Research Article: 2019 Vol: 23 Issue: 1

Single Entry Method as the Way to Improve Small and Medium Enterprise Governance

Nuramalia Hasanah, Universitas Negeri Jakarta

Ratna Anggraini, Universitas Negeri Jakarta

Unggul Purwohedi, Universitas Negeri Jakarta

Abstract

This study aims to investigate the role of ‘single entry method’ in improving the financial governance of Micro, Small and Medium Enterprises so as to assist SME owners in providing reliable and accountable information on financial position, improving the quality of work, making decisions, identifying business development, managing finances and facilitating access to finance. The primary data used in this study are questionnaires distributed to owners of SMEs in the area of Ciomas, Bogor. The obtained research sample consisted of 113 respondents. The study also uses descriptive qualitative research. This research uses a survey approach combined with a descriptive methodd to measure and analyse responses from respondents. The research process determined that SMEs have the ability and willingness to record financial transactions but still require training and mentoring program. For SMEs, "Single Entry" recording is an alternative method for recording simple accounting, especially Micro and Small businesses as a way to fill understanding gaps on SAK ETAP that are not understood by SMEs.

Keywords

SMEs, Single Entry, Financial Reporting.

Introduction

The demand to be able to further apply the standard of financial reporting based on the standard applicable to SMEs grew after the enactment of the ASEAN Economic Community (MEA) system, where business competition expanded beyond Indonesia into various ASEAN countries. The proprietors of SMEs in Indonesia should be wary of increasingly sharp competition with increased productivity of business development. One of the main problems in the development of SMEs, appropriate financial governance and management, requires an understanding of accounting skills. However, many SMEs have not been able to make a decent financial report in accordance with applicable standards. Micro and small-sized SMEs have not optimally conducted and used accounting information due to lack of education and understanding of accounting, making bookkeeping more difficult and complicated for SMEs (Rudiantoro & Siregar, 2011; Tuti, 2014). SME managers also assume financial statements are not important (Putra & Kurniawati, 2012).

Neag et al. (2011) found that the standardized financial statements (IFRS and GAAP) are still too complex that cannot afford applied and hard-filled for micro and small business. In addition, the implementation of the financial accounting standards of non-public accountability (SAK ETAP) for SMEs is constrained by the limited knowledge of SMEs entrepreneurs (Nedsal et al., 2014). This is corroborated by the survey conducted by Grant Thornton Org. (2011), which found that business actors and accountants agree to simplify existing financial statements and if this occurs than 80% of businesses will apply. Nevertheless, the simpler SMEs’ financial reporting must be in accordance with the needs of SMEs for internal analysis, tax analysis and business credit needs.

Padachi Research (2012) stated that "Entity Concept" is the basis for establishing a formal accounting system for SMEs, so it is necessary to distinguish the accounting needs for financial reporting of Micro, Small and Medium Enterprises. This is in accordance with Armando (2014), who created the model design to facilitate SMEs in conducting Accounting and Accounting Information. Amoako's research (2013) discusses that the main factors affecting SMEs’ Accounting Practices in Ghana is the managers or owners of SMEs’ understanding of Accounting Records and Special Guidelines for SMEs Accounting Practices need to be designed and adjusted with the Entity Concept. While the Base used in SMEs’ Accounting System conducted in Jordan in Smirat’s research (2013) use base recording base Cash (73%) more than Acrual base (27%). The "Single Entry" method using Cash Basis is widely used by SMEs in Jordan. In the study of Ntim et al. (2014), the implementation of accounting records in the interest of financial reporting in Ghana used single entry method (54%) more frequently than double entry method (46%).

Single Entry Methods in Financial Reporting has been used in Ghana and Jordan for SMEs. Researchers tried to apply the "Single Entry" method to the financial reporting of financial governance for SMEs to resolve issues related to weak preparation of financial statements. The application of the method "Single Entry" will be aligned with the criteria for Micro, Small and Medium Enterprises for the needs of each level of the different financial reporting.

This research will gather more detail about accounting record and financial reporting of Micro, Small and Medium Enterprises. In this context, the research questions are as follows: What is SMEs owners’ perceptions of the accounting record? How to stage recording needs and financial statements for SMEs and how to use the single entry method in the implementation stage of recording and financial reporting. Thus, this study is expected to contribute to the provision of an initial description of the implementation of accounting method, especially with single entry in the SMEs sector.

Literature Review

SMEs and Single Entry Method Financial Statements

Act No. 20 of 2008 on SMEs Article 1 (1)-(3) listed the definition of micro, small, and medium enterprises. A micro business is a productive enterprise owned by an individual and/or an individual business entity fulfilling the criteria of micro business as stipulated in this Law. Smallscale business is a stand-alone productive economic enterprise undertaken by an individual or entrepreneur who is not a subsidiary or not a company branch owned, controlled, or is a direct or indirect part of a medium business or a large enterprise that meets the criteria of small business as referred to in this Act.

Financial statements are the means of communication between financial data and business activities in the accounting process that generates business value to offer explanations for decisions (Lontoh & Librawati, 2004). The financial statements are intended to provide information that is useful for decision making. According to the Indonesian Institute of Accountants (2007), the purpose of financial statements is to provide information regarding the financial position, performance and changes of the financial position of an enterprise that is useful for a large number financial decision makers. Without financial statements, decisions will be difficult for both businesses and banks as providers of funds. Therefore, bookkeeping and financial reporting is quite important in the growth and development of business (Rudiantoro & Siregar, 2011).

A good accounting system is judged by how well records are stored and how well it can meet the information needs of internal and external decision makers. Maseko & Mayani (2011) suggest that for small or micro businesses, accounting practices are maintained to ensure adequate cash books (if possible by analysis), bank accounts (with policy and withdrawal deposits), petty cash systems, bank reconciliation statements, with lenders for customer buying and selling, stock policy, fixed asset lists and budgeting for the entire business. Ntim et al. (2011) state that SMEs bookkeeping is primarily intended to retrieve information from fixed assets, sales and cash transactions. However, there is other additional accounting information, such as the operating expenses shown by some number of SMEs. SMEs bookkeeping identifies that many SMEs used the "Single Entry" method in transaction recording as evidenced by the majority of sample companies in this study.

Businesses with a cash base system can use a single entry bookkeeping method in accounting. In Smirat’s research (2013) SME accounting system conducted in Jordan used a cash base (73%) more than actual base (27%). The "Single Entry" method for bookkeeping is simpler than the double entry method. The advantages of using Single Entry Method are:

1. Easy to understand by people who have no financial or accounting background.

2. For many small companies, a single entry method can be implemented without the involvement of a trained bookkeeper or accountant.

3. Single entry method does not require complex accounting software. Single Entry methods can be created using very simple spread sheets such as Excel.

This research tries to explore how to stage recording needs and financial statements and to design a financial reporting application with "Single Entry" method for SMEs by giving simplicity and ease in reporting for each Recording and Financial Reporting Level.

Methods

This study uses a survey approach with descriptive methods. Researchers use descriptive method to describe the phenomena that occur in connection with the utilization of financial statements of micro, small and medium enterprises in accordance with the circumstances, events and activities that occur. The collection of primary data will occur through the distribution of questionnaires to be filled out by respondent. All questionnaires filled selection phase will be carried out first so incomplete questionnaire contents were not included in the analysis.

Researchers will collect Financial Reporting data from Questionnaires obtained by visiting the Small Entrepreneurs, Micro and Medium Enterprises. This research held in Bogor spread over Ciomas, Ciapus, Ciherang and Dermaga area . The population in this study is SMEs in the city of Bogor. The sample numbers in this study were 113 Micro, Small and Medium Enterprises. This research used non-probability convenience as the sampling technique.

Results And Discussion

The technical analysis conducted employs a descriptive quantitative analysis of a survey concerning financial reporting of Micro, Small and Medium Enterprises by looking at the frequency distribution of respondents' answers about age, business age and the instrument under study.

Profile of Respondents and Enterprises SMEs in Survey

The research was conducted in Bogor district spread over Ciomas, Ciapus, Ciherang and Dermaga areas. Survey respondents totalled 113 SMEs. The majority of respondents surveyed consist of various types of businesses that manufacture and trade, with some that are more service-oriented. The result of the survey was that 113 respondents were divided into 3 business categories, namely Micro entity 55 respondents (49%), Small entity 50 respondents (44%) and medium entity 8 respondents (7%). Respondents in this study are dominated by 92.93% by male respondents and the rest of them are 07.07% are women. Education level categories are elementary, junior high, high school, diploma and undergraduate level. The results of the education level of respondents is quite diverse. Small and medium enterprises in the city of Bogor ownership is dominated by high school graduates (41.41%). This educational background categories of the respondents are accounting/economics, engineering, law and others who are not included in the area. The biggest educational data is the varied educational background, so it is possible that SMEs do not implement SAK ETAP because it has 20.41% accounting/economics education background.

What is SME Owners’ Perception of the Accounting Record?

Based on the results of the questionnaire, the events and conditions in SMEs are classified according the subject of research. The following descriptive form explains the description of this data:

Components of financial statement

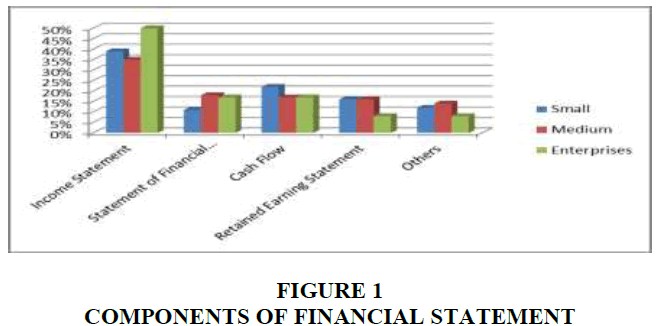

Questions about the components of the company’s’ financial statements are shown in the Figure 1.

The data shows that among the five components of the financial statements, owners of Micro Small and Medium Business assume that Income Statement is the most important report because it demonstrates whether there has been a gain of profit or loss. Thirty-nine percent of micro enterprises 35% of small businesses and 50% of medium businesses answered with this belief. After that, each business varies in the order of importance of the report in the components of the financial statements. According to micro businesses, the sequence of components of financial statements is: Income statement, Statement of cash flows, Retained Earning Statement and the Statement of Financial Position. Small and medium enterprises rank the importance of components of financial statements as follows: Income Statement, Statement of Financial Position, Cash Flow Statement and Retained Earnings Statement. This means that small and medium enterprises have the same understanding in making components of financial statements that are adjusted to the applicable accounting standards.

Type of book used in accounting record

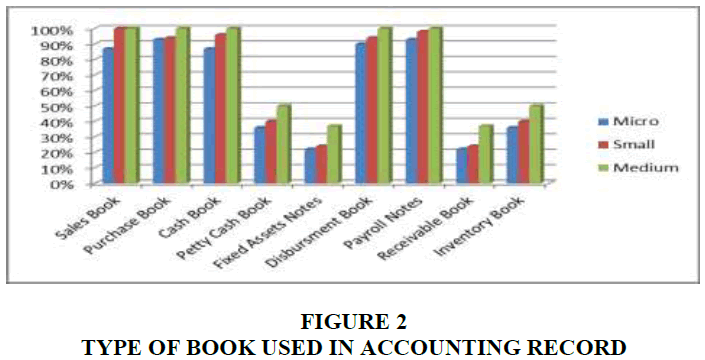

In the questionnaires distributed to respondents, managers/owners of SMEs have also been asked what kind of books are used in accounting records. There are several books mentioned in the questionnaire. The Figure 2 below shows the result of the respondents' answers.

The books that are used most frequently are:

1. Micro Businesses: Purchase Book, Sales Book and Cash Book.

2. Small Businesses: Sales Books, Payroll Records and Cash Books.

3. Medium Business: Sales Books, Books Purchases and Cash Books.

Accounting recording method

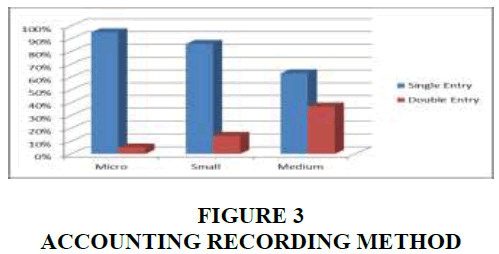

The next question is about the accounting method. Respondents do not understand the term of accounting recording by Single Entry and Double Entry method. The questionnaire spreader assisted respondents in determining whether accounting records were used using the two methods. The Figure 3 below shows the respondents’ results.

Micro, small and medium enterprises agreed that the accounting method used is a single entry method. Ninety-five percent of micro businesses, 86% of small businesses and 63% of medium businesses provided this answer. This indicates that single entry methods for accounting systems are the preferred by SMEs.

How to Stage Recording Needs and Financial Statement for SMEs

The financial statements presented should be able to meet the following financial reporting objectives:

1. Provide reliable and accountable information on the financial position.

2. As a material to assess performance.

3. As a basis for making decisions.

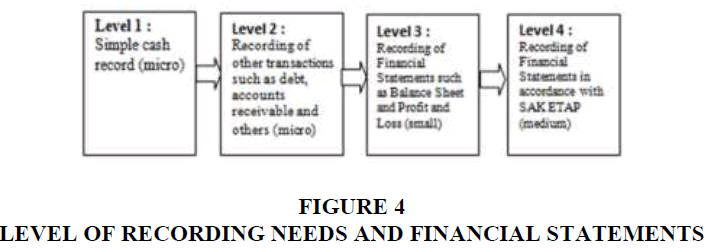

The modelling of recording and reporting of SMEs should be simple and easily understood by SMEs (Narsa et al., 2012). Nevertheless, simple financial reporting must be in accordance with the needs of SMEs for internal analysis, tax analysis and credit requirements. Several previous studies have found that the financial information needs of SMEs are determined by the volume of business. Wati (2011) found that business turnover affects the application of accounting. The greater the turnover of a business, the greater the information required by the business, so the greater the application of accounting in the business. Based on the approach of basic accounting information in SMEs and the theory approach that the volume of business affects the accounting, the formulation of recording needs to be based on business scale. This formulation occurs at the stage when a business needs a simple cash record, when a company needs a credit card, receivable card, payroll and production card as well as financial statements and the preparation of financial statements in accordance with SAK ETAP. This formulation is presented in Figure 4, which contains the level of financial recording and reporting requirements.

The model to formulate the recording needs and Financial Statements of SMEs at several levels is as follows:

1. Level 1 (Micro Business), where every business is obliged and must record cash in and cash out. With a simple record, businesses can perform various analysis, such as turnover, total transactions per day, production cost records, employee payments and so on. This basis facilitates the need for internal analysis, credit analysis needs and tax reporting needs.

2. Level 2 (Micro Enterprises), indicates a special transaction with a higher intensity in the business. This transaction is important because it is an integral part of the business and is directly related to the availability of cash. Transactions that require special records due to the increased intensity are sales, accounts payable, accounts receivable and production.

3. Level 3 (Small Business), is the preparation of financial statements in the form of balance sheet and profit and loss. The preparation of financial statements is needed when the volume of business is increasing and large. The need for more complex financial analysis is needed to explain the real business conditions.

4. Level 4 (Medium-Sized Enterprises) uses Financial Statements based on SAK ETAP that is only formulated for SMEs whose businesses are complex and capable of providing specialized labor in the field of accounting, especially if there is accounting software used in the business. This will ease the effort because the need for internal analysis is a much more complex process for ensuring that the business is more effective and efficient.

A good accounting system is judged by how well records are stored and how well it is able to meet the information needs of internal and external decision makers. Many SMEs used the "Single Entry" method in transaction recording as evidenced by the majority of sample companies in this study. The use of Single Entry method can be applied in micro and small business as long as transaction volume is not too big and frequent, and there is no VAT transactions recorded.

How is the Implementation Stage of Recording and Financial Reporting with Single Entry Method?

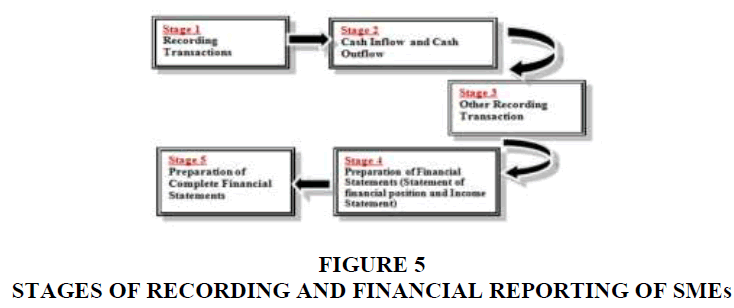

Here are the stages in implementation of business transaction recording and preparation of financial statements. Stages are based on business scale with the consideration that the listing requirement will increase as the business volume increases (Figure 5).

The stages are as follows:

Stage 1: Transaction Recording

At this stage it is expected that SME entities understand the recording of transactions, especially for business actors themselves and in relation to third parties such as licensing and financeial institutions. One of the obstacles to the implementation of recording transactions and the preparation of financial statements for SMEs is that the activity is not seen as essential and the benefits obtained are not comparable to the work performed. This early stage is an important stage before proceeding to the next stage. This stage is expected to be achieved by micro-scale SME entities.

Stage 2: Recording of Cash In and Out Cash

The recording of cash transactions is the initial basis of the recording stages of SMEs. This is in line with the form of activities of UMKM, which are mostly cash basis, capital, cost, purchase or sales. This is recorded daily. This stage is expected to have been achieved by micro and small scale SMEs entities.

Stage 3: Recording of Other Transactions

Examples of recording other transactions are:

Sales recording

Sales are recorded daily. The entity requires this listing to know some of the key points:

1. The amount of the sale of goods on credit.

2. What items are sold.

3. Who are the biggest buyers.

Purchase recording

The entity requires a purchase record to know several things, including:

1. The amount of merchandise that is still in the warehouse/which items are deposited in the outlet/shop/exhibition with a consignment system.

2. Is it necessary to re-purchase.

3. Merchandise that most customers demand.

This stage is expected to have been achieved by micro and small-scale SME entities.

Step 4: Preparation of Financial Statements (Balance Sheet and Profit and Loss)

At this stage it is assumed that the recording of transactions has covered all the minimal aspects of the balance sheet and profit and loss calculation, thus it can be said that the SME entity has been able to construct the financial statements. The financial statements are prepared in a simple form by applying the standard accounting principles. This stage is expected to be achieved by micro and small-scale SMEs entities.

Step 5: Preparation of Complete Financial Statement based on SAK ETAP

At this stage the SME entity has all the complete and detailed records of all transactions that occur in real transactions (Purchases, Sales, Returns, Price Discounts, etc.) and non-real transactions (Depreciation, Backup, etc.). Recording also covers all aspects (items) in the balance sheet and profit and losses are accounted for. The company has also applied the accounting principles and transactional treatment stipulated in the Financial Accounting Standard. Organizations are also expected to have their own unit of work that handles all financial activities. This stage is expected to be achieved by medium-scale SMEs entities.

The minimum standard formulation of financial statements shall be prepared based on the businesses’ scale as follows:

1. Micro business in the form of recording financial transactions in the cash book (cash in and cash out).

2. Small business in the form of balance sheet recording (at least there are components of Current Assets, Fixed Assets, Debt and Capital) and income statement (income and expenses).

3. Medium enterprises in the form of balance sheet, income statement and other recording according to SAK ETAP.

For SMEs to have the ability and willingness to record the financial transactions conducted, it is necessary to deliver training and mentoring programs to SMEs. The "Single Entry" method of recording is an alternative method for recording simple accounting for SMEs, especially Micro and Small business to teach aspects of SAK ETAP not understood by SMEs.

Conclusion

The result of SME owner’s perception SME for accounting record, Income Statement is the most important report. The books most used for SME are purchase book (Micro) and Sales book (Small and medium). Micro, small and medium enterprises agreed that the accounting method used is a single entry method; this indicates that single entry methods for accounting systems are the preferred by SMEs.

The desired stages are as follows: Stage 1 in the form of recording transactions (understanding the benefits of recording transactions); Stage 2 in the form of recording cash inflows and cash outflows; Stage 3 in the form of recording of other transactions (e.g. sales books and inventory books); Stage 4 in the form of preparation of minimum financial statements consisting of balance sheet and income statement; Stage 5 in the form of preparation of complete financial statements referring to SAK ETAP.

The minimum standard formula of financial statements shall be prepared on the following business scale: Micro business in the form of recording financial transactions in the cash book (cash in and cash out). Small business in the form of balance sheet recording (with components of Current Assets, Fixed Assets, Debt and Capital at minimum) and income statements (income and expenses), and Medium enterprises in the form of balance sheets, income statements and other recording according to SAK ETAP. "Single Entry" method of recording is an alternative method for recording simple accounting for SMEs, especially Micro and Small business to fill knowledge gaps concerning SAK ETAP not understood by the proprietors of SMEs.

This research only used the criteria of making simple or complex financial statements to determine the sample. Researchers suggest adding more criteria in future research such as gender, age, SMEs who get credit from banks, and others. A final recommendation is to try to add or replace other independent variables that may affect the level of use of SME accounting information that this study did not include, such as accounting training, corporate culture, and business sectors.

References

- Amoako, G.K. (2013). Accounting practices of SMEs: A case study of Kumasi Metropolis in Ghana. International Journal Business and Management, 8(24), 73-83.

- Armando, Z.R. (2014). Exploration of accounting remodeling in micro and small enterprises (MSEs). FEB Student Scientific Journal, 1(2), 59-70.

- Bank Indonesia. (2009). Study of minimum financial report standards and business plan for MSMEs. Directorate, Credit, Rural Banks and MSMEs.

- Ikatan Akuntan Indonesia (2009). Entity financial accounting standards without a public accountant.

- Jati, K., & Beatus dan, O.N. (2009). Grow the habit of small businesses preparing financial statements. Business Journal and Businessman, 11(8), 1-14.

- Maseko, N., & Dan Manyani, O. (2011). Accounting Practices of SMEs in Zimbabwe. Journal of Accounting and Taxation, 3(8), 171-181.

- Narsa, I.M., Agus, W., & dan Sigit, K. (2012). Revealing the UMKM Readiness in the Implementation of the entity's public accountability financial accounting standards (PSAK-ETAP) to improve banking capital access. Economic Paper.

- Neag, R., Masca, E., & Dan Pascan I. (2009). Actual aspects regarding the IFRS for SME opinion, debates and future development. Chronicle Univertsitatis Apulensis Series Economica, 11(1).

- Ntim, A.L., Oteng, E., & Fianu, A. (2014). Accounting practices and control systems of small and medium size entities: A case study of techiman municipality. Journal of Finance and Accounting, 2(3), 30-40.

- Nuramalia., H., & Ratna Anggraini, Z.R. (2017). Accountingstandars perception in small medium enterprises: Case Study in Indonesia. Advanced Science Letter, 23(11), 10753-10756

- Padachi, K. (2012). Why SMEs ignore formal accounting systems? Entity concept explanation. Artikel Ilmiah. International Conference on Applied and Management Sciences.

- Putra Hermon Adhydan Elisabeth Penti Kurniawati (2012). Preparation of Financial Statements for Small and Medium Enterprises (SMEs) Based on Entity Financial Accounting Standards without Public Accountability (SAK ETAP). Proceeding for Call Paper SWCU FEB Lecturer Scientific Week.

- Rudiantoro, R., & dan Sylvia, V.S. (2012). Quality of MSME financial reports and prospects for implementation of SAK ETAP. Journal of Indonesian Accounting and Finance, 9(1), 1-7.

- Smirat, B.Y.A.L. (2013). The use of accounting information by small and medium enterprise in south district of Jordan (An empirical study). Research Journal of Finance and Accounting, 4(6), 1-7.

- Solovida, G.T. (2010). Factors affecting the preparation and use of accounting information in small and medium enterprises in Central Java. Journal of Investment and Management, 6(1), 2-89.

- Tuti, R. (2014). Factors affecting the understanding of MSMEs in compiling financial statements based on SAK ETAP. The 7th NCFB and Doctoral Colloquium, Faculty of Business and UKWMS Postgraduate.

- Wahyudi, M. (2009). Analysis of factors affecting the use of accounting information. The 7th NCFB and Doctoral Colloquium, Thesis Published, Dipenegoro University, Yogyakarta.