Research Article: 2020 Vol: 24 Issue: 1S

The Evaluation of Impacts of a Seven Factor Model on NVB Stock Price in Commercial Banking Industry in Vietnam - And Roles of Discolosure of Accounting Policy in Risk Management

Dr. Nguyen Thi Thanh Phuong, Thuongmai University Hanoi Vietnam

Dinh Tran Ngoc Huy, Banking University of Ho Chi Minh city Vietnam – GSIM, International University of Japan

Dr. Pham Van Tuan, National Economics University

Abstract

Risk management including stock price impacts and fluctuations and disclosure of accounting policy aspect is becoming vital in commercial bank system. Navibank (NVB), later became NCB, in Vietnam has restructured and recruits more qualified officers in banking industry and build new retail strategy serving SMEs more. Fluctuation of stock price in commercial banks in developing countries such as Vietnam will reflect the business health of bank system and the whole economy. Good business management requires us to consider the impacts of multi macro factors on stock price, and it contributes to promoting business plan and economic policies for economic growth and stabilizing macroeconomic factors. By data collection method through statistics, analysis, synthesis, comparison, quantitative analysis to generate qualitative comments and discussion; using econometric method to perform regression equation and evaluate quantitative results, the article analyzed and evaluated the impacts of six (6) macroeconomic factors on stock price of a joint stock commercial bank, Navibank (NVB or NCB) in Vietnam in the period of 2014-2019, both positive and negative sides. The results of quantitative research, in a seven factor model, show that the increase in GDP growth and lending rate and VNIndex has a significant effect on increasing NVB stock price with the highest impact coefficient, the second is decreasing CPI and the exchange rate. This research finding and recommended policy also can be used as reference in policy for commercial bank system in many developing countries. It also proposes risk management plans including disclosure of accounting policy and improving transparency.

Keywords

Navibank Stock Price; Sp500; Gdp Growth; Inflationary; Risk Free Rate; Market Interest Rate.

JEL

M21, N1

Introduction

Navibank, or later NCB, has identified that changing images must be accompanied by improved service quality. It has continuously organized intensive hours of professional training for employees, built and applied the quality standard system, accelerated the speed of customer service, and used secret customers to check investigate and evaluate service quality throughout the system.

Navibank or NCB, has also recognized Vietnamese accounting standards have not been updated according to international practices (IFRS), limiting management efficiency, reducing attractiveness in investment attraction and international integration. The mechanism, content and form of supervision of the compliance with accounting and auditing standards are incomplete and ineffective, the resources for organizing the supervision activities are limited.

Hence, the need for improving transparency and faith of financial information is necessary in banks today.

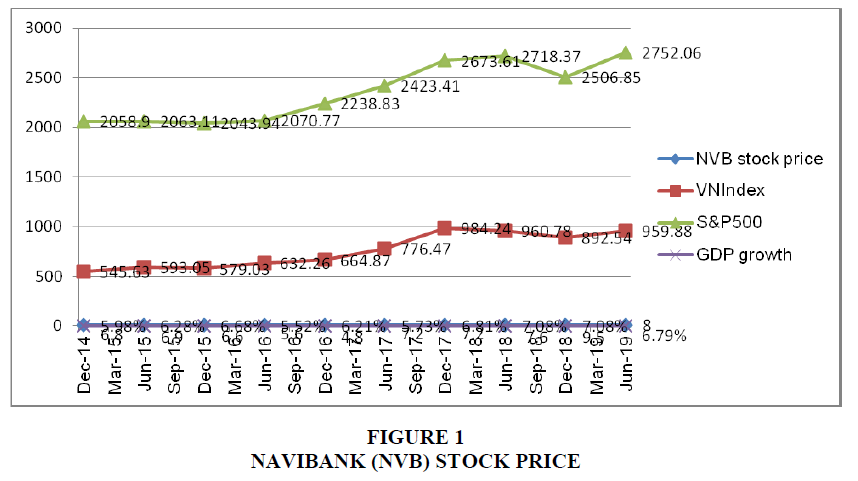

Commercial bank system in Vietnam in recent years plays a key role in helping the whole economy. In the context that GDP growth in Vietnam has been increasing during 2014-2019 and CPI goes down and up and Vietnam stock market has been growing much, it is necessary to evaluate impacts of seven (7) internal and external macro economic factors on bank performance, esp. bank stock price. From these analytical results, we could suggest bank and government policies to encourage and stabilize the growth of bank system and stock market in developing countries such as Vietnam.

Looking at the below chart, we find out that Navibank (NVB) stock price (Figure 1) moves in the same trend with VN Index and GDP growth, although it fluctuates in a smaller range.

This study will calculate and figure out the impacts of seven (7) macro-economic factors such as inflation, GDP growth, market interest rate, risk free rate, VNIndex, S&P500 and exchange rate on Navibank stock price (NVB or NCB). The paper is organized as follows: after the introduction it is the research issues, literature review and methodology. Next, section 3 will cover methodology and data and section 4 presents main research findings/results. Section 5 gives us some discussion and conclusion and policy suggestion will be in the section 6.

Research Issues

The scope of this study will cover:

Issue 1: What are the correlation and relationship among many economic factors: NVB stock price, interest rate, exchange rate, inflation, VNIndex, S&P 500 and GDP growth?

Issue 2: What are the impacts of above 7 macro-economic factors on Navibank stock price?

Issue 3: Based on above discussion, we recommend some solutions regarding to commercial bank management in incoming period.

This paper also tests two (2) below hypotheses:

Hypothesis 1: An increase in lending rate will make NVB or NCB stock price declines.

Hypothesis 2: An increase in inflation can increase pressure in NVB or NCB stock price.

Literature Review

Lina (2012) indicated that both the change of inflation rate and the growth rate of money supply (M2) are positive but insignificant to the banking industry stock return, the exchange rate is positive and significant to banking industry stock return and interest rate is negative and significant to banking industry stock return. Next, Sadia and Noreen (2012) found out exchange rate, and Short-term Interest Rate have significant impact on Banking index. Macroeconomic variables like Money Supply, Exchange Rate, Industrial Production, and Short-Term Interest Rate affects the banking index negatively whereas Oil prices has a positive impact on Banking index.

Manisha & Shikha (2014) stated that Exchange rate, Inflation, GDP growth rate affect banking index positively whereas Gold prices have negative impact on BSE Bankex but none of them have significant impact on Bankex. Then, Winhua & Meiling (2014) confirmed that macroeconomic do have a substantial influence to the earning power of commercial banks.

Krishna (2015) investigated the nature of the causal relationships between stock prices and the key macro-economic variables in BRIC countries. The empirical evidence shows that long-run and short-run relationship exists between macro-economic variables and stock prices, but this relationship was not consistent for all of the BRIC countries. And Kulathunga (2015) suggested that all macroeconomic factors influence the stock market development. More precisely, volatile inflation rate and exchange rate together with higher deposit rate have curtailed the stock market development in Sri Lanka. Moreover, positive optimism created by the economic growth and the stock market performance during the previous periods tend to enhance stock market performance. Moreover, Duy (2015) mentioned through the evolution of interest rates and the VNI could see that the relationship between these two variables in the period 2005-2014 is the opposite. This relationship is shown in specific periods of the year the stock market proved quite sensitive to interest rates. When interest rates are low or high but the bearish stock market rally, and vice versa when the high interest rates the stock market decline.

Last but not least, Quy & Loi (2016) found that 3 economic factors (inflation rate, GDP growth rate, and exchange rate) impact significantly on real estate stock prices; but the relationship between 10-year Government bond yield and trading volume, and real estate stock prices was not found. Ahmad and Ramzan (2016) stated the macroeconomic factors have important concerns with stocks traded in the stock market and these factors make investors to choose the stock because investors are interested to know about the factors affecting the working of stock to manage their portfolios. Abrupt variations and unusual movements of macroeconomic variables cause the stock returns to fluctuate due to uncertainty of future gains. Until now, many research have been done in this field, however, they just stop at analyzing internal macroeconomic factors on stock price. Within the scope of this paper, we measure impacts of both internal and external macro factors on Navibank stock price and suggest policies for bank system, Vietnam government, Ministry of Finance, State Bank and relevant government bodies. We also analyze data throughout time series from 2014-2019.

3. Methodology and data

This research paper establishes correlation among macro-economic factors by using an econometric model to analyze impacts of seven (7) macro-economic factors in Vietnam such as: GDP growth, inflation, interest rate, exchange rate, on Navibank (NVB) or NCB stock price.

In this research, analytical method is used with data from the economy such as inflation in Vietnam and market interest rate, GDP growth rate, exchange rate (USD/VND). Data are included from 2014 -2019 with semi-annual data (10 observations in total). Data is estimated based on exchange rate and lending interest rates of commercial banks such as: Vietcombank, BIDV, Agribank, Vietinbank… (average calculation). S&P 500 index data is from USA Stock exchange, data source (inflation, GDP) is from Bureau of Statistics. Beside, econometric method is used with the software Eview. It will give us results to suggest policies for businesses and authorities.

We build a regression model with Eview software to measure impacts of factors. Navibank stock price is a function with 5 variables as follows:

Y (NVB or NCB stock price) = f (x1, x2, x3, x4, x5, x6, x7) = ax1 + bx2 + cx3+dx4+ ex5 + fx6 + k

With: x1 : GDP growth rate (g), x2 : inflation, x3: VNIndex, x4: lending rate, x5: risk free rate (Rf), x6: USD/VND rate,x7: SP500

Beside, this paper also uses analytical and general data analysis method to measure and generate comments on the results, then suggest policies based on these analyses.

Results

General Data Analysis

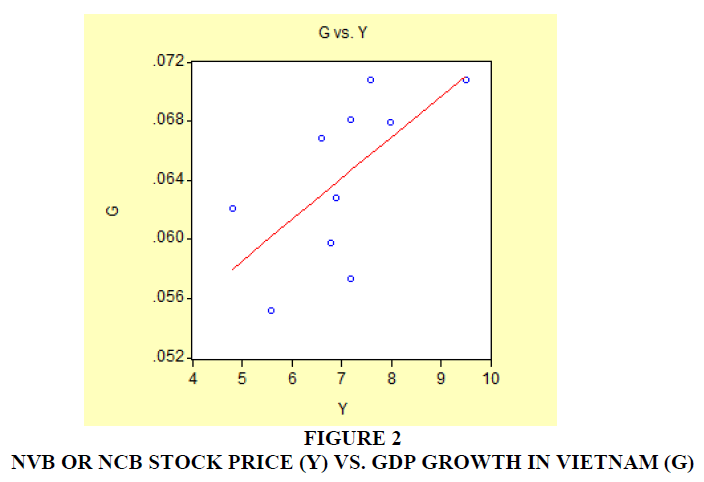

First of all, The below chart 1 shows us that Y has a positive correlation with GDP growth (Figure 2):

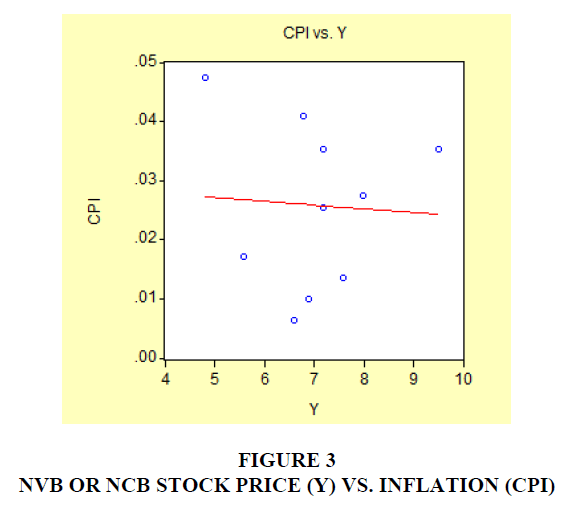

Next we find out that, based on the below scatter chart, Y (NVB stock price) has slightly negative correlation with inflation (CPI) (Figure 3).

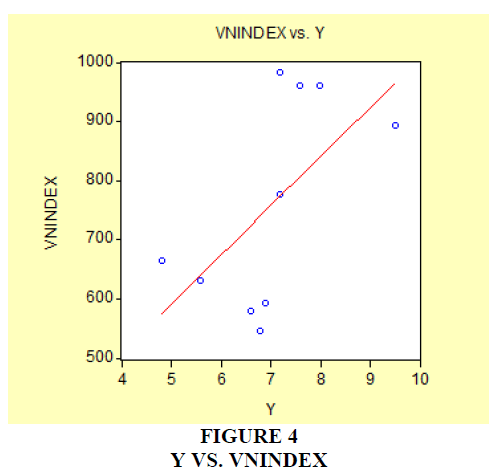

Looking at the below Figure 4, we also recognize that NVB stock price (Y) and VNIndex have positive correlationship.

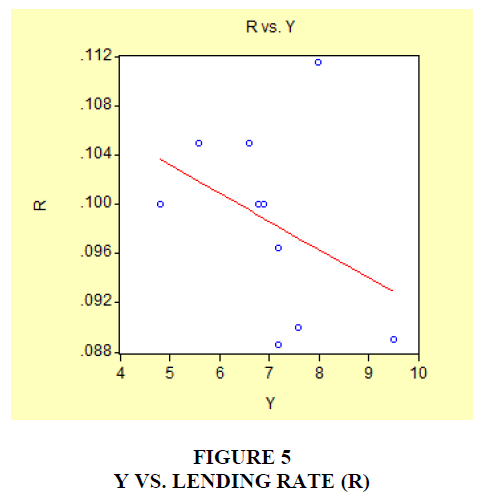

We see that, NVB or NCB stock price (Y) and lending rate have negative correlation:

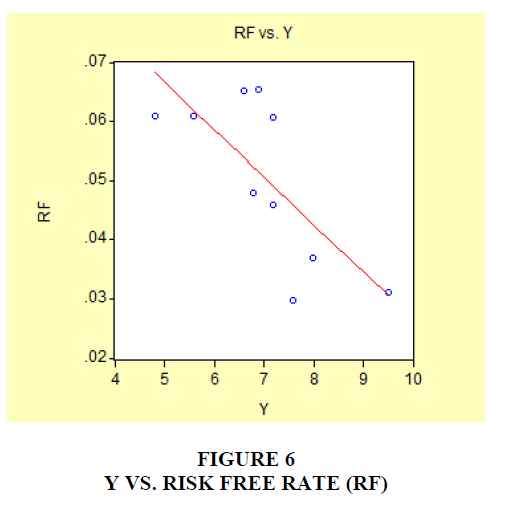

In addition to, the below scatter graph shows us that NVB or NCB stock price (Y) and risk free rate (Rf) also have negative correlation (Figure 5-6).

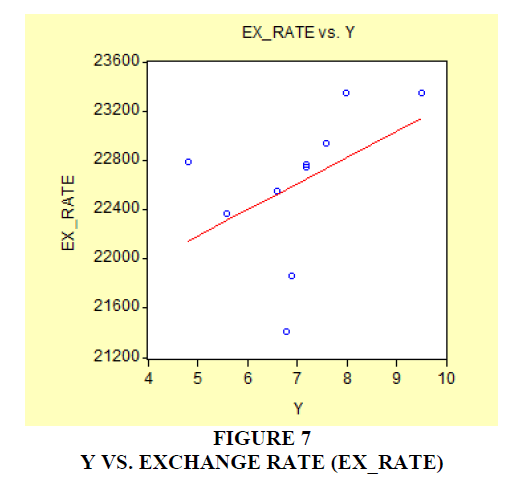

The below chart 6 shows us that Y and USD/VND rate have a positive correlation (Figure 7).

On the other hand, we could see statistical results with E-view in the below Table 1 with 6 variables:

| Table 1 Statistics for Macro Economic Factors | |||||||

| NVB or NCB stock price | GDP growth | Inflation (CPI) | VN Index | Lending rate | Risk free rate | USD/VND rate | |

| Mean | 7.02 | 0.06416 | 0.02588 | 758.875 | 0.09856 | 0.050485 | 22611.7 |

| Median | 7.05 | 0.0648 | 0.0264 | 720.67 | 0.1 | 0.05435 | 22757.5 |

| Maximum | 9.5 | 0.0708 | 0.0474 | 984.24 | 0.1115 | 0.06535 | 23350 |

| Minimum | 4.8 | 0.0552 | 0.0063 | 545.63 | 0.0886 | 0.0297 | 21405 |

| Standard dev. | 1.278 | 0.005549 | 0.013884 | 176.4835 | 0.007636 | 0.014066 | 610.2313 |

Looking at the above table, we recognize that standard deviation of exchange rate and VNIndex are the highest values. Whereas standard deviation of GDP growth and lending rate are the lowest values.

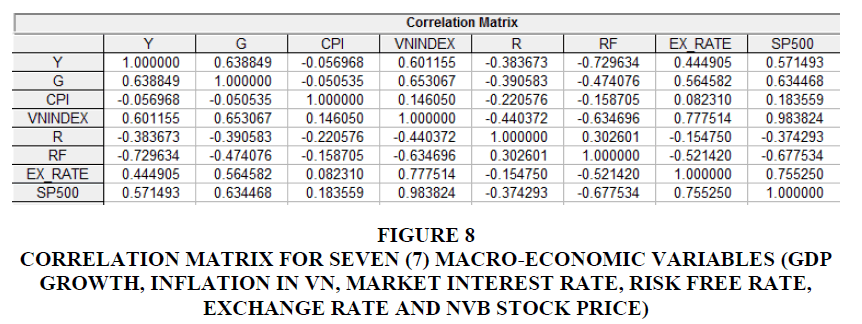

If we want to see correlation matrix of these 8 macro variables, Eview generate the below result in Figure 8:

Figure 8 Correlation Matrix for Seven (7) Macro-Economic Variables (GDP Growth, Inflation in VN, Market Interest Rate, Risk Free Rate, Exchange Rate and NVB Stock Price)

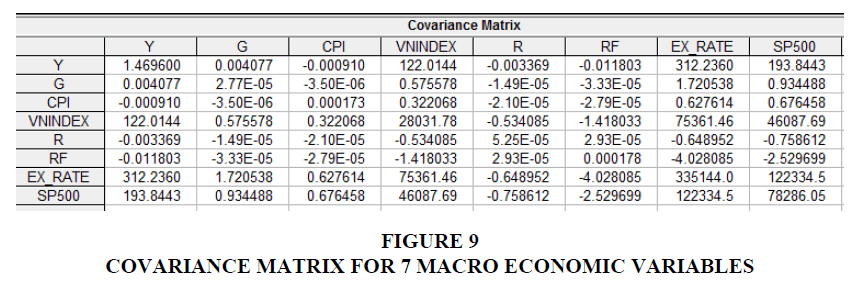

The above Figure 8 shows us that correlation among 8 macro variables. An increase in exchange rate and decrease in lending rate might lead to an increase in NVB or NCB stock price. It also indicates that correlation between NVB stock price (Y) in Viet Nam and VNIndex in Viet Nam and S&P 500 in the US (0.6 and 0.57) is higher than that between Y and lending rate (-0.3) or between Y and CPI (-0.05). The below Figure 9 shows us that covariance matrix among eight (8) macro economic variables. NVB stock price (Y) has a negative correlation with risk free rate but has a positive correlation with exchange rate (EX_Rate), SP500 and GDP growth.

Hence, an increase in GDP may lead to an increase in NVB stock price.

Regression Model and Main Findings

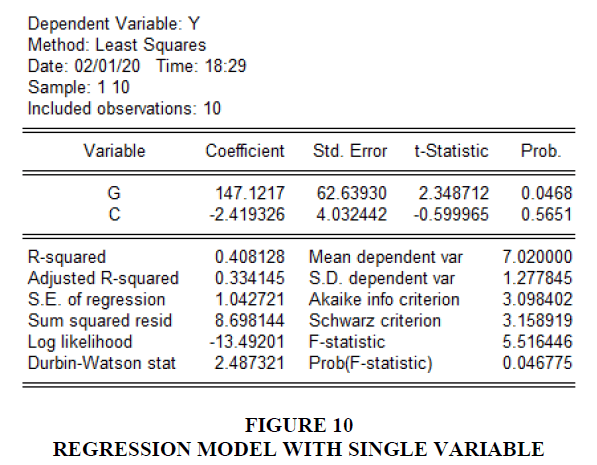

In this section, we will find out the relationship between 7 macro economic factors and bank stock price (Figure 10)

Scenario 1: Regression model with single variable: analyzing impact of GDP growth (G) on NVB stock price (Y). Note: C: constant

Using Eview gives us the below results:

Hence, Y = 147 * g – 2.4, R2 = 0.4, SER = 1.04

Within the range of 10 observations (2014-2019) as described in the above scatter chart 1, coefficient 147, when GDP growth increases, NVB stock price will increase.

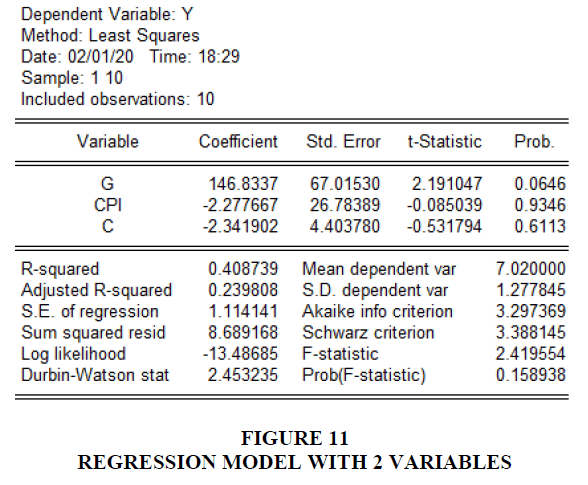

Scenario 2 - Regression model with 2 variables: analyzing impact of GDP growth (G) and Inflation (CPI) on NVB stock price (Y):

Running Eview gives us below Figure 11 results:

Therefore, Y = 146 * g - 2.2*CPI – 2.3, R2 = 0.4, SER = 1.1

Hence, this equation shows us NVB stock price has a positive correlation with GDP growth and negative correlation with inflation in Vietnam. Esp., it is highly positively affected by GDP growth rate.

Scenario 3 - Regression model with 3,4,5,6 variables (Table 2):

| Table 2 Regression Model with 3,4,5,6 Variables | |||

| 3 variables- | 5 variable- | 6 variables- | |

| Coefficient | Coefficient | Coefficient | |

| GDP growth (G) | 130 | 70 | 74 |

| Lending rate (R) | -29.6 | -20 | -15 |

| CPI | -6.2 | -14 | -14 |

| Risk free rate | -51 | -51 | |

| VNIndex | 7.65E | 0.0006 | |

| Exchange rate | -0.0002 | ||

| R-squared | 0.4 | 0.67 | 0.67 |

As we see from the above tables, NVB stock price has positive correlation with VNIndex while it has negative correlation with the other 5 factors Figure 12.

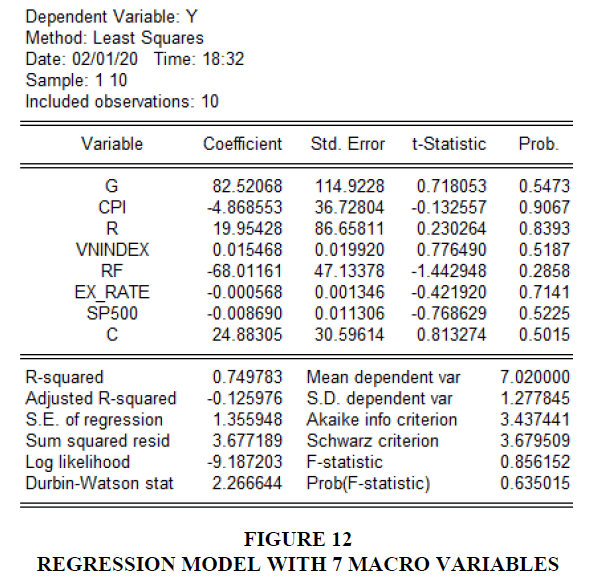

Scenario 7 - regression model with 7 macro variables:

Running Eviews gives us results:

Y = 82.5*G – 4.8*CPI + 19.9*R + 0.01* VNINDEX – 68* Rf - 0.0005*EX_RATE -0.008*SP500+24, R2 = 0.74, SER = 1.3

Therefore, we see impacts of 7 macro factors, with the new variable: SP500, the above equation shows that NVB stock price (Y) has negative correlation with inflation and risk free rate, SP500 and exchange rate whereas it has positive correlation with GDP growth, lending rate, VNINDEX. We also recognize that GDP growth and lending rate, then risk free rate have the highest impact on NVB stock price, while exchange rate just has a slightly impact on stock price.

Discussion and Further Researches

Through the regression equation with above 7 macroeconomic variables, this research paper used updated data from 2014-2019 to analyze the regression equation via Eview in order to show that an increase in GDP growth has a significant impact on increasing NVB stock price (Y) with the highest coefficient of impact, followed by an increase in lending rate and decrease in risk free rate, then an increase in VNINDEX, a reduction in inflation and decrease in SP500, as well as a little reduction in exchange rate.

Data are from observations in the past 10 years, it is partly based on the market economic rules, and the research results are also affected by socio-economic characteristics in Vietnam such as: efficiency of public investment, waste of public investment, enterprise bankruptcy, and investment in areas that increase GDP such as production, electricity, etc. or investing in healthcare, environment and education sectors. We have not yet considered the impact of these factors.

Beside, we can analyze impact of another macro factor, for example, deposit rate when we add this variable into our regression model of stock price. Furthermore, we can add unemployment rate or public debt increase into our econometric model to measure the impact of these extra factors on NVB stock price.Conclusion and Policy Suggestion

Based on the above data analysis from our regression model, although low inflation during 2015-2016 is a good signal for NVB stock price, we would suggest the government, Ministry of Finance and State Bank of Vietnam consider to control inflation more rationally, i.e not increasing much and suitable with each economic development stage. Governmental bodies and bank system also need to apply macro policies to stimulate economic growth, however not reducing lending rate too much, together with credit, operational and market risk management, corporate governance and controlling bad debt.

For NVB or NCB board of management, they need to pay attention to economic stages in which there is high inflation and high risk free rate as it may reduce stock price. NCB has focused on consolidating and improving the efficiency of the entire bank, developing a strategic product system in the retail banking sector, building a separate service package for corporate customers, and increasing revenue handling. recover debts, tighten risk management and improve working processes and regulations, and improve the capacity of human resources.

Generally speaking, managing NVB stock price depends on many factors, so the government need to use fiscal policy combined with monetary policies and socio-economic policies to reduce unemployment and stimulate economic growth, toward a good stock price management.

Transparency and Disclosure of Financial Accounting Policy in Risk Management

For better stock price management, we need to improve transparency of financial disclosure and a disclosure policy of financial accounting information, esp. In commercial bank system, and in a specific case, Navibank, later became NCB, so it is vital to improve transparency of financial activities to shareholders and board of internal audit, internal control.

Banks need to apply International Financial Reporting Standards (IFRS) creates new business cooperation opportunities, creating motivation for enterprise's transformation. However, when converting the consolidated financial statements, from Vietnamese Accounting Standards (VAS) to IFRS, besides the burden of costs and resources to be allocated for IFRS implementation, the biggest difficulty is is the commitment of the business leadership. Hence, board of management of NVB needs to make high efforts and high commitment for international standards such as ISO 9001 and IFRS process.

IFRS improves the planning process, contributes to better resource management and reduces capital costs. Strengthen the close association of internal governance processes with financial information. Support to identify gaps and risks existing in internal processes and to improve and adjust accordingly.Next, it improves the financial analysis capability of foreign enterprises in the same industry according to IFRS standards. Since then, making appropriate investment decisions, effective business cooperation.

Acknowledgement

I would like to take this opportunity to express my warm thanks to my family, my colleagues in assisting convenient conditions for my research paper.

References

- Ahmad, N., & Ramzan, M. (2016). Stock market volatility and macroeconomic factor volatility. International Journal of Research in Business Studies and Management, 3(7), 37-44.

- Arshad, Z., Ali, R.A., Yousaf, S., & Jamil, S. (2015). Determinants of share prices of listed commercial banks in Pakistan. IOSR Journal of Economics and Finance, 6(2), 56-64.

- Ayub, A., & Masih, M. (2013). Interest rate, exchange rate, and stock prices of islamic banks: A panel data analysis, MPRA, 58871.

- Cherif, R., & Hasanov, F. (2012). Public debt dynamics: The effects of austerity, Inflation, and Growth Shocks, IMF Working paper WP/12/230.

- Krishna, R.C. (2015). Macroeconomic variables impact on stock prices in a BRIC Stock Markets: An empirical analysis. Journal of Stock & Forex Trading, 4(2).

- Kulathunga, K. (2015). Macroeconomic factors and stock market development: With special reference to colombo stock exchange. International Journal of Scientific and Research Publications, 5(8), 1-7.

- Ihsan, H., Ahmad, E., Muhamad, I.H., & Sadia, H. (2015). International Journal of Scientific and Research Publications, 5(8).

- Jarrah, M., & Salim, N. (2016). The Impact of Macroeconomic Factors on Saudi Stock Market (Tadawul) Prices, Int'l Conf. on Advances in Big Data Analytics.

- Luthra, M., & Mahajan, S. (2014). Impact of macro factors on BSE Bankex. International Journal of Current Research and Academic Review, 2(2), 179-186.

- Ndlovu, M., Faisal, F., Nil, G.R., & Tursoy, T. (2018). The impact of macroeconomic variables on stock returns: A case of the johannesburg stock exchange, romanian statistical review, 2, 88-104.

- Pan, Q., & Pan, M. (2014). The impact of macro factors on the profitability of china’s commercial banks in the decade after WTO accession. Open Journal of Social Sciences, 2, 64-69.

- Quy, V.T., & Loi, D.T.N. (2016). Macroeconomic factors and stock price-a case of real estate stocks on Ho Chi minh stock exchange. Journal of Science Ho Chi Minh City Open University, 2(18), 63-75.

- Saeed, S., & Akhter, N. (2012). Impact of macroeconomic factors on banking index in Pakistan. Interdisciplinary Journal of Contemporary Research in Business, 4(6), 1200-1218.