Original Articles: 2017 Vol: 21 Issue: 1

Firm Renewal Through Corporate Venturing and Strategic Agility: Shifting from Spin-Out to Spin-in Ventures

Peña-Legazkue, Iñaki. Deusto Business School

Abstract

A qualitative case study approach is applied using both in depth interviews and ethnography to understand the lived experiences of the managers and executives of the successfully closed spin out firm, parent firm and newly created spin in firm. Overall this research provides insights into the relationship between parent firms and their offspring and contends that opportunity exploitation can be maximised when a parent firm flexibly reconfigures the surplus resources remaining after the closure of a spin out and leverages them to create a new venture in the form of a spin in. The study builds on existing literature through the exploration of firm renewal and corporate venturing strategies in three specific ways. Firstly the study finds that selected remaining resources from spin out ventures can be beneficial for other businesses when appropriately reconfigured. Secondly, existing work exploring on human capital and corporate venturing are elaborated on as the research highlights the linkage between the profile of parent firm employees and the propensity to create new spinoffs. Thirdly, the impact of formal and informal institutional factors and the impact they may have on workers cooperative firms are explored. The study’s focus on the study parent firm internal factors that convert an independently created spin in firm into a part of a worker cooperative company and sheds light on the way in which the strategic factors of parent firms can influence new worker cooperative spin in ventures.

Keywords

Opportunity recognition and exploitation, strategic agility, successful closure, spin-out, spin-in, Workers Cooperatives.

Introduction

Corporate venturing can be understood as an intrapreneurial behavior that blends together a myriad of strategic components of an organization - such as corporate culture, firm resources and capabilities - leading to the discovery, evaluation and exploitation of new business opportunities (Shane & Venkataraman, 2000; Miles & Covin, 2002; Guerrero & Peña, 2013). The study of spin-out and spin-in strategies of corporate venturing by parent firms has deserved scarce attention in the entrepreneurship literature; limited knowledge exists about the link between parent firms and their spin-off subsidiaries (Semadeni & Cannella, 2011); as such, there is a need to gain a better understanding of the relationship between parent firms and their offspring. Whilst little is known about the link between parent and spin-off firms following a spin-out event even less is known about what happens if the spin-off subsequently closes. Yet the closure of a subsidiary leads to a clear change in the relationship between the subsidiary and the parent company, and as such, this unexceptional phenomenon requires further investigation.

Although firm closure can be difficult for those involved, it can be beneficial for the economy and society overall due to the release of knowledge and resources from defunct businesses (Hoetker & Agarwal, 2007; Knott & Posen, 2005); hence, it is not a wholly negative occurrence as it may contain the seeds of future project success (Shepherd et al., 2009). Where corporate venturing is concerned, the successful closure of a subsidiary may lead to a surplus of resources that can then be repurposed by the parent firm. The release of resources, being directed towards a new venture, may be positive if the parent organisation can strategically reconfigure the resources. In this paper, we analyse the unexplored phenomenon of how a parent firm transfers resources from the successful closure of a spin- out to further develop the creation of a new spin-in venture.

Qualitative case-study research is applied and data gathered using in-depth interviews to current and former owners, managers and employees of a parent company including its spin-out and spin-in firms, whose analysis and findings are examined in relation to the existing literature. There are two main contributions to the corporate venturing literature arising from this study: firstly, the research uncovers how a successful closure of a spin-out firm results in a surplus of core competencies that can be repurposed; the second contribution lies in the discovery that strategic agility enhances the efficiency and effectiveness of the transition of firm resources from a spin-out to a spin-in. In global, the study examines the way a parent firm can reach strategic choices by managing entrepreneurial decisions which concern the exploitation of obsolete, emerging and reconfigured core competencies. While strategic agility accelerates the efficiency and effectiveness of the reconfiguration of firm resources, the transition from a closing spin-out to a newly created spin-in brings new challenges and opportunities to the parent firm.

The reminder of this study is organized as follows: in the forthcoming section the connection between corporate venturing, firm renewal and strategic agility is explained; next the chosen methodological approach is described, and the paper then continues with the case analysis where key notions are discussed with respect to the literature. Finally, the conclusions of the research and directions for future research are presented.

Theoretical Background

Firm Renewal Through Corporate Venturing

The corporate venturing literature defines a spin-off as a specific organizational entity newly created for the purpose of commercializing one or more technologies, products or services originated within the parent firm (adapted from Chesbrough, 2000). As the parent firm establishes the governance structure of the spin off and how much ownership to retain, it has a central role in setting the performance trajectory of its spin-off (Semadeni & Cannella, 2011; Seward & Walsh, 1996; Miles & Woolridge, 1999). In this paper, we study two particular cases of spin-offs, namely, spin-out and spin-in ventures. For the purpose of our study, a spin-out is a spin-off terminated or sold by the parent firm. The term “spin-in” here refers to a firm externally co-created or acquired by a parent company that ultimately leads to the parent firm becoming the primary owner.

The literature on corporate venturing holds that not all firms or individuals recognize uniformly opportunities, understand their value for further business or gain competitive advantage from them (Shane & Venkataraman, 2000). A major concern for a parent organization that has recently closed a spin-out is to reinforce its position: this may be done through the extraction of any resources that remain following the spin-out’s closure and using these to facilitate the exploitation of new opportunities. This research aims to analyse how a parent firm manages the closure of a spin-out towards the development of new opportunities through a new spin-in.

Parent firms can lose agility if they don´t reach out the capacity to shift quickly and effectively out of less promising businesses into attractive ones; thereby, shifting from spin- outs to spin-in ventures can allow incumbent parent firms to maintain, and often to enhance, strategic agility (Sull, 2010). The parent firm can be a crucial source of strategic guidance at the end of the spin-out´s lifecycle, that is, during the process of resource transference between the spin-out and other ventures in the parent firm’s portfolio (i.e., including the acquisition of new spin-in ventures).

In general when a firm closes, tangible and intangible resources remain beyond the lifespan of the business; a future spin-in can absorb these resources to further their goals. The coordination and resource deployment between business units, such as the transition from the closure of spin-outs towards emerging spin-in ventures, have been scarcely studied in the corporate venturing literature. Companies should identify, classify and develop their own valuable resources to reinforce their position against relevant competitors; once the decision to close a spin-off firm has been made, parent firms will readapt prior resources in order to remain competitive in the marketplace (Barney,1991; Becker,1964; Williamson, 1975; Tomer,1987;Wernerfelt,1984). Ultimately, the ability to successfully carry out this transition is an important source of strategic renewal and comparative advantage. Parent firms have a vested interest in managing the task of closing a subsidiary firm as flexibly as possible, since they will seek effectiveness and efficiency in the use of time and resources; their supervision, guidance and support during the closure process of a spin-off will determine the strategic agility of the regeneration of the corporation. By buying spin-in ventures, rather than internally investing in R&D (i.e, often with uncertain results), velocity is gained for the entire renewal process of the corporation.

Strategic Agility for the Transition from Spin-Out to Spin-In Ventures

Strategic agility is an ability of the organization to renew itself and stay flexible without losing efficiency (Doz & Kosonen, 2010). Since agility is necessary for parent companies to gain competitive advantage and more importantly sustain it, strategic agility enables companies to respond effectively and flexibly to the tensions of their environment identifying and integrating new opportunities while facing barriers resulting from those challenges (Barney, 1991; Jahanmir, 2016; Lewis, Andriopoulos, & Smith, 2014). Strategic agility will be reinforced by absorptive capacity to acquire, assimilate, transform and exploit new knowledge (Cohen & Levinthal, 1990; Zahra & George, 2002); this is particularly true for inter-organizational learning and knowledge transference (Flatten et al., 2011; Lane et al., 2006). Hence, the strategic agility of a parent firm enables a more efficient knowledge transfer between their owned companies (Mowery et al., 1996; Wijk van et al., 2008). To investigate how resources are transferred and re-allocated between spin-out and spin-in ventures is still a pending task in the corporate venturing literature.

We believe that corporate venturing and strategic agility contribute to rapidly renewing an entire corporation; the transition period will be the time-lapse between the transference of the remaining resources from the spin-out to the spin-in firm. This process requires agility in resource transference in order to avoid undermining new project´s viability and strategic orientation (Barney, 1991). Both the parent’s ability to segregate resources and the spin-in´s resource absorptive capacity will be critical to connect prior core competences with new strategic plans (Cohen & Levinthal, 1990).

Method

A Qualitative-Study Approach

A qualitative research approach contributes to theory building when interviews help in discovering the what, why and how of occurrences (Yin, 1994; Bluhm et al., 2011; Myers,2013). We conducted interviews with the managers and executives from all the target firms of our study: Fagor Ederlan (i.e., a parent firm), FIT (i.e., a recently closed spin-out by the parent firm) and Comarth (i.e., a recently acquired spin-in venture). We captured their cognitive, affective and behavioural responses in an effort to obtain a rounded picture of different strategic actions throughout the parent firm´s strategic renewal process; more precisely, we focussed on corporate venturing activities undertaken by a parent firm, where the closure of a spin-off firm allowed the transfer of tangible and intangible resources to a recently acquired spin-in new venture in an attempt to rapidly rejuvenate the parent firm. For that purpose, we followed a method based on ethnography study.

Ethnography is an approach to studying human social life, usually seen as studying ‘at first-hand what people say and do in particular contexts’ and focused on understanding a phenomenon within its natural stage; hence, ethnography is a form to study a culture, like organizational culture, learning from people directly involved in a situation or event to understand their vision (Hammersley & Atkinson, 2007; Hammersley, 2006). Since culture cannot be observed directly and researchers can´t always gain access to the key aspects of an organization, it becomes necessary to get evidences from field work and include participants´ arguments, behaviours or thoughts literally (Spradley, 2016; Plowman,2016). Using participant observation as the main method for information gathering and the prevailing data collection technique, the concepts and associations with observed factors may lead to the establishment of models, hypotheses or theories of the studied reality (Myers, 1999).

Data Collection and Case Development

As an initial screening step, we looked for parent companies acting in global markets that exhibited corporate venturing activity. Several corporations in Spain were identified; following the screening procedure applied in previous studies, four factors were used as a selection criterion (Miller, 1983; Zaragoza-Sáez & Claver-Cortés,2011): innovativeness, proactiveness, risk assumption and social-relational capital. In addition, economic results, certifications and homologations reached by companies were considered as evidence of firm performance. After scrutiny, the firm that appeared most suited to our criteria and research goals was Fagor Ederlan, a Workers Cooperative firm, located in the Basque region of Spain. Fagor Ederlan is a company operating under the umbrella of Mondragon Corporation, a leading Spanish business group with almost 75,000 employees, integrated by autonomous and independent cooperatives, with production subsidiaries and corporate offices in 41 countries and sales in more than 150 countries.

It is worthwhile to mention that the workers cooperative Fagor Ederlan pursues not only corporate economic values implemented by most conventional companies, but also social values that affect Mondragon Corporation and the communities where they are present. It is well known that workers cooperative firms maintain and create employment in local and foreign territories following cooperative principles (Flecha & Ngai, 2014; Redondo et al., 2011). The particular management model consisting in cooperation among workers includes several collective rules and mechanisms, one of them being to re-allocate jobs when one firm of the group ceases operations. This includes reabsorbing or redirecting employees by the parent firm among subsidiaries when one quits.

In 1996 Fagor Ederlan Workers Coop. - a leading supplier of complete solutions for the automotive industry- and the US company ITT (International Telephone & Telegraph) - a supplier of brakes and electronics to the industry- created jointly the spin-off FIT Automotion (i.e., spin-out firm). The main activity of the company was manufacturing front callipers - a brake part in automobiles - for one exclusive top client. FIT became soon a profitable spin- off of Fagor Ederlan; later, in 1998 a German company (i.e. Continental AG) acquired ITT, and therefore FIT. FIT grew up to reaching a size of 130 employees and 60 million euro annual sale revenues. In 2012, Fagor Ederlan purchased the Continental AG´s equity-share of FIT.

Simultaneously board members and workers of Fagor Ederlan began considering how to strategically renew and re-position the firm in the marketplace. In the face of the closure of FIT in 2012, a year later 2013, Fagor Ederlan acquired Comarth, a newly created firm (i.e., spin-in firm). Comarth was a manufacturer in the emerging Utility Electric Vehicle industry sector, with a workforce of 50 employees and annual sale revenues of approximately 5 million euros. The response of Fagor Ederlan encapsulates strategic agility of the parent corporation, which Hemmati et al (2016) regards as organizational sensitivity, collective commitment and resource fluidity.

A semi-structured interview approach was applied to gather information from the worker cooperative parent firm Fagor Ederlan, and its two ventures, FIT and Comarth. The fact that the interviews were not overly regulated provided each interviewee with the opportunity to reflect on key events and actions (Hermanowicz, 2002). The interviewees added insights on their experiences related to past events, topics and themes that they deemed important in addition to covering the core topics relevant to the study; at the same time the balance between person oriented and task oriented rapport was significantly careful mainly because of the emotional background linked to some experiences of the participants (Marshall & Rossman, 1999). Influential managers and executives - three participants from each of the three firms (i.e., Fagor Ederlan, FIT and Comarth)- provided rich information and an overall view of the organisation in question: this aspect was regarded essential for this research since it allowed us to gain easier access to the necessary interlocutors avoiding biased data (Huber & Power, 1985). Given our focus on a parent company with a successfully closed spin-out and resource transfer to a newly created spin-in our sampling frame was very specific and interviewees came from all the three companies (i.e., parent, spin-out and spin-in firms). Incumbents -former and current-managers and executives from the analysed firms- were included in the interviews in order to obtain an overview of the entire historical information from the companies.

The paper aims at gaining our understanding on the transfer of key core competencies from a successful spin-out to an emerging spin-in venture by asking former and current managers and executives from selected companies about their activities during the transfer process; we were able to isolate all references that managers and executives perceived across a wide range of activities during different periods of time. Due to the ethnographic character of the study, the main researcher of the present study worked within the parent company, Fagor Ederlan and alongside many of the managers involved in the firm throughout the process of finalizing the activity. Hence, we developed a unique perspective into the whole exit process of the spin-out FIT and the resource transference to the spin-in Comarth.

Data were collected from September 2015 to June of 2016 and initial exploratory interviews were conducted in one of the companies to test the interview protocols. The close working relationship between the main researchers with key professionals within the firm built up trust with interviewees: this factor led to relatively broad access to the top management team within parent firm and its offspring despite the turbulence the firms were undergoing. The use of an open-ended interview procedure enabled the researchers to get a better sense about the range of activities in their area (Maxwell, 2004); this approach contributed to a broader and deeper understanding of how the parent company resourced and supported the spin-out. Following Doz, & Kosonen, (2010), we identified the most representative strategic milestones of each company (i.e., Fagor Ederlan, FIT and Comarth), and conducted interviews asking questions about two generic subjects: firm renewal and strategic agility during the transference process.

The analysis proceeded in several steps: first, we discerned who were engaged in the closure of FIT, in the acquisition of Comarth, and in the resource transference process from Fagor Ederlan. In addition, we used field notes, interviews, secondary data, and time-specific information asking the interviewees to describe their practices at a particular period of time. In a second stage, we searched the highlighted paragraphs in which participants provided very revealing answers to our questions. Finally, in the third phase, we analyzed the primary codes with data following the method by Gioia et al. (2013) to come up with core concepts which were then examined in conjunction with the existing literature.

Coding Procedures and Data Analysis

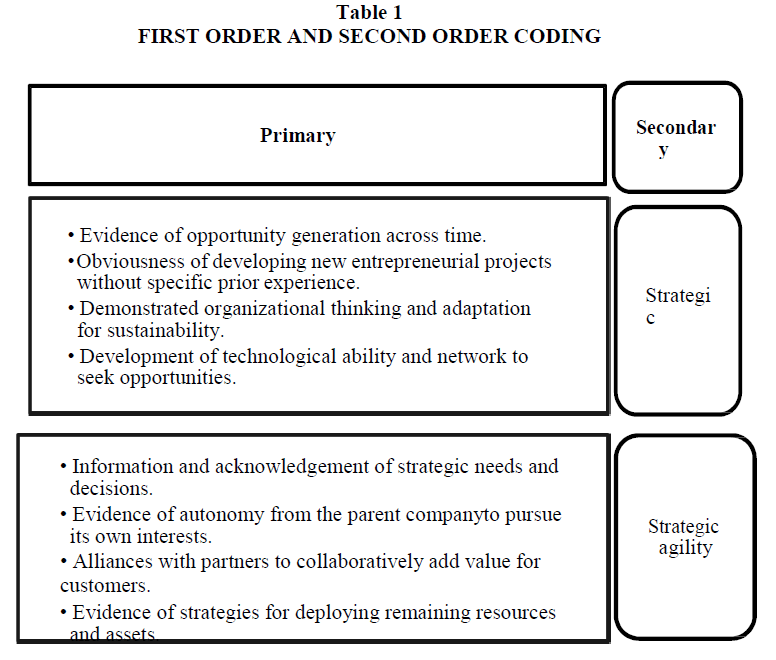

The analysis began with first-order coding. This involved reading through interview transcripts and the primary researcher’s notes, which were taken both throughout the interviews and during the researchers time working at the company. This led to the development of primary codes – excerpts of text considered important to answering the study’s research question were then grouped under particular primary codes (See Table 1).

The coding process was iterative, with interview notes and transcripts being read and reread numerous times whilst the data was coded and recoded as constant comparison techniques were carried out. The codes were then more grouped into secondary codes. It is at this stage that themes and patterns began emerging from the data. It is these emerging patterns that contributed to the development of the secondary codes (See Table 1). As the themes and patterns were identified the data was revisited constantly in order to test their validity (Creswell, 2007; Miles & Huberman, 1994). Once the core themes were clear – strategic agility and strategic renewal-, the primary data relevant to each one was examined in full and contrasted with existing literature on those topics.

Case Description and Discussion

Corporate Venturing to Reshape the Parent Firm

The following quotes illustrate how the top management team and board members of the worker cooperative were able to analyse the momentum of being outward and opportunity oriented by imprinting a strategic renewal mindset across all the parent and spin-out/spin-in ventures. The importance of firm renewal was reinforced by the Human Resources Corporative Manager of Fagor Ederlan (i.e., the parent firm): “Since our global presence in world markets is increasing we need to look for opportunities and long term positive results, and this may require the recombination of current assets and resources; all is possible with the right design, flexibility, clear internal communication of objectives and implementation of valiant strategies”. The Manager of FIT (i.e., the spin-out firm) added a similar idea from a different angle: “Our company is based on permanent adaptation to our customer needs… an externally driven renewal process with agile adaptation is a distinctive feature of our identity”. Linked to this notion, the Manager of Comarth (i.e., the spin-in firm) noted that: “The spin in is the result of a long-term strategic reflexion since the parent company itself was searching for entrepreneurial opportunities and future potential markets to add in their portfolio; the Utility Electric Vehicles was a feasible strategic option for them, and most importantly, we were fully aligned with their new vision and goals”.

In one of the initial interviews, the former Manager of FIT (i.e., the spin-out firm) pointed out that “The spin out was created as an opportunity, initially limited to a term of several years and with a very uncertain long-term survival prospect since the company depended only on just one customer”. Workers of FIT had to develop skills to work in the highly demanding sector with such an important client, the labour force was trained to rigorously attend to very specific needs: excellence in reliability and delivery performance. Operating due to the business of one top client, FIT had no other choice but to learn how to succeed in a captive and rigorously competitive marketplace. After the closure of the spin- out, the expertise of key workers of FIT became crucial for the newly acquired firm by Fagor Ederlan mainly due to the efficiency of the management model with consistent results in efficiency and profitability; in this regard, the Manager of Comarth described how the process of the acquisition worked for them: “Comarth was an Utility Electric Vehicles manufacturer and Fagor Ederlan was a consolidated and solvent company with deep knowledge and know-how in the automotive manufacturing industry…their corporate venturing experience and expertise with industrial assembly solutions for automotive manufacturers fit in our relevant organizational needs…since the spin-off FIT had been under intensive pressure from its previous customer for several years, the transfer of their proficiency in continuous improvement, market experience and quality guarantee was fundamental to strengthen this type of emerging business in Europe”. This excerpt highlights how Comarth benefited from the transfer of key employees coming from FIT. We should bear in mind that a major weakness of Comarth was not only the fact it is targeting a new market, but a low commercial and nascent business-industrial development. Connecting employees of Comarth with remaining workers of FIT opens a transfusion mechanism to improve its industrial development, promote product innovation and enhance the firm´s standards of quality and safety, which were remarkable hallmarks within FIT’s strategy and are also required factors in the field of electric mobility. Moreover, it refreshed strategic goals of the parent firm (i.e., the ability to innovate and launch rapidly modern products to new markets) and it also complied with workers´ cooperative principles within the umbrella of Mondragon Corporation (i.e., reallocating the jobs lost by the closure of FIT into the newly acquired Comarth); these examples show how Fagor Ederlan faced firm renewal and was able to reinvent itself as a parent firm by peripherally managing tangible and intangible resources available from the spin-out and spin-in ventures.

After considering the testimony of different managers involved in the parent firm renewal, spin-out and spin-in processes, we realize that it becomes necessary to develop key capabilities internally and also externally through corporate venturing, to accelerate the renewal of incumbent businesses in order to rapidly respond to environmental changes and challenges; this is congruent with previous findings in the literature: a firm must identify and develop the core competencies needed to create a new or renewed organization (Barney, 2002). Parent firms typically share resources across subsidiaries to achieve and increase profitability and market value (Weber & Tarba, 2014). However, in our study we focus on the velocity of firm renewal: we claim that corporate venturing is a tool to accelerate the rejuvenation process of a parent firm by strategically coordinating spin-out and spin-in ventures.

Following the closure of a subsidiary, surplus resources can be immediately repurposed by the parent company and redeployed to other functioning subsidiaries; hence, resources are leveraged as drivers of added value and of diversification when they are reconfigured to fit with a spin-in´s necessity. The parent company made an assessment of an integrated strategy examining the remaining residual resources after a successful closure, and then, a process of resources transference was enacted.

Furthermore, we believe that the integration of resources from a spin out into a spin in (when both are owned by the same parent company) does not necessarily result in cultural clashes or disruption of organizational routines because despite being largely separate entities they are still integrated and all share a corporate culture based on workers cooperative principles; moreover, rotating and inducting people who have gained a new perspective through their experience working with the spin-out, provides the parent company with fresh ideas and it oxygenates the parent company. Workers cooperatives generally have a low power distance culture which may facilitate the adaptation into the organizational routine within existing or newly created firms in contrast with companies under other legal forms (Junni et al., 2015).

Full integration of resources transferred requires the complete acceptance of the spin in reinforcing a total system perspective with all its elements richly connected to the advancement of the parent company´s interests (Teerikangas, 2004). Since integrating surplus resources facilitates the identification of potentially valuable information and knowledge, complementarity and real acceptance is possible, and so too, success (Gupta & Govindarajan, 2000; Zollo & Singh, 2004). While several resources may be rapidly transferred - such as machines, equipment or tools- others may require a progressive adaption including workers who need to gain a new psychological contract (Conway & Briner, 2005). Therefore, parent’s hierarchical influence may allow for a swift adaption process facilitating the degree of integration and supervising the acceptance of the recipient firm (Tushman & Anderson, 1986); this is consistent with Junni et al. (2015) as high degree of integration supports one- directional knowledge transfer.

Since the adequate combination of resources seems to lead to the creation of new knowledge, the spin in and the parent firm have the opportunity to increase the potential of experienced and qualified assets combining them efficiently (Yiu, Lau, & Bruton, 2007). Thus, benefits for the entire group are possible, including the parent company (i.e., renewing entity), the spin in (i.e., acquirer of talent) and the spin out (i.e., successful closure and re allocation of assets).

A Flexible Transforming Process

According to the interviewees, strategic agility was related to an efficient response to rapid changes, which mainly included quickly reshaping the parent firm. When the spin-out decision of FIT was confirmed from Fagor Ederlan (the parent firm) all the employees of FIT feared for their jobs and professional careers. FIT was a successful company but it was sentenced to closure: it was not easy to explain to the workers the spin-out decision taken by the parent company. Moreover, a solution should be provided to the soon job-less workers of FIT. The former Manager of FIT underlined “Once the closure of FIT was known, workers were expectant about their future jobs and their potential contribution to other workers cooperatives; the re-allocation of cooperative workers to other firms within Mondragon Corporation is a complex task: not only should the re-organization should be agile, but also feasible and motivating for FIT workers”. Several ex-workers of FIT were re-allocated within the industrial group while few ex-workers holding a managerial position in FIT were appointed to launch and develop the new Comarth spin-in venture because they had qualified know-how, contrasted business experience and entrepreneurial intuition in the automotive industry sector. The transfer of key workers from the spin-out FIT to the spin-in Comarth would not be possible without the strategic agility of Fagor Ederlan concerning their re- allocation decisions of cooperative workers.

Some years earlier, the importance of being strategically agile had been also recognised by the Manager of FIT who argued: “Fagor Ederlan adapted quickly to the new customer needs identified by FIT, targeting strategically a business activity that Fagor Ederlan had no previous experience but entrepreneurial interest. Fagor Ederlan provided all the support and assistance that FIT needed to develop new products in order to meet tailored needs of its customer”. This insight illustrates that Fagor Ederlan, the parent firm, was flexible and open to developing other projects beyond its core business. In essence, FIT was a spin-off firm (prior to its closure) which allowed the identification and exploitation of new marketable manufactured goods within the overall product portfolio of Fagor Ederlan. All the interviewees recognized the autonomy, a reflection of their confidence in their off-spring, that Fagor Ederlan (i.e. the parent company) grants to its spin-offs: such autonomy increases the agility of the companies, which is strategically important to enable the firms to act quickly and maintain customer satisfaction.

In addition Fagor Ederlan has been described by participants as a “consolidated company with high entrepreneurial concern and attitude” with an interest in flexibly transforming and adapting to the needs of the new spin-in Comarth by utilising several remaining assets from the whole company. Fagor Ederlan provided the strategic agility needed to facilitate the shift in the infrastructure for the production of electric vehicles and to integrate the labour force of Comarth into the culture and discipline of the cooperative group.

Strategic agility is a non-substitutable capability that enhances competitive advantage (Ojha, 2008). The parent firm exhibits strategic agility in its shared responsibility and flexible transfer of the surplus core capabilities between the closed spin out and newly developed spin in (Long, 2000). Strategic agility contributes to the ease of the closure process of the parent company, as once the spin-out closure is confirmed it begins to explore the most efficient and innovative use of the remaining resources. The creation of an effective system and corporate culture that enables and exploits existing competencies leads to an increased chance of a successful merging process.

When an organisation is in a period of transition (as the parent company is experiencing with the closure of a spin-out and the acquisition of a spin-in) timing is important: faster implementation of changes increases new firm viability without altering current development. Moreover, appropriate decision-making and speed are needed to respond to environmental changes adequately (Sanchez, 1995); this is particularly the case when a parent firm needs to rapidly redeploy and reconfigure remaining resources into the new firm (Doz & Kosonen, 2010). Strategic agility allows a company to operate successful strategies with imperfectly mobile firm resources, meaning resources that cannot be freely acquired in the market (Dierickx & Cool, 1989; Barney).

Since parent companies have a unique position over their subsidiaries, they can reinforce their leadership position by guiding successful transference of remaining resources from a spin out into a spin in. According to Weber & Tarba (2014) positioning the resources for strategy execution is a major component of strategic agility. Thus, as performance and survival chances depends upon the effective use of resources, flexible and innovative forms of using resources are beneficial for those organizations that have learned to use their resources effectively over a period of time (Bradley et al., 2011; Haveman,1992).

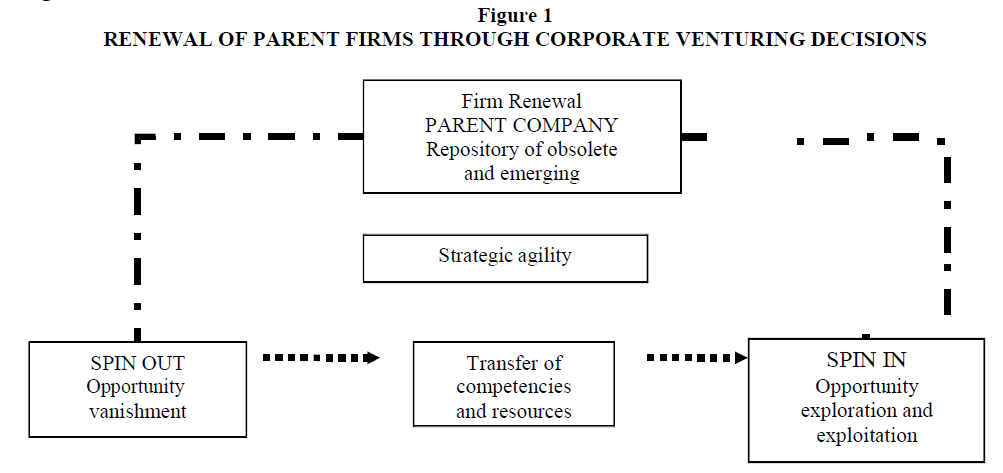

After assessing the declaration of all the interviewees, we propose a framework embracing key notions to shed light on how corporate venturing can sustain and enhance the parent´s firm comparative advantage by coordinating spin-out and spin-in ventures with cost effective resource re-allocation and time saving strategic agility. Our framework is presented in Figure 1:

Firm renewal is the result of a positive transference process that allows for the renewal of the parent firm’s core knowledge and the creation of renewed competencies (Floyd & Lane, 2000). The spin-out firm FIT developed a bulk of skills and competencies that were directed towards the new spin-in venture Comarth; more than “learning by doing” firm resources were valued as “learning by done”, which relates to successfully experienced assets (Koloupolus et al.,2006; Spreitzer et al., 2005; Levitt & March, 1988). Resource transference contributes to knowledge assimilation whereby external information is considered and combined with internal knowledge (Todorova & Durisin, 2007; Zahra & George, 2002). Furthermore, spin-offs with a shared organizational culture face lower barriers for transferring resources and this facilitates knowledge exchange and (re)combination. As entrepreneurial organizations, such as Fagor Ederlan, explore and assess new opportunities internal organizational renewal through resource transference (i.e., from closing spin-out ventures towards emerging spin-in ventures) allows them to provoke continuous organizational change and re-adaptation to the context; this in turn can be oriented to rapidly introduce products in new markets or introducing new products in the existing ones (Covin & Miles, 1999). Ultimately, the strategic agility of parent firms in designing and implementing corporate venturing actions (i.e., like the spin-out and spin-in activities of this study) lead not only to the renewal of key core competences of the parent firm but also to the velocity needed to sustain (and to enhance) above-normal profits in today´s competitive landscape. As one of the top executives emphasized “like in aging of human beings, companies must find out the way to become increasingly agile as they get older if they really aim at remaining healthy and young in a continuously changing world…”

Conclusion

In our qualitative study, firm renewal through corporate entrepreneurship is examined as a mechanism to rejuvenate the resources and competencies of parent firms. In our case a parent organization adapted to the rapidly changing environment by collaborating with third parties via spin-out and spin-in strategies: the strategic renewal of the parent company Fagor Ederlan focuses on the counterpoint between the innovative entrepreneurship (Comarth) versus a traditional activity (foundries of Fagor Ederlan). Our study makes a modest contribution to the entrepreneurship literature in several fronts. First, we conclude that selected remaining resources from spin-out ventures can be beneficial for other businesses when appropriately reconfigured. We found that they can be drivers of added value not only for parent firms but also for other spin-in ventures. Our evidence contests the findings by Purkayastha et al. (2012) in that, according to our results, corporate venturing triggers diversification rapidly at a low cost. Secondly, we expand the work by Guerrero & Peña (2013) on human capital and corporate venturing where the authors empirically show the linkage between the profile of parent firm employees and the propensity to create new spin- offs. In our case analysis, we take a step further and claim that the transfer of key employees (i.e., with all their human capital attributes) from peripheral spin-out firms to spin-in ventures can enhance the capacity to innovate of the parent firm, and thereby, contribute flexibly to firm renewal. In addition to the human capital embedded in the parent firm the re-allocation of the workforce among adjacent spin-out and spin-in is also crucial for the parent firm to gain agility and remain competitive in the marketplace. These contributions bring new insights into the debate on corporate venturing and strategic firm renewal. Thirdly, Arando et al. (2009) examined how formal and informal institutional factors affected the creation of workers cooperative firms. Rather than firm-external factors in our study we study parent firm-internal factors that lead to the conversion of an independently created spin-in firm in a worker cooperative company. Not only (external) context factors matter (i.e., economic market and institutional conditions) as it has been explored in the literature but also (internal) strategic factors of parent firms seem to influence the generation of new worker cooperative spin-in ventures. The analysis of firm creation for different legal forms is a topic barely studied in the entrepreneurship literature and our evidence sheds some light on corporate venturing strategies implemented by worker cooperatives to coordinate spin-out and spin-in firms.

This paper is not exempt from limitations. We should emphasize two main challenges: on the one hand, the company was immersed in an outplacement and grief process; and on the other hand, each manager that was interviewed had specifically focused on the results and the activities in which they were involved. Nevertheless, the ethnographic approach followed in our study meant the lead researcher was wholly submerged in the daily processes of the parent firm as a manager and this allowed us to develop a broad and general perspective of the whole spin-out and spin-in process. This condition was helpful to amend the above mentioned limitations; essentially, the qualitative approach applied in our case provided sound evidence and all the necessary information to learn about the scope and depth of the renewal process of the parent firm through corporate venturing and strategic agility.

An important implication of this paper for management teams and board members is that the successful design and implementation of corporate entrepreneurship strategies via spin-out and spin-in mechanisms may enhance the strategic agility of the parent organization: workers cooperatives apply collective values to re-allocate workers among different business units and recombining the skills of employees coming from different spin-offs may lead to enhanced innovation capacity of the whole group. Policy makers should pay attention not only to the profile of parent firms but also to the performance of their corporate venturing spin-offs before putting in practice “one size fit all” type of policies.

We detected some issues that warrant further research and suggest for future studies to investigate the performance of spin-out and spin-in strategies in order to gain a better understanding about the engagement of parent firms for continuously (re)shaping dynamic capabilities and value creation. Moreover, since firm closure is not equivalent to firm failure and intelligent failure can produce beneficial advantages to the parent firm, it would be interesting to discern successful from non-successful closing experiences. All these recommendations illustrate that still there is more to learn on corporate venturing and business performance.

References

- Arando, S., Pena, I. & Verheul, I. (2009). Market Entry of Firms With Different Legal Forms: An Empirical Test Of The Influence Of Institutional Factors. International Entrepreneurship and Management Journal, 5(1), 77-91.

- Barney, J. (1991). Firm Resources And Sustained Competitive Advantage. Journal of management, 17(1), 99- 120.

- Barney, J.B. (2002). Strategic Management: From Informed Conversation to Academic Discipline. Academy of Management Executive, 16(2), 53-57.

- Becker, G.S. (1964). Human Capital Theory. Columbia, New York.

- Bluhm, D.J., Harman, W., Lee, T.W. & Mitchell, T.R. (2011), Qualitative Research In Management: A Decade of Progress, Journal of Management Studies, 48(8), 1866-1891.

- Bradley, S.W., Aldrich, H., Shepherd, D.A. & Wiklund, J. (2011). Resources, Environmental Change, And Survival: Asymmetric Paths Of Young Independent And Subsidiary Organizations. Strategic Management Journal, 32(5), 486-509.

- Chesbrough, H. (2000). Designing Corporate Ventures In The Shadow Of Private Venture Capital. California Management Review, 42, 31-49.

- Cohen, W.M. & Levinthal, D.A. (1990). Absorptive Capacity: A New Perspective On Learning And Innovation. Administrative Science Quarterly, 128-152.

- Conway, N. & Briner, R.B. (2005). Understanding Psychological Contracts At Work: A Critical Evaluation Of Theory And Research. Oxford University Press.

- Covin, J.G. & Miles, M.P. (1999). Corporate Entrepreneurship and The Pursuit Of Competitive Advantage.Entrepreneurship: Theory and Practice, 23(3), 47-63.

- Creswell, J.W. (2007), Qualitative inquiry and research design: Choosing among five approaches (2nd ed.).Thousand Oaks, CA.: Sage.

- Dierickx, I. & Cool, K. (1989). A Set Stock Accumulation And Sustainability Of Competitive Advantage.Management Science, 35(12), 1504-1511.

- Doz, Y.L. & Kosonen, M. (2010). Embedding Strategic Agility: A Leadership Agenda For Accelerating Business Model Renewal. Long Range Planning, 43(2), 370-382.

- Flatten, T.C., Engelen, A., Zahra, S.A. & Brettel, M. (2011).A Measure Of Absorptive Capacity: Scale Development and Validation. European Management Journal, 29(2), 98-116.

- Flecha, R. & Ngai, P. (2014). The Challenge For Mondragon: Searching For The Cooperative Values In Times Of Internationalization. Organization, 21(5), 666-682.

- Floyd, S.W. & Lane, P.J. (2000). Strategizing Throughout The Organization: Managing Role Conflict In Strategic Renewal. Academy of management review,25(1), 154-177.

- Gioia, D.A., Corley, K.G. & Hamilton, A.L. (2013). Seeking Qualitative Rigor In Inductive Research Notes On The Gioia Methodology. Organizational Research Methods, 16(1), 15-31.

- Guerrero, M. & Pena, I. (2013). The Effect Of Intrapreneurial Experience On Corporate Venturing: Evidence From Developed Economies. International Entrepreneurship and Management Journal. 9, 397?416. DOI 10.1007/s11365-013-0260-9

- Gupta, A.K. & Govindarajan, V. (2000). Knowledge Flows Within Multinational Corporations. Strategic management journal, 21(4), 473-496.

- Hammersley, M. (2006). Ethnography: Problems And Prospects. Ethnography and Education, 1(1), 3-14. Hammersley, M. & Atkinson, P. (2007). Ethnography: Principles In Practice. Routledge.

- Haveman, H.A. (1992). Between A Rock And A Hard Place: Organizational Change And Performance Under Conditions Of Fundamental Environmental Transformation. Administrative Science Quarterly, 48-75.

- Hemmati, M., Feiz, D., Jalilvand, M.R., & Kholghi, I. (2016). Development Of Fuzzy Two-Stage Dea Model For Competitive Advantage Based On Rbv And Strategic Agility As A Dynamic Capability. Journal of Modelling in Management,11(1).

- Hermanowicz, J.C. (2002). The Great Interview: 25 Strategies For Studying People In Bed. Qualitative Sociology,25(4), 479-499

- Hoetker, G. & Agarwal, R. (2007). Death Hurts, But It Isn?t Fatal: The Post-Exit Diffusion Of Knowledge Created By Innovative Companies. Academy of Management Journal, 50(2), 446-467.

- Huber, G.P. & Power, D.J. (1985). Retrospective Reports Of Strategic-Level Managers: Guidelines Fir Increasing Their Accuracy. Strategic Management Journal, 6, 171-180.

- Jahanmir, S.F. (2016). Paradoxes Or Trade-Offs Of Entrepreneurship: Exploratory Insights From The Cambridge Eco- System. Journal of Business Research.

- Junni, P., Sarala, R.M., Tarba, S.Y. & Weber, Y. (2015). The Role of Strategic Agility in Acquisitions. British Journal of Management, 26(4), 596-616.

- Knott, A.M. & Posen, H.E. (2005). Is failure good?. Strategic Management Journal, 26(7), 617-641.

- Koulopoulos, T.M. & Roloff, T. (2006). Smart Sourcing: Driving Innovation and Growth Through Outsourcing.Adams Media.

- Lane, P.J., Koka, B.R. & Pathak, S. (2006). The Reification Of Absorptive Capacity: A Critical Review And Rejuvenation Of The Construct. Academy of Management Review, 31(4), 833-863.

- Levitt, B., & March, J.G. (1988). Organizational Learning. Annual Review of Sociology, 319-340.

- Lewis, M.W., Andriopoulos, C. & Smith, W.K. (2014). Paradoxical Leadership To Enable Strategic Agility.California Management Review, 56(3), 58?77.

- Long, C. (2000). You don't have a strategic plan?--good!. Consulting to Management, 11(1), 35.

- Marshall, C. & Rossman, G.B. (1999). Designing Qualitative Research. Sage: Thousand Oaks, CA.

- Maxwell, J.A. (2004). Using Qualitative Methods For Causal Explanation. Field Methods, 16(3), 243?264

- Miller, D. (1983). The Correlates of Entrepreneurship In Three Types Of Firms. Management Science, 29.

- Miles, M.B. & Huberman, A.M. (1994), Qualitative Data Analysis. Thousand Oaks, CA, Sage.

- Miles, J. & Woolridge, R. (1999). Spin-offs and equity carve-outs. Achieving faster growth and better performance. Financial Executives Research Foundation.

- Miles, M.P. & Covin, J.G. (2002). Exploring The Practice Of Corporate Venturing: Some Common Forms And Their Organizational Implications. Entrepreneurship: Theory and Practice, 26(3), 21-41.

- Mowery, D.C., Oxley, J.E. & Silverman, B.S. (1996). Strategic Alliances And Interfirm Knowledge Transfer. Strategic management journal, 17(S2), 77-91.

- Myers, M. (1999). Investigating Information Systems With Ethnographic Research. Communications of the AIS, 2(4es), 1.

- Myers, M.D. (2013). Qualitative Research In Business & Management, 2nd ed. Sage publications, London.

- Ojha, D. (2008). Impact of Strategic Agility On Competitive Capabilities And Financial Performance. MSc Dissertation, Graduate School of Clemson University, Clemson, US.

- Plowman, L. (2016). Revisiting Ethnography By Proxy. International Journal of Social Research Methodology,1-12.

- Purkayastha, S., Manolova, T.S. & Edelman, L.F. (2012). Diversification And Performance In Developed And Emerging Market Contexts: A Review Of The Literature. International Journal of Management Reviews, 14(1), 18-38.

- Redondo, G., Santa Cruz, I. & Rotger, J.M. (2011). Why mondragon? Analyzing what works in overcoming inequalities. Qualitative Inquiry, 17(3), 277-283.

- Sanchez, R. (1995). Strategic Flexibility In Product Competition. Strategic Management Journal, 16(S1), 135- 159.

- Semadeni, M. & Cannella, A.A. (2011). Examining The Performance Effects Of Post Spin1off Links To Parent Firms: Should Thse Apron Strings Be Cut?. Strategic Management Journal, 32(10), 1083-1098.

- Seward, J.K. & Walsh, J.P. (1996). The Governance And Control Of Voluntary Corporate Spin-Offs. Strategic

- Management Journal, 17(1), 25-39.

- Shane, S. & Venkataraman, S. (2000). The Promise Of Entrepreneurship As A Field Of Research. Academy of management review, 25(1), 217-226.

- Shepherd, D.A., Covin, J.G. & Kuratko, D.F. (2009). Project Failure From Corporate Entrepreneurship: Managing The Grief Process. Journal of Business Venturing.

- Spradley, J.P. (2016). The ethnographic interview. Waveland Press.

- Spreitzer, G., Sutcliffe, K., Dutton, J., Sonenshein, S. & Grant, A.M. (2005). A Socially Embedded Model Of Thriving At Work. Organization Science, 16(5), 537-549.

- Sull, D. (2010). Competing Through Organizational Agility. McKinsey Quarterly, 1, 48-56.

- Teerikangas, S. (2004). Systems Intelligence In Mergers And Acquisitions?A Myth Or Reality?. Systems Intelligence, 131.

- Todorova, G. & Durisin, B. (2007). Absorptive Capacity: Valuing A Reconceptualization. Academy of Management Review,32(3), 774-786.

- Tomer, J.F. (1987). Organizational Capital: The Path To Higher Productivity And Well-Being. Praeger Publishers. Tushman, M.L. & Anderson, P. (1986). Technological Discontinuities And Organizational Environments. Administrative science quarterly, 439-465.

- Van Wijk, R., Jansen, J.J., & Lyles, M.A. (2008). Inter1and Intra1organizational Knowledge Transfer: A Meta- Analytic Review And Assessment Of Its Antecedents And Consequences. Journal of Management Studies, 45(4), 830-853.

- Wernerfelt, B. (1984). ?A Resource Based View of The Firm?. Strategic Management Journal, 5(2), 171-180. Williamson, O.E. (1975). Markets And Hierarchies. New York, 26-30.

- Weber, Y. & Tarba, S.Y. (2014). Strategic Agility: A State Of The Art. California Management Review, 56(3), 5-12.

- Yin, R. (1994). Case Study Research: Design And Methods . Beverly Hills.

- Yiu, D.W., Lau, C. & Bruton, G.D. (2007). International Venturing By Emerging Economy Firms: The Effects Of Firm Capabilities, Home Country Networks, and Corporate Entrepreneurship. Journal of International Business Studies. 38(4), 519-540.

- Zahra, S.A. & George, G. (2002). Absorptive Capacity: A Review, Reconceptualization, and Extension. Academy of Management Review, 27(2), 185-203.

- Zaragoza-Sáez, P. & Claver-Cortés, E. (2011). Relational capital inside multinationals. Knowledge Management Research & Practice, 9(4), 293-304.

- Zollo, M. & Singh, H. (2004). Deliberate Learning In Corporate Acquisitions: Post1acquisition Strategies And Integration Capability In Us Bank Mergers. Strategic Management Journal, 25(13), 1233-1256.