Research Article: 2022 Vol: 25 Issue: 2S

Partnership Strategies in Global Entrepreneurship: How Does South Korea Participate In African Electric Vehicles Market Development

Olga A. Shvetsova, School of Industrial Management, Korea University of Technology and Education

Mokom BRENDA, School of Industrial Management, Korea University of Technology and Education

Abstract

Electric vehicles enhance transportation cost, pollution, car maintenance, energy efficiency properties, economic sustainability, among others. As many developed countries, if not all, are moving to completely ban Internal Combustion Engine (ICE) and fully engage in electric cars, this paper investigates how the change from internal combustion engine cars to Electrical vehicles may affect the car market in developing countries. To investigate this, a systematic overview of online data using archival analysis of relevant reports and articles related to electric cars in Africa from 2010 to 2020 was performed.

Results reveal that low-income households, the cost and maintenance of EVs and the sluggish government attitude of most African countries towards electric car adoption may even widen the technological gaps with the developed (advanced) economies in the short-run. This review is important for legislators to comprehend the challenges and prospects related to this change from CEV to electric vehicles because it explains the stability of the EV market and the niches in Africa, including regulations, plans on this new technology, demand structures and prospects for the EVs in this part of the world.

Keywords

Electric Vehicles, Challenges in African Market, Internal Combustion Engine, Technology Adoption, South Korea, Entrepreneurship

Introduction

Following the early arrival and fast decline of electric vehicles in the late 19th and early 20th century, the negative effects of air pollution, climate crisis and rising oil prices in the 1960s and 1970s reaffirmed the need for vehicles to go electrical from the conventional internal combustion engines.

Electric Vehicles (EVs) are a very attractive option relative to conventional ones for many reasons, including usually high overall energy efficiency, no local emissions and typically reduced ones, reduced dependence on oil imports, quietness, and low operating cost and maintenance. The electricity for charging the batteries can be generated by fossil, nuclear or renewable energy power plants (Klender & Joey, 2018). Apart from the input energy, the power plant efficiency should also consider the embodied energy, preparation and any environmental restoration energy, and all these reasons obviously varies widely.

The overall energy efficiency is a product of that electricity generation efficiency, electricity transmission efficiency, battery charging and discharging efficiency, the battery-to-wheels efficiency that is typically about 75% (or possibly somewhat higher), and the extent to which braking and mechanical energies are converted back to electricity (Geels & Schot, 2007). The latter regenerative processes are of advantage to EV efficiency, and the actual improvement depends on the type of driving and vehicles but is estimated to be about 25%.

EVs were invented already in the 19th century, but a major deficiency that is holding back their massive use is the short driving range, limited by the batteries, as well as the currently high cost of batteries if the range is made comparable to that of conventional vehicles. A combination of battery technology and cost improvements, with prospects for further improvements in the relatively near future, alongside with government subsidies of one type or another, made EVs a major target for vehicle development in the world.

Considering that developing countries and the African continent in particular has served as dumping ground for both second-handed vehicles and manufacturing-defaulted vehicles from Europe, North America and Asia amongst others. Some of the world`s most powerful economies (e.g. Norway, Germany, South Korea, part of U.S etc.) have announced their plans to ban fossil energy using vehicles from 2025 through 2027. Others have extended their ban period to 2035 through 2050.

In a short term, the market for second-handed (used) electric vehicles will surface worldwide. There are 3 main research questions are announced in this paper:

1. Will developing countries in African region be ready as a market for used EV?

2. What technological plans and infrastructures are in place to support EV cars? What is role of Korean entrepreneurs?

3. Will there be an even greater technological difference in African when electric cars are fully in use by the West?

The future pathway of the Electric Vehicles sector consists of a range of technological curves especially in developing economies where little is made to adapt to this fast-coming change.

Background: Global Trends in Electric Vehicle Market

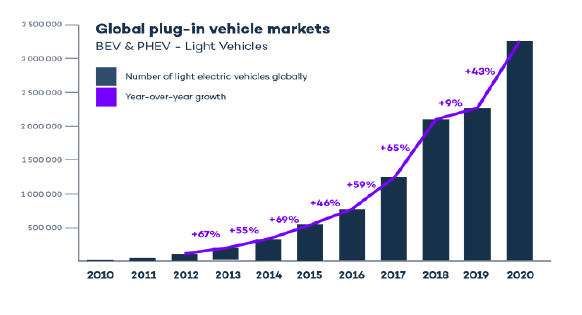

The operating range of EVs has been in continuous demand after most technologically advanced nations announced their plan to ban internal Combustion Engine. Few years back, some of the reasons why EVs usage was much lower than internal combustion engines was that an electric car battery that approaches affordability, with generous subsidies, has a driving range of about 100-160 km on a full charge, the infrastructure for charging the batteries was still weak, and EVs cost more than conventional cars of similar size (Laurence Kavanagh, 2018). However, they were nevertheless appearing in the market and being sold in increasing numbers. The global electric vehicles Market growth over past 10 years.

Figure 1: Global Trends in EV Market, 2010-2020

Source: Global EV Volume 2021, https://www.ev-volumes.com/

Recently, as automobile producers were obliged to prioritize their projects due to COVID 19`s major economic impact, pressing technological advancements, such as electric vehicles received more attention and subsidies (table 1). Many countries target deadlines for Level three and four Autonomous Vehicles (AV), which were initially set for 2022, have been postponed to several years (Paul Eichenberg, 2020).

For example, Volvo`s plan to present a fully-autonomous Level 4 system by 2024, has pushed back the Level 4 target date to 2027 and will now aim to present a Level 3 AV model around the same timeframe as they had originally planned for a Level 4. Argo and Ford also delayed their robot-taxi and AV programs while committing an additional $28 billion to EV.

| Table 1 Difference Between Internal Combustion and Electric Vehicles |

||

|---|---|---|

| Features | ICE (Internal combustion Engine) | EVs ( Electric Vehicles) |

| Engine | Combustion engine | Rechargeable battery |

| Energy | Gas power | Electrical power |

| Maintenance cost | Less cost efficiency especially as car ages. Changing the transmission fluid, engine oil, coolant, belt and frequent stops at gas stations can be expensive and time consuming. | More cost efficient. Frequent Battery charge and update through Bluetooth or Wi-Fi.Replacing battery can be expensive after the warranty period. |

| Source of energy | Fuel (gasoline and diesel) | Coal, gas or Renewable (wind, solar, hydrogen) |

| Environment | Less friendly | More friendly |

| Car parts | More car parts (more assembling time) | Less car parts (less assembling time) |

EVs unique eco-friendly features, high speed and no noise attracts the customers globally than ICE Vehicles as they create very less air and noise pollution (K. Nandini Tomekar, 2019).

Methodology

Research Goal

This study examines how the change from internal combustion engine cars to Electrical vehicles may affect the car market in developing countries, African countries in particular. To investigate this, a systematic overview of online data using archival analysis of relevant reports and articles related to electric cars in Africa was performed.

Methods

This systematic review was gathered from electronic databases from 2010 to 2020 Web of Science and Google scholar. About 147 other relevant reports and articles related to challenges and opportunities were found (table 2). There are two types of data were collected: primary (focus interview) and secondary (literature review; open access source review).

| Table 2 Source of data collection |

|||

|---|---|---|---|

| Source type | Total number of resources | Period | Example |

| Research article | 23 | 2010-2021 | Gonzalez, C. and S. R. K. Jensen (2015), ‘IRF World Road Statistics 2015: Data 2008 – 2013’, International Road Federation, Geneva. Grubel, Herbert G. “International Trade in Used Cars and Problems of Economic Development.” World Development 8, no. 10 (October 1980) 781–88. |

| Report | 5 | 2015-2021 | UN Environment Program reportfrom October 2020: Global Trade Used Vehicle Report;Center for Science and Environment, CSE (2018).’Clunkered Combating Dumping of Used Vehicles: A Roadmap for Africa and South Asia.’ Clean Air Network Nepal. (2015). A Global Strategy to Introduce Low Sulphur Fuels and Cleaner Diesel Vehicles. |

| Website | 11 | 2017-2021 | Deloitte. (2016). Deloitte Africa Automotive Insights. Retrieved April 19, 2018, from https://www2.deloitte.com/content/dam/ Deloitte/za/Documents/manufacturing/ ZA_Deloitte-Africa-automotive-insightsEthiopia-Kenya-Nigeria-Apr16.pdf |

| Book | 5 | 2010-2021 | Coffin, D., Horowitz, J., Nesmith, D., & Semanik, M. (2016). Existing Barriers to Trade in Used Vehicles. United States International Trade Commission. |

| Interview (primary data) | 2 | 2020-2021 | Korean company + African company (Kiira Motors Corporation) |

Scope of the Study

The scope of this study is based on the challenges faced by Africa to adapt to electric vehicles despite the increasing world market shares. An Electric Vehicle (EV) operates on a rechargeable electrical battery. Therefore, such a vehicle is seen as a possible replacement for current-generation automobiles to address rising pollution, global warming, depleting natural resources, etc.

Statistics and Examples

African countries are by 95 percent of automobile consumers of used vehicles. Most of whom (if not all) are still fully into internal combustion engine cars (Jonathan Gaventa, 2021). Among the eleven car production countries in African, even the top two producers, (Morocco and South Africa) are still high in internal combustion engine vehicles production. For examples: In South Africa, out of 12 millions cars that run the streets, only 1000 cars are electric vehicles. In Kenya, the average age of imported used cars is seven years. In Ethiopia and Nigeria, most imported vehicles are more than 11 years old; a quarter of vehicles imported to Nigeria are more than 19 years old. Cape Verde Islandhas set an end to used vehicles imports by 2035.

Only South Africa, Egypt and Sudan have banned used car imports entirely. However, due to heavy reliance on used car imports and major infrastructure constraints, the pathway to EVs in many African countries is far less clear.

Survey and Results. Electric Vehicles Market Challenges in Africa

South Korea Establishes Partnership with Africa

South Korea wants a seat at the table in sub-Saharan Africa. It is seeking to define its policies toward the region and assess how it might fit into Africa’s pre-existing network of traditional partners and new entrants. In December, I had the honor of representing CSIS at the second Seoul Dialogue on Africa, the theme of which was “Africa’s Integration: Legacies and New Horizons.” The event was hosted by the Korea-Africa Foundation, an arm of the Korean Foreign Ministry, which promotes cooperation between Korean and African private sectors. It brought together experts from around the world to provide insight into African demographic, economic, and security trends to a diverse audience of academics, practitioners, and diplomats. The conference showcased Seoul’s commitment to increasing its engagement and assisting its African counterparts in developing their economies, as well as to signal potential opportunities to deepen collaboration with the United States (Center for Strategic and International Studies, 2020).

The very theme of this conference hints to where Seoul is on its journey to African partnership. Let’s start with “legacies.” Under President Roh Moo-hyun (2003-2008), South Korea started to renew its ties with the continent. His government announced Korea’s Initiative for African Development in 2006, and he embarked on the first presidential trip to the region in 24 years. His immediate successors, Lee Myung-bak and Park Geun-hye, followed suit with their own travels to Africa. The final panel at the event featured presentations on UK, U.S., Chinese, and Turkish partnership strategies with Africa, suggesting Korean policymakers see value in these historical and current examples to inform their own path.

Now let’s look at “new horizons,” the true centerpiece of this dialogue. Current President Moon Jae-in has been slow to develop his own policy toward the region, although his foreign minister recently visited Ghana, Ethiopia, and South Africa. If the Seoul Dialogue on Africa is any indication, Moon wants to approach Africa with a fresh perspective focusing on youth, technology, and entrepreneurship.

The Korea-Africa Foundation hosted the Korea-Africa Youth Forum just prior to the conference, which provided panel discussions on African start-ups and an opportunity for young African and Korean entrepreneurs to network. The GSMA trade associationreportsthat there are more than 442 active tech hubs in Africa as of 2018, and that Amazon, Facebook, and Google are already investing in some of these companies, making support to tech entrepreneurs a potentially important partnership strategy. The Korea-Africa Foundation also provided African graduate students an afternoon to present their research to experts and peers for feedback, again highlighting Seoul’s intention to support African youth and build early relationships with people who could emerge as Africa’s industry and political leaders.

Africa, among other developing countries is slowly make sustainable plans for EVs and is still to touch necessary approaches related to EV product technology, Battery industry, markets research, consumer behavior, policy, infrastructure, and cultural meaning’ (Geels, 2015). This interpretation is helpful for understanding that EVs challenges in Africa are not driven by single factors such as price or technological change, but typically involves co-evolution between multiple developments. Policies

As Electric Vehicles are in the nascent stage on the continent, most countries are yet to set out incentives for the deployment of EVs, such as free charging stations, Green bank loans, etc. However, some countries have taken a few initiatives, which are likely to boost the EV demand. Moreover, favorable government policies and incentives will offer lucrative opportunities to major players to promote the adoption of electric vehicles over the coming years in the region.

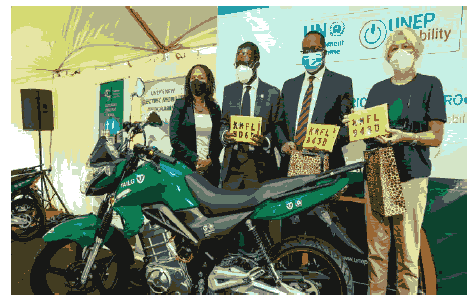

The African continent is also part of this growing electric-powered transport wave. Several African countries such as Kenya and Rwanda have adopted tax incentives to encourage electric vehicle imports and are working on developing their own electric two- and three-wheelers (figure 2).

The growing focus of the governments across the region to promote the use of electric vehicles and increased awareness about energy storage solutions in the renewable-based power sector is expected to drive the market during the forecast period

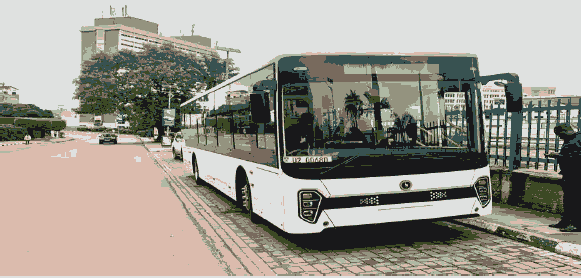

A few countries are already tapping into this potential. In Kigali, Rwandan start-up Ampersandis introducing a fleet of electric motorcycle taxis and plans to expand to other East African countries. In Uganda, locally manufactured electric buses from Kiira Motors have started transporting passengers in Kampala (figure 3).

Namibian start-upebikes 4 Africa with electric bicycles supplying the tourist market and finally in Nigeria, Jet Motor Company has partnered with GIG Logistics to provide its EVs for both transport and logistics services in the Nigerian market.

International Cooperation and Projects

As the demand for electric vehicles is growing in the region, companies such as Tesla Motors Inc., Volkswagen AG, Toyota Motor Corporation, Nissan Motor Co. Ltd, and Geely, among others, are entering into partnerships, joint ventures, acquisitions with major players in the market. Although the electric vehicle market in the African region is in the nascent stage, various key players in the market are trying to establish new facilities for product development, thereby, increasing their presence in the market. For instance.

• In October 2019, to increase their presence in the African market, Volkswagen and Siemens signed an agreement to start an electric mobility feasibility project in Rwanda, East Africa.

• In November 2019, Foton Motors started to localized AUV pure-electric Bus production with new energy technology in Cairo, Egypt. Some of the other key players in the market include Ford Motor Company, Groupe PSA, Kia Motors Corporation, Groupe Renault, Daimler AG, BMW, Hyundai Motor Company, BYD Company Ltd, Continental AG, etc.

• In February 2021, Rubicon, a commercial solar components and solutions supplier in South Africa, announced that it is bringing a Tesla Model X Performance Edition all-electric SUV into the country to emphasize its focus on electric mobility in the country.

• In June 2020, Nissan announced a four-year business strategy for the Middle East, Africa, and India to increase its presence in these regions. Nissan plans to introduce eight new models, focus on core segments to channel investment to profitable products, and give regional priority on Sports Utility Vehicles (SUV) and affordable sedan models (B-sedan segment) as a part of this strategy.

The Middle-East and African electric vehicle market was valued at USD 35 million in 2020, and it is expected to reach USD 84 million by 2026, registering a CAGR of over 15% during the forecast period (2021-2026).

Main Challenges

For about century now, the notion that Electric Vehicles (EVs) could be an alternative Internal Combustion Engine was unthinkable. With evolving policies, technological advancements, and the growing popularity of EV companies, EVs are now sharing the same roads with conventional vehicles. Some regions already perceived it as the future of transportation. The adoption ofEVs across the globe has increased more than six-fold since 2015.

Government Policies

Unlike in most developed countries where government policies are forcing automotive markets to embrace more climate-friendly options like EVs, most Africa’s governments are more relaxed.

Poor Infrastructure – Roads, Electricity, EV chargers: The relatively slow adoption of EVs in Africa faces infrastructural challenges like weak electricity grids, Bad roads and few charging stations.

Frequent blackouts in some countries could limit consumer demand for electric cars, as it cuts off access to transport. For example, in Nigeria, the average access to electricity is about 12 hours and there are no known public EV charging stations in the country.

Better still, South Africa which is ranked fifth globally in the ratio of public Electric Vehicle (EV) chargers to electric vehicles in 2020 after Korea, Chile, Mexico, and the Netherlands have more chargers per EV. Insufficient charging infrastructure continues to prevent wider use, as does the low supply of appropriate electric vehicles in many sectors, such as heavy industry.

Average cost of living: Despite falling battery costs, the promise of savings over the lifetime for an EV, the upfront prices remain out of the range of average Africa. According to Cox Automotive, the average cost of a new electric vehicle is about $55,600 (N23M). This is way above the average yearly salary of N2M of an average Nigerian living in Lagos.

Results

Reveal that low-income households, the cost and maintenance of EVs and the sluggish government attitude of most African countries towards electric car adoption may even widen the technological gaps with the developed (advanced) economies in the short-run. This review is important for legislators to comprehend the challenges and prospects related to this change from CEV to electric vehicles because it explains the stability of the EV market and the niches in Africa, including regulations, plans on this new technology, demand structures and prospects for the EVs in this part of the world.

Discussion Future Perspectives of EV Market Development in Africa

The future of transportation appears to be electric. More and more people across the globe are opting for electric vehicles and the industry is undeniably on a positive trajectory. According to the International Energy Agency, the number of electric cars, trucks, vans and buses on the world’s roads is on course to increase from 11 million vehicles to 145 million by the end of the decade.

This growth is being driven by the technological advancements in charging systems and battery ranges, as well as policies being adopted by governments to divest from fossil fuels and address the climate crisis. The substantial investments automobile giants are making to go electric are further signs that electric vehicles are the future.

As EVs begin to be imported in Africa once their original owners in Europe, Japan or North America have moved on to newer models. This would see a small number of used electric cars exported to Africa over the next few years, then a greater number in the coming years.

Firstly, Even a relatively slow diffusion of EVs may face challenges in African countries with weak electricity grids. Electricity systems in many African countries are already under strain still struggling to sustain daily household basic needs. Frequent brownouts in some countries could limit consumer demand for electric cars, as power cuts would cut off access to transport. For example, In Mozambique, only a third of households have regular electricity access (though the government targets universal energy access by 2030). While most of these households are not car owners, transport services in rural areas such as minibus and motorcycle taxis will struggle to go electric until a more extensive electricity grid is in place.

Secondly, EV market adapts to local needs by transporting electrification. For consumers affected by regular power cuts, it may be possible to use electric car batteries with smart technologies and appropriate regulation to power domestic usages until grid electricity is restored.

Thirdly, it is also likely that electric cars will only be a minority part of Africa’s electric mobility journey. Africa has the smallestper capita car ownership levelof any region in the world. Private cars representa minority of journeysin sub-Saharan Africa. Other segments – buses, shared minibuses, taxis and moto-taxis, motorcycles and even bicycles – may be better suited to be electrified first.

Finally, the dumping of internal combustion engine vehicles in rich countries could mean a flood of redundant petrol and diesel cars being exported to Africa, with vehicle electrification in Africa remaining sluggish.

This could exacerbate global environmental inequity. Health impacts from air pollution in African cities would continue to worsen, while air quality would improve in the developed world as diesel and petrol cars disappear.

Conclusion

While the world’s biggest economy has started adopting measures that would benefit the adoption soon, Africa has shown little progress. The huge gap in adoption between regions is related to the level of the challenges affecting the EVs growth.

Fewer electric cars are in operation in most African countries because the most popular vehicles are second-hand cars, an estimated 40% of the global exports of used vehicles go to Africa. Specifically, in Nigeria, Kenya and Ethiopia it is estimated that the proportion reaches about 80%–90% of total vehicles imported.

The Electric Vehicle market is expected to witness substantial growth owing to the fast adoption rate of electric vehicles across the region. Sub-Saharan African (SSA) countries are in urgent need for alternative energy sources for transport to solve the growing burden of fuel dependency and subsidies, as well as an electricity storage solution to leverage their abundant renewable energy resources. Electric Vehicles (EVs), powered by electricity and running on battery storage, offer a potential solution to both these problems. Many SSA countries should shape out policies and make large investments in power capacity in the next decade.

References

ACEA. (2018). Average Vehicle Age.

African development group. (2013). ‘Road safety in Africa assessment of progresses and challenges in road safety management system’.

Akhtar, S. (2016). Building the roads to sustainable development.

Ayaburi, J., Bazilian, M., Kincer, J., & Moss T. (2020). Measuring “Reasonably reliable” access to electricity services.Electronic Journal of Biotechnology. 33, 106828.

Crossref, Google scholar, Indexed at

Alsabbagh, M., Siu, Y.L., Barrett, J., & Gelil, I.A. (2013). ‘CO2 emissions and fuel consumption of passenger vehicles in Bahrain: Current status and future scenarios.’ SRI working paper series, 53.

Black, A., & McLennan, T. (2016). “The last frontier: Prospects and policies for the automotive industry in Africa.”International Journal of Automotive Technology and Management, 16(2).

Crossref, Google scholar, Indexed at

Bliss, T. (2016). Imported second hand vehicle and innovative financing opportunities. Road safety management limited.

Center for Science and Environment. CSE (2018). Clunkered combating dumping of used vehicles: A roadmap for Africa and South Asia.

Clean Air Network Nepal. (2015). A global strategy to introduce low sulphur fuels and cleaner diesel vehicles.

Coffin, D., Horowitz, J., Nesmith, D., & Semanik, M. (2016). Existing barriers to trade in used vehicles. United States International Trade Commission. Collins.

Collett, K.A., Hirmer, S.A., Holger, D., Crozier, C., Mulugetta, Y., & McCulloch M. (2020). Can electric vehicles be good for Sub-Saharan Africa?Energy Strategy Reviews J., 38, 56-87.

Crossref, Google scholar, Indexed at

Dargay, J., Gately, G., & Sommer, M. (2007). ‘Vehicle ownership and income growth, Worldwide: 1960 – 2030’,Energy Journal, 28(4).

Crossref, Google scholar, Indexed at

Lucas, W.D., & Kahn, M.E. (2010). “International trade in used vehicles: The environmental consequences of NAFTA.”American Economic Journal: Economic,2(4), 58-82.

Crossref, Google scholar, Indexed at

Deloitte. (2016). Deloitte Africa automotive insights.

Crossref, Google scholar, Indexed at

Essoh. (2013). “Shipping and invasion of second-hand vehicles in West African ports. Analyzing the Factors and Market Effects at the Port of Abidjan”, American Journal of Industrial and Business Management, 209– 221 Eurostat (2017).

Gammon, R., & Sallah, M. (2021). Preliminary findings from a pilot study of electric vehicle recharging from a stand-alone solar mini grid front. Energy Resource.

Gonzalez, C., & Jensen, S.R.K. (2015). ‘IRF world road statistics 2015: Data 2008 – 2013’. International Road Federation, Geneva.

Gaventa, J. (2021). Energy monitor: Energy policy consultancy with Electric Vehicle in Africa UN Environment Program report from October 2020: Global Trade Used Vehicle Report.

Herbert, G. (1980). “International trade in used cars and problems of economic development.” World Development 8(10), 781–88.

Moeletsi, M.E. (2021). Socio-economic barriers to adoption of electric vehicles in South Africa: Case study of the gauteng province, World Electric Vehicle Journal, 12, 167.

Nakajima M., & Yagita, K.H. (2009). Global flow of metal resources in the used automobile trade. Material transactions, 703-710. Global auto trading, Steering conversion .

Nandini, K., & Tornekar. (2019). Mastered in journalism and a dedicated writer for electric vehicles.

Shvetsova, O.A. (2021). Patchara Tanubamrungsuk and Sangkon Lee. Organization leadership in the automobile industry: Knowledge management and intellectual capital.The Open Transportation Journal, 15(16), electronic Publication Date: April 16, 2021.

Shvetsova, O.A. (2019). Technology learning in automobile industry: Comparative study between Korean and Thai Companies/Open Transportation Journal, 13, 236-249.

Rowling, M. (2021). Journalist, Thomson Reuters Foundation.

Torno, R. (2020). The growth of EV Markets on AIYL EVs Battery Charging Station.

Received: 16-Dec-2021, Manuscript No. IJE-21-9556; Editor assigned: 18-Dec-2021, PreQC No. IJE-21-9556(PQ); Reviewed: 27-Dec-2021, QC No. IJE-21-9556; Revised: 09-Jan-2022, Manuscript No. IJE-21-9556(R); Published: 15-Jan-2022