Research Article: 2020 Vol: 24 Issue: 1S

Factors Affecting the Access to Bank Credit of SMEs in Northeastern Region, Vietnam

Ly Thi Hue, National Academy of Public Administration

Nguyen Thu Thuy, TNU-University of Economics and Business Administration (TUEBA)

Dinh Tran Ngoc Huy, Banking University of Ho Chi Minh city, Vietnam - International University of Japan

Le Ngoc Nuong, TNU-University of Economics and Business Administration (TUEBA)

Nguyet Viet Binh, Thuongmai University

Dam Thanh Huyen, Thuongmai University

Nguyen Thi Minh Thao, Thuongmai University

Abstract

Thai Nguyen province is the center of the Northeastern region with the leading economic development rate in the region. In the period of 2013-2018, the access of small and mediumsized enterprises (SMEs) in Thai Nguyen province to bank credit tended to increase in terms of both number and amount of the loan. However, only 36,9% of businesses borrowed capital from banks (State Bank Branch in Thai Nguyen province, 2018) - This is a limited figure compared to demand. Conducting a survey of 300 SMEs in Thai Nguyen province with exploratory factor analysis, and multiple regression, this paper pointed out the factors and their impact on access to capital bank credit from businesses such as: Collateral, financial reports, business plans...Moreover, using Oneway Anova test the paper showed that medium-sized enterprises have better access to capital than small businesses; commercial enterprises’s access to credit is better than industrial enterprises and agricultural enterprises.

Keywords

Access to Credit, Bank, Small and Medium Enterprises (SMEs).

Introduction

In the world, depending on the level of development of financial products and the capital market of each country, SMEs have the opportunity to access various sources of capital from banks, credit funds, financial institutions or individual funds...Studies by Paul (2011), Nguyen Ha Phuong (2012), Doherty (2013), Masato Abe (2015) point out that there are many opportunities for SMEs in developed countries by various funds with a variety of credit policies such as: guarantees of loans from private organizations, informal finance, internal finance, debt, equity and finance based on assets, government support, raising capital from the community...SMEs in developing countries faces more difficulties in access to credit in terms of loans, credit lines to the loan term (Gbandi, 2014; Phan Quoc Dong, 2015). Therefore, loans from banks are still considered the main financial source of SMEs in developing countries. In Vietnam in general and Thai Nguyen province in particular, the important role of capital resources for the development of SMEs are recognized. Among the loans from banks, credit funds, stock market, friends...bank credit is always a source of capital that most businesses need and borrow because of the advantages such as large amount of loans, high levels of high guarantee, professionalism in business... However, surveys have shown that SMEs in the country have many obstacles when accessing bank credit capital. Accordingly, 32.38% of enterprises have access to credit sources of banks, 35.24% are difficult access and 32.38% don’t have access (CIEM, 2017). The reason that the researchers pointed out focuses on the following reasons: Low financial transparency; Business management capacity is still weak; Risk of high business plans; Collateral don’t meet the requirements; Complex loan procedures; Time to consider loan extension; The qualifications of credit officers are limited...In addition, instability in the macroeconomics also affects SMEs' access to credit capital (Vo Tri Thanh, 2011; Nguyen Hong Ha, 2013; Ha Thieu Dao, 2014; Nguyen Quoc Hoan, 2018 ...). Actual research in Thai Nguyen province shows that in the period of 2013 - 2017, although the number of SMEs and the amount of loans obtained from banks has increased, but only 1004 of total 2800 SMEs are operating in this province (State Bank Branch in Thai Nguyen province report, 2017). Therefore, the article focuses on assessing factors affecting the access to bank credit of Thai Nguyen SMEs by exploratory factor analysis, multivariate regression and showing some factors from enterprises including: collateral assets, financial statements, business and production plans...have a strong impact on the process of borrowing capital at banks. Moreover, this study adds 02 new observed variables to the scale Qualification of business owner: Enterprise owners get information on credit policies of banks, and Business owners resolve business situations well and the result said that they are affected access to credit bank of SMEs Specially, using the difference test oneway Anova, this paper found out that in Thai Nguyen, enterprises with medium size have access to bank capital better than small-scale enterprises; the commercial enterprises have access to the best capital, followed by industrial enterprises and finally agricultural enterprises.

Literature Review

According to the World Bank 2008 report, access to credit is understood as the absence of barriers to costs incurred or no costs incurred when using financial services. This doesn’t mean that all businesses will be able to borrow money with official interest rates. Kitili (2012) argued that access to credit refers to the ease with which SMEs can receive financial support or loans from lending institutions. According to Dang Thi Huyen Thuong (2016): "The access to loans of enterprises is the ability of enterprises to meet the conditions of borrowing subject to the regulations of credit institutions at the suitable interest rate and credit institutions are willing to lend”. For the article, the Researchers have concept of accessing bank credit of SMEs: “Accessing bank credit is the fact that enterprises can meet the requirements of the bank to borrow capital with interest appropriate rates at a low level in conditions that don’t arise or incur extra costs but”.

There are many studies with different methods used by domestic and foreign scientists to assess the accessibility and the degree of influence of factors on SMEs' ability to access credit. In particular, the studies of Ricardo (2004), Qian (2009), Tran Dinh Khoi Nguyen & Ramachandran (2006), Vo Tri Thanh (2011), Ajagbe (2012), Khalid (2014), Ha Thi Thieu Dao (2014 ), Do Thi Thanh Vinh (2014), Dang Thi Huyen Thuong (2016) pointed out the factors inside SMEs including: Characteristics of the enterprise owner, the size of the enterprise, the time of operation of the enterprise, the relationship between the enterprise with banks, enterprises capacity, revenue, collateral Specifically:

Collateral

Enterprises with large security value are more likely to borrow bank loans easily because banks recognize enterprises to ensure higher repayment, lower financial risks. Moreover, when businesses own many tangible fixed assets go bankrupt, the value of losses is often lower than those that own many intangible fixed assets (De Jong et al., 2008; Daskalakis & Psillaki, 2009; Bevan & Danbolt, 2004).

The relationship of enterprises with banks: According to Khalid Hassan Abdesamed (2014), if enterprises have good relations with banks, the enterprises will complete procedures faster because they have grasped regulations of banks. By multiple regression analysis, Tran Quoc Hoan (2018) has pointed out that the relationship between enterprises and banks has a positive impact on SMEs' access to credit capital.

Capacity of SMEs: according to Huang & Song (2006), Qian (2009), Tran Dinh Khoi Nguyen & Ramachandran (2006), Vo Tri Thanh (2011), enterprises with high profits will strengthen bank loans to expand production and business. Currently, with small capital scale, low security, the ability to set up projects is weak, information is lack of transparency that make banks don’t really believe in the ability to repay debts and the development of SMEs leading to affected the access to bank credit is very difficult (Nguyen Hong Ha, 2013).

Financial report: According to Nguyen Thi Minh Hue (2012), Nguyen Hong Ha (2013), Tran Trung Kien (2015) financial report is one of the factors hindering SMEs borrowing at banks because basic regulations make it difficult for businesses to meet requirements from the bank. Size of SMEs: The research of Dang Thi Huyen Thuong (2015) has shown that characteristics of enterprises including SMEs' operating time; Credit history of SMEs have a significant impact on the borrowing of enterprises. Moreover, the operating time, capital of enterprises and type of business decide how SMEs can borrow capital. Many studies show that there is a positive relationship between borrowing and firm size (Fama & French, 2002; Chen, 2004; Tran Dinh Khoi Nguyen & Ramachandran, 2006).

Business plan: Nguyen Hong Ha (2013) found that a good business plan will make SMEs easier for businesses to borrow bank with higher credit limit. According to Ho Ky Minh (2013) the reason for the business plan is not feasible because of limited vision, no specific strategy. Building a business plan is really just dealing with requirements from the NH. It reduces the trust of banks in business capacity and debt repayment of enterprises, affecting the access to capital of SMEs.

Qualification of business owner: Wagema (2011) said that the characteristics of business owners will form the business style and the way of borrowing capital of enterprises. The age, gender and experience of business owners sometimes also affect the access to capital of SMEs, although mainly will be the impact factor, promoting the building of close relationships with banks. According to Tran Quoc Hoan (2018), the capacity of business leaders and advisors have a positive impact on SMEs' access to credit capital.

Methodology and Data

Analysis Model

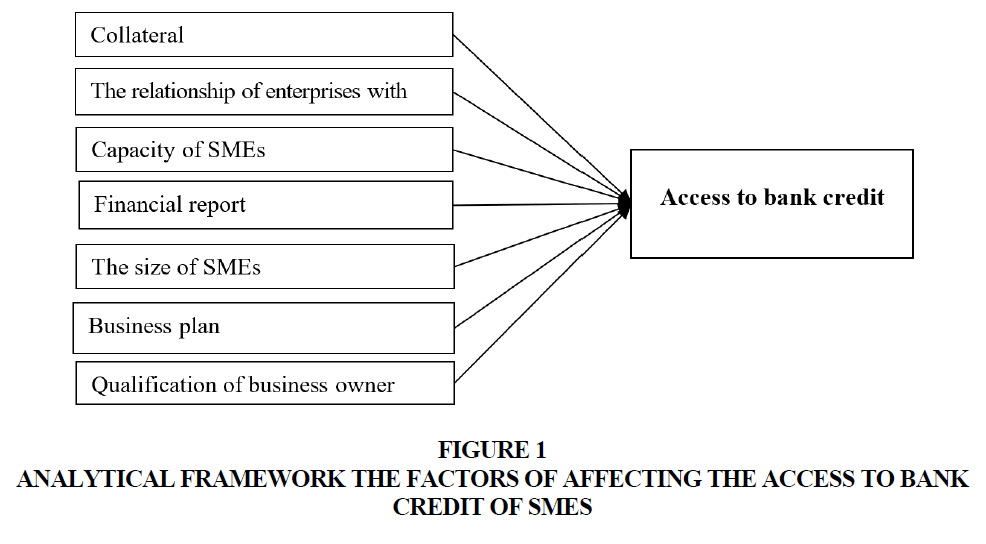

Based on background theory, combining previously research results and expert interview (Wagema, 2011; Vo Tri Thanh, 2011; Ajagbe, 2012; Nguyen Hong Ha, 2013; Khalid, 2014; Dang Thi Huyen Thuong, 2016; Tran Quoc Hoan, 2018), the authors identified factors affecting SMEs’ access to bank credit including:

Dependent variable:

AC: Access to bank credit

Independent variable:

CO: Collateral

RE: The relationship of enterprises with banks

CA: Capacity of SMEs

FI: Financial report

SZ: The size of SMEs

BP: Business plan

QU: Qualification of business owner

Inside: Collateral (CO) (Figure 1) includes contents related to legal procedures, asset value, time to complete documents; The relationship of enterprises with banks (RE) includes the content related to the number of times borrowed from banks, the level of information exchange between the two parties; The capacity of SMEs (CA) includes the content related to the ability to pay debts, market share of enterprises, revenue and brand of enterprises; Financial statements (FI) include the content related to the time to complete the report, the content and standards of the report; The scale of SMEs (SZ) includes the content related to the increase in capital, labor and industry of enterprises; Business production plan of the enterprise (BP) includes the content related to the possibility of making a feasible plan that identifies future risks; The level of business owner (QU) includes the content related to the process of improving the capacity of business owners, the ability to cope with arising problems in business; The access to NH credit capital of SMEs (AC) includes the content related to the ability to access information and loans of enterprises.

Regression model

AC = α0 + α1*CO + α2*RE + α3*CA + α4*FI + α5*SZ + α6*BP + α7*QU + zi

Description and Data Source of Variables

Preliminary analysis

Conducting Cronbach’s Alpha preliminary inspection through interviews with 30 SMEs leaders, the Researchers removed 3 observed variables from the model due to unsatisfactory requirements. Thus, the model of factors affecting SMEs' access to credit has 8 good quality assurance variables with 40 observed variables and the questionnaires is scientific, coherent and ensuring that they can accurately reflect the SMEs' access to credit capital.

Subject of Investigation

Directors of Thai Nguyen SMEs who used to borrow capital at the bank. Due to different fluctuations in the number of SMEs that can borrow bank capital by year, the process of investigating enterprises is relatively similar in the classification criteria of scale, industry and location.

Sample Size

The article uses the method of Tabachnick & Fidell (2005) to calculate the appropriate sample size whereby the sample size must satisfy the formula n ≥ 8m + 50. With 40 observations in the survey, size sample minimum 370. The research team has issued 372 SMEs survey forms that used to borrow capital at banks and to avoid duplication of information, each enterprise will use one questionnaire. The number of votes collected is 325 (87,5%), of which there are 300 valid votes and 25 votes with insufficient information.

Results and Discussion

Statistical Analysis

Summary of results in Table 1 shows that: Collateral is the lowest factor (2,48/5 points), business leaders do not agree when it is easy to complete procedures related to collateral, enough assets to borrow means that there should be many adjustments related to collateral factors to improve access to capital. Next, Financial report, Capacity of SMEs and Business plans have been underestimated, indicating that enterprises have not yet met the requirements stated in the questionnaire. The size of SMEs receives the highest rating, business owners are quite satisfied and think that the related contents of revenue increase, industry expansion, salary increase are basically implemented by enterprises. This is a favorable condition to help bank decide to consider lending to businesses.

| Table 1 Summary of Statistical Results of Factors from SMES | ||

| Factor | Mean | Degree |

| Collateral (CO) | 2,48/5 points | Low |

| The relationship of enterprises with banks (RE) | 2,69/5 points | Average |

| Capacity of SMEs (CA) | 2,52/5 points | Low |

| Financial report (FI) | 2,51/5 points | Low |

| The size of SMEs (SZ) | 2,99/5 points | Average |

| Business plan (BP) | 2,54/5 points | Low |

| Qualification of business owner (QU) | 2,90/5 points | Average |

| (Source: Estimation of authors by SPSS 22.0) | ||

Exploratory Factor Analysis

The results of factor analysis affecting the access to bank credit resources of SMEs in Thai Nguyen province show that the coefficient KMO ranges from 0,774 to 0,906 and sig=0,000 so factor analysis method is relevant. Furthermore, Eigenvalues is from 2,646 to 4,000 > 1 and Cumulative is from 51,930 to 71,627 (Total Variance Explained) > 50%. Test the total variable is KMO = 0,882 (0,5 < KMO < 1), so Exploratory factor analysis is suitable for research data. Bartlett's Test is Sig. = 0,000 < 0,05, the observed bines have a linear correlation with the representative factor (Table 2).

| Table 2 Kmo and Bartlett's Test & Total Variance Explained | ||||

| Factor | Symbol | KMO | Eigenvalues | Cumulative |

| Collateral | CO | 0,906 | 3,921 | 65,351 |

| The relationship of enterprises with banks | RE | 0,774 | 2,724 | 68,095 |

| Capacity of SMEs | CA | 0,912 | 4,000 | 66,666 |

| Financial report | FI | 0,814 | 2,865 | 71,627 |

| The size of SMEs | SZ | 0,864 | 3,404 | 68,088 |

| Business plan | BP | 0,830 | 2,833 | 70,836 |

| Qualification of business owner | QU | 0,832 | 3,425 | 51,930 |

| Access to bank credit | AC | 0,805 | 2,646 | 66,147 |

| (Source: Estimation of authors by SPSS 22.0) | ||||

Total Cumulative and Matrix Rotation show that: Cumulative value = 66,550%, mean 66,550% changes in the elements of the study are explained by observed variables. Characteristic variables have factor loadings > 0,5. Result of Matrix Rotation point out: there are 7 representative factors to SMEs' ability to access credit with observed variables of factors from theoretical model or qualitative research, questionnaires and result of status have been connect.

Multiple Regression Analysis

Multiple regression analysis is R2=0,548 mean 54,8% changes the degree of affecting the access to bank credit of SMEs of Thai Nguyen province have been explained by independent variables in the research model. Anova analysis is F = 50,477 with Sig.<0,01, mean the research model is conformity with the real data (Table 3).

| Table 3 Results of Model Testing | ||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95,0% Confidence Interval for B | Collinearity Statistics | ||||

| B | Beta | Beta | Upper Bound | Tolerance | Upper Bound | Tolerance | VIF | |||

| 1 | (Constant) | 8.12E-14 | ,039 | ,000 | 1,000 | -,077 | ,077 | |||

| CA | ,227 | ,042 | ,185 | 5,761 | ,031 | ,149 | ,304 | ,961 | 1,040 | |

| CO | ,333 | ,035 | ,298 | 8,457 | ,017 | ,255 | ,410 | ,903 | 1,108 | |

| SZ | ,141 | ,039 | ,102 | 3,582 | ,000 | ,064 | ,218 | ,863 | 1,158 | |

| QU | ,157 | ,041 | ,116 | 3,988 | ,017 | ,080 | ,234 | ,940 | 1,064 | |

| BP | ,471 | ,049 | ,422 | 11,960 | ,018 | ,393 | ,548 | ,985 | 1,015 | |

| RE | ,216 | ,033 | ,183 | 5,476 | ,030 | ,138 | ,293 | ,964 | 1,037 | |

| FI | ,269 | ,043 | ,226 | 6,846 | ,031 | ,192 | ,347 | ,932 | 1,052 | |

(Source: Estimation of authors by SPSS 22.0)

The research model is explained as:

AC=0,333*CO+0,216*RE+0,227*CA+0,269*FI+0,141*SZ+0,471*BP +0,157*QU

The results show that the impact of independent factors on SMEs' access to bank credit in the order of decrease importance: Business plan (BP), Collateral (CO), Financial report (FI), Capacity of SMEs (CA), The relationship of enterprises with banks (RE), Qualification of business owner (QU), The size of SMEs (SZ). According to credit officer, loan plans include financial report and business plans, there are important steps, taking the most time because it will assess the ability to repay loans to banks on the basis of understanding and comprehensive evaluation of businesses. For Thai Nguyen SMEs, the factor of business plan of enterprises has the greatest impact on the access to NH credit because the contents need to be built in the plan include: capacity, production and construction capacity of the enterprise; Plan and schedule of production and construction; Policies and methods of selling products; The output and sales of product and the expected consumption situation in the near future...are often incomplete, the information provided sketchily does not create trust for banks so files is rejected. For Collateral, the reason is hindered the process of accessing bank credit sources coming from 02 sides: From the bank: due to unclear and specific regulations for each group of Collateral make the expertise process takes a lot of time and the value of the property is not accurate. From SMEs, the legality of the security assets is not clear, the documents proving the non-standard ownership, security assets are not appropriate...Therefore, in the future, banks need to loosen and stipulate in writing specific requirements relating to Collateral to help credit officers and businesses easily complete the documents. SMEs need to select appropriate assets, ensure value and legality, so shortening the time to complete procedures and higher loan amounts. For financial report with the 3rd largest impact level, based on information collected from SMEs, businesses in Thai Nguyen often do not meet the solvency targets such as: Net working capital usually produces negative results, Instant solvency < 1, Asset use efficiency < 1; The number of business capital turnover is low ... especially for enterprises opening loan documents for the first time in banks, the relevant criteria in financial report must be provided, causing enterprises to take time to complete. The remaining factors have a certain impact on the access to bank credit of SMEs, in the coming time, the board of directors of Thai Nguyen province should continue to promote the achievements, overcome weaknesses related to the weaknesses. The aim is to improve the ability to access bank credit to help businesses be more active in financial resources for business expansion and production.

Oneway Anova Test

Testing of Oneway Anova, the researchers found that there are differences from business type and the size of enterprises of access to bank credit of Thai Nguyen SMEs. Specifically:

Differences from business type: Table 4 shows that commercial SMEs access to credit bank better than industrial enterprises, because: sig. = 0,000 and Mean Difference column (I-J) = 0,46345315. This is the advantage of its because it has advantages of Collateral, compact size. In the future, commercial enterprises should continue to maintain and speed up access to credit. Industrial enterprises and agricultural enterprises need more efforts in completing financial report, building business plans and transparency of Collateral...to serve as basis for banks to consider granting credit to businesses.

| Table 4 Multiple Comparisons to Business Type | ||||||

| Independent variables: AC | ||||||

| LSD | ||||||

| (I) LV | (J) LV | Mean Difference (I-J) | Std. Error | Sig. | 95% Confidence Interval | |

| Lower Bound | Upper Bound | |||||

| " Industry" | "Agriculture" | -0.1108456 | 0.3201832 | 0.729 | -0.740961 | 0.5192697 |

| "Commerce" | -.46345315* | 0.1150414 | 0 | -0.689853 | -0.237054 | |

| "Agriculture" | " Industry" | 0.11084555 | 0.3201832 | 0.729 | -0.51927 | 0.7409608 |

| "Commerce" | -0.3526076 | 0.3186115 | 0.269 | -0.97963 | 0.2744145 | |

| "Commerce" | " Industry" | .46345315* | 0.1150414 | 0 | 0.2370537 | 0.6898526 |

| "Agriculture" | 0.3526076 | 0.3186115 | 0.269 | -0.274415 | 0.9796297 | |

(Source: Estimation of authors by SPSS 22.0)

Differences from the size of enterprises: Table 5 showed that: medium-sized enterprises have access to the most favorable sources of capital, then to small businesses and finally enterprises with micro-scale, because: column Mean Difference (I-J) from medium sized enterprises and small sized enterprises is 0,39742238, between medium sized enterprises and micro sized enterprises is 0,50116685. Due to the advantages of Collateral, uptime and size of operation, enterprises often access credit capital more easily than the other groups of SMEs. Therefore, small and super-sized enterprises, in addition to improving their business and production capacity, need to seek for special preferential credit programs from the Government and banks.

| Table 5 Multiple Comparisons to the Size of Enterprises | ||||||

| Independent variables: AC | ||||||

| LSD | ||||||

| (I) QM | (J) QM | Mean Difference (I-J) | Std. Error | Sig. | 95% Confidence Interval | |

| Lower Bound | Upper Bound | |||||

| "Medium sized" | "Small sized" | .39742238* | 0.130573 | 0.003 | 0.1404568 | 0.6543879 |

| "Micro sized" | .50116685* | 0.1519413 | 0.001 | 0.2021489 | 0.8001848 | |

| "Small sized" | "Medium sized" | -.39742238* | 0.130573 | 0.003 | -0.654388 | -0.140457 |

| "Micro sized" | 0.10374448 | 0.1451757 | 0.475 | -0.181959 | 0.3894478 | |

| "Micro sized" | "Medium sized" | -.50116685* | 0.1519413 | 0.001 | -0.800185 | -0.202149 |

| "Small sized" | -0.1037445 | 0.1451757 | 0.475 | -0.389448 | 0.1819588 | |

(Source: Estimation of authors by SPSS 22.0)

Conclusion

In the period of 2013 - 2018, the credit policies of the bank were relaxed along with the positive changes of enterprises, so the number and capital of Thai Nguyen SMEs borrowed from banks continuously increased. However, the result still has not met the expectation of both businesses and banks. Combining many analysis methods, the article has pointed out the level of influence of factors from SMEs to the access to banks credit as: Business plan (BP) contributed 27,5%, Collateral (CO) contributed 19,5%, Financial report (FI) 14,8%, Capacity of SMEs (CA) contributed 12,1%, The relationship of enterprises with banks (RE) contributed 11,9%, Qualification of business owner (QU) contributed 7,6%, The size of SMEs (SZ) contributed 6,7% to the access to bank credit from SMEs. Moreover, 02 new observed variables are included in Qualification of business owner including Enterprise owners catch information on credit policies of banks and Business owners resolve business situations well have positive impacts on access banks credit of SMEs. Using Oneway Anova test, the article has shown that commercial enterprises has the best access to credit include such contents as: diversity in capital sources and credit information. , the level of loan application completion. medium-sized enterprises based on business characteristics such as large capital, large number of employees, valuable collateral...should access credit much better than small and micro sized enterprises. This shows that SMEs depending on their business, and scale need to find specific remedial directions to be more proactive in accessing bank resources in particular and financial resources of enterprises in general. There are many reasons affecting the access to bank credit of SMEs in Thai Nguyen province as: Business capacity of SMEs is limited, accounting system is not professional, ability to build poor business and production plans. The dynamics and flexibility of some business owners are still weak, so understanding the new policies and preferential credit package is slow; Products of enterprises lack competitiveness, enterprises have not created position and brand in the market; Legal knowledge is limited, human resources are limitted, backward technology, most business is short-term, weak in marketing and seeking markets. Therefore, in the coming time to strengthen the access to NH credit, help SMEs to be more proactive in capital, enterprises in the whole country in general and SMEs in Thai Nguyen in particular need to consider some following measures:

(1) General solution groups: Enterprises focus to improve approachable capacity finance sources; Information transparency and complete financial report; Increase the ability to set up a business plan; Improve the capacity business of SMEs.

(2) Solution groups for business type: For agricultural enterprises, it is necessary to focus on production and supply of goods which are strengths of the locality such as tea production, safe vegetables, chicken and pig raising in the direction of applying clean technologies and modern technologies to improve production capacity. For industrial enterprises, it is necessary to have a periodic debt repayment strategy to take the initiative in borrowing capital; Joint venture, cooperation with large enterprises in providing input and consumption of products of large local enterprises (Mani, Nui Phao, Samsung). For commercial enterprises: Actively apply information technology in service provision, especially technology 4.0; Diversify sales channels; Linking bank loans through business contracts.

(3) Solution groups for the size of enterprises: For medium-sized enterprises, it is necessary to develop long-term business plans and strategies; Conduct independent audits annually; Organizing accounting apparatus both professionally and compactly; Investing in human resources in developing business plans and projects. For small and micro sized enterprises, it is possible to link between micro enterprises according to the chain model to have mutual support in production; Actively source loans, look for capital support channels other than banks.

The article hasn’t mentioned the factors affecting SMEs' ability to access credit from the money supply side, nor studying the loan source of one of the bank credit sources; nor analyzing the impact of macroeconomics on SMEs' access to capital...These limitations will be studied and published by the researchers in the coming time.

References

- Ajagbe. F.A. (2012), Features of small scale entrepreneur and access to credit in Nigeria: A microanalysis. American Journal Of Social And Management Sciences, 39- 44.

- Canovas, G.H., & Solano, P.M. (2006). Banking relationships: Effects on debt terms for small Spanish firms. Journal of small business management, 44(3), 315-333.

- Daskalakis, N., & Psillaki, M. (2009). Are the determinants of capital structure country or firm specific? Small Business Economics, 33(3), 319-333.

- De Jong, A., Kabir, R., & Nguyen, T.T. (2008). Capital structure around the world: The roles of firm-and country-specific determinants. Journal of Banking and Finance, 32(9), 1954-1969.

- Doherty. R, (2013), UK SMEs are Finding more Ways to Raise External Finance as Optimism Increases.

- Dang, T.H.T. (2015). Factors affecting the access to loans of SMEs. Journal of Economics and Forecasting, 10, 15- 18.

- Dang, T.H.T. (2016). Factors affecting the access to loans of small and medium enterprises in Hanoi. Economic Doctoral thesis, Foreign Trade University, Hanoi.

- Fama, E.F., & French, K.R. (2002). Testing trade-off and pecking order predictions about dividends and debt. Review of Financial Studies, 15(1), 1-336.

- Gbandi, D., & Amissah, G., (2014). Financing options for SMEs in Nigeria. European Scientific Journal, 10, 14-18.

- Ha Thi Thieu Dao., Nguyen Thi Mai., Nguyen Thien Kim. (2014). Accessibility to credit of small medium enterprises in Viet Nam. The Vietnam Economist Annual Meeting (VEAM).

- Ho Ky Minh., Vo Thi Thuy Anh., Le Thi Hong Cam. (2013). Assessing the access to bank capital of enterprises in the Central-Highland region. Danang Economic and Social Review, 33, 33-39.

- Huang, G., & Song, F.M. (2005). The financial and operating performance of China's newly listed H-firms. Pacific-Basin Finance Journal, 13(1), 53-80.

- Khalid, H.A., & Kalsom, A.W. (2014). Financing of small and medium enterprises (SMEs) in Libya: Determinants of accessing bank loan. Middle-East Journal of Scientific Research, 21(1), 113-122.

- Kitili, E.K. (2012), Factors influencing access to credit facilities among small and medium entrepreneurs in island division, Mombasa County, Unpublished thesis submitted to Kenyatta University.

- Masato, A. (2015). Financing small and medium enterpises in Asia and The Pacific. Journal of Entrepreneurship and Public Policy, 4(1), 2-32.

- Mukiri, W.G. (2011), Determinants of access to Bank credit by micro and small enterprises in Kenya, Beacon Consultant Service, Kenya.

- Nguyen, H.H. (2013), Analysis of factors affecting the ability to access credit capital of small and medium enterprises in Tra Vinh province. Journal of Social Sciences and Humanities, 9, 37-45.

- Naresh, K.M., Francis, M.U., James, A., Shainesh, G., & Lan Wu. (2005). Dimensions of service quality in developed and developing economies. Multi-country cross-cultural comparisons, 22(3), 256-278.

- Nguyen, H.P. (2012). International experience on financial policies to support small and medium enterprises. Institute of Banking Strategy, Portal of Ministry of Planning and Investment http://www.mpi.gov.vn/Pages/tinbai.aspx?idTin=18465&idcm=234

- Phan Q.D., Tran Hai, Y., & Pham H.M. (2015). Lending model for small and medium enterprises: African experience and lessons for Vietnam. Science Journal of Hanoi National University: Economics and Business, 31(1), 71.

- Qian, Y., Tian, Y., & Wirjanto, T.S. (2009), Do chinese publicly listed companies adjust their capital structure toward a target level? China Economic Review, 20(4), 662-676.

- Ricardo, N.B. (2004). What determines the access to credit by SMEs in Argentina? Department of economics. Universidad Nacional de La Plata, Argentina, 48, 15-30.

- Thanh, V.T (2011). Small and Medium enterprise access to finance in Vietnam. Central Institute for Economic and Management, Chapter 6.

- Tran, Q.H. (2018). Enhance the ability of small and medium enterprises to access bank credit capital in Phu Tho province, Doctoral thesis of Financial Academy, Ha Noi.

- Tran, T.K. (2015). Improving SMEs' access to capital from a banker perspective. Workshop on Improving access to capital of Small and Medium Enterprises in the context of Vietnam's integration into the ASEAN Economic Community 2015, Ha Noi.

- World Bank. (2008). Finance for all? Policies and Pitfalls in Expanding Access, Washington D.C, World Bank.