Research Article: 2022 Vol: 26 Issue: 6S

Money supply as a mediator in the inflation-output Nexus

Adegbola Olubukola Otekunrin, Landmark University SDG 8 (Decent work and Economic Growth Group) & Landmark University

Okonkwo Jisike J, Nnamdi Azikiwe University Awka

Damilola Felix Eluyela, Landmark University SDG 8 (Decent work and Economic Growth Group) & Landmark University

Okoye Nonso John, Nnamdi Azikiwe University Awka

Anachedo Chima K, Nnamdi Azikiwe University Awka

Okonkwo Ebube V, Nnamdi Azikiwe University Awka

Toluwalase Eniola Awe, Landmark University

Keywords

Mediation, Money supply, Inflation, Economic growth.

Citation Information

Otekunrin, A.O., Jisike, O.J., Eluyela, D.F., John, O.N., Chima, A.K., Ebube, O.V., & Awe, T.E. (2022). Money supply as a mediator in the inflation-output nexus. International Journal of Entrepreneurship, 26(S6), 1-12.

Abstract

This study appraises the role of money supply as a mediator in the association between economic development and inflation in Nigeria using data on broad money supply (M2), inflation rate and real GDP (1981 to 2018) sourced from the CBN statistical bulletin (2019). The ordinary least square regression was used to establish significant associations in order to show the mediating effect of money supply in the inflation-output nexus. The findings revealed that money supply eases the harsh consequences of inflation on the Nigerian economy. The researcher therefore recommends that monetary authorities to collaborate with the fiscal authorities in the formulation and execution of monetary policies in order to ensure strategic injection of funds into key and productive economic with the aim of mitigating the adverse effects of inflation instead of the conventional contractionary monetary policies.

Introduction

The main objectives of central banks are accomplishing high and economic output development rates alongside price stability. Economic growth is believed to be enhanced by having a moderate inflation rate (Asab, 2019).Empirical writings have tracked down that the effect of inflation on output development becomes negative when inflation rate surpasses a specific edge level; a level below which inflation can promote the economic growth. According to Phibian (2010), moderate level of inflation and money supply are significant determinants of sustainable economic growth, thereby increasing the rate of employment, reducing poverty, and increasing per capita income and standards of living. The nexus among inflation and economic development has acquired consideration throughout the years. In more often than not especially before 70's there were arguments on inflation and economic growth relationship with the contention being that there was no relationship or that the relationship is positive (Behera, 2014).This issue has generated continuing debate between stracturalist and monetarist.

From one viewpoint, monetarists contend that output and inflation have a negative relationship. Structuralists, on the other hand, argued that the relationship is rather positive.

Additionally, monetarists likewise accept that money supply may prompt development in productivity in the short-run, yet not over the long-run (Rana, 2020). Nonetheless, money stock development may cause inflationary pressing factors on the off chance that it surpasses the real economic growth rate. This recommendation is gotten from the monetary theory and empirical literature. Therefore, it very well may be proposed that the connection among economic growth and inflation is coordinated by money growth (Asad, 2019).

In Nigeria, inflation rate has reached very high, moderate and low levels and the implications of these levels of inflation on economic growth have been unpredictable. Often times in Nigeria, against expectation, high inflation rate has coincided with high economic growth and vice versa. For instance, CBN(2019) statistical bulletin, revealed that from 1992 to 1995 when inflation rates were 44.6%, 57.2%, 57.03% and 72.9%, output in Nigeria recorded high growth rates of 52.7%, 38.4%, 40.01% and 64.24%; some of the highest growth rates recorded in the Nigerian history. However, in 2015 inflation rate as low as 9% culminated into output growth rate of 5.73%; one of the lowest growth rates recorded in Nigeria. Between 2000 and 2006, inflation rate and output growth exhibited a negative relationship as a rise in inflation rate from 6.93% in 2000 to 18.87% in 2001 led to a fall in the output growth from 29.9% to 17.38. Inflation rate then fell the following year to 12.88% while output growth rose to 39.32%. By 2003, inflation rate rose slightly to 14.03% and output growth plummeted to 17.93%. A rise in inflation rate from 15% in 2004 to 17.86% in 2005 saw output growth fall from 30.22% to 28.57% (CBN, 2019).

This shows that the nexus between inflation rate and output in Nigeria is not a straightforward one; certain factors determine the direction and extent of this relationship. As opined by Asad (2019), supply of money is a vital factor of the nature of the connection between economic development and inflation rate. A basic macroeconomic variable that influences economic development of a nation by facilitating efficient performance of economic activity both in private and public sectors via liquidity availability is money supply. The private sectors can access credits for executing businesses at a given interest rate via money supply. Supply of money is a monetary policy which is exceptionally instrumental in promoting a country’s economic development (Asuquo, Emefiele, Olugbemi & Ita, 2020). Therefore, this research embraces the mediation analysis method in investigating the role of money supply in the inflation-output nexus. Schwartz (2019) highlighted the importance of money supply to economic activities. According to Schwartz (2019) money supply is so important because it facilitates all forms of economic transactions thereby having a strong impact on economic performance. Increase in money supply reduces the lending rates and fosters investments.

Schwartz additionally argued that raising money supply places more money in the possession of purchasers accordingly giving them a wealthy feeling making them increase their spending. The issue of worry is that despite of the importance of money stock in economic activities, contractionary monetary policies are usually being advocated for as the solution to inflation. This implies that during inflation, consumers are left battling with rise in prices with less money supply to match consumption expenditure. The situation is worsened if the source of inflation is driven by non-monetary increases in demand (such as increase in population or seasonal consumptions).This could mean that consumers channel more of their finance to basic consumption on the same amount of goods and there is little to save which will eventually affect investment and ultimately economic growth.

Bozkurt (2014) confirms this by positing that inflation is undeniable consequential to the economy. It distorts savings and investment by creating uncertainty about future prices. It causes firms and individuals to spend more effort, time and money in attempts to predict the future prices. All of these factors hamper growth, causes lower standards of living, and leads to less economic efficiency. Several studies have identified money supply as the causal agent of inflation levels and output growth. Though, the reactionary monetary policies include the change in the supply of money in response to the degree of price increment, to such an extent that it would seem like rate of inflation is somewhat the determinant of money supply.

This is affirmed in a several investigations that have shown bi-directional causality between money supply and inflation (Sultana, Koli & Firoj, 2019; Hatemi, 2008). Also, having found uni-directional causality flowing from inflation to money supply, Chi-Wei, Jiao-Jiao, Hsu-Ling & Xiao-Lin (2016) advocated that controlling inflation should not always involve reducing the money supply as the supply of money is instrumental to economic growth. There is a dearth in studies examining the role of money supply in the inflation-output nexus in Nigeria. The nearest any of such studies have come to this assessment is to look at the inflation rate and money supply impact on economic development (Olanipekun & Akeju, 2013; Asuquo et al., 2020; Babatunde & Shuaibu, 2011). No research has inspected the mediating role of money supply in the association between inflation and output in Nigeria to the best of the investigator’s knowledge, having identified these issues of concern, the researcher examined money supply as a mediator in the inflation-output nexus.

Literature Review

Conceptual Framework

Simply put, the quantity of cash that is accessible for use in an economy throughout a specific time period is referred to as money supply (Bozkurt, 2014).Money supply is substitutable used with terms like, money stock, stock of money and amount of money. There are three perspectives on money supply; the first view, M1 means money held by general society as well as demand deposit with commercial banks. It can likewise be called high powered money or narrow money. The subsequent view is alluded to as (M2) and is otherwise called broad money. It is related with modern quantity theorist headed by Friedman and M2 comprise of M1 plus time and saving deposits. The third view is the broadest and is related with M3. It incorporates M2 plus deposits of building societies, deposits of other credit and financial institutions, savings bank and loan associations (Prasert, Kanchana, Chukiat & Monekeo, 2015).

According to Olu & Idih (2015), inflation refers to the continuous and persistent ascent in the general level of prices of goods and services in an economy. Fatukasi (2012) refers to inflation as a consistent rise in the overall price level of goods and services throughout a given timeframe. Inflation is portrayed by a decline in value or purchasing power of money and loss in the worth of some other financial resources. Inflation is extensively categorized as demand-pull and cost-push inflation. Cost-push inflation originates from rise in productive factors cost like raw materials, labour, land, technology, etc. On the other hand, demand-pull inflation stems from factors that lead to increase in demand for goods and services such as increased money supply, salaries and wages, population growth, seasonal adjustment in consumption, etc.

Economic development is an increment in real GDP per capita occurring throughout some time-frame or a rise in real Gross Domestic Output (GDP) building throughout some time-frame (McConnell & Brue, 2005). Economic growth is determined as a percentage of growth per quarter (3-Month time span) or each year. Real GDP per capita (or per capita yield) is obtained by dividing real GDP by the size of the population (McConnell & Brue, 2005).

Theoretical Framework

Solow (1956); Swan (1956) propounded the initial model of Neo-classical theory which shows diminishing returns to capital and labour independently and constant returns to both factors jointly. Technological change replaced investment as pricing factors explaining long term development and its level was acknowledged by Solow and other growth theories to be settled exogenously (autonomously) of different variables including inflation. Tobin (1965) propounded Mundell's model as a revision of Solow's and Swan's of 1956 in bringing money as a store of value in the economy.

Contemporary thought on the subject of money and development has its foundation in work by Tobin (1965). Tobin considers the assignment of a fixed progression of savings between two resources, money and actual capital. A rise in interest rate cuts down the real profit on money, driving specialists to substitute out of money and into capital. That is, higher inflation rate is related with bigger capital stock and greater amount of output per capita. Tobin's structure shows that a higher inflation rate through money perpetually raise the level of output. However, the effect on output development is temporal, occurring during the change from an initial consistent state capital stock to another consistent state capital stock. Inflation actuates more capital buildup and higher development, just until the return of capital falls. Inflation impels more capital growth and higher development, just until the return of capital falls.

Subsequently, higher investment will pause and consistent condition of advancement will result. Basically, Tobin effect suggests that inflation makes individuals substitute out of money and interest earning resources, which prompts more capital force and advances economic development. In actuality, inflation shows a positive relationship to economic development.

Keynes developed the demand-pull theory regarding money supply and inflation. His theory countered the classical theories of inflation which suggested that rise in the level of available money in the economy is attributed to inflation. As indicated by John Keynes and his partners (the Keynesian view), demand pull inflation happens when total demand surpasses total supply at the level of full employment of economic yield that is crediting expansion to the association between the total expenditure (C+I+G) and full employment measure of productivity (Agba, 1994).

This recommends that only price level increment above the full employment can be implied as inflation. Therefore, an economic system has not accomplished the full employment, any addition in the supply of money or the price would be spent in increasing the level of employment and yield and not the general price level (expansion) in the economic system (Bayo, 2004).This suggests that only increase in price level beyond full employment can be inferred as inflation. Consequently, an economic system has not accomplished the full employment, any increase the availability of money or the price would be spent in increasing rate of employment and yield and not the overall price level (development) in the economic system (Bayo, 2004).

Empirical Review

Asab (2019) inspected the threshold impact of broad money growth in the association between economic development and inflation in the short run for Qatar. Making use of quarterly data over the time frame of 2004 to 2017, the model description identifies the presence of one threshold level of money progression at 2.9% where the sum square of residuals is curtailed. Lower than this level, the relationship is significantly positive. Although, beyond the threshold rate, the nexus levels out as the impact of inflation on economic development approaches zero and turns insignificant. Rana (2020) analyzed the impact of supply of money and inflation on development of output in Nepal over the time span of 45 years from mid-July 1975 to 2019. Autoregressive Distributed Lag (ARDL) model was used in the study to research the presence of long-run and short-run association among the factors.

In addition, the research made use of natural logarithm of real GDP as a substitute output development, natural logarithm of broad money (M2) as a substitute for supply of money and percentage change in Consumer Price Index (CPI) as a substitute for inflation rate. The results of ARDL bounds test revealed that inflation and money supply are cointegrated with economic growth over the study period. Also, money supply in Nepal brings about output development over the long-run and short-run, nonetheless, inflation negatively influences output development both over the long-run and short-run. Based on these results, it can be concluded that money supply in Nepal can stimulate output growth, while inflation can have negative impact economic development. Kasidi & Mwakanemela (2013) investigated the impact of inflation on economic development in Tanzania for the period 1990 to 2011.They made use of Johansen Cointegration Test to uncover that while there is no cointegration and long-run relationship among inflation and economic development, inflation has an adverse effect on economic development.

Barro (2013) aimed to investigate the association between inflation and economic development for a sample in excess of 100 countries somewhere in the range of 1960 and 1990 which showed that statistically significant negative association is evident between inflation and economic development in all countries. Barro (2013) found that an average increase ascent of inflation by 10 percentage points in a year brings about diminished development pace of real perception GDP by 0.2 to 0.3 percentage points each year on the average and reached the resolution that a few reasons exist to recommend that higher inflation on the long term decreases economic development. Babatunde and Shuaibu (2011) in their research on inflation supply of money and economic development in Nigeria analyzed the association between supply of money and inflation. The research utilized the Johansen cointegration and the Vector Error Correction Model (VECM) in estimating the data. The examination uncovered that money supply had a negative and insignificant relationship with inflation in Nigeria and that inflation adversely influenced economic development in Nigeria.

Denbel, Ayen & Regasa, (2016) investigated the fundamental relationship among economic development, money supply and inflation in Ethiopia for the time span 1970/71 to 2010/11.They used Johansen Cointegration Test and VECM to depict the presence of long long-run bidirectional causality among supply of money, inflation and unidirectional causality from financial development to inflation. In the short-run, unidirectional causality is obtained from supply of money and economic development to inflation reasoning that inflation is money related issue in Ethiopia and is influenced significantly but negatively by economic development. Gatawa, Abdulgafar & Olarinde (2017) researched the effect of interest rate, money supply and inflation on economic development in Nigeria utilizing the time series data from 1973 - 2013. They utilized VAR Model and Granger Causality Test to uncover the positive effect of broad money supply, while interest rate and inflation negatively affects development in the long-run. In addition, interest rate and money supply has negative influence on economic yield, yet none of the variables granger caused economic development. Acharya (2019) applied correlation analysis to investigate the relationship among GDP, consumer price index, money supply, foreign assistance and government expenditure using yearly data between 1975 and 2015. She found that consumer price index, money supply, government expense and foreign assistance have strong, significant and positive relationship with GDP.

Methods

Mediation

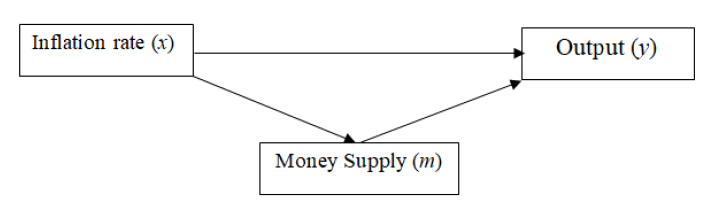

Mediation in statistics implies that a variable (which is eventually referred to as the mediator) acts as the medium through which the predictor variable affects the response variable. The conditions for mediation show that there must first be a substantial association between the explanatory variable (X) and the measured variable (y). Also, substantial relationship must be evident between the explanatory variables and the mediating variable (m).To establish mediation,the significance of the association between x and y must be greatly reduced or eliminated when m is introduced into the mix of regressors (Shrout & Bolger, 2002).

The mediation model is restated in econometric terms to account for econometric properties in the regression thus the econometric model is expressed in equations 1, 2, 3 and 4

Where α0 is the constant term, α1and α2 are the respective coefficients of regression for each equation and μt is the stochastic error term.

The regression analysis was conducted using the Ordinary Least Square method. The regression coefficients and the probability values were major criteria used in interpreting the results. Post estimation tests include; the redundant variable test to investigate the predictor variable redundancy; the heteroscedasticity test to check for heteroscedasticity of the residuals and the Ramsey RESET test to check for misspecification of the model. Data on the variables from 1981 to 2018 was collected from the CBN statistical bulletin (2019).

Results

The multi-collinearity test shown in table 1 reveals that no strong correlation exists between the independent variables. Therefore, there is no multi-collinearity problem between the variables.

| Table 1 Multi-Collinearity Test |

||

|---|---|---|

| INF | MS | |

| INF | 1.000000 | -0.292667 |

| MS | -0.292667 | 1.000000 |

Mediation

Regression Analysis

Stage 1: Establishing a Significant Relationship between Money Supply and RGDP

| Table 2 Regression Result for Money Supply and RGDP |

||||

|---|---|---|---|---|

| Dependent Variable: RGDP | ||||

| Method: Least Squares | ||||

| Date: 02/06/21 Time: 10:41 | ||||

| Sample: 1981 2018 | ||||

| Included observations: 38 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| MS | 2.494642 | 0.319566 | 7.806332 | 0.0000 |

| C | 23900364 | 2331037. | 10.25310 | 0.0000 |

| R-squared | 0.628632 | Mean dependent var | 33724953 | |

| Adjusted R-squared | 0.618316 | S.D. dependent var | 19577598 | |

| S.E. of regression | 12095154 | Akaike info criterion | 35.50570 | |

| Sum squared resid | 5.27E+15 | Schwarz criterion | 35.59189 | |

| Log likelihood | -672.6084 | Hannan-Quinn criter. | 35.53637 | |

| F-statistic | 60.93882 | Durbin-Watson stat | 0.590245 | |

| Prob(F-statistic) | 0.000000 | |||

The regression coefficient (2.494642) shown in table 2 discloses that relationship between RGDP and supply of money is significant, which infers that unit increase in money supply has coincided with an upturn of N2.49million in Nigeria.

Stage 2: Establishing a Significant Relationship between Inflation Rate and Money Supply

| Table 3 Regression Result for Money Supply and Inflation Rate |

||||

|---|---|---|---|---|

| Dependent Variable: MS | ||||

| Method: Least Squares | ||||

| Date: 02/07/21 Time: 06:37 | ||||

| Sample: 1981 2018 | ||||

| Included observations: 38 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| INF | -109574.7 | 46898.70 | -2.336412 | 0.0296 |

| C | 6015986. | 1495836. | 4.021821 | 0.0003 |

| R-squared | 0.085654 | Mean dependent var | 3938277. | |

| Adjusted R-squared | 0.060256 | S.D. dependent var | 6222278. | |

| S.E. of regression | 6031902. | Akaike info criterion | 34.11422 | |

| Sum squared resid | 1.31E+15 | Schwarz criterion | 34.20041 | |

| Log likelihood | -646.1702 | Hannan-Quinn criter. | 34.14488 | |

| F-statistic | 5.372410 | Durbin-Watson stat | 0.481780 | |

| Prob(F-statistic) | 0.029565 | |||

As shown in table 3, the result uncovers that in Nigeria supply of money and inflation rate has a significant but negative relationship. From this indication, every percentage rise in the rate of inflation results in a decline in the money supply by N109, 574million

Stage 3: Establishing a significant relationship between Inflation rate and RGDP.

| Table 4 Regression Result For Inflation And RGDP |

||||

|---|---|---|---|---|

| Dependent Variable: RGDP | ||||

| Method: Least Squares | ||||

| Date: 02/06/21 Time: 10:49 | ||||

| Sample: 1981 2018 | ||||

| Included observations: 38 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| INF | -427575.0 | 182944.2 | -2.337189 | 0.0251 |

| C | 41832451 | 4586301. | 9.121175 | 0.0000 |

| R-squared | 0.131745 | Mean dependent var | 33724953 | |

| Adjusted R-squared | 0.107626 | S.D. dependent var | 19577598 | |

| S.E. of regression | 18494082 | Akaike info criterion | 36.35500 | |

| Sum squared resid | 1.23E+16 | Schwarz criterion | 36.44118 | |

| Log likelihood | -688.7449 | Hannan-Quinn criter. | 36.38566 | |

| F-statistic | 5.462451 | Durbin-Watson stat | 0.123345 | |

| Prob(F-statistic) | 0.025108 | |||

The result of the regression shown in table 2 indicates that RGDP and inflation rate have a significant but negative relationship in Nigeria. Going by the coefficient of regression, each percentage increase in inflation rate would significantly result in a decline in GDP by N427,575 million.

Stage 4: Establishing Reduction in Significance of Inflation-Output Nexus

| Table 5 Regression Result for RGDP, Inflation Rate and Money Supply |

||||

|---|---|---|---|---|

| Dependent Variable: RGDP | ||||

| Method: Least Squares | ||||

| Date: 02/06/21 Time: 10:51 | ||||

| Sample: 1981 2018 | ||||

| Included observations: 38 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| INF | -168673.0 | 123655.0 | -1.364062 | 0.1813 |

| MS | 2.362791 | 0.330275 | 7.154012 | 0.0000 |

| C | 27617937 | 3568544. | 7.739274 | 0.0000 |

| R-squared | 0.647378 | Mean dependent var | 33724953 | |

| Adjusted R-squared | 0.627228 | S.D. dependent var | 19577598 | |

| S.E. of regression | 11953114 | Akaike info criterion | 35.50654 | |

| Sum squared resid | 5.00E+15 | Schwarz criterion | 35.63582 | |

| Log likelihood | -671.6242 | Hannan-Quinn criter. | 35.55254 | |

| F-statistic | 32.12818 | Durbin-Watson stat | 0.575221 | |

| Prob(F-statistic) | 0.000000 | |||

The result reveals that introducing money supply into the regression reduces the significance of the relationship between RGDP and inflation rate. The improvement in the R-squared result also shows the inclusion of a significant variable to the regression. The F-statistics probability shows that the combined effect of money supply and inflation on RGDP is significant.

Post-Estimation Tests

Coefficient Diagnostics: Redundant Variable Test

| Table 6 Redundant Variable Test Output |

||||

|---|---|---|---|---|

| Redundant Variable Test | ||||

| Equation: UNTITLED | ||||

| Redundant variables: INF | ||||

| Specification: RGDP INF MS C | ||||

| Null hypothesis: INF is not significant | ||||

| Value | Df | Probability | ||

| t-statistic | 1.364062 | 35 | 0.1813 | |

| F-statistic | 1.860665 | (1, 35) | 0.1813 | |

| Likelihood ratio | 1.968283 | 1 | 0.1606 | |

| F-test summary: | ||||

| Sum of Sq. | Df | Mean Squares | ||

| Test SSR | 2.66E+14 | 1 | 2.66E+14 | |

| Restricted SSR | 5.27E+15 | 36 | 1.46E+14 | |

| Unrestricted SSR | 5.00E+15 | 35 | 1.43E+14 | |

| LR test summary: | ||||

| Value | ||||

| Restricted LogL | -672.6084 | |||

| Unrestricted LogL | -671.6242 | |||

Table 6 shows that the introduction of supply of money into the inflation-output nexus caused inflation to become a redundant variable as F-statistic probability (0.1813) is more than 0.05 meaning that the null hypothesis of insignificance (redundancy) is accepted.

Residual Diagnostics: Heteroskedasticity Test

| Table 7 Heteroskedasticity Test Output |

||||

|---|---|---|---|---|

| Heteroskedasticity Test: Breusch-Pagan-Godfrey | ||||

| Null hypothesis: Homoskedasticity | ||||

| F-statistic | 1.191509 | Prob. F(2,35) | 0.3158 | |

| Obs*R-squared | 2.422348 | Prob. Chi-Square(2) | 0.2978 | |

| Scaled explained SS | 10.38449 | Prob. Chi-Square(2) | 0.0056 | |

The homoscedasticity null hypothesis cannot be rejected as F-statistic probability is higher than 0.05. Therefore, there are no heteroscedasticity problems associated with the regression.

Stability Diagnostics: Ramsey RESET Test

| Table 8 Heteroskedasticity Test Output |

||||

|---|---|---|---|---|

| Ramsey RESET Test | ||||

| Equation: UNTITLED | ||||

| Omitted Variables: Squares of fitted values | ||||

| Specification: RGDP INF MS C | ||||

| Value | df | Probability | ||

| t-statistic | 0.998070 | 34 | 0.3253 | |

| F-statistic | 0.996143 | (1, 34) | 0.3253 | |

| Likelihood ratio | 1.097339 | 1 | 0.2949 | |

| F-test summary: | ||||

| Sum of Sq. | df | Mean Squares | ||

| Test SSR | 1.42E+14 | 1 | 1.42E+14 | |

| Restricted SSR | 5.00E+15 | 35 | 1.43E+14 | |

| Unrestricted SSR | 4.86E+15 | 34 | 1.43E+14 | |

| LR test summary: | ||||

| Value | ||||

| Restricted LogL | -671.6242 | |||

| Unrestricted LogL | -671.0756 | |||

The F-statistic probability confirms the correct specification of model, and that none of the variables needs to be expressed in logs.

Discussion

The result of the research reveals that in Nigeria, the inflation rate has a negative and significant relationship with output. This finding conforms to the a-prior expectations and also backs up the research outcome of Mala (1997); Farra & Carneiro (2001); Barro (2013) who found that inflation rate had a significant but negative relationship with output. This negative relationship is attributable to the high rates of inflation recorded in Nigeria over the years under review. The findings of Sarel (1996) supports this as he found that in the periods of modest inflation rate, a positive relationship was found while a negative relationship was found in periods of high inflation rate.

The negative relationship between inflation rate and money supply in Nigeria is in contrast to economic theories and priori expectations. However, this is not difficult to grasp especially because inflation seems to have several causes other than money supply. These causes of inflation include rising value of dollar, import prices and high dependence on importation; rising cost of factors of productions; rising taxation, scarcity and speculation and so on. However, doing little to address these inflation sources, the monetary authorities usually focus on increasing interest rate and reducing money supply when inflation is high. This kind of monetary policies are what Keynes termed as cyclical policies of the classical theories.

Mediation was confirmed as money supply showed significant relationship with inflation and RGDP as well as reduced the significance of the relationship between RGDP and inflation. The introduction of money supply into the regression mix reduced the significance of the inflation-output nexus. The findings show that in the event of inflation, the availability of money in the economy determines the response of economic growth in terms of real GDP. In other words, just as the Tobin’s theory puts it, when inflation sets in, economic players are influenced to substitute money for capital goods. The increases in capital goods therefore spur economic development. Thus, money availability in the economy determines how economic development is influenced by inflation. Without the availability of money to be exchanged for capital goods, inflation would have more adverse effects on the economy.

Conclusion

The research examined the role of money supply in mediating the inflation-output relationship in Nigeria. The mediation model was adopted and the analysis was conducted using Ordinary Least Square method. From the findings of the study, the investigator concludes that reducing money supply may not necessarily be the solution to reducing inflation. On the contrary both variables were found to have negative relationships indication that the inflation rate had been relatively lower when the money supply was higher. The effect of inflation on output has been a subject debate for ages. Many studies have indicated that the association between output and inflation rate relay on the level of inflation and some had tried to draft thresholds for inflation rate that would culminate into better output growth. However, the findings of this study shows that making money available for the acquisition of capital assets would stimulate higher growth in output faster than demand and this would in turn reduce the inflation rate and lead to higher output. Thus, the adverse effect of inflation on output is nullified by money supply.

The researcher therefore makes recommendation to the monetary authorities to collaborate with the fiscal authorities in the formulation and execution of monetary policies. There should also be a strategic injection of funds into key and productive economic sectors so as to mitigate the adverse effects of inflation instead of the conventional contractionary monetary policies.

References

Acharya, M. (2019). Relationship between inflation and economic growth of Nepal. Lumbini Banijya Campus: Butwal.

GoogleScholar , semantic scholar

Agba, V.A. (1994). Principle of Macroeconomics. Concept Publication Ltd, Lagos.

Asab, N. (2019). Threshold effects of money growth in the nexus between inflation and economic growth: The case of Qatar. Journal of Social, Political and Economic Studies, 44(3), 283-297.

GoogleScholar, Cross ref, semantic scholar

Asuquo, E., Emefiele, C., Olugbemi, K. & Ita, I. (2020). Money supply, inflation and economic growth in Nigeria. IIARD International Journal of Banking and Finance Research, 6(2), 40-51.

GoogleScholar, Cross ref ,semantic scholar

Babatunde, M., & Shuaibu, M. (2011). Money supply, inflation and economic growth in Nigeria.Asian-African Journal of Economics and Econometrics, 11, 1-23.

GoogleScholar ,Cross ref ,semantic scholar

Barro, R. (2013). Inflation and economic growth. Annals of Economics and Finance, 14(1), 121- 144.

GoogleScholar, Cross ref, semantic scholar

Bayo, F. (2004). Determinants of Inflation in Nigeria: An empirical analysis. International Journal of Humanities and Social Science, 1(18), 262-271.

GoogleScholar, Cross ref ,semantic scholar

Behera, J. (2014). Inflation and its impact on economic growth: Evidence from six South Asian countries.Journal of Economics and Sustainable Development, 5(7), 145-154.

GoogleScholar, Cross ref ,semantic scholar

Bozkurt. (2014). Money, inflation and growth relationship: The Turkish case. International Journal of Economic and Financial Issues, 4(2), 309-322.

GoogleScholar ,Cross ref, semantic scholar

Chi-Wei, S., Jiao-Jiao, F., Hsu-Ling, C., & Xiao-Lin, L. (2016). Is there causal relationship between money supply growth and inflation in China? Evidence from Quantity theory of money.Review of Development Economics, 20(3), 702-719.

GoogleScholar , semantic scholar

Denbel, F.S., Ayen, Y.W., & Regasa, T.A. (2016). The relationship between inflation, money supply and economic growth in Ethiopia: Co integration and causality analysis.International Journal of Scientific and Research Publications, 6(1), 556–565.

GoogleScholar, semantic scholar

Faria J., & Carneiro, F. (2001). Does high inflation affect growth in the long and short run?Journal of Applied Economics, 4, 89-105.

GoogleScholar , semantic scholar

Fatukasi B. (2012). Determinants of Inflation in Nigeria: An empirical analysis. International Journal of Humanities and Social Science, 1(18).

GoogleScholar ,Cross ref, semantic scholar

Gatawa, N.M., Abdulgafar, A., & Olarinde, M.O. (2017). Impact of money supply and inflation on economic growth in Nigeria (1973-2013). IOSR Journal of Economics and Finance, 8(3), 26–37.

GoogleScholar ,semantic scholar

Hatemi, A. (2008). Controlling money supply and price level with unknown regime shifts: The case of Chile.Journal of Applied business Research – Second Quarter, 24(2), 139-146.

GoogleScholar ,Cross ref ,semantic scholar

Indalmanie, S. (2011). The relationship between money supply and the rate of inflation: A Causality approach to the study of the Jamaican economy. Available at SSRN: https://ssrn.com/abstract=2586254

GoogleScholar , semantic scholar

Kasidi, F., & Mwakanemela, K. (2013). Impact of inflation on economic growth: A case Study of Tanzania. Asian Journal of Empirical Research, 3(4), 363–380.

GoogleScholar ,semantic scholar

Malla, S. (1997). Inflation and economic growth evidenced from a growth equation. Department of Economics, University of Hawaii at Monoa.

GoogleScholar, Cross ref ,semantic scholar

Olanipekun, D., & Akeju, K. (2013). Money supply, inflation and capital accumulation in Nigeria. Journal of Economics and Sustainable Development, 4(4), 173-181.

GoogleScholar, Cross ref, semantic scholar

Phibian, N.O. (2010). The Quantity Theory of Money: Evidence from Nigeria. Central Bank of Nigeria (CBN) Economic and Financial Review, 48(2), 91-107.

GoogleScholar, Cross ref, semantic scholar

Sarel, M. (1996). Nonlinear effects of inflation on economic growth. IMF Staff Papers, 43(1), 199-215.

GoogleScholar , semantic scholar

Schwartz. (2019). Money Supply.

Shrout, P., & Bolger, N. (2002). Mediation in experimental and nonexperimental studies: New procedures and recommendations. Psychological Methods, 7, 422-445.

GoogleScholar , semantic scholar

Solow M. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics. (Oxford Journals) 70(1), 65-94.

GoogleScholar , semantic scholar

Swan, T. (1956). Economic growth and capital accumulation. Economic Record, 32(2), 334-361.

Sultana, N., Koli, R., & Firoj, M. (2019). Causal relationship of money supply and inflation: A study of Bangladesh.Asian Economic and Financial Review, 9(1), 42-51.

GoogleScholar , semantic scholar

Tobin, J. (1965). Money and economic growth. Econometrica, 33(4), 671-684.

Received: 03-Apr-2022, Manuscript No. ije-21-6752 ; Editor assigned: 06-Apr-2022, PreQC No. ije-21-6752 (PQ); Reviewed: 20-Apr-2022, QC No. ije-21-6752; Revised: 26-Apr-2022, Manuscript No. ije-21-6752 (R); Published: 03-May-2022.