Research Article: 2023 Vol: 27 Issue: 2

The Effect of Audit Fee, Internal Control and Audit Materiality on Switching Mandatory Auditors

Ahmad Badawi Saluy, Mercu Buana University

Peby Arwiyah, Mercu Buana University

Novawiguna Kemalasari, Mercu Buana University

Willy Arafah, Mercu Buana University

Citation Information: Badawi Saluy A. (2022). The Effect of Audit Fee, Internal Control and Audit Materiality on Switching Mandatory Auditors. International Journal of Entrepreneurship, 27(2),1-15.

Abstract

The research is to analyze the effect of Audit Fee, Internal Controls and Audit Materiality on Auditor Switching Mandatory at PT Bank Btpn Purna Bakti Kcp Jakarta, using the method of literature study, field observations and through questionnaires that have been distributed to the Auditors who are on duty at PT. Bank Btpn Purna Bakti Kcp Jakarta. The type of data used in this study is primary data. Based on the convenience sampling method, there are 30 final samples from this study. Data analysis was performed using descriptive statistical methods, verification methods, and hypothesis testing (bootstrapping) using the SmartPLS program as an analysis tool. Data analysis was performed to test the validity and reliability of the data. The results of this study indicate that Audit Costs do not have a significant effect on Auditor Switching. Internal Control has a positive effect on Auditor Switching. Audit materiality affects but is not significant to Auditor Switching. This is evidenced from testing the hypothesis on the Inner Model

Keywords

Audit Fee, Internal Control and Audit Materiality of Auditor Switching.

Introduction

The public accounting firm acts as a person who is trusted to examine the financial statements of a government or company. Moreover, in the management of government finances that must be supported by a quality public sector audit (Ekawati, 2013). Regulations regarding the mandatory KAP changes in Indonesia have been enacted and stated in the regulations per Law. But actually what factors influence companies in Indonesia to do Auditor Switching, especially if Auditor Switching occurs outside the stipulated regulations and how the influence of the mandatory KAP replacement regulations, and research on Auditor Switching is still very interesting to study because of empirical results previous studies vary, (COSO, 2013).

The deputy of financial services, surveys, and consultant of the BUMN Ministry Gatot Trihargo has asked Garuda Indonesia to conduct an interim audit, an interim audit is a type of audit strategy that is usually used at several points during the current fiscal year. This type of audit allows to complete some of the tasks involved with the preparation of the final audit once the fiscal year has closed. Regarding the financial statements of the 2018 fiscal year the audit was requested before the Financial Services Authority and the Ministry of Finance decided to sanction Garuda because its financial statements were considered to have violated regulations. "Gatot Subroto in his statement to request that an interim audit be carried out with a different Public Accounting Firm (KAP) to find out the performance and subsequent events. (Kompas.Com, Saturday 29/6/2019)

Ernst & Young's partner public accounting firm (EY) in Indonesia, namely KAP Purwantono, Suherman & Surja agreed to pay a fine of US $ 1 million (around Rp. 13.3 billion) to US regulators, due to being convicted of failing to audit the financial statements of their clients, EY Management in its written statement stated that it has strengthened the internal supervision process since the issue was revealed (Tempo.co Saturday, 11 February 2017 20:46 WIB).

Literature Review and Hypotheses Development

Comparing the audit fees of auditor's mandatory rotation

The American Institute of Certified Public Accountants (AICPA) revealed that the auditor's mandatory rotation is important. Mardiyah's research results, 2002 and Damayanti and Sudarma, 2007 showed the influence of audit fees on auditor turnover. On the other hand, the thing that can encourage companies to change auditors can be caused by the relatively high audit fee offered by the auditor so that there is no agreement between the parties regarding the audit fee and it causes the company to change auditors (Schwartz and Menon, 1985).

Coparing internal control of auditor's mandatory rotation

Kwon Theory (1996) argues that clients in more concentrated industries tend to be in tune with audit firms that are not related to their competitors because they do not want to risk transferring proprietary information, that clients in concentrated industries are reluctant to use the same audit firm because of concerns that information secrets might be transferred to competitors. Research conducted by Shanzadeh and Zolfaghri (2015) and Putri Tifani Malinda and Nur Cahyonowati (2014) shows the influence of the quality of the internal control system on audit quality has a significant positive relationship. On the other hand, research conducted by Lawrence J. Abbott (2012) Control conducted by internal audit has a negative effect on audit quality, which concludes that internal audit assistance affects the timeliness of external audits through the level of external audit delay.

Coparing audit materiality of auditor's mandatory rotation

In addition to audit fees and internal control, materiality is also a consideration of professionalism and adequate knowledge. In Australia, ASA Audit Standards 315 "Understanding Entities and Entities" To explain misconceptions of materiality as a concept and to investigate any need for materiality disclosure to the public at threshold level. In addition to giving a voice to the participating stakeholders, this research contributes to our understanding of the audit aspects that lead to the concept of audit materiality.

The auditor must consider audit risk and materiality to plan the audit and design audit procedures to obtain sufficient competent evidence and as an adequate basis for evaluating financial statements using his professional skills (Emrinaldi, 2014).

Research conducted by Septiant (2014) empirically proved that materiality considerations had a positive effect on the accuracy of the auditor's opinion. The better the consideration of materiality level by the auditor, the opinion given by the auditor himself will be more precise.

Rochman, Rita Andini, SE, and MM Abrar Oemar, SE (2016) The results of the study of materiality variables negatively affect the premature termination of audit procedures. The result of logistic regression testing of materiality variables showed a significance of 0.038 with a coefficient of - 0.445. With a p value below 0.05 and a coefficient marked negative, ie the lower the level of materiality inherent in an audit procedure, the possibility of premature termination of the audit procedure will be higher.

Methodology

Research Design

This type of research is causal research with descriptive statistics, classic assumption tests, multiple regression and hypothesis testing, which can be interpreted as problem solving procedures with the thinking of subjects and objects in research and based on facts that seem as they are. (Ghozali: 2018)

This study was conducted to look at the effect of audit fees, internal control and materiality audits on the transfer auditor with an empirical studio conducted at PT Babk Btpn Purnabakti Kcp Jakarta Area in 2019

B. Definition and Operationalization of Variables

This study uses two types of variables. The first variable is an independent variable, namely Audit Costs, Internal Control and Materiality. The second variable is the dependent variable, Auditro Switching.

Indicator and measurement scale

| Table 3.1 follows Operationalization Of Variables (X1): Audit Fee |

||||

|---|---|---|---|---|

| No | Concept | Dimension | Indicator | Measurement |

| 1 | Audit fee X1 | Risk Of Assignment | Inheren risk Acceptable audit risks. |

Ordinal |

| The complexity of the services provided | The large amount of information processed by the auditor The number of procedures that must be done |

Ordinal | ||

| Level of expertise | Auditor education Auditor experience |

Ordinal | ||

| KAP cost structure (Sukrisno Agoes, 2012:46) |

||||

| Appropriate salary Other Rewards excluding salary Overheads related to auditor training and development Number of hours available for a specified period |

Ordinal | |||

| Table 3.2 follows: Operationalization Of Variables (X2): Internal Control |

||||

|---|---|---|---|---|

| No | Concept | Dimension | Indicator | Measurement |

| 2 | Internal Control X2 |

1. Control environment Source : COSO (2013:5) |

How effective is the board of directors' participation in internal control 2. How effective is the defined organizational structure |

Ordinal |

| Risk Assessment Source : COSO (2013:5) |

Whether the completeness of the required documents required for the work process is hampered | Ordinal | ||

| Controlling Activities Source : COSO (2013:5) |

Is the separation of the task functions of the management unit already carried out in accordance with established procedures How often do documents verify before being authorized |

Ordinal | ||

| Information and Communication Source : COSO (2013:5) |

1. Are complete documents always communicated by each department before sending 2. Does the existing system always help processing information about document reports or Indicator data collection |

Ordinal | ||

| Monitoring Source : COSO (2013:5) |

How often is monitoring of the performance and accountability reports of the management unit Has the board of directors and the board of commissioners monitored internal controls to evaluate deficiencies in data collection management |

Ordinal | ||

| Table 3.3 follows: Operationalization Of Variables (X3): Materiality |

||||

|---|---|---|---|---|

| No | Concept | Dimension | Indicator | Measurement |

| 3 | Materiality X3 | 1. Initial Considerations of Materiality Erfan Erfan Muhammad (2013) |

1. Initial consideration of the concept of materiality. (Modifikasi) Materiality at the level of financial statements. (Modifikasi) Materiality at the account balance level. (Modifikasi) |

Ordinal |

| 1. Detect Errors Reza Minanda dan Dul Muid (2013) | Errors in a business entity organization. (Modifikasi) Errors in authorization systems and recording procedures. (Modifikasi) Possibility of unhealthy practices. (Modifikasi) |

Ordinal | ||

| 1.Professionalism Erfan Muhammad (2013) | Dedication to the profession. Social obligations. Independence and Confidence in the profession. Relationships with fellow professions. |

Ordinal | ||

| Auditor Experience Reza Minanda dan Dul Muid (2013) |

Experience gained from the length of work in one month. (Modifikasi) Experience gained from the many tasks performed by the auditor. (Modifikasi) Experience gained from the many types of companies conducted by the auditor. (Modifikasi) |

Ordinal | ||

| Table 3.4 follows: Variable Operationation (Y): Audit Switching |

||||

|---|---|---|---|---|

| No | Concept | Dimension | Indicator | Measurement |

| 1 | Audit Switching Y |

1. Relevant and Andal |

1. The mandatory change of auditors (mondatory) The Indonesian government has issued a regulation on the obligation to change auditors in a Decree of the Minister of Finance 2. Voluntary auditor turnover whose main concern is on the client side (Wea and Murdiawati, 2015 3. The change of management is decided at the general meeting of shareholders or the management stopping by their own volition, so that shareholders must replace the new management. With the new CEO, there may be a change of policy in the fields of accounting, finance, and also the selection of KAP ( Damayanti and Sudarma 2010, in Pratini 2013). 4. KAP's reputation, big KAP is identical with high reputation KAP and auditor's ability to be independent (Ephraim 2010) |

Ordinal Ordinal Ordinal Ordinal |

Population and Research Samples

The population used in this study were all companies of PT Bank Btpn Purnabakti Kcp East Jakarta in 2019. The sampling technique in this study was purposive sampling or Auditors who were on duty at the Btpn Purnabakti Kcp Bank in Jakarta area. The criteria for this research sample are:

| Table 3.5 General Description Of Respondent Profile |

||

|---|---|---|

| Information | Number of respondents | |

| Frequency | Presentation | |

| Gender | ||

| Male | 9 | 9% |

| Female | 21 | 91% |

| Total | 30 | 100% |

| Age | ||

| < 25 | 25 | 95% |

| 25-35 | 3 | 3% |

| 36-45 | 2 | 2% |

| >45 | - | - |

| Total | 30 | 100% |

| last Education | ||

| D3 | 7 | 7% |

| S1 | 23 | 93% |

| S2 | - | - |

| S3 | - | - |

| Total | 100% | |

| Length of work | ||

| < 3 Tahun | - | - |

| 3-5 Tahun | 25 | 95% |

| 5 Tahun | 5 | 5% |

| Total | 30 | 100% |

Source: Data processed, 2019.

Based on the above Tables 3.1-3.5, the samples obtained were 30 Auditors who were on duty at Bank Btpn Purnabakti Kcp Jakarta Purnabakti Kcp Jakarta

Result

Descriptive Statistics Analysis

| Table 4.3 Descriptive Statistics Test Results |

|||||

|---|---|---|---|---|---|

| Variable | N | Minimum | Maximum | Mean | Std. Deviation |

| Audit Fee | 30 | 44 | 71 | 60.3 | 4.34 |

| Internal Control | 30 | 64 | 104 | 87.63 | 6.764 |

| Audit Materiality | 30 | 66 | 97 | 87 | 6.918 |

| Auditor Switching | 30 | 7 | 20 | 15.27 | 2.067 |

| Valid N (list wise) | 30 | ||||

Based on the results of the research in table 4.3 above it is known to show that the amount of data analyzed is as many as 30 respondents can be known

1. The Independent Variable Audit Fee has the lowest (minimum) value of 44, which is derived from the answers of respondents who gave answers that strongly disagree with point (1), and the highest value of the questionnaire (maximum) of 71 figures was obtained from respondents who gave answers strongly agree with point (5) on the questionnaire, while the average value is 60.30 and the standard deviation is 4,340

2. The Independent Internal Control variable has the lowest value (minimum) of 64, which is taken from respondents' answers who give answers that strongly disagree with point (1), and the highest value of the questionnaire (maximum) of 104 numbers is obtained from respondents who give answers strongly agree with point (5) on the questionnaire, while the average value is 87.63 and the standard deviation value is 6,764

3. The Independent Variable Audit Materiality has the lowest value (minimum) of 66 in the answers of respondents who gave answers that strongly disagree with point (1), and the highest questionnaire value (maximum) of 97 figures was obtained from respondents who gave answers strongly agree with point (5) on the questionnaire, while the average value is 87.00 and the standard deviation is 6.918

4. Variable Dependent Auditor Switching has the lowest value (minimum) of 7 percent of respondents' answers who give answers that strongly disagree with point (1), and at the highest questionnaire value (maximum) of 20 figures obtained from respondents who gave answers strongly agree with point (5) on the questionnaire, while the average value is 15.27 and the standard deviation is 2.067

Test the assumptions and quality of the instrument

An analysis of the outer model is carried out to ensure that the measurements carried out are appropriate to be made measurements (valid and reliable). Testing the outer model explains how the relationship between variables with indicators or can be defined how each indicator relates to the latent variable.

Data Validity Test

Convergent Validity Convergent

Validity aims to measure the suitability between indicators of the measurement of variables and theoretical concepts that explain the existence of indicators of these variables. Convergent validity of the measurement model with reflective indicators can be seen from the correlation between item / indicator scores and construct scores. Convergent validity test can be evaluated by looking at outer loadings, outer loadings are tables that contain loading factors to show the magnitude of the correlation between indicators with latent variables.

Sumber : Hasil olah data dengan SPSS, 2019

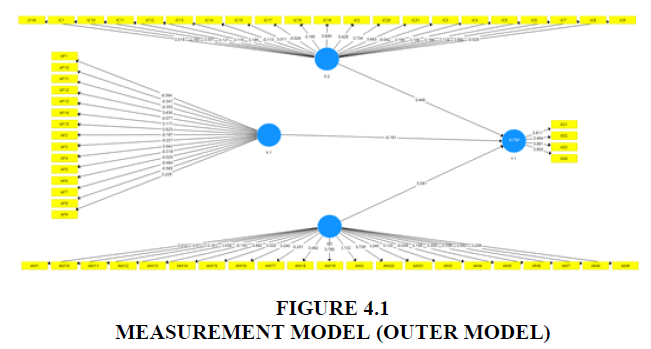

Based on Table 4.3, the figure 4.1 above states that there are several indicators of variables that have an outer loading of less than 0.5, so there is a need for elimination

Source: SmartPLS Output 2019

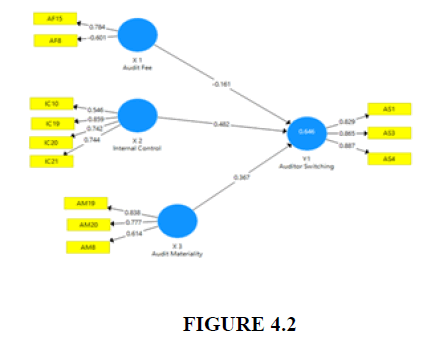

The Outer Model validity test results in Figure 4.2 show that all indicators have good validity because they have a loading factor of more than 0.50. Therefore the validity test with outer loadings has been fulfilled.

Outer loading test results

| Table 4.4 | ||||

|---|---|---|---|---|

| strong>Outer Loadings | X 1_Audit Fee | X 2_Internal Control | X 3_Audit Materiality | Y1_Auditor Switching |

| AF15 | 0.784 | |||

| AF8 | -0.601 | |||

| AM19 | 0.838 | |||

| AM20 | 0.777 | |||

| AM8 | 0.614 | |||

| AS1 | 0.829 | |||

| AS3 | 0.865 | |||

| AS4 | 0.887 | |||

| IC10 | 0.546 | |||

| IC19 | 0.859 | |||

| IC20 | 0.742 | |||

| IC21 | 0.744 | |||

The results of outer loadings in table 4.4 have fulfilled convergent validity because all loading factors are above 0.50, then the measurement model has the potential to be further tested.

b. Reliability Test

1. Composite Reliability, Cronbach’s Alpha and Average variance extracted (AVE)

Composite Reliability and Cronbach’s Alpha testing aims to test instrument reliability in a research model. The construct is declared reliable if the composite reliability and cronbach's alpha values are above 0.70. If the composite reliability and Cronbach's alpha values are above 0.70, it means that the construct has good reliability. Another method for assessing convergent validity is to look at the average variance extracted (AVE) value, where the AVE value must be greater than 0.5 in order to be declared valid. The results of Composite Reliability, Cronbach’s Alpha and Average variance extracted (AVE) testing can be seen in table 4.5

Alpha Cronbach's Test Results, Composite Reability, And Average Variance Extracted (Ave)

Construct Reliability and Validity

| Table 4.5 | ||||

|---|---|---|---|---|

| Cronbach's Alpha | rho_A | Composite Reliability | Average Variance Extracted (AVE) | |

| X 1_Audit Fee | 0.048 | -0.051 | 0.032 | 0.488 |

| X 2_Internal Control | 0.724 | 0.766 | 0.818 | 0.535 |

| X 3_Audit Materiality | 0.626 | 0.684 | 0.791 | 0.562 |

| Y1_Auditor Switching | 0.825 | 0.839 | 0.895 | 0.74 |

Sumber : Output SmartPLS 2019

The average variance extracted (AVE) results in table 4.5 have fulfilled convergent validity because all the average variance extracted (AVE) is above 0.50, and the results of the composite composite reliability and cornbach's alpha presented are said to have good reliability because the variables have composite reliability and cronbach's alpha above 0.70 then the measurement model can be said to be valid.

Discriminant Validity

Discriminant validity is carried out to ensure that each concept of each latent variable is different from the other variables. The model has a good discrimant validity if each loading value of the intended construct must be greater than the loading value with the other constructs, and by looking at the cross loading value for each variable must be> 0.50, the results of the discriminant validity test are obtained as follows:

| Table 4.6 Discriminant Validity (Cross Loading) Test Results |

||||

|---|---|---|---|---|

| DISCRIMINANT VALIDITY | ||||

| Cross Loadings | ||||

| X 1_Audit Fee | X 2_Internal Control | X 3_Audit Materiality | Y1_Auditor Switching | |

| AF15 | 0.784 | 0.055 | -0.378 | -0.332 |

| AF8 | -0.601 | 0.37 | 0.282 | 0.258 |

| AM19 | -0.429 | 0.264 | 0.838 | 0.646 |

| AM20 | -0.35 | 0.464 | 0.777 | 0.484 |

| AM8 | -0.264 | 0.434 | 0.614 | 0.303 |

| AS1 | -0.463 | 0.379 | 0.6 | 0.829 |

| AS3 | -0.355 | 0.691 | 0.452 | 0.865 |

| AS4 | -0.304 | 0.668 | 0.682 | 0.887 |

| IC10 | 0.199 | 0.546 | 0.067 | 0.173 |

| IC19 | -0.079 | 0.859 | 0.375 | 0.626 |

| IC20 | -0.412 | 0.742 | 0.434 | 0.589 |

| IC21 | -0.001 | 0.744 | 0.374 | 0.43 |

Source: SmartPLS Output 2019

Based on table 4.6 above shows that the loading value of each indicator item to the construct is greater than the value of loading with other constructs and the value of each variable> 0.50. So all constructs in the estimated model meet the discriminant validity criteria. Another method for assessing discriminant validity is by comparing the square root of the average variance extracted (AVE) for each construct and the correlation between the construct and other constructs in the model. The model has sufficient discriminant validity if the root of AVE for each construct is greater than the correlation between constructs and other constructs.

| Table 4.7 Discriminant Validity Test Results (Fornell Lacker Criterion) |

||||

|---|---|---|---|---|

| DISCRIMINANT VALIDITY | ||||

| Fornell-Larcker Criterion | ||||

| X 1_Audit Fee | X 2_Internal Control | X 3_Audit Materiality | Y1_Auditor Switching | |

| X 1_Audit Fee | 0.699 | |||

| X 2_Internal Control | -0.186 | 0.731 | ||

| X 3_Audit Materiality | -0.477 | 0.477 | 0.749 | |

| Y1_Auditor Switching | -0.425 | 0.687 | 0.673 | 0.86 |

Source: SmartPLS Output 2019

From table 4.7 it can be seen that the average variance extracted square root values are 0.699, 0.731, 0.749 and 0.860. These values are greater than the correlation of each construct with values greater than 0.50 meaning that 50% or more variance of the indicator can be explained. So there is no discriminant validity problem in the tested model.

Testing the Inner Model (Structural Model)

R-Square Test

In assessing a model with PLS it starts by looking at the R-square for each latent dependent variable. The coefficient of determination R-square shows how much the independent variable explains the dependent variable. R-square values are zero to one. If the R-square value approaches one, the independent variables provide all the information needed to predict the variation of the dependent variable. Conversely, the smaller the value of R-square, the ability of independent variables in explaining the variation of the dependent variable is increasingly limited. Because the independent variable in this study is more than 2, the R-square used is R-square-adjusted (Ghozali, 2015).

| Table 4.8 R-Square Test Value Results |

||

|---|---|---|

| R Square | ||

| R Square | R Square Adjusted | |

| Y1_Auditor Switching | 0.646 | 0.605 |

Source: SmartPLS Output 2019

Table 4.8 shows the R-Square Adjusted value for the auditor switching (AS) variable of 0.646. These results indicate that the auditor switching variable (AS) can be explained by the audit fee variable (AF), internal control audit (AIC), by 64%. While 26% is explained by other independent variables that are not present in the research model formulated in this study.

- If T Calculate> T Table (1.96) then the hypothesis is accepted.

- If Tcount <T Table (1.96) then the hypothesis is rejected

| Table 4.9 Hypothesis Test Results |

||||||

|---|---|---|---|---|---|---|

| Total Effects | ||||||

| X 1_Audit Fee -> Y1_Auditor Switching | Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | P Values | Information |

| X 2_Internal Control -> Y1_Auditor Switching | -0.161 | -0.118 | 0.199 | 0.81 | 0.418 | Not significant |

| X 3_Audit Materiality -> Y1_Auditor Switching | 0.482 | 0.44 | 0.18 | 2.677 | 0.008 | Positive Effect |

| 0.367 | 0.404 | 0.152 | 2.41 | 0.016 | Influential But Not Significant | |

Source: SmartPLS Output, 2019

Hypothesis 1: Audit Fee (AF) negatively affects Audit Switching (AS) The first hypothesis (H1) shows that the influence of audit fee (AF) variable on Audit Switching (AS) is not significant with a t-statistic value of 0.810, the value is more smaller than the value of t table (1.96), and has a value of P Value 0.418 less than 0.05. This result means that there is no influence between the audit fee and auditor switching variables, so the first hypothesis (H1) is rejected.

This hypothesis is in line with Schwartz and Menon 1985 which shows the results of the audit fee does not affect the change of auditors, that which can encourage companies to change auditors caused by not achieving an agreement between the two parties, between the company and the auditor regarding the amount of audit fees. (Carey et al., 2008) investigates lost costs as a direct measure of effects on audit firms, auditor switching or client bankruptcy. This research provides new evidence by assessing lost costs as a measure of costs in lost revenue to audit firms losing small clients due to auditor switching or bankruptcy of clients after the first GCM opinion and According to Nogler (2004), cost pressures motivate auditors to neglect reporting problems client finance.

Hypothesis 2: Audit Internal Control (AIC) has a positive effect on Audit Switching (AS) The second hypothesis (H2) shows that the effect of internal control variables (IC) on Auditor Switching (AS) is not significant with a t-statistic value of 2.677, this value greater than the value of t table (1.96), and has a P Value greater than 0.05 which is 0.008. This means that between the Internal Control and Auditor Switching variables there is a significant effect, so that the first hypothesis (H2) is accepted.

In line with the theory of Kwon (1996) argues that clients in more concentrated industries tend to be in tune with audit firms that are not related to their competitors because they do not want to risk transferring proprietary information, that clients in concentrated industries are reluctant to use the same audit firm because of concerns that confidential information might be transferred to competitors.

Hypothesis 3: Audit Materiality (AM) influences but is not significant towards Auditor Switching (AS). The third hypothesis (H3) shows that the influence of the Audit Materiality (AM) variable on Auditor Switching (AS) is influential but not significant with a t-statistic value of 2,410 that value is greater than the t table value (1.96), and has a P value Value is greater than 0.05 which is equal to 0.016.

Although this research has never been conducted before, there are studies that have results that are close to the dimensions and / or indicators of the research variables made in Chapter III of the Variable Operationalization Section.

Discussion

Based on the results of the PLS (Partial Least Square) analysis, this section will discuss the calculations that have been made. This study aims to determine the effect of Audit Fee, Internal Control, and Materiality Audit on Auditor Switching.

1. Effect of Audit Fee on Auditor Switching

Based on the results of research that has been done, it can be concluded that Audit Fee has no significant effect on Auditor Switching. The results of this study are in line with the theory (Martina, 2010) suggesting that the costs incurred will be greater than the benefits obtained when the auditor's mandatory rotation is carried out. Rotations that will result in an audit fee when the auditor first audits a client, the first thing to do is understand the client's business environment and the client's audit risk. For auditors who are completely unaware of the two problems, the start-up costs are high so that they can increase the audit fee.

2. Effect of Internal Control on Auditor Switching

Based on the results of research conducted, it can be concluded that Internal Control has a positive effect on Auditor Switching. In line with the theory of Kwon (1996) argues that clients in more concentrated industries tend to be in tune with audit firms that are not related to their competitors because they do not want to risk transferring proprietary information, that clients in concentrated industries are reluctant to use the same audit firm because of concerns that confidential information might be transferred to competitors.

3. Effect of Audit Materiality on Auditor Switching

Based on the results of research that has been done, it can be concluded that Audit Materiality influences but is not significant to Auditor Switching. Although this research has never been done before, there are studies that have results that are close to the dimensions and / or indicators of the research variables made in Chapter III Operational Variables Sub-Chapter The results of this study are in line with Rochman, Rita Andini, SE, and MM Abrar Oemar , SE (2016) The results of the study of materiality variables negatively affect the premature termination of audit procedures. The result of logistic regression testing of materiality variables showed a significance of 0.038 with a coefficient of - 0.445. With a p value below 0.05 and a coefficient marked negative, ie the lower the level of materiality inherent in an audit procedure, the possibility of premature termination of the audit procedure will be higher.

Conclusion

Based on the results of the analysis and the results of the discussion in the previous chapter four regarding the effect of Audit Fee, Internal Control, and Materiality Audit on Auditor Switching at Bank Btpn Kcp Jakarta. Then it can be concluded as follows:

1. Based on the results of research that has been done, it can be concluded that Audit Fee does not have a significant effect on Auditor Switching at Bank Btpn Purna Bakti Jakarta. that the costs incurred will be greater than the benefits obtained when the auditor's mandatory rotation is carried out. Rotations that will result in an audit fee when the auditor first audits a client

2. Based on the results of research conducted, it can be concluded that Internal Control has a positive effect on Auditor Switching. At Bank Btpn Purna Bakti Kcp Jakarta. Because in this study the auditor gave a response that shows the quality of the internal control system of Auditor Switching has a conducive and good relationship so it is said to be significantly positive

3. Based on the results of the research that has been done, it can be concluded that Audit Materiality influences but is not significant to the Auditor Switching at Btpn Purna Bakti Bank Jakarta. Because materiality considerations are also a benchmark for auditor reputation which is indicated by public trust in the auditor on its performance. Therefore, the auditor is responsible for maintaining public trust and maintaining the good name of the auditor and the Public Accounting Firm where the auditor works

References

Auditor’s Responsibility to Consider Fraud in an Audit of Financial Statements.Ethics in business, economics and finance in western, central and eastern Europ, 11-12.

Agoes, Sukrisno, 2012. Auditing. Fourth Edition, Jakarta: Fourth Salemba.

AICPA (2015). Substantive Differences Between the International Standards on Auditing and Generally Accepted Auditing Standards.

Arens et al. (2015). Auditing and Assurance Services. Book 1 Issue 15. Jakarta: Erlangga.

Committee of Auditing Concepts (2005) Definition of Auditing

Committee of Sponsoring Organizations of the Treadway Commission.

Carcello and Neal (2015). The Effect of the Going Concern Issuer Opinion on the Change of Auditors in Companies Listed on the Indonesia Stock Exchange. Journal of Accounting Dynamics, 7(1).

Cholifah Husti Laila and Novita (2019). The Effect of the Code of Ethics, Audit Materiality and Audit Risk on Auditor Opinions.

Ghozali, Imam (2015). The coefficient of determination of the R-square Smart PLS Method

Ghozali, Imam (2016). Descriptive Analysis with the IBM SPSS 25 Program: Issue 9. Diponogoro University Publisher Agency; Semarang.

International Standards ON Auditing ISA 315 "Internal Control Components".

Indonesian Institute of Certified Public Accountants (IAPI). 2011. Code of Ethics for Public Accountants. April 2008 edition. IAPI Publisher, Jakarta.

Juliantari, N. W. A., & Rasmini, N. K. (2013). Auditor switching dan Faktor-faktor yang Mempengaruhinya.E-jurnal Akuntansi,3(3), 231-246.

Kamal Naser and Yousef Mohammad Hassan. (2016) This study aims to examine the underlying determinants that may influence external audit fees paid by Emirati nonfinancial companies listed on the Dubai Financial Market (DFM). International Journal of Islamic and Middle Eastern Finance and Management, 9(3).

Keane, M. J., Elder, R. J., & Albring, S. M. (2012). The effect of the type and number of internal control weaknesses and their remediation on audit fees.Review of Accounting and Finance.

Indexed at, Google Scholar, Cross Ref

Luthfiyanti, Bint. (2016) Effect of company size, audit opinion, management change, firm size, and audit tenure on auditor switching. Journal of Accounting.

Lenard, M. J., Petruska, K. A., Alam, P., & Yu, B. (2012). Indicators of audit fees and fraud classification: Impact of SOX.Managerial Auditing Journal.

Indexed at, Google Scholar, Cross Ref

Mulyana, Bambang., Saluy, Ahmad Badawi., Karlina (2021)” Determinant of Devidend Policy and Its Implications on Company Value (Study on Construction and Building Issuer Year 2014-2019” Scholars Bulletin, 7(4) 104-117.

Ni Luh Putu Paramita Novi Astuti 1 I Wayan Ramantha2 (2014). The Effect of Audit Fee, Going Concern Opinion, Financial Distress and Firm Size on Auditor Substitution. E-Journal of Accounting, Udayana University, 7(3).

Pratini, (2013). The Influence of Audit Opinion, KAP Size, Management Substitution, and Financial Distress on Auditor Switching (Study Study on Manufacturing Companies Listed on the Indonesia Stock Exchange in 2008-2012). e-Proceeding of Management, 1(3).

Rivendra, U., Sudjono, S., & Saluy, A. (2021, May). Financial Distress Prediction: Case Study Plantation Companies Listed on Indonesia Stock Exchange. InProceedings of the 1st MICOSS Mercu Buana International Conference on Social Sciences, MICOSS 2020, September 28-29, 2020, Jakarta, Indonesia.

Savitri, (2017). The Effect Of Knowledge To Detect Errors, Professionalism Of Auditors, Auditors Experience, And Professional Ethics Of The Materiality Level Consideration (Case Study on the Audit Board of the Republic of Indonesia)

Saluy, A. B. (2018, November). Recruitment and profitability management (case study of primary sector companies listed on Indonesia Stock Exchange 2007-2016). InIOP Conference Series: Materials Science and Engineering, 453(1). IOP Publishing.

Saluy, A. B., & Mulyana, B. THE FINANCIAL PERFORMANCE BEFORE AND AFTER THE IMPLEMENTATION OF ENTERPRISE RESOURCES PLANNING SAP SYSTEM

Saputra, Y., Sudjono, S., & Saluy, A. (2021, May). Influence of Political Events, Inflation, and the Exchange Rate on Credit Growth of Commercial Banks. InProceedings of the 1st MICOSS Mercu Buana International Conference on Social Sciences, MICOSS 2020, September 28-29, 2020, Jakarta, Indonesia.

Suzulia, M. T., & Saluy, A. B. (2020). The effect of capital structure, company growth, and inflation on firm value with profitability as intervening variable (study on manufacturing companies listed on bei period 2014-2018).Dinasti International Journal of Economics, Finance & Accounting,1(1), 95-109.

Salehi, M., & Alinya, A. A. (2017). Relationship between corporate governance and audit switching: Iranian evidence.International Journal of Law and Management.

Indexed at, Google Scholar, Cross Ref

Svanberg, J., & Öhman, P. (2014). Lost revenues associated with going concern modified opinions in the Swedish audit market.Journal of Applied Accounting Research.

Indexed at, Google Scholar, Cross Ref

Winata, A. S., & Anisykurlillah, I. (2017). Analysis of factors affecting manufacturing companies in Indonesia performing a switching auditor.Jurnal Dinamika Akuntansi,9(1), 82-91.

Indexed at, Google Scholar, Cross Ref

Received: 02-Jan-2023, Manuscript No. IJE-23-13153; Editor assigned: 04-Jan-2023, PreQC No. IJE-23-13153(PQ); Reviewed: 18-Jan-2023, QC No. IJE-23-13153; Revised: 23-Jan-2023, Manuscript No. IJE-23-13153(R); Published: 30-Jan-2023