Research Article: 2022 Vol: 26 Issue: 2S

Impact on Employees Perception in Public Sector Banks in the Chennai Metropolis.

Shyam Sundar J, H.H. Rajah’s College, Bharathidasan University

Thiruchelvam C, H.H. Rajahs College

Keywords

Public Sector Bank, Perception, Employee‘s Performance

Citation Information

Sundar, J., & Thiruchelvam, C. (2022). “Impact on employees perception in public sector banks in the Chennai metropolis”. International Journal of Entrepreneurship, 26(S2), 1-14.

Abstract

The banking and financial sector is an important sector for the development of the economy and the nation as a whole, which helps to provide the necessary financing to the different sectors of the economy. As a service industry, employee efficiency has an impact on the quality of service offered. After the liberalization of the Indian economy in 1991 and the banking sector reforms of 1998, the Indian banking sector has witnessed the realization of a realistic model of change. For India's banking sector was designed to comply with the Basel Accords with the trustworthy insolence of the RBI. This regulation aimed to ease direct credit restrictions in the area of priority sector lending measures, reduce legal preemption, deregulate interest rates and promote prudential rules. This is an area where the banking sector needs a considerable change in the basic premises for the management and development of human resources. Therefore, the present study titled "Impact of Perception of Employees of Public Sector Banks in Chennai." The area covered is the city of Chennai and the study is limited to public sector banks. This study examines the impact of public sector banks. Some employees of public sector banks in Chennai this study was considered to be both analytical and descriptive. It depends on both primary and secondary data.

Introduction

The banking and financial sector is an important sector for the development of the economy and the nation as a whole, which helps to provide the necessary financing to the different sectors of the economy. As a service industry, employee efficiency has an impact on the quality of service offered. However, it would have been natural that the professionalization of personnel management had a higher priority, but unfortunately personnel management turned out to be the most neglected aspect of banking management. This aspect is further accentuated by the fact that the banks operate in a seller's market with a total absence of any element of opposition and that the prices of the deposits accepted are determined by the banks, but by an external body such as the RBI and the Government From India. In a privileged environment like this, the need for professionalization of bank management was never felt as the staffs were managed by a non-expert and usually by a poor civil servant who could not otherwise thrive in banking operations. After the liberalization of the Indian economy in 1991 and the banking sector reforms of 1998, the Indian banking sector experienced a realistic change of model. As the Indian banking sector was designed to comply with the Basel accords with the reliable insolvency of the RBI. Regulations aimed at relaxing direct credit limitations in the framework of credit measures in the priority sector, reducing legal preemption, liberalizing interest rates and promoting prudential regulations.

Statement of Problem

The Banking is now a part of the larger financial company agency in India. It is a number one player feature in Indian economy. The variety of game enthusiasts with inside the market and the type of services and facilities furnished are increasing, thereby signifying greater immoderate competition. In the past research has confirmed relationship and effect of HRM practices in banking ordinary overall performance, only a few precise statistical works has achieved to look at the relationship amongst HRM practices and ordinary overall performance basis and employees belief in banking location. Finally, the global places with inside the growing ranges like India need to recognize the contribution of different factors and intensity of their impact on the employee ordinary overall performance that leads towards monetary development. This is an area in which banking agency needs massive trade with inside the essential premises for human resource manage and development. Hence, the winning look at entitled ―Impact of employee Perception and Performance of Public Sector Banks in Chennai‖ has been undertaken. The area covered is Chennai and the look at is constrained to the overall public location banks.

Significance of the Study

Employees, whose workforce is sufficiently educated, educated, trained and mobilized to take advantage of new advances in production techniques in the organization that the creation of an industry of progress becomes possible. The ever-growing importance of HR practices in today's environment has led to a wider range of human resource dimensions moving away from treating humans as means towards a perspective where they are valued as an end in their own right. Empowerment depends on the expansion of people's capacities, which implies an expansion of choices and, therefore, an increase in freedom. People's development must involve them as active participants rather than making them passive beneficiaries. Human behavior is the result of power is the result of the interaction between individual consciousness and the forces and pressures of the outside world. Power resides in every aspect of the web of strengths, values and beliefs that determine human behavior.

Review of Literature

Harriet Kales Gather (2015) in the present competitive world, the banking sector, especially of the developing economies like India, is facing lot of tough competition, talent crunch, and skill shortage. All these have made the banks feel that the internal customer is also more important equally with external customers, so every bank is trying to devise innovative HR practices to attract best talent and give them comfortable environment to work with, that enables the banks to retain talents. In the present study, forty nine innovative HRM practices have been identified which are being used by the Indian public sector and private sector banks. The banking sector is the financial pillar of the Indian economy. No doubt the level of implementation of these innovations may not be satisfactory, yet the implementation has been started and the favorable results in the productivity will make these banks feel how important these are for their growth. It has been found that convergence of practices of new and innovative HR areas will benefit the banks to become more competitive in the global market. Researchers might also want to look at the differences, if any, in the adoption of innovative HRM practices from developed and emerging market perspectives. Industry wise comparisons can also be done using some secondary financial data.

Oyeniyi (2014) this research paper investigated the effect of HRM practices on job satisfaction among Nigerian banks staff. The current study used five HRM practices such as compensation practice, supervisory role practice, promotion practice, training practice and performance evaluation practice. On the basis of the findings of this research work, it can be concluded that compensation practice, promotion practice and performance evaluation have positive effect on job satisfaction among Nigerian banks staff but supervisory role practice and training practice have negative effect on job satisfaction among Nigerian banks staff.

The current study revealed that performance evaluation performance is most important factor for creating satisfaction among employees in Nigerian banks.

Objective of the Study

The Objectives of the Study are as Follows

1. To observe the worker belief and overall performance of Public Sector Banks in Chennai metropolis

2. To examine on belief of financial institution personnel toward the general public area banks.

3. To dealings with overall performance degree of personnel in public area banks.

Research Methodology

This study is impact employee perception and performance of selected public sector banks employees in Chennai. This study was taken as both analytical and descriptive in nature. It depends upon both primary and secondary data.

Research Design

The study was designed on the basis of the descriptive method. Therefore, both primary and secondary data were needed. Secondary data for the study was collected from sources such as the annual report of public sector banks, RBI newsletters, RBI quarterly reviews, government publications, and textbooks.

Hypothesis of the Study

Ho1: There is no significant relationship among the bank employees in their perception towards the employees of the selected banks.

Ho1: There is no significant among employees performance of selected public sector banks.

Field Work and Collection of Data

This study was conducted using the questionnaire method and personal interview by the researcher. The researcher used a structured interview program for personal interview purposes. Interviews are being conducted at some public sector banks in Chennai.

Sample Size

The researcher has adopted simple random sampling method. Initially 400 questionnaires were distributed to the customers spread over in Chennai. However, 22 questionnaires were found inadequate response. Hence, they were rejected, but only 378 respondents returned the filled up questionnaires out of 300. In which 378 of them are found usable. Hence, the accurate sample of the study is 378.

Framework Analysis

The sources of statistics are number one in addition to secondary. The data collected from the chosen public area banks in Chennai. The survey constitutes number one and data amassed via books, journals, magazines, reports, dairies are taken into consideration because the secondary source. The statistics amassed from each the reasserts is scrutinized, edited and tabulated. The statistics is analyzed the usage of statistical bundle for social sciences (SPSS).

Limitations of the Study

The study is limited to the segment of public sector banks in Chennai only. Private Banks were not included due to their limited presence in the study area. In addition, non-residents and account holders were not interviewed for obvious reasons. Although adequate security measures have been taken to minimize respondent reporting bias, a certain degree of error or prejudice is likely to be overcome.

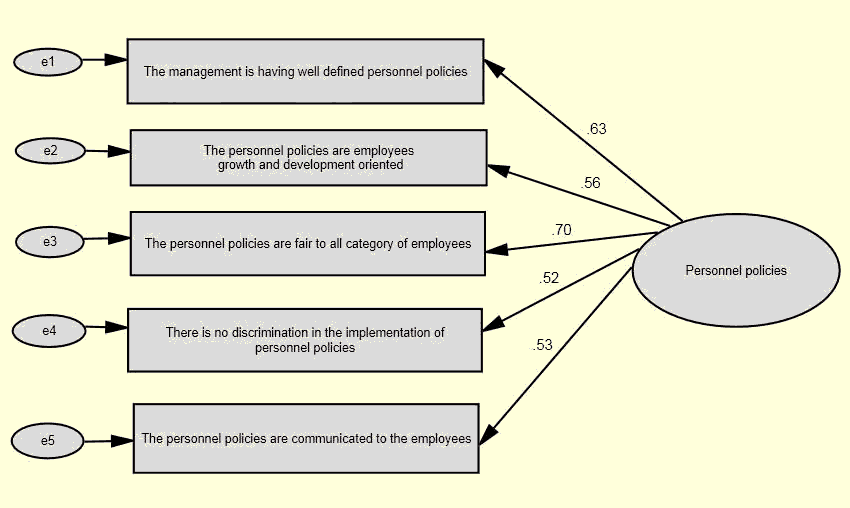

Perception towards Personnel Policies of PSBs

Personnel policies play a vital role among the employees of any organization. This section examines the perception that bank employees have of PSB personnel policies. To test the significant difference between the mean value of the variables measured and the mean test response of 3 (mean score), the following null hypothesis was formulated. as shows in Figure 1.

Figure 1 shows the perception of PSB employee‘s vis-à-vis the staff policies of the bank. The‗t‘ values for the variables, namely 20.61, 19.79, 19.20, 15.63 and 21.18 are significant at the 1% level. Difference between average responses given by employees to PSB personnel policies. The null hypothesis is therefore rejected. In addition, the mean values of the five variables are greater than the mean score of 3. This indicates that PSB employees have a positive perception of PSB personnel policies. Among the five variables, the average score of personnel policies is communicated to employees (average score: 4.02) first. This shows that PSBs in India clearly communicate personnel policies to their employees. Likewise, the personnel policy variables focus on employee growth and development, and personnel policies are fair for all categories of employees who score above the average of 3. Therefore, it can be concluded that the employees of PSB in Chennai have a positive perception of the personnel policies of PSB.

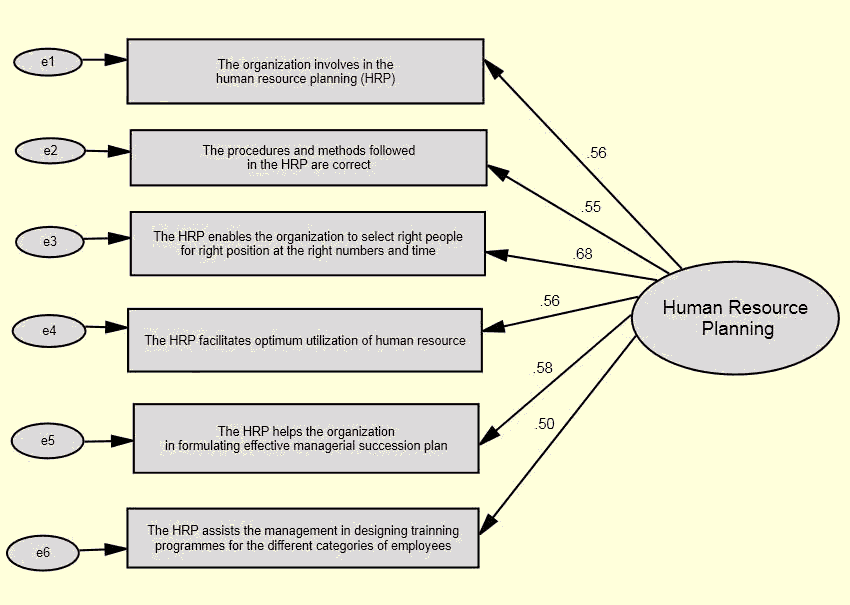

Perception towards Human Resource Planning in PSBs

Human resource planning (HRP) plays a vital role in the management of human resources in an organization. Human resource planning is a process of identifying the right employees for an organization. Thus, the success of the organization depends on this selection of human power. HRP helps an organization select the right people for the right job at the right time and the right numbers. The results of the analysis to test the perceptions of the PRH employees in the PSBs are presented in Figure 2.

Figure 2 shows the t values for the variables chosen for measuring the perception of bank employees towards the HRP in PSBs. Interestingly the t-values of all the six variables are significant at 1% level. Therefore, the null hypothesis is rejected. This shows that the there is significant difference among the mean responses given by employees of PSBs. Further, the mean values of the entire six variables are higher than the average score of 3. Of the six variables, the first variables, that is, organization involves the employees in HRP secured highest score. This shows that PSBs in India involve employees in HRP. Further, the variable procedures and methods followed in the HRP are correct secured 3.95 mean score against the average of 3. Therefore, it can be inferred that PSBs in India are adopting correct procedure for making HR plan. The mean values of all the six variables chosen for studying the perception of employees on HRP in PSBs have secured higher than the average mean score of 3. Hence it can be viewed that the employees of PSBs have positive perception towards the practice of HRP of PSBs.

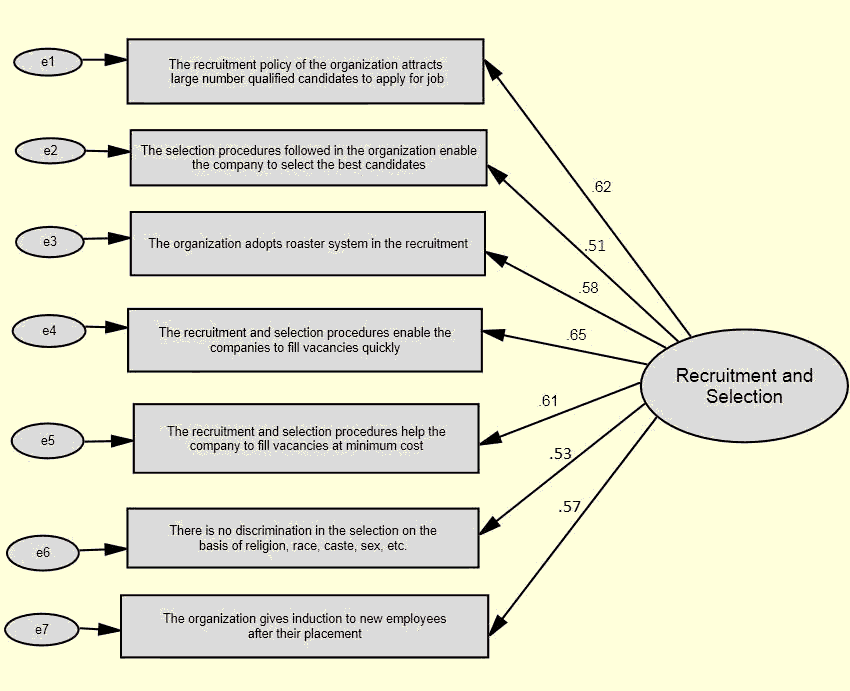

Perception towards Recruitment and Selection Process in PSBS

Appropriate recruitment and selection policy helps an organization to recruit right people for right position. In the present competitive environment, organization faces the problems of talent shortage. Fair recruitment and selection policy enables an organization to attract and select the best talents in a shorter period. Seven variables were taken to measure the perception of employees. One sample t-test was applied to study the perception. To test significant difference among the mean values of the variables measured the following null hypothesis was formulated. as shows in Figure 3.

Figure 3 shows the results of the employee test. Perception of the PSB recruitment and selection policy and procedure shows that the ―t‖ values for the seven variables taken for the study are significant at the 1% level. Shows that there is a significant difference between the average responses given by employees to the PSB recruitment and selection policy and procedure. The null hypothesis is therefore rejected. In addition, the mean scores for the seven variables are higher than the mean score of 3. Among the even variables, the variables no discrimination in selection based on religion, race, caste, sex, and so on. Note (3.95). This indicates that the PSBs do not discriminate against people on the basis of religion, race, caste, gender, etc). Shows that adequate recruitment and selection procedures help the bank to recruit people at lower cost. Given that all other variables scored above the mean score of 3, it can be concluded that PSB employees have a positive perception of PSB recruitment and selection procedures.

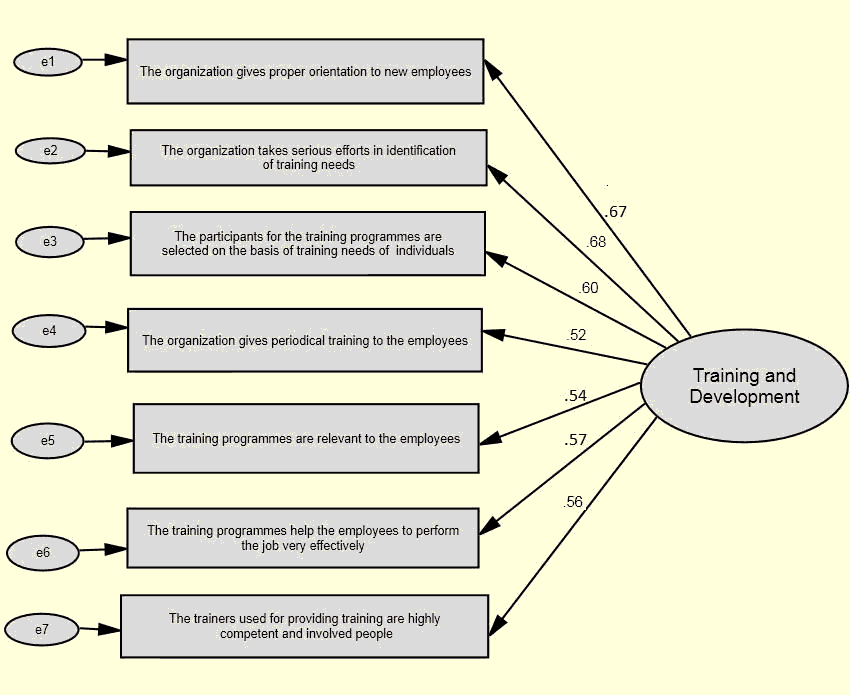

Perception of Training and Development practices in PSBS

Training and development (T and D) plays a fundamental role in updating employee knowledge and skills. In a fast-paced business environment, change happens at a faster pace. Technology very quickly becomes absolute. Therefore, T and D have become very essential to fill the skills gap in organizations. T and D must be based on necessity. Irrelevant training does nothing to help the employees and the organization. This section examines bank employees' perceptions of PSB's T&D practices. A test sample was used to study employee perception. Seven variables relating to T and D were used to measure employee perception. To test the significant difference between the mean values of the variables used to measure employee perception, the following null hypothesis was formulated. Table 4 shows the results of the tests on the variables used to measure employee perception of T and D. as shows in Figure 4.

Figure 4 shows that the t values of the variables used to measure employee perception of T and D are 26.82, 15.06, 11.95, 22.05, 22.76, 33.10 and 17.41. All these t values are significant at the 1% level. Difference between the average response given by employees on their perception of T and D in the PSB. The null hypothesis is therefore rejected. In addition, the mean values of the seven variables taken to measure the perception towards T and D are higher than the mean score of 3. This leads to the conclusion that PSB employees have a positive perception of T&D practices in PSBs. Of the seven variables, variable training programs help employees do their jobs effectively with the highest average score (4.31). Subsequently, the organization variable provides adequate orientation to new employees who obtained a high mean score (4.17). This shows that PSBs in India provide adequate counseling for new employees. The mean values of the other variables show that the PSB training programs are relevant, needs-based and effective. PSBs in India, with a separate training center, provide periodic training to their employees.

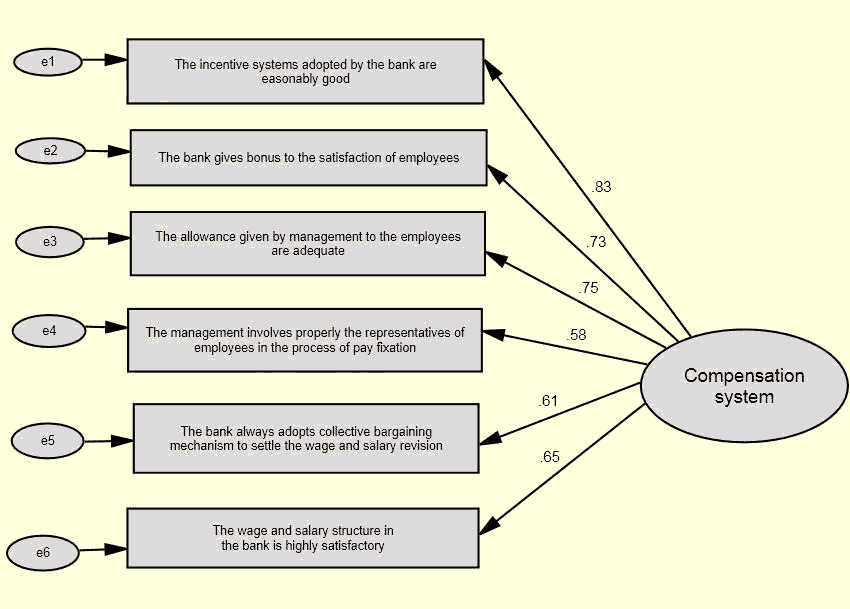

Perception of the Remuneration System in the PSB

The remuneration system plays a fundamental role in the human resources practices of an organization. The fair compensation system allows the organization to attract very talented people and retain the best talent in the organization. This section attempts to study the perception of bank employees the remuneration system in PSBs. For this purpose, a sample test was applied. The results of the test are shown in figure 5. To test the significant difference between the mean values of the variables used to measure employees' perception of the PSB salary, the following null hypothesis

Figure 5 presents the t values of the variables used to study employees' perceptions of the PSB remuneration system. The t-values of the six variables are significant at the 1% level. This shows that there is a significant difference between the average responses given by employees with regard to the remuneration of the PSB system. Therefore, the formulated null hypothesis is rejected. The mean values for the six variables are higher than the mean score for Test 3. Therefore, it can be concluded that the employees of the PSB have a positive perception of the bank's remuneration system.

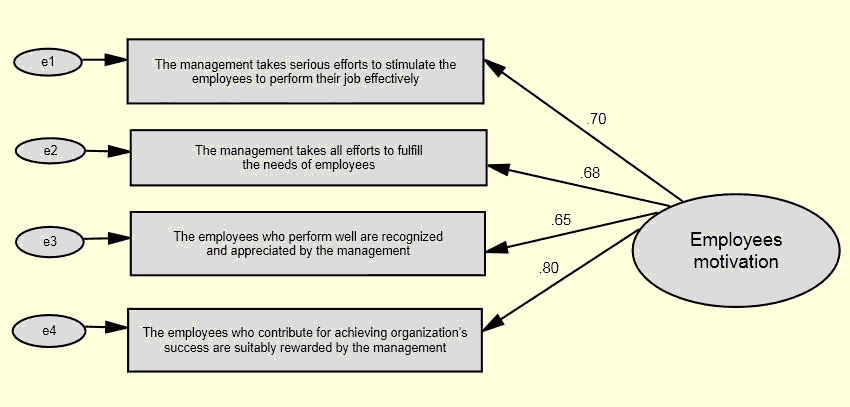

Perception towards the Motivation System in PSB

The motivation system has the capacity to convert people's skills into performance. This section deals with employee perceptions of the motivation system in PSBs. An example test was adopted to apply employee perception. Four variables, namely, (i) "management makes serious efforts to stimulate employees to do their jobs effectively", (ii) management strives to meet the needs of employees, (iii) employees who work well are recognized and appreciated by management, and (iv) employees who contribute to the success of the organization are appropriately rewarded by management are taken to measure employee perception of the motivation system within the PSB. To test the significant difference between the average values of the variables used to measure employees' perception of employee motivation, the following null hypothesis was formulated. as shows in Figure 6.

It can be deduced from figure 6 that the values of 't' for the four variables are significant at the 1% level. This shows that there is a significant difference between the average responses given by employees regarding their perception of employee motivation in PSBs. The null hypothesis is therefore rejected. In addition, the average values of the four variables used to measure employee motivation perceptions scored higher than the average score of 3. This shows that employees have a positive perception of the motivation system in PSBs. Of the four variables, ―employees who contribute to the success of the organization are adequately rewarded by management‖ obtained the highest average score (3.83). as shows in Table 1.

| Table 1 Association Between Age And Quality Of Work |

|||||||

|---|---|---|---|---|---|---|---|

| Sum of Squares | Df | Mean Square | F | Sig. | |||

| Neatness and perfection | Between Groups | 13.167 | 3 | 4.389 | 2.693 | .046 | |

| Within Groups | 611.255 | 375 | 1.630 | ||||

| Total | 624.422 | 378 | |||||

| Highest level of satisfaction | 5.346 | 3 | 1.782 | 1.113 | 0.344 | ||

| Within Groups | 600.686 | 375 | 1.602 | ||||

| Total | 606.032 | 378 | |||||

| Grasp the problems and find solutions | Between Groups | 9.944 | 3 | 3.315 | 2.089 | .101 | |

| Within Groups | 595.132 | 375 | 1.587 | ||||

| Total | 605.077 | 378 | |||||

The table 1 association between age, cleanliness and perfection has been tested by one-way ANOVA. The mean value was 1.630 within the groups and the F value was 2.693. There is a significant difference between age and cleanliness and perfection was 0.046. Age and level of satisfaction were tested and the mean value was 1,602 within the groups and the F value was 1,113. There is a significant difference with age and level of satisfaction (m. 344). Age, typing issues, and finding solutions were tested by one-way ANOVA. The average level was 1.587 and the F value was 1.113. The significant difference between age and the ability to understand problems and find solutions was 0.101. as shows in Table 2.

| Table 2 Association With Qualification And Quality Of Work |

|||||||

|---|---|---|---|---|---|---|---|

| Sum of Squares | Df | Mean Square | F | Sig. | |||

| Neatness and perfection | Between Groups | 1.208 | 3 | .403 | 0.242 | 0.867 | |

| Within Groups | 623.214 | 375 | 1.662 | ||||

| Total | 624.422 | 378 | |||||

| Highest level of satisfaction | Between Groups | 19.575 | 3 | 6.525 | 4.172 | 0.006 | |

| Within Groups | 586.456 | 375 | 1.564 | ||||

| Total | 606.032 | 378 | |||||

| Grasp the problems and find solutions | Between Groups | 6.681 | 3 | 2.227 | 1.396 | 0.244 | |

| Within Groups | 598.395 | 375 | 1.596 | ||||

| Total | 605.077 | 378 | |||||

Table 2 Respondents' qualifications and their accuracy and perfection in a job were compared to the one-way ANOVA test. The mean value was 1.662 within the groups and the F value was 0.242. There is a significant difference between the qualification of the respondents and their precision and perfection in the job (M. 867) The level of qualification and satisfaction was compared using the one-way ANOVA tool. The root mean square score was 1,564 in the groups and the F value was 4,172. There is a significant difference between qualification and level of satisfaction (M. 006). One-way ANOVA was used to uncover the relationship between skills and problems grasp and find solutions. The mean square was 1,604 and the F value was 0.772, 0.244). Qualification creates impact to grasp problems and find solutions to problems. as shows in Table 3.

| Table 3 Association With Annual Income And Quality Of Work |

||||||

|---|---|---|---|---|---|---|

| Sum of Squares | Df | Mean Square | F | Sig. | ||

| Neatness and perfection | Between Groups | 1.158 | 3 | 0.386 | 0.232 | 0.874 |

| Within Groups | 623.264 | 375 | 1.662 | |||

| Total | 624.422 | 378 | ||||

| Satisfaction of my superiors and customers | Between Groups | 1.499 | 3 | 0.500 | 0.310 | 0.818 |

| Within Groups | 604.532 | 375 | 1.612 | |||

| Total | 606.032 | 378 | ||||

| Grasp the problems and find solutions | Between Groups | 3.715 | 3 | 1.238 | 0.772 | 0.510 |

| Within Groups | 601.362 | 375 | 1.604 | |||

| Total | 605.077 | 378 | ||||

Table 3 Annual incomes and quality of work with three variables (cleanliness and perfection, satisfaction of my superiors and customers, Grasping problems and finding solutions) were compared using the ANOVA test. The average square for cleanliness and perfection was 1662, my supervisor and client satisfaction was 1612, and Capturing Problems and Finding Solutions was 1604 within a group. The F-value for three variables was 0.232, 0.320, and 0.772, respectively. The significant difference between the annual income and cleanliness and perfection was 0.874, the annual income and satisfaction of my superiors and clients was 0.818, and the annual income and the problems of entering and finding solutions were respectively of 0.510. as shows in Table 4.

| Table 4 Association With Age And Initiative And Dependability |

||||||

|---|---|---|---|---|---|---|

| Sum of Squares | Df | Mean Square | F | Sig. | ||

| Challenging task | Between Groups | 1.484 | 3 | 0.495 | 0.404 | 0.750 |

| Within Groups | 459.550 | 375 | 1.225 | |||

| Total | 461.034 | 378 | ||||

| Plan the work and go ahead | Between Groups | 29.887 | 3 | 9.962 | 7.094 | 0.000 |

| Within Groups | 526.657 | 375 | 1.404 | |||

| Total | 556.544 | 378 | ||||

| Self-starter and perform job without supervision | Between Groups | 15.702 | 3 | 5.234 | 3.259 | 0.022 |

| Within Groups | 602.245 | 375 | 1.606 | |||

| Total | 617.947 | 378 | ||||

Table 4 the relationship between the age of employees and the capacity for initiative and reliability with three variables (difficult tasks, planning and progress of work and ability to start and perform unsupervised work) was tested by the ANOVA tool in one direction. The average square for the difficult task was 1.225, the work and progress schedule was 1.404, and the automatic start and execution of unsupervised work was 1.606 within groups. The F value for three variables was 0.404, 7.094, and 3.259, respectively. There is a significant difference between the age and activity of the challenger was 0.750 and the age and self-defense and unsupervised work performance were 0.022 respectively. There is no relationship between age and work planning and advancement. as shows in Table 5.

| Table 5 Association with qualification and Initiative and dependability |

|||||||

|---|---|---|---|---|---|---|---|

| Sum of Squares | Df | Mean Square | F | Sig. | |||

| Challenging ask | Between Groups | 4.164 | 3 | 1.388 | 1.139 | 0.333 | |

| Within Groups | 456.870 | 375 | 1.218 | ||||

| Total | 461.034 | 378 | |||||

| Plan the work and go ahead | Between Groups | 12.257 | 3 | 4.086 | 2.815 | 0.039 | |

| Within Groups | 544.286 | 375 | 1.451 | ||||

| Total | 556.544 | 378 | |||||

| Self-starter and perform job without supervision | Between Groups | 10.913 | 3 | 3.638 | 2.247 | 0.082 | |

| Within Groups | 607.034 | 375 | 1.619 | ||||

| Total | 617.947 | 378 | |||||

Table 5 the one-way ANOVA tool was used to discover the relationship between qualification and initiative and employee reliability with three variables (demanding tasks, plan work and go ahead and start alone and work without supervision). a significant difference between qualification and initiative and reliability of employees with three variables. The result showed that the mean square for a difficult task was 1218, the work planning and progress was 1451, and the automatic start and execution of unsupervised work was 1619 within groups. The F value for three variables was 1.139, 2.815, and 2.247. The significant difference between qualifying and difficult task was 0.333, qualifying and planning work and moving forward was 0.039, and qualifying and starting self-employment and performing unsupervised work was 0.082.

Findings and Suggestions

• Most of the underage employees work as bank clerks and the middle aged clerks work at very low levels in banks.

• The number of male employees is higher than that of female employees in some banking sectors, work more other groups of diplomas. In banks, who work in banks, they are mostly married compared to single employees.

• Most bank workers earn more than 6 lakhs in salary compared to other salary categories.

• Most bank employees belong to the urban area than the employees, who studied from the rural and metropolitan city. The person who depends on the farm family works the most in the banking sectors. They really want to work in the banking industry compared to other employees born into the family.

• Almost all employees in the bank have a clear understanding of the metrics used for employee perception and performance. Most of the respondents in the sample agreed to a large extent for the performance goals set for them are action-oriented. They also have a clear understanding of the perception and performance assessment methods used in selected banking sectors.

• Most employees have a positive opinion of the management of the bank in recording the performance details of individual employees. Some banking sectors do not conduct performance appraisal and perception reviews at desired levels of their employees. Management in some banking sectors sets performance standards for its employees at the start of each fiscal year. The established standards are also communicated to its employees. The performance and perception assessment system is more transparent in some banking sectors, as most employees strongly felt.

• The relationship between the age and the capacity for initiative and reliability of employees with three variables (difficult tasks, work planning and progression and start of skills and execution of unsupervised work) was tested by the ANOVA tool one-way. There is a significant difference between age and demanding task was 0.750 and age and automatic start and unsupervised work performance were 0.022, respectively. There is no relationship between age and planning to work and move forward.

• The ANOVA One way tool was used to discover the relationship between qualification and initiative and employee reliability with three variables (demanding tasks, planning and progress of work, and autonomous starting and performing of work without supervision). The significant difference between skill and hard task was 0.333, skill and work schedule and progression was 0.039, and skill and auto start and unsupervised work was 0.082.

• A one-way ANOVA tool was used to compare the relationship between annual income and capacity for initiative and reliability with three variables (difficult tasks, plan work and go ahead and start alone and do a job unsupervised). The difference between annual income and demanding task was 0.008, annual income and work plan were 0.661, and annual income and auto starter were 0.628 respectively.

• A one-way ANOVA was performed to compare the relationship between age and creativity and decision making with three variables (working differently, creativity for constructive suggestions, and quick decision). The difference between age and working differently was. 032, age and creativity were 0.115, and age and rapid decision-making skills were 0.014, respectively.

• Employees in some banking sectors felt that the performance and perception assessment system would not lead them to understand the responsibilities and duties of the position. This means that the other areas of human resource development and functional areas are also responsible for understanding the responsibilities and functions, strengths and weaknesses of employees. The small number of employees in the sample among all middle managers did not share the view expressed by the majority of employees. Most of the underage employees work as bank clerks and the middle aged clerks work at very low levels in banks. The number of male employees is higher than that of female employees in some banking sectors.

• In banks, who work in banks, they are mostly married compared to single employees. Most bank workers earn more than 6 lakhs in salary compared to other salary categories.

• Most bank employees belong to the urban area than the employees, who studied from the rural and metropolitan city. The person who depends on the farm family works the most in the banking sectors. They really want to work in the banking industry compared to other employees born into the family.

• Almost all employees in the sample bank have a clear understanding of the metrics used for employee perception and performance.

• Most of the respondents in the sample agreed to a large extent for the performance goals set for them are action-oriented.

• They also have a clear understanding of the perception and performance assessment methods used in selected banking sectors.

• Most employees have a positive opinion of the management of the bank in recording the performance details of individual employees. Some banking sectors do not conduct performance appraisal and perception reviews at desired levels of their employees. Management in some banking sectors sets performance standards for its employees at the start of each fiscal year. The established standards are also communicated to its employees.

• The performance and perception assessment system is more transparent in some banking sectors, as most employees strongly felt. The relationship between the age and the capacity for initiative and reliability of employees with three variables (difficult tasks, work planning and progression and start of skills and execution of unsupervised work) was tested by the ANOVA tool one-way. There is a significant difference between age and demanding task was 0.750 and age and automatic start and unsupervised work performance were 0.022, respectively. There is no relationship between age and planning to work and move forward.

• The ANOVA One-way tool was used to discover the relationship between qualification and initiative and employee reliability with three variables (demanding tasks, planning and progress of work, and autonomous starting and performing of work without supervision). The significant difference between skill and hard task was 0.333, skill and work schedule and progression was 0.039, and skill and auto start and unsupervised work was 0.082.

• A one-way ANOVA tool was used to compare the relationship between annual income and capacity for initiative and reliability with three variables (difficult tasks, plan work and go ahead and start alone and do a job unsupervised). The difference between annual income and demanding task was 0.008, annual income and work plan were 0.661, and annual income and auto starter were 0.628 respectively.

• A one-way ANOVA was performed to compare the relationship between age and creativity and decision making with three variables (working differently, creativity for constructive suggestions, and quick decision). The difference between age and working differently was. 032, age and creativity were 0.115, and age and rapid decision-making skills were 0.014, respectively.

• Employees in some banking sectors felt that the performance and perception assessment system would not lead them to understand the responsibilities and duties of the position.

• This means that the other areas of human resource development and functional areas are also responsible for understanding the responsibilities and functions, strengths and weaknesses of employees. The small number of employees in the sample among all middle managers did not share the view expressed by the majority of employees.

Conclusions

To conclude, this study has highlighted the impact of the perception and performance of human employees of the selected banks. Most of the bank employees have a positive perception of their bank and the result of the analysis shows that their performance for the development of the bank is also good. Employees have a good understanding of the bank's personnel policy, resource planning, human resources, recruitment and selection, the remuneration system, employee motivation, performance evaluation and interpersonal relations. Banks provide adequate training to employees to improve their individual skills.

References

Browne, M.W., & Cudeek, R. (1993). ‗Alternative ways of assessing model fit. In Bollen K.A. and Long J.S (ed), Testing Structural Equation Models, Sage, Newbury Park, C.A.

Carmines, E.C., & Mclver, J.P. (1981). Analyzing models with unobserved variable‘. In Bohrnstedt, G.W. Borgatta, E.F. (edition). Social Measurement: Sage, Beverly Hills.

Joreskog, K.G., & Sorbon, D. (1984). LISREL-IV Users‘ Guide. Chicago: Scientific Software.

Haavelmo, T. (1943). The statistical implications of a system of simultaneous equations." Econometric 11, 1–2. Reprinted in D.F. Hendry and M.S. Morgan (Eds.), The Foundations of Econometric Analysis, Cambridge University Press, 477—490.

Pearl, J. (2000). Causality: Models, reasoning, and inference. Cambridge: Cambridge University Press.

Preeti, B. (2015). Impact of E-HRM system on organizational performance: A case study on banking sector 2. International Journal of Advance Research and Innovation, 3(4), 73.

Mayakkannan. (2020). A study on performance evaluation of selected public and private sector banks through camel model in India. Purakala, 31(25), 202-206.

Sumathy, M. (2010). Banking Industry Vision-2010. The Indian banker, 2, 33-37.

Wheaton, B., Muthen, B., Alwin, D.F., & Summers, G.F. (1977). ‗Assessing reliability and stability in panel models‘, In Heise, D.R. 84-136, Sociological Methodology, Joessey-Bas, San Francisco.

Wright, S.S. (1921)."Correlation and causation". Journal of Agricultural Research, 20, 557–85.