Research Article: 2021 Vol: 25 Issue: 1S

The Effects of Small and Medium Enterprises on Economic Development in South Africa

Netshidzivhani Mmbengeni, University of Limpopo

Musitha Mavhungu, University of South Africa

Mamokhere John, University of Limpopo

Keywords

Small and Medium Enterprises (SMEs), Economic development, Performance, Polokwane Local Municipality, South Africa.

Abstract

Small and Medium Enterprises (SMEs) play an important role in contributing to the economic development of countries. Despite the importance of SMEs an unacceptable and disappointingly high number of these ventures fail during the first few years of operation. It is in light of the importance and challenges faced by SMEs that the performance of SMEs is of interest to all countries. The study investigated the impact of economic factors on the performance of SMEs. A quantitative research design was used in conducting this research. Simple random sampling, a probability sampling technique was used to select a sample of 156 from the sample frame of 261 registered SMEs in retail and wholesale, construction, manufacturing and service. The cross-sectional survey method was used for data collection. Data was collected from small business owners/managers through the survey method. The self-administered questionnaire method was used to collect data from the participants. Descriptive statistics and multiple regressions were used for data analysis. The Cronbach’s alpha was used as a measure of reliability. The findings of this research showed that economic factors have a positive impact on the performance of SMEs and play a critical role in improving entrepreneurial skills and knowledge of SME owners and managers. Hence, the study is an important contribution to the literature that brings solutions to socio-economic challenges. The study suggested recommendations to improve the performance of SMEs in South Africa.

Introduction

This article argues that Small and Medium Enterprises (SMEs) contributes to the economic development. The sector is touted as an economic engine for many countries. There is a consensus among the scholars in the field of entrepreneurship that this sector has the potential for promoting economic growth, employment creation, poverty reduction and reducing levels of inequality (Mafini & Omoruyi, 2013; Saleh & Ndubisi, 2006). Unemployment, poverty and inequality are the three imperatives that have been identified in the National Development Plan (NDP) which need to be addressed and SMEs can be a tool to respond to these triple challenges in the country. The potential of the SMEs to address those triple challenges has led the South African government to call for support of these businesses and novice entrepreneurs, particularly in rural areas (Fatoki & Smit, 2011; Chimucheka & Mandipaka, 2015).

This does not suggest that the SME sector does not face challenges in both the developed and developing countries thus leading to high failure rates (Fatoki, 2020). Saleh & Ndubisi (2006) in their study have identified a low level of technological capabilities and limited skilled human capital resources as the major challenges that are faced by SMEs. Corroborating this study, Mafini & Omoruyi (2013) in their study also that financial constraints, the lack of logistics skills among the workforce, high costs of information technology and rapid technological advancements were the other challenges. In South Africa, about 75% of SMEs do not survive the first five years after formation (Small Enterprise Development Agency. 2015; USA Small Business Administration, 2016; Maome, 2018). One of the factors that can affect the survival of SMEs is unethical practice such as the sale of sub-standard goods, misleading of customers and avoidance of quality assurance certification. Some of these are bribery, extortion, deception and theft. Such unethical practices negatively impact on customer trust, reputation and performance (Botha, 2012; Mayanja & Perks, 2017; SME Survey, 2017; Turyakira, 2018). Robinson & Joncker (2017) indicate that the struggle for survival by SMEs in South Africa as well as the unique risks faced by these entities influence their leaders’ ethical behaviour. There is a paradoxical relationship between ethics and profitability as SMEs depend on their ethical reputation to survive but are also faced with the temptation to be unethical to survive. Besides, there is a high level of fraud and corruption in the business environment in South Africa as depicted by repeated scandals involving public and business sector leaders. Rampant corruption in South Africa has been one of the biggest challenges in the country’s corporate governance landscape (The Open Democracy Advice Centre, 2013; Makka, 2018). Transparency International (TI) ranks South Africa 73rd out of 180 countries that participated in its survey. The TI index uses a scale of zero to hundred where zero is highly corrupt and 100 very clean. South Africa’s score is 43 and the country is amongst the group of countries that scored below 50 (Transparency International, 2018).

The study is of significance in the sense that it intends to generate empirical findings on the relationship between economic factors and performance among SMEs from a South African perspective. Furthermore, the findings of the study will help improve the theoretical framework for business ethics. In light of the contribution of the SME sector in South Africa, it is of significance to investigate factors that can improve their performance. Hence, the findings of the study will be useful to SME owners and organizations that assist SMEs to better understand factors that can help to improve the performance of SMEs in South Africa.

Research Objectives

The objectives of this study are three-fold.

• To evaluate the importance of SMEs in South Africa;

• To investigate the socio-economic contributions of Small and Medium Enterprises in South Africa; and

• To determine the challenges faced by Small to Medium Enterprises in South Africa

Review Related Literature

Importance of SMEs in South Africa

Since 1995, the South Africa government started to promote small businesses actively to promote economic growth through competitiveness, employment generation and income distribution. The emergence of SMEs was hence facilitated in South Africa, leading to the identification of the effective role they play in economic development (Barry & Sebone, 2009).

This view is further supported by Mahembe & Chiumya (2011) in an article on the National Credit Regulator (NCR), which deals with the accessibility of credit facilities to SMEs. The author states that a healthy SME sector contributes prominently to the economy through creating more employment opportunities, generating higher production volumes, increasing exports and introducing innovation and entrepreneurial skills. Abor & Quartey (2010) estimated that at the time of their research, 91% of formal business entities in South Africa were SMEs, which contributed between 52% and 57% towards the GDP and provided 61% of employment. These figures suggest the importance of SMEs in economic development and employment creation, which has led the SA government to identify SMEs as major economic builders (Mahembe & Chiumya, 2011).

As much as these enterprises are important in driving economic growth, as argued above, the Global Entrepreneurship Monitor (GEM) report (2001-2010) noted that apart from reduced funding, SMEs in South Africa also suffers from poor management skills, which are a result of lack of inadequate training and education. This results in high rates of failure, with South Africa having one of the lowest SME survival rates in the world (GEM, 2010), a view supported by Ahiawodzi & Adade (2012).

Another SMEs constraint mentioned by Hodorogel (2009) who expresses the view that a financial crisis adversely affects SMEs by reducing the development rate and increasing the number of bankruptcies. The author further argues that start-ups in particular are most vulnerable, because they lack the resources to survive a downturn. This further increases the failure rate, which, according to Zimmerer, Searborough and Wilson (2008), occurs within the first five years of establishment and is estimated at 80%, especially in developing countries.

Nevertheless, for a small number of SMEs, those that identify the changes in the market and react promptly, this period may prove favourable (Zimmerer et al., 2008). In times of crisis, some SMEs, unlike big companies, have the advantage of greater flexibility, being able to implement new services and launch new products more easily. If they are allowed to have the freedom to make decisions, they can react more promptly and devise solutions adjusted to market circumstances. This adaptability of SMEs is an important factor to survive both internal and external factors affecting their performance.

Socio-Economic Contributions of Small and Medium Enterprises in South Africa

There is an increasing rise of SMEs in many African countries such as Ghana, Togo, Cote d’Ivoire, Nigeria, Burkina, Uganda and others as they see the importance of small business (Smit et al., 2012). The study by Musitha & Maloma (2017) has found that SMEs indeed can create job opportunities. They play an important role in the economy of countries like the United States of America and the United Kingdom, which employ to estimated one third to the industrial sector, gaining less percentage of productivity than other nations. When SMEs oversee economically in third world countries, they are lucky to be considered more important than in first world countries that are dominated by many SMEs (Rwigema & Karungu, 1999).

The activities of SMEs are vitally important for enhancing economic growth, creating employment and poverty reduction in the country (Rogerson, 2001). However, researchers such as Mead and Liedholm (1998) have found that in Africa on average there are more SMEs shutting down than opening. Since the democratic transition in the South African economy, the main focus has been to increase competitiveness by generating employment and economic growth in the country (Rogerson, 2006). To accommodate an SME environment, the South African government introduced the amended National Small Business Act of 1996 with Act 29 of 2004 to implement different standings of SMEs in the economy (Rwigema & Venter, 2004; Ntsika, 2001).

Human Development Report (2003) highlighted that SMEs contribute to addressing sustainable development (job creation) for the growth of the South African economy (Rogerson, 2004). It is estimated that 90% of all formal business are SMEs, which make it the biggest contribution to the economy, attracting people who were retrenched by the private and public sector (Smit et al., 2012). SMEs create more than 75% of new jobs. In Asian countries; SMEs’ employment contributes more than 80% (Friedrich, 2004). The majority of SMEs in South Africa are micro and show no evidence of growth because of the inadequate deference in organisation dynamics (Smit et al., 2012).

The South African government views SMEs as a means of achieving economic growth. However, the high failure rate of 80% of enterprises makes it hard to achieve the objectives (Van Niekerk, 2005). Their growth depends on the growth of macro-economics, which a drop in growth in the past few years has inhibited entrepreneurial performance and full potential growth (Berry, 2002). Lack of managerial skills can cause SMEs to fail. In South Africa, they have refused to adopt the best governance laws such as the non- compulsory use of King III (King, 2009).

Challenges Faced by Small to Medium Enterprises in South Africa

In South Africa, the SME sector has been placed on the government’s priority list for economic assistance and job creation (Cant, 2012). The government expects 500 000 jobs to be created every year for the next 10 years - the bulk which is expected to come from the SME sector. Research conducted by (Van Scheers, 2011)Bowler, Dawood and Page (2006) and Phakisa (2009) estimates that 40% of new business ventures fail in their first year, 60% in their second year, and 90% in their first 10 years of existence. There are numerous reasons for these failures and many authors have identified the challenges these businesses face. Wong (2005); Jun & Cai (2003) indicate that the SMEs are scarce in resources (time, human resource and capital resources). Several studies have recognised several aspects that can lead to success for SMEs. Rogerson (2001) states that "human capital" or "brainpower" has a positive impact on the growth of the organisation and leads it to fail or succeed. Human capital is viewed to be an important factor established in a study conducted on African enterprises where an organisation that implements training and education for its employees has a high chance of succeeding (Rogerson, 2001). A study based on the accomplishment factors of SMEs in Gauteng, South Africa, found that they lack technical and managerial skills to guide the success of the business (Rogerson, 2001). Research done on SMEs incompetent in South Africa exposed that failures are initiated by a lack of managerial training and skills. However, education and skill development are not solutions to the challenges facing the growth of SMEs (Rogerson, 2001).

Many researchers (Berger & Udell, 2001; Reynolds & Lancaster, 2006) have found growing evidence that small organisations have a higher chance of failing within the first five years of trading due to financial and management difficulties. Capital is a major constraint that many African SME experience when entering into a new market environment when they depend more on personal loans and savings from family members as a starting capital source (Rogerson, 2001; Skinner 2005). To enhance the enterprise environment, SMEs must implement key elements (skill, finance and business training) to improve the competitiveness of the enterprise (Rogerson, 2001). While the government may have legislations to support the SMEs, the study by Musitha & Maloma (2017) found that government officials are not keen to support MSMEs particularly those operating in townships.

Research Methodology

The study utilised the quantitative research approach with the descriptive and causal research design. Data was collected through the cross-sectional survey approach. The survey was conducted in the Central Business District of Polokwane in the Limpopo provinces of South Africa. The areas were used for the survey because they contain a large number of SMEs. Because of the difficulty in obtaining the population of new SMEs in the study area, convenience and the snowball sampling methods were used to identify survey participants. All the respondents in this study were in the retail business, and were owners of the firms. This helped to control the effect of industry on entrepreneurial marketing. Owners are expected to possess both personal information on firm and personal performance. The phone numbers and Email addresses of the participants were obtained by the researcher during the distribution of questionnaires. Repeated phone calls, emails and visits were made to the participants to complete the questionnaire. If the questionnaire is not completed after two months, it is treated as nonresponse. A pilot study was conducted on the survey instrument used in this research with 15 new SME owners to ensure face and content validity. The questionnaire was divided into four parts: (1) the owners/managers demographical information; (2) Economic factor and performance of SMEs; (3) Improving entrepreneurship skills and performance of SMEs and (4) business strategy. Descriptive statistics, correlation and multiple regression analysis were used for data analysis. The Cronbach’s alpha was used as a measure of reliability. For ethical consideration, the participants were informed about the aim of the study, participation was voluntary and confidentiality and anonymity were assured.

Results

Response Rate and Demographical Information

A total of 156 questionnaires were sent out to owners/managers of SMEs in Polokwane Local Municipality. A hundred and twenty-one (121) questionnaires were returned, but only 104 were fully completed. Of the returned questionnaires, 17 were discarded. This means that only 104 questionnaires were analysed. This gave a 66.7% response rate, which is high enough to guarantee accurate results.

| Table 1 Demographical Information of The Respondents (n=104) | |

|---|---|

| Demographical characteristics | Frequency (n=104) |

| Industry or sector of the business | |

| Retail and wholesale | 35 |

| Construction | 12 |

| Manufacturing | 21 |

| Service | 36 |

| Gender of the respondents | |

| Male | 69 |

| Female | 35 |

| Position of respondents in business | |

| Managers | 18 |

| Owners | 50 |

| Both | 36 |

| Age of the respondents (years) | |

| Below 25 years | 7 |

| 25-30 years | 12 |

| 31-40 years | 37 |

| Above 40 years | 48 |

| Years in business | |

| 0-3 years | 28 |

| 4-8 years | 42 |

| Above 8 years | 34 |

| Number of employees | |

| Less than 5 employees | 21 |

| 5-10 employees | 49 |

| More than 10 employees | 34 |

| Educational qualification of owner/manager | |

| Not stated | 6 |

| Never been at school | 13 |

| Primary | 35 |

| Secondary | 50 |

The results as depicted by table 1 show that the majority of the small business owners/managers that participated in the survey are male with secondary qualification and above 40 years of age, have been in business for between 4 and 8 years. It is also indicated that most of SMEs participated in the study are in retail and wholesale.

Factors Affecting Performance

| Table 2 Descriptive Statistics on Factors Affecting Performance | |||||

|---|---|---|---|---|---|

| Descriptive Statistics | |||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

| Infrastructure | 104 | 1 | 5 | 3.44 | 1.148 |

| Finance | 104 | 1 | 5 | 2.74 | 1.329 |

| Industry | 104 | 1 | 5 | 3.69 | 1.098 |

| Crime | 104 | 1 | 5 | 2.9 | 1.326 |

| Information | 104 | 1 | 5 | 3.73 | 0.997 |

| Cost | 104 | 1 | 5 | 2.07 | 1.264 |

| Government support | 104 | 1 | 5 | 3.31 | 1.183 |

| Skills | 104 | 1 | 5 | 2.91 | 1.142 |

| Labour | 104 | 1 | 5 | 2.36 | 1.253 |

| Taxes | 104 | 1 | 5 | 2.26 | 1.132 |

| Corruption | 104 | 1 | 5 | 3.22 | 1.299 |

| Valid N (listwise) | 104 | ||||

Table 2 shows that all the scales were significant, having the mean and standard deviation. Finance and Crime had the highest standard deviation of 1.329 and 1.326 respectively followed by Corruption (σ = 1.299), and cost (σ = 1.264), Crime had the lowest (α=0.997). The study found that the finance and crime are the disturbing factors affecting business performance.

Performance

The purpose of this question is to analyze the performance of SMEs. Different performance measures which include both financial and non-financial were used as measures of performance. More specifically, sales growth, profitability, satisfaction with performance compared to competitors and the overall performance of the SME represented composite measures of performance. The results of this question are presented in Table 3

| Table 3 Performance of SMES | |||||

|---|---|---|---|---|---|

| Strongly disagree | Disagree | Neutral | Agree | Strongly agree | |

| Performance compared to Competitors | 20.20% | 28.80% | 29.80% | 12.50% | 8.70% |

| Sales growth | 23.10% | 22.10% | 21.20% | 24.00% | 9.60% |

| Profitability | 7.70% | 14.40% | 20.20% | 38.50% | 19.20% |

The average/aggregated mean for networking is represented in table 4 below.

| Table 4 Overall Performances of SMES | |||||

|---|---|---|---|---|---|

| Descriptive Statistics | |||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

| Performance | 104 | 3 | 15 | 8.83 | 2.878 |

The mean result of SME performance shows that SMEs are SME owners are satisfied with the performance of their businesses. These results are supported by Nieman & Nieuwenhuizen (2009) who suggest that an SME’s level of performance will also be determined by the owner’s level of networking. SMEs with weak networking will, most likely, also have weak performance.

Multiple Regression Analysis

The regression analysis was used to predict the score on one variable based on their scores on several other variables that is the relationship between the predictor and the criterion variables.

| Table 5 Model Summary. R2 = 0.955 | ||||

|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.977 | 0.955 | 0.948 | 0.654 |

The result of the study indicates that 95.5% of the variations in the dependent variables are explained by the independent variables. We therefore note that in the model, only 4.5% of the variations are explained by other factors not reflected in this model and are accounted for by the error term whereas 95.5% of the variations in the business performance of SMEs quoted in the economic factors. This is therefore a strong model.

Interpretation of Regression Analysis Results and Hypotheses Testing

A hypotheses test refers to the determination of whether the hypothesis is rejected or is accepted. This section will discuss the testing of each hypothesis.

Regression Analysis

When running a regression, the main objective is to discover whether the coefficients of the independent variables are different from 0 (so the independent variables are having a genuine effect on your dependent variable). In other words, regression seeks to establish whether any apparent differences from 0 are just due to random chance. The null hypothesis always shows that each independent variable is having no effect (has a coefficient of 0) and will be looking for a reason to reject this theory. Several regression models were carried out to test the relationship between the variables.

Hypotheses Testing

Hypothesis testing refers to the determination of whether the hypothesis is accepted or rejected. This section will test the primary and secondary hypotheses of this study.

Significance of the Model on the Relationship between Economic Factors and Business Performance.

Hypothesis was analysed using the ANOVA. ANOVA partitions the variability among all the values into one component that is due to variability among group means (due to the treatment) and another component that is due to variability within the groups (also called residual variation). The firm performance of all the firm types were further analysed using ANOVA one-way test to determine if there was a significant difference in the performance based on the economic factors.

| Table 6 Anova Table | |||||

|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. |

| 1 Regression Residual Total | 814.435 | 13 | 62.649 | 146.642 | 0 |

| 38.45 | 90 | 0.427 | |||

| 852.885 | 103 | ||||

This study used a 95% confidence level to determine the significance of the tests. This means that for the tests to be accepted, the p-value has to be less than 0.05. The analysis of variance (ANOVA) test was used to test the significance of the model. The p-value (Pr>F) for this model is <.0001 which is less than 0.05 indicating that the model is statistically significant. The results of the regression model will now be shown below.

| Table 7 Coefficients | ||||||

|---|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| 1 | B | Std. Error | Beta | |||

| (Constant) | 0.191 | 0.433 | 0.441 | 0.66 | ||

| Sales growth | 0.939 | 0.067 | 0.39 | 14.009 | 0 | |

| Profitability | 1.188 | 0.071 | 0.542 | 16.81 | 0 | |

| Infrastructure | 0.555 | 0.098 | 0.221 | 5.634 | 0 | |

| Financial management | -0.011 | 0.084 | -0.01 | -0.127 | 0.899 | |

| Industry | 0.197 | 0.109 | 0.075 | 1.808 | 0.074 | |

| Crime | 0.05 | 0.085 | 0.023 | 0.588 | 0.558 | |

| Information | -0.016 | 0.132 | -0.006 | -0.122 | 0.903 | |

| Cost | -0.022 | 0.131 | -0.01 | -0.171 | 0.865 | |

| Government support | 0.143 | 0.08 | 0.059 | 1.797 | 0.076 | |

| Skills | 0.061 | 0.073 | 0.024 | 0.84 | 0.403 | |

| Labour | -0.06 | 0.081 | -0.026 | -0.742 | 0.46 | |

| Taxes | -0.006 | 0.124 | -0.002 | -0.045 | 0.964 | |

| Corruption | -0.054 | 0.058 | -0.024 | -0.925 | 0.357 | |

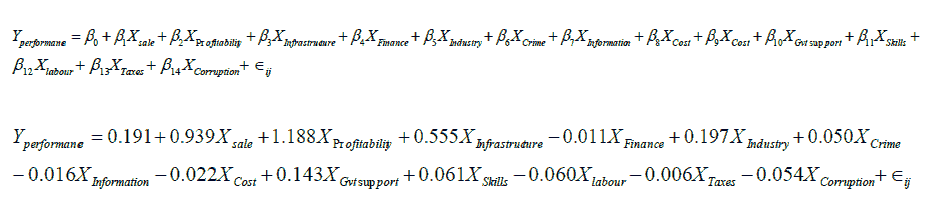

The results of the first regression model show that in terms of the overall performance capability of SMEs, the entrepreneurial characteristics that are statistically significant are sales growth (p=0.0001), profitability (p=0.0001), and Infrastructure (p=0.0001). whereas all other economic factors are insignificant. Economic factors have relationship with business performance.

Model

The study sought to establish the relationship between economic factors as an explanatory variable and Business performance as a dependent variable. Because the relationship involves one dependent variable (Business performance) which is determined by multiple independent variables (Economic factors as mentioned in the study), the model used to determine such relationship was the multiple regression model. Multiple regression analysis tends to establish the relationship between one dependent variable and multiple independent variables. Multiple regression model presented below:

Where Y= dependent variable (Financial performance depicted by the return on Assets)

β1+β2+β3+...... ......+βn = the coefficients of corporate governance attributes

Eij: Error term or the disturbance term; this variable includes all other factors which influenced the dependent variable y.

Challenges experienced by SMEs in their daily operations.

Figure 1 shows that financial management, corruption and lack of information is the challenges that are affecting many SMEs in Polokwane municipality. Means were 7.07, 3.73 and 3.69 respectively. A lack of business skills, crime and the taxes were also relatively large obstacles experienced.

Conclusion and Recommendation

This study helps understand how the owners-managers measure performance. The research study attempted to establish a deeper understanding of the factors contributing to the performance of SMEs in South Africa. The skills required for SMEs development are divided into five categories, namely general management, marketing management, production management, financial management and human management skills. Despite, the positive relationship between the economic factors and SMEs performance, there is a need from SMEs owners/ managers and government to improve the small business strategies. Further study could investigate the constraints perceived by new SMEs to credit access (that is, from the demand side). Besides, further studies could examine the efficiency of government programmes to enhance SME financing. (Administration, 2016). Based on the challenges faced by SMEs, the study encourages government to invest in the SMEs to encounter some of socio-economic challenges such as unemployment and poverty. It is affirmed in this study that SMEs is the drive for economic development and contributes to economic growth.

References

- Ahiawodzi, A.K., & Adade, T.C. (2012). Access to credit and growth of small and medium scale enterprises in the Ho municipality of Ghana. British Journal of Economics, Finance and Management Sciences, 6(2), 34-51.

- Barry, M.L., & Sebone, M.F. (2009). Towards determining critical success factors for SME electrical contractors in the construction industry in South Africa. South African Journal of Industrial Engineering, 20(1), 185-195.

- Cant, M. (2012). Challenges faced by SMEs in South Africa: Are marketing skills needed?

- International Business & Economics Research Journal, 11(10), 1107-1116.

- Chimucheka, T., & Mandipaka, F. (2015). Challenges faced by small, medium and micro enterprises in the Nkonkobe Municipality. International Business & Economics Research Journal, 14(2), 309-316.

- Dzomonda, O., & Fatoki, O. (2017). The impact of ethical practices on the performance of small and medium enterprises in South Africa. Journal of Economics and Behavioral Studies, 9(5), 209- 218.

- Fatoki, O. (2020). Ethical leadership and sustainable performance of small and medium enterprises in South Africa. Journal of Global Business & Technology, 16(1), 62-79.

- Fatoki, O.O., & Smit, A.A. (2011). Constraints to credit access by new SMEs in South Africa: A supply- side analysis. African Journal of Business Management, 5(4), 1413-1425.

- Fatoki, O., & Garwe, D. (2010). Obstacles to the growth of new SMEs in South Africa: A principal component analysis approach. African Journal of Business Management, 4(5), 729-738.

- Hodorogel, R.G. (2009). The economic crisis and its effects on SMEs. Theoretical & Applied Economics, 16(5).

- Mafini, C., & Omoruyi, O. (2013). Logistics benefits and challenges: The case of SMEs in a South African local municipality. The Southern African Journal of Entrepreneurship and Small Business Management 6(1).

- Mahembe, E., & Chiumya, C. (2011). Literature review on small and medium enterprises’ access to credit and support in South Africa. Pretoria, South Africa: National Credit Regulator.

- Musitha, M.E., & Maloma, P.A. (2017). The Contribution of micro, small, and medium enterprises to job creation in the Limpopo province of South Africa: Prospects and constraints. International Journal of Small and Medium Enterprises and Business Sustainability, 2(4), 80- 103.

- Nieman, G., & Nieuwenhuizen, C. (2019). Entrepreneurship: A South African perspective. Pretoria: Van Schaik.

- Rogerson, C.M. (2001). In search of the African miracle: debates on successful small enterprise development in Africa. Habitat International, 25(1), 115-142.

- Rwigema, H., & Karungu, P. (1999). SMME development in Johannesburg's Southern Metropolitan Local Council: an assessment. Development Southern Africa. 16(1), 107-124.

- Saleh, A.S., & Ndubisi, N.O. (2006). An evaluation of SME development in Malaysia. International Review of Business Research Papers, 2(1), 1-14.

- Small and medium enterprises survey. (2017). Unlock the power of the entrepreneur.

- Small enterprise development agency (2015).

- Transparency International. (2018). South African 2017 report.

- Van Scheers, L., & Louisa, M. (2011). SMEs marketing skills challenges in South Africa. African Journal of Business Management, 5(3), 5048-5056.

- Zimmerer, T.W., Scarborough, N.M., & Wilson, D. (2008). Entrepreneurship and small business management. Jakarta: Salemba Empat.