Research Article: 2019 Vol: 23 Issue: 1

Macroeconomic Effects of Entrepreneurship: Evidences from Factor, Efficiency and Innovation Driven Countries

Masoud Khairandish, Gonbad-e Kavous University

Hossein Torabi, Gonbad-e Kavous University

Abstract

Entrepreneurship is a vehicle of growth and job creation. Approaches taken to encourage entrepreneurship vary around the world based on cultural norms, market conditions, and economic circumstances. Entrepreneurial ecosystems are generally comprised of the government, which builds rules and regulations to support entrepreneurship, the angel and venture capital industry, which provide necessary startup and growth capital to support entrepreneurship, the financial market, which provides financial incentives and exit routes for startups, and finally the entrepreneurs, who form teams and start companies. In present study, we investigate causal relationships between the conditions of economic efficiency ensuring framework and different macroeconomic effects of entrepreneurship, mediated by the entrepreneurial behavior, in the panel of 97 countries based on factor, efficiency and innovationdriven countries during 2008-2017. Using a MIMIC model, we find that a national efficiencyenhancing framework such as entrepreneurial finance, government policy, government supportive programs, entrepreneurship based education, Research and Development (R&D) transfer, commercial and legal infrastructure, internal market dynamics, internal market burden, physical infrastructure, cultural and social norms, act as stimulants for the entrepreneurial behavior of entrepreneurs. While a superior level of entrepreneurial behavior generates simultaneous and/or medium-term favorable effects on the growth of gross domestic product, exports, imports and employment. Therefore, besides immediate growth, assure sustainable economic and social progress in the analyzed countries. Our result also confirms previous findings of other empirical studies in the field. These findings are consistent with received economic theorizing on how national context affects entrepreneurial activity.

Keywords

Economic Framework Conditions, Entrepreneurial Behavior, Macroeconomic Effects of Entrepreneurship, GEM Model.

Introduction

Entrepreneurship drives innovation, social change, and economic development locally, regionally, nationally, and worldwide (Konczal, 2013). The activities, relationships, and entities utilized to enhance entrepreneurial activity are just one important part of what scholars have termed the entrepreneurial ecosystem, in acknowledgement of the interconnectedness of these factors with other market dimensions. The notion of entrepreneurial ecosystems has become increasingly prevalent in the entrepreneurship policy literature (Acs et al., 2014; Auerswald, 2015; Drexler et al., 2014; Spigel, 2017; Stam et al., 2014). The entrepreneurial ecosystems approach seeks to understand the environment around the entrepreneurs and entrepreneurship in an economy and appreciate its effects on performance (Acs et al., 2017) but also on medium- and long-term structural forces that might be even more important. A key element is the interdependence of actors and factors in a particular community that leads to value creation in a certain territory, that is, entrepreneurship is the output of the entrepreneurial ecosystem.

The construct of entrepreneurial ecosystems has grown in popularity, appealing to the imaginations of consultants, policy-makers, educators, investors, influencers, researchers, opinion leaders and entrepreneurs that can play an important role in the development and level of entrepreneurial activity for a particular environment. Factors such as access to entrepreneurial finance, government support and policies, government entrepreneurship programs, entrepreneurship education, policies that lead to transfer of research and development, legal and commercial infrastructure, market dynamics in relation to business change and openness, ease of entry regulations, the business and protection of intellectual property rights, including the constituent factors, is an entrepreneurial ecosystem. These factors create a complex relationship between economic actors that encourage them to create an entrepreneurial society. This research is based on this perspective and aims at understanding and identifying the role of entrepreneurial ecosystems in entrepreneurial activities. Although knowledge about entrepreneurship has increased, different stages of entrepreneurship are different throughout the development process of an economy. Social, cultural and ideological barriers can affect entrepreneurship and, ultimately, affect people's willingness to participate in entrepreneurial activities (Carter et al., 2003). In the literature, two models explain the relationship between economic development and entrepreneurship. In the first model, this relationship is explained by the difference in economic activity between the development stages, while; In the second one, in order to explain the relationship between entrepreneurship and economic development, the motivation of entrepreneurial activities as an explanatory variable is examined (Reynolds, 2011).

Entrepreneurship can generate employment, innovation, increase production, and diversify the economy source of revenue while fostering the development of small and medium enterprises. The aggregated value created by domestic and international entrepreneurial ventures can be estimated at national level as component of gross domestic product and exports, while the higher employment rate transforms into increased level and quality of internal demand, satisfied with a higher volume of domestic and imported products. Therefore, the main questions that this research seeks to answer are:

1. How does the entrepreneurial ecosystem affect the promotion of entrepreneurial activities in different stages of development process?

2. What is the contribution of entrepreneurship to the economic development through employment generation, GDP growth, and import and export activities?

3. How do the entrepreneurial activities affect the performance of macroeconomic indicators in different stages of development process?

The structure of this paper is organized as follows: In the second part, the theoretical foundations of the research are presented in which the concept of entrepreneurial ecosystem and its impact on economic growth are explained; in the third section, the methodology of research and data is presented. In the fourth section, the empirical analysis is carried out and in the fifth part; the conclusions and suggestions are presented..

Literature And Research Hypotheses

Ecosystems in Entrepreneurship

The MIMIC model simultaneously takes into account diff erent causes and indicators that directly influence the development of entrepreneurial activities over time. In the following, some theoretical considerations of the diff erent cause and indicator variables are made.

Causal Variables

Financial environment

Entrepreneurship is one of the most effective ways to generate employment and income, and to strengthen an economy. In this process, access to financing is a key to the birth of new companies and remains over time. The supply and accessibility of finance for new and small firms is an important condition for their growth and survival. In addition, Finance is arguably the most widely recognized regulator of allocation of effort to entrepreneurship. Growth of entrepreneurial activities is in the process of designing new financing methods. Lack of adequate access to financing sources for entrepreneurs is considered as one of the main challenges of starting a business. Because of the disadvantages of commercial banks and financial institutions active in the field of financial services of the countries, financing and provision of other financial services to micro, small and medium businesses is often costly. Existing research on access to finance for entrepreneurs considers both the demand and supply side factors affecting access to finance for entrepreneurs (Carter et al., 2003). Demand-side arguments raise risk aversion as a factor in reducing the willingness of entrepreneurs to use external financial resources (Mittal & Vyas, 2011). On the other hand, supply-side argumentation discriminates financial institutions on the payment of entrepreneurship-based financial resources (Carter & Shaw, 2006). Access to finance is also the most widely recognized object of entrepreneurship policy, and entrepreneurs regularly cite insufficient finance as a barrier to starting a business (Choo & Wong, 2006). Furthermore, there is ample empirical evidence regarding the positive relationship between SMEs and access to financing. The results show that the main obstacles to achieving growth and sustainability of SMEs are access to credit in the formal banking system (Ayyagari et al., 2008, Ferraro & Goldstein, 2011; Moritz et al., 2016). Therefore, we propose the following hypothesis:

H1: The higher the access to finance in a country, the higher the level of entrepreneurial activity, ceteris paribus.

Government Policy and Support

Entrepreneurial policy research has further identified channels through which entrepreneurship policy operates to influence decisions made at the individual, industry, and regional levels (Audretsch et al., 2007). According to this research, a policy falls into one of six broad categories, depending on which aspect of the entrepreneurial ecosystem it influences (Carree et al., 2007). Policy can increase the demand for entrepreneurship (e.g., technology transfer policies), supply of potential entrepreneurs (e.g., immigration policy), knowledge, skills, and abilities of potential entrepreneurs (e.g., training programs), preference of individuals to pursue entrepreneurship (e.g., values and attitudes about entrepreneurship), attractiveness of entrepreneurial vs. non-entrepreneurial decisions (e.g., taxation policy benefitting self employment), and finally the market access for potential entrepreneurs (e.g., property rights protections) (Audretsch et al., 2007; Thurik, 2009). The conclusion has been that it is the portfolio of policy decisions, rather than any particular policy that influences the development of entrepreneurship in a region (Thurik, 2009). All of these mechanisms are also related to the role of the government as either a social actor or facilitator in the entrepreneurial ecosystem, whether influencing cooperation, communication, or factor access.

However, governments can directly affect entrepreneurial firms through their regulatory controls. In addition, the combination of government policy and support pushes policies to support innovation-focused activities (Stevenson & Lundstrom, 2007). The GEM model does not propose specific policies for entrepreneurship development; instead, it considers entrepreneurship to be the top priority of government programs and in the same way, increasing market efficiency, providing conditions for motivating entrepreneurs (Leibenstein, 1968) and economic development (Acs et al., 2005). The results of a number of studies link government policy to entrepreneurial activities (McMullen et al., 2008), while a number of other studies have found no evidence that government policies affect entrepreneurial activities (Levie & Autio, 2008). Based on the literature, we form the following hypothesis:

H2: The greater the extent and quality of government programs to entrepreneurial activity in a country, the higher the level of entrepreneurial activity, ceteris paribus.

Taxes and Bureaucracy

Regulations, taxes and labor market laws are among the obstacles to the pursuit of risk activities such as entrepreneurship (Acs et al., 2008). Business regulations are necessary in order to have a well-functioning market economy, but excessive regulations can have a negative effect on the level of entrepreneurial activity. Commercial and legal regulations that prolong the investment process can lead to the loss of entrepreneurial business opportunities (Mullins & Forlani, 2007).

Entrepreneurial activity can also be affected by total tax rate. The tax policy of a country has a major influence on the decision of a person to become entrepreneur, because it can make this activity more or less attractive compared with the wages offered for their work. The theoretical literature states that taxation may influence entrepreneurship positively or negatively depending on changes in its absolute, relative, evasion and insurance channels (Henrekson & Stenkula, 2010).

In accordance with the studies analyzing tax indicator (Klapper et al., 2006; Vidal & Lopez, 2013; Salman, 2014; Arin et al., 2015) high tax rates lead to lower self-employment, because they are seen as an obstacle for starting new business and lead to a decrease in business activity. Thus, we expect a negative relationship between tax rates and entrepreneurial activity. Other studies show that higher tax rates result in higher entrepreneurial rates, because entrepreneurial and risky activities create an opportunity to report incomes to wage-earning jobs. These studies argue that changes in tax rates over time can explain changes in entrepreneurial rates. Some studies have found that regulations, taxes and labor market rigidities tend to load together in analyses of barriers to start-up. Therefore, the following hypothesis will be tested:

H3: The greater the Tax burden on entrepreneurial activity in a country, the lower the entrepreneurial activities, ceteris paribus.

Government Entrepreneurship Programs

Government programs, policies, and the functioning of the public sector are important factors in entrepreneurial ecosystems and are the most important drivers in turning entrepreneurial intentions into actual entrepreneurial behavior. The government can support entrepreneurs through entrepreneurial training programs that provide subsidies, materials and professional advice for entrepreneurial activities, and develop entrepreneurial activities through co-ordination and cooperation with chambers of commerce or through incubators under government supervision (Keuschnigg & Nielsen, 2004). Such plans minimize transaction costs for organizations and firms and, at the same time, increase the human capital of business owners (Delmar & Shane, 2006). Governmental programs create competition through market failures. Governments may support entrepreneurial firms through programs through which they provide subsidies, material, and informational support for new ventures (Dahles, 2005).

The legislations, general policies and legislative settings provided by governments towards supporting entrepreneurial investments have in turn displayed a positive impact on economic growth (Méndez-Picazo et al., 2012). In addition, researchers emphasize on government support of entrepreneurship, be it through subsidies, skills development, advice services (Pickernell et al., 2013) or less restrictive policies (Michael and Pearce II, 2009). On the other hand, research conducted in a more socialistic culture, such as Cheng et al. (2017) concludes that governmental interventions actually exert a negative impact on entrepreneurship by weakening its innovative inclination. Growing evidence shows that entrepreneurship contributes to economic growth and innovation, as well as increase prosperity within societies through the production of more commodities and services, hence creating new job opportunities (Bourne, 2011; Debus et al., 2017; Sabella et al., 2014; Yang & Li, 2011). This has led many governments to consider entrepreneurship as an essential factor in acknowledging the society’s progress, therefore promoting entrepreneurship through different support schemes (Congregado et al., 2012) and render efforts to consolidate entrepreneurship activities (Méndez-Picazo et al., 2012). When there are strong supportive programs to support entrepreneurship, one can expect a higher level of entrepreneurial activity.

H4: The more Supportive the government programs in a country, the higher the entrepreneurial activities, ceteris paribus.

Entrepreneurship Education

Education and training for entrepreneurship has been one of the most widely studied and used tools to encourage entrepreneurial activity. Training, by providing practical skills for starting a business, increases the number of entrepreneurs by improving the ability to understand and recognize entrepreneurial opportunities and encouraging risk activities as a career option (Peterman & Kennedy, 2003). Extant research has shown that there is a correlation between the levels of perceived capabilities of would-be entrepreneurs, entrepreneurial intentions and the level of total early-stage entrepreneurial activity (Europea, 2012; Tsai et al., 2016). Therefore, education is inextricably linked to entrepreneurial intentions and the vibrancy of the entrepreneurial ecosystem, as it aff ects entrepreneurs’ confidence in having the necessary skills and knowledge to start a business. In essence, education that is focused on entrepreneurshiprelated skills can have a powerful influence over entrepreneurial intentions and behavior. More specifically, there is evidence that practical entrepreneurship training may better prepare school leavers for the transition from school to the labor market, enabling them to identify business opportunities and improving their chances of success in business and self-employment ventures (Cheung & Chan, 2011).

Universities are key players in the startup ecosystem because they hold and attract young talent; shape and influence students’ mindset; create and serve as a repository of knowledge and expertise in learning and education, all of which nurture entrepreneurial ecosystems. However, according to Isenberg (2014), entrepreneurial knowledge provided by a university is not crucial for creating a regional entrepreneurial ecosystem. Nonetheless, entrepreneurship education also has a great impact on venture creation as it provides insights in the entrepreneurial process, aids with developing entrepreneurial skills and offers networks from which the resources and expertise can draw (Shah & Pahnke, 2014). Similarly, Feld (2012) argues that there are two powerful ways to engage students with an entrepreneurial ecosystem. The first one is by internships and recruiting events. The second one is by creating a mentor relationship between the entrepreneurial alumni and the students. Stam & Spigel (2016) further emphasize the importance of entrepreneurial education as they argue that the entrepreneurial ecosystem approach incorporates a third type of knowledge, entrepreneurial knowledge, next to the commonly accepted technical and market knowledge.

Therefore, we expect that, countries that have stronger educational programs to support entrepreneurship be expected to have a higher engage entrepreneur; thus, the following hypothesis proposed:

H5: The higher the level of education and training programs in a country, the higher the entrepreneurial activities, ceteris paribus.

R&D Transfer

Entrepreneurship is the main driver of innovation and a catalyst for technological changes in the economy, and the governments should ensure that different results of research and development find their way to the market. However, just a small number of inventions as results of the government funded scientific research experience commercialization. In addition, R&D transfer is one of the least favorably conditions, which significantly affects the degree of innovation and the competitiveness of businesses, especially in factor-driven and efficiencydriven economies (Avlijas, 2017).

In addition, Schumpeter (1996) emphasized the important role of technological development as a driving force behind entrepreneurial opportunities. This argument has been developed further in the knowledge spillover theory of entrepreneurship (Acs et al., 2005). The knowledge spillover theory of entrepreneurship claims that entrepreneurial activities respond to investing in other companies' knowledge and thus provide an opportunity for entrepreneurs (Acs et al., 2008). Entrepreneurship benefits from the knowledge spillovers because new knowledge usually has a higher level of asymmetric information and uncertainty than other economic commodities, and hence the identification of opportunities in new knowledge by business owners requires the consciousness and discovery (Audretsch & Lehmann, 2005). Accordingly, in economies where the transfer of knowledge from business owners to entrepreneurs is faster and cheaper, compared to countries where this trend is slower and more expensive, the rate of entrepreneurial activity is higher. Therefore, it can be concluded that the expansion and spillover of knowledge in the local environment It positively affects the level of entrepreneurship at the national level. We therefore propose:

H6: The more accessible new technology is to individuals in a country, the higher the entrepreneurial activities, ceteris paribus.

Commercial and Legal Infrastructure

The business and legal infrastructure includes business services that are essential to creating new businesses. These infrastructures provide groundwork for business-related activities, such as the availability of contractors, suppliers, consultants, accountants, advertising, banking and finance, and legal services (Levie & Autio, 2008). Access to business services allows entrepreneurs to focus on key capabilities that facilitate operational efficiency. Lack of legal services can be a barrier to entrepreneurial activity. Similarly, legal systems with less complex and transparent bankruptcy laws have a positive effect on the level of entrepreneurial activity at the national level (Li et al., 2012). Based on the previous literature; we derive the following hypothesis:

H7: The higher the level and quality of Commercial and Legal Infrastructure that serves entrepreneurial activity in a country, the higher the entrepreneurial activities, ceteris paribus.

Domestic Market Dynamics

Strong local markets often act as a catalyst for the development of an entrepreneurial ecosystem (Spigel, 2015), as domestic customers with specific and specialized needs create opportunities for startups and ignite entrepreneurial spinoffs (Foster et al., 2013). Local entrepreneurs are in the perfect position to identify these opportunities within the local marketplace, because they are in close contact with these potential customers, enabling them to do vigorous market research (Spigel, 2015). Along similar lines, Motoyama & Mayer (2016) found that customers act as a company’s major source of information. Moreover, their research revealed that a company’s growth mainly came from its ability to find a market niche by identifying problems and solutions. The ways to discover these market niches are extremely heterogeneous. In line with Motoyama & Mayer (2016), Parker et al. (2010) argue that highgrowth firms are characterized by a strong market orientation and customer engagement. Moreover, large companies encourage the creation of new markets, as they require mutually complementary products/services to foster their own (business) ecosystem (Clarysse et al., 2014). In addition to these domestic markets, international markets can have an impact on the development of the entrepreneurial ecosystem (Foster et al., 2013). Especially in regions with small domestic markets, internationalization becomes a necessity rather than a choice (Autio et al., 2007).

Furthermore, Market dynamics affects macroeconomic growth in the long run. Market and industry structure and firm entry have been widely studied in the industrial organization and entrepreneurship literatures (Klepper & Sleeper, 2005). Market dynamics represents the speed of market changes, also known as “market clock speed” (Nadkarni & Narayanan, 2007). The market clock speed is characterized by a high rate of change, uncertainty and unpredictability of the environment (Dess & Beard, 1984). These conditions provide an opportunity for entrepreneurs to gain higher returns against uncertainty (Knight, 1921). Changing market conditions is an important source of entrepreneurial opportunities, since it enables resources to be allocated to generating productions with higher productivity. In countries where market dynamics are changing rapidly, a high level of entrepreneurial activity is expected.

H8: The higher the Domestic market dynamics in a country, the higher the entrepreneurial activities, ceteris paribus.

Internal Market Capacity

The domestic market capacity (openness of the domestic market) encompasses ease of entry into the market. The previous findings are ambiguous about market capacities and have not resulted in a single result. Research indicates that barriers to entry are associated negatively with entrepreneurial activity in all economies (Sobel et al., 2007). However, a number of studies have shown that barriers to entry affect the distribution of business activity between formal and informal economies, not the total volume of national activity. In other studies, entry barriers affect the distribution of business activity between formal and informal economies, rather than the total volume of national activity at the national level (Van Stel et al., 2007). The high rate of entrepreneurship in an economically viable way has a positive effect on entering the new market (Salimath & Cullen, 2010).

H9: The greater the Internal Market Capacity in a country, the higher the entrepreneurial activities, ceteris paribus.

Access to Physical Infrastructure

Physical infrastructure (such as transportation, land or operational space, communication services, etc.) is critical to entrepreneurship (Hansen & Sebora, 2003). Access to physical infrastructure facilitates entrepreneurship by accelerating access to resources (Carter et al., 2003). While access to physical infrastructure may be insignificant in innovation-based economies, resource-based economies are a major barrier to launching a new business (Ghani et al., 2014). Woolley (2013) points out, in one of the few existing studies linking infrastructure to entrepreneurship, infrastructure can spur entrepreneurial opportunities along with the ability of nascent entrepreneurs to act upon those opportunities in the form of starting a new firm. In this line, Audretsch et al. (2015), suggest that startup activity is positively linked to infrastructure in general, but that certain specific types of infrastructure, such as broadband are more conducive to infrastructure than are highways and railroads. In addition, Singha (2013), found that the physical infrastructure, especially road network and market opportunity (law and order condition of the State) have positive impact on entrepreneurship development; thus, we can propose the following hypothesis:

H10: The greater the access and quality of physical infrastructure that serve entrepreneurial activity in a country, the higher the entrepreneurial activities, ceteris paribus.

Social and Cultural Norms

Culture is a commonly cited determinant of entrepreneurial behavior (George & Zahra, 2002). In addition, Culture is considered a very important factor among the factors that strengthen or weaken entrepreneurship. The values and norms of the society greatly affect the development of entrepreneurship. Therefore, the type of attitudes, values and norms that exist, determines culture, and how the growth of innovation is driven by culture. Therefore, it seems that in a society where social values and norms are high and committed by those who are committed to it, there is a trust and the tendency to engage in opportunistic and rentier behavior is limited. It is important to differentiate between the criteria of national culture or global values (Inglehart, 1997; House, 1998), in contrast to specific attitudes toward entrepreneurship or beliefs about entrepreneurship. In fact, the values, attitudes and beliefs about entrepreneurship and legitimacy can change rapidly (Etzioni, 1987), contrary to global sustainable values. Social status for entrepreneurship (considering attitudes about individuals who have earned personal wealth through entrepreneurial activity), as well as positive and media advertising on this subject, can affect a person's perceptions of social utility and willingness to engage in entrepreneurship (Reynolds, 2011).

Furthermore, some academics have investigated how cultural attitudes influence the regional entrepreneurship process. Aoyama (2009), for instance, declares that local cultures affect entrepreneurial activities “by shaping acceptable entrepreneurial practices and norms”. Another study found out that societal norms influence opinions about entrepreneurship-such as making it look like a standard path on someone’s career ladder or just the opposite, by depicting it as something you do when there are no other options available (Kibler et al., 2014). In addition, success stories have a great influence on these cultural attitudes (Feldman et al., 2005; Isenberg, 2010; Motoyama & Knowlton, 2014). Not to mention the role local policy makers can play by celebrating these successes and using them to promote entrepreneurship (Isenberg, 2010; Nelles et al., 2005). Therefore, we can propose the following hypothesis:

H11: The more supportive the Social and cultural norms in a country, the higher the entrepreneurial activities, ceteris paribus.

Indicator Variables

After considering the different causes that affect the entrepreneurial activities, the MIMIC model requires the specification of different indicators that reflect to the creation of entrepreneurial opportunities. Entrepreneurship plays a major role in national economies, being considered one of the main engines of economic growth, and an important contributor to creating new jobs and innovations. Nyström (2008) reviews the empirical evidence for the effect of entrepreneurship on employment, productivity, and economic growth. Most studies have discussed the relationship between entrepreneurship and employment from a regional perspective (Li et al., 2011; Nițu-Antonie et al., 2017). Furthermore, in recent decades, entrepreneurship has been recognized as a profound factor in affecting economic growth. Among others, many scholars (Toma et al., 2014; Aparicio et al., 2016; Nițu-Antonie et al., 2017) have devoted considerable attention to the relationship between entrepreneurship and economic growth in general. While other scholars (González-Pernía et al., 2012; González-Pernía & Peña-Legazkue; 2015) have described and examined the relationship between export-oriented entrepreneurship and economic growth. They concluded that there is a positive impact of entrepreneurship on economic growth is empirically confirmed, and furthermore enhanced by the export orientation. Consequently, we can formulate the following hypothesis:

H12: The higher the level of entrepreneurial behavior in a country, the higher the level of economic development.

H13: The higher level of the entrepreneurial behavior in a country, the higher the size of imports.

H14: The higher level of the entrepreneurial behavior in a country, the higher the size of exports.

H15: The higher the level of the entrepreneurial behavior, the larger the size of the employed population.

Methodology

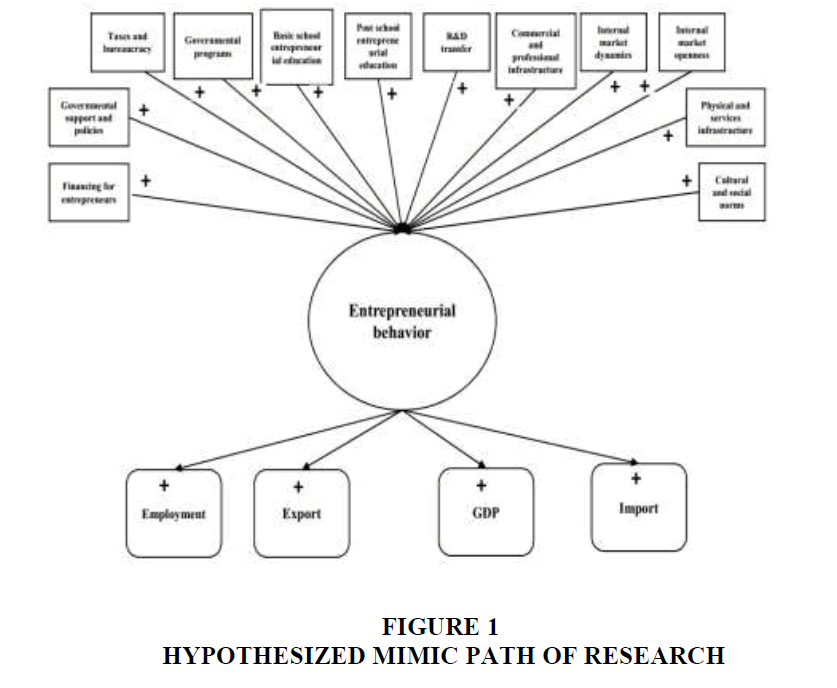

The MIMIC model is a special type of Structural Equation Modeling (SEM) that is widely applied in psychometrics and social science researches. The MIMIC model is a theorybased approach to confirm the influence of a set of exogenous causal variables on the latent variable (entrepreneurial activities), and the effect of the entrepreneurial activities on macroeconomic indicator variables. At first, it is important to establish a theoretical model explaining the relationship between the exogenous variables and the latent variable. Therefore, the MIMIC model is considered a confirmatory rather than an explanatory method. The hypothesized path of the relationships between the observed variables (economic framework condition) and the latent variable (entrepreneurial behavior) based on our theoretical considerations is shown in Figure 1.

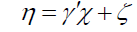

Formally, the MIMIC model has two parts: the structural model and the measurement model. The structural model shows that the latent variable X is linearly determined by a set of exogenous causal variables, which can be illustrated as follows:

Where,

is a vector of causal variables,

is a vector of causal variables,

is a vector of scalars, η is the latent variable

(entrepreneurial activities) and ς is a structural disturbance term. The measurement model, which

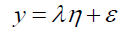

links the economic performances with the set of selected indicators, is specified by:

is a vector of scalars, η is the latent variable

(entrepreneurial activities) and ς is a structural disturbance term. The measurement model, which

links the economic performances with the set of selected indicators, is specified by:

Where, y is a vector of indicator variables, and λ is a vector of loading factors to represent the magnitude of the expected change for a unit change in the latent variable η. The ε is the measurement error term.

Estimation of the Model

After establishing an economic theoretical model explaining expected relationship between the latent variable and the observed variables as shown in Figure 1, the MIMIC model tests these theoretical considerations and may confirm the hypothesized relationships between the latent variable and observed variables. The analysed panel encompasses Resource, Efficiency and Innovation driven Countries, selected depending on their development level, according to the Global Entrepreneurship Monitor (2017) as shown in Table 1.

| Table 1:List Of Countries Based On Gem Division | ||

| Innovation driven Countries | Efficiency driven Countries | Resource driven Countries |

|---|---|---|

| Australia, Austria, Belgium, Canada, China, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany , Japan, Lithuania, Malaysia, South Korea, Netherlands, Norway, Poland, Portugal, Qatar, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, United Kingdom, United States | Algeria, Argentina, Bosnia, , Jamaica, Latvia, Luxembourg, Macedonia, Mexico, Montenegro, Panama, Peru, Philippines, Puerto Rico, Russia, Saudi Arabia, Denmark, Estonia, Finland, France, Germany, Greece, Hong Kong, Hungary, Iceland, Ireland, Israel, Italy, Serbia, South Africa, Taiwan, Uruguay, Thailand | Angola, Bangladesh, Barbados, Belize, Bolivia, Botswana, BurkinaFaso, Cameroon, Ethiopia, Guatemala, Ghana, Jordan, Kazakhstan, Kosovo, Lebanon, Libya, Madagascar, Malawi, Morocco, Namibia, Nigeria, Palestine, Pakistan, Senegal, Suriname, Syria, Tonga, Trinidad and Tobago, Tunisia, Vanuatu, Venezuela, Vietnam Uganda, Zambia |

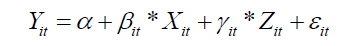

The main objective of the statistical data analysis using STATA 14, represents the evaluation of the research model hypotheses, the assumptions regarding the existence or nonexistence of causal relations between the constructs at aggregated panel level. Simultaneous regressions were created to estimate the equation system reflecting the mathematical description of the research model as follows:

Where, Y=endogenous dependent variable (increase in gross domestic product, in import, in export, and in employment rate); X=exogenous independent variables (financial environment, Government policy and support, Taxes and Government Policies, government programs, Education and training, R&D transfer, Commercial and Legal Infrastructure, Domestic market dynamics, Internal Market Capacity, Access to physical infrastructure and Social and cultural norms); Z=endogenous latent variable (entrepreneurial behavior); α=constant; β and γ =coefficients (corresponding to path analysis), ε =the error term for observed and latent variables, i = 1, ..., N (number of countries in the panel), and t=1, ..., T (number of years analyzed in the time series). For the construction and estimation of the empirical model, specifications were introduced in the SEM Builder, and due to the limitation imposed by few unavailable data, the Maximum Probability with Missing Values (MLMV) econometric method was applied.

Results

After establishing an economic theoretical model explaining expected relationship between the latent variable and the observed variables as shown in Figure 1, the MIMIC model tests these theoretical considerations and may confirm the hypothesized relationships between the latent variable γ (entrepreneurial behavior) and its causes and indicators. In our MIMIC estimations, we use annual data from 2008 to 2017 for the 97 countries in our sample.

The MIMIC results showed in Tables 2-4 for factor driven, efficiency driven and innovation driven countries, repectively. Table 2 displays the results of the test of Hypotheses 1- 11, that is, the independent effect of different EFCs on overall entrepreneurial activity, controlling for various contextual variables, in the case of factor driven countries. In addition, Table 2 shows the test of Hypotheses 12-15, that is, the effect of entrepreneurial activity on economic performances of GDP growth, Employment, Export and Import.

| Table 2: Mimic Estimation Results For Factor Driven Countries | ||

| Variables | Coef. | Z |

|---|---|---|

| Causes | ||

| Entrepreneurial finance | -8.212 | -3.19 |

| Governmental support and policies | -2.152 | -0.64 |

| Taxes and bureaucracy | -7.472 | -0.31 |

| Governmental entrepreneurship programs | 3.652 | 0.52 |

| Entrepreneurial education and training | 1.521 | 0.31 |

| R&D transfer | -6.165 | -0.81 |

| Commercial and professional infrastructure | -4.322 | -0.42 |

| Internal market dynamics | 2.721 | 0.55 |

| Internal market capacity | -10.512 | -3.11 |

| Physical and services infrastructure | -2.143 | -0.31 |

| Cultural and social norms | 6.065 | 1.89 |

| Indicators | ||

GDP growth (annual %)

|

0.014993 | 1.85 |

| Employers, total (% of total employment) | 0.017083 | 1.78 |

| Exports of goods and services (% of GDP) | -0.00113 | -0.75 |

| Imports of goods and services (% of GDP) | 0.001484 | 0.79 |

| Goodness-of-fit indices | ||

| Chi2 (p-value) | 12.32 (0.2790) |

|

| GFI | 0.92 | |

| CFI | 0.913 | |

| CD | 0.411 | |

| RMSE | 0.019 | |

The results of the model in Table 2 can be summarized as follows: The impact of the financial environment on the entrepreneurship has been negative and meaningful. Due to the lack of development of markets and financial institutions in factor-driven economies countries, this result is expected. Meanwile, due to the inadequacy of government policies and bureaucracy in these countries, government policies and programs and the process of entrepreneurship have not been effective. In addition, Entrepreneurship education has a positive and significant effect on the entrepreneurial process in these countries, while along with the lack of development and underdeveloped business, physical and legal infrastructure Infrastructure variables and the transfer of research and development have not been effective. The dynamics of the domestic market has had a positive and significant effect on entrepreneurial activities, which can be explained by the high level of demand and unmet needs.

Considering the result of our MIMIC estimations in Table 2 for cusual variables, we clearly see that in the case of factor driven countries, Hypothesis 5, 8, and 9 are not supported. However, all of the other hypothesis are supported, that is, they have the theoretically expected sign and is highly statistically significant at the 1% confidence level. Furthermore, considering the indicators, GDP growth and employment have the expected sign and are statistically significant at 10% confidence level, thus Hypotheses 12 and 13 supported; while the import and export are found to be insignificant and thus a weak indicators for the entrepreneurial behavior in factor driven countries, in other words, in the case of factor-driven countries, the Hypotheses of 14 and 15 not supported.

Table 3 displays the results of the test of hypotheses in the case of efficiency driven countries. In addition, Table 2 shows the effect of entrepreneurial activity on economic performances of GDP growth, Employment, Export and Import.

The results of Tables 3 can be summarized as follows:

| Table 3: Mimic Estimation Results For Efficiency Driven Countries | ||

| Variables | Coef. | Z |

|---|---|---|

| Causes | ||

| Entrepreneurial finance | 1.432 | 1.73 |

| Governmental support and policies | 1.442 | 0.72 |

| Taxes and bureaucracy | 2.124 | 4.15 |

| Governmental entrepreneurship programs | 2.314 | 1.32 |

| Entrepreneurial education and training | 2.412 | 3.13 |

| R&D transfer | 5.513 | 3.78 |

| Commercial and professional infrastructure | 2.167 | 1.21 |

| Internal market dynamics | 1.145 | 2.95 |

| Internal market capacity | 1.133 | 3.21 |

| Physical and services infrastructure | 1.331 | 3.32 |

| Cultural and social norms | 2.729 | 2.76 |

| Indicators | ||

GDP growth (annual %)

|

0.007534 | 3.20 |

| Employers, total (% of total employment) | 0.0237 | 4.25 |

| Exports of goods and services (% of GDP) | 0.003587 | 2.85 |

| Imports of goods and services (% of GDP) | -0.00131 | -0.96 |

| Goodness-of-fit indices | ||

| Chi2 (p-value) | 12.45 (0.2930) |

|

| GFI | 0.93 | |

| CFI | 0.942 | |

| CD | 0.421 | |

| RMSE | 0.011 | |

The impact of the financial environment on the process of entrepreneurship in the efficiency-driven countries has been positive but not meaningful, given the growing trend of financial markets in these countries, and the transition from the resource-driven stage to the effiecincy-driven stage, the possitive sign of entrepeneurial finance is a plausible phenomenon. Government policies, tax efficiency and bureaucracy in efficiency-driven countries have a positive impact on the entrepreneurial activities in these countries. In addition, Entrepreneurial education has encouraged entrepreneurial activities in these countries, which confirms the effectiveness of the educational system. Moreover, The R&D transfer in these countries has had a positive impact on entrepreneurship in line with theoretical foundations. Also, Influence of infrastructure in these countries has had a positive and significant effect on the motivation of entrepreneurship and new entrepreneurship. Given the dynamic environment, competitive markets and the steady growth of demand in these countries, the dynamics and the capacity of the domestic market have had a positive and significant effect on entrepreneurship.

Furthermore, the result of MIMIC estimations in Table 3 show that in the case of efficiency driven countries, hypothesis 8 not supported. However, all of the other hypothesis are supported. Furthermore, considering the indicators, GDP growth, employment and export have the expected sign and are statistically significant at 1% confidence level, thus Hypotheses 12-14 supported; while the import is found to be insignificant and thus a weak indicators for the entrepreneurial behavior in resource driven countries. Table 4 displays the results of the test of hypotheses in the case of innovation driven countries.

| Table 4: Mimic Estimation Results For Innovation Driven Countries | ||

| Variables | Coef. | Z |

|---|---|---|

| Causes | ||

| Entrepreneurial finance | 0.123 | 2.32 |

| Governmental support and policies | 0.124 | 0.32 |

| Taxes and bureaucracy | -0.431 | -0.69 |

| Governmental entrepreneurship programs | 0.311 | 0.58 |

| entrepreneurial education and training | 2.233 | 2.64 |

| R&D transfer | 1.461 | 3.43 |

| Commercial and professional infrastructure | 2.497 | 2.81 |

| Internal market dynamics | 0.409 | 2.73 |

| Internal market capacity | 2.647 | 2.41 |

| Physical and services infrastructure | 2.481 | 3.41 |

| Cultural and social norms | 2.133 | 2.46 |

| Indicators | ||

GDP growth (annual %)

|

0.403423 | 8.23 |

| Employers, total (% of total employment) | 0.01779 | 4.47 |

| Exports of goods and services (% of GDP) | 0.01646 | 5.45 |

| Imports of goods and services (% of GDP) | 0.00138 | 4.35 |

| Goodness-of-fit indices | ||

| Chi2 (p-value) | 12.14 (0.2771) |

|

| GFI | 0.96 | |

| CFI | 0.921 | |

| CD | 0.474 | |

| RMSE | 0.015 | |

The results of Table 4 can be summarized as follows: effect of financial environment on entrepreneurial entrepreneurship in innovative countries is a positive and significant, which confirms the development of financial markets in these countries. In addition, Policies and government programs in innovative countries have a positive impact on the development of entrepreneurship. Entrepreneurship education have a significant and positive effect on entrepreneurship, which can be attributed to the development of the educational system and the relation between industry and university in these countries. The level of R&D and innovation in these countries has had a positive impact on entrepreneurship, which reflects the great investment of these countries in research and development. Influence of infrastructure in these countries is on all levels of positive and significant entrepreneurship, which expresses strong and developed infrastructure. The capacity and dynamics of the domestic market in innovative countries is a good environment for encouraging entrepreneurial activities and growth and sustainability. The results of the model estimation are consistent with these results.The impact of social norms on the development and development of emerging entrepreneurial activities in these countries has had a positive effect. Morover, the result of MIMIC estimations in Table 4 show that, all of the hypotheses are supported. Furthermore, considering the indicators, GDP growth, employment, export and import have the expected sign and are statistically significant at 1% confidence level.

Goodness of fit indices have been considered to evaluate the proposed research model, as compared to the saturated model, in which all the variables are correlated, and to the basic model, which assumes the total lack of correlations between the variables. In this sense, chi2 is in normal limits, having p>0.05 in the case of all the four specified models depending on the effect variables. The values of Root Mean Squared Error of Approximation (RMSEA) also fall within the normal limits, The values less than 0.08 indicate a good model fit. Coefficient of Determination (CD): A perfect fit corresponds to a CD=1, Similarly, Comparative Fit Index (CFI) tends to reach the 0.8 limit, when the comparative fit index is closer to one, it indicates a good model fit.

Discussion

This paper investigated the causal relationships between the conditions of economic efficiency ensuring framework and different macroeconomic effects of entrepreneurship, mediated by the entrepreneurial behaviour, in the panel of 97 countries based on factor, efficiency and innovation-driven countries during 2008-2017. The results of model estimation showed that the impact of entrepreneurial ecosystem and furthermore the macroeconomic effects of entrepreneurship in different countries in different stages of development of countries is different. The results of this paper showed that the impact of the financial environment on the entrepreneurial stages in the factor-driven countries was negative and significant. These results are contrary to the results of Stam (2015) and Fraser et al. (2015). However, this result is due to the lack of development of financial markets in these countries. In addition, government programs to improve entrepreneurial activities, extensive administrative bureaucracy, commercial, physical and legal infrastructure, and the amount of R&D in these countries did not have a significant effect on the venture creation. However, the impact of entrepreneurship education, the dynamics of the domestic market, social status of entrepreneurs and GDP growth have had a positive and significant impact on the growth of entrepreneurship in factor-driven countries. This result is in line with the findings of Spigel (2017), DeTienne & Chandler (2004), Klepper & Sleeper (2005), and Runiewicz-Wardyn (2013). The results also indicate that ecosystem factors such as education, research transfer, domestic market dynamics and physical and commercial infrastructure have a positive and negative relationship on entrepreneurial activities in efficiency-driven countries. These results are consistent with Audretsch et al. (2015), Spigel (2017), Ghani et al. (2014) and Runiewicz-Wardyn (2013). Governmental policies and programs, the transfer of development research, legal and commercial infrastructure, market dynamics, social culture and social status of entrepreneurs have had a positive impact on the entrepreneurial activities in innovation- driven countries. These results confirm the findings of Stam (2015), Reynolds (2011), Clarysse & Bruneel (2007), Levie & Autio (2008) and Markman et al. (2004). Unlike factor-driven countries, the effect of government policies on institutions quality and the development of financial markets have had a positive effect on venture creation and improving export, import, employment and economic growth in efficiency and innovationdriven countries. In addition, the effect of variables of commodity market efficiency and complexity of business have a negative impact on the economic growth of factor-driven countries, but the positive impact in efficiency driven countries. This result is consistent with the findings of Hechavarría and Ingram (2018), and Acs et al. (2018). Moreover, the impact of entrepreneurship on macroeconomic indicators such as import and export are not significant in factor-driven countries, nevertheless, entrepreneurial activities, as expected, have a positive and meaningful effect on macroeconomic indicators like GDP growth, employment and export in efficiency and innovation-driven countries. These findings are similar with the results of previous studies such as Nyström (2008), Li et al. (2011), Nițu-Antonie et al. (2017), Aparicio et al. (2016), González-Pernía & Peña-Legazkue, (2015).

Conclusion

In this paper, we present the estimation of entrepreneurship on economic performance for 97 countries including factor, efficiency and innovation-driven countries from 2008 to 2017 using the MIMIC estimation method. The empirical analysis applying SEM, aims building the entrepreneurial behavior as a latent construct based on the dimensions provided in the reference model; assessing the impact of specific components of the economic efficiency framework on stimulating entrepreneurial behaviour and analysing the simultaneous effects of entrepreneurial behavior on the growth of gross domestic product imports, exports and the employment rate.

According to our results, Entrepreneurial ecosystems of countries are driving forces of the entrepreneurial behavior. We also find that the entrepreneurial behavior in this sample of countries have a meaningful impact on economic performance of countries. The knowledge/insights with respect to the entrepreneurial behavior of 97 countries lead to the following three conclusions:

The first conclusion from these results is that the impact of entrepreneurship ecosystem on the economic growth of countries in different stages of development of countries is different. The results of this paper showed that the impact of the financial environment on the entrepreneurship in the resource-driven countries was negative and significant. In addition, government policies and programs, administration and administrative bureaucracy, business infrastructure, physical and legal infrastructure, and the amount of research and development on the process of entrepreneurship in these countries have not had a significant effect. However, the impact of entrepreneurial education, the dynamics of the domestic market, the social status of entrepreneurs, and GDP growth have had a positive and significant impact on the growth of entrepreneurship in resource-based countries.

The second conclusion shows that ecosystem factors such as government policies and programs, taxes and bureaucracy, entrepreneurial education at basic and academic levels, the transfer of development research, infrastructure, market dynamics and appropriate business environment to the process of promoting and enhancing entrepreneurial activities at different stages Entrepreneurship has had a positive and significant impact in innovative and innovative countries. The impact of policies on institutions and the development of financial markets have had a positive effect on the economic growth of economically efficient countries and innovative countries, while the impact of these variables on the economic growth in the resource-rich countries has been negative. In addition, the effect of variables of the efficiency of the commodity market and the complexity of the business on the economic growth of the sourceoriented countries has had a negative effect on the growth trend of the emerging economies.

The third conclusion shows that there are large regional disparities in the level of entrepreneurial behavior. There is innovation driven countries at the top level of entrepreneurship. At the lowest level of entrepreneurial activities, there are factor driven countries.

References

- Acs, Z. (2006). How is entrepreneurship good for economic growth?Innovations: Technology, Governance, Globalization,1(1), 97-107.

- Acs, Z.J., Audretsch, D.B., Braunerhjelm, P., & Carlsson, B. (2005).Growth and Entrepreneurship: An Empirial Assessment. Papers on Entrepreneurship, Growth and Public Policy.

- Acs, Z.J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: Measurement issues and policy implications. Research Policy, 43(3), 476-494.

- Acs, Z.J., Desai, S., & Hessels, J. (2008). Entrepreneurship, economic development and institutions.Small Business Economics,31(3), 219-234.

- Acs, Z.J., Estrin, S., Mickiewicz, T., & Szerb, L. (2018). Entrepreneurship, institutional economics and economic growth: An ecosystemperspective.Small Business Economics, 51(2), 501-514.

- Acs, Z.J., Stam, E., Audretsch, D.B., & O’Connor, A. (2017). The lineages of the entrepreneurial ecosystem approach. Small Business Economics, 49(1), 1-10.

- Aoyama, Y. (2009). Entrepreneurship and regional culture: The case of Hamamatsu and Kyoto, Japan. Regional Studies, 43(3), 495-512.

- Aparicio, S., Urbano, D., & Audretsch, D. (2016). Institutional factors, opportunity entrepreneurship and economic growth: Panel data evidence.Technological Forecasting and Social Change,102, 45-61.

- Arin, K.P., Huang, V.Z., Minniti, M., Nandialath, A.M., & Reich, O.F. (2015). Revisiting the determinants of entrepreneurship: A Bayesian approach. Journal of Management, 41(2), 607-631.

- Audretsch, D.B., & Lehmann, E.E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy,34(8), 1191-1202.

- Audretsch, D.B., Grilo, I., & Thurik, A. R. (2007). Explaining entrepreneurship and the role of policy: A framework. The Handbook of Research on Entrepreneurship Policy.

- Audretsch, D.B., Heger, D., & Veith, T. (2015). Infrastructure and entrepreneurship.Small Business Economics,44(2), 219-230.

- Audretsch, D.B., Heger, D., & Veith, T. (2015). Infrastructure and entrepreneurship. Small Business Economics, 44(2), 219-230.

- Auerswald, P.E. (2015). Enabling entrepreneurial ecosystems: Insights from ecology to inform effective entrepreneurship policy.

- Autio, E., Kronlund, M., & Kovalainen, A. (2007). High-growth SME supports initiatives in nine countries: analysis, categorization, and recommendations: Report prepared for the Finnish Ministry of Trade and Industry. Ministry of Trade and Industry.

- Avlijas, G. (2017). Research and development transfer as driver of entrepreneurial activity, innovative (Eco-) technology. Entrepreneurship and Regional Development.

- Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, V. (2008). How important are financing constraints? The role of finance in the business environment. The World Bank Economic Review, 22(3), 483-516.

- Baumol, W.J. (1990). Entrepreneurship: Productive, unproductive, and destructive.Journal of Political Economy,98(5), 893-921.

- Bourne, L. (2011). Advising upwards: Managing the perceptions and expectations of senior management stakeholders.Management Decision,49(6), 1001-1023.

- Carree, M., Van Stel, A., Thurik, R., & Wennekers, S. (2007). The relationship between economic development and business ownership revisited. Entrepreneurship & Regional Development, 19(3), 281-291.

- Carter, N., Brush, C., Greene, P., Gatewood, E., & Hart, M. (2003). Women entrepreneurs who break through to equity financing: the influence of human, social and financial capital.Venture Capital: An International Journal of Entrepreneurial Finance,5(1), 1-28.

- Carter, S., & Shaw, E. (2006). Women’s business ownership: recent research and policy developments. Small Business Service Research Report, London: DTI.

- Cheng, H., Hu, D., Xu, C., Zhang, K., & Fan, H. (2017). Does government paternalistic care promote entrepreneurship in China? Evidence from the China employer-employee survey. China Economic Journal, 10(1), 61-75.

- Cheung, C.K., & Chan, R.Y.C. (2011). The introduction of entrepreneurship education to school leavers in a vocational institute. International Journal of Scientific Research in Education.

- Choo, S., & Wong, M. (2006). Entrepreneurial intention: Triggers and barriers to new venture creations in Singapore.Singapore Management Review,28(2), 47-64.

- Clarysse, B., & Bruneel, J. (2007). Nurturing and growing innovative start‐ups: The role of policy as integrator.R&d Management,37(2), 139-149.

- Clarysse, B., Wright, M., Bruneel, J., & Mahajan, A. (2014). Creating value in ecosystems: Crossing the chasm between knowledge and business ecosystems. Research Policy, 43(7), 1164-1176.

- Congregado, E., Golpe, A.A., & Parker, S.C. (2012). The dynamics of entrepreneurship: Hysteresis, business cycles and government policy. Empirical Economics, 43(3), 1239-1261.

- Dahles, H. (2005). Culture, capitalism and political entrepreneurship. Transactional business ventures of the Singapore-Chinese in China.Culture & Organization,11(1), 45-58.

- Davidsson, P., & Henrekson, M. (2002). Determinants of the prevalance of start-ups and high-growth firms.Small Business Economics,19(2), 81-104.

- Debus, M., Tosun, J., & Maxeiner, M. (2017). Support for policies on entrepreneurship and self-employment among parties and coalition governments. Politics & Policy, 45(3), 338-371.

- Delmar, F., & Shane, S. (2006). Does experience matter? The effect of founding team experience on the survival and sales of newly founded ventures.Strategic Organization,4(3), 215-247.

- Dess, G.G., & Beard, D.W. (1984). Dimensions of organizational task environments. Administrative Science Quarterly,29(1), 52-73.

- DeTienne, D.R., & Chandler, G.N. (2004). Opportunity identification and its role in the entrepreneurial classroom: A pedagogical approach and empirical test.Academy of Management Learning & Education,3(3), 242-257.

- Drexler, M., Eltogby, M., Foster, G., Shimizu, C., Ciesinski, S., Davila, A., & McLenithan, M. (2014). Entrepreneurial ecosystems around the globe and early-stage company growth dynamics. Geneva, Switzerland: World Economic Forum.

- Etzioni, A. (1987). Entrepreneurship, adaptation and legitimation: a macro-behavioral perspective.Journal of Economic Behavior & Organization,8(2), 175-189.

- Europea, U. (2012). Entrepreneurship determinants: Culture and capabilities.

- Feld, B. (2012). Startup communities: Building an entrepreneurial ecosystem in your city. John Wiley & Sons.

- Feldman, M., Francis, J., & Bercovitz, J. (2005). Creating a cluster while building a firm: Entrepreneurs and the formation of industrial clusters. Regional Studies, 39(1), 129-141.

- Ferraro, C.A., & Goldstein, E. (2011). Policies for access to financing for small and medium enterprises in Latin America.

- Foster, G., Shimizu, C., Ciesinski, S., Davila, A., Hassan, S., Jia, N., & Morris, R. (2013). Entrepreneurial ecosystems around the globe and company growth dynamics. World Economic Forum.

- Fraser, S., Bhaumik, S.K., & Wright, M. (2015). What dowe know about entrepreneurial finance and its relationship with growth? InternationalSmall Business Journal, 33(1), 70-88.

- George, G., & Zahra, S.A. (2002). Culture and its consequences for entrepreneurship.Entrepreneurship Theory and Practice,26(4), 5-8.

- Ghani, E., Kerr, W.R., & O'connell, S. (2014). Spatial determinants of entrepreneurship in India.Regional Studies,48(6), 1071-1089.

- Goldfarb, B., & Henrekson, M. (2003). Bottom-up versus top-down policies towards the commercialization of university intellectual property.Research Policy,32(4), 639-658.

- González-Pernía, J.L., & Peña-Legazkue, I. (2015). Export-oriented entrepreneurship and regional economic growth.Small Business Economics,45(3), 505-522.

- González-Pernía, J.L., Peña-Legazkue, I., & Vendrell-Herrero, F. (2012). Innovation, entrepreneurial activity and competitiveness at a sub-national level.Small Business Economics,39(3), 561-574.

- Hansen, J., & Sebora, T.C. (2003). Applying principles of corporate entrepreneurship to achieve national economic growth. InIssues in Entrepeneurship,(pp. 69-90). Emerald Group Publishing Limited.

- Hechavarría, D.M., & Ingram, A.E. (2018). Entrepreneurial ecosystem conditions and gendered national-level entrepreneurial activity: A 14-year panel study of GEM.Small Business Economics.

- Henrekson, M., & Stenkula, M. (2010). Entrepreneurship and public policy. In Handbook of Entrepreneurship Research (pp. 595-637). Springer, New York, NY.

- House, R.J. (1998). A brief history of globe.Journal of Managerial Psychology,13(3/4), 230-240.

- Inglehart, R. (1997).Modernization and postmodernization: Cultural, economic, and political change in 43 societies. Princeton University Press.

- Isenberg, D. (2010). How to start an entrepreneurial revolution. Harvard Business Review, 88(6), 40-50.

- Isenberg, D. (2014). What an entrepreneurship ecosystem actually is. Harvard Business Review, 5, 1-7.

- Keuschnigg, C., & Nielsen, S. B. (2004). Start-ups, venture capitalists, and the capital gains tax.Journal of Public Economics,88(5), 1011-1042.

- Kibler, E., Kautonen, T., & Fink, M. (2014). Regional social legitimacy of entrepreneurship: Implications for entrepreneurial intention and start-up behaviour. Regional Studies, 48(6), 995-1015.

- Kirzner, I.M. (1997). Entrepreneurial discovery and the competitive market process: An Austrian approach.Journal of Economic Literature,35(1), 60-85.

- Klapper, L., Laeven, L., & Rajan, R. (2006). Entry regulation as a barrier to entrepreneurship. Journal of Financial Economics, 82(3), 591-629.

- Klepper, S., & Sleeper, S. (2005). Entry by spinoffs.Management Science,51(8), 1291-1306.

- Knight, F.H. (1921). Cost of production and price over long and short periods.Journal of Political Economy,29(4), 304-335.

- Konczal, J. (2013). The most entrepreneurial metropolitan area? SSRN.

- Leibenstein, H. (1968). Entrepreneurship and development.The American Economic Review,58(2), 72-83.

- Levie, J., & Autio, E. (2008). A theoretical grounding and test of the GEM model.Small Business Economics,31(3), 235-263.

- Li, H., Yang, Z., Yao, X., Zhang, H., & Zhang, J. (2012). Entrepreneurship, private economy and growth: Evidence from China.China Economic Review,23(4), 948-961.

- Markman, G.D., Gianiodis, P.T., Phan, P.H., & Balkin, D.B. (2004). Entrepreneurship from the ivory tower: Do incentive systems matter?The Journal of Technology Transfer,29(4), 353-364.

- McMullen, J.S., Bagby, D.R., & Palich, L.E. (2008). Economic freedom and the motivation to engage in entrepreneurial action.Entrepreneurship Theory and Practice,32(5), 875-895.

- Méndez-Picazo, M.T., Galindo-Martín, M.A., & Ribeiro-Soriano, D. (2012). Governance, entrepreneurship and economic growth. Entrepreneurship & Regional Development, 24(10), 865-877.

- Michael, S.C., & Pearce, J.A. (2009). The need for innovation as a rationale for government involvement in entrepreneurship. Entrepreneurship and Regional Development, 21(3), 285-302.

- Mittal, M., & Vyas, R.K. (2011). A study of psychological reasons for gender differences in preferences for risk and investment decision making.IUP Journal of Behavioral Finance,8(3), 45-60.

- Moritz, A., Block, J.H., & Heinz, A. (2016). Financing patterns of European SMEs-An empirical taxonomy. Venture Capital, 18(2), 115-148.

- Motoyama, Y., & Knowlton, K. (2014). Examining the connections within the startup ecosystem: A case study of st. louis.

- Motoyama, Y., & Mayer, H. (2017). Revisiting the roles of the university in regional economic development: A triangulation of data. Growth and Change, 48(4), 787-804.

- Mullins, J.W., & Forlani, D. (2005). Missing the boat or sinking the boat: A study of new venture decision making.Journal of Business Venturing,20(1), 47-69.

- Nadkarni, S., & Narayanan, V.K. (2007). Strategic schemas, strategic flexibility, and firm performance: The moderating role of industry clock speed.Strategic Management Journal,28(3), 243-270.

- Nelles, J., Bramwell, A., & Wolfe, D. A. (2005). History, culture and path dependency: Origins of the Waterloo ICT cluster. Global Networks and Local Linkages: The Paradox of Cluster Development in an Open Economy, 227-252.

- Nitu, A.R.D., & Feder, E.S. (2012). Labour market dynamics as time-lagged effect of entrepreneurship in the case of Central and Eastern European countries.Procedia Economics and Finance,3, 950-955.

- Nițu-Antonie, R.D., Feder, E.S., & Munteanu, V.P. (2017). Macroeconomic effects of entrepreneurship from an international perspective.Sustainability, 9(7), 1159.

- Nyström, K. (2008). The institutions of economic freedom and entrepreneurship: Evidence from panel data.Public Choice,136(4), 269-282.

- Parker, S.C., Storey, D.J., & Van Witteloostuijn, A. (2010). What happens to gazelles? The importance of dynamic management strategy. Small Business Economics, 35(2), 203-226.

- Peterman, N.E., & Kennedy, J. (2003). Enterprise education: Influencing students’ perceptions of entrepreneurship.Entrepreneurship Theory and Practice,28(2), 129-144.

- Pickernell, D., Senyard, J., Jones, P., Packham, G., & Ramsey, E. (2013). New and young firms: Entrepreneurship policy and the role of government-evidence from the federation of small businesses survey. Journal of Small Business and Enterprise Development, 20(2), 358-382.

- Reynolds, P.D. (2011). Informal and early formal financial support in the business creation process: Exploration with PSED II data set.Journal of Small Business Management,49(1), 27-54.

- Runiewicz-Wardyn, M. (2013).Knowledge flows, technological change and regional growth in the European Union. Cham, Heidelberg: Springer.

- Sabella, A.R., Farraj, W.A., Burbar, M., & Qaimary, D. (2014). Entrepreneurship and economic growth in West Bank, Palestine. Journal of Developmental Entrepreneurship, 19(1), 1450003.

- Salimath, M.S., & Cullen, J.B. (2010). Formal and informal institutional effects on entrepreneurship: a synthesis of nation-level research.International Journal of Organizational Analysis,18(3), 358-385.

- Salman, D. (2014). Mediating role of research and development on entrepreneurial activities and growth: Evidence from cross-country data. World Journal of Entrepreneurship, Management and Sustainable Development, 10(4), 300-313.

- Schumpeter, J.A. (1996).Behavioral norms, technological progress, and economic dynamics: Studies in Schumpeterian economics. University of Michigan Press

- Shah, S.K., & Pahnke, E.C. (2014). Parting the ivory curtain: Understanding how universities support a diverse set of startups. The Journal of Technology Transfer, 39(5), 780-792.

- Singha, K. (2013). Infrastructure for entrepreneurship development in India's Trouble-Torn State of Manipur.

- Sobel, R.S., Clark, J.R., & Lee, D.R. (2007). Freedom, barriers to entry, entrepreneurship, and economic progress.The Review of Austrian Economics,20(4), 221-236.

- Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory and Practice, 41(1), 49-72.

- Stam, E. (2014). The Dutch entrepreneurial ecosystem.

- Stam, E. (2015). Entrepreneurial ecosystems and regional policy: A sympathetic critique. European Planning Studies, 23,1759-1769.

- Stam, E., & Spigel, B. (2016). Entrepreneurial ecosystems and regional policy. Sage Handbook for Entrepreneurship and Small Business. London: SAGE.

- Stevenson, L., & Lundström, A. (2007). Dressing the emperor: The fabric of entrepreneurship policy.Handbook of Research on Entrepreneurship Policy, 94-129.

- Thurik, A.R. (2009). Entreprenomics: Entrepreneurship, economic growth and policy. Entrepreneurship, Growth, and Public Policy, 219-249.

- Toma, S.G., Grigore, A.M., & Marinescu, P. (2014). Economic development and entrepreneurship.Procedia Economics and Finance,8, 436-443.

- Tsai, K.H., Chang, H.C., & Peng, C.Y. (2016). Refining the linkage between perceived capability and entrepreneurial intention: Roles of perceived opportunity, fear of failure and gender. International Entrepreneurship and Management Journal, 12(4), 1127-1145.

- Van Stel, A., Storey, D.J., & Thurik, A.R. (2007). The effect of business regulations on nascent and young business entrepreneurship.Small Business Economics,28(3), 171-186.

- Vidal Suñé, A., & López Panisello, M.B. (2013). Institutional and economic determinants of the perception of opportunities and entrepreneurial intention.

- Woolley, J.L. (2014). The creation and configuration of infrastructure for entrepreneurship in emerging domains of activity. Entrepreneurship Theory and Practice, 38(4), 721-747.

- Yang, T.T., & Li, C.R. (2011). Competence exploration and exploitation in new product development: The moderating effects of environmental dynamism and competitiveness. Management Decision, 49(9), 1444-1470.