Research Article: 2024 Vol: 28 Issue: 2S

Governance of Gold Deposits in Africa: Economic Benefits as Store of Value and Source of Socioeconomic Conflict

Mamadou MBAYE, Iba Der Thiam University of Thies

Citation Information: MBAYE, M.,(2024). Governance of gold deposits in africa: economic benefits as Store of value and source of socioeconomic conflict. International Journal of Entrepreneurship, 28(S2),1-9

Abstract

Gold deposits offer significant economic benefits for the African countries that hold them. They constitute for those who have a developed mining industry an important economic engine and a vector of growth. For these immature economies often subject to socio-political uncertainties, gold, as a safe haven and stable asset, allows them to protect their heritage. It serves as a guarantee for loans and investments in order to stimulate the economy by promoting the raising of substantial funds necessary for their development. They use it as an international currency in commercial transactions and bilateral exchanges, which constitutes a diversification of their investment portfolios and a reduction of risk in the capital market. However, their exploitation causes significant environmental damage, such as the destruction of natural habitat and pollution (air and water), leads to land and social conflicts with indigenous communities, and attracts criminals, traffickers, armed groups illegals who seek to profit from illegal mining activities. Added to this is the foreign pressure that extracts this wealth at a low price on the basis of fallacious contracts stuffed with leonine articles. It is therefore, if we are not careful, a source of conflict and destabilization that can lead to the disintegration and destruction of democratic and socio-political achievements. This article aims to analyze the governance of gold mining by African countries under the bipolar prism of hope for development and the curse of destabilization.

Keywords

Mining, Gold, Development, Conflict.

JEL Classifications

D74, P45, Q32, Q34

Introduction

The governance of gold deposits in Africa is a complex subject that encompasses economic, political, social, and environmental issues. They represent an opportunity for the economic development of African countries, providing revenue and jobs, stimulating investment, and enhancing financial stability. However, their exploitation can lead to negative social and environmental impacts, such as environmental degradation, discrimination against local communities, and the escalation of social and political conflicts.

This governance is largely influenced by public policies and institutional arrangements that govern mining activities. African governments are trying to adopt policies that promote responsible and sustainable exploitation, ensuring transparency and accountability in resource management, protecting the rights of local communities, and respecting environmental standards. But, in many cases, they lack the capacity or willingness to establish adequate governance, leading to irresponsible practices and social and political conflicts.

Furthermore, multinational mining companies influence the governance of deposits by adopting business practices in close collaboration with governments and local communities. However, many of them have selfish and purely financial motivations, ignoring the social and environmental consequences of their activities and actions.

The tax evasion or optimization practices of foreign companies lead to revenue leakage, not to mention the dependence of rulers on them, which undermines national sovereignty and increases the risks of political instability. This is compounded by the complexity of mining codes and the opacity of exploration and exploitation agreements. The focus, according to Mainguy (2013), is on the attractiveness of mining policies with considerable fiscal expenditures without ensuring that the host countries of these foreign direct investments (FDI) sufficiently benefit from these resources.

To ensure their use in a responsible and beneficial manner for local populations, it is important to strengthen governance by ensuring that public policies and business practices are aligned with sustainable development goals. This requires close collaboration between African leaders, mining companies, and local communities, as well as the rigorous implementation of environmental and social policies and standards.

Through this article, the issue of governance in gold mining in African countries is analyzed. Our study will be carried out in four parts: an introduction, a section on the benefits of gold deposits with a classic consideration of gold as a store of value, another detailing the socio-political disadvantages, and finally, a conclusion that synthesizes our analysis, proposes recommendations for better (and inclusive) governance, and outlines prospects for the future.

Store of Value and Financial Benefits

Gold has been considered a safe-haven asset for thousands of years, due to its rarity and consistent demand for the manufacture of jewelry and luxury products, as well as its use as a store of value for governments and investors. In Africa, gold deposits represent a significant source of revenue for countries, capable of stimulating economic growth and providing jobs for local residents. However, for these benefits as a safe-haven asset to be fully realized, effective governance must be established, taking into account the entire stratification of exploitation, which is not only industrial but often artisanal and semi-industrial in the form of gold panning.

According to the OECD report (2021), aside from the fact that gold panning causes huge losses for the countries where it is developed due to smuggling, the activity is a hotbed of problems. Risks of corruption, false declarations, money laundering, and non-payment of taxes, as well as the development of practices contrary to human rights, such as child labor, prostitution, sexual violence, and forced labor, are among the vulnerabilities observed in this sector. However, West African states are increasingly adopting a pragmatic approach towards artisanal and small-scale gold mining, considered a source of problems and a hindrance to the development of the mining industry, by issuing permits to gold panners in order to regulate the sector.

The West African region is attracting more and more foreign actors such as Barrick Gold, Iamgold, Endeavour Mining, and Perseus Mining. However, production is predominantly assured by industrialists, while clandestine gold panning is expanding throughout the Sahel, giving rise to millions of artisanal gold panners. This phenomenon has intensified in recent years, increasing the risks of territorial conflicts between industrialists and artisans and the abandonment of agricultural activities in favor of the pursuit of immediate wealth.

According to (Gagnol, 2022), the redistribution of balances in the management of informality tips gold panners towards regularization or more often towards precariousness, or even criminalization. The maintenance of illegalities rests on issues of land appropriation.

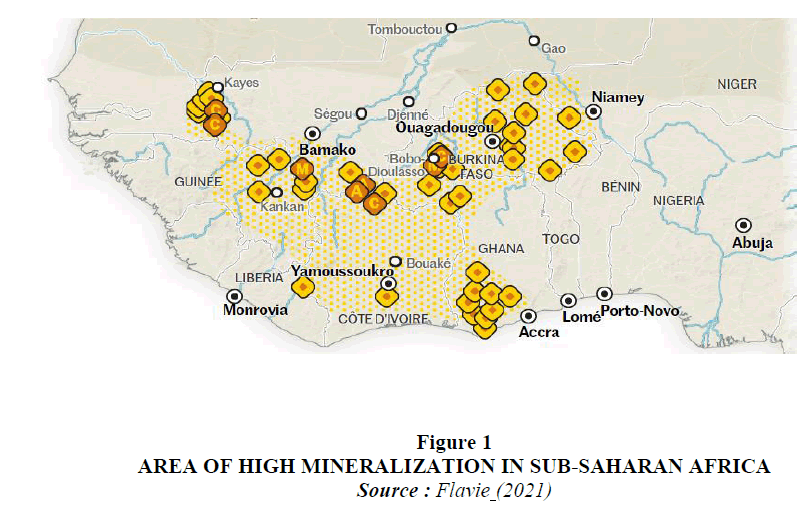

Today, three countries in the sub-region are among the top twenty (20) largest global gold producers (Figure 1). Ghana has become the continent's leading producer with 147 tons extracted in 2019, ahead of Mali (73 tons) and Burkina Faso (64 tons). Gold is the leading export product for these three countries, as well as for Niger (Cyril (2021)).

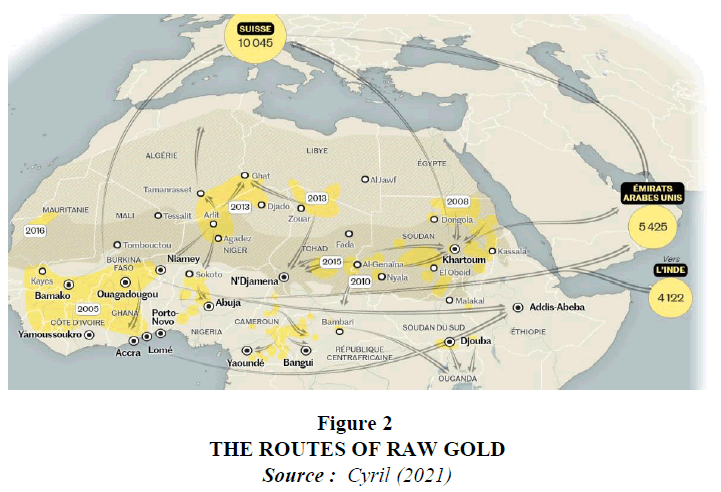

It is challenging to specify the exact contribution of gold mining to the GDP of the concerned countries, as it depends on several factors, such as the size of the mining industry, gold production, and fluctuations in gold prices. However, it is an undeniable driver of growth, with a significant contribution to the GDP. Ghana, Mali, Burkina, and Côte d'Ivoire have a considerable portion of their growth linked to mining, particularly gold mining. In other countries, its share may be smaller, but it still has a significant impact on the local economy in terms of job creation and infrastructure development. Therefore, it is crucial to consider the situation of each African country individually to understand its impact on the GDP (Ristel, 2020). Predominantly mined by international companies, this gold is primarily exported in its raw form to major capitals (Figure 2).

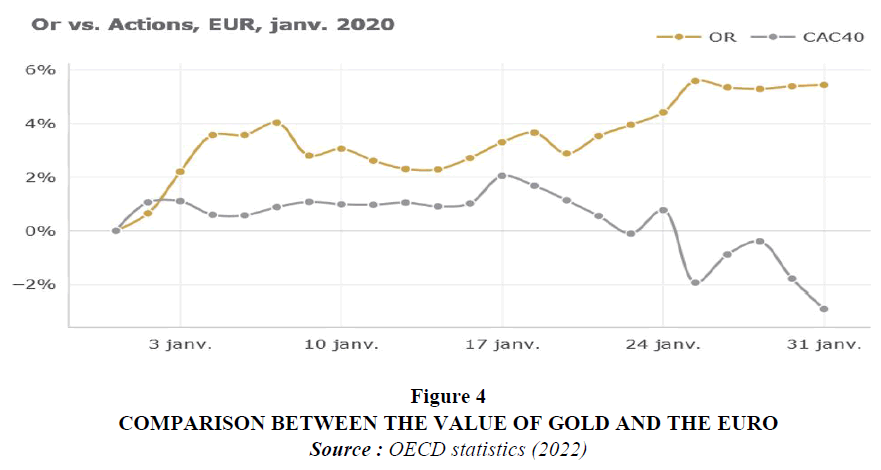

Financially, gold is considered a safe haven due to its financial stability and independence from the global economy. Gold deposits provide numerous economic benefits to the countries that possess them, helping to stabilize their financial policy and attract foreign investments. Firstly, it can be used as a store of value for African economies in the form of stocks in their foreign exchange reserves to support their currency. It's a reliable asset that helps governments cope with exchange rate volatility during economic crises. Gold deposits contribute to the financial stability of African countries by generating foreign currency revenues ; they increase their foreign exchange reserves, and assist in financing crucial structural development projects. They significantly contribute to economic growth and allow for investment in key sectors such as infrastructure, education, and health.

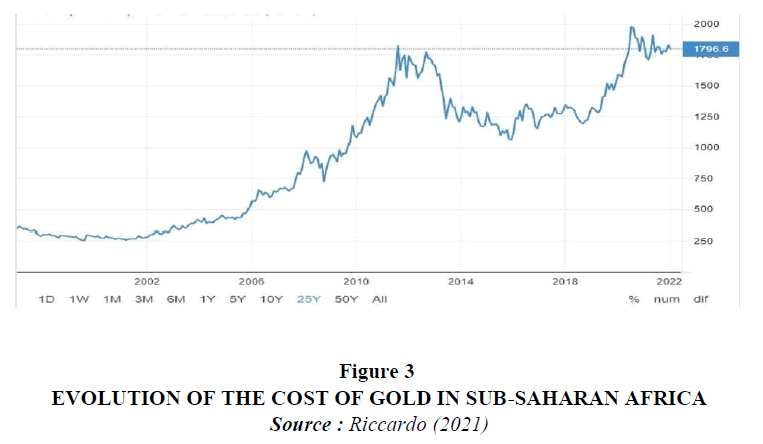

Gold mining attracts foreign investments in Africa due to the growing global demand for this precious metal (Figure 3), boosting investments and stimulating economic growth by creating jobs and improving macroeconomic aggregates. It is also a source of financing that allows governments to sell gold-backed bonds to raise funds for development projects, thus helping to reduce reliance on international donors and improve the financial stability of African countries.

Therefore, gold deposits offer numerous financial advantages to African countries that possess them. They stabilize economies, attract foreign investments, stimulate economic growth, and serve as a source of financing for governments. However, it is crucial to ensure that they are exploited in a fair and sustainable manner to guarantee the well-being of communities. For producing countries, gold provides financial stability by allowing governments to maintain a store of value during politico-economic crises and helps stabilize financial micro-markets. Gold production boosts economic growth by generating revenues and creating jobs for local workers. It enables the development of infrastructure and encourages investments in the energy, communications, and transportation sectors. It offers economic diversification by allowing a non-dependence on a single sector or product. This diversification reduces risks and provides growth opportunities for local businesses.

Gold is also a source of additional revenue through the collection of royalties on gold exports and, more broadly, on all mining activities. These revenues can thus contribute to the financing of development initiatives and social programs. With corporate social responsibility (CSR), exploitation develops local communities through the employment of local labor, the improvement of basic public services, the construction of schools, and health centers.

Source of socio-economic conflict

Gold is a precious metal that has always been coveted for its beauty and rarity. For centuries, it has been used as a medium of exchange, a store of value, and as a precious metal for jewelry. However, its exploitation often leads to socio-economic conflicts in African countries. Since the 1990s, large-scale gold mining has seen a significant increase in Africa. This situation has caused numerous social and economic problems for local populations. Its impact on natural resources, such as water and land, is severe and leads to conflicts between local communities and mining companies. The massive migration of workers to mining sites is also a source of social conflicts.

The exploitation also causes serious environmental damage, such as deforestation, air and water pollution, and soil degradation. Local populations suffer from the loss of their habitats and their means of subsistence, leading to social and economic conflicts (Riccardo, 2021). Moreover, the economic benefits of exploitation are often not equitably distributed among the different parties involved. Governments, mining companies, and local populations often have divergent interests, leading to socio-economic conflicts. For example, governments receive taxes and royalties, while local populations do not receive adequate compensation for the negative impacts of mining activities on their immediate environment. Finally, conflicts related to exploitation are exacerbated by a lack of transparency and accountability. Mining companies are often not required to report on their activities, and governments lack the means to effectively monitor these activities and ensure compliance with environmental and human rights laws and regulations.

Gold deposits, though considered a potential source of wealth for African countries, often cause serious political problems. Their exploitation leads to numerous social, economic, and political conflicts that compromise the long-term economic development and stability of countries. Governments often face pressures to grant mining concessions to foreign companies without sufficient consideration of all the consequences. They are often forced to make decisions that are not in the people's interest for political reasons or to maximize mining revenue. This leads to conflicts with parties whose interests are not considered. Moreover, conflicts are exacerbated by a lack of transparency, accountability, and corruption. They are exploited by armed groups to strengthen their power and political influence. These groups seek to control mining sites and demand bribes and taxes on activities, leading to political instability and increased vulnerability to armed conflicts.

Financially, gold deposits, despite being potential sources of wealth for African countries, can be sources of serious financial problems. Indeed, they pose numerous financial challenges that can compromise the countries' growth prospects. Firstly, the costs associated with gold mining are very high and complex. Mining companies spend large sums of money to acquire the necessary permits, build mining infrastructure, explore, develop mines, and extract gold. These expenses also include investments in environmental protection and human resources, which can impact the profitability of the activity.

Furthermore, governments, under pressure from external powers, grant mining concessions to foreign companies without demanding adequate financial compensation to cover the interests of local populations and ecological damages. Generally, they are not able to effectively regulate exploration and exploitation activities to ensure compliance with environmental and human rights laws, avoiding significant financial losses. They also face challenges in securing funds to finance non-mining economic activities while being overly dependent on the gold industry. This dependence deters investors from participating in the development of other economic sectors. The loss of economic diversity leads to increased vulnerability to fluctuations in gold prices and other capital market factors. Finally, there is the complexity of managing revenues from gold exploitation effectively and transparently. Governments, in addition to pressures to spend revenues inappropriately or divert them for political-personal purposes, lack the administrative capacity necessary to use them strategically for sustained and sustainable growth.

For many years, gold deposits in African countries have been linked to the development of terrorism. Although this relationship is not direct, several factors explain it. The Sahel-Saharan strip is currently experiencing intense extractive dynamics related to the discovery of gold in these particularly unstable desert margins. In the Central Sahel, particularly in Mali, Burkina Faso, and Niger, the gold boom represents a new source of financing, and even a recruitment ground for various armed groups, including jihadists. To counter this, the Sahelian states should re-establish their presence around gold mines and better formalize artisanal gold mining (Ouédraogo, 2022).

Mining activities often attract armed groups and bandits, who disrupt the country's stability by engaging in acts of violence and extortion. Gold mines are used to finance the criminal activities of these armed groups, leading to a deterioration of national security and tensions between local populations and extractive companies. Thus, mining contributes to the development of terrorism by providing funding and resources to armed groups. Mining companies are forced to pay taxes or ransoms, indirectly encouraging the continuation of criminal and terrorist activities in the face of states incapable of controlling mining activities and ensuring that companies comply with security and peace laws and regulations.

Gold is also a symbolic resource. The "sacred thirst for gold" feeds many fantasies, as it is assimilated to wealth par excellence (Goujon, 2022). Populations feel a sense of marginalization and exclusion that can lead them to turn to armed groups to defend their rights and interests. They are also confronted with a deterioration of their quality of life. Mining causes economic disruptions that fuel the development of terrorism. Populations face job losses and reduced resources, which encourage them to turn to armed groups for survival means. According to (Mégret 2008), several violent episodes have marked the relationship between the inhabitants of villages located in areas of artisanal mining and industrial exploitation zones.

Often, governments face pressures that push them to use the revenues from mining inappropriately, resulting in reduced quality of life and additional tensions. Also, for many years, gold deposits in African countries have been associated with geopolitical difficulties, negatively impacting economic development goals; gold exploitation leads to political disruptions due to pressures to strengthen regulations on exploitation, ensure the protection of local population rights, and maximize their production-related gains. Governments are then forced to deal with protests and social conflicts due to the awareness of the natives. Rivalries between countries for control of gold deposits also lead to geopolitical conflicts. Some states are tempted to use illegal means to appropriate wealth, risking diplomatic tensions, armed conflicts, and possibly a loss of sovereignty.

Additionally, we also face economic disruptions due to the increase in market demand for precious metals. The fluctuations in gold prices vary significantly based on market behavior (Figure 4), which sometimes negatively impacts local economies. Governments' initiatives to strengthen the regulation of gold trade generally lead to a drying up of liquidity and available resources for developing other sectors of the economy.

Finally, it should be noted that the pollution of water, air, and soil caused by exploration and exploitation activities adversely affects the health of the resident or surrounding populations. However, the tightening of mining policy leads to the flight of partners and a reduction in investments in the gold sector.

Conclusion

Africa is rich in natural resources, notably gold, and the production of this precious metal is constantly increasing. However, the governance of this wealth is often a subject of controversy and a vector for conflict related to the poor distribution of economic benefits. On one hand, gold mining offers development opportunities for African countries, such as job creation and increased revenues; on the other hand, it leads to social and environmental problems such as corruption, human rights violations, and pollution. Governance in this sector remains a significant challenge for African states, mining companies, and local communities. Its exploitation offers real growth opportunities if managed in a fair and responsible manner. To achieve this goal, work is needed on mining policies, institutional capacity, transparency, and support for local communities to ensure their interests are safeguarded.

Nevertheless, it is important to consider the costs and risks associated with mining activities. The social and environmental impacts are significant and must be managed effectively and objectively. African countries need to implement effective regulations and policies to promote transparency and good governance in mining agreements. Mining companies must be compelled to respect environmental and social standards to minimize the multifaceted negative impacts of their activities. It is also important to promote social and economic inclusion for surrounding communities. African countries must invest in infrastructure to support local economic development, promote citizen participation, and ensure the interests of indigenous communities are considered in decision-making.

African countries should promote the development of the local mining industry's value chain to reduce dependence on foreign companies. Managing impacts on the environment and indigenous populations is important for improving mining practices. They should also promote economic diversification and reduce reliance on gold resources. It is also important to promote effective and simplified regulation to combat corruption in the mining sectors.

Finally, African countries should encourage investment in clean technologies to reduce ecological impacts. It is crucial that they establish mechanisms to manage risks associated with the volatility of gold prices on global markets. In summary, gold deposits offer significant economic benefits for African countries, but it is important to manage the costs and risks that arise, ensure the well-being of local populations, and protect the environment.

References

Assane Ouédraogo, (2022). Power Struggles Surrounding Artisanal Gold Mining in the Sahel. Economic Warfare School, September.

Claire Maingy, (2013). Foreign Investments and Development: The Case of the Gold Sector in Mali. In mondes en Développement Vol.41-2013/2-n°162.

Cyril Bensimon, (2021). In West Africa, a High-Risk Gold Rush. The world journal, April 14, 2021.

Emmanuel Goujon, (2022). West Africa: The New Paradigm of Space and Time for Gold Diggers. Veille, October 20, 2022.

Flavie Holzinger, (2021). In West Africa, a High-Risk Gold Rush. The world journal, April 14, 2021.

Gagnol Laurent, Rhoumour Ahmet, Afane Tchilouta, and Abdoulkader Afane, (2022). Territorial and Ethical Challenges in the Regulation of the Gold Rush in Northern Niger. International Review of Development Studies.

Michèle Leclerc-Olive, (2022). The Water of Gold : In the Era of Environmental Ethics. International Review of Development Studies.

Quentin Mégret, (2008). Gold 'Dead or Alive'. Gold Panning in Burkina Faso's Lobi Country, in Cros M. and Bonhomme J. (eds.), 2008, Cheating Death in Africa, Orphans, Ghosts, Trophies, and Fetishes. L'Harmattan. Paris.

Report, (2022). OECD International Trade Statistics: Trends in the First Quarter of 2022.

Riccardo Pravettoni (2021), "In West Africa, a High-Risk Gold Rush," The world journal, April 14, 2021.

Ristel Tchounand, (2020). Mali : An Economic Precipice in Sight for Africa's Third-Largest Gold Producer. The Africa Tribune journal, August 20, 2020 (ISSN 1760-4869).

Received: 01-Dec-2023, Manuscript No. IJE-24- 14311; Editor assigned: 03-Dec-2023, Pre QC No. IJE-24- 14311(PQ); Reviewed: 17-Dec-2023, QC No. IJE-24- 14311; Revised: 21-Dec-2023, Manuscript No. IJE-24- 14311(R); Published: 29-Dec-2023