Research Article: 2020 Vol: 24 Issue: 5

Software Firms Knowledge Exchange Activities and Performances in Industry Clusters: Focus on Startups and Small and Medium Enterprises

Jungho Cho, Wuhan University

Sung-Eui Cho, Gyeongsang National University

Abstract

The software industry is related to creative knowledge works and intangible products. Thus, firms in the industry can interact, cooperate, and collaborate online globally. However, many software start-ups and small and medium enterprises tend to prefer the location in start-up incubators or innovation clusters for various reasons, including affordable office spaces, government support, and access to required knowledge. This study focuses on the relationship between firms' knowledge exchange activities and performances in start-up incubators and innovation clusters in the software industry. In particular, this study deals with the effects of knowledge exchange activities for talent and human resources, R&D and technology, customers and marketing, investment and funding, government policy and support, and strategic insights to the dependent factors, including firms' satisfaction with knowledge spill over, industry cluster location, and financial performances. This research tests the effect of knowledge exchange activities with adjacent companies and institutions in start-ups and small and medium enterprises in the software industry where much necessary knowledge can substantially be acquired and exchanged online, as different features from manufacturing. The study conducts surveys on entrepreneurs and employees in software start-ups and small and medium enterprises and analyzes collected data with statistical analysis methodologies.

Keywords

Knowledge, Remote Interaction, Software Industry.

Introduction

As an industry dealing with intangible knowledge products, the software industry essentially can have the characteristics of online, real-time, and remote interaction, cooperation collaborations. For this reason, international collaboration and labor division can take place in real-time, and global offshoring is actively taking place in the software industry. Thus, cooperation and collaboration show diverse shapes according to firm capabilities, ranging from local interaction to wide-area and international collaborations. However, despite these characteristics, there is also an apparent tendency to develop business incubators and innovation clusters aiming at active knowledge exchanges and promoting innovations. Of course, there are many exceptional cases of dispersed locations in many cities and countries. Large enterprises with various networks, resources, and capabilities can have diverse interaction channels to acquire the necessary knowledge, not depending on adjacent sources. It can be similar to some startups and small and medium-sized enterprises with broad networks, superior technologies, or outstanding competitive advantages, enabling active online interactions and collaborations. However, for many startups and small and medium enterprises that lack networks, resources, and capabilities, it can differ. Generally, the company sizes and individual company capabilities can be critical factors in building various knowledge exchange channels. Thus, some software companies, particularly many startups and small and medium enterprises, tend to get their necessary knowledge from adjacent contactable sources. Startup incubators and innovation clusters can provide an environment for knowledge exchange activities for these companies. Generally, the acquisition and exchange of diverse knowledge, human resources availability, accessibility to large cities, government policy to build industrial districts, business model characteristics, and company size can play critical roles in developing industry clusters in the software industry (Cho, 2019).

This study investigates the relationship between the knowledge exchange activities and the performance factors such as a firm's satisfaction with knowledge spillover, industry cluster location, and financial performances in startups and small and medium enterprises accommodated in startup incubators and innovation clusters. In particular, this study focuses on the impact of knowledge exchange activities for talent and human resources, R&D and technology, customers and marketing, investment and funding, government policy and support, and strategic insights in the software industry.

This study consists of five chapters. This chapter is an introduction, and chapter 2 explains the research background and the process of developing research hypotheses based on the existing literature review related to this study. The research model of this study is also presented here. Chapter 3 explains the research methodology and addresses the relationship between the knowledge exchange activities and performance factors in the software industry. It also gives the results of statistical analysis and hypothesis tests. Chapter 4 is the conclusion of this study, including a summary, academic and practical contributions, and future research challenges.

Background

Knowledge exchange in the software industry

Nowak & Grantham (2000) emphasize that many business activities can be performed online very naturally in the software industry, including marketing, sales, and cooperation. It is related to the software industry features that deal with creative knowledge works and intangible products. The authors say that international collaboration, subcontracts, and labor division are very popular and active in the software industry due to the characteristics. Caballero et al. (2001) also argue that the software industry can develop by forming a virtual industrial cluster online due to the industry characteristics. On the contrary, there is a phenomenon that the software industry develops by forming industrial clusters. Many software companies often cluster in specific metropolitan areas forming industrial clusters (Campbell-Kelly et al., 2010; Jeon & Lee, 2013). Many studies on industry clusters in the software industry emphasize the benefits of locations in metropolitan areas. In finding the enablers, Lee & Yun (1999) focused on high-quality office space, transportation, proximity to customers and suppliers, and access to competitors. Choi (2010) argues that the provision of sufficient land and economical office space, such as apartment-type factories, plays a critical role in forming software industry clusters. Cho (2019) asserts that securing outstanding talents, knowledge sharing and exchanges, and the government policy to form industrial districts significantly affect the industry cluster development in the software industry. Indeed, there are many cases in which the software industry develops by forming industrial clusters in certain districts in many countries. India and China are the representative countries where central or local governments have developed software industry clusters in specific regions. Bangalore and Hyderabad in central India, and Dalian, Shanghai, and Xi'an in China are well-known for their huge software industry clusters. These cases share the characteristics of initially starting as global outsourcing bases for global software companies. In Korea, Guro and Gasan, Pangyo are representative areas.

As a knowledge-based creative industry that deals with intangible products, the software industry can have the characteristics that can develop independently from the location or spatial factors. Many software companies interact and cooperate globally online in reality, carrying out international outsourcing and offshoring. This study notes the knowledge exchange characteristics in the software industries. The attributes of knowledge acquisition, sharing, and exchange in startups and small and medium enterprises can be different from large and global companies. This study particularly focuses on the relationship between knowledge exchange activities and the performance factors in startups and small and medium enterprises in the software industry.

Building hypothesis

Promoting innovations through knowledge exchange activities is one of the critical goals of developing startup incubators and innovation clusters. Individual companies can benefit from acquiring the necessary information and knowledge with less effort within the districts. It is also in line with the point that industry or innovation clusters aim at promoting innovation through various knowledge exchanges and cooperation (Cho, 2012). In particular, the knowledge sharing culture, leadership, systematic promotion activities, information systems, and the provision of human interaction channels appear to affect knowledge exchange activities and their outcomes. Various factors can affect the company location in business incubators and innovation clusters in the software industry. It includes government policy to form industry districts, supplies of apartment-type factories and good office spaces, securing outstanding talents and human resources, and the proximity to large cities (Cho, 2019).

Zhao et al. (2009) argue that the software industry cluster also contributes to enhancing the competitive advantage of accommodated companies through various networks and cooperation in the district. Zhan (2012) also argues that various networks between R&D, support agencies, and producer services play a critical role in improving performance through cooperation and collaboration in clusters. In particular, many startup companies inevitably lack the necessary resources and capabilities. Therefore, knowledge exchange activities in startup incubators and innovation clusters can be key sources of acquiring and exchanging information and knowledge.

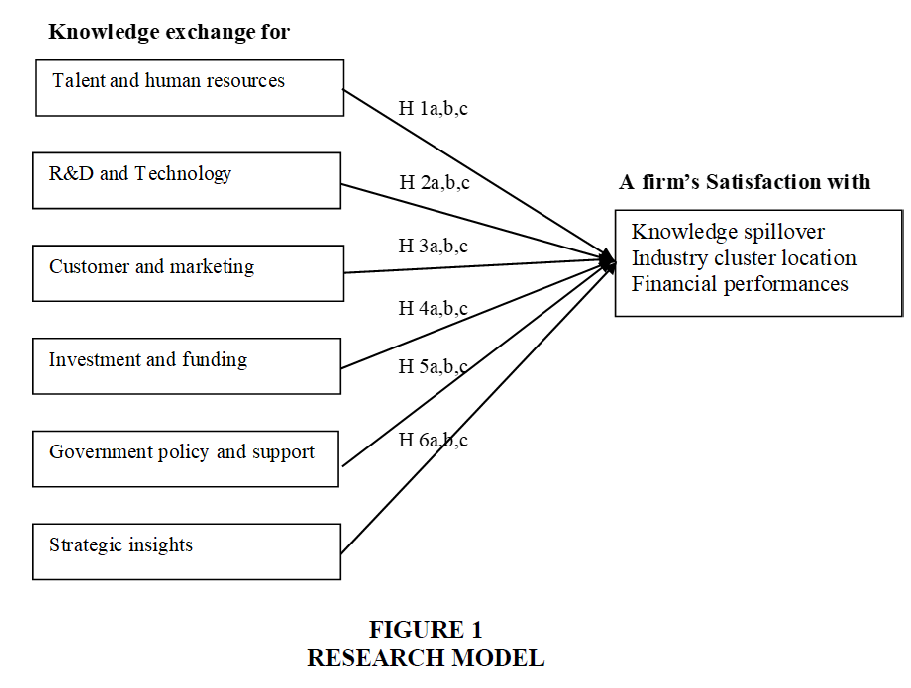

The ease of information and knowledge exchanges is surely a critical factor in deciding a company's location in the software industry that belongs to a knowledge-based industry. Thus, this study focusses on the characteristics of knowledge exchange activities and their relationships with performance factors in the software industry. The independent factors include the talent and human resources, R&D and technology, customers and marketing, investment and funding, government policy and support, and strategic insights, as knowledge exchange activity characteristics. The dependent factors include a firm's satisfaction with knowledge spillover, industry cluster location, and financial performances. The satisfaction with knowledge spillover is adopted to examine the knowledge exchange effects to performances to promote innovations in business incubators and innovation clusters. The satisfaction with industry cluster location is included to test how knowledge exchange activities affect company satisfaction with the locational factors in business incubators and innovation clusters. In addition, satisfaction with financial performances is included to understand how knowledge exchange activities are related to financial performances in software startups and small and medium enterprises. The research hypotheses are established to understand the relationships.

Talent and human resources

The software industry is known for an industry in which securing outstanding talent and human resources critically influence competitiveness and business success (Cho, 2019). For this reason, various studies emphasize the necessity of fostering human resources to enhance competitiveness through investment in human resource development, securing outstanding talents, and management of human resources (Aryanto, 2015; Jan et al., 2012; Agrawal et al., 2012; Fitzgerald et al., 2008; Arora & Athreye, 2002; Patibandla & Petersen, 2002; Arora et al., 2001). Some authors argue that the software industry cluster development in the vicinity of excellent universities is also related to securing outstanding talents and human resources (Puangpronpitag & Phongsiri, 2012; Chaminade & Vang, 2008). Acquiring information and knowledge of outstanding talents and human resources can be more critical for startups and small and medium enterprises who lack various networks, resources, and capabilities to acquire information from broad sources and pursue new technologies and markets. The importance of talent and human resource information in the software industry is also recognized in previous case studies (Cho, 2019). Based on the discussions, the following hypothesis is established.

H1 (a, b, c): Sharing and exchanges of information and knowledge on outstanding talents and human resources will positively affect a firm's satisfaction with knowledge spillover (1a), industry cluster location (1b), and financial performances (1c) in software startups and small and medium enterprises.

R&D and technology

In the software industry, the R&D characteristics vary with pursued technology levels (Cho, 2019). When dealing with low-level technologies, the required information and knowledge are often available online, and therefore the importance of R&D is not so high. Many technicians and developers obtain and exchange their necessary information and knowledge online in the software industry. Some software development processes even have features that can be automated, like production and assembly processes in manufacturing (Nowak & Granham, 2000). On the other hand, R&D for high-tech technologies often require active cooperation with universities, research institutes, and other companies (Cho, 2019). Thus, the R&D centers for many global software companies locate dispersed internationally to collect various information and knowledge broadly (Nowak & Grantham, 2000). In addition, many software companies need cooperation and collaboration with other companies specialized in different technology sectors. It is why subcontracts and offshoring get popular internationally in the software industry (Nowak & Grantham, 2000). The necessity of cooperation and collaboration is similar in startups and small and medium enterprises. They need cooperation to form a joint development group, build a consortium, or make an R&D project team. The business incubators and innovation clusters can provide a better environment for companies to easily find appropriate participants and cooperators in conducting their cooperative projects. The startup incubators and innovation clusters that accommodate many companies with various technologies and specialized areas become prominent knowledge sources for startups and small and medium enterprises.

Although promoting innovations through information and knowledge exchange is a critical policy goal in forming business incubators and innovation clusters in the software industry, the empirical research investigating the effect is hardly found until now. The software industry is related to knowledge-based works and intangible goods. Therefore, knowledge exchange activities can be critical for business success. In particular, R&D and technology knowledge can be more critical for startups and small and medium enterprises who pursue innovation and new technology development and lack various networks to diverse R&D resources. In particular, it is true that many startups and small and medium companies do not have a proper channel to secure technical information and knowledge other than the Internet and adjacent sources. Therefore, it is meaningful to test the relationship between knowledge exchange activities for R&D and technology and performance factors in startup incubators and innovation clusters. Hypothesis 2 is established to test their relationships with a firm's satisfaction with knowledge spillover, industry cluster location, and financial performances in the software industry.

H2 (a, b, c): Sharing and exchanges of information and knowledge on R&D and technology will positively affect a firm's satisfaction with knowledge spillover (2a), industry cluster location (2b), and financial performances (2c) in software startups and small and medium enterprises.

Customers and marketing

In the software industry, many business activities, including sales, marketing, cooperation, and collaboration, can be done online (Nowak & Grantham, 2000). Therefore, Caballero et al. (2001) say that the software industry has characteristics that can develop forming virtual clusters where many interactions are conducted online. For these reasons, the necessity of knowledge exchange activities for customers and marketing with adjacent companies and institutions can decrease in the software industry. However, online channels have apparent limitations in exchanging tacit knowledge. Also, startups and small and medium enterprises can lack the necessary networks, resources, and capabilities to interact online. Thus, many software companies think it very important to acquire market or buyer information from adjacent sources in industrial clusters (Cho, 2019), although online channels are still critical information sources. In reality, many software industry clusters are developed within or near metropolitan areas (Campbell-Kelly et al. 2010; Jeon & Lee, 2013). It is closely related to the accessibility to customers and gathering customer and market information.

Acquiring information and knowledge for customers and marketing is essential for business success. For startups and small and medium companies, knowledge exchange activities for customers and marketing in business incubators and innovation clusters can be a more important knowledge source. Thus, it is meaningful to test the relationship between knowledge exchange activities for customers and marketing and various performance factors in the software industry. Through the discussion, hypothesis 3 is established.

H3 (a, b, c): Sharing and exchanges of information and knowledge on customers and marketing will positively affect a firm's satisfaction with knowledge spillover (3a), industry cluster location (3b), and financial performances (3c) in software startups and small and medium enterprises.

Investment and funding

Among the business incubator functions, providing information for external investors and funding occupies an important position. These days, there are many online channels to attract investment and recruit investors, including crowdfunding and online investor relations. However, it is not easy that many startups and small and medium companies that do not have advanced technology and excellent business models take advantage of the online channels. In a case study, some respondents emphasize the importance of acquiring information for investment attraction in industrial clusters (Cho, 2019).

For startups and small and medium enterprises that lack various networks and resources for information gathering, the knowledge exchange activities for investment and funding from adjacent institutions and companies can be more important in industry clusters. Many startup incubators and innovation clusters provide relevant services for startups and small and medium enterprises in reality. In this study, hypothesis 4 is established to test the effect of knowledge exchange activities for investment and funding on the performance factors in startups and small and medium enterprises in the software industry.

H4 (a, b, c): Sharing and exchanges of information and knowledge on investment and funding will positively affect a firm's satisfaction with knowledge spillover (4a), industry cluster location (4c), and financial performances (4c) in software startups and small and medium enterprises.

Government policy and support

Previous studies point out that government plays a critical role in forming the software industry clusters in many cases, whether the role is direct or indirect. Arora et al. (2001) emphasize that government policy played a critical role in developing many software technologies parks in India in the early stage. Of course, outstanding low-wage human resources and appropriate timing of entry in the global market were also essential factors in the growth of the software industry in the country. It is also emphasized that government policies for the regional innovation and national innovation system to support university-industry-government cooperation played a critical role in forming and developing industrial clusters in Bangalore software industry district in addition to individual company roles (Chaminade & Vang, 2008). It is mentioned that federal government support also played an important role in the United States in the early stage of software industry development (Mowery & Langlois, 1996). Generally, in the early stage of industry development, the government's wills and policies to nurture or develop the software industry plays an important role. Recently, governments in many countries are carrying out various plans and activities to support the software industry. Representative policies include tax reduction, R&D support, low-interest loans, and other funding channel provisions. For startups and small and medium companies that lack internal resources and capabilities, the information and knowledge on government policy and support can be more important than in large enterprises. Therefore, the relationship between knowledge exchange activities for government policy and support and the performance factors are worth testing. From this discussion, hypothesis 5 is established.

H5 (a, b, c): Sharing and exchanges of information and knowledge on government policy and support will positively affect a firm's satisfaction with knowledge spillover (5a), industry cluster location (5b), and financial performances (5c) in software startups and small and medium enterprises.

Strategic insights

The software industry has the characteristics where the technology advances rapidly, and the competitive environment changes so dynamically. Thus, many companies need strategic insights concerning the directions and trends in technological advances, customers and markets, and competitor behaviors. Cooperation and collaboration with other institutions and companies are also often required for various purposes, increasing the need for strategic relationship building. Thus, subcontracting, building project consortiums, strategic alliances, R&D collaboration, co-marketing are very frequent and active in the software industry. For this reason, many software companies have the characteristics to cooperate and collaborate even globally (Nowak & Granham, 2000). Sometimes, the industry can develop by forming a virtual industrial cluster by establishing various online partnerships (Caballero et al., 2001). However, for startups that do not have the necessary resources and capabilities enough, the knowledge exchange activities for strategic insights within the industrial clusters can be a critical knowledge source. In this respect, the startup incubators and innovation clusters in the software industry can provide a good environment for acquiring and exchanging tacit knowledge for strategic insights. From this discussion, hypothesis 6 is established. It tests the relationship between knowledge exchange activities for strategic insights and the performance factors in startups and small and medium enterprises in the software industry.

H6 (a, b, c): Sharing and exchanges of information and knowledge on strategic insights will positively affect a firm's satisfaction with knowledge spillover (6a), industry cluster location (6b), and financial performances (6c) in software startups and small and medium enterprises.

Research model

The research model in this study is shown in Figure 1. It reflects the research questions on the relationships between knowledge exchange activities and performance factors in startups and small and medium enterprises accommodated in business incubators and innovation clusters in the software industry. The six research hypotheses and eighteen sub-hypotheses are explained in the figure. The relationships are tested by multiple regression analysis.

Empirical Study

Research method

In this study, a survey was conducted on entrepreneurs and employees in startups and small and medium enterprises accommodated in business incubators and innovation clusters in the software industry. The collected data were analyzed by statistical analysis methodologies to test the research hypothesis. The research progressed with the following order. First, a structured questionnaire was developed for the survey. It was developed by referring to relevant concepts in previous relevant studies and modifying the questions to suit this research that focuses on the relationships between knowledge exchange activities and performances in the software industry. Table 1 shows the results of the developed questionnaire.

| Table 1 Demographics | |||

| Items | Frequency | Items | Frequency |

| Annual gross sales | Respondent age | Average of 37 Years | |

| Under 1 Million $ | 48 (32.7) | In 20S | 37 (25.2) |

| 1 ̴ 5 | 39 (26.5) | 30S | 60 (40.8) |

| 5 ̴ 10 | 14 (9.5) | 40S | 31 (21.1) |

| 10 ̴ 30 | 46 (31.3) | 50S and higher | 19 (11.6) |

| Employee | Education | ||

| Under 10 employees | 53 (36.1) | Diploma | 2 (1.4) |

| Nov-50 | 43 (29.3) | Bachelors | 125 (85.0) |

| 50-100 | 42 (28.6) | Maters and higher | 20 (13.6) |

| 101-300 | 9 (6.1) | Work period | Average of 9 years |

| Location of Clusters | Position | ||

| Guro and Gasam | 18 (12.2) | Management | 41 (27.9) |

| Pangyo | 26 (17.7) | Middle | 28 (19.0) |

| Pusan Centom and Changwon | 61 (42.2) | Employee | 78 (53.1) |

| Deagu | 38 (25.8) | ||

| Others | 3 (2.0) | ||

| Main market | Department | ||

| Within the city | 13 (8.8) | Management | 31 (21.1) |

| Domestic | 69 (46.9) | R&D | 90 (61.2) |

| Domestic and global | 65 (44.2) | Sales & marketing | 4 (2.7) |

| Consulting | 19 (12.9) | ||

| Others | 3 (2.0) | ||

| Industry | Software technology | ||

| IT service | 71 (48.3) | High-end | 21 (14.3) |

| Package S/W | 28 (19.0) | Mid-high | 106 (72.1) |

| Internet S/W | 9 (6.1) | Low-end | 20 (13.6) |

| Contents and game | 14 (9.5) | ||

| Io T/AI | 12 (8.2) | ||

| Others | 13 (8.8) | ||

The survey was conducted in multiple business incubators and innovation clusters in South Korea to reflect the general characteristics. Data was collected from startups and small and medium enterprises in various software industry districts, including Guro and Gasan, Pangyo, Busan Centum, Changwon, Daegu, and others. The survey procedure was managed to include entrepreneurs and executive managers as many as possible to enhance research reliability.

The survey was also strictly controlled to get less than three questionnaires from a startup and small companies and less than ten from middle-sized companies to reflect various knowledge exchange characteristics that can vary along with different companies. The survey was conducted in the period from March to July 2020. A total of 147 questionnaires were collected from 78 startups and small and medium enterprises. The answers were measured with a seven-point scale. Table 2 shows the demographics of the respondents and companies participated in this study.

| Table 2 Factor Analysis for Independent Factors | |||

| Factors and Variables | Average (S.D) | Factors Loadings | Alpha |

| Talent and Human resources | |||

| Cluster location helps secure outstanding personnel | 3.73 (1.026) | 0.862 | 0.946 |

| Various talent information can be obtained from the cluster sites | 0.802 | ||

| Cluster location helps solve human resource problems | 0.847 | ||

| Cluster location is advantageous in securing talented people | 0.841 | ||

| it is easier in clusters to recruit human resources | 0.734 | ||

| R&D and Technology | |||

| Cluster location helps acquire R&D and technology knowledge | 3.93 (1.051) | 0.68 | 0.934 |

| There are knowledge exchange channels for R&D and Technology | 0.681 | ||

| Cluster location helps solve technology problems | 0.717 | ||

| Cluster location is advantageous for technical knowledge exchange | 0.673 | ||

| Customers and marketing | |||

| Cluster location helps obtain various market knowledge | 3.71 (1.014) | 0.708 | 0.939 |

| Cluster location helps obtain customers and sales information | 0.738 | ||

| Cluster location provides favour for market frontiers | 0.737 | ||

| It is easier in clusters to obtain customer and market knowledge | 0.73 | ||

| Investment and funding | |||

| Cluster location helps attract investment | 3.66 (1.088) | 0.629 | 0.935 |

| Cluster location is advantageous in exploring investors | 0.644 | ||

| Obtaining various investments and funding information is possible | 0.783 | ||

| It is easier in clusters to get financial information | 0.061 | ||

| Government policy and support | |||

| Cluster location is advantageous for government policy information | 3.96 (1.071) | 0.77 | 0.958 |

| It is easy to obtain government policy and support information | 0.804 | ||

| Knowledge sharing and exchange for government policy are active | 0.73 | ||

| There are various knowledge exchange channels for policy matters | 0.766 | ||

| Government policy and support information helps start ups | 0.768 | ||

| Strategic insights | |||

| Cluster location helps understand the industry, competitive environment | 3.91 (.956) | 0.675 | 0.903 |

| it helps obtain strategic knowledge of technology, industry and market | 0.622 | ||

| it helps identify a company’s position in industry and competition | 0.778 | ||

| it helps understand a company's capabilities and competitiveness | 0.627 | ||

Results

Knowledge exchange activities

An exploratory factor analysis (EFA) was performed with the survey data to analyze the relationship between knowledge exchange activities and performance factors in the software industry. The principal components analysis and the Verimex rotation method were employed. The factor extraction was done by specifying the factor numbers according to the initially designed research model for this research. The results of factor analysis on the knowledge exchange activities, independent variables in this research, and the dependent variables such as satisfaction with knowledge spillover, industry cluster location, and financial performances are shown in Table 3.

| Table 3 Factor Analysis for Dependent Factors | |||

| Factors and Variables | Average (S.D) | Factors Loadings | Alpha |

| Satisfaction with knowledge spillover | |||

| Cluster location helps exchange various information and knowledge | 4.11 (1.092) | 0.804 | 0.954 |

| Knowledge sharing and exchange help enhance competitiveness | 0.785 | ||

| Knowledge sharing and exchange help improve various performances | 0.775 | ||

| Knowledge sharing and exchange help solve various performances | 0.778 | ||

| Knowledge sharing and exchange promote innovation | 0.749 | ||

| Satisfaction with industry cluster location | |||

| Cluster location is relatively satisfactory | 3.89 (1.189) | 0.719 | 0.97 |

| Cluster location is helpful for business activities | 0.758 | ||

| Cluster location is advantageous for business growth | 0.839 | ||

| Cluster location contributes to improving competitiveness | 0.786 | ||

| Cluster location is helpful for innovation | 0.816 | ||

| Satisfaction with financial performances | |||

| Cluster location is economically helpful | 3.92 (1.078) | 0.757 | 0.899 |

| Cluster location helps reduce costs | 0.851 | ||

| Cluster location contributes to improving sales and profit | 0.574 | ||

Independent variables consist of six factors, including knowledge exchange activities for 1) talent and human resources, 2) R&D and technology, 3) customer and marketing, 4) investment and funding, 5) government policy and support, 6) strategic insights. The eigenvalues for the independent factors were acceptable at 4.650, 4.640, 3.555, 3.191, 3.007, 2.868, respectively. The total variance described was relatively high at 84.27%, and the Cronbach alpha values were also satisfactory with .903-.958, indicating that the survey was conducted with high and acceptable reliability. The factor loadings were all acceptable at all over 0.6. The dependent factors adopted in this research, including a firm's satisfaction with 1) knowledge spillover, 2) industry cluster location, and 3) financial performances, were also identified well as initially intended. The eigenvalues were 4.431, 4.240, 2.638, respectively, and the cumulative variance described was 86.997%. The Cronbach alpha values also showed satisfactory figures with 944, .970, and .899, respectively. The factor analysis results show that all six independent and three dependent factors are well identified as initially intended.

Relationship with performances

Multiple regression analysis was conducted to analyze the relationship between the knowledge exchange activities and a firm's satisfaction with knowledge spillover, industry cluster location, and financial performances that are the dependent factors in this study. The average value of each factor was input for the analysis. The multicollinearity problems were examined with the tolerance indices and VIF values for independent factors in the multiple regression analysis. If the independent variables have serious multicollinearity problems, the analysis results may not be reliable. The results showed that the multicollinearity was not problematic in the collected data with the tolerances indices of 2.275~.516, 2.275~.514, and 2.275~.514, and the VIF values 1.938~3.643, 1.945~3.637, and 1.945~3.637, respectively, for the three multiple regression analyses. It indicates that the data obtained from this study are appropriate for the multiple regression analysis. In general, the tolerance index of 0.1 or less and the VIF values of 10 or higher are considered to have a problem with multicollinearity (Myers, 1990). The multiple regression analysis was conducted between the six independent factors and a firm's satisfaction with knowledge spillover, industry cluster location, and financial performances. The results are summarized in Table 4, Table 5 and Table 6, along with three independent factors, respectively.

| Table 4 Regression Analysis With Knowledge Spillover | ||||

| Coefficient | Beta | t-value | p-value (**<0.05) | |

| Talents and information | 0.275 | 0.259 | 3.793 | 0.00** |

| R&D and technology | 0.234 | 0.229 | 2.438 | 0.016** |

| Customer and marketing | 0.285 | 0.265 | 2.937 | 0.004** |

| Investment and financing | 0.052 | 0.047 | 0.51 | 0.611 |

| Government policy and support | 0.091 | 0.09 | 1.069 | 0.287 |

| Strategic knowledge | 0.069 | 0.061 | 0.698 | 0.486 |

| Constant | 0.298 | 1.237 | 0.218 | |

| Statistics | R. 820, R2. 672, Durbin-Watson 1.849 Sum of squares 112.641 (freedom 6), F 46.361 (p=.000) |

|||

| Table 5 Regression Analysis with Industry Cluster Location | ||||

| Coefficient | Beta | t-value | p-value (**<0.05) | |

| Talents and information | 0.236 | 0.202 | 3.414 | 0.001** |

| R&D and technology | 0.56 | 0.494 | 6.119 | 0.00** |

| Customer and marketing | -0.087 | 0.074 | 0.942 | 0.348 |

| Investment and financing | 0.057 | 0.047 | 0.595 | 0.553 |

| Government policy and support | 0.114 | 0.102 | 1.4 | 0.364 |

| Strategic knowledge | 0.256 | 0.205 | 2.704 | 0.008** |

| Constant | -0.519 | 2.261 | 0.025 | |

| Statistics | R. 868, R2. 754, Durbin-Watson 1.765 Sum of squares 155.351 (freedom 6), F 70.042 (p=.000) |

|||

| Table 6 Regression Analysis with Financial Performances | ||||

| Coefficient | Beta | t-value | p-value (**<0.05) | |

| Talents and information | 0.095 | 0.092 | 1.135 | 0.258 |

| R&D and technology | 0.325 | 0.323 | 2.93 | 0.004** |

| Customer and marketing | 0.006 | 0.006 | 2.937 | 0.004** |

| Investment and financing | 0.032 | 0.03 | 0.055 | 0.957 |

| Government policy and support | 0.163 | 0.164 | 0.273 | 0.785 |

| Strategic knowledge | 0.242 | 0.218 | 1.649 | 0.101 |

| Constant | 0.567 | 2.106 | 0.037 | |

| Statistics | R. 736, R2. 541, Durbin-Watson 1.735 Sum of squares 87.877 (freedom 6), F 26.943 (p=.000) | |||

Table 4 shows the multiple regression analysis results on the relationship between the six independent factors reflecting knowledge exchange activities and a firm's satisfaction with knowledge spillover in business incubators and innovation clusters. The R-square value was relatively high at 1.672, and the Durbin-Watson ratio was acceptable at 1.849. The Durbin Watson ratio tests the possibility of the autocorrelation of residuals. The closer to 2 its value is, the more independent from the autocorrelation it is evaluated. In addition, the regression model was significant, with the sum of squares of 112.641 (6 degrees of freedom), the F value of 46.361, and the p-value of .000. The analysis says that the knowledge exchange activities for talent and human resources, R&D and technology, and customer and marketing significantly affect the satisfaction with knowledge spillover (p values .000, .016, .004). The relatively high and stable Beta values of .259, .234, and .285 for the three independent factors indicate that these factors significantly affect the dependent factor, the satisfaction with knowledge spillover. On the other hand, the knowledge exchange activities for investment and funding, government policy and support, and strategic insights are not found to have significant causative effects on the dependent factor. The Beta values are also minimal.

Table 5 explains the analysis results of the relationship between the six independent factors and a firm's satisfaction with the industry cluster location. The R-square value was relatively high at .754, and the Durbin-Watson ratio was acceptable at 1.765. The regression model was also significant, with the sum of squares 155.351 (6 degrees of freedom), the F value of 70.042, and the p-value of .000. The analysis says that the knowledge exchange activities for talent and human resources, R&D and technology, and strategic insights significantly affect a firm's satisfaction with the industry cluster location (p values .001, .000, .008). Beta values are relatively high at 202, .494, and .205, indicating that these independent factors significantly affect a firm's satisfaction with the industry cluster location. In particular, the Beta value of the exchange activities of R&D and technology is particularly high and significant at 494, indicating that the factor has a significant and critical impact on the dependent factor in the startups and small and medium enterprises. On the other hand, the effects of knowledge exchange activities of customer and marketing, investment and funding, and government policy and support are not significant. The Beta values were also relatively low.

In addition, Table 6 shows the analysis results on the relationship between the six independent factors and a firm's satisfaction with financial performances. The R-square value is .541, indicating a relatively high level. The Durbin-Watson ratio was acceptable at 1.735. In addition, the regression model was significant with the sum of squares 87.8777, the F value 26.943, and the p-value .000. The result says that the knowledge exchange activities for the R&D and technology, and customers and marketing significantly affect a firm's satisfaction with financial performances (p-value .004, .004). However, the Beta values were .323, .006, respectively. The small Beta value for the second factor, the customer and marketing, means that the effect can be very mimic. In contrast, the effect of R&D and technology is very high, indicating a significant and critical impact. The rest factors are not significant in the relationships with financial performance satisfaction.

Overall, the analysis results say that knowledge exchange activities can play critical roles in performances in startups and small and medium enterprises in business incubators and innovation clusters in the software industry. In particular, knowledge exchange activities for talent and human resources, R&D and technology, and customers and marketing are significant in a firm's satisfaction with knowledge spillover (Hypotheses 1a, 2a, 3a. adopted). Also, the knowledge exchange activities for the talent and human resources, R&D and technology, and strategic insights are significant in the relationships with the dependent factor, a firm's satisfaction with the industry cluster location (Hypothesis 1b, 2b, 6b adopted). It indicates that various knowledge exchanges for strategic issues, including environment, competition, cooperation, collaboration, and trends in addition to the talent and human resources and the R&D and technical knowledge, can play a critical role in a firm's satisfaction with the industry cluster location. In the impact on satisfaction with the financial performances, the result verifies that the independent factors of the R&D and technology and the customers and marketing significantly impact the dependent factor (Hypothesis 2c, 3c adopted). However, the customers and marketing knowledge impact was very mimic with a minimal Beta value. As a result, business incubators and innovation clusters need to pay attention to the knowledge exchange activities factors in promoting innovations and nurturing accommodated software startups and small and medium enterprises.

Conclusion

This study attempted to explore how the knowledge exchange activities in startups and small and medium enterprises in business incubators and innovation clusters in software industries relate to the performance factors, including a firm's satisfaction with knowledge spillover, industry cluster location, and financial performances. The result of the study can be summarized as follows. First, the knowledge exchange activities for the R&D and technology significantly influence all three dependent factors that include satisfaction with knowledge spillover, industry cluster location, and financial performances. The beta values were high and stable for all three dependent factors. The results indicate that the knowledge exchange activities for R&D and technology can be the most critical factor affecting performance factors in the startups and small and medium enterprises in the software industry. Second, the knowledge exchange activities for talent and human resources significantly affect two dependent factors of satisfaction with knowledge spillover and industry cluster location. The Beta values are also relatively high and stable, indicating that this independent factor can be a major target of knowledge exchange activities by startups in business incubators and innovation clusters. However, it does not appear to have a significant impact on financial performance. Third, the knowledge exchange activities for customers and marketing significantly influence the satisfaction with knowledge spillover, and the beta value is relatively large. But, the beta value is minimal for the financial performances, although the effect is statistically significant. Therefore, it can be concluded that the customers and marketing knowledge effect is meaningful only for the satisfaction with knowledge spillover. Fourth, the knowledge exchange activities for strategic insights significantly affect a firm's satisfaction with the industry cluster location.

In conclusion, it is sure that knowledge exchange activities meaningfully influence the performance factors in startups and small and medium enterprises in business incubators and innovation clusters in the software industry. Although the software industry has the characteristics that can interact, cooperate, and collaborate online globally, knowledge exchange activities in the industry clusters can be meaningful for competitiveness and business success for startups and small and medium enterprises accommodated in business incubators and innovation clusters. The research results say that knowledge exchange activities with adjacent institutions and companies can play critical roles in performances. It is not irrelevant to the startups and small and medium enterprises' characteristics that lack many necessary networks, resources, and capabilities in these companies. In particular, knowledge exchanges in R&D and technology, talent and human resources, customers and marketing, and strategic insights need to be managed well to enhance performances to promote innovations and nurturing business growth in startup incubators and innovation clusters in the software industry. These days, the software industry has become a target of industrial policy development in many countries due to its importance and economic ripple effects in the digital and intelligent economy. Building business incubators and innovation clusters is an approach to promoting and supporting startups and small and medium enterprises in the software industry. It draws much attention because it enables systematic and consistent policies for software industry development. The study results can provide meaningful implications for innovation studies and building policies on business incubators and innovation clusters.

This study also has several limitations in the research and therefore suggests several future research challenges. First, this study collected 147 questionnaires from 78 companies accommodated in business incubators and innovation clusters in various regions in South Korea. However, it cannot be said that the research has been done based on a sufficient number of data, although the data can statistically provide stable analysis results. Therefore, further data collection and analysis for the relevant topics can help make a more solid theoretical foundation of the findings in this study. Second, the characteristics of knowledge exchange activities can be different along with company sizes or capabilities. In particular, there can be significant differences between startups and small and medium enterprises, and large companies in the characteristics of knowledge exchange activities. Many large enterprises with various networks and resources can have diverse channels of information and knowledge acquisition and exchange in addition to adjacent institutions and enterprises. On the other hand, many startups and small and medium enterprises often lack internal networks, resources, and capabilities for these activities. Therefore, they tend to seek to acquire the necessary information and knowledge from adjacent contactable sources, although online channels are still critical. Thus, knowledge exchange activities can be more significant for startups and small and medium enterprises in industry clusters. Therefore, it will be meaningful to investigate the differences in knowledge exchange characteristics by firm sizes and owned capabilities.

Acknowledgement

The second author Sung-Eui Cho acknowledges that he is the corresponding author of this paper

References

- Agrawal, N. M., Khatri, N., & Srinivasan, R. (2012). Managing growth: Human resource management challenges facing the Indian software industry. Journal of World Business, 47(2), 159-166.

- Arora, A., Arunachalam, V. S., Asundi, J., & Fernandes, R. (2001). The Indian software services industry. Research policy, 30(8), 1267-1287.

- Arora, A., & Athreye, S. (2002). The software industry and India’s economic development. Information Economics and Policy, 14(2), 253-273.

- Aryanto, R., Fontana, A., & Afiff, A. Z. (2015). Strategic human resource management, innovation capability and performance: An empirical study in Indonesia software industry. Procedia-Social and Behavioral Sciences, 211, 874-879.

- Caballero, D., Molina, A., & Bauernhansl, T. (2000). A methodology to evaluate enterprises to become members of Virtual Industry Clusters. In Working Conference on Virtual Enterprises. Springer, Boston, MA, pp. 443-454.

- Campbell-Kelly, M., Danilevsky, M., Garcia-Swartz, D. D., & Pederson, S. (2010). Clustering in the creative industries: Insights from the origins of computer software. Industry and Innovation, 17(3), 309-329.

- Chaminade, C., & Vang, J. (2008). Globalisation of knowledge production and regional innovation policy: Supporting specialized hubs in the Bangalore software industry. Research policy, 37(10), 1684-1696.

- Cho, S. (2019). A study on the characteristics of location and development of software firm agglomerated districts, Journal of The Korean Association of Regional Geographers, 25(3), 361-375.

- Cho, S. E. (2012). Factors Affecting Performance of the Activities Promoting Knowledge Exchanges in Industrial Clusters. Journal of the Economic Geographical Society of Korea, 15(4), 515-533.

- Choi, J., & Oh, K. (2010). Analyzing the determinants for the relocation of SW companies in the Seoul metropolitan area. Journal of Korea Planners Association, 45(6), 161-178.

- Fitzgerald, C. A., Flood, P. C., O'Regan, P., & Ramamoorthy, N. (2008). Governance structures and innovation in the Irish Software Industry. The Journal of High Technology Management Research, 19(1), 36-44.

- Jan, C. G., Chan, C. C., & Teng, C. H. (2012). The effect of clusters on the development of the software industry in Dalian, China. Technology in Society, 34(2), 163-173.

- Jeon, J. H., & Lee, C. W. (2013). The Spatial Characteristics on the Mobile Industry's Value Chain in Daegu-Gyeongbuk Region. Journal of the Korean association of regional geographers, 19(1), 45-59.

- Lee, H.Y., Yun, S.M., (1999) Study on the locational characteristics and spatial linkages of software-related industries, Journal of Korea Planning Association, 101(2), 29-43.

- Mowery, D. C., & Langlois, R. N. (1996). Spinning off and spinning on (?): the federal government role in the development of the US computer software industry. Research Policy, 25(6), 947-966.

- Nowak, M. J., & Grantham, C. E. (2000). The virtual incubator: managing human capital in the software industry. Research Policy, 29(2), 125-134.

- Patibandla, M., & Petersen, B. (2002). Role of transnational corporations in the evolution of a high-tech industry: the case of India's software industry. World development, 30(9), 1561-1577.

- Puangpronpitag, S., & Phongsiri, W. (2012). Khonkaen One Stop Services: a Thai Triple-Helix-based project in taking University expertise to serve provincial ICT Strategies and promote software industry. Procedia-Social and Behavioral Sciences, 52, 246-252.

- Zhan, J. (2012). The Spatial Characteristics of Network in Zhongguancun Cluster-Focus on the Corporate Activities. Journal of the Korean association of regional geographers, 18(3), 298-309.

- Zhao, W., Watanabe, C., & Griffy-Brown, C. (2009). Competitive advantage in an industry cluster: The case of Dalian Software Park in China. Technology in Society, 31(2), 139-149.