Research Article: 2021 Vol: 25 Issue: 5S

Sub-Prime Mortgage and CDS - Detonator and Catalyzer of the 2007/8 Crisis

Siyuan Chen, School of Science, Xi'an Jiaotong - Liverpool University

Keywords

GFC, Sub-Prime Mortgage, CDs, Systemic Risk, Event Study

Abstract

Based on an event study, this paper analyses two main causes of the 2007/8 Global Financial Crisis (GFC) - the Sub-prime mortgage and Credit Default Swap (CDS). According to the recording data and historical research, the over-packed sub-prime mortgage can be the epicentre of the 2007/8 financial crisis. The unbefitting issue of CDS, simultaneously, acted as a catalyser which exacerbated it to a larger extent of deterioration. An essential contribution of this study is to provide suggestions for listed companies to resist systemic risks with adjustments on their further crisis strategies.

Introduction

The financial crisis of 2007-2008, also named the global financial crisis, evolved from the sub-prime mortgage crisis. In the early 2000s, the U.S. housing market continued to rise, and loans were available to people with poor credit (Blackwell, 2016).

Financial institutions lent money to people who could not afford to repay their loans. These mortgage-backed securities were then turned into derivatives, bundled up and sold to investors and other financial institutions. Rating agencies irresponsibly rated these bonds as triple A, and buyers thought they could hedge themselves against risk by means such as Credit Default Swaps (CDS). Eventually, large scale sub-prime mortgage defaults caused the housing price to plummet as the bubble burst. Financial institutions worldwide suffered heavy losses, and the international banking crisis followed. Theories vary about the causes of the financial crisis. The purpose of this article is to assess the impact of the selected two main reasons that have caused the crisis: credit default swaps and mortgage lenders and borrowers.

Literature Review

Our research contributes to the following literature and attempts to fill the gap of study in this area. Dating back to the year of 2005, (Chinloy & MacDonal, 2005) had conducted a research on the prevailing sub-prime mortgage in the states; they also found that these mortgage borrowers tended to share a characteristic of low solvency. In the same year, (Staten & Yezer, 2005) evaluated U.S. sub-prime borrowers with similar but more categorical conclusions. Dermot (2008) observed and analyzed the dramatic rise in the rate of default, delinquency and foreclosure across the US mortgage market before and amid the global crisis. (Mirochnik, 2010) held the perspective in his article that the unexpectedly large-scale default increased the risk of counterparties. He took the largest insurance company in the United States - AIG as a typical example.

Analysis of Causes

Aspect of Sub-prime mortgage lenders and borrowers

Dating from the mid-1990s, the secondary mortgage market in the U.S. became a new source of mortgage finance via securitization. Special purpose vehicles were created to receive residential mortgages, which were structured into Residential MortgageBacked Securities (RMBS) and promoted to investors in the next place (Tomlinson, 2012). Initiators may tend not to apply the same level of diligence to whom they are lending to than if the loans remained on their books, which fostered the perverse deregulation and loan defaults.

The reason why sub-prime mortgage was popular among the American mortgage market is that, firstly, the loan interest rate is 2% to 3% higher than that of prime mortgage loans (Johnston et al., 2008), and secondly, the applicants of sub-prime mortgage loans usually do not need to submit proof of income or even make a down payment for a house purchase. Moreover, the lender can tailor a variety of personalized repayment plans for different borrowers. These reasons also made housing demanders who were not qualified in fact obtained the house purchase opportunity. An expanding group of buyers resulted in a rapid inflation on property prices so that even if borrowers cannot repay their loans, they can still pay off their debts by selling properties that have appreciated. Correspondingly, as a result of the house property that continues to rise, even if the borrower defaults and refuses to pay off the loan, the lenders can obtain the total amount of pay off through disposition of collateral. Under such financial circumstances, real estate finance companies consider more liquidity issues rather than risk problems, that is, how to obtain and maintain sufficient funds to meet the continuous demand of loan buyers. Under the assistance of investment banks, real estate finance company created several of asset securitization to handle the liquidity issue. The capital source problem was eliminated by transforming long-term loan claims into spot claims that can be immediately repaid. However, the snowballing bubble cycle of real estate finance started to roll simultaneously, especially when the default rates rose among borrowers.

Such sub-market has been featured by loans with high default rates and dominance by specialized lenders (Chinloy & MacDonald, 2005). This characteristic can be ascribed to the low solvency of borrowers and irresponsibility of lenders.

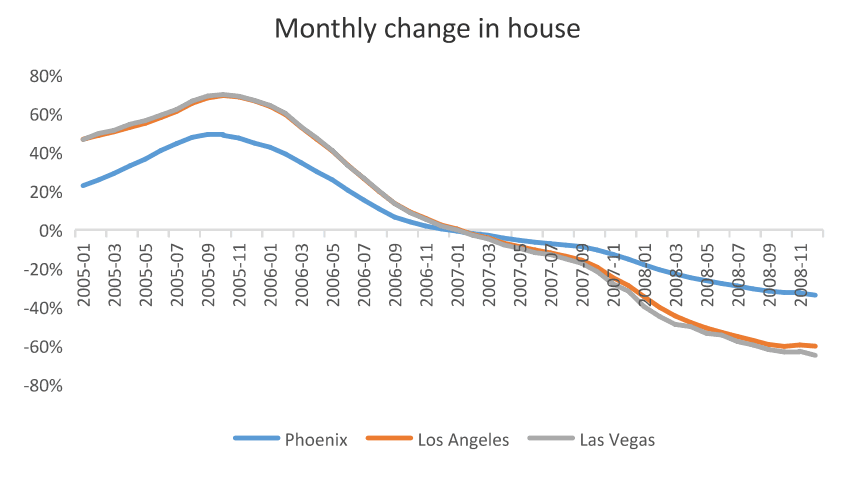

This paper collected the monthly change rate of house price in Phoenix, Los Angeles and California from January 2005 to December 2008, reflecting the house price trend in America. Simultaneously, the delinquency rate of prime mortgage and the subprime mortgage during the same period are gathered. These data sets can be conducive to explain the relationship between house price fluctuation and delinquency rate.

Figure 1 displays a similar trend for house price shock in three different cities, and we can find the change rate in house price peaked at the end of 2005, and then there was a downward trend. However, after hitting zero in 2007, the growth rate was still falling, and prices did not rebound until December 2008.

According to Table 1, the average delinquency rate of sub-prime mortgage is distinctly higher than prime mortgage. Especially in the year of 2008, peak at 12.20%, almost 8 times larger than prime mortgage.

| Table 1 Data Description of Average Rates. |

|||||||

|---|---|---|---|---|---|---|---|

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |

| Average delinquency rate of prime | 0.54 | 0.50 | 0.43 | 0.44 | 0.72 | 1.53 | 3.00 |

| Mortgage (%) Average delinquency rate of sub- | 6.06 | 4.43 | 3.36 | 4.86 | 6.54 | 12.20 | 15.08 |

| Prime mortgage (%) | |||||||

| Average growth rate of housePrice (%) | 7.63 | 9.44 | 10.48 | 5.92 | -0.03 | -8.17 | -5.89 |

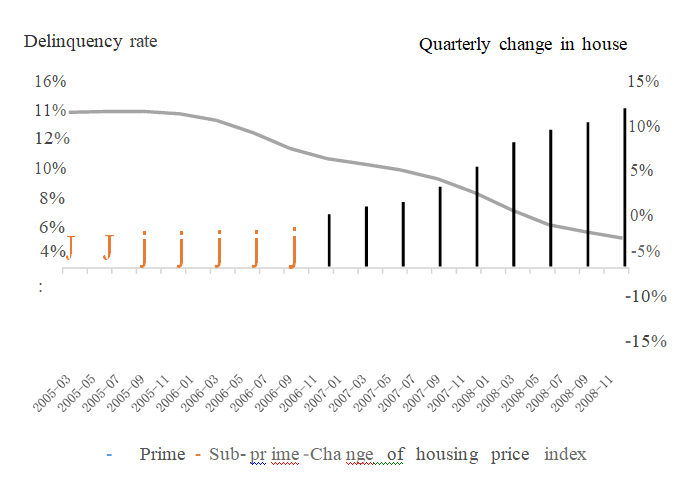

Figure 2 displays the quarterly deteriorating default situation of both prime and subprime mortgage, along with the falling housing price. The sub-prime mortgage delinquency rates maintained at around 4% before 2007. The default started to break out from Jan 2007, with delinquency rate rose rapidly. By the end of 2008, the delinquency rate of sub-prime mortgage reached 14%. Such high delinquency rate is closely related to borrowers' low solvency. According to (Staten & Yezer, 2005), they evaluated sub-prime borrowers with the following conclusions:

1) Sub-prime borrowers may be less skilled at property care and maintenance,

2) Sub-prime borrowers may be less knowledgeable about property values and may have overpaid, and

3) Sub-prime borrowers may buy properties that appreciate at a slower pace.

The research also found that sub-prime borrowers tended to default earlier and impose higher losses on default than were typical in the prime sector. Meanwhile, compared with weak borrowers, lenders suffer larger losses on defaulted loans concerning the balance when default.

The substantial rise in the rate of default, delinquency and foreclosure across the US mortgage market has had a very severe impact over the period 2006/2007. In particular, this has been most prevalent in the sub-prime section of the market where default rates have been climbing in recent years, had exceeded 13% by 2006 and are continuing to rise (Dermot, 2008). As these rates rise, acute fears have emerged regarding the extent of bad debts and the incidence of loose lending standards in this section of the market. The loosening in standards has been exemplified by the emergence of 'stated income loans' where borrowers could access 100% finance without producing any evidence of earnings. Such has been the fall in standards and the parallel crisis on capital markets.

Aspect of Credit Default Swap

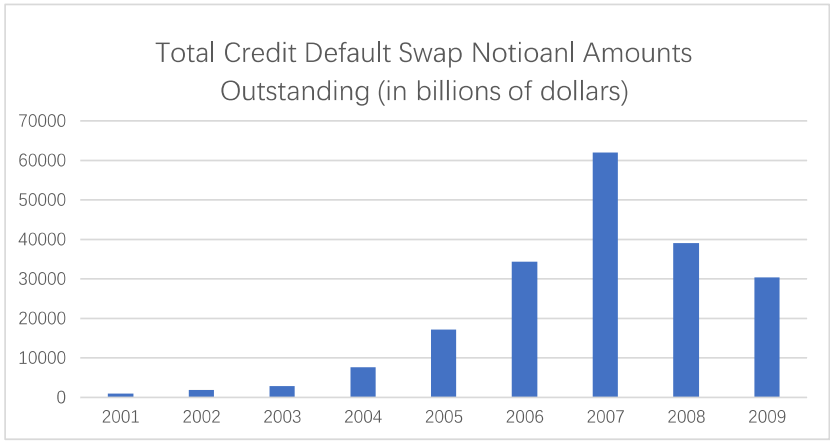

Credit Default Swap (CDS) sold as the insurance of packaged subprime mortgage. After signing a CDS contract, the buyer pays a regular premium to the seller. If no credit default occurs on the underlying asset, the CDS seller will not pay any fees and receive the premium. However, the CDS seller was obligated to compensate the buyer for losses in the event of a default. CDS were used extensively to hedge with the expansion of the subprime mortgage market and the increasing need to prevent the loan default risk. And the CDS amounts outstanding increased from 920 billion dollars in 2001 to a peak of 62 trillion dollars in 2007. (Figure 3)

Figure 3: Total Credit Default Swap National Amounts Outstanding Results and Impacts

Source: Inte rnational Swaps and Derivatives Association

The impacts of CDS on the 2008 subprime crisis will be discussed as follows. Firstly, because of the highly leveraged nature of CDS mentioned above, the liquidity risk of CDS issuers was aggravated when the crisis occurs. When the underlying securities did not default, the CDS contract would bring stable income to the issuer. However, when it defaulted, especially under the systemic risk of the financial crisis, the market value of securities would shrink sharply, and leverage caused multiple risks.

Secondly, the issue of CDS promoted banks to issue more subprime mortgage loans and exacerbated the irrational expansion of the housing bubble in the United States and the accumulation of risks. Although holders of mortgage-backed securities were aware of the potential risks of these securities, they turned to the CDS market instead of stopping buying these risky securities. The mortgage-backed securities investors purchased CDS to reduce the losses caused by the default. Therefore, CDS stimulated the market of mortgage-backed securities and increased the total losses of MBS in the crisis. As reported in Financial Crisis Inquiry Commission (2011), CDS expanded the securitization of mortgage loans, thereby contributing to the accumulation of real estate bubbles and financial market risks in the United States.

In addition, the transaction of CDS gradually developed away from the underlying assets. This innovation expanded the risk of counterparties and aggravated the crisis. In this stage, CDS was no longer a tool for underlying securities holders to hedge risk but as an independent securities product. More investors and financial institutions bought CDS for speculative purposes, which increased the compensation amount of AIG and the risk of trading partners when default occurred.

Moreover, the default risk was underestimated, which led to the result that the issue scale of CDS was too large. The significant phenomenon that caused the underestimation of the default risk was that credit rating agencies wrongly rated the risk of asset-backed bonds to collect commissions. A large number of CDS contracts were issued by insurance companies and traded among institutions. Once the unexpectedly large-scale default occurred, it was difficult for companies to finance a large amount of money to make compensation in a short time. Thus, the risk of counterparties was increased. For example, the largest insurance company in the United States, called AIG, sold more than 513 billion US dollars of CDS before the outbreak of the crisis, accounting for about 50% of the total assets of the AIG group (Mirochnik, 2010). And it was on the verge of bankruptcy finally.

Furthermore, the liquidity of CDS was restricted during the crisis and caused difficulties for commercial banks to raise funds. Due to the increasing default rate and capital deficiency of commercial banks, the liquidity of CDS was significantly reduced, and it was difficult for commercial banks to hedge their risks by selling risky assets and buying CDS contracts. As a result, commercial banks experienced financing difficulties and were on the verge of collapse.

Conclusion

On one hand, sub-prime mortgages in the U.S. were packaged by fund managers who viewed RMBS as a good investment due to its low risk, long-dated debt.

Nevertheless, as the mortgage-backed securities demand aggrandized, the size of loaning into the higher-risk sub-prime market had expanded for the purpose of catering to the increasing investors' appetency. Such wild extension without corresponding risk examination eventually became a detonator resulting in the 2008 financial crisis.

On the other hand, the unbefitting issue of CDS can be a catalyzer which exacerbated the subprime crisis through channels such as its nature of high leverage, the expanding effect on the MBS market, the stimulating effect on speculation due to separation from the underlying securities, the underestimated default risk, and the limited liquidity of itself during the crisis.

References

- BELASCU, L. (2016). 'Risk and contagion on financial markets after the 2007 subprime mortgage crisis'. Annals of 'Constantin Brancusi' University of Targu-Jiu. Economy Series, 5, 51-55.

- Blackwell, A. (2016). 'How to turn a foreclosure crisis into a domestic revolution'. Border Crossings, 35(2), 90-95.

- Chinloy, P., & MacDonald, N. (2005). 'Sub-prime lenders and mortgage market completion.' The Journal of Real Estate Finance and Economics, 30(2), 153-165.

- Dermot, C. (2008). 'The Irish sub-prime residential mortgage sector: International lessons for an emerging market'. Journal of Housing & the Built Environment, 23(2), 131-144.

- International Swaps and Derivatives Association (ISDA, 2008). Yearly data 2008.

- Johnston, K.C., Greer, J.B., Biermacher, J.K., & Hummel, J. (2008). 'The sub-prime morass: Past, present and future. North Carolina Banking Institute, 12, 125-128.

- Mirochnik, M. (2020). Credit default swaps and the financial crisis.

- Official Government (2011). The Financial Crisis Inquiry Commission (FCIC) Report. "Final Report of the 197 National commission on the causes of the financial and economic crisis in the united states".

- Staten, M.E., & Yezer, A. (2005). 'Introduction to the special issues on the sub-prime mortgage market, part II: Theoretical and empirical studies of sub-prime lending.' The Journal of Real Estate Finance and Economics, 30(2), 111-113.

- Tomlinson, M.R. (2012). "'Managing risk" in the delivery of housing finance: Australia's mortgage lenders', Housing Finance International, 26(3), 41-46.

- Zhou & Jie. (2015). Credit-default-swaps and the 2008 financial crisis: An inquiry into the underlying legal origins and the European Union regulatory reforms.