Case Reports: 2021 Vol: 27 Issue: 4

Hewlett Packard Photo Creations: What to Do With Its Free Photo Creations Product?

Feraidoon Raafat, San Diego State University

Donald Sciglimpaglia, California State University San Marcos

Abstract

This case, set in 2018, presents a decision for HP Inc. involving a potential application of freemium marketing strategy for its Hewlett-Packard Photo Creations (HPPC) software product. The HPPC software had been offered by HP for free to stimulate printer and printer supplies usage. Although HPPC appeared to be making positive contributions to HP’s Print division by spurring the use of home printing, management wondered if it should consider responding to changes in the market environment, particularly in terms of how consumers create projects based on pictures and photographs and how they share them with others. HP is now considering what aspects of HPPC to change and if the Print unit should employ a freemium model. Management must address whether to continue offering the product for free and, if not, what product offering and pricing strategy to use.

Keywords

Marketing, Pricing, Survey Research, Business Strategy, Freemium Business Model

Introduction

The Hewlett-Packard Company markets a product line of printers, ink, and media, primarily the very successful InkJet ink and LaserJet laser printers. In 2010, to spur overall printer and printer supply usage, it acquired a software product to help stimulate the usage of its printers and to increase demand for its printer consumables, specifically printer ink. The software was branded Hewlett-Packard Photo Creations (HPPC), a free downloadable product that allowed users to print their photo-based creations free of charge. HP Photo Creations was initially a computer application for creating photo books, calendars, greeting cards and other keepsakes. HPPC is a highly automated program for simple photo production or customization using an array of photo editing tools. Once something is created, users then have the option of printing the work themselves or paying to have it printed and shipped. The recipients can print the work and are able to edit it with all the same options as the original producer of the work. Most products take two to four business days to produce, plus shipping time, except photo books, which take four to seven days to produce. International orders and orders placed during peak holiday seasons may take longer. HPPC is compatible with Facebook, Twitter and through email.

By 2018, over 30 million people had activated the software, and in any given month, there were just over one million users. Since the company’s profit margin for printer ink is very high, the significant value for the company is to encourage accelerating the printing of its users’ projects, as its business model was based on non-direct monetization. In other words, the product is offered for free, with no upgrades available, but it was intended to indirectly increase revenues for its other products. Given the success of other companies with freemium marketing business models (see Sciglimpaglia and Raafat, 2020), HP was now considering whether this would be a viable option for HPPC, and if so, how should the freemium offer be developed?

This was an intriguing option as freemium models have found success in various business ventures (Gunzel-Jensen and Holm, 2015) and recently there has been considerable research into freemium business models, strategy, and marketing. For example, Kumar (2014) pioneered a demand side view of freemium business practice evaluation. Lee, Kumar, and Gupta (2017) conducted an empirical study to address how consumers decide whether and when to upgrade, whether premium customers demonstrated usage behavior different from free customers, how consumers trade-off upgrading to a premium plan compared to using other strategies and, most importantly, what is the value of a “free” customer? In another demand side study, Rietveld (2017) examined the consumer behavior of premium versus freemium computer games. Harmari et al., (2020) assessed consumers' perceived value associated with their intention to use freemium services and to upgrade to premium by conducting an online survey of players of freemium/free-to-play games. Ya et al. (2018) studied factors that directly and indirectly affect users’ willingness to subscribe to a paid plan for individual cloud services. This is relevant because the freemium business model of many such vendors consists of a free-use phase that precedes users’ paid subscription. Ross (2018) studied freemium user retention of video games. Wu et al (2018) explored software upgrade strategy in the presence of piracy. Bond et al. (2019) examined drivers of consumer word of mouth in freemium settings compared with traditional, paid-product settings. Research has established that social engagement (Oestreicher-Singer & Zalmanson, 2013) and peer influence (Bapna & Umyarov, 2015) are two important drivers of users converting to premium subscribers. Similarly, Van riel et al. (2011) found that it is both difficult and expensive for a web-based company to acquire customers and suggest that customer experience and positive word-of-mouth may be at the heart of easing the acquisition process.

Sciglimpaglia and Raafat (2020) provide numerous examples of successful freemium marketing strategies and business models. As an example, they point to Dropbox, the on-line file storage company that has built a global sharing network with more than 4.5 billion connections to shared content. It had revenues of $1.66 billion and more than 14 million subscribing paid users, even though it still had net losses ($52.7 million). Dropbox has exploited Web 2.0 scalability advantages of freemium marketing strategy to quickly grow to over 100 million users. The overwhelming majority of these customers use it to share and collaborate, and many of its users initially accessed its platform free of charge. The company strives to demonstrate the value of its platform to these registered users, encouraging them to convert to paying users through inproduct prompts and notifications and by time-limited trials of paid subscription plans. It offers subscription plans to serve the varying needs of its diverse customer base, which includes individuals, teams, and organizations of all sizes and offers monthly subscription pricing in levels for individuals and businesses which vary in storage size and functionality.

Now, although HPPC appeared to be making positive contributions to the Print division, HP management wondered if the company should consider responding to changes in the market environment, particularly in terms of how consumers created projects based on pictures and photographs and how they shared them with others. The possibility of generating revenues directly from HPPC through some form of freemium business strategy was potentially appealing.

Company

The Hewlett-Packard Company has been a global firm operating in over a hundred countries, regions, and localities with a network of thousands of channel partners. It has been a leading global provider of personal computing and other access devices, imaging and printing products and related technologies, and services. The company had developed a wide variety of hardware components as well as software and related services for consumers, small-and medium-sized businesses and large enterprises, including customers in the government, health, and education sectors. In 2015, the Hewlett-Packard Company split into two separate companies: HP Inc. (HP) and Hewlett Packard Enterprise (HPE). In 2020 the HP brand was ranked as number 42 of the world’s most valuable brands1.

Both HP Inc. and Hewlett Packard Enterprise make their products and services available worldwide as geographic diversity allows them to meet both consumer and enterprise customers’ demand on a global basis and draw on business and technical expertise from a wide-reaching workforce. This also provides stability to operations, provides revenue streams that may offset geographic economic trends and offers an opportunity to access new markets for maturing products. As a global company, approximately 65% of HP’s net revenue for fiscal year 2019 came from outside the United States (HP Inc. 2020).

HP Inc. operates through three business units: Personal Systems, Printing, and Corporate Investments. The Personal Systems segment offers commercial and consumer desktop and notebook personal computers, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories, software, support and services for the commercial and consumer markets. The Printing segment provides consumer and commercial printer hardware, supplies, solutions and services, and scanning devices. The Corporate Investments segment includes HP Labs and certain business incubation projects. (WSJ, 2020). Altogether, in 2018, HP had approximately 56,000 employees worldwide (Statista, 2020). Hewlett Packard Enterprise (the other firm) provides servers, storage, networking, technology services and, when combined with its Cloud Service Automation software suite (HP CloudSystem), enables infrastructure, platform, and Software-as-a-Service (SaaS) in private, public or hybrid environments. It provides technology consulting, outsourcing and support services across various infrastructure, applications, and business process domains.

In the Print business unit, HP Inc. focuses on driving print innovation and maximizing the value to its installed base of printers. The main product lines in the business printer unit are its LaserJet printers, Inkjet printers, and supplies such as toner and replacement cartridges. The company operates in an intensely competitive industry and encounters aggressive competition from numerous and varied competitors. It tries to counter such competitive pressures by competing based on technology, innovation, performance, price, quality, reliability, brand, reputation, distribution, range of products and services, ease of use of products, customer training, service and support, security, and availability of applications. Many of HP’s products have short life cycles and to remain competitive it must develop new products and services. Moreover, many of its current and potential partners design, manufacture and often market their products under their own brand names. For example, many printer and printing components are obtained from single sources (due to technology, availability, price, quality, or other considerations), such as parts, cartridges, and engines for laser printers which are sourced from Canon. In addition, sellers of non-original (i.e., non-HP) supplies, including facsimile, refilled or remanufactured alternatives for its LaserJet toners and Inkjet cartridges, compete with the Printing Supplies segment of its business. Customers are increasingly using online and omnichannel resellers and distributors to purchase HP products. These resellers and distributors often sell HP products alongside competing products, including non-original supplies, or they may highlight the availability of lower cost non-original supplies. The total worldwide vendors

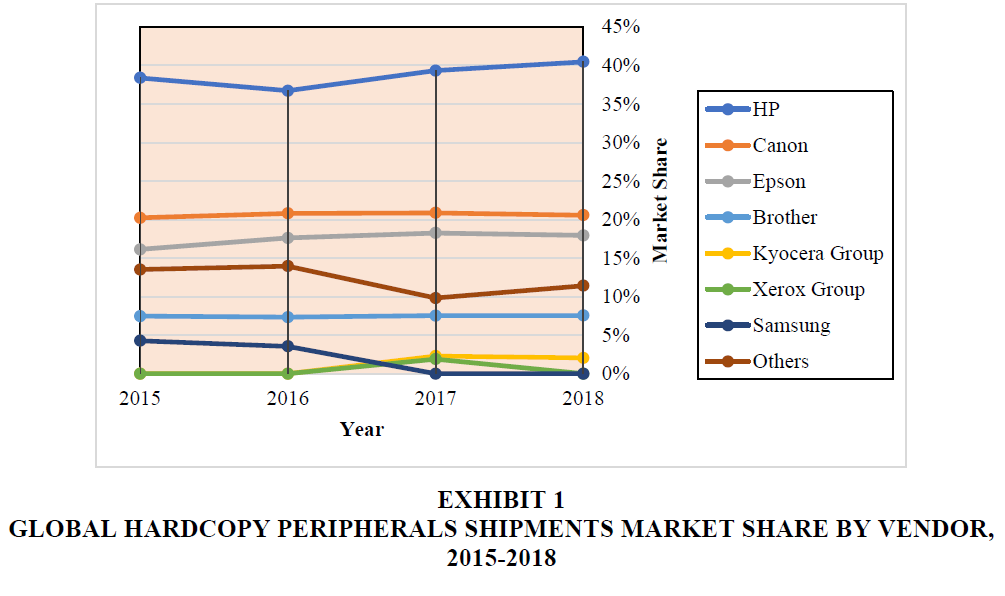

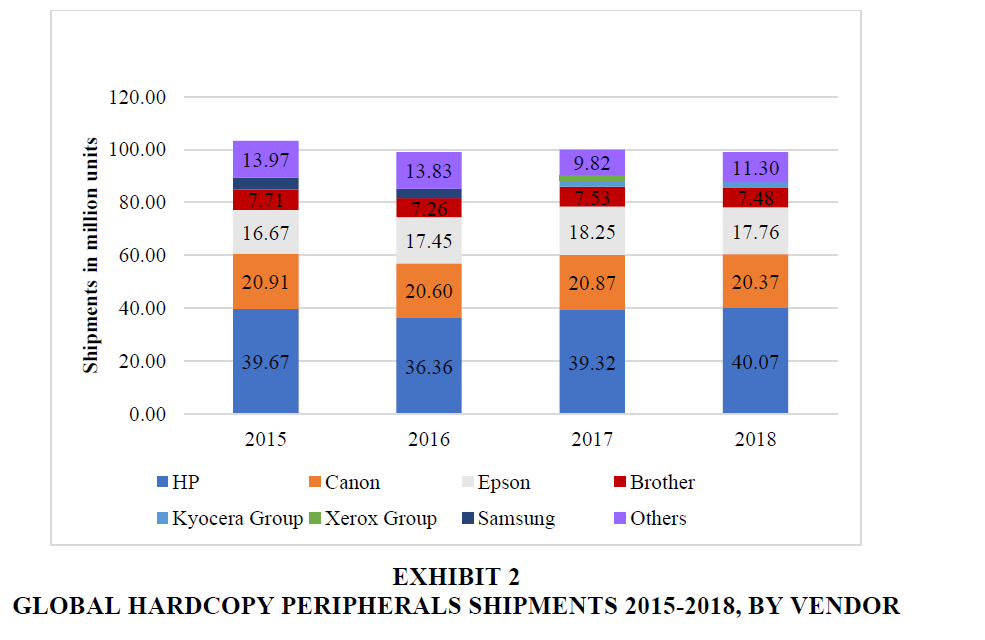

and market for hardcopy peripherals (which covers single-function printers, multi-function systems, and single-function digital copiers) are shown in Exhibits 1 and 2. There were nearly 100 million units shipped in 2018 (Statista, 2020). HP’s major competitors include Canon, Lexmark, Epson, and Brother. In addition, independent suppliers offer non-original supplies (including imitation, refill, or remanufactured alternatives). HP has been the worldwide leader in printers shipped worldwide as can be seen in Exhibit 1.

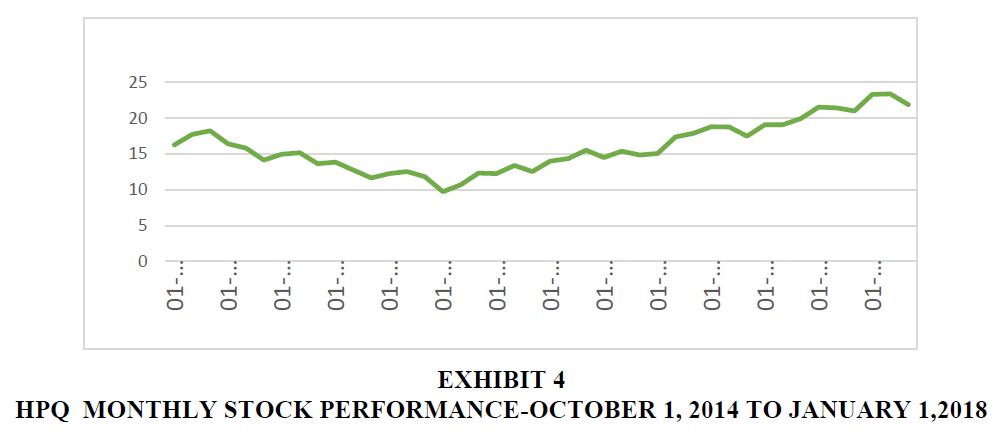

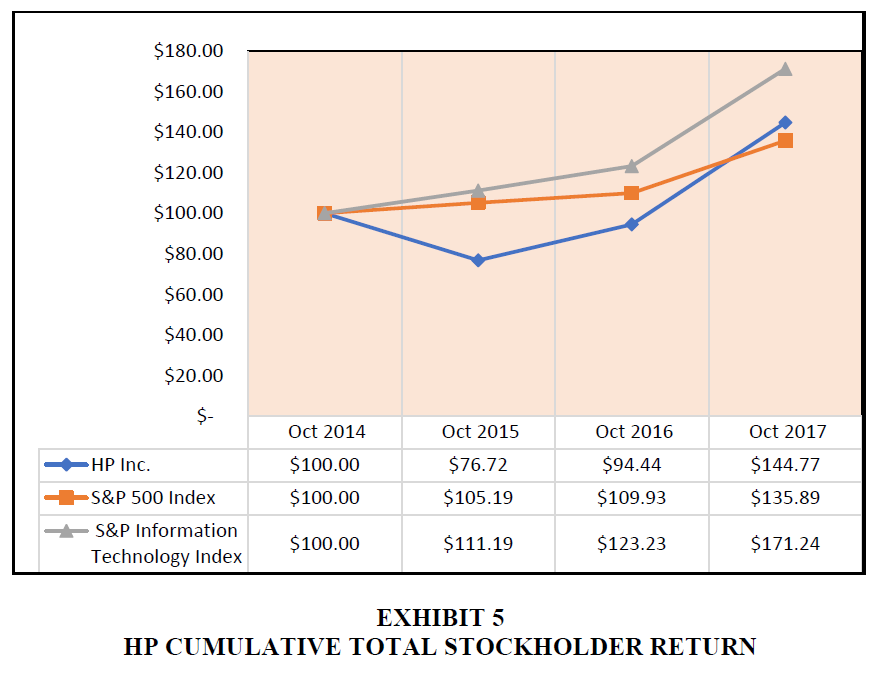

In 2018, HP had total revenue of $58.5 billion, of which $20.8 billion was derived from the Print business unit. That included $13.6 billion from the sale of printer supplies (see Exhibit 3), a good portion of which was from the consumer market. In addition, $2.7 billion was derived from the sale of consumer market printers. Exhibits 4 and 5 show the overall stock performance and return to shareholders for HP. Exhibit 5 shows the cumulative total stockholder return assuming the investment of $100 at the market close on October 31, 2014 (and the reinvestment of dividends thereafter) in each of HP common stock, the S&P 500 Index, and the S&P Information Technology Index. (HP 2018, 10-K). Therefore, from a revenue and profitability standpoint, increasing consumer usage of replaceable printer supplies is crucial for the company to boost its bottom line, as these are extremely high margin products.

Competition and Industry

Many HPPC users employ the product for producing various items that they can design using built-in templates to print at home, including calendars, announcements, newsletters and greeting cards. These uses have come at the expense of existing industries. For example, the published greeting card industry in the U.S. generated $4.5 billion in 2018 with an expected growth rate of 2.4% per year until 2024 (Kennedy, IBISWorld, 2019), but consumers are shifting to more accessible digital alternatives. Consequently, the $713.5 million U.S. online greeting card industry was expected to grow at the rate of 2.6% until 2024 to $812.9 million (O'Connor, IBISWorld, 2019), which was an attractive segment to pursue in the future. The online greeting card industry is characterized by a low level of concentration. The two largest players are Hallmark and American Greetings, with 15.6% and 6.9% market share respectively, and collectively accounting for 22.5% of total industry revenue in 2018. The rest of the industry consists of many small operators producing specialized cards or e-cards that generate relatively little revenue for the industry. However, both market leading companies have experienced declining growth due to intense competition from smaller brands. (O’Conner, IBISWorld, 2019). Competitors abound in the consumer printing market. Direct competitors to HPPC include online photo creation and storage services, such as Winkflash and Shutterfly, as well as photo software programs, such as Adobe Creative Suite and Windows Live Gallery. Indirect competitors include Facebook, Instagram, and Pinterest, where creations are shared virtually. Other competitors include retail printing services, like those found in Target, Wal-Mart, and various other retail outlets.

Freemium Business Models

Freemium business models are widely used, including by major companies such as Spotify, Pandora, SurveyMonkey and Dropbox. Many freemium based start-ups are very common in industry segments such as mobile gaming, music, personal productivity, and office collaboration. Other successful freemium based examples include MailChimp, Box, OneDrive, Evernote, Slack, Hootsuite, Zapier, FreshBooks, Trello, EchoSign, 23 and Me, Ancestry and Wordpress. Freemium business models typically utilize no-cost entry pricing to generate downstream profitability. Freemium marketing is a strategy of providing something for free and then charging a premium for something else. It is a combination of both “free” and “premium”, and the concept typically suggests that a company offer a subset of its services to some users for free, perhaps into perpetuity. Successful freemium model strategy expects that most users will utilize only the free basic service but that a small core group of frequent users will pay for the additional services.

In the freemium business model, a product or service is provided free of charge, but money is charged for a “premium” version of the product or service (Schenck, 2011). This pricing model is possible because technology allows services or products to be replicated and provided at very low incremental costs, thereby removing traditional barriers to profitability. The key success element of this business model is conversion. Most freemium companies have reported customer conversion rates of 1 to 10 percent (with the average of 2 to 4 percent). Koch and Benlian (2017) report that premium users typically account for 3 to 5 percent of total users. In any case, premium users rarely pay more than a few hundred dollars per year. Reported conversion rates for major freemium companies range from 4% (Dropbox), 6.5% (Skype), 7% (Flickr) to 10% (Spotify). Another variation to the free version is offering a trial version of a complete product or service. Companies using a trial period model allow consumers or business users to access the full product for a limited amount of time before requiring consumers to purchase the product for further use. Examples of this model include IBM SPSS (data analysis), YouSendIt (large file sharing) and 37 Signals (office collaboration). As a further illustration, Amazon.com uses this model extensively to pivot customers to one of its new product or service offerings.

The freemium model has been increasingly popular with start-up companies and has aided in the adoption of services that would have not been otherwise tried out. There are many alternatives, but three common freemium models that have evolved are offering multi-tiered products, the no-advertising upgrade, and the full usage trial period. The multi-tiered product is the most popular of these models, as well as the best representation of what freemium pricing implies. A “lite” version of the product is offered for free, with the option of a paid upgrade to access premium features. A common theme among products in this category is the benefit to small businesses. Examples include SurveyMonkey (online surveys), Zoom Communications (video conferencing), Box (cloud storage) and Asana (project management). Since the free version is often extremely limited, the expectation is that a significant number of free users will convert to paid. For SurveyMonkey, the conversion rate from free to paid is reported to be around 3% (Goldberg, 2016). The “no advertising upgrade” model is based on allowing users to sample most of or the entire product with advertising included. The user is offered the ability to upgrade to a level that eliminates the advertising content. Examples are Pandora (music), Spotify (music) and Flickr (photo sharing). Sciglimpaglia and Raafat (2020) categorized various freemium business models as multi-tier upgrade, no advertising upgrade and service upgrade strategies. Table 1 shows the free or trial offerings, premium or upgrade offerings and conversion rates for many of examples above. What is common across these examples is that generating sustainable profits from a baseline zero price and motivating free consumers to convert to becoming premium subscribers and then retaining them (Ross, 2018) is a continuing challenge for all freemium marketers.

| Table 1 Synopsis of Freemium Models | |||||

| Freemium Model |

Company | Industry | Trial/Free Offering | Premium/Upgrade Offering | Reported Conversion Rate |

| Multi-Tier Upgrade | Survey Monkey | Online Survey | Up to 10 questions per survey Limited to 40 respondents One crosstab filter |

Multiple plans start at $25 per month Unlimited number of questions and respondents |

3% |

| Multi-Tier Upgrade | Zoom Communication | Video Conferencing | Free version is limited to 40 minutes per session and number of “seats” | Pro: $14.99 per host/mo Business: $19.99/host/mo Enterprise: $19.99/host/mon |

N/A |

| Multi-Tier Upgrade | Dropbox | Online Cloud File Storage |

Free individual version is limited in amount of file storage (2GB) | Plus: $9.99/month Professional: $19.99/month |

1.6-4% |

| Multi-Tier Upgrade | Box | Online Cloud File Storage |

Free individual version is limited in amount of file storage (10GB) | Personal Starter: $5/month (100GB) Personal Pro: $10/month (100GB) -Business: $15/month/unlimited Business Plus: $25/month |

NA |

| Multi-Tier Upgrade | Tinder | Online Dating |

Tinder–allows users 18+ to view potential suitors within a pre-determined radius and age bracket | Tinder Plus – allows access to more profiles and “top picks” -$9.99/month for under 30 -$19.99/month for over 30 |

|

| Multi-Tier Upgrade | Flickr | Photo Sharing |

Flickr Free-allows for a few photos for personal blogs-1000 photo/video storage | Flickr Pro – Unlimited storage Ad-free Partner discounts photo/video storage - $5.99/month |

7% |

| No Ad Upgrade | Pandora | Music | Free version/Ad-Supported | No ads Plus - $4.99/month Premium – $9.99 Premium Family - $14.99 |

NA |

| No Ad Upgrade | Spotify | Music | Free version/Ad-Supported | No ads Premium Plan - $9.99/month |

10-26.6% |

| Service Upgrade | Candy Crush | Mobile Gaming |

Free to use Candy Crush Saga on mobile devices | “Gold bar system” – Users pay to upgrade their play when playing | NA |

| Service Upgrade | Skype | VOIP Communication |

Free Skype calls in network | Premium price for out of network calls Cell/ or landline phone calls in the US starts at $2.99/month |

2.9-6.5% |

Business Issues

HPPC was a completely free, downloadable software product in the creative print-at-home market. No purchase was required, and consumers were able to download and create projects immediately. The HPPC software was developed and maintained by RocketLife, an outside software developer located in Northern California. Since there was no direct revenue capture for HPPC, HP was obligated to pay RocketLife for software support and updates from its ink and paper revenues. RocketLife worked with HP on a contractual basis by implementing quarterly updates for HPPC.

Primarily, HP management questioned what, if anything, could be done to improve the contribution of HPPC to its Print unit business. Ideally, the company desired to implement a new business model for HPPC that would allow revenue to be generated directly from consumer participation. This new business model would allow HPPC to be self-sustaining, so that payment for the software maintenance might also come from the software usage, rather than ink sales, which would in turn improve the bottom-line. HP wanted to determine the strategic options that might have positive impact on these consumables by increasing usage. As consumer usage of HPPC increases, consumption of ink and paper was expected to increase, which would have positive impact on HP’s Print division. Therefore, a major question was to determine if HPPC might be converted to a monetized freemium business model, and, if so, to identify the relevant strategies to deploy.

Hp’s Market Study

HP conducted a major survey of HPPC registered users. A random sample of 100,000 HPPC users was drawn from those who had already activated the software. An incentive of a drawing for several $250 American Express gift cards was offered to encourage participation and feedback. The survey was done online, using Qualtrics. A total of 5,039 respondents completed the survey and provided insight into preferred and desired features, usage behavior, and method of payment method preferences. The survey was designed to determine a consumer profile or set of profiles that represent frequent and target HPPC users and to understand their price sensitivity, their most valued product features, and their social sharing behaviors. This information was crucial to developing recommendations for premium upgrade features for HPPC software and for determining the terms of payment. Questions were also asked about at-home printing behavior, including projects or items printed at home, frequency, and brand of printer. Respondents were also asked directly about their preferences for existing features and potential premium features. The listed existing features were either points of differential advantage for HPPC or were indicated on previous surveys by consumers as being of high importance. The potential premium features were determined through an analysis of features offered by competitors and an analysis of freemium features offered. Recommended premium features were then determined using input from the preferred pricing schedule and based on market value. Finally, respondents were asked directly about competitor printing services. Users were also asked about their recent past purchase behavior, which was used as an indicator of future purchase behavior. Survey responses were used to determine which users are most likely to pay for upgraded services; what past purchase behavior of software indicates about future purchase behavior; and to determine the profiles of respondents who indicated preferences for various possible upgrades, including discounts on ink and paper, points earned on purchases, free shipping, and improved editing tools.

Results

A total of 5,039 HPCC users responded to the survey, a response rate of 5%. Respondents came from a total of 81 countries. Of these, the majority reside in the United States, followed by India, the Philippines, Indonesia, Russian Federation, Indonesia, Pakistan, and Canada. Results show that usage skews predominantly toward older, female, and lower to middle income individuals. A significant amount of time is spent weekly on projects with children at home, which positively impacts the usage of photo creation products. Over one-half of users print photos at home once or more per month. The types of personalized photo projects include greeting cards (24% of all respondents), photo collages (17%), photo books (15%), invitations (15%), calendars (14%) and newsletters (6%). In addition to HPPC, a wide variety of other software is used by respondents, including MS Word (30%), Photoshop (26%), MS Publisher (15%), Hallmark Card Studio, (14%), Snapfish (13%) and American Greetings (12%). Users regularly post photos on Facebook, Twitter, Instagram, Pinterest, Flickr, and Tumblr. Nearly one quarter (23%) of users who had made a purchase subscribed to a photo project service in the prior year, led by Snapfish and Shuttterfly. Users then rated the importance of current product attributes. Survey results showed that a lite version of HPPC would be well received and many users (53%) responded that they would use an HPPC application on their smartphone and a slight smaller proportion (47%) responded that they would use the application on a tablet. Overall, consumers rated HPPC very highly - the top attributes were print at home capability (an average of 88.6 on a scale of 0 to 100), overall ease of use (88.4), ability to personalize projects (86.7) the variety of themed templates available (79.9) and variety of themed projects available (79.8). Features that might be included in an upgrade version were evaluated in a similar fashion, including discounts on ink and paper (84.2), different templates (77.3), free shipping on ship-tohome products (76.4), personalized "made by" stamp on cards (71.7), easier sharing on social media (62.5) and cloud-based project storage (64.3). Users were asked about how often they post pictures on social media. This is an important feature for photo sharing software. A variety of social media sites are used, with Facebook the overwhelming leader. Over half of all users post photos on the site at least monthly.

Discussion of Results

Survey results showed that a lite version of HPPC would be well received, as 53% of users responded that they would use an HPPC application on their smartphone and 47% would use the application on a tablet. Roughly 60% indicated that they would be interested in an upgraded product, with many (22%) saying that would pay when initially registering the product and over ten percent of users either as a monthly or yearly subscription. The key elements of the upgraded product were design tools (such as exclusive templates and graphics), free shipping on orders, discounts on ink purchase and loyalty reward points.

Conclusion and Business Decision

To address how to best modify its freemium model, HP management decided to consider two strategic alternatives: (1) offer a “lite” version, which could be used on a mobile device and (2) offer a premium bundle of services as a paid upgrade. The benefit of the first was to expand the total volume of usage, while the second was the classic freemium upgrade strategy. Further analysis showed that users overwhelmingly expressed willingness to upgrade, regardless of income. HP management now needs to address two specific issues. First, how should the free version of HPPC be modified and what aspects of the product should it emphasize? Second, does it appear that HPPC should be converted from a free to a freemium product? If so, how should that is done?

End Note

1. https://www.forbes.com/search/?q=Hewlett-Packard#56d520ca279f

References

- Bapna, R., & Umyarov, A. (2018) Monetizing Freemium Communities: Does Paying for Premium increase Social Engagement? MIS Quarterly, 42 (3), 719-736.

- Bond, S.D., Stephen, X.H., & Wen, W. (2019). Speaking for “Free”: Word of mouth in free- and paid product settings. Journal of Marketing Research, 56(2), 276-290.

- Goldberg, D. (2016). “CEO of Survey Monkey.” Quora, 7 June 2016.

- Gunzel-Jensen, F., & Holm, A.B. (2015). Freemium business models as the foundation for growing an e-business venture: a multiple case study of industry leaders. Journal of Entrepreneurship, Management and Innovation, 11(1), 77-101.

- HP Inc. (2020). https://investor.hp.com/financials/annual-reports-and-proxies/default.aspx

- Kennedy, K. (2019). IBISWorld. https://my-ibisworld-com.libproxy.sdsu.edu/us/en/iexpert/51119/iexpert

- Koch, O.F., & Benlian, A. (2017). The Effect of Free Sampling Strategies on Freemium Conversion Rates. Electronic Markets, 27(1), 67-76.

- Kumar, V. (2014). Making ‘freemium’ work: many start-ups fail to recognize the challenges of this popular business model. Harvard Business Review, 92(5), 27-29.

- Lee, C., Kumar, V., & Gupta, S. (2017) Designing Freemium: A Model of Consumer Usage, Upgrade, and Referral Dynamics. Working Paper, Harvard Business School.

- O'Connor, C. (2019). IBISWorld, Retrieved from https://my-ibisworld-com.libproxy.sdsu.edu/us/en/industry-specialized/od5449/industry-at-a-glance.

- Oestreicher-Singer, G., & Lior-Zalmanson, L. (2018) Content or Community? A Digital Business Strategy for Content Providers in the Social Age. MIS Quarterly, 37(2), 591-616.

- Rietveld, J. (2017) Creating and Capturing Value from Freemium Business Models: A Demand-Side Perspective. Strategic Entrepreneurship Journal, 12(2), 171-193.

- Ross, N. (2018) Customer Retention in Freemium Applications. Journal of Marketing Analysis, 6, 127-137.

- Sciglimpaglia, D., & Raafat, F. (2020). Freemium Marketing: Use of Demand Side Research in Market Segmentation Strategy, Journal of Strategic Marketing.

- Schenck, B.F. (2011). Freemium: Is the Price Right for Your Company. Entrepreneur, Retrieved from https://www.entrepreneur.com/article/218107

- Statista. (2020). Retrieved April 13, 2020. Global shipments of hardcopy peripherals. https://www.statista.com/statistics/272071/global-shipments-of-hardcopy-peripherals/.

- Statista. (2020). Retrieved December 6, 2020. Number of employees at HP Inc (Hewlett Packard) from 2001 to 2019. https://www.statista.com/statistics/264922/number-of-employees-at-hewlett-packard-since-2001/.

- Van Riel, A.C., Liljander, V., & Jurriens, P. (2001) Exploring Consumer Evaluations of e-Services: A Portal Site. International Journal of Service Industry Management, 12(4), 359-377.

- WSJ: Markets. (2020). Description: HP Inc. Retrieved December 14, 2020. https://www.wsj.com/market-data/quotes/HPQ/company-people

- Wu, C., Rajkumarbuyya, A., & Ramamohanarao, K. (2019) Cloud Pricing Models: Taxonomy, Survey, and Interdisciplinary Challenges. ACM Computing Surveys, 52(6), Article 108.

- Ya, J., & Wakefield, R. (2018). The Freemium (Two-Tiered) Model for Individual Cloud Services: Factors Bridging the Free Tier and The Paying Tier. Journal of Information Technology Management XXIX (1).

Discussion Questions (This section and the next, “what actually happened”, should be made available to instructors by request rather than included in the online version of the paper)

What was HP’s relative market position in printing?

At the time of the case HP’s position in printing was very strong. The company had been a product innovator in both ink based and laser printing. This included both consumer and business segments. HP was the worldwide leader in printers shipped worldwide. In addition, its relative market share position was increasing. Also, in 2018, HP had total revenue of $58.5 billion, of which $20.8 billion was derived from the Print business unit. That included $13.6 billion from the sale of printer supplies, a good portion of which was from the consumer market. In addition, $2.7 billion was derived from the sale of consumer market printers.

The market situation for HPPC is much different. From a usage standpoint consumer use the product to produce calendars, announcements, newsletters and greeting cards. These uses have come at the expense of existing industries, notably the published greeting card industry. The online greeting card industry is characterized by a low level of concentration but led by firms from the published greeting card industry (Hallmark and American Greetings. The rest of the industry consists of many small operators producing specialized cards or e-cards that generate relatively little revenue for the industry. Moreover, there are many competitors in the consumer printing market, including online photo creation and storage services (Winkflash and Shutterfly) photo software programs, (Adobe Creative Suite and Windows Live Gallery), and indirect competitors (Facebook, Instagram, and Pinterest. Other competitors include retail printing services, like those found in Target, Wal-Mart, and various other retail outlets. The level of competition is shown in the HP survey results. Most consumers were using an HP printer at home. But less were using HPPC. Other software being used included Microsoft Word Adobe Photoshop, Microsoft Publisher, Hallmark Card Studio, and American Greetings.

HP management felt that it needed to address two specific issues. First, how should the free version of HPPC be modified and what aspects of the product should it emphasize? Second, does it appear that HPPC should be converted to a free to a freemium product? If so, how should that is done? Which of these points do you agree with? Why?

Answers will vary.

Do you agree or disagree that HPPC can have positive results for revenues in the HP Print division?

Revenue from the Print division comes from sales of new printers, replacement sales of printers, sales of printer supplies such as toner and ink cartridges and paper. HPPC clearly had a positive impact for the division since it could attract new users to the brand and could stimulate increased printer usage. That, in turn, positively impacted sales of replacement printers and supplies.

What are the advantages and disadvantages of just continuing to offer HPPC for free? Should it be converted from a free to freemium?

Consumers are happy with the current HPPC model and that argues for keeping things as they are. The principal disadvantage is the potential loss in revenue from converting to a freemium model. Many consumers appear to be willing to pay for an upgraded bundle of services, which could be added to the free version.

Do you agree or disagree that HP needs to consider whether to continue offering HPPC for free? Why?

If HP elects to maintain the free version, regardless of whether to also offer an upgrade version as a freemium offering, the survey results suggest several things. Consumers use the software to create various products (calendars, invitations, photo book pages, collage photos and greeting cards). Easy to use templates should make it easy for consumers to do this. HPPC might be tied to reordering ink and paper, which would enhance revenues in the Print division.

How important do you think that social media posting of photos and being able to modify photos on a smartphone or tablet are?

Survey results show that HPPC users post photos to social media, particularly on Facebook (at the time). In addition, roughly half of all users would use do that using a smartphone or tablet. Thus, being able to do that seems very important, particularly to younger generation users.

What are the advantages of offering a new “lite” version of HPPC?

Survey results showed that a lite version of HPPC would be well received and many users (53%) responded that they would use an HPPC application on their smartphone and a slight fewer proportion (47%) responded that they would use the application on a tablet. Competitive products already offer this feature. Users could use the program to create photo products in a wider variety of circumstances and on the go. Many users post photos on social media, principally using Facebook (over 80%). This would be particularly helpful for interacting with younger, more tech savvy consumers. There are few disadvantages to this strategy.

What are the advantages of offering a new premium bundle of services as a paid upgrade of HPPC?

The key advantage is revenue enhancement. As it now stands, there is no direct monetary revenue stream from HPPC, although the licensing agreement stipulated that HP pay RocketLife for quarterly updates and software support from its ink and paper revenues. The upgraded package would create a positive revenue stream. In addition, roughly 60% of users indicated that they would pay to upgrade.

What contributed to the success of freemium business strategy and why is conversion so important?

The key to most freemium business models is conversion, unless using a paid upgrade strategy. Success is driven by understanding the potential value consideration of consumers and developing an appealing offer. As noted in the case, most freemium companies see relatively low conversion rates (averaging about 2-4 %). Of those pay to upgrade, most pay less than $100 per year. The HP research suggests that HPPC users are likely to pay to upgrade, but that is uncertain.

Consider the survey conducted by HP. What are the positive aspects of that marketing research project? What things may have changed since that prior survey was conducted?

The prior survey was well done. Some of the positive features were: (1) use of Qualtrics (2) random sampling (3) use of incentives and (4) multiple contacts. This resulted in a large international sample with a response rate within industry standards. Since that time consumer internet access and use of social media has changed dramatically.

For the “print at home” product category, how important is change in technology?

This case is a good example of how technology quickly changes markets. At the outset, HPPC was a pioneering product. But things changed quickly. As is noted below: “It’s a desktop solution, and more and more of the content was being captured, edited, and even printed from mobile devices.” Consumer use changed rapidly and that rendered HPPC less relevant.

What Actually Happened

Initially, HP continued to offer a free version of HPPC. HP also created a “lite” version that could be used on smartphones and tablets on both Android and Apple operating systems (which was later called HP Smart). In the prior survey roughly 27% of users had indicated that they would pay to upgrade to version that they could use in this fashion. This proved to be very successful.

The company seriously considered developing a freemium version of HPPC, which would be a premium version upgrade. Nearly 60% of consumers in the prior survey indicated that that they would upgrade if the software included additional applications that were desired. It would have which included many of the features that were highly rated in the consumer survey. But major changes in the consumer market had taken place since the time of the pr ior survey which reduced the enthusiasm for this addition. Most of the features that were originally considered were, by 2018, available in other free applications and many had moved principally to mobile platforms. For several reasons, the move to freemium did not occur. Primary attention was given to HP Smart.

Finally, after ten years of existence, the HP Photo Creations program was retired on November 30, 2019 and the software no longer ran after that date. HP posted the following:

“Over the last several years, HP has worked diligently to make it easier to print from desktop and mobile devices. After November 30, 2019, please use the built-in apps for Windows, macOS, and your mobile devices for the majority of your printing needs. You can also install the HP Smart app to manage your printer and access solutions designed to increase your productivity and creativity. HP Smart is available for Windows, Mac, iOS, and Android devices”.

When asked to elaborate on the decision to retire HPPC, a senior HP manager said the following: “The short story-It’s a desktop solution, and more and more of the content was being captured, edited, and even printed from mobile devices. With limited dollars to invest, we directed efforts to mobile printing solutions. We also wanted to enable printing from online social locations (FB, Instagram, etc) and that was not something HPPC was going to support”.

Appendix

| Exhibit 3 HP Total Revenue and Printing Segment Revenue (HP 2018, 10-K) | ||||

| In US $ millions | ||||

| 2015 | 2016 | 2017 | 2018 | |

| Net Revenue | $51,463 | $48,238 | $52,056 | $58,472 |

| Printing | $18,728 | $20,805 | ||

| Supplies | $12,524 | $13,575 | ||

| Commercial Hardware | $3,792 | $4,514 | ||

| Consumer Hardware | $2,412 | $2,716 | ||