Research Article: 2021 Vol: 25 Issue: 1

Information Support of the Entrepreneurship Model Complex with the Application of Cloud Technologies

Aleksy Kwilinski, London Academy of Science and Business

Valeriya Litvin, Financial University under the Government of the Russian Federation

Ekaterina Kamchatova, State University of management

Julia Polusmiak, Zaporiszhzhia National University

Daria Mironova, Don State Technical University

Abstract

The study has proved that the use of V-statistics is a reliable tool for assessing the forecast horizon of the entrepreneurship model. According to the results obtained, the forecast time horizon for most of the studied cryptocurrencies does not exceed 30 days when using daily observations. Computer experiments have confirmed the effectiveness of the implementation of machine learning methods and algorithms for solving the problems of forecasting the short-term dynamics of financial instruments, for example, cryptocurrency. In particular, a BART model has been developed or ARIMA-ARFIMA ensembles can be used as the basis for algorithms for automated trading systems designed for online trading. The developed methodological approach and recommendations on the practical application of the system of economic and mathematical models based on the tools of binary autoregressive trees and data mining allow developing a short-term forecast of innovative financial instruments in order to make effective investment decisions on the crypto market. A comprehensive analysis of the state and dynamics of the cryptocurrency market, their features, advantages, and disadvantages allows concluding that despite significant fluctuations in their exchange value and gaps in legislative regulation, digital currencies are a modern stage in the evolution of means of payment. Therefore, crypto assets and IT technologies on their platforms quickly adapt in the modern globalized world and will occupy a worthy place in the innovative digital economy.

Keywords

Entrepreneurship Model, Cryptocurrency, Digital Currency, Forecast, Forecasting, Mining.

Introduction

Today, the growth in world trade, the widespread adoption of information technology, the active use of the Internet and electronic payments, plastic cards and electronic signatures have created the prerequisites for the transition of the world economy to a new state - the “digital economy” - an economy, which is based on digital computer technologies.

At the same time, it should be noted that, in the digital economy, it is not goods that come first, but services, including services of a virtual nature, in particular those related to intellectual property that exist only in the process of using computer programs. Among the whole variety of technologies of the digital economy developing at an accelerated pace, innovative digital technologies in the financial sector occupy a special place.

The need for reliable information support for financial transactions and mutual payments has led to the rapid development and widespread adoption of blockchain technology, on the platform of which in 2009 the first cryptographic currency bitcoin was developed and put into circulation (Bitcoin, BTC).

In the early 2000s, the technological basis for the implementation of digital money was finally formed: this process lasted more than 40 years in the field of cryptography and the concept of virtual money has been developed by various researchers and enthusiasts for 20 years.

On the other hand, the development and use of digital currencies were significantly stimulated not only by current but also long-term problems of the modern financial system. The global financial crisis of 2008 most clearly revealed its contradictions, in particular, an increase in the regulatory role of central banks, an increase in cash emissions and a general decrease in economic stability.

In addition, the existing money transfer system is outdated and clearly needed innovative ideas: world money began to insufficiently fulfill one of its main functions - to be an effective means of payment and savings.

The aim of the work is to develop the theoretical basis for the application of economic and mathematical methods and models for assessing statistical properties and forecasting the exchange rate value of cryptocurrency, to develop on this basis practical recommendations on the use of cryptocurrency as an effective financial instrument in the modern digital economy.

Review of Previous Studies

In economic science, active theoretical and applied research of cryptocurrency began in the last decade, so the question of their economic nature and functions, classification and taxonomy, areas of use, and economic and mathematical modeling and development prospects are new and require further development.

The rapid fluctuations in the exchange rate and capitalization level of leading cryptocurrencies over the past few years, on the one hand, and the uncertainty regarding their legal status in most countries of the world, on the other, have led to fierce dispute about the appropriateness of their use as investment assets or means of payment (Bech & Garratt, 2017).

From an applied point of view, these issues are related (Apostolaki, et al., 2017; Tatiana, et al., 2018), in particular, with the possibility and effectiveness of assessing the riskiness of investing in crypto assets based on the forecasting of their exchange rate and potential volume capitalization, level of volatility and the like.

The theoretical and applied aspects of modeling and forecasting innovative financial instruments are the subject of scientific papers by Alzakholi, et al. (2020); Fernández-Pérez, et al. (2019); Leong, et. al. (2020) and others.

However, the analysis of literary sources shows that, in the scientific literature, the issues of modeling the cryptocurrency market receive much less attention (Phillip, et al., 2018) than the study of other financial instruments.

At the same time, there is no consensus among scientists regarding the fundamental value of cryptocurrency. An analysis of recent theoretical and applied research indicates (Filser, et al., 2020; Pal, 2020; Baber, et al., 2020) that the thesis that the cryptocurrency exchange rate is determined primarily by the ratio of supply and demand is dominant. Many latent factors influence the price dynamics of cryptocurrencies, while key factors or drivers are still not well understood and identified.

In addition, the time series of the vast majority of cryptocurrencies are characterized by a high degree of volatility, non-stationarity, and non-Gaussian distribution laws (Gilad, et al., 2017).

Therefore, the use of traditional forecasting methods based on the use of casual models built within the framework of a certain theoretical concept or classical time series models has proved to be ineffective.

Thus, to solve the problem of forecasting and evaluating cryptocurrency, it is necessary to develop adequate economic and mathematical tools, which, in our opinion, should be based on a synthesis of classical and modern methods of processing time series, fractal analysis, and artificial intelligence models, in particular, machine learning technology.

Methodology

To solve the tasks set in the work, the author used general scientific methods, the fundamental principles of science in the field of financial investments and innovations, a systematic approach that allowed critically interpreting the economic essence of cryptocurrency and its role in the development of a modern digital economy.

For the software implementation of scientific research, modern information technologies, data mining, and machine learning methods using MS Azure ML Studio, Power BI, R-Studio were used.

The research information base was composed of official data of world stock exchanges; factual materials contained in monographic studies, articles of domestic and foreign scientists; reference information on special publications, including those posted on Internet services.

Results and Discussion

The need to predict financial indicators is objective because no decision making (short, medium or long-term) can be improvised. The quality of decisions depends on the ability to predict. Among the factors that provide high-quality forecasting are: the efficiency of information processing, the ability to critically analyze forecast estimates and the like. All stages of forecasting, from the organization to interpretation of the results, can be described as non-trivial.

Therefore, information technology is of great help in this process. Today, there are a large number of application software packages that have been specially developed for carrying out calculations using various forecasting methods, which allow for large-volume calculations and high-quality forecasts.

Segmentation occurs at the level of services that are designed for a particular target audience. Traditionally, clouds are distributed for ordinary users and for business but this separation is somewhat arbitrary because the locomotives of the IT industry such as Google, Microsoft, Amazon, and others offer comprehensive solutions taking into account various tasks for various consumers using cloud technologies:

SaaS (software as a service) is a software as a service or software that does not require installation on a computer. SaaS includes various document management systems, as well as servers for organizing collaboration and communication with customers. An example is email or Google Does.

IaaS (Infrastructure-as-a-Service) is an infrastructure as a service, or directly cloud storage technologies. The most famous world infrastructure service IaaS is Amazon Web Services.

PaaS (Platform as a Service) is cloud technologies that allow creating your own applications and services without installing special equipment and software. A striking example of PaaS technology is the Microsoft Azure service, with which any user (individual or collective) can create its own applications based on Windows or Linux.

Azure Machine Learning was designed for applied machine learning and has an intuitive drag-and-drop interface. The service has the best and most common algorithms. In the process of working on the practical implementation of our tasks, it turned out that the standard functionality of Azure ML is not enough. This disadvantage is offset by the presence of an extension in the form of a script in the programming language R (and it is also possible to use the Python or C# language).

- Power BI is a web service for creating and sharing dashboards and reports. Power BI Desktop is a tool that allows developing reports (that is, visualizing the results) both at the initial stage of data preparation, processing and analysis and at the final stage of evaluation of the results.

For joint application of Microsoft Azure Machine Learning Studio, Microsoft Power BI and RStudio, Azure Cosmos DB database is used. It stores the input and processed data and accesses it from any of the three sources mentioned above.

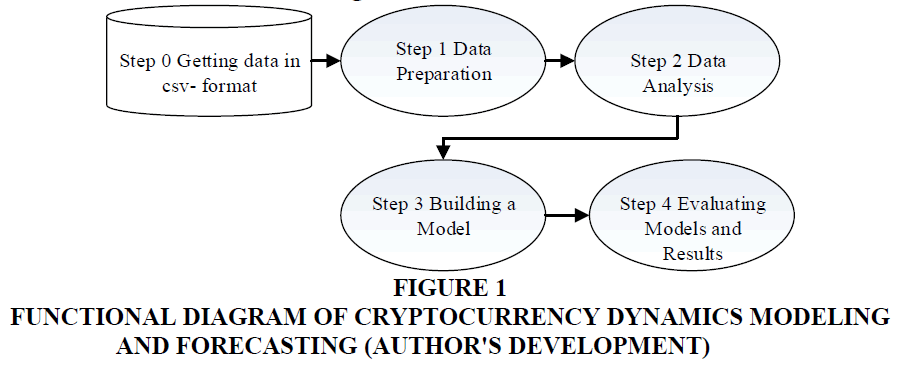

Figure 1 shows generalized and expanded functional diagrams of cryptocurrency dynamics modeling and forecasting as a step-by-step process of performing the basic research steps in Microsoft Azure Machine Learning Studio.

Figure 1 Functional Diagram of Cryptocurrency Dynamics Modeling and Forecasting (Author's Development)

Implementation projects for practical tasks in Azure ML Studio are called experiments. In our work, six experiments for 10 time series were performed (Table 1). The data from 2 time series for classical financial instruments and 8 cryptocurrencies were used in the work.

| Table 1 Experiments on Forecasting Exchange Rates of Cryptocurrencies in Azure ML Studio (Author's Development) | ||

| Experiment | Model | Explanation |

| No 1 | AR, MA, ARMA | The experiments were conducted using the traditional procedure of mathematical modeling and analysis of time series |

| ARIMA | ||

| No2 | BART | The experiments were conducted using machine learning approaches |

| No3 | ARFIMA | |

Since all three types of models use only past observations of the investigated time series to make a forecast, then one of the main tasks of their identification is the choice of lag depth. According to the results of many empirical studies, for “traditional” financial assets (fiat currencies, stock and commodity indices, stock prices, etc) that are traded for 5 business days a week, there is a seasonal lag, which is a multiple of 5 if daily observations are used.

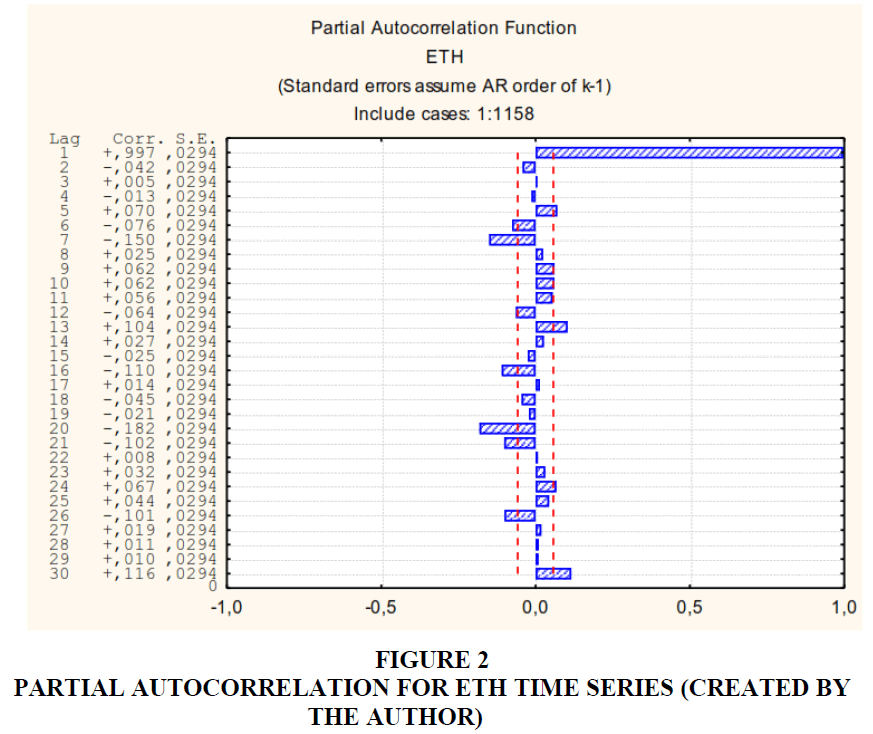

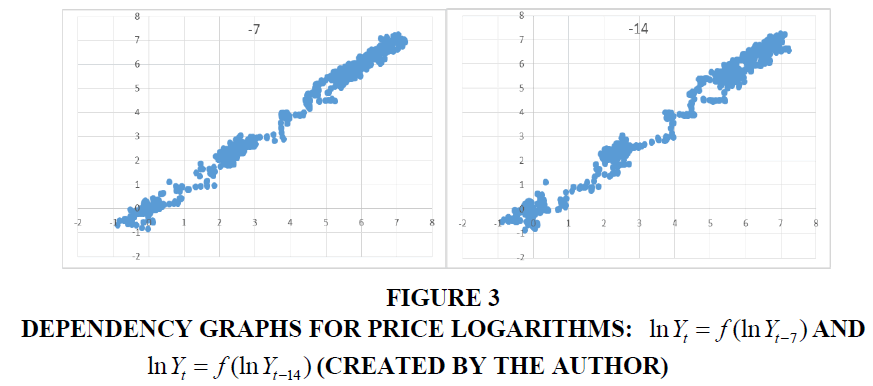

Since cryptocurrencies are traded 24/7, a seasonal lag multiple of 7 days is expected. Carrying out correlation analysis using the autocorrelation and partial autocorrelation functions confirmed this hypothesis: for the vast majority of the studied cryptocurrencies, there are statistically significant correlations on lags 7, 14, 21. Besides, there are correlations on other lags.

Figure 2 shows a graph of a partial autocorrelation function for the ETH cryptocurrency,

and Figure 3. (a), (b) shows dependency graphs for the logarithms of prices: ln (ln )  and ln (ln ) c accordingly. For other time series, a similar correlation structure is

observed, which is a multiple of 7 days.

and ln (ln ) c accordingly. For other time series, a similar correlation structure is

observed, which is a multiple of 7 days.

Daily quotes from 01 August 2015 to 01 October 2018 were selected for analysis. Such a time period was chosen to ensure the same length of all time series (1158 observations).

It should be noted that the selected period is characterized by various types of dynamic modes: from slow to rapid growth, anomalous fall, and then stabilization.

The first 1098 observations for the constructed models were divided in a ratio of 80% to 20% between the training and test samples and were used to fit, train models and evaluate their parameters, while the last 60 observations were reserved for model validation and forecast quality estimation based on the mean absolute percentage error (MAPE) and root-mean-square error (RMSE).

It is also possible to see that all models, despite the generally adequate consideration of existing trends in the dynamics of cryptocurrency, show a certain delay relative to real data.

To test the prognostic properties of the proposed BART algorithm, the authors also made a forecast of the dynamics of selected cryptocurrencies using classic time series models: ARlMA and ARFIMA. The fractional integration parameter d was chosen as the local Hurst coefficient of the corresponding currency (Table 2).

| Table 2 Results of Estimation of Forecast Accuracy for the Period 08.01.18 - 01.10.18 (Developed by the Author on the Basis of Model Experiments) | ||||||

| BTC | ETH | XRP | ||||

| MAPE, % | RMSE | MAPE, % | RMSE | MAPE, % | RMSE | |

| The trend of price change is transitional | ||||||

| BART-7 | 2,47 | 212,31 | 3,78 | 15,09 | 4,66 | 0,0227 |

| ARIMA | 3,21 | 246,5 | 4,52 | 18,15 | 4,88 | 0,0228 |

| ARFIMA | 2,65 | 211,6 | 3,8 | 15,26 | 5,22 | 0,0232 |

Based on the analysis of the data in the Table 2 it can be argued that the accuracy of the BART model turned out to be higher for all the series under study than for the models of the ARIMA-ARF1MA family, and averaged (arithmetic mean for the basket of 8 cryptocurrencies studied) 3.7% in the sense of the MAPE metric. According to the RMSE metric, the BART model was also the best.

It should be noted that the RMSE indicator can only be used to assess the quality of various forecasts for one financial instrument (time series). It provides information about the magnitude of the error but not about how large this error is compared to the real value of the quote. Unlike RMSE, MAPE in percentage allows evaluating the effectiveness of forecasts of both individual models and their ensembles for various assets and comparing them with each other.

Model experiments were also carried out both for the studied time interval and for subperiods, which were characterized by different types of dynamics of the series under study. According to the obtained estimates of the forecast horizon, a forecast was made for 5, 10, 14, 21 and 30 time periods (days).

Recommendations

To evaluate the prognostic properties, the authors used the mean absolute percentage error metric (MAPE). Results (average results for the basket of cryptocurrencies studied) of the forecast for all sub-periods for 3 models (BART, ARFIMA, ARIMA) are obtained.

Thus, according to the results obtained, the forecast accuracy using the BART algorithm was within 4% for the forecast horizon of up to 14 days, regardless of the dynamic mode of the series under study; 6% for the forecast horizon of 21 days; 8% for a 30-day forecast.

At the same time, the errors of the forecast of the proposed model based on the BART algorithm are on average twice lower than that of ARIMA models and 15-20% lower than of ARFIMA models for subperiods of slow dynamics change.

Note that for the subperiods of complex dynamics (rapid changes in trends) of the cryptocurrencies studied, all models showed the worst prognostic properties, but the BART model provides more accurate forecasts than the ARIMA-ARFIMA model family.

Conclusion

Given the fact that the search for drivers for cryptocurrencies (factor, explanatory variables) remains open, complicating the use of cause-and-effect models, machine learning (ML) methods and algorithms are more effective for forecasting the dynamics of innovative financial instruments, in particular, cryptocurrencies. This is because the methods used to search for patterns and hidden templates do not require a priori information about data structures and the nature of their relationships.

The analysis of statistical properties indicates that for the vast majority of the cryptocurrencies under study, the hypothesis of a normal law of distribution of both prices and returns is not confirmed.

Using both classical statistical tests and the approach proposed by the author, based on the application of Monte Carlo simulation and the maximum likelihood method, shows that the vast majority of cryptocurrencies are described by power laws and log-normal distribution, which makes use of classical statistical and econometric forecasting methods ineffective.

The analysis of the fractal properties of the studied cryptocurrencies showed that almost all time series are persistent (i.e., trend persistent). The assessment of the forecast horizon using fractal properties (V statistics) and entropy methods has an average of about 30 days.

According to the results obtained, the forecast accuracy using the BART algorithm was within 4% for the forecast horizon of up to 14 days, regardless of the dynamic mode of the series under study; 6% for the forecast horizon of 21 days; 8% for the 3-day forecast. At the same time, the errors of the forecast of the proposed model for the BART algorithm are on average twice lower than for ARIMA models and 15–20% lower than ARFIMA ones for subperiods of slow dynamics change.

According to the results of binary classification of the direction of price changes, the proposed BART models showed an average accuracy of about 63% for the time series under study, which is higher than for the “naive forecast” model.

References

- Apostolaki, M., Zohar, A., & Vanbever, L. (2017, May). Hijacking bitcoin: Routing attacks on cryptocurrencies. In 2017 IEEE Symposium on Security and Privacy (SP) (pp. 375-392). IEEE.

- Alzakholi, O., Shukur, H., Zebari, R., Abas, S., & Sadeeq, M. (2020). Comparison among cloud technologies and cloud performance. Journal of Applied Science and Technology Trends, 1(2), 40-47.

- Bech, M. L., & Garratt, R. (2017). Central bank cryptocurrencies. BIS Quarterly Review September.

- Gilad, Y., Hemo, R., Micali, S., Vlachos, G., & Zeldovich, N. (2017, October). Algorand: Scaling byzantine agreements for cryptocurrencies. In Proceedings of the 26th Symposium on Operating Systems Principles 51-68.

- Fernández-Pérez, V., Montes-Merino, A., Rodríguez-Ariza, L., & Galicia, P. E. A. (2019). Emotional competencies and cognitive antecedents in shaping student’s entrepreneurial intention: the moderating role of entrepreneurship education. International Entrepreneurship and Management Journal, 15(1), 281-305.

- Leong, C., Tan, F. T. C., Tan, B., & Faisal, F. (2020). The emancipatory potential of digital entrepreneurship: A study of financial technology-driven inclusive growth. Information & Management, 103384.

- Filser, M., Tiberius, V., Kraus, S., Zeitlhofer, T., Kailer, N., & Müller, A. (2020). Opportunity recognition: Conversational foundations and pathways ahead. Entrepreneurship Research Journal, 1.

- Pal, S. (2016). Information Sharing and Communications with Mobile Cloud Technology: Applications and Challenges. In Handbook of Research on Mobile Devices and Applications in Higher Education Settings (pp. 53-71). IGI Global.

- Phillip, A., Chan, J. S., & Peiris, S. (2018). A new look at Cryptocurrencies. Economics Letters, 163, 6-9.

- Tatiana, U., Ludmyla, G., Iryna, T., Olga, D., & Ludmila, S. (2018). Economical Self-Sufficiency of a Territorial Community as a System Characteristic of Its Self-Development. Academy of Strategic Management Journal, 17(5), 1-8.

- Baber, W. W., Ojala, A., & Martinez, R. (2020). Digitalization and Evolution of Business Model Pathways Among Japanese Software SMEs. In Transforming Japanese Business (pp. 153-165). Springer, Singapore.