Research Article: 2018 Vol: 22 Issue: 1S

Operating Cash Flow, Corporate Governance And Sustainable Dividend Payouts

Abbas Saad Hamada Alkhuzaie, University of Qadisiyah

Dr. Muzaffar Asad, Capital University of Science and Technology

Abstract

Dividend stability is considered as important in order to enhance the confidence of investor . In order to determine the stability in dividends financial performance of the companies matters and operating cash flow has a major role. In the literature of governance , board size, ownership structure , and CEO duality are considered as very important determinant s of dividend pay - out . For the purpose of conducting this study, the data of 150 companies was operating in the non - financial sector of Pakistan stock exchange was collected from the annual reports of those companies . Proportionate sampling was conducted in order to include all the sectors. After ensuring the normality of data, regression was applied on the variables that were chosen on the basis of literature review . The results highlighted that all the variables i.e. board size, CEO duality, ownership structure, and operat ing cash flow, have a significant impact on the dividend pay - out . The findings of the study also supported agency theory and added operating cash flow in the agency theory which was the main contribution and significance of the study . The future researcher s are guided to analyse the same model in other stabilized economies a nd also with longitudinal data.

Keywords

Board Size, CEO Duality, Ownership Structure, Operating Cash flow, Dividend Payout.

Introduction

Dividends are considered as important feature of investment (Abdelwahed, 2016). Stable dividends or stability in the growth of dividends show stability and financial soundness of the company. Sustainable dividend means that the company is following a stability or stable growth in the dividends without high fluctuations (Shaker et al., 2018). Sustainability in dividends is possible when the operating cash flows of the company are good. Moreover, shareholders predict the future of the company in the light of past and present activity of the board (Grosvold et al., 2015). Furthermore, changes in dividend policies over time may change the investor’s subsequent behaviour regarding investment decision (Asad and Farooq, 2009; Caoa et al., 2017; Shaker et al., 2018). Dividends help to scrutinize the interests of managers and investors by reducing the free cash flow within the firm (Biswas and Benjamin, 2017), consequently, aligning corporate governance role, because large cash flow may lead to managerial discretion and agency problem (Almansour et al., 2016).

Every investor around the globe is interested in secured investment by ensuring the financial soundness of the company which can be ensured if the corporate governance of the company is smooth (Asad et al., 2011; Almansour et al., 2016). Companies attract investors by increasing shareholder’s wealth (Kajola et al., 2015) which can be depicted by sustainable and smooth dividends. Whereas, some companies fail to maintain good financial position which is depicted by unpredictable dividends and as a result loose investors’ confidence (Kanwal and Hameed, 2017). Especially for the passive investors who invest for dividends rather than capital gains through short selling, sustainability of dividends is very important (Asad and Farooq, 2009). The management of the company has to decide the dividend policy in the best interest of the company and shareholders. Dividend policy is linked with funds management (Asad and Qadeer, 2014). For the management of funds, effective governance plays a very important role (Bashir and Asad, 2018). Several studies have identified the importance of capital structure (Asad and Qadeer, 2014), cash flows (Almeida et al., 2004) and other financial measures (Abdelwahed, 2016), similarly, researchers have also identified the impact of corporate governance components (Abdelsalam et al., 2008; Adams et al., 2010; Afzal and Sehrish, 2011; Almansour et al., 2016), however, the literature on combined financial and governance effects is scarce with perspective of sustainability in dividends. Therefore, the purpose of this study is to analyse the combined effect of operating cash flow and corporate governance components on sustainable dividend pay-out in the light of agency theory in the context of Pakistan Stock Exchange. The study is conducted on all the sectors excluding financial sector of Pakistan Stock Exchange.

Literature Review

Literature of dividend policy is much diversified and several controversies exist among several previous studies. A major reason behind those controversies is that every study has been conducted in a different context. Every finding is according to the financial position of the market where the study was conducted and on the basis of the industry which gave different conclusions (Ajanthan, 2013; Florackis et al., 2015; Abdelwahed, 2016; Caoa et al., 2017; Bashir and Asad, 2018). In the current era the mind set of investors is dependent on different factors. In the stock markets like Pakistani stock markets people invest for capital gains rather than dividends (Asad and Farooq, 2009). Shareholders invest in different companies to obtain different benefits in shape of bonuses, right shares, preference shares, and dividends (Abdelwahed, 2016). For attracting the interest of investor the most common method of companies is distribution of dividends (Brown and Roberts, 2016). But at the same time payment of dividends also create conflict between corporate managers and shareholders. Corporate managers prefer to retain dividends to reinvest whereas, shareholders prefer to receive cash dividends creating agency conflict (Ullah et al., 2012). In this agency issue, the importance of corporate governance cannot be ignored. Corporate governance is a combination of different board practices among which broad size, CEO duality and managerial ownership are considered as very important in respect of dividend payout (Abels and Martelli, 2013; Shehu, 2015; Abdelwahed, 2016; Almansour et al., 2016; Jatmiko and Kusumastuti, 2017; Bashir and Asad, 2018).

Board size is a key factor in corporate governance. Several researchers across the globe have different critics on board size in relation with dividend pay-out behaviour. Corporate Governance Codes stipulate boards neither too large nor too small but a preferable size between 5 to 16, dependent on the size of the organization (Yasser et al., 2011). The main corporate governance characteristic, board size has shown volatile correlation with dividend pay-out (Abor and Fiador, 2013) which shows that it need to be studied further.

The CEO duality is another major issue of corporate governance. The CEO duality could work for the benefit of firm to maximize the shareholder wealth, but CEO behaviour may vary when CEO is appointed for both positions in the firm (Abels and Martelli, 2013). Thus, it may also affect dividends (Mansourinia et al., 2013). The prior studies have shown both negative and positive relations between CEO duality and dividend pay-out (Abor and Fiador, 2013; Ahmad, Rashid and Gow, 2017).

Similarly, ownership structure has a significant impact on dividend pay-out (Abdelwahed, 2016). Abdelwahed (2016) examined that coefficient on the individual ownership has a negative impact on dividend payments. Likewise, managerial ownership belongs to the managers and board of director which is also considered as negative from the governance point of view because governance promotes separation of ownership from management (Almansour et al., 2016). When the owners are not managers they will think like entrepreneurs (Asad et al., 2016) and can have better decisions regarding financing (Asad et al., 2016) and market (Asad et al., 2016).

Managerial ownership is defined as the number of shares owned by director divided by total number of shares issued by the company (Zabihi and Ghaleb, 2013). Managers may have a more voting power and may attempt to influence corporate decisions regarding dividends (Baker and Wurgler, 2004). Several studies have negative relationship with managerial ownership and dividend pay-out (Din and Javid, 2011; Gharaibeh et al., 2013; Florackis et al., 2015). Other than corporate governance issues another important aspect that determines the dividend sustainable stability is availability of operating cash flow (Zabihi and Ghaleb, 2013). Companies having high liquidity can easily pay cash dividends (Lin and Lin, 2016) and can keep their dividends stable (Yarram, 2015). The major reason behind linking corporate governance with operating cash flow was that at times when the companies have sufficient and idle cash they retain dividends which is mainly the result of governance issues including ownership structure, CEO duality, and board size.

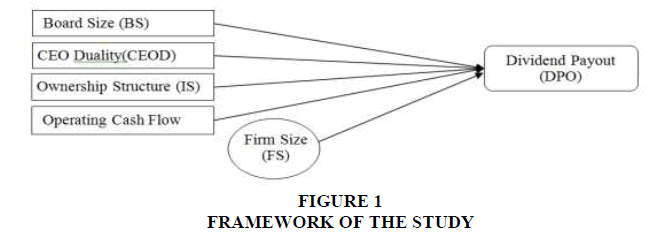

Another important aspect is that this study is being conducted on 150 companies listed on Pakistan Stock Exchange which were chosen using proportionate sampling. A major issue may arise because of the size of the organization. Therefore, to overcome the issue, size of the company was taken as a control variable. Profitability is influenced by size (Niresh and Thirunavukkarasu, 2014) and dividends are dependent on the performance of the company (Adil et al., 2011; Tijjani and Sani, 2016). Stability of dividends has been observed in large organization (Bokpin, 2011). Therefore, importance of size cannot be ignored and it is necessary to add size as a controlling variable. This study is in support of agency theory and add operating cash flow in the agency theory considering it as a major factor influencing dividends stability. On the basis of the literature reviewed and in support of agency theory, in order to enrich the body of knowledge, following framework has been proposed further strengthen and enrich agency theory in the context of non-financial sector of Pakistan (Figure 1).

Research Methodology And Analysis

The purpose of this study is to identify the relationship between operating cash flow, corporate governance, and dividend pay-out. The study is quantitative and based on secondary data collected from the annual reports of 150 non-financial sector companies listed in Pakistan stock exchange. The companies were chosen on systematic sampling and the assumptions of Ordinary Least Square (OLS) were tested before running regression. For the purpose of running OLS, SPSS22 was used.

Results

Primarily, descriptive analysis has been conducted in which mean and standard deviation along with skewness and Kurtosis has been calculated. After ensuring that the data is normal, multicollinearity has been analysed. The threshold level for Skewness and Kurtosis is 2 and 7 respectively (Hair et al., 2010). The calculated values are mentioned below (Table 1).

| Table 1 Descriptive Analysis |

||||

| Model | Mean | SD | Skewness | Kurtosis |

| DPO | 0.3907 | 0.28817 | 0.743 | 2.701 |

| OCF | 0.03 | 0.17145 | 0.524 | 2.689 |

| CEOD | 7.33 | 1.70593 | 0.538 | 2.407 |

| BS | 17.5821 | 24.0796 | 0.546 | 2.859 |

| OS | 22.4952 | 15.6022 | 0.357 | 2.468 |

| FS | 10.3076 | 0.55686 | 0.587 | 2.175 |

After ensuring that the data is normal the next thing is to check multicollinearity. In order to check multicollinearity VIF and Tolerance has been calculated. The threshold level for the threshold level for tolerance is above 0.10 and the threshold level for VIF is below 10 (Hair et al., 2010). The calculated values are mentioned below (Table 2).

| Table 2 Collinearity Diagnostic |

||

| Model | Tolerance | VIF |

| DPO | 0.701 | 1.071 |

| OCF | 0.572 | 1.025 |

| CEOD | 0.424 | 1.068 |

| BS | 0.652 | 1.224 |

| OS | 0.784 | 1.225 |

| FS | 0.625 | 1.448 |

After ensuring that the data is normal and free of multicollinearity, regression analysis has been conducted in order to find the significance of the variables under study. The results of regression analysis are mentioned below (Table 3).

| Table 3 Summary Of Linear Regression Analysis |

|||

| Variables | Beta Values | T statistics | Sig. |

| (Constant) | 0.12 | 1.221 | 0.225 |

| BS | 0.521 | 1.997 | 0.01 |

| CEOD | -0.43 | 1.966 | 0.041 |

| OS | 0.631 | 2.001 | 0.022 |

| OCF | 0.793 | 3.5 | 0.001 |

| FS | 0.113 | 1.199 | 0.53 |

The abovementioned table shows the results of data analysis using regression analysis. All the variables are showing significant contribution towards the dividend pay-out. All the variables are significant at 5%.

Therefore, the final developed equation is mentioned below:

SDP=0.120+0.521BS-0.430CEOD+0.631OS+0.793OCF+0.113FS

The controlling affect which is supposed to be significant has turned insignificant which shows that if the board size is appropriate, the issue of CEO duality has a negative impact, ownership structure is not concentrated, and operating cash flows are sufficient then size of the company is insignificant in determining the dividend pay-out.

Discussion

The data analysis started from the descriptive analysis of the data which shows significant satisfactory results. The skewness and kurtosis values are as per the limits and shows the normality of the data. Afterwards VIF and tolerance values have been calculated which shows that the issue of multicollinearity does not exists. In the presence of multicollinearity, the results may be extra inflated and not be true. After ensuring the accuracy of the data the nest thing was equation testing. In order to test the equation regression analysis has been conducted.

The regression analysis highlighted the significant variables that actually leads to the sustainability of dividends. The findings revealed that if the company board size is appropriate as per the size of the company then the board size act positively towards the payment of dividends in case of large board size the decisions get delayed and performance is affected which jeopardize the consistency of the dividend pay-out. Similarly, when the CEO and chairman board are two different persons the conflict of interest does not arise, which causes sustainability in dividend pay-out which is because due to lack of conflict of interest both act as per the best interest of the company as well as the shareholders. Likewise, if the ownership structure is not concentrated into family ownership or managerial ownership a sustainable dividend pay-out policy is being followed by the company. In case of family owned companies, the management prefers to retain the dividends, which in fact affects negatively on the sustainability of the dividends.

Conclusion And Recommendation

In the light of the literature reviewed and the analysis of data, all the variables that were included on the basis of literature have shown a significant impact on the sustainability of dividend pay-out. The component of sustainability of dividends is vital because several investors thinks about passive buying and holding the shares. In case of stable dividends their interests are secured. The aim of agency theory is to save the shareholders. Thus, the main contribution of this study was the addition to the agency theory, operating cash flow was the main addition in the agency theory. This actually shows that it’s not only the governance that has to keep the dividends sustainable but also the financial position of the company which mainly covers cashflow. The overall model is significant which shows that for securing the rights of the shareholders to provide them with sustainable dividends corporate governance and cashflow both acts collectively for the securing the sustainability of dividends. Operating cash flow also determines sustainable dividend pay-out because of the operating cashflow of the company is too low then it would be difficult for the company to pay the dividends. Hence, theoretical contribution of the study is that along with agency issues operating cash flow matter in stabilizing the dividend.

The current findings of the study are significant for the top management of the companies. The top management of the company has to decide the governance structure and cashflow strategy of the company. The findings of this study will help the management of the company to decide that how can they keep the dividends sustainable. Because sustainability of dividends is important for the passive investors. On the basis of the current findings future researchers are guided to work on the same topic but by analysing longitudinal data. This phenomenon should be checked over a longer period of time. Furthermore, the economic, political, and law and order situations of Pakistan are not stable for the business because of strikes, agitations, and government policies; therefore, it is also recommended that the model should be analysed in a stable economy or non-financial and non-governance factors may also be catered in the future studies.

References

- Abdelsalam, O., El-Masry, A., & Elsegini, S. (2008). Board composition, ownership structure and dividend policies in an emerging market: Further evidence from CASE 50. Managerial Finance, 34(12), 953-964.

- Abdelwahed, G. (2016). The impact of ownership structure on dividend pay-out policies: An empirical study of the listed companies in Egypt. The Business and Management Review, 7(2), 113-126.

- Abels, P.B., & Martelli, J.T. (2013). CEO duality: How many hats are too many? Emerald Group Publishing Limited, 13(2), 135-147.

- Abor, J., & Fiador, V. (2013). Does corporate governance explain dividend policy in Sub-Saharan Africa? International Journal of Law and Management, 55, 201-225.

- Adams, R., Hermalin, B., & Weisbach, M. (2010). The role of boards of directors in corporate governance: A conceptual framework and survey. Journal of Economic Literature, 48(1), 58-107.

- Adil, Z., & Yaseen. (2011). Empirical analysis of determinants of dividend pay-out: Profitability and liquidity. Interdisciplinary Journal of Contemporary Research in Business, 3(1), 289-300.

- Afzal, M., & Sehrish, S. (2011). Ownership structure, board composition and dividend policy in Pakistan. African Journal of Business Management, 1-24.

- Ahmad, N.B., Rashid, A., & Gow, J. (2017). CEO duality and corporate social responsibility reporting: Evidence from Malaysia. Corporate Ownership and Control, 14(2), 70-81.

- Ajanthan, A. (2013). The relationship between dividend pay-out and firm profitability: A study of listed hotels and restaurant companies in Sri Lanka. International Journal of Scientific and Research Publications, 3(6), 1-6.

- Almansour, A.Z., Asad, M., & Shahzad, I. (2016). Analysis of corporate governance compliance and its impact over return on assets of listed companies in Malaysia. Science International, 28(3), 2935-2938.

- Almeida, H., Campell, M., & Weisbach, M.S. (2004). The cash flow sensitivity of cash. The Journal of Finance, 59(4), 1777-1804.

- Asad, M., & Farooq, A. (2009). Factors influencing KSE 100 index/share prices. Paradigms A Journal of Commerce, Economics, and Social Sciences, 3(1), 34-51.

- Asad, M., & Qadeer, H. (2014). Components of working capital and profitability: A case of fuel and energy sector of Pakistan. Pardigms A Journal of Commerce, Economics, and Social Sciences, 8(1), 50-64.

- Asad, M., Haider, S.H., & Fatima, M. (2018). Corporate social responsibility, business ethics, and labour laws: A qualitative analysis on SMEs in Sialkot. Journal of Legal, Ethical and Regulatory Issues, 21(3), 1-7.

- Asad, M., Haider, S.H., & Javaid, M.U. (2011). Working capital management and corporate performance of textile sector in Pakistan. Paradigms: A Research Journal of Commerce, Economics and Social Sciences, 6(1), 100-114.

- Asad, M., Shabbir, M.S., Salman, R., Haider, S.H., & Ahmad, I. (2018). Do entrepreneurial orientation and size of enterprise influence the performance of micro and small enterprises? A study on mediating role of innovation. Management Science Letters, 8(10), 1015-1026.

- Asad, M., Sharif, M.N., & Alekam, J.M. (2016). Moderating role of entrepreneurial networking on the relationship between access to finance and performance of micro and small enterprises. Paradigms A Research Journal of Commerce, Economics, and Social Sciences, 10(1), 1-13.

- Asad, M., Sharif, M.N., & ALekam, J. M. (2016). Moderating role of entrepreneurial networking on the relationship netween entrepreneurial orientation and performance of MSEs in Punjab Pakistan. Science International, 28(2), 1551-1556.

- Asad, M., Sharif, M.N., & Hafeez, M. (2016). Moderating effect of network ties on the relationship between entrepreneurial orientation, market orientation, and performance of MSEs. Paradigms: A Research Journal of Commerce, Economics, and Social Sciences, 10(2), 69-76.

- Baker, M., & Wurgler, J. (2004). Appearing and disappearing dividends: The link to catering incentives. Journal of Financial Economics, 73(2), 271-288.

- Bashir, A., & Asad, M. (2018). Moderating effect of leverage on the relationship between board size, board meetings and performance: A study on textile sector of Pakistan. American Scientific Research Journal for Engineering, Technology, and Sciences (ASRJETS), 39(1), 19-29.

- Biswas, P.K., & Benjamin, S.J. (2017). Board gender composition, dividend policy and cost of debt: The implications of CEO duality. Financial Markets and Corporate Governance, 1-22.

- Bokpin, G.A. (2011). Ownership structure, corporate governance and dividend performance on the Ghana Stock Exchange. Journal of Applied Accounting Research, 12(1), 61-73.

- Brown, T., & Roberts, H. (2016, December). Agency theory, corporate governance and dividend pay-out in New Zealand. Asia-Pacific Research Exchange, 32.

- Caoa, L., Du, Y., & Hansen, J.Ø. (2017). Foreign institutional investors and dividend policy: Evidence from China. International Business Review, 26(5), 1-12.

- Din, S.U., & Javid, A.Y. (2011). Impact of managerial ownership on financial policies and the firm’s performance: evidence Pakistani manufacturing firms. International Research Journal of Finance and Economics, 81, 13-29.

- Florackis, C., Kanas, A., & Kostakis, A. (2015). Dividend policy, managerial ownership and debt financing: A Non-parametric perspective. European Journal of Operational Research, 241(3), 1-38.

- Gharaibeh, M., Zurigat, Z., & Harahsheh, K. (2013). The effect of ownership structure on dividends policy in Jordanian companies. Interdisciplinary Journal of Contemporary Research in Business, 4(9), 769-796.

- Grosvold, J., Rehbein, K., & Baker, P. (2015). Predicting board decisions: Are agency theory and resource dependency theory still relevant? Academy of Management Proceedings, 1, 121-155.

- Haider, S.H., Asad, M., & Almansour, A.Z. (2015). Factors influencing growth of cottage industry in Punjab, Pakistan: Cottage industry owners' perspective. Paradigms: A Research Journal of Commerce, Economics, and Social Sciences, 9(1), 78-87.

- Haider, S.H., Asad, M., & Fatima, M. (2017). Entrepreneurial orientation and business performance of manufacturing sector small and medium scale enterprises of Punjab Pakistan. European Business and Management, 3(2), 21-28.

- Haider, S.H., Asad, M., & Fatima, M. (2017). Responsibility of global corporations towards human resource to attain competitive advantage: A review. Journal of Research in Administrative Sciences, 6(2), 9-12.

- Haider, S.H., Asad, M., Atiq, H., & Fatima, M. (2017). Mediating role of opportunity recognition between credit, savings and performance of micro and small enterprises in Pakistan. Journal of Advanced Research in Business and Management Studies, 7(2), 91-99.

- Haider, S.H., Asad, M., Fatima, M., & Abidin, R.Z. (2017). Microfinance and performance of micro and small enterprises: Does training have an impact. Journal of Entrepreneurship and Business Innovation, 4(1), 1-13.

- Hair, J.F., Black, B., Babin, B., & Anderson, R.E. (2010). Multivariate data analysis. Jersey: Pearson Education International.

- Jatmiko, I., & Kusumastuti, R. (2017). Ownership structure and dividend policy in nonfinancial company. Mimbar, 33(1), 21-28.

- Kajola, S.O., Desu, A.A., & Agbanike, T.F. (2015). Factors influencing dividend pay-out policy decisions of Nigerian listed firms. International Journal of Economics, Commerce and Management, 3(6), 539-557.

- Kanwal, M., & Hameed, S. (2017). The relationship between dividend pay-out and firm financial performance. Research in Business and Management, 4(1), 1-13.

- Lin, D., & Lin, L. (2016). How does corporate governance affect free cash flow? Journal of Applied Finance and Banking, 6(3), 145-156.

- Mansourinia, E., Emamgholipour, M., Rekabdarkolaei, E.A., & Hozoori, M. (2013). The effect of board size, board independence and CEO duality on dividend policy of companies: Evidence from Tehran stock exchange. International Journal of Economy, Management and Social Sciences, 2(6), 237-241.

- Niresh, A., & Thirunavukkarasu, V. (2014). Firm size and profitability: A study of listed manufacturing firms in Sri Lanka. International Journal of Business and Management, 9(4), 57-64.

- Shah, M., & Asad, M. (2018). Effect of motivation on employee retention: Mediating role of perceived organizational support. European Online Journal of Natural and Social Sciences, 7(2), 511-520.

- Shaker, R.Z., Asad, M., & Zulfiqar, N. (2018). Do predictive power of fibonacci retracements help the investor to predict future? A study of Pakistan Stock Exchange. International Journal of Economics and Financial Research, 4(6), 159-164.

- Shehu, M. (2015). Board characteristics and dividend pay-out: Evidence from Malaysian public listed companies. Research Journal of Finance and Accounting, 6(16), 35-40.

- Thanatawee, Y. (2013). Ownership structure and dividend policy: Evidence from Thailand. International Journal of Economics and Finance, 5(1), 121-132.

- Tijjani, B., & Sani, A. (2016). An empirical analysis of free cash flow and dividend policy in the Nigerian oil and gas sector. Research Journal of Finance and Accounting, 7(12), 1-7.

- Ullah, H., Fida, A., & Khan, S. (2012). The impact of ownership structure on dividend policy: Evidence from emerging markets KSE-100 index Pakistan. International Journal of Business and Social Science, 3(9), 298-307.

- Yarram, S.R. (2015). Corporate governance ratings and the dividend pay-out decisions of Australian corporate firms. International Journal of Managerial Finance, 11(2), 162-178.

- Yasser, Q.R., Entebang, H., & Mansor, S. A. (2011). Corporate governance and firm performance in Pakistan: The case of Karachi Stock Exchange (KSE)-30. Journal of Economics and International Finance, 3(8), 482-491.

- Zabihi, A., & Ghaleb, R. (2013). Investigating the effect of ownership structure and cash flows on the dividend policy in accepted companies of Stock Exchange of Tehran. Interdiciplinary Journal of Contemporary Research in Business, 5(6), 102-114.