Research Article: 2020 Vol: 24 Issue: 1S

Strategic Support of Impact-Investment Processes in International Entrepreneurship

Petro Atamas, Alfred Nobel University, Ukraine

Mykola Serbov, Odessa State Environmental University, Ukraine

Vitaliy Omelyanenko, Institute of Industrial Economics of National Academy of Sciences of Ukraine

Ivan Kravchenko, Sumy National Agrarian University, Ukraine

Oksana Portna, V. N. Karazin Kharkiv National University, Ukraine

Abstract

The analysis of the objective preconditions of the transformation of economic systems of different levels according to the conception of sustainable development made it possible to clarify the process of strategic support and transformation of the economic system according to the conception of sustainable development in international entrepreneurship. Determination of peculiarities of the run of economic processes in terms of content and levels of the economic system at all stages of the renewable cycle in the context of sustainable made it possible to identify the problematics of use of the conception of sustainable development in strategic management of the region and the need to adapt enterprise management systems to the conditions and purposes of sustainable development of the region.

Keywords

International Entrepreneurship, Strategic Process in Entrepreneurship, Income Investing, Impact Investing, Angel-Investments, Sustainable Development, Institutional Procurement.

JEL Classifications

M5, Q2.

Introduction

Implementing of the conception of sustainable development on the regional level of management and on the level of enterprises’ management faces the problem of interrelation of the goals of enterprises and the goals of sustainable developments of the regions that leads to absence in the practice of management on the regional level of stimuli to implementing of effectual organizational and economic mechanisms of sustainable development. The mentioned contradiction is enforced by the necessity of dominating in the conditions of the economy of sustainable development of social ecological and economic interests over individual ones. Solving of this contradiction is possible on the base of formation and development of effectual institutional environment that would contribute essentially to the actualization of the conception of sustainable development of the region on the bases of target management of enterprises. Complicated nature of transformation of the modern economic system together with its dynamic features, the necessity of determination of institutional bases of procurement of sustainable development of the region and implementing of target management of enterprises as of the base of procurement of sustainable development of the regions conditioned the relevancy of the chosen topic.

Methodology

General scientific and special methods of making of research are used in this research: analysis and synthesis (at the analysis of the objective preconditions of transformation of economic system according to the conception of sustainable development, features and characteristics of institutional procurement of sustainable development); systematization, generalization and comparison (at the analysis of problematics of use of the conception of sustainable development in management of economic systems, of modern tendencies of institutionalization; at the analysis of views on the ratio of private and public goals in the context of sustainable development of the region on the base of target management of enterprises); semantic analysis (at the analysis of the current of publications for definition of methodological grounds of sustainable development of the region on the base of target management of enterprises).

Literature Review

Modern tendencies of the development of the world system of economic management, of the economy of separate regions and enterprises are characterized by a high level of indeterminacy, changeability of outer conditions, complicating of the management system, of organizational forms and mechanisms of carrying out of the activity that in total change characteristics of the economic system by its content (totality of productive forces, economic relations and the management mechanism) (Anna, 2016), on all its levels (of meso economy, macro economy, regional economy and micro economy) (Bende-Nabende, 2017), and on all the stages of the reproductive process (production, distribution, exchange and consuming) (Carley, & Christie, 2017). The transformation of the economic system leads irrevocably to essential quantitative and qualitative changes that needs complication and change of approaches to the management of economic system and appropriate institutional procurement (Charles et al., 2017).

The run of processes by the content and levels of the economic system and on all the stages of the reproduction process is complicated by a general scientific and practical problem of the limitedness of resources at the increase of people’s needs in the world that demanded from the scientists during the last tens of years to review methodological basics of management of economic systems according to the conception of sustainable people’s development (Drobyazko, et al., 2019 a,b,c). The majority of famous scientists and scientific schools nowadays acknowledge that socio-economic situation in the world and in separate regions is characterized by a high level of indeterminacy and has a tendency to complication (Day, 2016). So, sustainable development is identified with balanced development that unites harmoniously its components: social, economic and ecological (Hilorme et al., 2019), Hilorme et al., 2019). Some scientists define sustainable development as achievement of some balanced state of the system (Hilorme et al., 2019). From the point of view on sustainable development in the context of economic and ecological components, there are exact criteria that are necessary to fulfil for its achievement (Romão et al., 2017). However, it is contestable if they are enough for sustainable development as it is difficult to describe economy or ecology by one index (Schwerhoff & Sy, 2017).

Findings and Discussion

The analysis of the objective preconditions of the research should be made by levels of the economic system (meso economy, macro economy, regional economy and micro economy) and on all the stages of the reproductive process (production, distribution, exchange and consumption). Within the limits of the task on the analysis of the objective preconditions of transformation of the economic system, we should analyze in the context of sustainable development the state and the dynamics of the economic system by its levels and stages of the reproductive process.

Transfer of the economic system of all levels to the conception of sustainable development is conditioned by objective changes on all the stages of the reproductive cycle: production, distribution, exchange and consumption. Analysis of the changes that appear in the stages of the reproductive cycle in the context of sustainable development showed that they might be as positive, as negative (Table 1).

| Table 1 Changes in the Stages of the Reproductive Cycle of the Economic System in the Context of Sustainable Development | ||

| Stage | Negative changes | Positive changes |

| Production | Increase of negative influence of extensive development on the environment and lack of natural resources for future generations | Transfer intensive development on the base of use of innovational technologies of production, conservation of resources and energy |

| Distribution | Complication of relationships of possession and of mechanism of distribution of the results | Implementation of social responsibility |

| Exchange | Increase of the influence of monopolies on global markets, international division of work and specialization | Appearance of informational conditions for perfect competition and effective processes of exchange |

| Consumption | Global stimulation of increase of needs and development of the society of overconsumption | Comprehension by subjects of the necessity of formation of stimuli to economic consumption of resources |

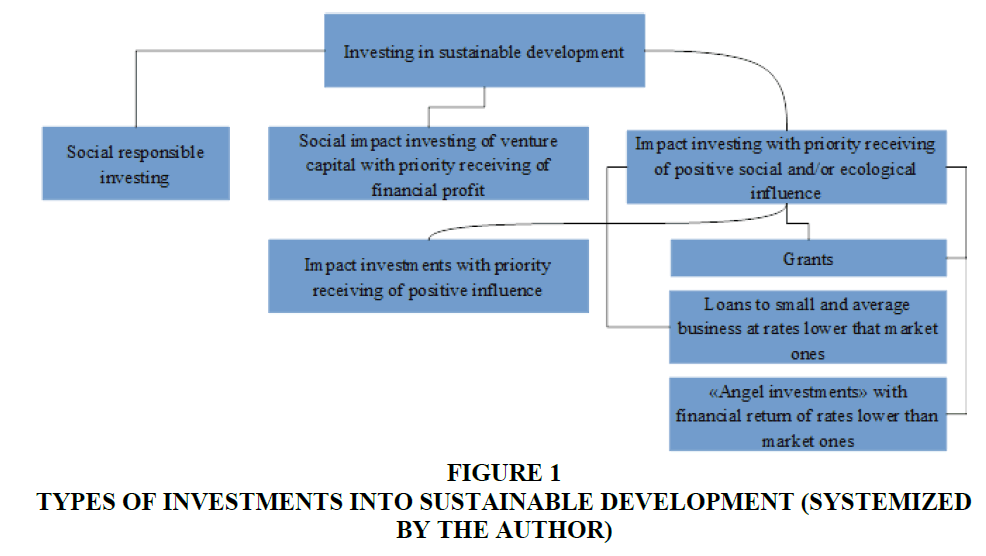

Concerning introduction of sustainable development, some authors have already proposed a system of standards in the field of provision of sustainable development of the enterprise that are used in different countries of the world. In our opinion, these standards should be reviewed as a component of the system of target management of the enterprise, as introduction of standards in the management system contributes to more exact fulfilment of all procedures, regulations, processing of all organizational documents according to these standards. The experience of introduction of principles of sustainable development into the enterprise activity is generalized in the worked-out standards in the field of sustainable development of the enterprise that make methodological bases of provision of such development (Makedon et al., 2019a) (Figure 1).

From viewpoint on solution of the problems of sustainable development, use of such form of investment as state and private grants is of interest. Grants, so state, as private, continue playing an important role at the market, especially considering the fact that a lot of social or ecological problems do not have commercially viable solutions. Grants and social aid are often needed before or simultaneously with social investments to help social enterprises to reach necessary level of readiness for investment of capital.

From viewpoint on the attempt to find a compromise between private goals of the owners of the enterprise and goals of sustainable development, impact investing is a market mechanism of solution of search of this compromise. Impact investing is social investing or investments into social effect that become more and more popular in the world. But you cannot think that impact investing is a simple demonstration of irrational behavior of separate economic actors. Really, in short-term period impact investing is the means of demonstration of good intentions and activity oriented on solution of big social and ecological problems that is really very expensive. But such short-term irrationality receives big rational compensation in long-term period, as impact investing allows making of “capitalization increase” of resources (i.e. of the process of transformation of non-used resources or potential for the capital).

The Global network of impact investing distinguishes from main characteristics of impact investments the following ones:

1. presence of intention: the investor has an intention to give positive social and/or ecological influence through investments, that is obligatory and essential for impact investing;

2. waiting for the profit: it is waited that as a result of impact investing, a financial profit will be gained or, at least, the invested capital will return;

3. variable profitability: impact investments can preview profitability that varies from the level – lower that market (sometimes it is called concessional) to the market stake corrected to risk, and profit that can be received in the form of different assets: monetary funds, fixed profit, venture capital, private capital;

4. measuring of influence: the distinctive feature of impact investments is the obligation of the investor to measure and report about social and ecological indices and progress of the investments themselves, to guarantee transparence and accountability, as well as to inform about impact investing and widening of this sphere.

The UNDP defines impact investments as one of the financial solutions for sustainable development that contributes to achievement of 16 from 17 goals of sustainable development (Sorensen et al., 2017). By analogy to the given by the Global network of impact investing characteristics of impact investments, the UNDP also states that such investments are described (and differ from other forms of investments) by three main principles ((Makedon et al, 2019b); Szopik-Depczyńska et al., 2017): expecting of financial profitability; intentionality as presence of the intention to solve social or ecological challenges; obligation of the subject to measure previewed social influence and environmental influence, using standardized indices, and to report about this influence.

In the opinion of the UNDP representatives (Yang et al., 2017), impact investors traditionally deny the thought about the fact that sustainable development must be reached and be ruled only by social aid or charity. On the contrary, the theory of impact investing previews that business and investments are important factors for achievement of more inclusive and sustainable society. That’s why impact investors strive to show that investments can reach positive (social or ecological) influence and financial profitability (or, at least, return of the capital). For successful realization of the examples of impact investing, corresponding institutional procurement is needed. As it is fairly stated, the government can provide favourable environment for corresponding market operations, realize measures on stimulation of impact investing, as well as make co-financing in important projects with economic, social and ecological profit.

The following features can be distinguished among main positive features of impact investing: 1) impact investing puts under doubt long-term opinion about the fact that market investments must be concentrated exceptionally on achievement of financial profitability; 2) impact investing can stimulate additional flows of capital to the economy of the developing countries and stimulate the development of private sector; 3) the market of impact investing gives different and sustainable possibilities for investors in promotion of social and ecological tasks at the account of investments, that also guarantee financial profitability; 4) impact investments can compete, and sometimes even overpass traditional strategies of assets investing; 5) uniting different forms of capital with different demands to return, impact investments are capable to solve social challenges in a more scaled way than it can be reached only by the government; 6) impact investing gives new ways of more effective distribution of the state and private capital, that, in its turn, can contribute to cooperation of state and private subjects; 7) impact investing can enforce organizations and enterprises of the social sector, giving them access to the full range of variants of financing available for common enterprises; 8) impact investing can stimulate creation and increase of innovative enterprises, so, to expand all the economy.

Recommendations

The conception of sustainable development demands participation of different interested parties that agree to adjust and unite different and sometimes contradictive values and goals, and to make further coordination of common actions for achievement of several values simultaneously and even synergistically. However, as real experience testimonies, coordination of goals, values and actions according to the conception of sustainable development is often a difficult task, as the interested parties have to reveal their own interests, compare them with the interest of other interested parties, criticize and discuss. Sometimes, separate interested parties think that the process is too complicated or threatening for their own interests and goals or they deny the process in total to reach their own goals, or they criticize it too much. Nevertheless, critics is an important part of a conscious evolution of the conception of sustainable development which as a result represents different local and global efforts to imagine and implement a positive worldview, in which main person’s needs are satisfied, without ruining or inalterably counter-balancing nature systems, on which the whole world community depends.

Conclusion

In such a way, instruments that contribute to organisation of institutional procurement of sustainable development of regions is creation of mutual values, social investing, impact investing. Use of these conceptions in practice creates a corresponding base for defining by the enterprise of its influence on the society and taking into account of goals of its groups of interests at setting and achievement of own goals. Creation of mutual values and impact investing is an acting market mechanism of solution of search of compromise between private goals of owners of the enterprise and goals of sustainable development.

Appearance of the conception of sustainable development is an objective process that became a reaction of the world community on deepening and spreading of the global problems of the mankind. During the last tens of years, sustainable development turned from a theoretical conception and paradigm that is comprehended by the scientific community into certain applied instruments that are implemented by economic systems of different levels into management of their activity. Sustainable development as a management conception combines economic, ecological and social aspects, and defines certain principles that countries, regions, and enterprises must follow at goal setting for conserving of resources for future generations.

Unfortunately, the conception of sustainable development has not gained yet such spreading on the level of regions and activity of separate market subjects like on the level of countries, although some of its aspects are already used (for example, social responsibility). However, these are only fragmentary separate elements of the general conception that should be implemented systematically. Achievement of sustainable developments of the region is possible only upon condition of many transformations and changes on enterprises, institutions, organisation, in the society that function on the territory of this region. These changes concern, first of all, goal setting of the mentioned subjects of regional development, defining of the problem of ratio of private goals of owners of the enterprises and of public interest, taking into account of the conception of sustainable development in target management of enterprises.

One of the most complicated issues for implementation of the conception of sustainable development not only as a theoretical conception but for certain means of solution of practical tasks is such an important instrument as institutional procurement of sustainable development. Basing on the analysis made in the work, we can affirm that institutional procurement of sustainable development has evolutionized during recent years in connection with spread of attention to the global problems of the mankind that influence directly sustainable development of separate regions. However, nowadays, effectual institutes that contribute to taking into account of the conception of sustainable development in target management of the enterprise are absent. That’s why it is important to create appropriate institutional procurement of sustainable development of the region on the base of target management of enterprises that will preview existence so of formal, as of informal institutes. The institutes must create corresponding conditions for implementing into target management of enterprises of the principles of sustainable development: this will give a possibility to set appropriate goals coordinated with the principles of sustainable development, and harmonize private goals of owners of enterprises and goals of other subjects of the region.

The intended use of institutional procurement of sustainable development of the region on the base of target management of enterprises, from the viewpoint of organizational aspect, is creation of optimal organizational conditions for effective functioning of economic systems of different level with taking into account of private interests of owners of separate enterprises that do not contradict to the principles of sustainable development at this. The work shows four target allocations of institutional procurement of sustainable development of the region on the base of target management of enterprises that are the most actual for today. These allocations include development of social institutes, development of citizen society, formation of energetic safety of the region, development of ecological environment of the region.

References

- Anna, B. (2016). Classification of the european union member states according to the relative level of sustainable development. Quality & quantity, 50(6), 2591-2605.

- Bende-Nabende, A. (2017). Globalisation, FDI, regional integration and sustainable development: Theory, evidence and policy.

- Carley, M. & Christie, I. (2017). Managing sustainable development. Routledge. URL: https://www.taylorfrancis.com/books/9781315091525

- Charles Jr, O.H., Schmidheiny, S., & Watts, P. (2017). Walking the talk: The business case for sustainable development. Routledge. URL: https://www.taylorfrancis.com/books/9781351281966

- Day, K.A. (2016). China's environment and the challenge of sustainable development. Routledge. URL: https://www.taylorfrancis.com/books/9781315497693

- Drobyazko S., Barwińska-Małajowicz A., Ślusarczyk B., Zavidna L., & Danylovych-Kropyvnytska M. (2019). innovative entrepreneurship models in the management system of enterprise competitiveness. Journal of Entrepreneurship Education, 22(4), 2019.

- Drobyazko S., Shapovalova A., Bielova O., Nazarenko O., & Yunatskyi M. (2019). Formation of hybrid costing system accounting model at the enterprise. Academy of Accounting and Financial Studies Journal, 23(6), 2019.

- Drobyazko, S., Hryhoruk, I., Pavlova, H., Volchanska, L., & Sergiychuk, S. (2019). Entrepreneurship innovation Model for Telecommunications Enterprises, 22(2), 2019.

- Hilorme, T., Perevozova, I., Shpak, L., Mokhnenko, A., & Korovchuk, Yu. (2019). Human capital cost accounting in the company management system. Academy of Accounting and Financial Studies Journal, 23(2), 2019.

- Hilorme, T., Shurpenkova, R., Kundrya-Vysotska, O., Sarakhman, O., & Lyzunova, O. (2019). Model of energy saving forecasting in entrepreneurship. Journal of Entrepreneurship Education, 22(1S).

- Hilorme, T., Zamazii, O., Judina, O., Korolenko, R., & Melnikova, Yu. (2019). Formation of risk mitigating strategies for the implementation of projects of energy saving technologies. Academy of Strategic Management Journal, 18(3).

- Makedon, V., Kostyshyna, T., Tuzhylkina, O., Stepanova, L., Filippov, V. (2019a). Ensuring the efficiency of integration processes in the international corporate sector on the basis of strategic management. Academy of Strategic Management Journal,18(1), 2019.

- Makedon, V., Valikov V., Kurinnaya I., & Koshlyak E. (2019b). Strategic innovative development of the enterprises: Theory and methodology. Scientific journal Economics and finance, (2), 52-62.

- Romão, J., Guerreiro, J., & Rodrigues, P. M. (2017). Territory and sustainable tourism development:A space-time analysis on European regions. Region, 4(3), 1-17.

- Schwerhoff, G., & Sy, M. (2017). Financing renewable energy in Africa–Key challenge of the sustainable development goals. Renewable and Sustainable Energy Reviews, 75, 393-401.

- Sorensen, A., Marcotullio, P.J., & Grant, J. (2017). Towards sustainable cities. In Towards Sustainable Cities.

- Szopik-Depczyńska, K., Cheba, K., Bąk, I., Kiba-Janiak, M., Saniuk, S., Dembińska, I., & Ioppolo, G. (2017). The application of relative taxonomy to the study of disproportions in the area of sustainable development of the European Union. Land use policy, 68, 481-491.

- Yang, B., Xu, T., & Shi, L. (2017). Analysis on sustainable urban development levels and trends in China's cities. Journal of Cleaner Production, 141, 868-880.