Research Article: 2020 Vol: 24 Issue: 1S

Investments and Energy Conservation Projects: Format of International Entrepreneurship

Svitlana Petrovska, National Aviation University, Ukraine

Alla Hotsalyuk, Kyiv National University of Culture and Arts, Ukraine

Dеnys Martyshyn, Interregional Academy of Personnel Management, Ukraine

Nadiia Tymchenko, Kherson State Maritime Academy, Ukraine

Olena Kuzmenko, Kherson State Maritime Academy, Ukraine

Abstract

The article defines the components of the implementation of entrepreneurship elements of investment energy conservation processes. A structural justification for the strategic support of the investment energy conservation has been provided and a compositional model of the strategic support for regulation of the investment process of energy conservation at the international entrepreneurship level has been formed. A mechanism for the functioning of the infrastructure of strategic planning support for energy conservation at the national level has been developed.

Keywords

Entrepreneurship Elements, International Entrepreneurship, Investment Support, Compositional Model Of Strategic Support, Social And Economic Policy, Strategic Development, Energy Conservation Process.

JEL Classifications

M5, Q2.

Introduction

Constant social and economic transformations in the global world and deepening of the market relations determine a change in the principles of organization and functioning of the investment process at all levels of economic relations management, including the national one. Indeed, the management of investment processes at this level is the most important means of implementing an effective social and economic policy, conducting strategic transformations of the leading sectors of the national economy, and increasing the efficiency of their functioning. In modern conditions, the urgent task of economic science is the study and justification of new forms and methods of national strategic regulation of investment activity. It is clear that a balanced investment strategy is one of the key factors determining the nature of the country's sustainable economic development. These issues are extremely important for the investment policy of energy conservation and its strategic support.

Methodology

In terms of the methodological support of this scientific work, three dialectical concepts are distinguished, namely: 1) the concept of resource saving as the strategic vector of the functioning of the national economy and as the basis for increasing its competitiveness, efficiency, and profitability of economic activity as a whole at the country level and its regional formations; 2) the concept of priority of economic policy, that is, the provision by the state of benefits to certain economic spheres, types of economic activity, amd forms of management in order to most effectively use the natural and economic potential, investment resources and provide a solution to existing social and economic problems; 3) the concept of the investment energy conservation policy, within which we proceed from the fact that it is a focused activity of state and regional government bodies to attract and efficiently use the investment potential of the region, which is aimed at reducing the level of use of energy resources and the energy-intensive GDP by introducing scientific and technological achievements in the field of energy and improving the strategic management of energy conservation processes.

Literature Review

The need for the theoretical justification of the mechanisms for implementing the investment energy conservation policy and their practical application in modern conditions in the context of further strengthening and developing the national economy are identified in (Brunke et al., 2014; Fleiter et al., 2012; Somov, 2018). A study of the problems of developing investment activity and increasing its efficiency was performed by such scientists as (Cooremans, 2012; Francis & Ibbotson, 2002). It is worth noting the fundings of the studies of well-known scholars in the field of investment policy and its strategic support, in particular (An & Pivo, 2017; Hourcade et al., 2006; Uihlein & Eder, 2010; Tatiana et al., 2018). Changes in recent years necessitated the development of scientific provisions in the direction of the formation of effective mechanisms for strategic support of the investment policy of energy conservation (Drobyazko et al., 2019 a, b), aimed at ensuring favorable conditions for the social and economic development of the national economy.

Findings and Discussion

In the context of globalization of the world economy, such a characteristic of the country's economy as its competitiveness in the global commodity and financial markets, which increasingly depends on the latest technologies and innovations in production and financial spheres, and the transformation of science into the main productive force, comes to the fore. The stimulation of investment activity in any country should be considered as part of the model for the strategic development of its economy, provided that this model is a priority for social and economic development. An important factor affecting the development and effectiveness of national investment processes is investment infrastructure (Rezessy & Bertoldi, 2010).

This is the issue of energy conservation that is central among the strategic areas of investment policy of the countries of the world because the transition to an innovative development path has necessitated a review of the existing and formatting of new strategic areas for the development of national economies, which should provide an increase in the relationship between the “education → science → production” model (Van Soest & Bulte, 2001).

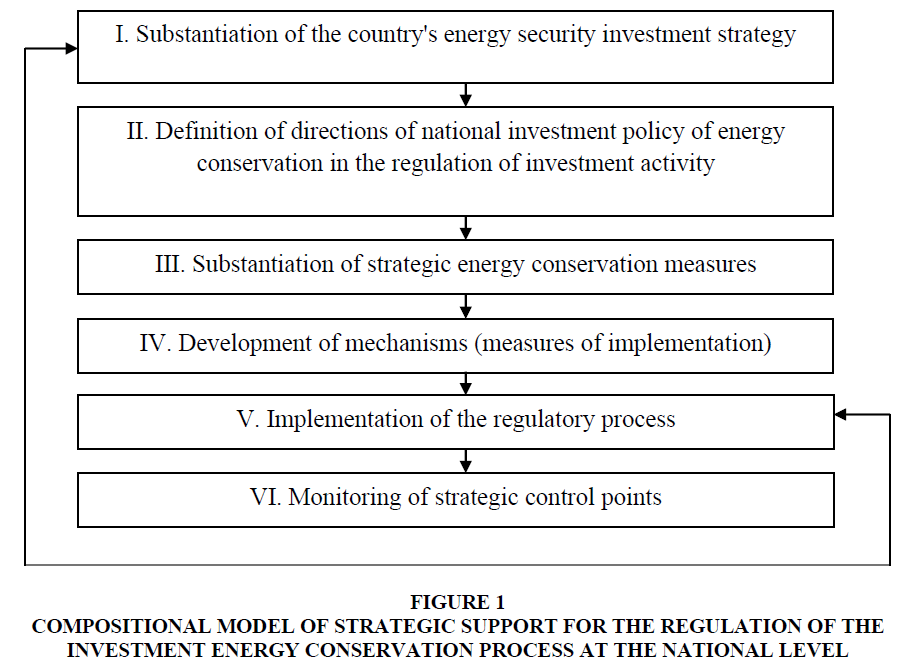

The strategic support of the investment energy conservation process can be defined as the actual process of creating conditions for the optimal formation and allocation of investment resources in order to ensure the rational use of energy resources or as the activities of state and regional authorities to develop a state energy conservation policy, and the definition and effective application of mechanisms for its implementation. Based on the principle of hierarchy, an appropriate strategic support scheme for this system is proposed (Figure 1).

Figure 1 Compositional Model of Strategic Support for the Regulation of the Investment Energy Conservation Process at the National Level

The functions of state regulation of investment support for energy conservation processes should be (Popescu et al., 2012; Trianni et al., 2014):

1. formulation of strategic and tactical goals and priorities for investing in the region's energy conservation sphere.

2. creation of a legal framework for the functioning of regional capital markets.

3. protection of the competition and regulation of investment prices.

4. observance of social values.

5. partial redistribution of income of fields and industries.

6. regulation of foreign investment in the field of national energy conservation.

7. investments in the development of energy conservation projects and activities in the region’s economy.

8. compliance with the focus of investments on equalizing the aggregate demand and aggregate supply.

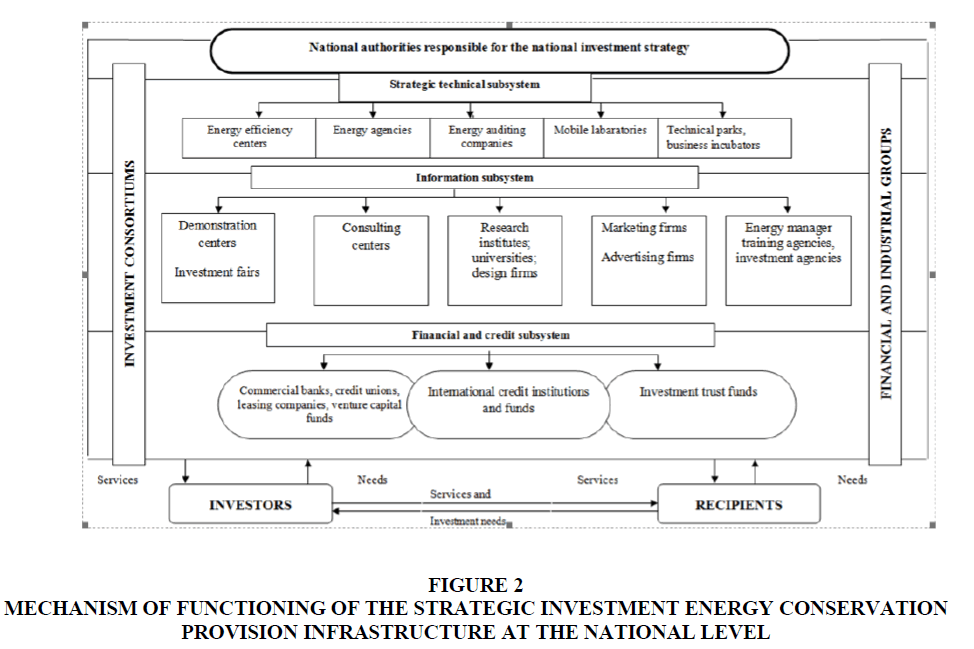

Thus, the innovation and investment infrastructure as a system should be formed on the basis of three subsystems: 1) financial and credit, 2) technical and organizational, 3) information and consulting, which operate in close interconnection and as a result have a synergistic effect (Borgeson et al., 2014; Metelenko et al., 2019).

Infrastructure as a complex system of institutions and mechanisms combines them into separate subsystems for their functional purpose (Figure 2).

Figure 2 Mechanism of Functioning of the Strategic Investment Energy Conservation Provision Infrastructure at the National Level

For a more detailed analysis of infrastructure functions, it should be noted that their implementation is possible through the joint activity of the elements that form it. In particular, the effective accumulation and distribution of financial resources among entities that implement energy conservation projects is an important task for financial intermediaries.

The quality and cost of services provided by banks, international financial institutions, donor organizations, determine how quickly, cheaply, and to what extent mobilization of financial resources will occur (Bierman & Smidt, 2012). At the same time, the efficiency of decision-making on financing national energy conservation projects is directly influenced by the level of work of the technical and organizational infrastructure subsystem, which is designed to carry out energy audits and energy management of investment objects.

On the other hand, ensuring the strategic feasibility and continuity of the investment process and creating a reliable, transparent mechanism for the distribution of available financial resources is possible only in the conditions of high level of functioning of the information subsystem for the dissemination of information about energy conservation measures and projects, consulting and exploring the possibilities of their implementation, and assessing the benefits related to investing and more.

Given the functional relationship between the infrastructure subsystems and their elements, the distribution of the main infrastructure tasks of the strategic investment support for energy conservation, which each of the subsystems is designed to fulfill, is carried out (Table 1).

| Table 1 Main Tasks of the Subsystems of the Strategic Investment Energy Conservation Provision Infrastructure | |

| Subsystem name | Infrastructure subsystem task |

| Financial and credit subsystem | - ensuring the optimal distribution of financial resources among investment projects and energy conservation measures; - risk assessment of the investment decision; - creation of new effective mechanisms for financing the energy conservation projects |

| Technical and organizational subsystem | - prioritization and justification of the feasibility of implementing the energy conservation measures; - introduction of the energy management system at investment sites; - monitoring and control of the implementation of energy conversation projects and evaluation of their effectiveness after implementation; - provision of technical support when developing investment projects in the field of energy conservation |

| Information subsystem | - acceleration of the movement of market information about the possibility of attracting financial resources in energy conservation projects; - popularization and information on energy conservation opportunities in the country; - implementation of research work on energy conservation; - involvement of the public in the discussion of the most important energy efficiency projects; - protection of intellectual property when introducing new technical and design solutions |

Thus, the interaction of elements of the national infrastructure will ensure the maximum efficiency and timely implementation of any energy conservation programs and activities.

In our opinion, the assessment of the current level of infrastructure development should be carried out in order to identify the potential, additional opportunities associated with the social and economic development of the country and increase its investment attractiveness (Copiello, 2017). It should be linked to the analysis of social and economic development and its strategy and also take into account the interests of entities of national relations. As the studies showed, the process of development of the infrastructure support in the country influences the interests of three main groups of entities of public relations, which interact within the national space: population, entrepreneurs, and government bodies. For all these entities, this process is associated with the presence of both a number of advantages and a number of possible disadvantages or risks.

Recommendations

To ensure the intensive social and economic development of the regions, long-term growth and the achievement of a high level of economic indicators, conditions for activating the investment policy of energy conservation may be formed. This problem is very important in the context of global technological development, the solution of which requires a review of the impact of existing investment mechanisms on energy conservation processes in the planes of national economic borders, the search for effective forms of interaction between the entities of international investment policy in accordance with the requirements of the global economy, social and economic and political goals of global development society and modern practice of investment activity.

It is believed that an important social and economic problem of improvement of energy efficiency indicators cannot be solved without taking into account the specific features of the social and economic development of countries where a certain energy conservation infrastructure is created. At the same time, despite a number of achievements in the field of improvement of the energy efficiency indicators at the national level, there is practically no systematic approach to the development of the regional energy conservation investment policy and the economy energy efficiency management strategy.

Conclusion

The article has stated that national investment infrastructure in the field of energy conservation should be represented by: 1) national and regional programs, projects; 2) programs, projects and grants of international organizations; 3) energy conservation enterprises, associations, and organizations; 4) educational and consulting and analytical organizations and resources. Most of its components are at the stage of their formation or act solely on their tasks without coordination with national problems of innovative development.

The study of the peculiarities of financing innovative and investment projects in the field of energy conservation (at the country level) has shown that there is an objective need today to combine effective forms of interaction of state, international, and market institutions and to develop effective financial mechanisms based on this experience, current experience situation on the domestic financial market, and prospects for its development. It is proved that a wide strategic development of innovative energy conservation technologies is necessary and the implementation of the appropriate policy is required that would contribute to: reduction of GDP energy intensity and energy consumption in general; stimulation of the development of knowledge-intensive industries; effective investment of domestic and foreign investment in them.

References

- An, X., & Pivo, G. (2017). Green buildings in commercial mortgage-backed securities: The E_ects of LEED and Energy Star Certification on Default Risk and Loan Terms. Real Estate Economics, 1-36.

- Bierman, H. Jr., & Smidt, S. (2012). The capital budgeting decision. Economic analysis of investment projects. 9th ed., Routledge Taylor & Francis Group

- Borgeson, M., Zimring, M., & Goldman, C. (2014). The limits of financing for energy efciency. Technical report, Lawrence Berkeley National Laboratory.

- Brunke, J-C., Johansson, M., & Thollander, P. (2014). Empirical investigation of barriers and drivers to the adoption of energy conservation measures, energy management practices and energy services in the Swedish iron and steel industry. Journal of Cleaner Production, 84, 509-525.

- Cooremans, C. (2012). Investments in energy efficiency: Do the characteristics of investments matter? Energy Efficiency, 5, 497-518.

- Copiello, S. (2017). Building energy e_ciency: A research branch made of paradoxes. Renewable and Sustainable Energy Reviews, 69, 1064-1076.

- Drobyazko S., Barwińska-Małajowicz A., Ślusarczyk B., Zavidna L., & Danylovych-Kropyvnytska M. (2019). Innovative entrepreneurship models in the management system of enterprise competitiveness. Journal of Entrepreneurship Education, 22(4), 2019.

- Drobyazko S., Okulich-Kazarin V., Rogovyi A., Goltvenko O., & Marova S. (2019). factors of influence on the sustainable development in the strategy management of corporations. Academy of Strategic Management Journal, 18(Special Issue 1).

- Fleiter, T., Hirzel, S., & Worrell, E. (2012). The characteristics of energy-efficiency measures-A neglected dimension. Energy Policy, 51, 501-513.

- Francis., Jack, C., & Roger Ibbotson. (2002). Investments: A Global Perspective. Prentice Hall Inc.

- Hourcade, J.C., Jaccard, M., Bataille, C., & Ghersi, F. (2006). Hybrid modeling: New answers to old challenges. The Energy Journal, (Special Issue), 1-11.

- Metelenko, N.G., Kovalenko, O.V., Makedon, V., Merzhynskyi, Y.K., & Rudych, A.I. (2019). Infrastructure security of formation and development of sectoral corporate clusters. Journal of Security and Sustainability Issues, 9(1), 77-89.

- Popescu, D., Bienert, S., Schtzenhofer, C., & Boazu, R. (2012). Impact of energy efficiency measures on the economic value of buildings. Applied Energy, 89(1), 454-463.

- Rezessy, S., & Bertoldi, P. (2010). Financing energy efficiency: Forging the link between financing and project implementation. Ispra, Italy: European Commission, Joint Research Center.

- Somov, D. (2018). The functional approach to strategic management. Economic Annals, XXI(171), 19-22.

- Tatiana, U., Ludmyla, G., Iryna, T., Olga, D., & Ludmila, S. (2018). Economical self-sufficiency of a territorial community as a system characteristic of its self-development. Academy of Strategic Management Journal, 17(5).

- Trianni, A., Cagno, E., & De Donatis, A. (2014). A framework to characterize energy efficiency measures. Applied Energy, 118, 207-220.

- Uihlein, A., & Eder, P. (2010). Policy options towards an energy efficient residential building stock in the EU-27. Energy and Buildings, 42(6), 791-798.

- Van Soest, D.P., & Bulte, E.H. (2001). Does the energy-efficiency paradox exist? Technological progress and uncertainty. Environmental and Resource Economics, 18, 101-112.