Research Article: 2021 Vol: 25 Issue: 6

Is there a reduction in inequality in Peru as a result of foreign direct investment since the pacific alliance? A descriptive retrospective analysis

Percy David Maldonado-Cueva, Universidad César Vallejo

Cira Nancy Ozejo-Ludeña, Universidad César Vallejo

Víctor Hugo Fernández-Bedoya, Universidad César Vallejo

Citation Information: Percy David Maldonado-Cueva, Cira Nancy Ozejo-Ludeña, Víctor Hugo Fernández-Bedoya. (2021). Is there a reduction in inequality in peru as a result of foreign direct investment since the pacific alliance? A descriptive retrospective analysis. International Journal of Entrepreneurship, 25(6), 1-13.

Abstract

Research that analyzed how the member of the Pacific Alliance have presented a notable increase in foreign direct investment and how this situation led to constant social conflicts generated by income inequality, due to the fact that most of the commercial countries are characterized by being mineral-extracting economies, with the exception of Mexico. Despite showing economic growth, Peru suffered constant social conflicts; in view of this, the author’s pose the following research question: How has foreign direct investment favored the members of the Pacific Alliance and has this reduced inequality in Peru? A retrospective descriptive analysis based on information documented in government reports, books, and scientific articles published in indexed scientific journals was used to answer the research question. It was concluded that, despite economic growth due to foreign direct investment, the Pacific Alliance countries, particularly Colombia, Chile, and Peru, have experienced income inequality and ongoing social conflicts as a result of this situation.

Keywords

Foreign Direct Investment, FDI, Regional Integration, Economic Growth, Trade, Commerce, Economic Inequality.

Introduction

This research article examines foreign direct investment in Pacific Alliance member countries (Mexico, Colombia, Chile, and Peru), with a focus on Peru. The Pacific Alliance was consolidated on June 6, 2012, when its member countries went through a stage of opening their markets, with Mexico and Chile leading the way.

In the case of Mexico, this began in early 1994 with the signing of NAFTA (North American Free Trade Agreement) with the United States and Canada; Chile, seeking to introduce its agro- industrial products to international markets, developed an aggressive trade policy to liberalize its economy. Finally, we have Colombia and Peru, which decided to open their markets through free trade agreements at the end of the twentieth century.

In 2015, these four countries demonstrated continental leadership (Concha & Gómez, 2016). In the last decade, both Peru and the member countries have incorporated a trade policy presenting the same economic objectives; thus, Marchini (2015) mentions that the Pacific Alliance has proposed changes in the strategy of its development as a bloc, for the insertion of its products. This is positive when Foreign Direct Investment (from now on “FDI”) is accompanied by domestic investment and results in the formation of new companies with increased employment; however, foreign direct investment can displace local investment, lowering the employment rate; this occurs when companies already established in the domestic market are purchased, which rationalizes the workforce (Chiatchoua et al., 2016).

There is talk of an increase in FDI in Peru, but there has also been an increase in the privatization of companies or the purchase of already established companies, resulting in unsustainable economic growth and, as a result, an increase in inequality.

As a result, the authors posed the following research question: How has foreign direct investment benefited Pacific Alliance members, and how has this reduced inequality in Peru?

In Latin America, particularly in Pacific Alliance member countries, problems such as poverty, unemployment, and low competitiveness exist due to low added value in production and a lack of technology and innovation in comparison to their main trading partners in Asia (Arévalo, 2014); this unsustainable situation will continue in Pacific Alliance member countries.

The goal of this article was to identify and detail how foreign direct investment has favored Pacific Alliance members and whether this phenomenon has reduced inequality in Peru.

Literature Review

Peru's membership in the Pacific Alliance

The Pacific Alliance, signed on April 28, 2011 in Lima, Peru, and the Cali Declaration of 2013, established free transit of people, goods, services, and capital, as well as the creation of a platform for political projection and the improvement of the quality of life of its inhabitants. The regional bloc seeks trade liberalization among its trading partners in order to attract foreign investment and, as a result, to expand global value chains (Goulart, 2014).

Unlike other regional blocs such as Mercosur and CAN, the Alliance is interested in the participation of the business sector, generating the attraction of investments due to political stability, which is critical for the achievement of the regional bloc's objectives.

As a result, the Pacific Alliance represents a model of open regionalism, cooperating for access to Asia-Pacific markets due to their common interest, without abandoning their commitment to the region, as evidenced by their joint trust in education through scholarships and internships aimed at residents of their countries (Aranda & Salinas, 2015).

Another achievement of the Alliance, as mentioned by Duarte (2015), was to increase people exchange by eliminating visa requirements for tourism and business travel; in education, academic mobility increased through scholarships.

From a macroeconomic standpoint, the Pacific Alliance shows interesting data for international markets in 2012, such as GDP per capita of US$ 10,000, a population of 209 million inhabitants, and it’s GDP representing 35% of Latin America's total. It also attracted 70 billion dollars in FDI, with China being the main investor (Morales & Soto, 2014).

These indicators have increased due to the economic stability presented by the partner countries and the level of interdependence that Colombia, Chile, and Peru have due to their geographical location. However, interdependence takes into account more than just the member countries' trade volume; it also takes into account the economic and political aspects (Morales, 2017).

In the commercial aspect, the Pacific Alliance countries direct their interest in these last points, demonstrating similarity in similar political ideologies with a view to the Asian market, which is taken advantage of by its extractive economic system (Peru, Colombia, and Chile), exporting traditional goods (Maldonado, 2020), and the economic stability shown generates interest in the investment in international markets. Other authors believe that the Pacific Alliance is a US intervention against Mercosur, in which Brazil and Venezuela maintain South American leadership, and that this block, despite having a commercial nature, is focused on social and productive aspects (Hernández & Muñoz, 2015).

Is FDI within the Pacific Alliance sustainable for Peru?

FDI is defined as the international capital flows of a company that establishes a subsidiary in a country other than its own; this includes not only the transfer of resources, but also the generation of control (Krugman & Obstfeld, 2006). The Pacific Alliance demonstrates a policy focused on providing the highest level of FDI protection (Sarria, 2016), with members of the Alliance presenting increases in FDI leading to an increase in inequality, as mentioned by Suanes and Roca (2015) when referring to Latin American economies where FDI and income inequality present a positive relationship.

Although the FDI has a positive impact on economic growth, it also increases inequality in developing countries, such as Colombia, where investment is focused on extracting natural resources such as mining and petroleum (Aarón Iregui & Ramrez, 2012), rather than providing products with added value. Stiglitz (2020) claims that countries with higher inequality indices are less efficient and, as a result, their long-term growth is slowed.

During the 1980s, Peru experienced an economic crisis that necessitated a change in the economic system, particularly in its s enterprises, which resulted in their privatization and concessions; concessions being defined as the transfer of the use of national resources to the private sector (or foreign investments), as opposed to privatization, which consists of transferring ownership (Silva, 2008).

The Peruvian government used these strategies to reduce the fiscal deficit caused by the lost decade of the 1980s, while the level of inequality increased, causing social conflicts. This same perspective exists in Latin American countries where FDI has resulted in negative effects such as social inequality; one example is Colombia, where FDI has increased in recent years, focusing on the primary sector such as mining and oil extraction, but causing irregularities in its development and causing social protests (Cruz, 2018). Thus, Flores and Saavedra (2016) mention internal and external factors that favor FDI, the former being those controlled by the destination country and the latter being exogenous situations that do not depend on the country, an adequate adaptation of these factors generates FDI attraction and, as a result, economic growth, but at a high cost due to inequalities.

Carhuaricra & Parra (2016) also mentions vertical FDI and horizontal FDI; the former occurs when a company directs its production to another country with low production costs (from industrialized to less industrialized countries), while the latter occurs between industrialized country in order to avoid trade barriers, allowing greater access to local economies. Because their industries are so similar, horizontal FDI predominates among trading partners.

The four Pacific Alliance countries have different types of foreign direct investment. In the case of Peru, Colombia, and Chile, FDI is focused on the extraction of natural resources for subsequent export, accounting for 40% in Peru, 35% in Chile, and more than 50% in Colombia (all from 2006 to 2013), and only 5% in Mexico, where FDI is directed to the manufacturing sector, accounting for 47% (Marchini, 2015).

FDI favored the economies of the Andean countries at the time, owing to the extraction of minerals, which resulted in an increase in their prices, as did oil for Colombia. As a result of its proximity to and trade with the United States, manufacturing is the most prevalent sector in Pacific Alliance member countries, accounting for 61 percent in Mexico. Countries such as Peru and Chile, on the other hand, show investment in the mining sector of 22.9 percent and 44.9 percent, respectively, with Asian countries as the primary destination (see Table 1). As a result, from a legal standpoint, the Pacific Alliance is an appealing regional block for attracting investments. Sarria (2016).

| Table 1 Foreign Direct Investment Flows by Economic Sector 2009 - 2015 (%) | ||||

| Economic Sector | Chile | Colombia | Mexico | Peru |

| Mining | 44.9 | 4.6 | 22.9 | |

| Mining and roads | -0.8 | |||

| Electricity, gas and water | 11.1 | 26.7 | ||

| Financial services | 9.5 | 18.9 | 9.3 | 17.4 |

| Petroleum | 16 | 2.8 | ||

| Trade | 6.7 | 3.3 | ||

| Manufacturing | 5.7 | 14 | 61 | 13 |

| Communications | 2.9 | 19.7 | ||

| Community services | 2.5 | |||

| Energy | 13.7 | |||

| Generation, transmission and distribution of electric power | 4.2 | |||

| Other services | 1.9 | 2.7 | ||

| Transportation and warehousing | 1.3 | 8.1 | 6.4 | |

| Construction | 0.9 | 5 | 1.6 | |

| Real estate and business services | 0.5 | |||

| Agriculture and fishing | 0.2 | 1.9 | ||

| Hotels and restaurants | 0.1 | |||

| Trade, restaurants and hotels | 7.7 | |||

| Others | 14.3 | 14.5 | 2.9 | |

| Total | 100.0 | 100.0 | 100.0 | 100.0 |

Does the legal framework for FDI really help to reduce inequality?

In terms of politics, the Pacific Alliance has established trust-building mechanism among its members, despite ideological differences (Duarte, 2015); this aspect keeps the regional bloc more cohesive, generating the attraction of the Asian market; this is how Peru in its investment policy, in order to provide greater incentive, presensitizes the Asian market (Paredes, 2012).

Unlike Peru, the Pacific Alliance's four trading partners have a constitutional mechanism in place where FDI is regulated at the legislative level, with the congress issuing the norm; whereas, in Colombia, the regulation is carried out by the Banco de la Republica, which serves as the country's Central Bank (Isignares et al., 2018).

Within the framework of Peruvian law, there is no need for prior authorization or restrictions on foreign investment; additionally, Peruvian laws establish an equal treatment between domestic and foreign firms; and finally, foreign firms have the authority to send net profits to other countries without any restrictions.

There are no restrictions on the minimum or maximum amount of capital that foreign investors can invest in Chile, and the country also promotes economic freedom, non- discrimination, and non-discretionary procedures.

Colombia, for its part, demonstrates a legal framework to protect foreign investors, granting equal treatment, expropriating the investor without just cause at least for public utility or social interest with due process (payment of compensation), the conditions for the return of the investment and the issuance of profits that were in force at the time of registration may not be modified, unless the international reserves are less than three months of imports and, finally, the sectors that have restrictions on investment are mining, hydrocarbons, and insurance and financial. Finally, Mexico, where FDI is intended to create long-term economic or business interests, but there are restrictions on foreign investment by establishing delimited activities, established zones, and constitutional aspects for the investor (Pantigoso, 2017).

Methodology

The research method used was quantitative. According to Fernández et al. (2014), it is called this because it seeks to achieve the research objectives through the useof numbers, which can be expressed as integer values, percentages, or coefficients.

A descriptive research level was conducted. According to Vara (2015), these are used to precisely and precisely describe a national or international reality. As for a retrospective research, a timeline of events from the year 2000 to the year 2019 was created, using various government management reports, books, and indexed scientific journals as sources.

Results

FDI in the members of the Pacific Alliance and how it generates income inequality

In Latin American countries, inequality has decreased as a result of state interventions such as redistribution, increased access to education, and an increase in average labor income, all thanks to an increase in commodity prices, which has resulted in a positive trade balance (Rojas, 2016). On the other hand, the free flow of capital and international integration, which make countries vulnerable, can cause an increase in inequality. In turn, the Pacific Alliance receives approximately45 percent of total FDI flows in Latin America, owing to one of its key characteristics of presenting macroeconomic indicators in growth that are above the global average (Duarte, González, & Montoya, 2015).

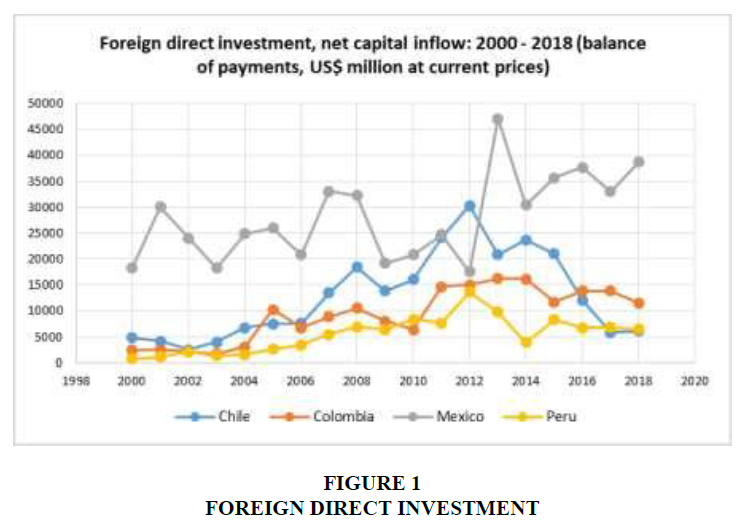

The member countries took advantage of their strategic geographic location for commercial growth, as in the case of Mexico, which, due to the characteristics of its economy and proximity to the United States, has presented greater foreign investment than its commercial partners, with the lowest in 2012 (Figure 1) with 17,551 million dollars. This was due to a variety of factors, including the insecurity caused by its change of government, which increased in 2013 to 47,076 million dollars (Table 2), the automotive sector, which drew the attention of major global manufacturers due to its low labor costs (between 600 and 700 dollars per vehicle), as opposed to the northern countries, which were its main destinations, accounting for 86 percent of the total (United Nations Economic Commission for Latin America and the Caribbean, 2017). In turn, the increase in foreign direct investment has a positive impact on employment in secondary sectors (construction, electricity, gas, water, and manufacturing companies) and tertiary sectors (the service sector, transportation, and commerce), but has a negative impact on employment in the primary sector (agriculture, forestry, livestock, mining, and fishing) due to the sector's weak infrastructure (Chiatchoua et al., 2016). These factors contribute to an increase in income inequality in the country, and as Stiglitz (2020) points out, these economic inequalities are mirrored in political inequalities, which deepen as a result of their laws (Figure 1).

| Table 2 Foreign Direct Investment, Net Capital Inflow: 2000 – 2018 (Balance of Payments, US$ Millions at Current Prices (In Millions of US$; Updated as of June 30, 2020) | ||||

| Year | Chile | Colombia | Mexico | Peru |

| 2000 | 4,860 | 2,436 | 18,382 | 810 |

| 2001 | 4,200 | 2,542 | 30,060 | 1,144 |

| 2002 | 2,550 | 2,134 | 24,055 | 2,156 |

| 2003 | 4,026 | 1,720 | 18,224 | 1,335 |

| 2004 | 6,797 | 3,116 | 24,916 | 1,599 |

| 2005 | 7,462 | 10,235 | 26,018 | 2,579 |

| 2006 | 7,586 | 6,751 | 20,798 | 3,467 |

| 2007 | 13,475 | 8,886 | 33,081 | 5,491 |

| 2008 | 18,473 | 10,564 | 32,282 | 6,924 |

| 2009 | 13,855 | 8,035 | 19,155 | 6,431 |

| 2010 | 16,020 | 6,430 | 20,796 | 8,455 |

| 2011 | 24,150 | 14,647 | 24,683 | 7,682 |

| 2012 | 30,293 | 15,040 | 17,551 | 13,622 |

| 2013 | 20,825 | 16,210 | 47,076 | 9,826 |

| 2014 | 23,736 | 16,169 | 30,397 | 3,930 |

| 2015 | 21,056 | 11,724 | 35,653 | 8,314 |

| 2016 | 12,136 | 13,848 | 37,685 | 6,739 |

| 2017 | 5,852 | 13,837 | 32,978 | 6,860 |

| 2018 | 6,082 | 11,535 | 38,644 | 6,488 |

Chile, another Pacific Alliance partner, has demonstrated a significant superiority in foreign direct investment, with a maximum of $30,293 million dollars in 2012 (Table 2), with the main sector being mining, to which is added the southern country's governmental efficiency in administering and defending public order and civil rights through the imposition of constitutional policies and laws (Flores & Saavedra, 2016).

In accordance with what was previously established, Table 2 also shows a 52.4 percent decrease from 2012 to 2018, owing to external factors such as lower raw material prices, which reduces the extraction of natural resources, particularly in the mining sector (United Nations Economic Commission for Latin America and the Caribbean, 2017).

Unlike Mexico and Chile, Colombia has seen an increase in FDI (Figure 1) from 2,436 million dollars in 2000 to 11,535 million dollars in 2018, with 2013 accounting for the highest amount with 16,210 million dollars (Table 2).

According to Cruz (2018), FDI can have a positive impact on the economy, but it can also cause problems such as inequality among its citizens, because every developing country is focused on the primary sector, such as mining and oil.

Similarly, Colombia experienced a drop in FDI in 2011 as a result of the international financial crisis, which caused a lack of liquidity in multinational corporations (Aarón, Iregui, & Ramrez, 2012).

Foreign Investment in Peru by Pacific Alliance Trading Partners, 2000 - 2018

The Peruvian government has implemented the liberation and facilitation of foreign investment, which began with the new Magna Carta of 1993, which transformed Peru into an important recipient of investments, but only in the extraction of primary resources (Stanley, 2020) and, as a result, purchases of already established companies. According to Conde and Mendoza (2019), in low-competitiveness countries, FDI initially generates positive effects on GDP growth before quickly turning negative and dissipating within three years.

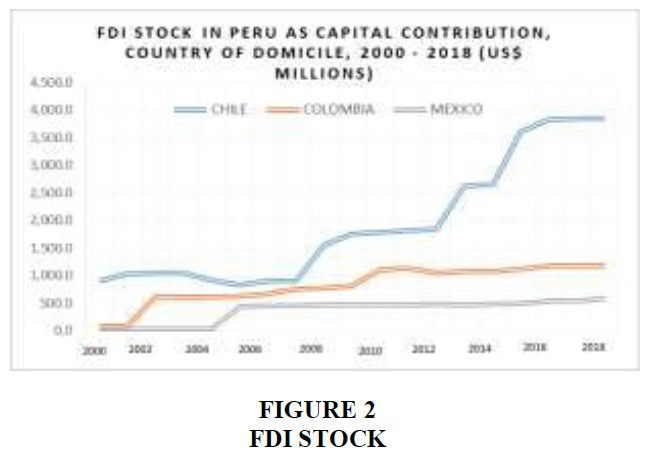

Chile is the Pacific Alliance trading partner that has invested the most in Peru, from US$ 904.5 million in 2000 to US$ 3842.8 million in 2018, while the communications sector was identified as the main destination with 1462.6 million dollars in 2019, followed by finance with 1049.1 million dollars, representing 42.9 percent and 31 percent of total investments, respectively (Table 3). On the other hand, as shown in Figure 2, Mexico has a lower investment in Peru, reaching US$ 570.1 million in 2018 and directing as the main destination communications with US$ 407.2 million, followed by mining with US$ 90.1 million in 2019, and finally the main sector invested by Colombians was industry, followed by energy with US$ 516.5 million and US$ 493.9 million, respectively (Table 3).

| Table 3 Balance of Foreign Direct Investment in Peru as a Contribution to Capital, by Country of Domicile and Sector of Destination (In Millions of US$; Updated as of June 30, 2020) | |||

| Economic Sector | Chile | Colombia | Mexico |

| Mining | 192.1 | 0.0 | 90.1 |

| Communications | 1,462.6 | 7.6 | 407.2 |

| Finance | 1,049.1 | 15.2 | 15.5 |

| Energy | 153.7 | 493.9 | 0.0 |

| Industry | 201.0 | 516.5 | 2.2 |

| Commerce | 143.2 | 6.1 | 50.1 |

| Services | 64.8 | 8.0 | 0.0 |

| Oil | 0.0 | 97.9 | 0.0 |

| Transportation | 21.8 | 13.5 | 0.0 |

| Construction | 86.9 | 0.0 | 4.7 |

| Fishing | 0.0 | 0.0 | 0.0 |

| Tourism | 17.3 | 0.0 | 0.0 |

| Agriculture | 11.7 | 20.4 | 0.0 |

| Housing | 3.1 | 0.0 | 0.3 |

| Total | 3,407.2 | 1,179.1 | 570.1 |

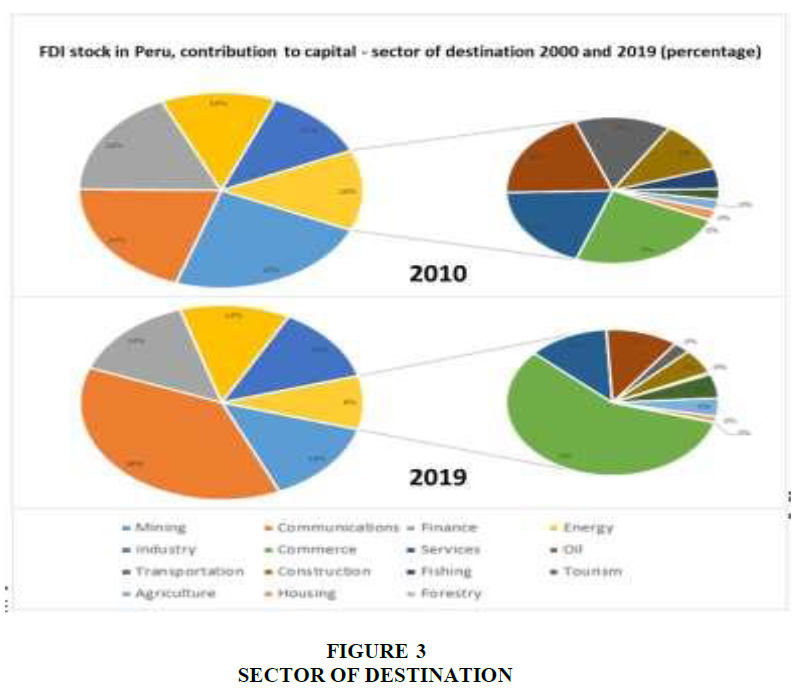

Foreign investment in Peru has been directed to the communications and mining sectors over the last 19 years, as shown in Figure 3, with FDI in the communications sector decreasing from 38 percent (2000) to 20 percent (2019) and FDI in the mining sector increasing from 14 percent (2000) to 23 percent in 2019. In monetary terms, we see an increase in the mining sector from 1,698 to 6,257 million dollars (Table 4), representing a 268.5 percent increase.

| Table 4 Balance of Foreign Direct Investment in Peru as a Contribution to Capital, by Country of Domicile and Sector of Destination (In Millions of US$; Updated as of June 30, 2020) | |||||||||||||||||||||

| Economic Sector | 2000 | 200 | 200 | 2003 | 2004 | 200 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 201 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | TOTAL |

| Mining | 1,698.0 | 1,703. | 1,706. | 1,776.5 | 2,016.3 | 2,069. | 2,650.8 | 2,747.7 | 3,204.0 | 4,126.3 | 5,028.4 | 5,391.0 | 5,611.7 | 5,592. | 5,691.5 | 5,763.0 | 5,840.5 | 5,872.2 | 6,257.0 | 6,257.0 | 81,002. |

| Communicatio | 4,587.6 | 4,366. | 4,669. | 4,697.4 | 4,310.3 | 3,687. | 3,679.6 | 3,751.1 | 3,651.9 | 3,699.6 | 3,788.6 | 3,808.0 | 3,932.4 | 4,569. | 4,569.2 | 5,119.2 | 5,324.2 | 5,327.4 | 5,330.1 | 5,330.1 | 88,199.7 |

| Finance | 1,764.1 | 2,251. | 2,057. | 1,910.2 | 1,967.5 | 2,300. | 2,498.6 | 2,564.9 | 3,614.6 | 3,736.4 | 3,895.5 | 4,081.8 | 4,213.5 | 4,257. | 4,297.9 | 4,695.2 | 4,715.0 | 4,715.0 | 4,765.0 | 4,785.0 | 69,087.2 |

| Energy | 1,537.1 | 1,625. | 1,626. | 1,632.1 | 1,647.8 | 1,647. | 1,664.2 | 1,673.0 | 1,831.8 | 2,189.6 | 2,458.9 | 2,521.4 | 2,630.2 | 3,078. | 3,287.1 | 3,377.3 | 3,449.8 | 3,451.1 | 3,451.1 | 3,486.6 | 48,267.4 |

| Industry | 1,556.8 | 1,719. | 2,432. | 2,456.9 | 2,375.3 | 2,295. | 2,789.6 | 2,808.6 | 2,922.6 | 3,058.8 | 3,092.9 | 3,105.5 | 3,124.3 | 3,166. | 3,215.5 | 3,216.0 | 3,216.4 | 3,216.4 | 3,216.4 | 3,216.4 | 56,201.5 |

| Commerce | 625.2 | 646. | 645. | 645.6 | 667.3 | 665. | 701.3 | 710.5 | 725.8 | 756.0 | 786.9 | 794.5 | 795.8 | 796. | 800.8 | 803.4 | 851.3 | 851.8 | 851.8 | 851.8 | 14,973.9 |

| Services | 133.7 | 281. | 327. | 344.5 | 351.3 | 363. | 373.7 | 398.8 | 422.9 | 532.9 | 625.2 | 632.7 | 636.5 | 651. | 668.5 | 671.8 | 673.2 | 673.3 | 673.3 | 673.3 | 10,108.5 |

| Oil | 119.9 | 179. | 229. | 229.9 | 229.9 | 229. | 229.9 | 255.2 | 416.3 | 437.9 | 659.7 | 679.7 | 701.6 | 701. | 701.6 | 701.6 | 701.6 | 701.6 | 701.6 | 701.6 | 9,511.3 |

| Transportatio | 27.8 | 40.8 | 133. | 246.9 | 248.4 | 265. | 265.2 | 265.2 | 302.9 | 322.9 | 331.3 | 360.2 | 392.8 | 409. | 457.9 | 457.9 | 522.6 | 522.6 | 522.6 | 522.6 | 6,618.7 |

| Construction | 60.2 | 70.6 | 70.6 | 81.4 | 86.1 | 95. | 124.2 | 163.9 | 204.7 | 224.9 | 329.1 | 329.1 | 360.4 | 372. | 381.5 | 382.5 | 387.7 | 396.6 | 398.5 | 399.8 | 4,919.6 |

| Fishing | 5.5 | 5.5 | 5.5 | 5.5 | 10.0 | 14. | 133.0 | 163.0 | 163.0 | 163.0 | 163.0 | 163.0 | 163.0 | 163. | 163.0 | 163.0 | 163.0 | 163.0 | 163.0 | 163.0 | 2,298.5 |

| Tourism | 58.4 | 58.4 | 58.4 | 62.1 | 62.1 | 63. | 63.4 | 63.5 | 63.8 | 72.3 | 76.6 | 76.6 | 81.6 | 83. | 83.1 | 83.1 | 83.1 | 83.4 | 83.4 | 83.4 | 1,442.9 |

| Agriculture | 44.4 | 44.4 | 44.4 | 44.4 | 44.4 | 44. | 44.4 | 44.8 | 45.7 | 45.7 | 45.7 | 45.7 | 45.7 | 45. | 69.8 | 69.8 | 82.9 | 82.9 | 82.9 | 82.9 | 1,101.0 |

| Housing | 13.4 | 24.1 | 23.3 | 23.7 | 24.8 | 25. | 25.7 | 25.7 | 26.8 | 28.3 | 29.8 | 32.7 | 32.7 | 32. | 32.7 | 46.9 | 46.9 | 81.6 | 81.6 | 81.6 | 740.1 |

| Forestry | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 24.9 |

| Total | 12233.4 | 13018. | 14031. | 14158.3 | 14042.7 | 13767. | 15245.0 | 15637.3 | 17598.1 | 19395.9 | 21312.9 | 22023.1 | 22723.3 | 23921. | 24421.4 | 25551.9 | 26059.6 | 26140.3 | 26579.7 | 26636.5 | 394,498 1 |

These investments resulted in economic improvement for the country, but also in ongoing social protests due to income inequality, environmental damage, and the erroneous distribution of the Peruvian mining canon; this canon should have been destined to public investments such as education and health to improve the quality of life, but instead it was destined to infrastructure, a source of contention (Fernandez, 2020).

In this regard, De Althaus (2009) states that since the 1990s, Peru has been in the process of privatizing mining companies, and as a result of the increase in international prices, FDI has increased, which has resulted in increased tax revenues for Peru, but has displaced the agricultural sector, causing an increase in social protests in the Peru.

It is important to note that in 2011, mining exports accounted for 59% of total exports in Peru, despite the fact that only 1% of the population was directly employed in that sector; additionally, only 20% of the inputs used corresponded to the region of extraction, with the remainder coming from the capital (Fernandez, 2020), which is consistent with the assertion of Kristjanpoller and Salazar (2016).

The Pacific Alliance partner countries seek not only to increase trade among themselves through a free trade zone, but also to adopt political mechanisms to increase the competitiveness and internationalization of their small and medium-sized enterprises, particularly with Asia Pacific (Rodríguez, 2015).

As a regional bloc, they have high hopes for their countries' economic growth. According to Kristjanpoller and Contreras (2017), globalization reduces inequality by opening their markets, but financial integration increases it. This is the goal of the member countries, but their policies have resulted in an increase in inequality, as is the case in Peru.

It is important to note that economic interaction between Peru, Mexico, Colombia and Chile has increased over the years. According to Table 5, at the end of 2018, the balance of foreign direct investment in Peru as a contribution to capital amounted to US$ 5,599.6 million dollars, coming mostly from Chile (68.63%), having increased by 324.8% compared to the year 2000.

| Table 5 Balance of Foreign Direct Investment in Peru as a Contribution to Capital, by Country of Residence (In Millions of US$; Updated as of June 30, 2020) | ||||

| Year | Chile | Colombia | Mexico | Total |

| 2000 | 904.5 | 75.8 | 27.0 | 1,007.4 |

| 2001 | 1,027.4 | 83.1 | 29.1 | 1,139.6 |

| 2002 | 1,053.5 | 617.2 | 29.4 | 1,700.1 |

| 2003 | 1,054.7 | 619.3 | 29.4 | 1,703.4 |

| 2004 | 914.6 | 619.3 | 29.4 | 1,563.3 |

| 2005 | 830.6 | 624.0 | 444.8 | 1,899.3 |

| 2006 | 902.6 | 666.4 | 446.8 | 2,015.8 |

| 2007 | 908.8 | 759.9 | 455.3 | 2,124.0 |

| 2008 | 1,559.7 | 774.3 | 462.4 | 2,796.3 |

| 2009 | 1,753.1 | 818.9 | 472.4 | 3,044.3 |

| 2010 | 1,784.6 | 1,111.3 | 472.4 | 3,368.3 |

| 2011 | 1,821.0 | 1,139.7 | 472.4 | 3,433.1 |

| 2012 | 1,845.1 | 1,054.2 | 484.4 | 3,383.6 |

| 2013 | 2,635.0 | 1,079.1 | 464.6 | 4,178.8 |

| 2014 | 2,661.1 | 1,079.1 | 484.3 | 4,224.5 |

| 2015 | 3,612.4 | 1,124.1 | 494.7 | 5,231.1 |

| 2016 | 3,839.1 | 1,179.1 | 542.6 | 5,560.8 |

| 2017 | 3,840.9 | 1,179.1 | 542.6 | 5,562.6 |

| 2018 | 3,842.8 | 1,179.1 | 577.7 | 5,599.6 |

An analysis of the top 30 Chilean investors that have made capital contributions in the 2011- 2020 period was conducted. Table 6 presents them together with the economic sector in which the target company is engaged.

| Table 6 Main Chilean Investors that Have Made Capital Contributions During the Period 2011-2020 | |||||

| INVERSIONISTA | SECTOR | INVERSIONISTA | SECTOR | INVERSIONISTA | SECTOR |

| Hortifrut | Agriculture | Fondo de inversion privadoaef i chile | Energy | Proyectos, asesorías y servicioss.p.a | Industry |

| Sally chile holding spa | Commerce | Inversiones inverfal peru spa | Finance | Talbot hotels s.a. | Services |

| Cima s.a. | Commerce | Forum servicios financieros S.a. |

Finance | Empresas relsa s.a. (before Rentaequipos comercial s.a.) |

Services |

| Empresa nacional de telecomunicaciones s.a. | Communications | Forum servicios financieross.a. | Finance | Sociedad de inversiones fenixlimitada | Services |

| Entel inversiones s.a. | Communications | Inversiones nittra s.a. | Finance | Inversiones quildos ltda | Services |

| Sociedad de inversiones Maravilla s.a. |

Construction | Habitat andina s.a. | Finance | Inversiones monte sur s.a | Servicios |

| Sociedad comercial Fasser limitada |

Construction | Skbergé s.a. | Finance | D y b asesorias ltda | Services |

| Rodrigo manuel briones Espinoza |

Construction | Inversiones altair s.a. | Finance | Mol chile limitada | Services |

| Enersis s.a. | Energy | Cementos bio bio s.a. | Industry | Inversiones logísticas limitada | Transportation |

| Latam energy chile spa | Energy | Proyectos, asesorías y Servicios dos s.p.a |

Industry | Dreams perú s.a. | Tourism |

Discussion

The Pacific Alliance is a regional bloc with many economic and commercial ambitions, which has generated expectations in world trade, which has led to an increase in foreign investments, without the expected results for the welfare of the population, as mentioned by Ríos (2018); where FDI has presented an inverse relationship with the labor rate, because investments have not caused the creation of jobs.

According to Valdez (2018), foreign investment has no effect on economic growth in Peru because it generates income for Peru but not in a sustained manner, resulting in social conflicts and inequality in distribution. This is because FDI is directed toward mergers and acquisitions of industries, rather than creating new jobs or increasing productivity in the states that receive it (Ortiz, 2017); in recent years, this participation of foreign investment has been observed in Latin American countries, without expanding their production capacity or increasing their efficiency.

Finally, the Pacific Alliance mentions economic development, competitiveness, and growth, but always seeks income equality while minimizing social protests; however, the proposed liberal system is less equitable, reducing opportunities and rights of the population (Vargas, 2015).

Conclusions

The Pacific Alliance members have grown in the last decade, which can be attributed to the fact that they have maintained the same economic direction, with the goal of opening their markets, resulting in an increase in the flow of investments from economic powers such as the United States, countries of the European Union, and the Asian continent, due to the macroeconomic stability of their co-members.

These investments have not resulted in increased employment or sustained growth in household income; on the contrary, they have resulted in increased income inequality and ongoing social conflicts in rural areas, as is the case in Peru.

Foreign investment in Peru's mining sector increased by 268.5 percent and is the source of the most conflict for Peruvians. Chile is the member country that has invested the most in Peru, increasing by 324.8% (years 2018 vs. 2000), with a predominance of the finance and service sectors with 07 companies.

Finally, the authors conclude that, despite experiencing increases in foreign direct investment because their economic systems encourage it, countries such as Colombia, Chile, and Peru, where primary product exports predominate, have consistently experienced social conflicts as a result of income inequality.

Funding Statement and Acknowledgments

This study was carried out and funded by the Universidad César Vallejo, via its program “Fondo de Apoyo a la Investigación”. The co-author, Víctor Hugo Fernández Bedoya was able to develop this research thanks to the dedicated time for research provided by Universidad César Vallejo and stipulated in the RVI N° 052-2019-VI-UCV.

References

- Aarón, G.A. Iregui, B.A., & Ramírez, G.M. (2012). Inversión Extranjera Directa en Colombia: Evolución reciente y marco normativo. Borradores de Economía, 713, 1-63. https://doi.org/10.32468/be.713

- Aranda, G., & Salinas, S. (2015). ALBA and the Pacific Alliance: A Clash of integrations? Universum, 31(1), 17-38. http://dx.doi.org/10.4067/S0718-23762015000100002

- Arévalo G.A. (2014). La Alianza Pacifico: geopolítica e integración económica. Vía luris, 16(1), 159–172. https://revistas.libertadores.edu.co/index.php/ViaIuris/article/view/442

- Carhuaricra A., & Parra, F. (2016). Foreign Direct Investment and export performance: The Peruvian experience inthe framework of APEC. Journal of Business, 8(1), 72–90. https://doi.org/10.21678/jb.2016.77

- United Nations Economic Commission for Latin America and the Caribbean (2017). La inversión extranjera directaen América Latina y el Caribe. Santiago de Chile: United Nations Economic Commission for Latin Americaand the Caribbean. http://www.iberglobal.com/files/2017-2/S1700431_es.pdf

- Chiatchoua, C., Castillo, O., & Valderrama, A. (2016). Foreign Direct Investment and Employment in Mexico: sectorial analysis. Economía informa, 398(3), 40-59. https://doi.org/10.1016/j.ecin.2016.04.004

- Concha, J., & Gómez, O. (2016). Analysis of foreign direct investment to Pacific Alliance countries. Estudios Generales, 32(141), 369-380. https://doi.org/10.1016/j.estger.2016.11.001

- Conde L., & Mendoza, A. (2019). Foreign direct investment, public investment and growth: evidence from the regionsin Mexico, 2006-2015. Estudios de Economía, 4(2), 191–225 http://dx.doi.org/10.4067/S0718-

- 52862019000200191

- Contreras, R., & Kristjanpoller, W. (2017). Globalización y desigualdad: evidencia en América Latina. Lecturas Económicas, 87(2), 9–33. https://doi.org/10.17533/udea.le.n87a01

- Cruz, J. (2018). Acuerdos comerciales de Colombia: Impactos en balanza comercial e inversión extrajera directa.

- Desarrollo Gerencial, 10(1), 48-63. https://doi.org/10.17081/dege.10.1.2970 De Althaus, J. (2009). La revolución capitalista en el Perú. Lima: El Comercio.

- Duarte, L.B. (2015). La Integración regional en América Latina: nuevos viejos esquemas. Incertidumbres de futuro. Madrid: Agencia Española de Cooperación Internacional para el Desarrollo.

- Duarte, L., González, C., & Montoya, D. (2015). Colombia de cara al nuevo regionalismo renovado: la Alianza del Pacifico. Punto de Vista, 5(9), 137-162. http://dx.doi.org/10.15765/pdv.v5i9.568

- Fernández, J. (2020). El territorio como espacio contradictorio: promesas y conflictos en torno a la actividad extractivaen Ecuador, Colombia, Perú y Chile. EURE, 46(137), 225–246. http://dx.doi.org/10.4067/S0250- 71612020000100225

- Fernández, Hernández, & Baptista (2014). Metodología de la investigación. (6th ed.). México: Mc Graw Hill.

- Flores, C., & Saavedra, R. (2016). La gobernabilidad como un determinante de la inversión extranjera directa en América Latina. Ensayos. Revista de economía, 36(2), 123–146. http://www.scielo.org.mx/pdf/ere/v36n2/2448-8402-ere-36-02-00123.pdf

- Goulart, R. (2014). La Alianza del Pacifico y la estrategia de integración sudamericana del Brasil. In Soto, W. Política Internacional e Integración regional comparada en América Latina. (81-92). Costa Rica: FLACSO.

- Hernández, J. y Muñoz, L. (2015). Comercio y evolución de la Alianza del Pacifico. Equidad y desarrollo, 1(24), 97– 118. https://doi.org/10.19052/ed.3682

- Isignares, S. (2018). Legal barriers to the foreign investment on the “Pacific Alliance”: conflicts of international law.

- Ius et Praxis, 24(1), 725-756. http://dx.doi.org/10.4067/S0718-00122018000100725

- Kristjanpoller, W., & Salazar, R. (2016) Foreign direct investment and income inequality in Latin American countries:A panel data cointegration approach. Cuadernos de economía, 35(68), 433–455. https://doi.org/10.15446/cuad.econ.v35n68.44852

- Krugman, P., & Obstfeld, M. (2006). Economía internacional teoría y política (7th ed.). Madrid: Pearson educación S.A.

- Maldonado., C.P. (2020). La Comunidad Andina y el Comercio Intrarregional: ¿ha mostrado beneficio para Perú?

- Espíritu Emprendedor TES, 4(3), 1-18. https://doi.org/10.33970/eetes.v4.n3.2020.208

- Marchini, G. (2015) Flujos de inversión directa e inserción en las cadenas de valor globales: ¿Qué puede cambiar la Alianza del Pacifico? In Rodríguez, I., & Vieira, E. En Perspectivas y oportunidades de la Alianza del Pacifico (179–225). Bogotá: CESA

- Morales, M., & Soto A. (2014). Centroamérica y la Alianza del Pacifico: los tratados de libre comercio con México y Perú. En Soto A., W. Política Internacional e Integración regional comparada en América Latina (233– 256). Costa Rica: FLACSO.

- Morales G., J. (2017). La Alianza del Pacifico y los efectos políticos de la interdependencia económica. Politai, 8(14), 33–51. http://revistas.pucp.edu.pe/index.php/politai/article/view/18841

- Ortiz, S. (2017). Foreign Direct Investment of China in Latin America and the Caribbean, methodological aspects and trends during 2001-2016. Economía Informa, 406(5), 4-17. https://doi.org/10.1016/j.ecin.2017.10.001

- Pantigoso, P. (2017). Guía de negocios e Inversión de la Alianza del pacifico 2017 – 2018. EY Peru. https://www.ey.com/es_pe/entrepreneurship/guia-negocios-inversion-alianza-pacifico-2017-2018

- Paredes, P. (2012). Crisis financiera internacional 2008 – 2013 proyecciones a futuro y la reforma del sistema financiero internacional. Lima: Peithos editores.

- Ríos, H. (2018). Libre comercio y apertura comercial en la alianza del pacifico e impacto económico: periodo 1970 – 2015. Pensamiento Crítico, 23(2), 47-72. https://doi.org/10.15381/pc.v23i2.15804

- Suanes, M., & Rosa, O. (2015). Inversión extranjera directa, crecimiento económico y desigualdad en América Latina.El trimestre económico, 82(327), 675–706. http://www.scielo.org.mx/pdf/ete/v82n327/2448-718X-ete-82- 327- 00675.pdf

- Rodríguez, I. (2015). Oportunidades y desafíos que plantea la Alianza del Pacifico para la política exterior y para los nuevos modelos de integración regional de sus miembros. In Rodríguez A., I y Vieira P., E., (Ed.) Perspectivas y oportunidades de la Alianza del Pacifico (33–60). Bogotá; CESA.

- Rojas, D. (2016). Las implicaciones de la Alianza del Pacífico sobre la evolución de la desigualdad en los países miembros. PEAP Working Paper, 1(3), 1-24. https://dx.doi.org/10.2139/ssrn.2809754

- Sarria, A. (2016). La Alianza del Pacifico: ¿Un bloque comercial atractivo para la inversión extranjera directa? Análisis del capítulo de inversiones del protocolo adicional al acuerdo marco (Bachellor Thesis). Universidad Pontifica Bolivariana. Medellín – Colombia. http://hdl.handle.net/20.500.11912/2688

- Silva, J. (2008). Política económica para países emergentes. Perú: Taurus

- Stanley, L. (2020). La regulación de la inversión extranjera directa: casos de la Argentina, Colombia, el Perú, República de Corea y Tailandia. Santiago de Chile: United Nations Economic Commission for Latin America and the Caribbean. https://repositorio.cepal.org/bitstream/handle/11362/45094/S1901162_es.pdf

- Stiglitz, J. (2020). People, Power, and Profits: Progressive Capitalism for an Age of Discontent. Madrid. Ed. Taurus Valdez, A. (2018). The effect of trade opening and direct foreign investment on Perú’s economic growth, 2007- 2016.

- Vargas, L. (2015). Colombia en la búsqueda de mecanismos que faciliten su desarrollo: la Alianza del Pacifico y el rumbo hacia la OCDE. Revista Internacional De Cooperación Y Desarrollo, 2(2), 33–68. https://doi.org/10.21500/23825014.2272