Research Article: 2020 Vol: 24 Issue: 1S

Model of Entrepreneurship Financial Activity of the Transnational Company Based on Intellectual Technology

Aleksy Kwilinski, The London Academy of Science and Business Henryk Dzwigol, Silesian University of Technology Vyacheslav Dementyev, Financial University- Government of the Russian Federation

Abstract

In order to ensure the sustainable competitiveness of multinational corporations in an integrated and at the same time segmented and diversified global financial market, it is first and foremost important to determine their mission and strategy, which have particularities for universal, specialized, niche, international bank oriented clients. Based on the principles of functionality, uniqueness and collegiality, necessary competence and conflict of interest, taking into account prevailing business processes and environmental factors, organizational structures of transnational banks are developed, the main types of which are linear-functional, divisional, mixed. Corresponding to the modern trends of global financial business and entrepreneurship, the methodology of organizational modeling is a multilevel organizational business model of a transnational bank with organizational and functional (business, functions, structure), technological (IT landscape, IT infrastructure, services), process role, regulatory, service, quantitative subsystems. The Bank's organizational design format introduces and develops a profile of its innovative, team, client-oriented, productive corporate culture. In today's global banking, comprehensive programs for improving business ecosystems with creative management tools are being updated.

Keywords

Entrepreneurship, IT Landscape, IT Infrastructure, Business Process, Business Model.

Introduction

The current global economic system is characterized by the uneven and slowing down of the dynamics of development and the permanent nature of crisis processes under the influence of fundamental forces, among which is the expansion of transnational financial capital. With the advent of new information and innovation technologies, on the one hand, the level of competition in the global financial market and the efficiency of redistribution of global capital flows increase, and on the other, the potential of financial transmission of shocks and financial and economic crises.

Under the influence of financial innovations at the micro level and the improvement of the institutional tools for supervision and regulation of the global financial market, which change the conditions of operation and necessitate new organizational models of transnational financial business, the problem of updating its organizational structures is actualized.

Review of Previous Studies

A new tool with extraordinarily wide functionality that can be used not only in the field of payments but also in the stock market is blockchain technology. The economic benefits of making digital payments are significant due to reduced transaction costs (Hilorme et al., 2019 a,b). This, in turn, creates a favorable economic cycle whereby increased consumption contributes to job creation and income growth.

Analysts estimate that the increase in electronic payments contributed an additional $ 296 billion. US consumption between 2011 and 2015, or an aggregate increase of 0.1% of world GDP during this period (Bettig, 2018). They also create 2.6 million jobs on average each year.

By leveraging innovation in the payment system, Asia can further accelerate economic growth (Paganetto, 2017); (Dzwigo?, 2019 a,b); (Karpenko et al., 2018).

At the same time, the impact of blockchain-based financial technologies on the global financial market is transforming its infrastructure towards strengthening the role of transnational banks and the emergence of new counterparties in the non-financial sector.

In particular, Dratler & McJohn, (2017) considered economies of scale in European payment processing based on the latest technologies, among which is the case of distributed register technology.

Researchers have paid considerable attention to the impact of new technologies on the transformation of financial infrastructure. Thus, Drobyazko (2019 a,b) analyzed the cost structure, customer profitability, retention costs and consequences of self-service banking online distribution channels.

Costa & Harris (2017) identified blockchain among the determinants and implications of Internet banking.

Goeschl & Perino (2017) identified the limits of using blockchain technology in the ability of the economy to self-organize from a banking perspective. The use of blockchain technology and decentralized registers for the operation of the world's first bitcoin cryptocurrency since 2008 was significant.

Methodology

Methodological and theoretical foundations of the study are the works of leading scientists who reveal the essence, features of the development of the global financial market. The following methodological apparatus was used: dialectical and historical methods of scientific knowledge, analysis and synthesis in the study of the evolution of economic systems; graphical methods of information processing for analysis of the activities of leading multinational financial companies; comparative analysis; A method of theoretical generalization in formulating conclusions to sections and general conclusions.

Results and Discussions

Being in line with the philosophy and the latest tendencies of modern management with mostly creative features, network organizational structures and coordination-motivational style, etc., business process management is organically combined with intellectual technologies of innovative management.

In fact, the impact is the impact of information and innovation technologies of financial business, which has a manifestation in the transformation of financial, in particular, banking capital in the direction of virtualization and reducing communication with the real sector of the economy. At the same time, financialisation is an objective process when the virtual financial sector based on financial innovation, etc., is playing an increasingly important role.

It should be noted that an important factor driving transnational financial business structures to change organizational models is the increasing competition both in banking and non-banking institutions due to the opportunities offered by IT platforms (Dalevska et al., 2019).

At the same time, multinational financial corporations are able to develop innovative payment and other payment mechanisms that are significantly cheaper to use for consumers, and they have significant competitive advantages in potentially attractive markets in developing countries compared to national financial companies.

Since significant financial resources are needed to implement blockchain-based financial innovations as large, high-tech, universal-type credit and financial complexes with an extensive network of foreign representative offices, controlling, with the support of the state, foreign exchange and credit operations on the world market and acting as the main intermediaries international large-scale borrowing can compete for consumers of financial services with non-financial corporations.

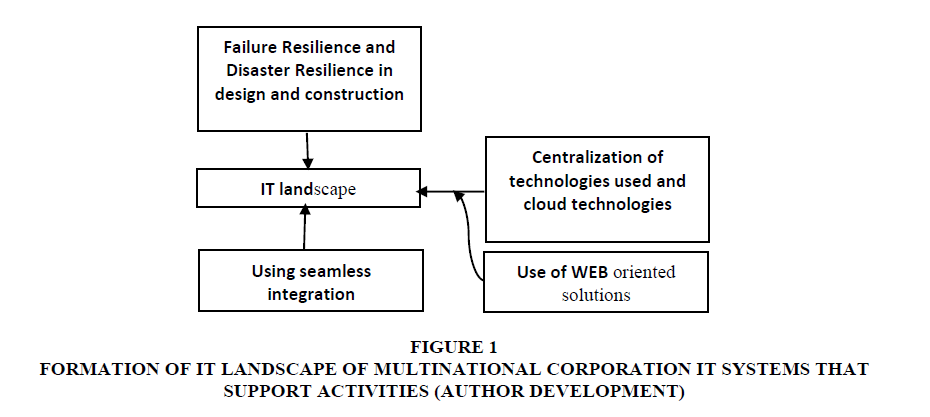

As a rule, the development and support of remote sales channels (Internet, self-service devices), as well as online and interactive components of the Bank's products and services are handled by the e-business department. At the present stage, there is a need to develop and implement a technological model. In accordance with modern requirements, a new terminology is being formed for banking, for example, the term IT landscape (Figure 1).

Figure 1: Formation of it Landscape of Multinational Corporation it systems that support activities (Author Development).

In the format of modern approaches we have defined the following principles of technological model construction:

1. Ensuring the integration of IT technologies (hardware, software, services), staff and customers (internal and external).

2. Orientation when building services on SOA (Service Oriented Architecture).

3. Creating a balanced IT landscape and IT infrastructure.

4. Use in the IT landscape and IT infrastructure of solutions that provide only centralized services, the transition to cloud computing.

5. Creating reliable, productive and scalable IT landscape and infrastructure.

6. Compliance of the technological model with international standards (ISO 20000).

7. Consistency and interdependence of assembly of technological model (defined sequence of implementation of IT-solutions and IT-infrastructure).

Such principles reflect the particularities of industry-leading IT landscapes, core platforms and the supporting systems that shape them. The simplified architecture of the bank's applied IT landscape contains external (accounting chamber, reporting to the state regulator, transaction accounting system, regulatory reference system, SWIFT) and internal systems (core banking and client-bank). The developed architecture of the bank's applied IT landscape includes processes, channels, services that collectively provide infrastructure, management and security. Basic, general functions and position management in the core banking process are linked to the financial reporting system and the General Ledger.

One of the most difficult regulatory challenges to address today is the identification of its productive, unproductive (speculative) and virtual components. In the context of information globalism, deepening and maintaining the trends of intersectoral diversification in the medium term, the crisis of the banking system can significantly increase and acquire new institutional quality. Already, a serious competitor of banks in certain segments of the market are IT companies integrated into global payment systems. Being interdisciplinary, this problem obviously requires some theoretical research, and in practical terms, banks need to take their business processes seriously, otherwise they may be behind the current trends of the information revolution.

Recommendations

It should be noted that the technological model has not become simpler in the process of scientific advancement, but rather has become even more complicated in the part of the IT landscape and IT infrastructure. The emergence of industrial integration solutions of the BPM class, integration buses made it possible to significantly improve the quality of integration of different systems and created the prerequisites for the implementation of SOA-architecture.

The development of cloud technology has shifted the focus to reliability, security, end-to-end resiliency and infrastructure. This greatly simplified the requirements for end users while increasing the requirements for cloud organization. The market is divided into large players (IBM, Oracle, Cisco, etc.) who stand for standardization, and many startups that typically operate with a great deal of freedom.

As a consequence, there are complexities in integration (different architecture, performance, fault tolerance) of heterogeneous systems into one landscape within the SOA. This is ultimately reflected in the processes that are supported. There is a growing demand for IT staff competence in both development and support.

Conclusions

It is clear that information networks will be global with universal basic principles of formation, channels and technological means of circulation of information, etc., depending on the types of business have their specificity. However, while virtualization and the intellectualization of financial services have significantly increased the number of people involved in the financial market over the past few years, in many developing countries, the use of bills and other electronic tools remains low.

Transformations of the business environment, primarily related to global informatization, lead to qualitative changes in the strategic behavior and management of its subjects, in particular transnational banks. The volatile, and in many manifestations, turbulent state of the financial markets forms a new corporate governance paradigm, as its traditional paradigm is not focused on prioritizing business processes directly in the form of innovative trends and strategies, business models, current procedures and operations.

The initiation, development and practical implementation of innovative projects becomes an integral part of their activities in a dynamic competitive business environment. They, on the one hand, are focused on the fulfillment of the mission of the bank, and on the other, contribute to the development of its technical and social architecture in the context of global informatization and international technological unification, when the ITC platform for managing general and local business processes becomes the most appropriate. Equally important is the targeted stimulation of individual performers, their groups and divisions, related to the growth of organizational capital and the formation of an innovative corporate culture.

References

- Bettig, R.V. (2018). Copyrighting culture: The political economy of intellectual property. Routledge.

- Costa, C., & Harris, L. (2017). Reconsidering the technologies of intellectual inquiry in curriculum design. The Curriculum Journal, 28(4), 559-577.

- Dalevska, N., Khobta, V., Kwilinski, A., & Kravchenko, S. (2019). A model for estimating social and economic indicators of sustainable development. Entrepreneurship and Sustainability Issues, 6(4), 1839-1860.

- Dratler Jr, J., & McJohn, S.M. (2017). Cyberlaw: Intellectual property in the digital millennium. Law Journal Press.

- Drobyazko, S., Alieksieienko, I., Kobets, M., Kiselyova, E., & Lohvynenko, M. (2019a). Transnationalities and segment security of the international labor market. Journal of Security and Sustainability Issues, 9(2), XX.

- Drobyazko S., Barwi?ska-Ma?ajowicz A., ?lusarczyk B., Zavidna L., & Danylovych-Kropyvnytska M. (2019b). Innovative entrepreneurship models in the management system of enterprise competitiveness. Journal of Entrepreneurship Education, 22(4), 2019.

- Dzwigo?, H., Dzwigo?–Barosz, M., Zhyvko, Z., Miskiewicz, R., & Pushak, H. (2019a). Evaluation of the energy security as a component of national security of the country. Journal of Security and Sustainability Issues, 8(3), 307-317.

- Dzwigol, H., Aleinikova, O., Umanska, Y., Shmygol, N., & Pushak, Y. (2019b). An entrepreneurship model for assessing the investment attractiveness of regions. Journal of Entrepreneurship Education, 22(SI1), 1-7.

- Goeschl, T., & Perino, G. (2017). The climate policy hold?up: Green technologies, intellectual property rights, and the abatement incentives of international agreements. The Scandinavian Journal of Economics, 119(3), 709-732.

- Hilorme, T., Perevozova, I., Shpak, L., Mokhnenko, A., & Korovchuk, Yu. (2019a). Human Capital Cost Accounting in the Company Management System. Academy of Accounting and Financial Studies Journal, 23(2), 2019.

- Hilorme, T., Zamazii, O., Judina, O., Korolenko, R., & Melnikova, Yu. (2019b). Formation of risk mitigating strategies for the implementation of projects of energy saving technologies. Academy of Strategic Management Journal, 18(3).

- Karpenko, L., Serbov, M., Kwilinski, A., Makedon, V., & Drobyazko, S. (2018). Methodological platform of the control mechanism with the energy saving technologies. Academy of Strategic Management Journal, 17(5), 1-7.

- Paganetto, L. (2017). Knowledge economy, information technologies and growth. Routledge.