Case Reports: 2020 Vol: 26 Issue: 3

Importance of the Implementation of Processes Derived From Strategic Management. A Case Study

Melva Inés Gómez-Caicedo, Fundación Universitaria los Libertadores

Nelson Orlando Alarcón-Villamil, Fundación Universitaria los Libertadores

Abstract

Companies are in need of developing business assessments that allow them to identify whether their activities meet the criteria required by the market. The objective of the research is to establish the strategic factors that promote the competitiveness of companies in the plastics sector in the city of Bogotá. This is presented through the application of a diagnosis to 21 companies belonging to the plastics sector, using the MIGSA diagnosis tool (Sustainable Management and Partnership Indicators Model) and the use of Principal Component Analysis (PCA) to establish strategic factors by grouping study variables

Keywords

Competitiveness, Strategy, Plastics sector, MIGSA

Introduction

Organizations have generated a series of business practices and strategies to prevail in the market and mechanisms to facilitate the development of activities that promote the competitive activity of their business (Quero, 2008).

Competitiveness relies on certain elements to be able to fully develop, among which are human resources, innovation, technology, quality, organizational performance (Matiz, 2000), among other internal and external factors that are necessary for market positioning Porter & Kramer (2019).

Other elements that improve and strengthen business activity are: the working environment, education, foresight, market knowledge and planning Peteraf (1993); Chavarría & Sepúlveda (2001); Barney (1991); Eden & Ackermann (2013); Alarcón & Gómez (2016); Hamel & Prahalad (2000).

One of the most dynamic products in the manufacturing industry is plastic, since it is part of the intermediate goods required in the production of various economic sectors. However, due to situations in the world economy that have weakened the trade of several countries, plastic exports in Colombia have not grown proportionally or more than imports, and therefore, companies have significantly reduced their level of production, as a result of the lack of knowledge in administrative, marketing, production and financial processes.

Of the plastics destined specifically to the packaging sector, 62% is used in the food segment, followed by the beverage sector with 22% and cosmetics and toiletries with 9%. In 2015, packaging sales exceeded 29 billion units (23,397 flexible and 6,422 rigid) and it is estimated that by 2019 they will exceed 32 billion units (Carvajal, 2016).

For Múnera et al. (2011), the demand for packaging is distributed as follows: 36% cardboard, 34% plastic, 17% metal, 10% glass and 3% other. This makes cardboard and plastic packaging 70% of total demand. At the same time, the industries of greater demand for this type of products are Food with 38%, drinks 18%, pharmaceuticals 5% and cosmetics 3%. Therefore, the market where the greatest amount of waste management practices and intentions are concentrated is the food market.

In this order of ideas, the plastic companies have been really affected, due to the lack of sustainable processes, the unproductiveness, the low competitiveness of the products and processes and the absence of strategies to mitigate the effects of external variables Gómez & Corrales (2015).

According to Munera, et al. (2011) businessmen in the plastics sector are highly dependent on external sources of raw materials, technology and inputs; they are also concerned about the image of disapproval of their products due to the association they have with environmental and biodegradation difficulties.

Another situation that affects the plastics industry is the environmental impact generated by the final disposal of waste, which is accentuated by the lack of technology for waste management Ministerio de Ambiente & Vivienda y Desarrollo Territorial (2004), at the same time, the negative image that some of the stakeholders - Government, workers, customers, community in general - have about them, makes necessary the existence of rules, decrees, laws that constantly regulate the activity.

Some empirical and analytical studies have shown the difficulties of the sector and highlight the problem it has in generating competitive and comparative advantages (Chaparro, & Meza, (2009); Quijano & Santa María (2009); Gómez, (2010); Noriega et al. (2013), among the most significant problems: the proposal and formulation of policies that strengthen the industry, the difficulties in research and development, the lack of strengthening of mutual collaboration Chaparro & Meza (2009); Múnera et al. (2011); Noriega et al. (2013), the generation of new market opportunities Gómez (2010); Noriega et al. 2013), the rudimentary innovation processes that condition the presence in international markets Chaparro & Meza (2009); Gómez (2010); Noriega et al. (2013), the improvement in profitability (Noriega, et al, 2013), the lack of studies that clearly identify the characteristics of the sector Múnera et al. (2011) and the environmental difficulties it generates (Ministerio de Ambiente, Vivienda y Desarrollo Territorial, 2004; Quijano & Santa María (2009); Chaparro & Meza (2009); Noriega et al. (2013).

Therefore, the activities of companies in the plastics sector in Colombia must be in accordance with environmental and ethical standards, as established in international regulations on safety, occupational health and environmental protection - ISO 14000 and OHSAS 18000 - and in co-responsibility with social actors, seeking continuous improvement in the protection of people and the environment, In addition, they must provide information on the risks and benefits of their production, address the concerns of stakeholders and cooperate with governments in implementing rules and regulations that protect the environment and promote sustainable development Ministerio de Ambiente & Vivienda y Desarrollo Territorial (2004).

The document is divided into three parts: in the first part, the context of the Bogotá plastics sector is presented in general terms. In the second part, an analysis is made of the variables that influence the development of the companies, initially through a diagnosis made through the Sustainable Management and Association Indicator Model and then using the results the application of the Principal Component Analysis (PCA) is made; its results will allow the establishment of the strategic factors that are fundamental for the sector in which it concentrates its actions in search of being competitive and that allow the definition of a competitive profile of these. Finally, the conclusions of the article are presented.

Methodology

The analysis of the factors affecting the competitive development of companies belonging to the plastics sector in Bogotá will be done through the use of the business diagnostic tool called MIGSA (Modelo de Indicadores de Gestión Sostenible y Asociatividad), which allows through 2 dimensions (Sustainable Management and Partnership), 9 properties (Environmental Management, Human Resource Management, Marketing Management, Technology Management, Management with the Community, Management of Business Ethics, Knowledge Management, Quality Management and Perceptions and Practices of Association), 31 indicators and 112 measurement indexes, identify the situation of the company, its strengths, aspects to be improved and variables that are of significant incidence for the structuring of improvement plans that are fundamental to be competitive and generate positioning in the market Danna-Buitrago & Alarcón & Gómez (2014) that favor the measurement of this case study.

MIGSA is applied to 21 companies in the Bogotá plastics sector registered in the Cámara de Comercio de Bogotá. Information was collected through interviews, seeking to identify the most relevant information on the realities of the sector and on the degree of progress in the implementation of policies and management practices.

Then, descriptive statistics and statistical inference were applied to the analysis of the information, making use of the Principal Component Analysis (PCA), through which it is intended to identify the factors that influence the competitive development of the companies belonging to the object of study.

The PCA was carried out with the help of the Stata 13 program, so it is necessary to consider the following information for its understanding:

1. The observations denominated EMP 1, EMP2,..., EMP21 and each one of them corresponds to a business unit analyzed.

2. The designations of analysis variables are represented as follows:

GA: Environmental Management; GRH: Human Resource Management; GCON: Knowledge Management; GCAL: Quality Management; GEE: Management of Business Ethics; GCOM: Management with the Community; GT: Technological Management; GM: Marketing Management; PPA: Perceptions and Practices of Association.

Results

Table 1 relates the correlation between the results obtained in the measurement of each pair of variables studied. From the estimates, it can be inferred that the analysis variables present a high degree of explanation among themselves, taking as a reference a significance level of 0.05.

| Table 1 Correlation Between Variables Studied | |||||||||

| GA | GRH | GCON | GCAL | GEE | GCOM | GT | GM | PPA | |

| GA | 1.0000 | ||||||||

| GRH | 0.6843 | 1.0000 | |||||||

| GCON | 0.6627 | 0.7459 | 1.0000 | ||||||

| GCAL | 0.7543 | 0.7779 | 0.8172 | 1.0000 | |||||

| GEE | 0.6100 | 0.6986 | 0.7471 | 0.8950 | 1.0000 | ||||

| GCOM | 0.2010 | 0.4765 | 0.4132 | 0.4105 | 0.5793 | 1.0000 | |||

| GT | 0.7007 | 0.6936 | 0.8920 | 0.8542 | 0.8409 | 0.4711 | 1.0000 | ||

| GM | 0.5595 | 0.7203 | 0.6705 | 0.8200 | 0.8650 | 0.7409 | 0.7370 | 1.0000 | |

| PPA | 0.5687 | 0.7212 | 0.7212 | 0.7075 | 0.7010 | 0.7487 | 0.6896 | 0.7007 | 1.0000 |

Subsequently, the Kaiser-Meyer-Olkin ?ndice or KMO sample adequacy measure was found from the correlation matrix found in table 1 and it could be determined that the relationship between variables is medium since KMO=0.7921. Therefore, the hypothesis of "no non-zero correlations between the variables studied" is rejected and the use of the PCA for data analysis is sound.

Table 2 presents the initial matrix of non-rotated factors with their respective values for the defined components, which are called main components and denoted as factor 1, ..., factor 9. The criterion for choosing the number of factors to be used to group the properties corresponds to the MIGSA model and meets the conditions of the latent root criterion.

| Table 2 Unrotated Factor Matrix | ||||

| Factor | Eigenvalue | Difference | Proportion | Cumulative |

| Factor 1 | 6.52954 | 5.50311 | 0.7255 | 0.7255 |

| Factor 2 | 1.02643 | 0.57752 | 0.1140 | 0.8396 |

| Factor 3 | 0.44891 | 0.08218 | 0.0499 | 0.8894 |

| Factor 4 | 0.36673 | 0.09411 | 0.0407 | 0.9302 |

| Factor 5 | 0.27262 | 0.10228 | 0.0303 | 0.9605 |

| Factor 6 | 0.17034 | 0.07142 | 0.0189 | 0.9794 |

| Factor 7 | 0.09891 | 0.03912 | 0.0110 | 0.9904 |

| Factor 8 | 0.05979 | 0.03306 | 0.0066 | 0.9970 |

| Factor 9 | 0.02673 | 0.0030 | 1.0000 | |

Source: Authors

In this sense, the main components Factor 1 and Factor 2, results of the analysis carried out have the capacity to explain 83.96% of the variability of the MIGSA model properties. To achieve simpler and theoretically more significant factorial solutions, the Varimax rotation method was used. The results of the orthogonal rotation are shown in Table 3.

| Table 3 Results of the Orthogonal Rotation | ||||

| Factor | Variance | Difference | Proportion | Cumulative |

| Factor 1 | 4.75875 | 1.96152 | 0.5287 | 0.5287 |

| Factor 2 | 2.79722 | 0.3108 | 0.8396 | |

Source: Authors

Factor analysis/correlation number of obs = 21

Method: principal component factors Retained factors = 2

Rotation: orthogonal Varimax (Kaiser off) number of params = 17

Consequently, the factorial loads resulting from the analysis account for two groups of variables as follows (Table 4):

| Table 4 Factorial Loads Resulting from Orthogonal Rotation | |||

| Variable | Factor1 | Factor 2 | Uniqueness |

| GA | 0.8867 | 0.0435 | 0.2119 |

| GRH | 0.7553 | 0.4101 | 0.2612 |

| GCON | 0.842 | 0.3291 | 0.1827 |

| GCAL | 0.8848 | 0.355 | 0.0911 |

| GEE | 0.7322 | 0.5471 | 0.1645 |

| GCOM | 0.1103 | 0.9743 | 0.0385 |

| GT | 0.8437 | 0.3743 | 0.148 |

| GM | 0.5921 | 0.7099 | 0.1454 |

| PPA | 0.5473 | 0.7071 | 0.2006 |

A first group, called Factor 1, composed of the properties Open Management, Human Resource Management, Knowledge Management, Quality Management, Business Ethics Management and Technology Management and a second group called Factor 2, composed of the properties of the model called Management with the Community, Marketing Management and Perceptions and Practices of Association.

The first group, Factor 1, is characterised by the implementation of management policies and practices to favour competitiveness and business sustainability from within the company.

The second group, called Factor 2, is characterised by the development and advancement of management policies and practices conducive to external relations.

In this way, the competitiveness and sustainability profile of the companies studied is understood through the following two axes:

1. First axis (Factor 1): Competitiveness and sustainability through management practices to improve the internal environment of the organization

2. Second axis (Factor 2): Competitiveness and sustainability through management practices to improve the external relationship of the organization

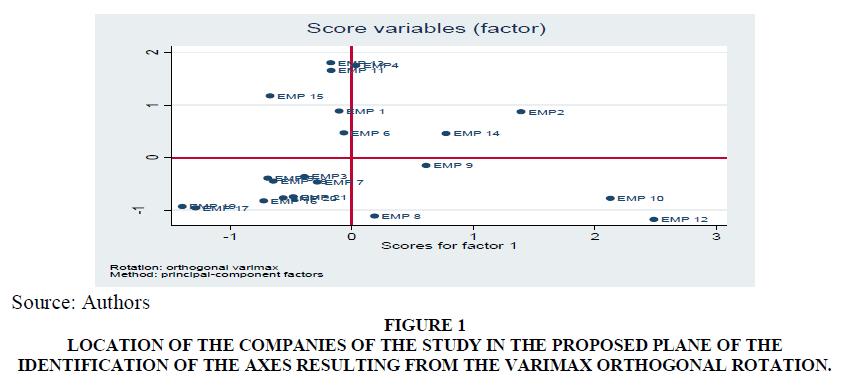

Graph 1 allows us to identify the location of each of the companies in the study in a new plan composed of four quadrants, which reflects the analysis of main components and especially the definition of axes resulting from it. In this sense, quadrants 1, 2, 3 and 4 are defined in which the following companies can be distinguished. In quadrant 1, companies 2, 4 and 14; in quadrant 2, companies 8, 9, 10 and 12; in quadrant 3, companies 3, 5, 7, 16, 17, 18, 19, 20 and 21, and finally in quadrant 4, companies 1, 6, 11, 13 and 15.

The companies in quadrant 1 have as a common characteristic the use of management practices and policies that recognize and favor the internal and external environment of the organization. The companies in quadrant 2 have as a characteristic the promotion of management policies and practices to improve their internal environment and difficulties in the implementation of such practices for the improvement of external relations. The companies in quadrant 3, on the other hand, have as a characteristic the scarce attention and implementation of management policies and practices to improve their internal environment and external relations.

Finally, the companies in quadrant 4 have as a characteristic the promotion of management policies and practices to improve their external relations and difficulties with the implementation of practices to improve their internal environment in order to favor competitiveness and sustainability Figure 1.

Figure 1 Location of the Companies of the Study in the Proposed Plane of the Identification of the Axes Resulting From the Varimax orthogonal rotation.

After the review carried out by quadrant, it was determined that the 3 companies located in quadrant 1 have as their main characteristic, among them, to carry out import and export operations, in addition to providing material and supplies to other companies in the sector and high demand for personnel. On the other hand, the 9 companies located in quadrant 3 are characterized by being the smallest in the sector, with less market share and little presence in the international market.

Conclusion

The analysis of the main components allowed the establishment of two axes that explain the competitive profile of the plastic companies in Bogotá and that allow the identification and analysis through the location of the companies of the scope in the implementation of policies and management practices that can be considered favorable to competitiveness and business sustainability. In this sense, a first axis was defined that relates aspects of competitiveness and sustainability through management practices to improve the internal environment of the organization, and a second axis, which relates aspects of competitiveness and sustainability through management practices to improve the external relationship of the organization.

In addition, he defined four competitiveness profiles of the two proposed axes, namely, a first profile in which companies share the implementation of policies and management practices that recognize and favor the internal and external environment of the organization, a second profile of companies in which companies share the promotion of policies and management practices to improve their internal environment and difficulties in implementing practices to improve external relations, a third profile in which companies are characterized by a lack of attention and implementation of management policies and practices to improve their internal environment and external relations, and finally, a fourth profile in which companies are characterized by the promotion of management policies and practices to improve their external relations and difficulties with the implementation of practices to improve their internal environment. The analysis of the sector shows that most of the companies in the study are characterized by a reduced scope in the implementation of management policies and practices to improve both their internal environment and their external relations in order to favor their competitiveness.

References

- Alarcón, N., Gómez, M. & Stellian, R. (2016). Competitive profile of business process outsourcing companies in Bogotá: principal component analysis. AD-minister, (29), 101-120.Amit, R., & Schoemaker, P. (1993). Strategic assets and organitational rent . Strategic Management Journal, 33-46.

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 99-120.

- Carvajal, M.B. (2016). "Panorama de la industria colombiana de empaques y envases plásticos".

- Chaparro, H., & Meza, V. (2009). Análisis del Plástico y sus derivados dentro del contexto de la economía santandereana. Universidad Industrial de Santander. Bucaramanga.

- Chavarría, H., & Sepúlveda, S. (diciembre de 2001). Factores no Económicos de la Competitividad.

- Danna-Buitrago, J. Alarcón, N. & Gómez, M. (2014). Gestión sostenible y asociativa alcanzada por PYMES proveedoras del sector hidrocarburos de Yopal- Casanare. Teoría y praxis investigativa, 9 (1), 86-107.

- Eden, C., & Ackermann, F. (2013). Making strategy: The journey of strategic management. Sage.

- Gómez C. (2010). Análisis Estructural del Sector Estratégico de plásticos. Universidad del Rosario. Bogotá.

- Gómez, M. & Corrales, J. (2015). Boletín de la Pyme Manufacturera Exportadora. Fundación Universitaria Los Libertadores. [en línea], Bogotá D.C, 09/2015. Disponible en: http://repository.libertadores.edu.co/handle/11371/233?mode=full

- Hamel, G., & Prahalad, C. (2000). Competing for the future. Cambridge. Harvard University press.

- Matiz, F. (2006). Elementos para la competitividad.

- Ministerio de Ambiente, Vivienda y Desarrollo Territorial (2004). Guías Ambientales sector Plásticos. Principales procesos básicos de transformación de la industria plástica y Manejo, aprovechamiento y disposición de residuos plásticos post-consumo. Bogotá, Colombia. Recuperado de: http://www.siame.gov.co

- Múnera, D., Molina, L., & Montoya, C. (2011). Caracterización económica del sector envases y empaques en Colombia. Documento elaborado en el marco académico de la feria Andinapack.

- Noriega, J.E.R., Gallego, C.A.D., López, L.Á., & Bonilla, A.V. (2013). Perfil del sector manufacturero Colombiano. Magazín Empresarial, 9(19), 49-61.

- Peteraf, M. (1993). The cornersotones of competitive advantage: a resource-based view. Startegic Management Journal, 179-191.

- Porter, M.E., & Kramer, M.R. (2019). Creating shared value. In Managing sustainable business (pp. 323-346). Springer, Dordrecht.

- Quero, L. (2008). Estrategias competitivas: Factor clave de desarrollo. Revista Negotium, (10), 36-49.

- Quijano, G. & Santa María, V. (2009). Plan de mercadeo para una empresa del sector de plásticos. Caso: JV Plásticos S.A. Escuela de Ingeniería de Antioquia. Envigado.