Research Article: 2019 Vol: 23 Issue: 1

Hedonic Motivation and Social Influence on Behavioral Intention of E-Money: The Role of Payment Habit as a Mediator

Husnil Khatimah, Universitas Pertamina

Perengki Susanto, Universitas Negeri Padang

Nor Liza Abdullah, Universiti Kebangsaan Malaysia

Abstract

E-money service as a new alternative for micro digital payment in Indonesia is growing in recent years. In fact, e-money service usage is limited only certain users, and also it is not as a priority for the micro-payment transaction. Therefore, this study examines the relationship between hedonic motivations, social influence on the behavioral intention of using e-money by payment habit as a mediator. This study is a survey study of 249 e-money users in Indonesia. The data were analyzed using Partial Least Square Structural Equation Model (PLS-SEM). The empirical findings revealed that hedonic motivation and social influence have a significant impact on payment habit. Interestingly, we also found that hedonic motivation and social influence have a significant effect on behavioral intention through payment habit as a mediator. This research is a cross-sectional study. Hence, it will have a limitation in generalizability. Besides, this study only focused on Indonesia context. For future research, it can be expanded to a longitudinal study and extended to some Southeast Asia countries. This study has contributed to the mediating effect of payment habit on the link between hedonic motivation, social influence and behavioral intention of e-money usage using UTAUT2. To the best of the authors’ knowledge, this link has been neglected in the previous studies.

Keywords

Behavioral Intention, UTAUT2, Hedonic Motivation, Social Influence, Payment Habit.

Introduction

In general, the instrument for micro digital payment transaction has been changed from cash to electronic money (e-money) by using chip or server as the medium. The user does not need to bring cash, where they can use e-money in their transactions as provided by the issuers such banks, mobile operators, enterprises information technology, and others. E-money is as a good alternative for micro digital payment transaction, which provides some benefits such as it is more safety and comfortable than cash. However, it is a new method for micro payment transaction in Indonesia users (Bank Indonesia, 2016). The government of Indonesia releases the specific regulations of e-money to ensure the safety payment in various transactions. It refers to the regulations of Bank Indonesia 16/8/PBI/2014 article 1 (3) stated that e-money is a payment tool with criteria: (i) issued based on money value deposited by the issuers, (ii) value of the money is saved electronically in chip or server, (iii) a payment tool for merchants (non-issuers), (iv) e-money value is controlled by issuers.

Based on Table 1, the average volume and value transaction of e-money have increased about 72% per year. The highest volume of transaction is in 2012 with the total value of 1.9 trillion. In 2013, volume transaction was increased to 2.9 trillion. It showed that e-money is a prospective tool for the society especially for the urban area. However, the total transaction of emoney is still low compared to the total value of transaction with the amount of 350 trillion per year. It shows a problem in adopting e-money even though various program and workshop have been done to socialize it. Accordingly, Chaira et al. (2014) have explained that most of Indonesian people do not know about e-money, and only limited merchants have provided it.

| Table 1 The Growing Of Volume And Value Transaction Of E-Money In Indonesia |

||||||||

| Year | 2010 | 2011 | 2012 | 2013 | 2014 | 2016 | 2016 | 2017 |

| Volume (million) | 26.542 | 41.060 | 100.623 | 137.900 | 203.369 | 535.579 | 683.133 | 753.861 |

| Value (million) | 693 | 981 | 1.972 | 2.907 | 3.320 | 5.283 | 7.064 | 9.672 |

Source: Bank Indonesia, 2017

Furthermore, the Unified Theory of Acceptance and Use of Technology (UTAUT) is considered to be underpinning theory because empirically no more is discussed in a previous study such as online bulletin boards (Marchewka et al., 2007), Web-based learning (Chiun & Wang, 2008), instant massagers (Lin & Anol, 2008), mobile banking (Nontsikelelo & Bulelwa, 2018; Tan et al., 2010), MP3 Player (Im et al., 2011), and internet banking (Lee et al., 2009; Martins et al., 2014). Otherwise, when a look at the societies’ behavior, it is a behavior of buying and using goods that is not based on consideration of rational and tends to consume something without boundaries where individuals are more concerned with the factor of the desire of the needs and characterized by the presence of a life of luxury and excess, the use of all things the most luxurious which gives satisfaction and physical comfort. Therefore, according to Engel et al. (1995) and Mowen (1995) lifestyle is a lifestyle that involves how people use time and money. Lifestyle can also be defined as a frame of reference or the reference frame used by someone in the act, in which the individual is trying to make all aspects of life related in a certain pattern, a set the strategy fantasize that he wants to be perceived by others. Lifestyle consists of activities, interests and opinions. The activities are concrete actions, such as watching a medium, shopping at the store, or tell others about new things (consumer behavior). Interest will be a kind of object, event, or topic is the level of excitement that accompanies a special and continuous attention to him. Opinions the answers either oral or written that people give as a response to the stimulus situation where a sort of question asked.

Life style affects the behavior of someone towards e-money who ultimately determines one's consumption choices. Lifestyle joined develop in accordance with the progress of time and supported by facilities exist (Wagner, 2009). In the broad sense of consumer behavior to consume wasteful and excessive, putting more desire than necessity, and there is no priority or can also be interpreted as a lifestyle extravagance. Lifestyle gradually penetrated all aspects of life can be a culture of its own. Someone consumptive lifestyle consumer culture extends into a group of people. This can be caused by several factors, one of which is a very reasonable conformity phenomenon occurred among teenagers and young adults. For a long term, it changes to be a habit as their performance behavior affected in learning. In directly, they have taken hedonics motivation. The consumers have been pleasured without any pain or feeling disappointed through e-money products and its transaction.

Theoretical Background

The technology of information is an important factor to improve performance of the (Jogiyanto, 2008). Venkatesh et al. (2003) explained eight models of technology acceptance; theory of reasoned action, technology acceptance model, motivational model, theory of planned behavior, a model combining the technology acceptance model and the theory of planned behavior, a model of PC utilization, innovation diffusion theory, and social cognitive theory. This model is generated for a new integration. It is known as a unified theory of acceptance and use of technology or called as UTAUT. The UTAUT is a prior research of technology acceptance. Performance expectancy, effort expectancy, social influence, and facilitating conditions are four key constructs explained.

Ventakesh et al. (2012) explain some weaknesses of previous studies. First, technology tends to be simple and individual orientation. Second, the respondents are students. Third, the survey is at the beginning of the technology is introduced. Fourth, the character of measurement is similar in some stages. Finally, the context of the research should be used freelance and mandatory to get general result. However, the extensions of UTAUT, was developed in UTAUT2. It was described completely in UTAUT2. It has four constructs to influence directly acceptance user; performance expectancy, effort expectancy, social influence, facilitating conditions. Then, four variables moderate them are gender, age, experience, voluntariness of use. However, refers to the issues of e-money in Indonesia generally, this study offers the hedonic motivation and habit adapted by UTAUT2 to be investigated the behavioral intention towards emoney user.

Proposed Model and Hypotheses

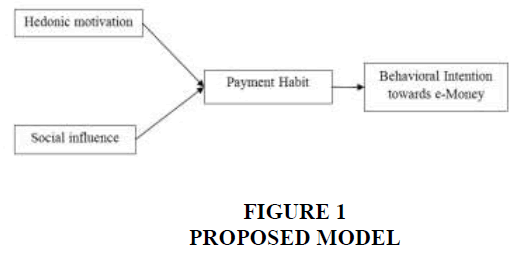

The framework is proposed in Figure 1 as below.

Hedonic Motivations

Motivation as the interaction for content in the research describes the pleasure of entertainment or hedonic of the users to what having. To get fun or entertained might be the indicator of it. Therefore, hedonic motivation has a direct influence on behavioral intentions as a study conducted in Venkatesh et al. (2012). Furthermore, motivation brings the hedonistic for having pleasure to use the technology be the important factor to determine the user’s acceptance and use the technology (Brown & Venkatesh, 2005). Many previous studies conducted hedonic motivation effect technology acceptance directly and be an important factor (van der Heijden, 2004; Brown & Venkatesh, 2005; Thong et al., 2006; Childers et al., 2001). There is few studies discuss hedonic as factors affected through users’ acceptance (Pillai & Mukherjee, 2011).

Therefore, hedonic motivation is important to be a predictor for users’ intention towards technology acceptance (Yang, 2010). Consumers’ pleasure in shopping activity had been discussed, and it brings emotional, multisensory and fantasy as crucial factors of the hedonic values and utilitarian for consumers (Jones et al., 2006; van der Heijden, 2004; Childers et al., 2002). It indicates that hedonic motivations have an important affect to the behavioral intention. Therefore, the hypothesis is presented as below:

H1: Hedonic motivation positively affects payment habit towards the behavioral intention of e-money user.

Social Influence

Social influence reflects to environments of social in the term of users’ opinion and views. In the technology acceptance, the users often are influenced by other users’decision. They have a positive habit to controls through the technology adopted. Many previous have discussed it (Smetana et al., 2006). It is supported in another previous study found both habits and social influence becomes the important variables in information system context (Woisetschläger et al., 2011). Habit can be high frequency in the behavior as automatically response to the context (Limayem et al., 2007). Therefore, a social group or individuals who have shared experiences, it can become habitually enacted (Quan-Haase & Young, 2010). Therefore, the hypothesis is proposed as below.

H2: Social Influence positively affects payment habit towards the behavioral intention of e-money user.

Payment Habit

The habit has significant influence behavioral intentions and the use of technology (Venkatesh et al., 2012; Pahnila et al., 2011). Habits are defined as the extent to which people tend to perform an automatic behavior for learning (Limayem et al., 2007), while Kim et al. (2005) equated with the habit of automaticity. Besides, the habit is a behavior before individual believes and behavior it becomes an automatic behavior (Kim & Malhotra, 2005). In the emoney contexts, it becomes payment habits because it is probably the most important driver for innovation adoption payments. Consumers for payments’ habits tend to be more secure, convenient and efficient in a payment transaction. Therefore, when the consumers have satisfied through the instruments, it makes them tend it automatically. Payment habits can change the background of the accessible payment because it is a significant obstacle to innovation distribution and advance payments. Therefore, the hypothesis is presented as below:

H3: Habit positively affects the behavioral intention towards e-money user.

Methodology

Measures

This study uses questioners as instruments. Types of questioners used in this study are open-ended and close-ended questioners. The behavior for adopter and non-adopter of e-money can be seen by involve open-ended as the instruments for this study. It is applied the theory of the Unified Theory of Acceptance and Use of Technology (UTAUT). The population is the total of elements or members population will be investigated (Cooper & Schindler, 2006). This study is used to analyze for individual level. Therefore, the member of population is e-money user in Padang or called as a sample.

The sample of this study used non-probability study. It offers purposive sampling. Otherwise, the sample’s criteria divided into 2 types are adopter and non-adopter of e-money. Sample size is about 249 samples consider a minimal sample statistically to get power 0.8 and alfa 0.05. Therefore, minimal sample is 5 times to 20 items observation (Hair et al., 2006). The data collection brings primary sources to get the data (Cooper & Schindler, 2006). The data sources are the e-money adopter in Padang.

Results

Profile of Respondents

The profile of respondents is based on demographic factors (e.g., age, jobs, and gender). Based on age, it is dominated by young people. It is started from 17 years old to 24 years old or about 88.13%. Based on job, it is dominated by university students is about 66.77%. These indicate that e-money user is limited to certain group such university students generally. Based on gender, is it dominated by female, it indicates that data is collected in a shopping center most visited by women such fashion center and cosmetics, and mini shop in campus provided emoney services. The profile of respondents is presented as below in Table 2.

| Table 2 Profile Of Respondent |

|||||

| Age | Job | Gender | |||

| Classification | % | Classification | % | Classification | % |

| 17-19 | 63.20 | Students | 66.77 | Female | 76.26 |

| 20-24 | 24.93 | Workers | 23.15 | Male | 23.74 |

| 25-29 | 6.23 | Traders | 5.64 | Total | 100 |

| 30-34 | 2.08 | Entrepreneurs | 3.68 | ||

| 35-39 | 1.19 | None | 0.59 | ||

| 40-44 | 0.59 | Total | 100 | ||

| 45-49 | 0.89 | ||||

| 50-54 | 0.89 | ||||

| Total | 100 | ||||

Measurement Model

The Structural Equation Modeling (SEM) that analyze data in this study is divided into 2 types are covariance-based techniques and variance-based techniques. Partial least square is the technique based on variance and uses to investigate with terms: (i) not all items in this study is distributed normally; (ii) this model is not tested yet in literature; (iii) this is a complex model (Martins et al., 2014). Smart PLS 2.0 M3 is software that used to analyze the relationship developed in a theoretical model (Ringle et al., 2005). Therefore, this study tested convergent validity and discriminant validity, close with tested structural model. First, structural model is tested to analyze indicator reliability, factor loadings with terms it is more than 0.7 (Chin, 1998; Hair & Anderson, 2010; Henseler et al., 2009). Second, to test construct’s reliability used 2 indicators are Composite Reliability (CR) and Cronbach’s Alpha (CA). CR and CA should be more than 0.7 to see internal consistency. Third, to evaluate the convergent validity is used Average Variance Extracted (AVE) should be more than 0.5 (Hair & Anderson, 2010). Finally, the discriminant validity should be more than AVE compare to the value of correlation between constructs (Hair & Anderson, 2010; Henseler et al., 2009). All the results can be shown in the Table 3.

| Table 3 Validity And Reliability Of Construct |

||||

| Variables | Items | Cronbach Alpha | AVE | Composite Reliability |

| Hedonic Motivation | HM1 | 0.86 | 0.78 | 0.91 |

| HM2 | ||||

| HM3 | ||||

| Behavioral Intention | IB1 | 0.84 | 0.62 | 0.89 |

| IB2 | ||||

| IB3 | ||||

| IB4 | ||||

| Payment Habit | IB5 | 0.93 | 0.81 | 0.95 |

| HT2 | ||||

| HT3 | ||||

| HT4 | ||||

| Social Influence | SI1 | 0.89 | 0.82 | 0.94 |

| SI2 | ||||

| SI3 | ||||

| SI4 | ||||

Table 3 showed that the values of factor loadings are more than 0.7. It means that all items in questionnaires are reliable. Otherwise, the value of AVE is more than 0.05. It means accepted the parameter (Fornell & Larcker, 1981). The values of square roots of AVE are more than the correlation between a latent variable.

Hypotheses Testing

To test the significant hypothesis used value T-statistic, it must be more than 1.96 (two tailed) and more than 1.64 (one tailed) with alpha 5% and power 80% (Hair et al., 2006). The result of the structural model with bootstrapping is gotten result of coefficient or inner model as showed in the following Table 4.

| Table 4 Path Coefficient Of Structural Model Test |

||||

| Variables | Beta | T Value | P Value | Decision |

| hedonic -> habit | 0.2565 | 5.3674 | 0.00 | support |

| social -> habit | 0.5182 | 11.5381 | 0.00 | support |

| habit -> intention | -0.5473 | 14.3445 | 0.00 | support |

Hypothesis 1 showed the variables hedonic motivation is significant affects habit towards the behavioral intention of e-money user with coefficient beta is 0.2565 and t-value is 5.3674. Hypothesis 1 is supported. Hypothesis 2 showed the variable of social influence is significantly effect on the behavioral intention to use e-money with coefficient beta is 0.5182and t-value is 11.5381. Hypothesis 2 is supported. Finally, Hypothesis 3 showed the variable of habit is significant the behavioral intention e-money with coefficient beta is -0.5473and t-value is 14.3445. Hypothesis 3 is supported.

Discussion

The variable of hedonic motivation is significant affects payment habit towards the behavioral intention of e-money user. The variable of social influence is significant affects payment habit towards the behavioral intention of e-money user. Finally, habit is significant affects to the behavioral intention towards e-money user. However, based on three variables above, the strongest variable affect to the behavioral intention towards e-money user is a habit with coefficient beta is -0.5473and t-value is 14.3445. It shows that the people have the intention towards e-money as payment transactions in daily need. It is categorized with these indicators such using e-money is compulsory, happiness or usually transaction.

Furthermore, social influence and hedonic motivations have significant affects to the behavioral intention towards e-money user. It shown that globally, the adoption e-money goes slowly despite expectation (Feng et al., 2014). As like in Canada, e-money is provided largely. It becomes competitors to the credit/debit card. In improved by Chaira et al. (2014) stated most people in Indonesia expect that no more merchant accepts e-money as payment tools. Same goes in Australia, the merchants are fewer experiences of e-money do not believe and need more information about product and feature of e-money before adopted as payment instruments (Roberts & Gregor, 2005).

In addition, the hedonic motivation brings the level of adoption and effect of new technology depends on motivation and successful users who get beneficial directly (especially key stakeholder) (Douthwaite, 2001; Roberta, 2018). However, hedonic motivation has important to accept and uses technology directly (Vander Heijden, 2004; Thong et al., 2006; Sabai & Tau Hoong, 2018). Furthermore, habit also influence to the behavioral intention towards e-money. Habit and social influence are similar to the automatic (Kim et al., 2005). In e-money context, someone who has habit to use e-money will pay automatically with e-money, not use cash anymore.

Therefore, an e-money transaction is a new tool for micro-payment transaction. However, the ability to fulfill the micro-transaction for daily need cannot be automatically transform the behavior of society who have used cash for daily need and daily living cost. The study found the relationship that was proposed in the framework had never discussed in a previous study especially in e-money area. This is in line with a previous study with underpinning theory of UTAUT-1 suggested for more variable to be investigated affects the behavioral intention of emoney user (Khatimah & Halim, 2014).

Limitations And Future Study

This study has some limitations, such as it is a cross-sectional study. Hence, it will have a lack of generalization power. Furthermore, it is only focused on one country research; accordingly, it might not be generalized for other areas. Therefore, for the future study, the authors suggest expanding it to a longitudinal study with several years of data collection and it can be conducted to several countries in the Southeast Asia to get more generalize results.

References

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behaviour and Human Decision Processes, 50(2), 179-211.

- Bank Indonesia (2013). Maintaining stability for sustainable economic growth. 2013 Annual Report.

- Bank Indonesia (2014). E-money: Mapping and implementation challenges in Padang. Report PCPM-XXXI, KPW VIII.

- Bank Indonesia (2016). E-money issuer list.

- Ben, F., Miguel, M., & Gerald, S. (2014). Electronic money and payments: Recent developments and issues. Bank of Canada Discussion Paper.

- Chaira, A., Nugroho, B.A., Dipo, D.R., Rahmat, D.A., Amanto, K., Yoga, M.P., Windrawan, R.F., & Farizqi, W.T. (2014). E-money: PemetaandanTantanganPenerapan di Kota Padang. LaporanPenelitian Bank Indonesia Wilayah VII Padang.

- Chiu, C.M., & Wang, E.T.G. (2008). Understanding web-based learning continuance intention: The role of subjective task value. Information & Management, 45(3), 194-201.

- Davis, F.D. (1989). Perceived usefulness, perceived ease of use and user acceptance of information technology. MIS Quarterly, 13(3), 319-339.

- Douthwaite, B., Keatinge, J.D.H., & Park, J.R. (2001). Why promising technologies fail: The neglected role of user innovation during adoption. Research Policy, 30, 819-836.

- Faul, F., Erdfelder, E., Buchner, A., & Lang, A.G. (2009). Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. Behavior Research Methods, 41, 1149-1160.

- Faul, F., Erdfelder, E., Lang, A.G., & Buchner, A. (2007). G*Power 3: A flexible statistical power analysis program for the social, behavioral and biomedical sciences. Behavior Research Methods, 39, 175-191.

- Hair, J.F., & Anderson, R.E. (2006). Multivariate data analysis. Prentice Hall.

- Im, I., Hong, S., & Kang, M.S. (2011). An international comparison of technology adoption: Testing the UTAUT model. Information & Management, 48(1), 1-8.

- Jogiyanto, H. (2008) Behavioral information system, (Revised Edition). Yogyakarta: Rajawali

- Khatimah, H., & Halim, F. (2014). Consumers’ intention to Use e-money in Indonesia based on unified theory of acceptance and use of technology (UTAUT). American-Eurasian Journal of Sustainable Agriculture, 8(12), 34-40.

- Lin, C.P., & Anol, B. (2008). Learning online social support: An investigation of network information technology based on UTAUT. Cyber Psychology and Behavior, 1(3), 268-272.

- Marchewka, J.T., Liu, C., & Kostiwa, K. (2007). An application of the UTAUT model for understanding student perceptions using course management software. Communications of the IIMA, 7(2), 93-104.

- Pahnila, S., Siponen, M., & Zheng. X. (2011). Integrating habit into UTAUT: The Chinese eBay case. Pacific Asia Journal of the Association for Information System, 3(2),1-30.

- Podsakoff, P.M., MacKenzie, S.B., Lee, J.Y., & Podsakoff, N.P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5).

- Riffai, M.M.M.A., Grant, K., & Edgar, D. (2012). Big TAM in Oman: Exploring the promise of on-line banking, its adoption by customers and the challenges of banking in Oman. International Journal of Information Management, 32, 239-250.

- Roberts, H., & Gregor, S. (2005). Why Australian merchants aren’t adopting e-money. Journal of Research and Practice in Information Technology, 37(1), 11-25.

- Tan, K.S., Chong, S.C., Loh, P.L., & Lin, B. (2010). An evaluation of e-banking and m-banking adoption factors and preference in Malaysia: A case study. International Journal of Mobile Communications, 8(5), 507-527.

- Tan, M., & Teo, T.S.H. (2000). Factors influencing the adoption of internet banking. Journal of the Association for Information Systems, 1(5).

- Venkatesh, V., Davis, G.B., Davis, F.D., & Morris, M.G. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27(3), 425-478.

- Venkatesh, V., Thong J.Y.L., & Xu. X. (2012). Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157-178.