctuated state of stock prices.

Corporate Governance & Financial Market

Corporate governance has attracted a great deal of public interest because of its importance for the economic health of both corporations and society (SurendraAijoon, 2005). Due to the recent geopolitical reasons, key variables have been affected corresponding to corporate governance disclosure that seeks an immediate investigation from researchers in order to examine the best possible way to re-allocate all the resources and help in reducing the amount of share price volatility in the UAE stock market. Which can be done through deep studies on the effect of corporate disclosure channels on share price volatility and assist the UAE regulators in reducing the amount of uncertainty involving in the stock market by formulating new laws and regulations that may govern corporate disclosures of any type. A look up at the code of corporate governance itself is necessary. Corporate governance has been a major subject and took huge attention from many legislators, regulators, professions, business bodies, media and the general community (leading Parker, 2007). Upon examination of the literature, research in corporate governance in emerging market economies located in the Gulf region was found to be rare (Mostafa Kamal Hassan, 2012). However, lots were found on relevant to this study. Corporate governance covers a variety range, including narrative & financial, mandatory & voluntary, printed & internet disclosure (Ali et al., 2007; Xiao et al., 2002) It represents the most holistic picture of information provision by corporations to the external world. This includes financial information, narratives, mandatory provision required by the law and accounting standards, and voluntarily shared insights due to the external pressures or internal decision-making (Ali et al., 2007). Corporate governance involves investors whom are allowed to discover the efficient share prices of the listed corporation, by the transparent information given by these firm, which are governed by the code of corporate governance that requests UAE listed corporations to publish corporate governance information, this code was issued by the UAE security & commodity Market Authority, in 2007 (Mostafa Kamal Hassan, 2012). Such information considered very critical for firms’ performance and share price stability that in turn reflects volatility and ethical business practice.

In business, corporate governance is considered to be an important tool that helps any organization and any market of concern to elevate and sustain against all norms and obstacles. Scholars have shown huge interest in studying the behavior and response of corporations toward corporate governance post-crises, although most conducted empirical analysis and very few who examined such relationship through any qualitative methods available. Scholars such, Küçükçolak & Özer (2007) who conducted a questionnaire to study in detail both the principles and practices of corporate governance conducted at the Istanbul stock exchange, found by examining the role of independent management and auditors that there is a linear relationship between firm’s performance and corporate governance principles implementation. Ergin (2012) examined a similar relationship to measure the market-based financial performance. His results suggest that the corporate governance rankings are positively and significantly associated not only with the financial performance but also with the accounting performance, as financial performance is positively associated with stakeholders, public disclosure and transparency (Ergin, 2012).

Lots of studies aimed to examine the effect of corporate governance disclosure on share price volatility and lots were found to hold different results, probably because of the different elements in effect and the extent to which the listed corporations does comply with each country’ code of corporate governance. Scholars such as (Baumann and Nier, 2004; and Schutter& O’Connell, 2006) argued that high disclosure is very beneficial in reducing the share price volatility. Were, others such (Matsumoto, & Miller, 2003) found a positive relationship between corporate governance disclosure and share price volatility. Moreover, changes in corporate governance that lead to a reduction in perceived risk will have no effect on past volatility (Li et al., 2013).

Sustainability & Financial Market

Even through sustainability reporting is voluntary it has gained huge interest in recent years from organizations as they choose to report on their social and environmental performance (Van Stekelenburg et al., 2015). As Solomon, et al., (2011) elaborated on how society and stakeholders do pressure companies to report their corporate sustainability performance as part of their financial performance. Van Stekelenburg, et al., (2015) reported the mixed results between sustainability performance and financial performance, as he illustrated on other researches findings of neutral, positive and negative relationship between both factors. However, the relationship between sustainability and market return is rather limited and also provide mixed results, as “Brammer, et al., (2006) examined the relation between CSP and stock returns in the UK. They evaluated the interactions between social and financial performance, employing a set of disaggregated social performance indicators for environment, employment, and community activities instead of an aggregate measure, and, surprisingly, they found that that firms with higher social performance scores tend to achieve lower returns, while firms with the lowest possible CSP scores of zero outperformed the market” (Van Stekelenburg et al., 2015, P75).

Methodology

Method & Data Collection

A survey questionnaire was developed based on four factors (Business Ethics, CG, CSR, Sustainability) in order to capture the driving forces of the financial market performance. Each element contains 3 sub-elements of measurement. The questionnaire targeted those in managerial positions in the UAE listed corporations in the stock market. The sample size was relevant to maintain good efficiency. Table 1 describes the measurement of construct. While table 2 provides a complete description of the targeted sample.

| Table 1 | ||

|---|---|---|

| MEASUREMENT OF CONSTRUCTS | ||

| Construct | Item | Source |

| Business Ethics | BE1: code of ethics & policy implication. | Smith, C. M., Jr. (2008). |

| BE2: illegal conduct. | ||

| BE3: quality of annual report. | ||

| Corporate governance | CG1: transparency & efficiency. | Diacon, S R;Ennew(1996) |

| CG2: informational efficiency. | ||

| CG3: shareholders right. | ||

| CSR | CSR1: transparency in issues related to the company. | Smith, C. M., Jr. (2008). |

| CSR2: performance. | ||

| CSR3: corporate risk assessment. | ||

| Sustainability | S1: importance. | Van Stekelenburg et. al., 2015 |

| S2: reputation. | ||

| S3: balance. | ||

| Table 2 | |||

|---|---|---|---|

| PROFILE OF SURVEY RESPONDENTS | |||

| Characteristics | N | Mean | Std. |

| Age | 52 | 1.33 | 0.474 |

| Gender | 52 | 1.69 | 0.781 |

| Educational level | 52 | 2.19 | 0.991 |

| Category | Frequency | Percent | |

| Age | 25 – 30 | 26 | 50 |

| 31 – 35 | 16 | 30.8 | |

| 36+ | 10 | 19.2 | |

| Gender | Female | 35 | 67.3 |

| Male | 17 | 32.7 | |

| Educational level | Diploma | 16 | 30.8 |

| Bachelor | 15 | 28.8 | |

| Masters | 16 | 30.8 | |

| Doctorate | 5 | 9.6 | |

Results

Reliability Test

To measure the consistency of the data Cronbach alpha was determined, as alpha coefficient is supposed to be above 0.7 to consider the data to be reliable (Field, 2009). In this study, the overall alpha coefficient was found to be equal to (0.782), which suggest that the consistency of the data was good. As shown in table 3.

| Table 3 | ||

|---|---|---|

| RELIABILITY STATISTICS | ||

| Cronbach's Alpha | Cronbach's Alpha Based on Standardized Items | N of Items |

| 0.81 | 0.782 | 5 |

Descriptive & Correlation

Descriptive statistics was used to extract the mean and the standard deviation for each variable “Business Ethics (BE)”, “Corporate Governance (CG)”, “CSR”, Sustainability “S” and “Organizational Performance (OP)”. As it focuses on simplifying and summarizing the data set in hand, hence operate the assumptions (Zeller, 1999). For that reason, the mean and the standard deviation considered very important to understand the nature of the collected data although this type of statistics does not show causality they demonstrate very well the meaning of the data as well as the average measurement that represents the mean and how these data are closely distributed (Marshall & Jonker, 2010). Table 4 bellow illustrates the mean and Std. of the variables. As BE has a mean of (3.88), CG mean=(3.97), CSR mean=(3.89) and S mean=(3.08). The highest average measurement goes to CG, nevertheless CSR are very close to it, which shows how important these constructs in deriving the organizational performance in the stock market.

| Table 4 | ||||||||

|---|---|---|---|---|---|---|---|---|

| DESCRIPTIVE STATISTICS & CONSTRUCT CORRELATION | ||||||||

| No. | Construct | Mean | Std. | 1 | 2 | 3 | 4 | 5 |

| 1 | BE | 3.878205 | 0.5198829 | 1 | ||||

| 2 | CG | 3.967949 | 0.5250153 | 0.824 | 1 | |||

| 3 | CSR | 3.897436 | 0.4646008 | 0.687 | 0.665 | 1 | ||

| 4 | S | 3.077193 | 0.1100066 | 0.191 | 0.153 | 0.049 | 1 | |

| 5 | OP | 3.987179 | 0.6295606 | 0.694 | 0.454 | 0.42 | 0.045 | 1 |

Table 4 shows the estimated correlation coefficient for the constructs. Construct validity is very crucial in defining the measurement of phenomenon, as it “involves the logical development of the constructs by systematically correlating many different kinds of test that are believed to represent objective representations of unique aspects of a construct” (Thomas, 1998). It also shows the degree in which two constructs are different, as it compares the square root of the average and the construct correlation (Cai, Chen & Bose, 2013). As shown in Table 5, the condition of discriminant validity was satisfied among all the constructs in the model.

| Table 5 | ||

|---|---|---|

| KMO AND BARTLETT'S TEST | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy | 0.611 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 352.497 |

| df | 66 | |

| Sig. | 0 | |

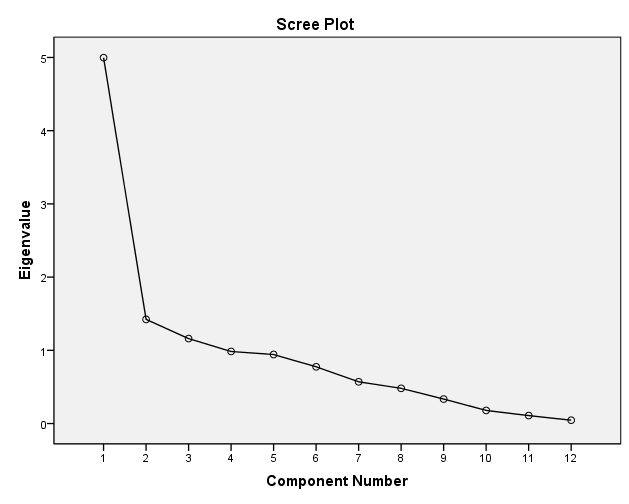

Exploratory Factor Analysis

After applying factor analysis using SPSS we found that, Bartlett's Test of Sphericity shows that the significance is equivalent to 0.00, thus p<0.05, which reflects that the correlation is sufficient to run the analysis. Moreover, KMO is equal to 0.611(greater than 0.5) indicating that the variables in the sample are suitable for the analysis (Table 5).

The construct validity is shown below in Table 6, surprisingly sustainability was excluded showing neutral effect, and we ended up having two factors mostly evolve around “BE”, “CG” and “CSR”. Factor 1 consists of six items (CG2, BE3, CG1, BE1, CSR1 & CSR2), while factor 2 consists of (CSR2, CG3 & BE2). On the other hand Factor 3 was removed since it only consists of one item.

| Table 6 ROTATED COMPONENT MATRIX |

|||

|---|---|---|---|

| Items | Component | ||

| Factor 1 | Factor 2 | Factor 3 | |

| CG2: Transparent relationship between securities issuers and investors constitutes a fundamental requirement for effective promotion of an adequate informational efficiency level for the UAE financial market. | 0.906 | -0.036 | 0.019 |

| BE3: Financial management ethical practice impacts the quality of the annual report in the company I work with. | 0.849 | 0.241 | 0.243 |

| CG1: Corporate governance should promote transparent and efficient markets and induce the need to obey rules and regulations | 0.846 | 0.104 | 0.178 |

| BE1: The company I work in has a clear code of ethics /policy in relation to corporate governance, dishonesty, corruption or unethical behavior. | 0.839 | 0.061 | -0.144 |

| CSR1: My company is transparent in reporting on CSR issues relevant to the company. | 0.826 | 0.279 | -0.054 |

| CSR3: My company’s corporate risk assessment is very strong. | 0.616 | 0.366 | -0.065 |

| CSR2: My company believes in "doing good socially is a way for improving performance". | 0.068 | 0.811 | 0.219 |

| CG3: Corporate governance structures protect and facilitate the exercise of shareholders’ rights. | 0.438 | 0.652 | -0.08 |

| BE2: The Board and (senior) management would never authorize unethical or illegal conduct to meet business goals. | 0.452 | 0.467 | 0.277 |

| S3 :There is a need to balance economic growth with environmental sustainability v and social cohesion for achieving overall development | 0.01 | 0.104 | 0.75 |

| S1: Ensuring sustainability is important in any company. | -0.064 | 0.374 | -0.534 |

| S2: The reputation of the company can sustains its performance | -0.007 | 0.185 | 0.532 |

| Eigenvalues | 4.428 | 1.772 | 1.38 |

| % of variance | 36.901 | 14.764 | 11.497 |

| Cronbach's Alpha Based on Standardized Items α | 0.913 | 0.636 | |

| Cronbach's Alpha α | 0.911 | 0.603 | |

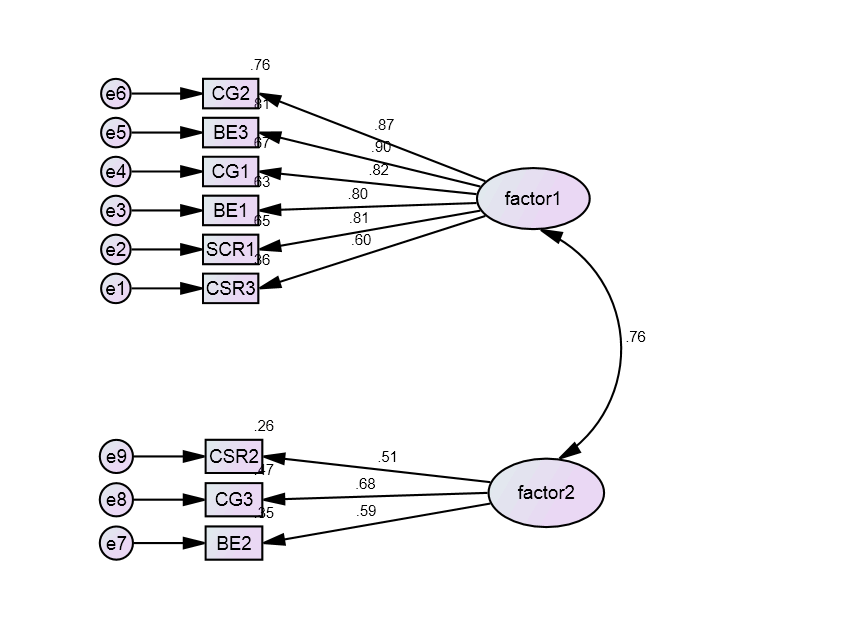

Confirmatory Factor Analysis

CFA was performed through Amos, in order to check the willingness of the measured variables that represents a smaller number of factors, which tests the validity of the measurement theory. The bellow model was constructed after defining the appropriate factors from EF Analysis. Figure 2 bellow shows the model fit, which tells us about the loadings as shown, loadings for factor 1 seems to be good and reasonable, however in factor 2 two there seems to be some issues with model fit. The co-variance between the two factors seems to be high. For that reason, we might have discernment validity issues while examining the validity check.

The Goodness-of-Fit Statistics are shown in Table 7, as it shows: Chi-square=118.066 and the RMSEA value is equal to 0.263>0.06, which clearly indicates the represented model is significant. The CMIN should be above the threshold of (5), in our study it equals to (4.541) and the p value is (0.000). Both GFI (0.716) and AGFI (0.577) are tolerable but cannot be described as being great. CFI (0.716) has a good value but having 0.8 and above would have been better. RMSEA equals to 0.263 when it should be less than 0.05. Were as TLI (0.607) in which we were looking for values greater than 0.9. Issues corresponding to model fit can be easily solved through modification indices, which actually shows the corresponding errors to each element. Elements with high error and low loading can be removed or by creating a co-variance with the corresponding errors (if they were in the same factor). Nevertheless during the analysis of this study, this was not done due to study limitations.

| Table 7 | |

|---|---|

| CFA GOODNESS-OF-FIT STATISTICS | |

| Chi-square (X2) | Chi-square=118.066 |

| Degree of freedom=26 | |

| Absolute Fit Measures | Goodness-of-Fit Index (GFI)=0.716 |

| Root Mean Square Error of Approximation (RMSEA)=0.263 | |

| 90 percent confidence interval of RMSEA=(0.216; 0.313) | |

| Root Mean Square Residual (RMR)=0.037 | |

| Increment FIT Indices | Normed Fit Index (NFI)=0.673 |

| Comparative Fit Index (CFI)=0.716 ( > 0.95) | |

| Relative Fit Index (RFI)=0.547 | |

| Parsimony Fit Indices | Adjusted Goodness-of-Fit Index (AGFI)=0.577 |

Table 8 & Table 9 indicate the critical ratio that presents significant indicators for the variables. As shown in the table 8 below, the CR is >1.96 for the regression weight, and the p-value shows significance at the level of p<0.001 for 6 items, so they can be interpreted as a normal linear regression. The standard regression coefficients is shown in table 9, it ranges from (0.508 – 0.90), so we can conclude that some indicator variables do correspond significantly with the survey data while the other do not.

| Table 8 | |||||||

|---|---|---|---|---|---|---|---|

| REGRESSION WEIGHTS: (GROUP NUMBER 1 - DEFAULT MODEL) | |||||||

| Estimate | S.E. | C.R. | P | Label | |||

| CSR3 | <--- | factor1 | 1 | ||||

| SCR1 | <--- | factor1 | 1.217 | 0.268 | 4.548 | *** | par_1 |

| BE1 | <--- | factor1 | 1.145 | 0.263 | 4.353 | *** | par_2 |

| CG1 | <--- | factor1 | 1.343 | 0.3 | 4.48 | *** | par_3 |

| BE3 | <--- | factor1 | 1.326 | 0.283 | 4.691 | *** | par_4 |

| CG2 | <--- | factor1 | 1.369 | 0.3 | 4.562 | *** | par_5 |

| BE2 | <--- | factor2 | 1 | ||||

| CG3 | <--- | factor2 | 0.973 | 0.357 | 2.723 | 0.006 | par_6 |

| CSR2 | <--- | factor2 | 0.522 | 0.216 | 2.417 | 0.016 | par_7 |

| Table 9 | |||

|---|---|---|---|

| STANDARDIZED REGRESSION WEIGHTS/ LOADINGS: (GROUP NUMBER 1 - DEFAULT MODEL) | |||

| Estimate | |||

| CSR3 | <--- | factor1 | 0.597 |

| SCR1 | <--- | factor1 | 0.806 |

| BE1 | <--- | factor1 | 0.796 |

| CG1 | <--- | factor1 | 0.817 |

| BE3 | <--- | factor1 | 0.899 |

| CG2 | <--- | factor1 | 0.872 |

| BE2 | <--- | factor2 | 0.593 |

| CG3 | <--- | factor2 | 0.683 |

| CSR2 | <--- | factor2 | 0.508 |

Discussion and Conclusion

This paper aims to explore some factors related to the financial market that come under the umbrella of financial ethics in association with the influence of Corporate Governance (CG), Corporate Social Responsibility (CSR) and Sustainability (S) disclosures on organizational performance. The method employed provides a clear overview of how these three factors affect organizational performance. The results of this paper serve as a good starting point when analysing the real results behind the fluctuation in share prices of the listed companies. Our results showed that the three factors of choice were efficient with a significance level of 0.00 after running Bartlett's Test of Sphericity. Moreover, KMO test showed the suitability of the factors in the sample with a level of 0.611. Throughout factor analysis specifically EFA we were able to identify relevant factors consist of items evolve around CG, CSR and business Ethics. However, sustainability was found to hold neutral results and was excluded accordingly. After factors identification stage, analysis of CFA was performed to identify the goodness-of-fit and the significance of the RMSEA. The model, which was analyzed throughout this paper needs more data and variables identification as it only examines a part of the relationship presented in the actual model that need to be researched. The results clearly indicates that there exist more variables affect the volatility of the firm’s performance in the financial market in the UAE. The findings of our study could contribute in preparing a guide for regulators to properly govern the listed corporation, limit the volatility of share prices and enhancing the stability of financial markets by developing a valid model in which the policy implications are fully covered through ethical practice.

Moreover, this study may be useful to academics, governments and authority seeking to improve the state of the financial market through better legislation and law enforcement. Also, this study is useful to capture the other factors related to compliance and may be useful for FATF (Financial Action Task Force) as it can be used to re-evaluate its’ recommendations related to the use of stock markets to launder money and to inject more ethical practices related to compliance instead of targeting technical compliance alone.

The study should be read in the context of its limitations of the data available, as the findings are not subject to information available elsewhere. Future research may be designed to compare and evaluate the findings of this study with those related to money laundering involved with stock market. A more punctual research direction that might serve government agencies is through analyzing the financial market abuse and to properly address its’ vulnerabilities. Addressing vulnerabilities will open a wider range of research areas for scholars working in financial econometrics, socio-economics and many others.

End Notes

Virtuous circle: A tool to determine if ‘‘doing good’’ socially leads to ‘‘doing well’’ financially, and whether firms exhibiting superior financial performance devote more resources to social activities (Nelling & Webb, 2009, p.2).

References

- Ali, A., Chen, T.Y., & Radhakrishan, S. (2007). Corporate disclosures by family firms. Journal of Accounting and Economics, 44(1/2), 238-68.

- Al-Suwaidi, N., Nobanee, H., & Jabeen, F. (2018). Estimating causes of cybercrime: Evidence from Panel Data FGLS Estimator. International Journal of Cyber Criminology, 12 (2), 392-407.

- Arjoon, S. (2005). Corporate governance: An ethical perspective. Journal of Business Ethics, 61(4), 343-352.

- Baumann, U., & Nier, E. (2004). Disclosure, volatility, and transparency: An empirical investigation into the value of bank disclosure. Economic Policy Review - Federal Reserve Bank of New York, 10(2), 31-45.

- Belak, J. (2013). Corporate governance and the practice of business ethics in Slovenia. Systemic Practice and Action Research, 26(6), 527-535.

- Bello, Z. (2005). Socially responsible investing and portfolio diversification. J Financ Res 28, 41–57

- Bushee, B.J., Matsumoto, D.A., & Miller, G.S. (2003). Open versus closed conference calls: The determinants and effects of broadening access to disclosure. Journal of Accounting and Economics, 34, 149-180.

- Dodji, M.S., Mahmoodi, M., &Asadi, A.A. (2014). Investigation of the relation between organizational culture, financial management tenure and financial performance with corporate social responsibility (CSR. Interdisciplinary Journal of Contemporary Research in Business, 5(12), 354-367.

- Ergin, E. (2012). Corporate governance ratings and market-based financial performance: Evidence from turkey. International Journal of Economics and Finance, 4(9), 61-68.

- Francisca, V.D. (2007). Corporate social responsibility: Market regulation and the evidence. Managerial Law, 49(4), 141-184.

- Helga, D. (2012). Guide to decision making, getting it more right than wrong. The economist newspaper Ltd.

- Hidalgo, R.L., García-meca, E., & Martínez, I. (2011). Corporate governance and intellectual capital disclosure. Journal of Business Ethics, 100(3), 483-495.

- Istianingsih,I., & Zulni, R. (2013). Corporate social responsibility disclosure and predictability of future earnings: Evidence from indonesia stock exchange. Paper presented at the 182-189.

- Jamnik, A. (2011). Business ethics in financial sector. EkonomskaIstrazivanja, 24(4), 153-163.

- Jo, H., & Kim, Y. (2008). Ethics and disclosure: A study of the financial performance of firms in the seasoned equity offerings market. Journal of Business Ethics, 80(4), 855-878.

- Küçükçolak, A., & Özer, L. (2007). Do corporate governance, independent boards, and auditors affect market and financial performance? an application to the istanbul stock exchange. Review of Business, 28(1), 18-31.

- Maggina, A., & Tsaklanganos, A.A. (2012). Predicting the corporate social responsibility of listed companies in greece using market variables. Journal of Applied Business Research, 28(4), 661-671.

- McWilliams, A., & Siegel, D. (1997). Event studies in management research: Theoretical and empirical issues’. Academy of Management Journal, 40(3), 626–657.

- Mostafa, K.H. (2012a). A disclosure index to measure the extent of corporate governance reporting by UAE listed corporations. Journal of Financial Reporting and Accounting, 10(1), 4-33.

- Nelling, E., & Webb, E. (2009). Corporate social responsibility and financial performance: The "virtuous circle" revisited. Review of Quantitative Finance and Accounting, 32(2), 197-209.

- Nobanee, H. (2018). Efficiency of working capital management and profitability of uae construction companies: Size and crisis effects. Polish Journal of Management Studies, 18 (2), 209-215.

- Nobanee, H., & Ellili, N. (2018). Anti-Money laundering disclosures and banks’ performance. Journal of Financial Crime, 25(1), 95-108.

- Obay, L.A. (2009). Corporate governance & business ethics: A Dubai-based survey. Journal of Legal, Ethical and Regulatory Issues, 12(2), 29-47.

- Parker, L.D. (2007). Financial and external reporting research: The broadening corporate governance challenge. Accounting & Business Research, 37(1), 39-54.

- Prasanna, P.K. (2013). Impact of corporate governance regulations on Indian stock market volatility and efficiency. International Journal of Disclosure and Governance, 10(1), 1-12.

- Quazi, A., & Richardson, A. (2012). Sources of variation in linking corporate social responsibility and financial performance. Social Responsibility Journal, 8(2), 242-256.

- Saleh, M., Zulkifli, N., & Muhamad, R. (2011). Looking for evidence of the relationship between corporate social responsibility and corporate financial performance in an emerging market. Asia - Pacific Journal of Business Administration, 3(2), 165-190.

- Schutter, P., & O’Connell, V. (2006). The trend toward voluntary corporate disclosures. Management Accounting Quarterly, 7(2), 1-9.

- Statman, M. (2000). Socially responsible mutual funds. Financ Anal J, 56, 30–38

- Tsoutsoura, M. (2004). ‘Corporate social responsibility and financial performance’. Working Paper Series, Center for Responsible Business, UC Berkeley.

- Wang, M., Qiu, C., & Kong, D. (2011). Corporate social responsibility, investor behaviors, and stock market returns: Evidence from a natural experiment in china. Journal of Business Ethics, 101(1), 127-141.

- Xiao, J.Z., Jones, M.J. & Lymer, A. (2002). “Immediate trends in internet reporting”. European Accounting Review, 11(2), 245-75.

- Lang, M.H, & Lundholm, R.J. (1993). “Cross-sectional determininats of analyst rating of corporate disclosures.” Journal of Accounting Research 31(2), (autumn), 246-71.

- Prasanna, P.K. (2013). Impact of corporate governance regulations on indian stock market volatility and efficiency. International Journal of Disclosure and Governance, 10(1), 1-12.

- Forker, J. (1992). “Corporate governance and disclosure”. Accounting & Business Research, 22, 111-24.

- Hassan, M.K. (2009d), “The UAE corporations-specific characteristics and level of risk disclosure”. Managerial Auditing Journal, 24(7), 668-87.

- Drew, M.E, Naughton, T., & Veeraraghavan, M. (2003). “Firm size, book-to-market equity and security returns: Evidence from the Shanghai Stock Exchange”. Australian Journal of Management, 28, 119-40.

- Shafana, M.A.C.N., Rimziya, A.L F., & Jariya, A.M.I. (2013). Relationship between stock returns and firm size, and book-to-market equity: Empirical evidence from selected companies listed on milanka price index in colombo stock exchange. Journal of Emerging Trends in Economics and Management Sciences, 4(2), 217-225.

- Hahn, R., & Lülfs, R. (2014). Legitimizing negative aspects in GRI-oriented sustainability reporting: A qualitative analysis of corporate disclosure strategies. Journal of Business Ethics, 123(3), 401-420.

- Michelon, G. (2011). Sustainability disclosure and reputation: A comparative study. Corporate Reputation Review, 14(2), 79-96.

- Moore, S., & Wen, J.J. (2008). Business ethics? A global comparative study on corporate sustainability approaches. Social Responsibility Journal, 4(1), 172-184.

- Chang, S.J. (2004). A cultural inspection of financial ethics in South Korea. The Asia Pacific Journal of Economics & Business, 8(2), 65-77, 97.

- Cockrell, S.R. (2012). A model of municipal disclosures using exploratory factor analysis. Academy of Accounting and Financial Studies Journal, 16, 1-15.

- Ousama, A.A., & Fatima, A.H. (2010). Voluntary disclosure by shariah approved companies: An exploratory study. Journal of Financial Reporting and Accounting, 8(1), 35-49.

- Boatright, J.R. (1999). Ethics in finance. Blackwell Publishers, Malden, MA.

- Luu, T.T. (2012). Corporate social responsibility, ethics, and corporate governance. Social Responsibility Journal, 8(4), 547-560.

- Othman, Z., & Rahman, R.A. (2011). Exploration of ethics as moral substance in the context of corporate governance. Asian Social Science, 7(8), 173-182.

- Stanwick, P.A. & Stanwick, S.D. (1998). ‘‘The relationship between corporate social performance and organizational size, financial performance, and environmental performance: an empirical examination’’. Journal of Business Ethics, 17(2), 195-204.

- Gill, A. (2008). ‘‘Corporate governance as social responsibility: A research agenda’’. Berkeley Journal of International Law, 26 (2), 452-78.

- Jamali, D. (2008). ‘‘A stakeholder approach to corporate social responsibility: Fresh insights into theory vs practice’’. Journal of Business Ethics, 82, 213-31.

- Sharma, J.P., & Khanna, S. (2014). Corporate social responsibility, corporate governance and sustainability: Synergies and inter-relationships. Indian Journal of Corporate Governance, 7(1), 14-38.

- Betts, S.C. (2009). An examination of the interedependence of ethics and sustainability: Why sustainability is the ethical choice. Allied Academies International Conference. Academy of Legal, Ethical and Regulatory Issues. Proceedings, 13(1), 15-20.

- Van Stekelenburg, A., Georgakopoulos, G., Sotiropoulou, V., Vasileiou, K.Z., & Vlachos, I. (2015). The relation between sustainability performance and stock market returns: An empirical analysis of the dow jones sustainability index europe. International Journal of Economics and Finance, 7(7), 74-88.

- Solomon, J., Solomon, A., Norton, S., & Joseph, N. (2011). Private climate change reporting: An emerging discourse of risk an opportunity? Accounting, Auditing & Accountability Journal, 24(8), 1119-1148.

- Zghal, I., Ben Hamad, S., Eleuch, H., & Nobanee, H. (2020). The effect of market sentiment and information asymmetry on option pricing. North American Journal of Economics and Finance, Elsevier, 54, 101235.

- Li, H., JaheraJr, J.S., & Yost, K. (2013). Corporate risk and corporate governance: another view. Managerial Finance, 39(3), 204-227.

- Carroll, A.B. (1979). “A three-dimensional conceptual model of corporate social performance”. Academy of Management Review, 4, 497-505.

- Abdolmohammadi, M.H., & Owhoso, V.D. (2000). Auditors’ ethical sensitivity and the assessment of the likelihood of fraud. Managerial Finance, 26(11), 21-32.

- Ghosh, B.N. (2003). Capital inflow, growth sustainability and financial debacles. Managerial Finance, 29(2/3), 73-97.