Research Article: 2020 Vol: 24 Issue: 5

Select Marketing Strategy and Activities Influencing Business Performance

Patrick R. Hariramani, De La Salle University

Abstract

This research will study about how Selected Marketing Strategy affects Perceived Financial Performance. The study has 10 Hypothesis which H1 to H5 tackles on the relationship of the Independent Variable to the Dependent Variable. Hypothesis 6 to Hypothesis 9 looks at the predictability of Perceived Financial Performance by using the different Independent Variable, while Hypothesis 10 is a multiple linear regression where all Independent Variables are used as predictors for Perceived Financial Performance. This research is a quantitative study which is Casual, Correlational and Descriptive in nature and will be conducted in Metro Manila with 110 family businesses owners and managers as a primary respondent. This research will look at the effects and relationship of Customer Service Differentiation, Product Differentiation, Promotion of Family Business and Use Image of Family Business to Perceived Financial Performance of Family Businesses. Data will be analyzed using Descriptive Analytics, Multiple Linear Regression Analysis and Correlational Analysis. Based on the findings and statistical tools, all the Independent Variables are significant predictor and has a positive relationship to Perceived Financial performance. Considering this findings, Family Businesses must use creative strategies and using their Family Business Brand as a leverage.

Keywords

Family Business, Regression Analysis, Perceived Financial Performance, Customer-Service Differentiation.

Introduction

Family Businesses here in the Philippines dates back to the mid-1800s. However, there are only a handful of prewar family businesses survived and still operates today. Those firms have lasted for about a century and have retained their family influence, but the organizational structure changed along with the times. Most of them have become corporations but still retain a portion for their family. A clear example is the Ayala-Zobel-Roxas clan. 150 years ago, the Ayala-Zobel-Roxas clan started as a distillery partnership and currently spreads out to diverse businesses, with each branch of the family carving a name for itself. Another notable family business is the Aboitizes, who engaged in abaca hemp trading at the turn of the century, and now owns a conglomerate whose holding company is publicly listed.

The Spanish influence on the economy is understandable, given the 300 years of a Spanish regime. However, in studying local family business, one cannot discount the influence of the Chinese community. (Palanca, 1995) Chinese families and their businesses are intertwined, as the business is considered to be another way of preserving the family. The Chinese presence in the Philippine business community is so ingrained that then Philippine President Fidel V. Ramos named six Chinese taipans as those expected to spur the country‟s economic growth via Asia‟s Emerging Dragon Corporation (Palanca, 1995). Chinese trading in the Philippines can be traced back to the 1500s. For three centuries, the Chinese were an abused minority, leading to uprisings in the 1900s. With the advent of American rule following World War II, the Spanish influence diminished as American influence began to take over. The shifting influence allowed Chinese business groups to emerge and Chinese families to proliferate. The descendants of the more prominent Chinese businessmen at that time, a majority of whom became naturalized, continue to play a dominant role in the Philippine economy.

The definition of a family business varies from study to study. Dyer, (2006) suggested two versions of such definitions. The first one is subjective, defining a family firm as one whose management is controlled by the family members who own it. In this case, outside persons are not involved in the management and there is strict family ownership/management. The second definition is more objective, considering a firm to be a family business if it meets certain criteria such as the family‟s ownership percentage or the number of family members holding directorships or filling key management Hosts (Nkam Micheal Cho, 2017).

Allouche & Amann (2008) provided a simpler definition of a family business. A Family Business is a business in which one or several families significantly influences its development through ownership of its capita, placing the emphasis on family ties in regard to the process of selecting company directors. Given the substantial debate on the definition of a family Business. Colli (2013) tried to put an end to the debate by using a definition of a family business provided by the European Commission and trying to complete it with the inclusion of a fifth feature related to longevity (Colli 2013; Colli & Larsson 2014). A firm of any size is a family business if (1) The majority of decision-making rights is in the possession of their spouses, parents, child or children‟s direct heirs, (2) The majority of decision-making rights are indirect or direct, (3) At least one representative of the family or kin is formally involved in the governance of the firm, (4) Listed companies meet the definition of family enterprise if the person who established or acquired the firm (share capital) or their families or descendants possess 25 percent of the decision-making rights mandated by their share capital and lastly (5) The firm must have been controlled by the same family for at least two generations.

Andy Yu et al. (2012) has created The Landscape of Family Business Outcomes wherein they cited different factors that affect the growth and success of a family business. They have conducted several studies and compared their finding with several authors. They have emphasized on Governance and Family Activities to increase the success of a Family Business. This Family Activities refers to Operations of the business, Strategy, Business Performance, Succession and Family Dynamics. Delaney & Huselid (1996) categorized performance into two areas: organizational performance and market performance. Organizational performance is based on the following indicators: the quality of company products and services, the development of new products, the company‟s potential to attract and retain talent, customer satisfaction, management-employee relationships, and relationships among employees. This measure is appropriate for family businesses because it can evaluate the relationships between employees and management and between family employees and non-family employees, including perceptions of fairness. Market performance is based on the following indicators: marketing, sales growth, profitability, and market share. These variables are suitable for the concept of competitive advantage (that is, growth, market share, and sales increase) and were implemented by Uysal (2008); Hernández & Peña (2008).

Marketing in Family SMEs most of the times adopts product or consumer orientation and strategies that differentiate themselves from their competitor may it be a Family or Non-Family Business (Farrington et al., 2018). Mustafa et al. (2015) defined Product differentiation as the process of incorporating unique high-quality features or attributes into products that enable the products to stand out in comparison to other similar products. In addition, it includes elements that customers perceived to be unique, resulting in customers not considering alternative products. Promoting a business as a family business has different benefits (Farrington et al. 2018). Some of these benefits are that the heritage of the owner is often closely related to the corporate heritage of the business (Balmer, 2017). It also gives employees a sense of belongingness and subsequently viewing the family business as an extension of themselves.

A family business image is created by presenting the business as a family business to stakeholders and by advertising and communicating a desired family business brand and image to the public. Business Performance is originally referred as achievement of the business as well as to the ratio of value created by the business over the value expected by the owners (Herath & Mahmood, 2013). Herath & Mahmood (2013), as well as Chen, Tsou & Huang (2009), explained that business performance focuses on achieving the objectives of the business, which are often both financial and non-financial in nature (Dirisu et al. 2013).

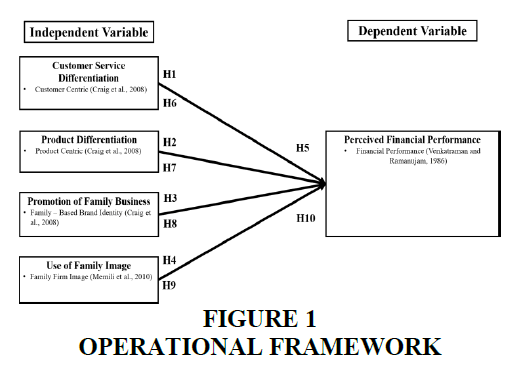

The conceptual framework in this research is an adoption from the study of Farrington et al. (2018). Farrington et al. (2018) has formulated this framework and conducted the study in South Africa. They have theorized that Customer Service Differentiation (CSD), Product Differentiation (PD), Promotion of Family Business (PFB), Use of Family Image (UFI) influences and impacts Perceived Financial Performance (PFP). In their research they found out that only Product Differentiation affects and impacts Perceived Financial Performance in Family SMEs. This research is important not just to the research community to further enhance this study but also to the family businesses that are in the forefront of the economy‟s growth in the Philippines.

Methodology

Operational Framework

Family Businesses are an integral part of the Philippines business field (Santiago, 2000). It is imperative that as a society we give attention to this type of business because it comprises 80% of all the businesses in the Philippines (Figure 1). The main problem that the researcher would like to explore and study: “What are the effects and relationship of Customer Service Differentiation, Product Differentiation, Promotion of Family Business and Use Image of Family Business to Perceived Financial Performance of Family Businesses?

The study has 10 Hypothesis which are:

(Ho1): There is no significant relationship between Customer Service Differentiation and Perceived Financial Performance in Family Businesses.

(Ho2): There is no significant relationship between Product Differentiation and Perceived Financial Performance in Family Businesses.

(Ho3): There is no significant relationship between Promotion of Family Business and Perceived Financial Performance in Family Businesses.

(Ho4): There is no significant relationship between Use of Family Image and Perceived Financial Performance in Family Businesses.

(Ho5): There is no significant relationship between Customer Service Differentiation, Product Differentiation, Promotion of Family Business and Use of Family Image to Perceived Financial Performance in Family Businesses.

(Ho6): Customer Service Differentiation does not significantly influence Perceived Financial Performance in Family Businesses.

(Ho7): Product Differentiation does not significantly influence Perceived Financial Performance in Family Businesses.

(Ho8): Promotion of Family Business does not significantly influence Perceived Financial Performance in Family Businesses.

(Ho9): Use of Family Image does not significantly influence Perceived Financial Performance in Family Businesses.

(Ho10): Customer Service Differentiation, Product Differentiation, Promotion of Family Image and Use of Family Image do not significantly influence Perceived Financial Performance in Family Businesses.

Research Design

The research undertaking can be described as descriptive, correlational, and casual explanatory. The research is descriptive because it identifies the factors influencing the Family Business Performance in Metro Manila. The research is also correlational as it aims to assess the relationship of each of the independent variables to the dependent variable. Previous research has shown that each of the independent variables has an impact on the dependent variable. Assessing the relationship of each independent variables on the dependent variable would help the researcher in making reccomendations on how family businesses in Metro Manila, Philippines can improve their performance. Lastly the study is also considered as a casual-explanatory research beacuse it aims to analyze the problem in order explain the patterns of relationship and effect among the variables. Morever, it also aims to quantify the impact of the independent variables on the dependent variable. The study would use survey questionaire that would be administered thru google forms and personal interview.

The respondents of the research questionnaire are family business owners, successor, CEO, Business Proprietor, or founders. They are located in the National Capital Region or Metro Manila in the Philippines. They can be from any age group, business industry, business size and market reach. However they should be knowledgeable about the business operations, financial performance and especially on its marketing activities. Due to the limitation of time, the researcher was able to get total sample size of 110. The sampling method the researcher has used is a non-probability sampling technique which is Convenience Sampling Method. A research survey questionnaire which contains questions for demographics profiling and 38 questions for the different variables and would be administered mainly in Google Forms and personal interview.

A pilot survey was conducted to test the effectiveness of the survey questionnaire and to gauge whether the terminologies used were clear and understandable to the respondents. The pretest was done by sending out an online survey form – through Google Forms to the business owners in Bocaue, Bulacan. Some of them are into retail, wholesaling, rice trading and garment manufacturing. This demographic was chosen as a similar proxy to the target research respondents from the Family Business Owners in National Capital Region. In total the survey received 20 respondents and a Cronbach‟s Alpha test was used to determine the reliability of the survey questionnaire and to measure the internal consistency. Computing the Cronbach Alpha‟s was done using MS Excel.

According to the result (Tables 1 & 2) of the pilot study conducted, the Cronbach‟s alpha value is more than 0.7 (Taber, 2018) for each variable which means that there is a high internal consistency based on the inter-item correlation.

| Table 1 Table on the Cronbach's Alpha Per Variable | ||

| Variable | No.of Items | Cronbach’s Alpha |

| Customer – Service Differentiation | 7 | 0.75 |

| Product / Service Differentiation | 8 | 0.89 |

| Use of Family Image | 6 | 0.92 |

| Promotion of Family Business | 7 | 0.86 |

| Perceived Financial Performance | 9 | 0.86 |

| Table 2 Total Cronbach's Alpha for the Whole Questionnaire | ||

| Variable | No. of Items | Cronbach’s Alpha |

| Total Cronbach’s Alpha Test | 37 | 0.95 |

Data for the main survey would be primarily be tested using Correlation Analysis, Linear Regression Analysis and Multiple Linear Regression Analysis.

Results and Discussion

Based on the data gathered the most frequently observed category of Gender was Male (n = 64, 47%), with the “Highest Educational Attainment” was College (n = 67, 49%), “Ethnicity” was Filipino (n = 48, 35%), while the “Business Industry” was Retailing (n = 37, 27%) and the most frequently observed category of “Generation of Ownership” was 1st Generation (n = 54, 40%).

The most used measure to evaluate the structural model is the coefficient of determination (R2 value). The coefficient represents the exogenous latent variables' combined effects on the endogenous latent variable. It also represents the amount of variance in the endogenous constructs explained by all of the exogenous constructs linked to it. The R2 value ranges from 0 to 1. In the case for this model it has a R of 0.576 an adjusted R2 of 0.560 which means it has a moderate effect.

The Hypothesis of the study is divided into two parts. H1 to H5 is for the relationship which can be measured using Pearson‟s Correlation and H6 to H10 is for the influence or predictability which can be measured using Multiple and Linear Regression.

The correlations were examined using Holm corrections to adjust for multiple comparisons based on an alpha value of 0.05. A significant positive large correlation was observed between path of CSD to PFP and PSD to PFP. This correlation indicates that as CSD increases, PFP tends to increase and this is also the same with PSD and PFP. In the case of PFB and PFP a significant positive moderate correlation was observed. This correlation indicates that as PFB increases, PFP tends to increase. Another significant positive large correlation was also observed between UOF and PFP. This correlation indicates that as UOF increases, PFP tends to increase. A summary of the correlation can be found on Table 3 with the decision on which Hypothesis to accept or reject.

| Table 3 Summary of Correlation Analysis and Hypothesis Testing | |||

| Hypothesis | IV – DV | Correlation | Decision |

| H1 | CSD TO PFP | rp = 0.77, p < .001 | Reject Null and Accept Alternate |

| H2 | PSD TO PFP | rp = 0.40, p < .001 | Reject Null and Accept Alternate |

| H3 | PFB TO PFP | rp = 0.44, p < .001 | Reject Null and Accept Alternate |

| H4 | UOF TO PFP | rp = 0.55, p < .001 | Reject Null and Accept Alternate |

| H5 | ALL IV TO DV | Reject Null and Accept Alternate | |

A Multiple Linea Regression Analysis was done to look at the influence, impact and predictability of the model. As a model the results of the linear regression model were significant, F (4,105) = 35.67, p < .001, R2 = 0.560, indicating that approximately 56% of the variance in PFP is explainable by CSD, PSD, PFB, and UOF. As a whole model it was able to predict PFB. The p value of the whole model is less than 0.001 which means that H10 is rejected.

To test the remaining Hypothesis which is H6 to H9 a simple linear regression Analysis was done. The result of the linear regression was CSD, PSD, PFB and UOF significantly predicted PFP. A summary of the Linear Regression Analysis can be found on Table 4 with the decision on which Hypothesis to accept or Rejected.

| Table 4 Summary of Regression Analysis and Hypothesis Testing | |||

| Hypothesis | IV – DV | P Value | Decision |

| H6 | CSD TO PFP | <= 0.001 | Reject Null and Accept Alternate |

| H7 | PSD TO PFP | <= 0.001 | Reject Null and Accept Alternate |

| H8 | PFB TO PFP | <= 0.001 | Reject Null and Accept Alternate |

| H9 | UOF TO PFP | <= 0.001 | Reject Null and Accept Alternate |

| H10 | ALL IV TO DV | <= 0.001 | Reject Null and Accept Alternate |

The hypothesis testing (Table 4) shows that all variables are significant predictors to Perceived Financial Performance of a Family Business. All have significant relationship and impact. This somehow contradicts the findings of Farrington et al. (2018) who have only seen a positive relationship between Product Differentiation to Perceived Financial Performance of Family SME‟s. While in this study all Independent Variables have a positive relationship and predicts the Dependent Variable.

The finding that Product or Service Differentiation predicts and significantly has a relationship to Perceived Financial Performance is supported by Pérez-Cabañero et al., (2012), Craig (2008); Farrington et al. (2018). Farrington et al. (2018) have contended that family businesses often differentiate themselves in the market through product or service differentiation. This product or service orientation stems from innovation, research and development and the delivery of high-quality products or services to different market. Which in turn becomes a competitive advantage of a business. Given this competitive advantage and differentiation, customers would follow the businesses and patronize its products or services.

The finding that Customer Service Differentiation predicts and significantly has a relationship to Perceived Financial Performance contradicts the finding of Farrington et al. (2018) but is somehow supported by the study done by Flören (2016); Craig (2008). They have contended the family businesses are likely to use a customer service differentiation competitive strategy or orientation in order to retain and gain new customers. In this way the business can show their consumers that they offer not just the product itself or service, but they welcome each customer and treats them fairly. This can be seen in the businesses here in the Philippines where they give special treatment to clients or customers. Filipinos want to be pampered and feel special when they enter a business establishment. This is not just only true with Filipino‟s but in other culture as well (Santiago, 2000). Due to the changing customer trends, the rise of membership businesses like; S&R, Landers and VIP membership in different business establishment. The biggest example of Customer Service Differentiation in the Filipino context is the word “SUKI” which means preferred customer. With this word customers gets additional discounts and freebies from businesses.

Promotion of Family Business predicts and significantly has a relationship to Perceived Financial Performance in this study, this finding contradicts the study of Farrington et al. (2018) but is supported by Astrachan & Astrachan (2015). They also found that the respondents of in their sample promotes the business as a family business to various stakeholder. Promotion of Family Business did also help the respondents in their sample achieve a higher financial performance because their customers look at their business not just a seller but as a business that stands for something.

The finding that Use of Family Image predicts and significantly has a relationship to Perceived Financial performance also contradicts the finding of Farrington et al. (2018); Memili et al. (2010); Zellweger et al. (2012). Their studies showed that family business shown a neutral stance when it comes to using family name as a basis for branding and marketing for the business. They found that branding a business as family owned, the identity and the image of the business overlap with those of the family, resulting in a mirror effect. In other words, if the image of the family business is under scrutiny by the public, it can also negatively affect the image of the family itself (Flören et al. 2015; Memili et al. 2010). However, based on the results presented, Use of Family Image here in the Philippines can be attributed to strength, legacy and quality. As Filipino‟s view businesses that have been operating for a long time, and capitalized on the their image of Family Business as a business that is homey, quality oriented and reliable.

Although a significant p-value value for the global F-test was reported, implying that the regression model was adequate for prediction purposes, the model only explains 56 per cent of the variance in “perceived financial performance”. The empirical results of this study show that there are significant relationship, and the independent variables are able to predict the dependent variable. This implies that family business must use a mix of different marketing strategy and management strategy in order to gain an increase on financial performance. The findings of this research are in line with the studies conducted by Beck & Kenning (2015); Kasmiri & Mahajan (2014); Mielotta & Raynard (2011).

Conclusion

Family Businesses are an important part of the Philippine Economy. From the biggest companies in the Philippine economy to the smallest business which we see on the streets, most of them are family businesses. There have been a lot of studies and research on family business especially in the field of succession. This is also true with the field of Marketing But in combination Family Business and Marketing, has areas to be explored and developed.

Based from the results of the survey and review of literature, marketing is needed by family business in order to grow. In this research only a selected marketing activity are used to identify if it has an effect and relationship to perceived financial performance of a family business. This selected marketing activity or tools are "Customer Service Differentiation", "Product - Service Differentiation", "Use of Family Image" and "Promotion of Family Business".

The results of this study are consistent with the results of the studies conducted by other researchers. The independent variables are connected and affects the dependent variable. Customer Service Differentiation, Product - Service Differentiation, Use of Family Image and Promotion of Family Business predicts and are correlated to Perceived Financial Performance. it is necessary for every business to use all the tools they can or available for them in order to grow. The business field now is highly competitive, fast changing customer preference and technology integration. businesses must act fast on opportunity because of changing trends in the market this goes as well to family businesses.

Family businesses must utilize their knowledge and resources to be competitive. In the Philippines, the first employees and human resources of a family business is its family members. It should capitalize on that. Customer Service Differentiation can be used by family business to strengthen their influence and relationship to their customers. By making sure that consumers feel special, welcomed and part of the business can guarantee a repeat purchase. Family Businesses must capitalize on their adaptability to customize their relationship with consumers. As consumers feel they are special they will patronize the business. Customer Service Differentiation is a marketing tool that is helpful in communicating to clients or customers the family and business values they have. A retail business, manufacturing or any type of business can use this to differentiate themselves to their competitors. Customer Service is one of the things that consumers look at a business. it not just the product or service that they buy but also the way how it is delivered, executed or presented to them from the beginning up to after sales support. Creating a meaningful and strong relationship with your customer is a free advertisement because they are the one that tells their peers about your company or business. All this effort will in turn increase perceived financial performance because consumers will patronize your product, invite friends to avail your products or services. Customer Service Differentiation is not a straightforward way or an activity that business can do and execute. This only shows the company and family values regarding customer service. In order for this to have great impact to the business, the business must first study its competitors. How does our competitors conduct their business? How do they execute sales and after sales services? How do they treat their customers? The important thing for a business to do is make sure that they communicate their brand, values and connect with their customers. They should take care of their customers and deliver their product or service in a different way that is economical and makes a lot of impact.

Given that Customer Service Differentiation is important, Product or Service differentiation cannot be neglected because it is also one of the keys in making sure customers will be interested with the products or services of the family business. Family Businesses should innovate and look at the current trends that are happening to make sure they are relevant in the times and their product or service is able to give value. Family Businesses must create their own specialized or unique product that only they can sell. In this way they can always have an edge over their competitors. This is can be one of the assets of any family business as this can be their source of their Sustainable Competitive Advantage if they are to replicate it thru different management generation.

Making your consumers return for your specialty product or service will surely increase your financial performance given that the business is managed well. The other factors as well should be the focus of any Family Business. Promotion of Family Business and the Use of Family Image. Family Businesses must communicate well that they are a Family Business because if consumers know or the community they can help and patronize the product or services it offers. If a family business can communicate to its stakeholders its unique selling point and its heritage, consumers would be willing to try the product or service and if they find that it is a quality and of value product or service, they could recommend it to their peers.

There are other advantages in using the image of a Family Business as its brand, however this should be used with caution. Using the image of the family business as the brand can be a double edge sword, if the family name is able to contribute to society and is associated with good comments and opinions then this can be good marketing tool, however if the family name was associated with negative opinions and comments from the public then it can hurt the business.

As with any business, may it be a family business or not, the right mix of marketing strategy is the key to success. Family Businesses must always refer to their Vision and Mission, so that they may be guided in their operations and growth. It must not deviate from its core competency and must stay true to its promises to its customers, employees, and other stakeholders.

In order to further enrich the field of Marketing in Family Business, research must be continuously especially on these variables and testing it on a bigger population in order to make a solid or concrete generalization. Even if in the past research have seen relationship and connections it is still not enough to make a big generalization but because of efforts of different researchers a path to finding knowledge has been paved. There is still a lot more variables that could be studied to get a bigger picture on how Perceived Financial Performance is affected. Some of the variables that may be considered in the future are new trends, consumer preference, green product and service revolution, effect of the pandemic and other variables that might affect consumer preference and perception.

References

- Andy Yu, G.T. (2012). The landscape of family business outcomes: A summary and numerical taxonomy of dependent variables. Family Business Review, 33-57.

- Aronoff, C. (1998). Megatrends in family business. Family Business Review, 181-192.

- Astrachan, C.B., Botero, I., Astrachan, J.H., & Prügl, R. (2018). Branding the family firm: A review, integrative framework proposal, and research agenda. Journal of Family Business Strategy, 9, 3-15.

- Autio, E.K. (2001). Entrepreneurial intent among students in Scandinavia and in the USA. Enterprise & Innovation Management Studies, 145-161.

- Balmer, M.E. (2017). Foundations of Corporate Heritage. Routledge: Oxford.

- Bandura, A. (1977). Bandura-social learning theory. Retrieved from simplypsychology: http://www.simplypsychology.org/bandura.html

- Bates, D., Mächler, M., Bolker, B., & Walker, S. (2014). Fitting linear mixed-effects models using lme4: arXiv preprint arXiv. Journal of Statistical Software.

- Beck, S., & Kenning, P. (2015). The influence of retailers’ family firm image on new product acceptance. International Journal of Retail and Distribution Management, 1126-1143.

- Blumentritt, T., Mathews, T., & Marchisio, G. (2013). Ame theory and family business succession: An introduction. Family Business Review, 51-67.

- Botero, I.C. (2016). Are family owned businesses taking advantage of their websites as strategic communication tools? Retrieved from Familyenterpriseusa.

- Botero, I.C., Thomas, J., Graves, C., & Fediuk, T.A. (2013). Understanding multiple family firm identities: An exploration of the communicated identity in official websites. Journal of Family Business Strategy, 12-21.

- Cabañero, C.P., Cruz, T.G., & Ros, S.C. (2012). Do family SME managers value marketing capabilities contribution to firm performance? Marketing Intelligence & Planning, 116-142.

- Cameron, K.S., & Quinn, R.E. (2006). Diagnosing and changing organizational culture. San francisco, CA: Jossey - Bass.

- Chandrasekar, K.S. (2010). Marketing Management: Text and Cases. New Delhi: McGraw-Hill.

- Chen, J., Tsou, H.T., & Huang, A.Y. (2009). Service delivery innovation: Antecedents and impact on firm performance. Journal of Service Research, 12, 36-55.

- Chong, H.G. (2008). Measuring performance of small-and-medium sized enterprises: The grounded theory approach. Journal of Business and Public Affairs, 2, 1-10.

- Churchill, G.J. (2002). Marketing research: Methodological foundations (8th ed.) . Orlando, FL: Harcourt College Publishers.

- Coffman, B. (2014). The family business succession model: an exploratory analysis of factors impacting family business succession preparedness. Kansas.

- Cohen, J. (1988). Statistical power analysis for the behavior sciences (2nd ed.). St. Paul, MN: West Publishing Company.

- Colli, A. (2008). The oxford handbook of business history. New York City: Oxford University Press.

- Conover, W.J., & Iman, R.L. (1981). Rank transformations as a bridge between parametric and nonparametric statistics. The American Statistician, 35(3), 124-129.

- Craig. J.B.D.C. (2008). Leveraging family-based brand identity to enhance firm competitiveness and performance in family businesses. Journal of Small Business Management, 351-371.

- Daft, R.L., & Samson, D. (2015). Fundamentals of management: Asia pacific edition. Melbourne: Cengage Learning.

- Davidsson, P., Achtenhagen, L., & Naldi, L. (2005). Research on Small Firm Growth: A Review. Retrieved from Eprints: http://eprints.qut.edu.au/2072/1/EISB_version_Research_on_small_firm_growth.pdf.

- De Massis, A., Chua, J., & Chrisman, J. (2008). Factors preventing intra-family succession. Family Business Review, 183-199.

- De Sarbo, W.D. (2007). A heterogeneous resource based view for exploring relationships between firm performance and capabilities. Journal of Modeling in Management, 103-130.

- De Sarbo, W., Di Benedetto, C., Jedidi, K., & Song, M. (2006). A constrained latent structure multivariate regression methodology for empirically deriving strategic types. Management Science, 909.

- De Sarbo, W., Di Benedetto, C., Song, M., & Sinha, I. (2005). Modeling a contingency framework of strategic choice involving strategic types, firm capabilities, and environmental uncertainty. Strategic Management Journal, 47-74.

- DeCarlo, L.T. (1997). On the meaning and use of kurtosis. Psychological Methods, 2(3), 292-307.

- Delaney J.T.H.M. (1996). The impact of human resource management practices on perceptions of organizational performance. The Academy of Management Journal 39, 950-969.

- Dess, G.A. (1984). Generic strategies as determinants of strategic group membership and organizational performance. The Academy of Management Journal, 467-488.

- Dirisu, J.I., Iyiola, O., & Ibidunn, O.S. (2013). Product differentiation: A tool of competitive advantage and optimal organizational performance (a study of unilever Nigeria). European Scientific Journal 9, 258-281.

- Dyer, W.J. (1988). Culture and continuity in family firms. Family Business Review, 37-50.

- Elmuti, D. (2000). The effects of global outsourcing strategies and participants' attitudes and organizational effectiveness. International Journal of Manpower, 112-128.

- Farrington, S., Venter, E., & Richardson, B. (2018). The influence of selected marketing and branding practices on the financial performance of family SMEs. Southern African Business Review, 33.

- Fernández-Roca, F.J., & Hidalgo, F.G. (2017). Special issue new perspectives in family business research. Journal of Evolutionary Studies in Business, 2(2).

- Ferrell, O.C., & Hartline, M. (2013). Marketing Strategy, Text and Cases. 6th ed. Mason: South West: Cengage Learning.

- Field, A. (2013). Discovering statistics using SPSS (4th ed.). Thousand Oaks, CA: Sage.

- Flören, R.H.B. (2016). Marketing en Het Familiebedrijf. Retrieved from NyenRode: http://www.nyenrode.nl/InternationalPartnerships/PublishingImages/Onderzoeksrapport%20Marketing%20en%20het%20familiebedrijf.pdf.

- Gallucci, C., Santulli, R., & Calabrò, A. (2015). Does Family Involvement Foster or Hinder Firm Performance: The Missing Role of Family-Based Branding Strategies. Journal of Family Business Strategy, 155-165.

- George, D., & Mallery, P. (2016). SPSS for windows step by step: A simple guide and reference, 11.0 update (14th ed.). Boston, MA: Allyn and Bacon.

- Gerba, Y.T., & Viswanadham, P. (2016). Performance measurement of small scale enterprises: Review of Theoretical and Empirical Literature. International Journal of Applied Research 2(3), 531-535.

- Hania, M.F. (2012). Factors influencing family business succession case study: Gaza Family Businesses.

- Herath, H.M., & Mahmood, R. (2013). Strategic orientation-based research model of SME performance or developing countries. Review Integrative Business and Economics Research, 2, 430-440.

- Hernández F,P. (2008). The effectiveness of human resources strategies: an integrative model of the theory of resources and capabilities and the theory of behavior in socio-economy entities. Revesco, 27-58.

- Hoelscher, M. (2002). The relationship between family capital and family business performance: Collaboration and conflict as moderators. Michigan: ProQuest Information and Learning.

- Hoskission, R.E. (1999). Theory and research in strategic management: Swings of a pendulum. Journal of Management, 417-456.

- Hoy, P.S. (2010). Entrepreneurial family firms. Upper Saddle River, NJ: Prentice Hall.

- Intihar, A.A. (2012). Exploring small family-owned firms’ competitive ability differentiation through trust, value-orientation, and market specialization. Journal of Family Business Management, 76-86.

- Johnson, A., Dibrell, C., & Hansen, E. (2009). Market Orientation, Innovativeness, and Performance of Food Companies. Journal of Agribusiness, 85-106.

- Kashmiri, S., & Mahajan, V. (2014). A rose by any other name: are family firms named after their founding families rewarded more for their new product introductions? Journal of Business Ethics, 124, 81-99.

- Kashuk, J.L. (2017). The emerging generation of family business leaders: an exploration study on the future orientation of young adults in family business. ProQuest.

- Lee, F.G. (2000). Financial management techniques in family businesses. Family Business Review, 201-216.

- Lipana-Gomez, C. (2018). Running an enduring family business. Retrieved from Manila Times: https://www.manilatimes.net/running-an-enduring-family-business/426092/

- Lude, M., & Prügl, R. (2018). Why the family business brand matters: Brand authenticity and the family firm trust inference. Journal of Business Research, 89, 121-134.

- Lumpkin, G.T., & Dess, G.G. (1996). Clarifying the Entrepreneurial Orientation Construct and Linking It to Performance. Academy of Management Review, 21, 135-172.

- McConaughy, D.L. (1999). Founders versus decedents: The profitability, efficiency, growth characteristics and financing in large, public, founding-family-controlled firms. Family Business Review, 123-131.

- Memili, E., Kimberly, A., Eddleston, K.A., Kellermanns, F.W., Zellweger, T.M., & Barnett, T.M. (2010). The critical path to family firm success through entrepreneurial risk taking and image. Journal of Family Business Strategy, 1, 200-209.

- Micelotta, M.R., & Raynard, M. (2011). Concealing or revealing the family: Corporate brand identity strategies in family firms. Family Business Review, 24, 197-216.

- Mustafa, H., Rehman, K., Zaidi, S., & Iqbal, F. (2015). Studying the phenomenon of competitive advantage and differentiation: Market and entrepreneurial orientation perspective. Journal of Business and Management Sciences, 111-117.

- Nkam Micheal Cho, S.O. (2017). Factors affecting the sustainability of family businesses in cameroon: An empirical study in northwest and southwest regions of cameroon. Journal of Entrepreneurship: Research & Practice.

- Nolega, K.S., Oloko, M., William, S., & Oteki, E.B. (2015). Effects of product differentiation strategies on firm product performance: A case of kenya seed company (KSC). International Journal of Novel Research in Marketing Management and Economics, 100-110.

- Okoroafo, S.C. (2009). The impact of marketing activities of family owned business on customer purchase intentions. International Journal of Business and Management, 3-13.

- Okoroafo, S.C., & Koh, A. (2009). The Impact of Marketing Activities of Family Owned Business on Customer Purchase Intentions. International Journal of Business and Management, 4, 3-13.

- Osborne, J., & Waters, E. (2002). Four assumptions of multiple regression that researchers should always test. Practical Assessment. Research & Evaluation, 8(2), 1-9.

- Palanca, E. (1995). Chinese business families in the Philippines since the 1890s. Chinese business enterprise in Asia, 197-213.

- Pérez-Cabañero, C., González-Cruz, T., & Cruz-Ros, S. (2012). Do family sme managers value marketing capabilities' contribution to firm performance? Marketing Intelligence and Planning, 30, 116-142.

- Pounder, P. (2015). Family business insights: An overview of the literature. Journal of Family Business Management, 116-127.

- Ross, D.F. (2015). Distribution Planning and Control. New York: Springer.

- Santiago, A.L. (2000). Succession experiences in philippine family businesses. Family Business Review, 13(1).

- Sharma P.C.J. (1997). Strategic management of the family business: Past research and future challenges. Family Business Review, 1-35.

- Sharma, P. (2014). Evolution in thinking about generational transition in family enterprises. Retrieved from FFPractitioner: https://ffipractitioner.org/2014/06/1 1/evolution-in-thinking-about-generational-transition-in-family-enterprises/.

- Sharma, P., Chua, J., & Chrisman, J. (2000). Perceptions about the extent of succession planning in Canadian family. Can. J. Adm. Sci, 233-244.

- Sharma, P., Chua, J., & Chrisman, J. (2003). Predictors of satisfaction with the succession process in family firms. J. Bus. Ventur, 667-687.

- Soininen, J., Martikainen, M., Pumaonen, K., & Kylaheiko, K. (2012). Entrepreneurial Orientation: Growth and Profitability of Finnish Small and Medium-Sized Enterprises. International Journal of Production Economics 140, 614-621.

- Sundaramurthy, C.A. (2008). Governing by managing identity boundaries: The case of family businesses. Entrepreneurship Theory and Practice, 32, 415-436.

- Taber, K.S. (2018). The use of cronbach’s alpha when developing and reporting research instruments in science education. Spinger, 1273–1296.

- Talib, S.A., & Shafie, M.F. (2016). The influence of entrepreneurial orientation on restaurant business performance.” In Hospitality and tourism 2015. HTC 2015 (pp. 63-66). London: Taylor and Francis Group.

- Tokarczyk, J.H. (2007). Resource-based view and market orientation theory examination of the role of ‘familiness’ in family business success. Family Business Review, 17-31.

- Tuominen, M., Mo¨ller, K., & Anttila, M. (1999). Marketing capability of marketing oriented organizations.

- Tuominen, M., Mo¨ller, K., & Rajala, A. (1997). Marketing capability: A nexus of learning-based resources and a prerequisite for market orientation. 26th EMAC Conference Proceedings, (pp. 1220-40). Warwick.

- Uysal, G. (2008). Relationship among HR and Firm Performance: A Turkey Context. The Journal of American Academy of Business, 77-84.

- Venkatraman, N. (1986). Measurement of business performance in strategy research: A comparison of approaches. Academy of Management Review, 803-814.

- Vorhies, D., & Harker, M. (2000). The capabilities and performance advantages of market-driven firms, an empirical investigation. Australian Journal of Management, 72-145.

- Wee Yu Ghee, M.D.H. (2015). Family Business Succession Planning. Asian Academy of Management Journal, 103 - 126.

- Westfall, P.H., & Henning, K.S. (2013). Texts in statistical science: Understanding advanced statistical methods. Boca Raton, FL: Taylor & Francis.

- Whittington, R.O. (2015). Wiley CPA Excel Exam Review 2015 Study Guide July: Business Environment and Concepts. New Jersey: Wiley and Sons.

- Wiklund, J., & Shepherd, D. (2005). Entrepreneurial Orientation and Small Business Performance: A Configurational Approach. Journal of Business Venturing, 20(1), 71-91.

- Williams, R. (2015). Measuring Family Business Performance: A Holistic, Idiosyncratic Approach. Kansan City: Coles College of Business.

- Zachary, M.A. (2011). Family business and market orientation: Construct validation and comparative analysis. Family Business Review, 233-251.

- Zellweger, T.M., Kellermanns, K.W., Eddleston, K.A., & Memili, E. (2012). Building a family firm image: How family firms capitalize on their family ties. Journal of Family Business Strategy, 239-250.