Case Reports: 2024 Vol: 30 Issue: 2S

MCB Bank

Zaheer Abbas, Superior University

Muhammad Rafiq, Superior University

Citation Information: Abbas, Z. & Rafiq. M (2024). MCB Bank. Journal of the International Academy for Case Studies, 30(S2), 1-8.

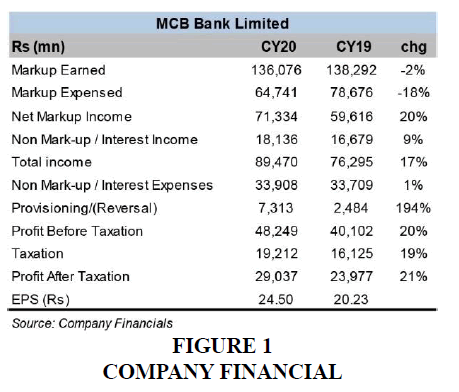

MCB Bank Limited, established in 1947, stands as a cornerstone in Pakistan's financial history. Over the years, it has evolved into a powerhouse within the banking sector, showcasing a steadfast commitment to providing a wide array of financial services. This includes retail banking, catering to individual consumers; corporate banking, addressing the needs of businesses; and Islamic banking, adhering to Sharia principles. The bank's reliability and efficiency have solidified its reputation, making it one of the most respected institutions in the country, serving not only the local populace but also extending its reach internationally. Upon completing my academic journey, I enthusiastically joined MCB Bank, eager to contribute to the institution's legacy. As a team member, I gained hands-on experience across various aspects of banking operations. In the course of my initial observations, it became apparent that there were areas within the organization that could benefit from refinement. Notably, challenges were identified in the handling of financial statements and customer accounts. In response to these observations, I actively engaged in initiatives aimed at addressing these challenges during my first six months at MCB Bank. Collaborating closely with my team, I delved into the complexities of financial statement management. The goal was to enhance accuracy and efficiency, ensuring that the bank's financial records were not only meticulous but also reflective of the highest industry standards. Simultaneously, I directed efforts toward streamlining customer account handling processes, recognizing the pivotal role this plays in shaping the overall customer experience (Exhibit 1, Figure 1).

Despite the dedication to improvement, challenges arose in managing the tasks associated with accounts, and certain disciplinary issues within the organization became apparent. These challenges were not viewed as setbacks but rather as opportunities for growth and development. In response, I sought to innovate solutions and contribute to the overall enhancement of internal processes. Through effective communication and collaboration, I played a role in implementing corrective measures, fostering a more cohesive and disciplined work environment. In essence, my journey at MCB Bank has been characterized by a dedication to tackling operational challenges head-on and contributing to the continual improvement of the bank's services. This experience has not only broadened my understanding of the intricacies of the banking industry but has also equipped me with the skills necessary to navigate complex financial environments, adapt to evolving challenges, and contribute meaningfully to organizational success. As time progressed, my role at MCB Bank involved a deepening understanding of the challenges that the bank faced, particularly in the realms of services and supply chain. Frustrations mounted as issues persisted, but rather than succumbing to dissatisfaction, I took it upon myself to proactively address and resolve these problems.

The primary source of discontent stemmed from service-related problems, where efficiency and quality were compromised. Recognizing the critical importance of excellent service in the banking sector, I undertook a thorough analysis to identify bottlenecks and inefficiencies. This involved scrutinizing customer feedback, internal processes, and employee workflows. Armed with a comprehensive understanding of the issues, I proposed and implemented targeted solutions to enhance service delivery. The supply chain also emerged as a critical area requiring attention. Inconsistent supply chain practices were affecting various aspects of operations, from procurement to distribution. To rectify this, I initiated a systematic review of the supply chain, identifying weak links and areas for improvement. Collaborating with relevant stakeholders, I implemented strategic changes that optimized the supply chain, ensuring a smoother and more reliable flow of resources throughout the organization. Despite the initial frustrations, these challenges became catalysts for positive change. By taking a proactive stance and offering accurate, viable solutions, I not only addressed the issues at hand but also contributed to the overall improvement of MCB Bank's operational efficiency. This experience reinforced my commitment to driving positive change within the organization and honed my ability to identify and solve complex problems.

MCB in other countries

MCB Bank has firmly established itself as a global financial institution, operating across more than 20 countries. This extensive international presence positions the bank as a key player in the global financial landscape, allowing it to effectively serve a diverse clientele. In terms of financial performance, MCB Bank has consistently demonstrated resilience and profitability. In the fiscal year 2021, the bank reported an impressive net profit of Rs. 31.5 billion ($220 million). This financial success highlights the bank's adept navigation of industry dynamics and its ability to generate substantial returns. MCB Bank's total assets closed at a significant Rs. 1.9 trillion ($13 billion) by the end of the 2021 fiscal year. This substantial asset base reflects the bank's financial strength and its capability to manage resources effectively.

MCB Bank's operations span various sectors, covering personal, corporate, and investment banking to provide a holistic range of financial services.

a) In personal banking, MCB Bank offers a variety of products and services tailored to individual needs. This includes checking and savings accounts, diverse loan options, mortgages to facilitate home ownership, and credit cards for a range of financial requirements.

b) For corporate clients, MCB Bank provides a comprehensive suite of financial solutions. This encompasses commercial loans to support business operations, trade finance services facilitating international transactions, and a robust set of investment banking services.

c) The bank's involvement in investment banking is characterized by activities such as mergers and acquisitions, capital raising initiatives, and expert portfolio management.

These services are designed to assist corporate clients in optimizing their financial strategies and achieving sustainable growth. MCB Bank's success is underscored by its ability to provide a diverse array of financial solutions while maintaining a strong international presence. The bank's consistent financial performance speaks to its resilience and adaptability in a dynamic economic environment, and its commitment to meeting the evolving needs of a global clientele.

Product and service’s

MCB Bank Limited, as one of the premier commercial banks in Pakistan, stands out for its commitment to delivering a comprehensive suite of financial products and services to a diverse clientele. The bank's offerings are strategically categorized to address the unique needs of individuals, businesses, corporations, and those seeking Islamic banking solutions.

Personal Banking

In the domain of personal banking, MCB Bank provides a spectrum of services that cater to the everyday financial needs of individuals. This includes traditional offerings such as checking and savings accounts, which form the backbone of personal finance. Complementing these are loan products designed to meet various financial requirements, credit cards for convenient transactions, and investment services to support the growth of personal wealth.

Checking and Savings Accounts

MCB Bank provides traditional checking and savings accounts, offering customers a secure and accessible means to manage their day-to-day finances.

Loans

The bank offers a range of loan products, catering to various personal needs such as home loans, auto loans, and personal loans.

Credit Cards

MCB Bank issues credit cards, providing customers with a convenient and flexible payment solution for their transactions (Exhibit 1, Figure 2).

Investment Services

Personal banking customers can access investment services, allowing them to grow their wealth through strategic financial planning.

Business Banking

For businesses, MCB Bank offers a tailored suite of banking solutions. Business owners can access specialized checking and savings accounts to manage their finances efficiently. Loans are available to address the diverse operational needs of businesses, while credit cards are provided to facilitate seamless financial transactions. Additionally, merchant services are offered to streamline payment processes and enhance the overall business ecosystem.

Checking and Savings Accounts

MCB Bank provides specialized business accounts to facilitate the financial management of businesses.

Loans

Business owners can access loans tailored to meet specific operational needs, fostering growth and development.

Credit Cards

Business credit cards are available to streamline financial transactions and expenses.

Merchant Services

MCB Bank offers merchant services to businesses, enhancing payment processing and facilitating smooth financial transactions (Exhibit 1, Figure 3).

Corporate Banking

MCB Bank's corporate banking services are designed to meet the complex financial requirements of larger enterprises. The bank provides sophisticated cash management solutions, allowing corporations to optimize their financial workflows. Trade finance services enable seamless international transactions, and project finance is available to support significant business ventures, reflecting the bank's commitment to facilitating the growth of the corporate sector.

Cash Management

MCB Bank provides sophisticated cash management solutions to optimize financial workflows for corporations.

Trade Finance

The bank facilitates international transactions through its trade finance services, supporting corporations engaged in global business.

Project Finance

MCB Bank offers project finance solutions to support major business ventures, reflecting a commitment to the growth of the corporate sector.

Islamic Banking

Recognizing the diversity of financial preferences within its customer base, MCB Bank offers a range of Islamic banking products and services. This includes Islamic checking and savings accounts designed in accordance with Sharia principles, Islamic loans structured to adhere to ethical financing standards, and investment services aligned with Islamic finance principles. These offerings reflect MCB Bank's commitment to providing financial solutions that respect diverse cultural and religious considerations.

Islamic Checking and Savings Accounts

MCB Bank provides Islamic banking options that adhere to Sharia principles, including checking and savings accounts.

Islamic Loans

Ethical financing solutions are available to customers seeking loans in compliance with Islamic financial principles.

Investment Services

MCB Bank extends investment services within the framework of Islamic finance, allowing customers to grow their wealth while maintaining adherence to Islamic principles.

To ensure accessibility and convenience, MCB Bank has established a robust network of branches and ATMs strategically positioned across Pakistan. Moreover, the bank embraces modern banking practices by offering online and mobile banking services, empowering customers to conduct transactions and manage their finances with ease. Through its comprehensive and customer-centric approach, MCB Bank continues to evolve its offerings, maintaining its position as a leader in the Pakistani banking industry.

Success pillars of MCB

MCB Bank's success is built on five key principles that guide how the bank operates and achieves its goals. Let's break down these principles in a more accessible way:

Customer Centricity

At MCB Bank, customers come first. The bank listens to what customers need and makes sure its products and services are designed with them in mind. This approach is all about keeping customers happy and satisfied.

Innovation

MCB Bank is always looking for new and better ways to do things. They invest in research and development and encourage their employees to come up with fresh ideas. This focus on innovation helps the bank stay modern and ahead of the curve.

Integrity

Being honest and transparent is a big deal for MCB Bank. They believe in doing business ethically and treating everyone – customers, employees, and shareholders – fairly. This commitment to integrity is the foundation of the bank's trustworthiness.

Teamwork

Teamwork is a big deal at MCB Bank. They believe that when employees work together and share their knowledge, great things happen. This collaborative spirit helps create a positive and innovative work environment.

Performance

MCB Bank aims high. They set challenging goals for themselves and always keep an eye on their progress. This commitment to high performance ensures that the bank consistently delivers good results and continues to improve.

These five principles, or Success Pillars, have played a crucial role in MCB Bank being recognized as one of the top banks in Pakistan. By focusing on customers, embracing innovation, maintaining integrity, promoting teamwork, and striving for high performance, MCB Bank has built a strong reputation for excellence in the banking industry.

Key issues in supply chain management

During my tenure at MCB Bank Supply Chain, several key issues were identified within the department's operations and coordination structure. One prominent challenge was the presence of communication gaps, hindering the smooth flow of information between different departments and key chain supervisors. These gaps, at times, resulted in delays and misunderstandings, impacting the timely execution of financial transactions and services. Another noteworthy issue involved coordination among departments, crucial for the interconnected nature of supply chain services. In some instances, effective collaboration proved challenging, affecting the overall efficiency of supply chain processes. Additionally, inconsistencies in supervisory oversight were observed, leading to variations in the application of policies and procedures across different stages of the supply chain. The adaptation to technological changes also presented challenges in certain departments, potentially hindering the full realization of efficiency gains expected from technological advancements. Moreover, establishing effective mechanisms for customer engagement and feedback collection emerged as an area for improvement, as real-time feedback is essential for refining and enhancing supply chain services. Addressing these issues requires a comprehensive approach involving improved communication channels, enhanced coordination mechanisms, consistent supervisory oversight, seamless adaptation to new technologies, and robust customer feedback mechanisms. Resolving these challenges will contribute to a more streamlined and efficient MCB Bank Supply Chain, reinforcing its role as a valuable resource for businesses in optimizing financial processes and supply chain management.

Plan

The plan represents the bank's commitment to strategic planning. Here, MCB Bank defines its long-term objectives and sets clear goals. This involves assessing market dynamics, identifying growth opportunities, and charting a strategic course for the bank's future initiatives. Through robust planning, MCB Bank ensures that its actions are aligned with its overarching vision and mission, providing a roadmap for sustainable success.

Source

MCB Bank focuses on efficiently acquiring and managing resources critical to its operations. This includes human resources, technological infrastructure, and financial assets. By strategically sourcing and managing these resources, the bank aims to enhance its operational capabilities. This phase is essential for fostering innovation, maintaining financial stability, and ensuring adaptability to changing market conditions.

Service

Under the service, MCB Bank places a strong emphasis on delivering exceptional customer service. This involves tailoring products and services to meet the diverse needs of its customer base. MCB Bank prioritizes customer satisfaction and engagement, aiming to build lasting relationships. By offering personalized and reliable services, the bank positions itself as a trusted financial partner for individuals, businesses, and corporations.

Process

The process centers on optimizing internal operational processes and workflows within the bank. This involves continuous improvement initiatives, adherence to industry best practices, and the integration of innovative technologies to enhance efficiency. By refining internal processes, MCB Bank ensures the seamless delivery of services to its customers. This phase is crucial for maintaining operational excellence and staying competitive in the dynamic financial market.

What I did?

During my tenure at MCB Bank Supply Chain, my role was multifaceted and involved actively contributing to the resolution of key challenges within the department. One significant aspect of my responsibilities was addressing communication gaps by facilitating improved channels between departments and key chain supervisors. I played a crucial role in fostering a more open and transparent flow of information, ensuring that relevant details were communicated efficiently to mitigate delays in financial transactions and service execution. I worked towards enhancing collaboration mechanisms. This involved initiating regular meetings, promoting cross-functional communication, and implementing collaborative tools to streamline processes. By fostering a culture of effective teamwork, I aimed to improve the overall efficiency of supply chain operations.

Recognizing the importance of consistent supervisory oversight, I actively contributed to the development and implementation of standardized procedures. This involved working closely with key chain supervisors to ensure uniform application of policies across different stages of the supply chain. By addressing inconsistencies, we sought to enhance the reliability and predictability of the department's operations. I played a role in facilitating the adaptation to technological changes within the Supply Chain department. This included organizing training sessions, providing support during the implementation of new technologies, and ensuring that employees were equipped with the necessary skills to leverage technological tools effectively. In terms of customer engagement and feedback mechanisms, I initiated and implemented strategies to gather real-time feedback from businesses utilizing supply chain services. This involved conducting surveys, organizing customer feedback sessions, and establishing communication channels to better understand customer needs and concerns.

Reflecting on the challenges faced, particularly in instances where there were shortcomings in communication and coordination, I gained valuable insights into the importance of proactive problem-solving and the need for agile responses to dynamic situations. The experience taught me the significance of adaptability, effective teamwork, and the continuous pursuit of improvements in operational processes. Witnessing the challenges faced by the bank underscored the critical role of innovation and technology in the banking industry. Learning from these challenges, I realized the importance of staying abreast of technological advancements to ensure that the bank remains competitive and resilient in a rapidly evolving financial landscape. My role at MCB Bank Supply Chain involved addressing key issues, fostering improved communication and collaboration, and actively contributing to the department's overall efficiency. The experience provided me with valuable lessons in problem-solving, adaptability, and the critical role of technology in the banking sector.