Research Article: 2022 Vol: 14 Issue: 4

Impact of COVID-19 on MSME sector in India: A literature review

Mora Saritha, Anna University

Citation Information: Saritha, M. (2022). Impact of covid–19 on msme sector in india: A literature review. Business Studies Journal, 14(4), 1-11.

Abstract

The world over has witnessed the pandemic called Covid-19 over the last 2 years. The unknown before and unanticipated doom has created havoc in an unprecedented manner. The adverse impact of this pandemic is globally recognized and it spread as a contagion affecting trade across nations undesirably. India being second largest populous country is no exception to this adversity. The lock down which is considered as one of the means to contain the spread of this pandemic was implemented in our country since March 2020, however unlock situation is being introduced in a phased manner. Though lock down was effective in containing the spread of pandemic, it was enabling the economy to cripple from progressing. Industries in manufacturing and services sector could not able to sustain lockdown and were pushed to doldrums. Majority of the enterprises suffered huge losses and were on the verge of closure. The MSME (Micro, Small and Medium enterprise) sector has been seriously hit due to this lock down measure. The present article reflects the review of literature surrounding MSMEs spanning from the last 2 years. The literature has been collected from various journal articles, government reports, newspaper articles etc.

Keywords

MSME, Classification, Lockdown, Relief Measures.

Introduction

This dreadful virus which is affirmed by the WHO as the pandemic has severely affected nearly 195 countries across the globe. It is evident that the Indian economy which is growing at one of the lowest rates in the last six years and now the challenges thrown open by the pandemic is leaving many sectors in pieces (Mishra, 2020a).

MSMEs are regarded as the backbone for the Indian economy. They are mostly the enterprises which are labor intensive and therefore provide huge employment opportunities, largely dominated by informal sector which are not under regulatory ambit, run by limited finances, provides huge potential for exports and imports and is involved in the production of over 6,000 products ranging from conventional to automated items (Rastogi, 2020). The following table provides the composition of MSMEs (Table 1).

| Table 1 Composition of MSMES | ||

| Number of MSMEs | % in total MSMEs in India | |

| Micro enterprises | 630.52 lakh | 99% |

| Small enterprises | 3.31 lakh | 0.52% |

| Medium enterprises | 0.05 lakh (5 thousand) | 0.01% |

| Total | 633.88 | |

From the above Table 1 we can understand that there are 633.88 lakh unregistered non-agriculture MSMEs in the country involved in varied economic activities according to the National Sample Survey (NSS) 73rd round, led by National Sample Survey Office, Ministry of Statistics & Programmer Implementation during the period 2015-16. Micro enterprises comprise a whopping 99% of the total number of MSMEs. The problem with this type of enterprises is that they are mostly unorganized and informal enterprises which are not covered by the regulatory regime.

It is worth noting that around 84.17 percent of the total numbers of MSMEs are managed by the owners of the enterprises themselves or else they are self-employed firms. They are more or less household enterprises and the next highest share of MSMEs are those enterprises that have workers strength of five. These are called micro units. These two categories of enterprises constitute around 97.4 percent of unregulated businesses in our country. The various government sources reveal different levels of informality or non-regulatory regime in MSME sector, but it is understood that it long-lastingly stood at 90 percent mark. It has been explicitly emphasized by the International Labor Organization (ILO) to the countries with large informal sectors that the respective governments do need to acknowledge and act accordingly on the issue. It has also been stressed that self-employed, street vendors, hawkers, construction, transport and domestic workers, etc. are the direct and worst affected segment of the population due to the imposition of the lockdown as there is no income replacement for them (Sipahi, 2020).

The benefits the MSMEs provide to the nation’s development are paramount in terms of contribution to GDP, employment, output and international trade. MSMEs account for about a third of the country’s gross domestic product, 45% of manufacturing output, and 48% of exports GoI 2017-2018 (Rathore & Khanna, 2021) (Table 2).

| Table 2 Difference Between Previous Classification and new Classification | ||

| Points of distinction | Previous classification | New classification |

| Criteria for classification | Investment in Plant & Machinery | Combined criteria of investment in Plant & Machinery and Annual Turnover |

| Distinction between sector | Existing | Not existing |

| (There are separate limits for manufacturing and service sector among micro, small and medium enterprises) | (There is no separate limits for manufacturing and service sector among micro, small and medium enterprises) | |

| NOTE: Export turnover will not be used in order to calculate annual turnover | ||

Definition of MSMEs

Previous Classification

For manufacturing enterprises, investment in plant and machinery is the original cost excluding land and building and the items specified by the Ministry of Small-Scale Industries vide its notification No.S.O.1722(E) dated October 5, 2006.

For enterprises engaged in providing or rendering of services and whose investment in equipment (original cost excluding land and building and furniture, fittings and other items not directly related to the service rendered or as may be notified under the MSMED Act, 2006 are specified below (Tables 3 & 4).

| Table 3 Previous Classification | ||

| Classification | Manufacturing* | Services** |

| Micro | Up to Rs.25 lakh | Up to Rs.10 lakh |

| Small | Above Rs.25 lakh and up to Rs.5 crore | Above Rs.10 lakh and up to Rs.2 crore |

| Medium | Above Rs.5 crore and up to Rs.10 crore | Above Rs.2 crore and up to Rs.5 crore |

| Table 4 New Classification | ||

| Classification | Investment | Turnover |

| Micro | Up to Rs. 1 Crore | Up to Rs. 5 Crore |

| Small | Up to Rs. 10 Crore | Up to Rs. 50 Crore |

| Medium | Up to Rs. 50 Crore | Up to Rs. 250 Crore |

Rationale

There has been an enduring necessity from the MSME entrepreneurs to increase the investment limit criteria of classification of MSMEs. Due to the inflationary pressures, MSMEs often surpass the threshold limits. For the sake of remaining within the threshold limit to reap the benefits, enterprises either deliberately operate their businesses at a lower level or establish multiple businesses so as to spread over the turnover. The new classification based on increased turnover is beneficial for enterprises as there is a chance to leverage a small amount capital to earn large incomes (Sipahi, 2020).

The new classification has brought in transparency. It has authenticated the revenue stated by the MSMEs under the new Goods and Services Tax Network (GSTN). The higher limit is expected to give the necessary fillip to the growth of MSMEs. Entrepreneurs will be motivated to undertake higher investment proposals and accomplish economies of scale and cost competitive advantage (Krishna, 2021).

Government’s Rationale (MoMSME Annual Report)

A revision in MSME criteria of classification was declared in the AatmaNirbhar Bharat package on 13th May, 2020 and it came into effect from 1st July, 2020. The need for revision was felt in order to:

1. Bring the MSME sector in tune with the changes in economy,

2. Be representative with time,

3. To create an unbiased system of classification and

4. To facilitate ease of doing business.

Benefits Expected to Realize

1. Facilitates growth in size of MSMEs

2. Ease of doing business will be promoted as export turnover will not be reckoned under new classification based on investment and turnover.

3. Entrepreneurs can take up any business and expand irrespective of whether it is manufacturing or service sector.

Critical Analysis of New definition of MSME

As per the survey results (Mukherjee & Mukherjee, 2021) regarding the revised MSMEs definition, 60 per cent of the respondent participants were of the opinion that this will negatively impact the MSME sector. There are chances that more number of larger companies will be incorporated under this new definition and actual deserving MSMEs will slip into in the micro-category where there will be no special incentives available; remaining 40% positively accepted this change due to enhanced transparency related to the incorporation of turnover as one of the criteria of classification.

It has been observed that upper limit on turnover has been kept at a very minimal level. It is understood that criteria based on turnover and investment is not suitable for small and medium enterprises. There is a threat that firms will be motivated to stay small in order to benefit from the policies and schemes. Firms lack the interest to expand and thus remain unproductive. There is also apprehension that enterprises would be out of the realm of MSME definition, if there is global investment in these enterprises which eventually may lead to rise in turnover (Borpuzari, 2020). As per Ghosh (2020), the composite definition has taken into account a turnover which is five times higher the investment amount for all three types of MSMEs. The definition has not considered the unique nature of the particular sector MSMEs. For example, firms in the gems and jewelry sector may achieve a high turnover with small amount of investments in fixed assets such as plant and machinery. Also, a leather processing unit primarily known for its labor-intensive techniques of production can generate higher sales with low levels of capital investment. There are also firms with high capital investment and low turnover. These aspects need consideration so that firms with good employment potential do not fall out of the MSME regime.

Negative Effects of Lockdown

1. The pandemic has affected MSMEs in a number of ways. It has created disruptions both on supply side and demand side. On the supply side:

2. Companies faced a fall in the supply of labor due to unhealthy workers and need to look after dependant family members and children.

3. Drop in production capacity utilization

4. Break in supply chains leading to shortages of parts and intermediate goods and exports adversely affected.

On the Demand Side

1. Severe fall in demand affects the MSMEs ability to function, revenues deteriorating and liquidity crises looming large.

2. Consumers’ loss of employment opportunities, fall in incomes and purchasing power reduces spending and consumption (OECD, 2020).

What Makes MSMEs Highly Vulnerable?

1. Lower resilience: Due to lower resilience related to their size, MSMEs become highly vulnerable to pandemic induced shocks. Breakdown in supply chains due to stoppage of transportation facilities and enterprises outsourcing many of their business services critical to their performance is leading to aggravation of problems.

2. Rebuilding broken alliances and partnerships: It’s difficult to rebuild broken partnerships and supply chains once the partners set up new alliances and business contracts.

3. Difficulty in shifting to alternative ways of working: It’s difficult for MSMEs to shift to alternative ways of working such as teleworking, digitalization and adoption of new technologies.

4. Non-availability of information: It is difficult for MSMEs to obtain information on measures to contain the spread of the virus and on substitute business strategies for revitalization and government initiatives available that grant support.

Effects of Lockdown on the Following

1. Rate of sales decline

2. Fall in production capacity

3. Employment

4. Percentage of loss and decline in earnings

5. Logistics

6. Gross domestic product

Rate of sales decline: It was observed that MSMEs with an annual sales of Rs. 25 crore or less witnessed a fall in the growth rate of net sales by -25.3% during Q1 of FY 2020-21(Roy et al., 2020). It has been observed that firms with lesser number of employees lost high percentage of sales. According to Krishna (2021) firms with less than 8 employees lost around 24 percent of their annual sales and those firms where there were around 45 employees lost about 10 percent sales.

Fall in production capacity: The production capacity experienced a dip from an average of 75% to just 13 percent. The lockdown created a complete squeeze of around 60 percent of economic activities that were carried out by the MSMEs in India (Roy et al., 2020).

Employment: There was loss of employment to the MSMEs workers. There is 44 percent of the pre-Covid 19 workforce which is retained by MSMEs post Covid-19 (Rathore & Khanna, 2021).

Percentage of loss and decline in earnings: During the lockdown, the survey results present a picture of distress among MSMEs where losses amounting to 17 percent of their past year sales were reported (Rathore & Khanna, 2021). The survey conducted on 14,444 MSMEs by a non-financial banking institution in the second half of May 2020 on the financial impact of the pandemic on MSMEs and their outlook towards the earnings reveal that nearly 50 percent of micro, small and medium enterprises (MSMEs) were reported to have a 20-50% fall in their earnings. As per another survey conducted by Clothing Manufacturers Association of India (CMAI) on 1500 of its members reveal no less than 60% of them predicted a 40 percent reduction in revenue and nearly 20 percent of them were planning for closure of their businesses post lockdown (Krishna, 2021).

Logistics: The lockdown has its effect on logistics. It has seriously affected the import of raw materials such as rubber, sports, goods, silk, etc. and their transportation from the docks to the production centers (Krishna, 2021). According to the All India Motor Transport Congress, the daily vehicular movement meant for the logistics purposes of the enterprises fell by 10 percent of the regular levels. As per the Indian Chamber of Commerce (ICC) an estimated loss of Rs. 50,000 crores has occurred in the logistics of MSMEs (Elaine Lilly Sajan, 2021).

Gross domestic product: For the quarter ending June 2020, India’s economic output contracted by about 24 percent, the sharpest decline amongst all major economies across the globe (Rathore & Khanna, 2021). A report published by the IANS (Indo-Asian News Service) states that $320 billion amount of loss was incurred on the economy due to 40-day lockdown (Elaine Lilly Sajan, 2021).

The MSMEs sector is considered to be one of the most adversely affected sectors during pandemic because of their nature, size and scale of operations and accessibility to financial resources. As per the observations from studies and survey results it is understood that around 95 percent firms were obstructed negatively due to nation-wide lockdown levied in April 2020. By August 2020, 70 percent of businesses got affected due to lockdown. Still after phased unlocking, it was noticed that nearly 40% enterprises got affected by February 2021. Business volume of Indian MSMEs declined at an average of 11 percent due to lockdown in 2021 compared to 46 percent decline in 2020 (Tripathi, 2021).

Lockdown and Subsequent Closure of MSMEs

As per several surveys in different OECD countries, there is an indication that between 25 percent and 36 percent of small businesses could shut down permanently due to the adversity caused by the pandemic in the initial four months of its eruption (OECD, 2020).

It was expected that 25 percent of firms under the MSME sector in India were about to close if the government of India extended the period of nationwide lockdown for more than eight weeks commencing from April 2020. After that it would be tough for the firms to run their commercial operations. The only suitable option then would be to close their business units perpetually (Roy et al., 2020).

At least 69% of businesses reported that they are not in a position to sustain for lengthier than three more months, while 30 percent suspected survival beyond one month, under the status quo (Rathore & Khanna, 2021).

Mostly, 70% of firms stated that they cannot survive the crisis for more than the next 3 months if the lockdown remains, and it is expected that the smallest firm might close within 1 month (Behera et al., 2020)

The survey conducted by the All India Manufacturers Organisation on MSMEs reveal that the self-employed MSMEs constituting 35 percent of the total population do not have any chances of recovery from adversities thrown open by the pandemic. They began winding up their units (Tripathi, 2021)

Positive Effects of Lockdown

Every cloud has a silver lining. This is proven in case of MSMEs where there were positive effects of lockdown. MSME started producing hand sanitizers, face mask, etc. A few enterprises produced the required items for livelihood and distributed packed products in the areas of containment zones. During the period of lockdown, there was heavy demand for essentials beyond the necessary limits, this led to rise in prices because of supply shortages and this advantage was captured by MSMEs (Behera et al., 2020). The other important advantage is that there has been a distinctive change of consumer and government preferences to domestic goods and services; this has made the country friendlier to FDI (Jha & Jha, 2021).

Problems of MSMES

MSMEs Problems Prior to Lockdown

MSMEs were facing slow growth because of various factors such as absence of financial support, lack of proper infrastructural facility, non-availability of sophisticated technology, etc. The difficulties got aggravated due to two reasons; one is demonetization process which rolled out in 2016 and other one Goods & Services Tax which came into force in 2017. Due to the labour force of MSMEs mostly comprising of the rural unskilled labourers, even the insignificant problems have a greater influence on these enterprises. The health crisis due to Covid-19 has made their capability and sustainability a big challenge. The operational environment for MSMEs has undergone lot of change due to pandemic.

MSMEs Problems Post Lockdown

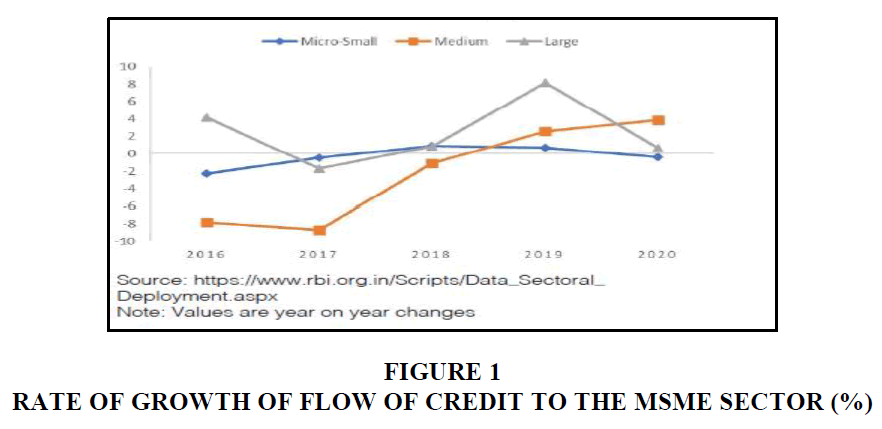

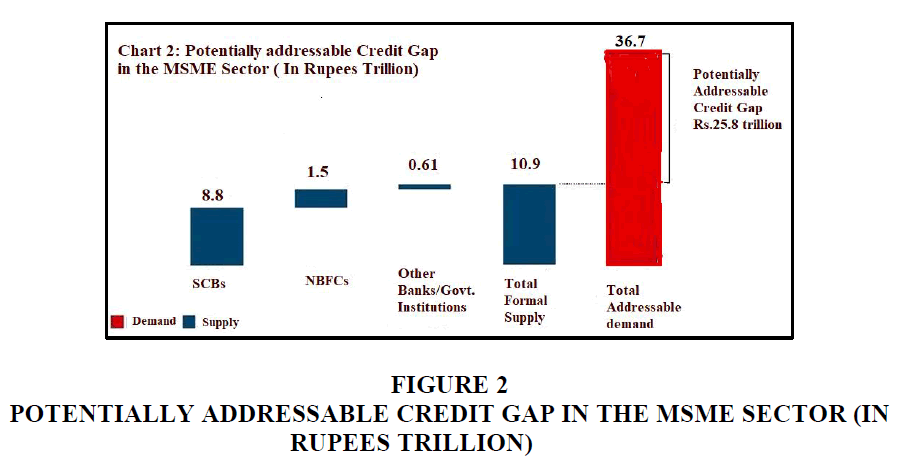

Financial problems of MSMEs: MSMEs encounter various hindrances to growth. Among them, absence or limited availability of finance is considered to be the utmost critical. As per the Economic Census, 2013, around 93 percent of the MSMEs were found to be denied of formal institutional or informal sources of finance. These MSMEs with limited collateral securities or substandard credit history encounter tough challenge obtaining credit facilities. An observation at the credit distribution to the MSME sector during 2016 to 2020 reflects that it witnessed the credit growth falling numerous times during this period.

The most significant challenge faced by the MSMEs is lack of financing. As per the findings of the report released in 2018 by the International Finance Corporation, a member of the world bank group, it is understood that the formal banking system caters to less than one-third (or about Rs 11 lakh crore) of the MSME financial needs. The next big challenge faced by the MSME sector is with regard to collections. Either there would be delay in receiving collections from their purchasers which includes the government too or delay in receiving GST refunds etc. (Mishra, 2020b) (Figures 1 & 2).

Other Problems of MSMEs (Mukherjee & Mukherjee, 2021)

Banks inability to lend: Over 90 percent of MSMEs firms are existing in the unregulated sector. They do not have facility to avail financing from banks. Under the priority sector lending scheme, even the banks were unable to disburse the funds reserved for MSMEs.

High interest rates: MSMEs in India get credit at comparatively higher rates of interest. The rate of interest charged on loans granted by the Export-Import Bank of India is around 10-12%. This is much higher compared to countries like China where interest rate is less than 1%.

MSMEs considered high risk for bank: Banks and business organizations consider lending to MSMEs as risky as they are incapable of providing collateral and they do not fulfill the tight conditions prescribed by banks or institutions like Small Industries Development Bank of India (SIDBI) for availing loan facilities.

Lack of credit rating mechanism and limited fintech products: Good credit rating facilitates easy availability of finance. There is non-availability of integrated credit rating machinery in India. MSMEs are beyond the reach of modern credit facilities such as digital credit and there is limited availability of advanced fintech products.

Suggestions for Revival and Development of MSMES

It is suggested by the ILO that governmental efforts should focus on worker health and safety, economic stimulus and income and employment support (Behera et al., 2020). In the phase of COVID-19 chaos, there is a need for the government to set up on a continuous basis, a monitoring system and announce immediate relief measures to increase the MSMEs sector’s confidence (Behera et al., 2020).

Given the devastating outcome of pandemic on MSME sector, many studies have identified measures which can be taken by the government for the revitalization and improvement of MSMEs. The measures have been classified into 5 headings:

1. Financial

2. Partnerships

3. Digitalization and technology support

4. Infrastructural

5. Reach and coverage of measures

Financial: Providing loans to MSMEs at low rates of interest and long-term repayments should be considered by the government. Besides, the lending limit to MSMEs should be augmented. The loan repayment period might be extended to decrease the burden in the short run. There should be provision for stable and decent cash flows from the government to the entrepreneurs (Behera et al., 2020). Moreover, the facilities to access credit should be improved. Government may guarantee the loans and providing adequate liquidity in terms of cash availability to MSME entrepreneurs based in rural areas in India will satisfy their financial needs. The Government would be the guarantor for loans rose by MSMEs from commercial banks and would repay it in case of default by enterprises. Subsidies need to be provided by the government to business enterprises so that they could withstand the losses and run their business operations uninterruptedly. The Government can bring in regulations to extend the repayment period of loans by enterprises. This measure would provide the necessary financial support and would enable entrepreneurs to recover their losses (Roy et al., 2020).

Partnerships: Government should foster partnerships. Partnerships may be through collaboration with current foreign players in order to establish strongly in the Indian market or to create efficient production base (Behera et al., 2020). Trade agreements with developed nations can help in importing innovative technical equipment which leads to efficiencies in production. Government should assist MSME business entrepreneurs to form trade agreements with developed nations (Roy et al., 2020).

Digitalization and technology support: Government should promote a digitally activated internal environment with arrangements in place for data protection and employee productivity, so that remote working can be possible. New-age technological advances need to be incorporated in MSMEs. Leveraging technology can bring in improvement of process efficiency, cost savings, transparency in information disclosure and boosts safety of worker. Online banking enables enterprises to run business transactions bypassing physical contact (Behera et al., 2020).

Infrastructural: Stable power supply (Mittal, 2020): Stable power supply has significant impact in the manufacturing industry and subsequently on India’s development. Quality of power determines the capacity utilization in the manufacturing sector. Substandard power that is not stable and subject to fluctuations results in constant tripping. This in turn leads to resetting thousands of machines, adversely affecting the productivity and finally asset quality deteriorates. This would pose risk for finance providers and stakeholders which should be addressed.

Reach and coverage of measures (Sipahi, 2020): The issue confronting MSMEs is that though the government relief measures are well conceptualized, there is no adequate information reaching the intended beneficiaries. There are problems pertaining to administration of schemes with speed and efficiency. The following steps are worthwhile to extend the reach and coverage of Covid-19 relief measures:

1. The measures and schemes must have rules which are very much clear and transparent and should be capable of reaching the intended.

2. The information should be disseminated by the Ministry of Finance on a weekly basis so as to know about implementation of schemes and to appraise whether they are working as planned.

3. The whole process must be swift and should have arrangements in place when it moves towards operationalization stage.

4. The identification of deserving enterprises and labourers in the unregulated sector can be done with the help of trade unions and other labour market oriented institutions prevalent in our country.

5. Government need to collaborate with manufacturing and retail trade bodies and associations in order to draw insights from the surveys conducted with members of their businesses.

6. Selecting the suitable mechanism to provide the relief to the deserving weaker group will be the tougher challenge than the financial requirements.

7. SIDBI being a financial institution set up for the promotion and development of the MSMEs should take the lead role in identifying the businesses and entrepreneurs who are in desperate need for financial assistance.

8. It is commendable that SIDBI has previously declared emergency assistance loans and also it must collaborate all the efforts in funding and refinancing MSME sector.

9. SIDBI, which is poised with its large network and experience in this sector, can make significant strides for pumping low-cost credit to the MSMEs.

10. The UAM (Udyog Aadhaar Memorandum) and the MSME Databank can provide the much needed support in identifying the targeted enterprises.

11. A very flexible approach may be needed in order to make the government schemes available to micro units and also to every participant of this sector. The information available in various schemes like MUDRA (Micro Units Development & Refinance Agency Ltd), UAM MSME data base and Jan dhan, Aadhar and mobile (JAM) etc. should be utilized for this purpose.

Suggestions for MSMEs

MSMEs need to adopt different strategies for their products, its quality, differentiators, distribution models, etc. They need to undertake a detailed examination of their operations in order to formulate a strategy suitable for post Covid-19 operations. They can exploit rise in disposal incomes of consumers’ and shift in consumer tastes as well. Innovative technologies are shaping the relationships between buyers and suppliers connecting more locations and actions, which will provide more prospects for enterprises (Behera et al., 2020). There is a necessity for MSMEs to implement strategies suitable for global expansion (Sipahi, 2020).

Scope for Further Research

The present article brings out the review of literature surrounding MSMEs under 4 headings namely new definition of MSMEs, negative and positive effects of lockdown on MSMEs, problems of MSME and suggestions for revival and development of MSMEs. There is much scope for further research on specific problems of MSMEs, government measures, ways to improve sustainability and competitive advantage of MSMEs. The further research can go long way in the formulation of policy recommendations by the government of India.

Declaration of Conflicting interest: The Author declares that there is no conflict of interest.

Conclusion

MSMEs advantages for the nation’s development are immense. It is the worst affected sector due to pandemic. Though various studies have highlighted the problems and suggestions for the revival and improvement of MSMEs, government of India under Atma Nirbhar Bharat Abhiyan scheme has provided the much needed support for uplifting MSMEs. The problems of lack of access to institutional credit, intended beneficiaries being out of reach of government support and lack of digital support to MSMEs have been adequately addressed under the relief package. It is also to be understood that government support is not only required to just tide over the pandemic raised concerns but also to build long-term sustainability and competitive advantage of MSMEs.

References

Behera, M., Mishra, S., Mohapatra, N., & Behera, A. R. (2020). COVID-19 pandemic and micro, small and medium enterprises (MSMEs): policy response for revival. SEDME (Small Enterprises Development, Management & Extension Journal), 47(3), 213-228.

Indexed at, Google Scholar, Cross Ref

Borpuzari, P. (2020). With a low 'turnover' threshold, Government's new MSME definition sows confusion. The Economic Times.

Ghosh, S. (2020). Examining the COVID-19 relief package for MSMEs. Economic & Political Weekly, 55(22), 11.

Jha, A.K., & Jha, R. (2020). India’s response to COVID-19 crisis. The Indian Economic Journal, 68(3), 341-351.

Indexed at, Google Scholar, Cross Ref

Krishna, R.V. (2021). Impact of COVID-19: Micro, small and medium enterprises in India, Pandemic Shock of COVID-19 and policy response: A bird’s eye view. part 2 02, Impact of COVID-19: Micro. Small and Medium Enterprises in India, Pandemic, 159-171.

Mishra, R. (2020a). Covid -19 and its impact on MSME in India. Outlook Money.

Mishra, U. (2020b). Explained: Why are medium, small, micro enterprises worst hit by Covid-19 lockdown?. The Indian Express.

Mittal, N. (2020). COVID-19 impact | Reviving post-lockdown MSME manufacturing. Moneycontrol.

Mukherjee, A., & Mukherjee, E. (2021). COVID-19: Impact on Indian SMEs and their Trade Integration'. IMI Konnect, 10(3), 11-26.

OECD. (2020). Coronavirus (COVID-19): SME Policy Responses.

Rastogi, V. (2020). Micro, small, and medium enterprises in India-An explainer. India Briefing.

Rathore, U., & Khanna, S. (2021). Impact of Covid-19 on MSMEs. Evidence from a Primary Firm Survey in India, Economic et Political Weekly, 56(24), 28-38.

Roy, A., Patnaik, B., Satpathy, I. (2020). Impact of Covid-19 crisis on Indian MSME sector: A study on remedial measures. Eurasian Chemical Communications, 2(9), 991-1000.

Indexed at, Google Scholar, Cross Ref

Sipahi, E. (2020). COVID 19 and MSMEs: A revival framework. Research Journal in Advanced Humanities, 1(2),7-21.

Tripathi, A. (2021). MSMEs in India-Post Covid Scenario. Times of India.

Received: 20-Jun-2022, Manuscript No. BSJ-22-12205; Editor assigned: 22-Jun-2022, PreQC No. BSJ-22-12205(PQ); Reviewed: 06-Jul-2022, QC No. BSJ-22-12205; Revised: 11-Jul-2022, Manuscript No. BSJ-22-12205(R); Published: 18-Jul-2022