Research Article: 2019 Vol: 23 Issue: 3

The Impact of Cash Flow Management on the Profitability and Sustainability of Small to Medium Sized Enterprises

Wadesango N, University of Limpopo

Tinarwo N, Midlands State University

Sitcha L, Midlands State University

Machingambi S, Mpumalanga University

Abstract

Small to medium sized enterprises (SMEs) are important in Zimbabwe because they contribute much towards creation of jobs. Sound cash management practices must be implemented to guarantee success of SMEs through profitability and sustainability. The purpose of this study was to classify the cash flow management practices that are currently practiced by Zimbabwean SMEs and try to figure out the effects of these practices on the profitability and sustainability of SMEs. Both qualitative and quantitative research approaches were adopted in this study. The target population was 14 small businesses in Harare and Gweru giving a total of 55 targeted participants. The sample was calculated using the Yamane formula which gave a result of 50 respondents. The data collection methods used includes questionnaires and interviews and the results from the data collection methods were presented in tables, graphs and pie charts. These results were analysed and tested using the chi square test method which revealed that most cash management practices that are being exercised by SMEs are significantly affecting the profitability and sustainability of these businesses. The results also revealed that most SMEs are reluctant to effectively apply cash management practices causing them to fail.

Keywords

Cash Flow Management, Profitability, Sustainability, Small to Medium-Sized Enterprises

Introduction

Small and Medium Enterprises Association of Zimbabwe (SMEAZ) defines a SME as a small business that is registered formally and has a turnover of below USD$ 240 000 or assets with value below US$100 000. It went on to define a medium enterprise as a formally registered, with turnover and assets above the verges for small enterprises, but below US$1 million each. According to Achiro (2014), small and medium enterprises can have employees counting from 6- 40 and from 41-75 respectively. However, the definition of SME differs from country to country depending on the circumstances such as the economy and government policy.

Zimbabwe is one of the developing countries whose economy is backed up with formal SMEs. Mugano (2015) witnessed a growth in the sector of SMEs after many big companies in Zimbabwe collapsed. It is because of this growth that motivated the government of Zimbabwe to promote SMEs through the creation of the Ministry of Small and Medium Enterprises and Cooperative Development (MSMECD). This ministry’s main objective is to guide the operation of SMEs through providing some legal advice to small businesses. The MSMECD also formulate and implement policies for SMEs. The Small and Medium Association of Zimbabwe is also a board which was formed in 2011 by individual business people to represent SMEs in overcoming severe problems faced by SMEs which were not being addressed by the government. There are other boards like AAG and UIPG which were created in favour of the SMEs survival.

Prior the formulation of MSMECD, the government of Zimbabwe had established a board called Small Enterprises Development Corporation (SEDCO), which is meant to organize funding facilities for SMEs (Chivasa, 2014:56). SEDCO is governed by the Small Enterprises Development Corporation Act (Chapter 24:12). This act’s functions include encouraging and assisting the formulation of co-operatives and small commercial or industrial enterprises and to provide assistance, in the form of financial assistance, management counselling and training, information, advice or otherwise, to cooperatives and small commercial or industrial enterprises (SMEDCO, Act 24:12).

According to Wadesango & Mhaka (2017), SMEs are regarded as the sea- bed for the development of large companies and are the life blood of commerce and industry at large. They are now considered as the backbone of the Zimbabwean economy. SMEs in Zimbabwe have spread in different sectors of the economy but the majority is in the agriculture sector. The following table shows the percentage in which SMEs occupy different sectors of the Zimbabwean economy.

From the above information provided in the Table 1, it is clear that SMEs are mainly distributed in the agriculture sector as represented by 43%. Agrawal et al. (2014) indicated that the reason why SMEs are mostly occupying the agriculture sector is because the agriculture sector is the most important sector in most countries especially developing countries like Zimbabwe. The wholesale and retail sector is the following sector where most SMEs are distributed and it’s shown by 33% of occupancy. Other sectors like manufacturing have few SMEs occupancy because more business minded people lack passion in these sectors.

| Table 1: Sectoral Occupancy Of Smes | |

| SECTOR | PERCENTAGE (% ) |

|---|---|

| Agriculture | 43 |

| Wholesale and retail | 33 |

| Manufacturing | 9 |

| Other services | 7 |

| Energy and construction | 3 |

| Art and entertainment | 2 |

| Transport | 1 |

| Mining and quarrying | 1 |

| Tourism | 1 |

| Source: Primary Source | |

SMEs make up about 70% of registered taxpayers contributing close to 20% tax revenue to the government (Nyoni, 2017). According to the Ministry of Finance, the SME sector employs more than 60% of the country’s workforce and contributes about 50% of the country’s Gross Domestic Product (GDP) (National Budget, 2013). According to Tinarwo (2016), SMEs allow innovation as individuals and their small business units provide useful new business ideas. She went on to say SMEs give birth to big entrepreneurs as they continue to grow and will eventually become big firms which yields a surplus to the Zimbabwean GDP.

Although SMEs are being supported in many ways, they still tend to fail and with the benefits they bring to Zimbabwean economy, their failure is an expense (Aren & Sibindi, 2014). Some maybe experiencing high profits but still they can pull out of business and this is because they suffer cash flow problems to enable growth and sustainability. Running out of cash is usually a result of poor cash flow management. Most Zimbabwean SMEs adopted poor cash flow management practices and they fail to realize their current ratio. Current ratio is defined as the ability to finance short term liabilities with cash and other current assets (Fleming, 2014). The most known reason for businesses’ failure is poor planning but the following cause after poor planning is poor cash flow management (McMahon, 2016). According to Wadesango & Wadesango (2016) 7 out of 10 new businesses survive at least 2 years and 51% survive for at least 5 years. 50% fail in the first year and 95% in 5 years and the mostly cause of this failure is poor cash flow management. Small businesses are under the misconception that high revenues result in high profits, but fail to realize that if the physical cash isn’t obtained from those revenues, businesses will have insufficient cash to pay off expenses and will ultimately face liquidity problems (Moore et al., 2015). If the cash flow management is not up to the standard required, then the business is more likely to liquidate no matter the profit figure.

In South Africa, there is a record of a rise in business failure by 30% since 2008 up to 2013 (Foster, 2013) and small businesses were the most affected ones. According to the author, 57% South African SMEs failed since then. Research by statistics South Africa (2002) proved that almost 9 out of 10 businesses fail during the first 10 years of set-up. The former minister of finance in South Africa, Mr. Trevor Manuel emphasized the SA government to pay more attention on SMEs and support them towards their growth, (Small business development in South Africa, 2009). The former minister’s emphasis was driven by the fact that South Africa was rated 41st out of 43 nations in relation to the SMEs survival rate.

This study therefore, sought to analyse the effects of poor cash flow management on the profitability as well as the sustainability of SMEs. The researchers also tried to identify the causes of poor cash flow management in small businesses which mostly leads to their failure. The main purpose of this study was to assist SMEs to improve their profitability and sustainability through improving cash flow management concepts.

Research Methodology

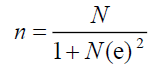

The study adopted a mixed research methodology where both qualitative and quantitative research approaches were employed. The researchers limited the target population to 14 small businesses in Harare and Gweru. The reason as to why the researcher chose to study small businesses is because their profitability and sustainability reduces Zimbabwe’s unemployment rate by a very significant figure if aggregated. In this case, the population was 6 small businesses in Harare and Gweru. The sample size was also verified through the Yamane software-1967 which was calculated using the function showed below (Uwonda & Okello dissertation, 2016).

The sample size determination at 95% confidence level, 5% margin of error and a 50% response distribution. The researchers used questionnaires and interviews as data collection instruments of this study. The structure of the questionnaire was designed according to the Likert scale style.

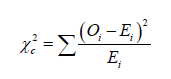

The results were also analysed using the 20th version of the SPSS software. The researchers also made use of inferential statistics to determine the effect of cash management on the profitability and sustainability of small businesses. This was done using the chi square test method.

Presentation, Analysis And Discussion Of Findings

Respondents’ Knowledge of Cash Management Practices

The Table 2 below shows the response of respondents on the knowledge they have about cash management:

| Table 2: Cash Management Practices Knowledge | ||

| Frequency | Percentage (%) | |

|---|---|---|

| Answered Yes | 31 | 62 |

| Answered No | 19 | 38 |

| Total | 50 | 100 |

A little more than two thirds of the respondents indicated that they knew cash management practices including the internal controls over cash in businesses. Because of this, it is clear that owners or managers of small business possess the essential knowledge of cash management practices and controls. Another 38% of the respondents revealed that they have no idea of the cash management practices which is quite shocking thinking how they manage their key roles in the businesses lacking the familiarity of cash management practices. These results did not concur with Makaudze (2018) who revealed that most managers and owners of small businesses lack knowledge on the implementation of cash management practices. However, they agreed with Sibanda (2016) who indicated that although small businesses can claim they have cash management knowledge, they fail to apply it in their businesses resulting in poor planning.

General Questions Question 1 (Yes or No Questions)

An analysis on the effects of formal record keeping on the profitability of the business

The Table 3 below shows response of respondents concerning formal book keeping 28% of the respondents indicated that they keep formal financial records in their business against 72% who insisted that they do not perform book keeping in their businesses. This shows that there is no awareness of importance concerning cash management practices in small businesses. These results agreed with the findings of Wadesango & Mwandambira (2018) who revealed that many small businesses do not follow the process of book keeping in their businesses. However, the findings did not support the outcomes of a study by Rust and Moorman (2018), which stated that accounting is not important since small businesses can focus on other business activities like marketing and can still be profitable.

| Table 3: Formal Record Keeping | ||

| Frequency | Percentage (%) | |

|---|---|---|

| Answered Yes | 14 | 28 |

| Answered No | 36 | 72 |

| Total | 50 | 100 |

An analysis on the preparation of cash budgets on the profitability of business

The Table 4 below shows respondents over the preparation of cash budgets in small businesses.

| Table 4: Preparation Of Cash Budgets | ||

| Frequency | Percentage (%) | |

|---|---|---|

| Answered Yes | 7 | 14 |

| Answered No | 43 | 86 |

| Total | 50 | 100 |

A total of 31 respondents (86%) indicated that they do not create cash budgets in their businesses which are quite alarming since cash budgets are important in predicting the future position of the business. Only a total of 5 respondents (14%) revealed that they do create cash budgets in their businesses. These results are in agreement with the findings of Marfo-Yiadom, Asante & Darkwa (2014) who revealed that 81.4% small business do not create cash budgets because they lack knowledge of how they are created and Mong (2014) who pointed out that about 20% and below of small businesses do not create cash budgets. However, this came in contrary with what Mclntosh (2017), found in his study that small business owners found the disturbing side of cash budgets which is the reason why they resist preparing them.

An analysis on the effects of performing regular stocks in the profitability of a business

Table 5 below shows a number of respondents who indicated their actions towards stock takes:

| Table 5: Regular Stock Takes | ||

| Frequency | Percentage (%) | |

|---|---|---|

| Answered Yes | 20 | 39 |

| Answered No | 30 | 60 |

| Total | 50 | 100 |

A two thirds of respondents revealed that they do not conduct regular stock takes while a total of 39.6% indicated that they practice stock takes. These results were quite shocking as stock take is very important in the business to measure what more quantities of goods to purchase. The results concurred with Marketwire (2014), who revealed that 73% of small businesses do not use inventory management systems.

An analysis on the effect of having a bank account on the profitability of a business

Table 6 below shows respondents’ responses concerning ownership of bank accounts.

A little more than two thirds (62%) indicated that they do have bank accounts and a total of 38% revealed that they do not have one. A bank account is a very important requirement of the book keeping which is a major contribution to cash management practice. This result did not agree with the research findings of Albanis et al. (2017) who stated that most SMEs’ weakness in poor management of cash is caused by the absence of bank accounts to record sales revenue. However, they did agree with Galandari (2015) who indicated that many small business owners have bank accounts to deposit their revenue only that the problem comes in that those accounts maybe their own accounts not separated for business.

,

| Table 6: Business Bank Accounts | ||

| Frequency | Percentage (%) | |

|---|---|---|

| Answered Yes | 31 | 62% |

| Answered No | 19 | 38% |

| Total | 50 | 100 |

An analysis on the effects of loans on the sustainability of a business

Table 7 below shows the dependence of small businesses on borrowing funds 43% of businesses have taken a loan in order to finance their business and their operations. More than half of the businesses (57%) were operating without a loan. Through the interview questions asked, it is clear that though the businesses obtained loans, they are finding it difficult to pay their instalments to the financial institutions.

| Table 7: Loans Acquired | ||

| Frequency | Percentage (%) | |

|---|---|---|

| Answered Yes | 22 | 43 |

| Answered No | 28 | 57 |

| Total | 50 | 100 |

An analysis on the current cash management practices that are being exercised by SMEs

Table 8 below shows a summary of cash management practices that are being exercised by small businesses.

| Table 8: Current Cash Management Practices | ||||||||||||

| Strongly agree | agree | neutral | disagree | Strongly disagree | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Debtors management | 14 | 28% | 8 | 16% | 23 | 46% | 1 | 2% | 4 | 8% | 50 | 100% |

| Inventory management |

5 | 10% | 7 | 14% | 13 | 26% | 15 | 30% | 10 | 20% | 50 | 100% |

| Creditors management | 5 | 10% | 5 | 10% | 8 | 16% | 13 | 26% | 19 | 38% | 50 | 100% |

| Use of cash budgets |

0 | 0% | 19 | 38% | 6 | 12% | 4 | 8% | 21 | 42% | 50 | 100% |

| Cash gap analysis |

0 | 0% | 9 | 18% | 9 | 18% | 17 | 34% | 15 | 30% | 50 | 100% |

| Total | 24 | 9.60% | 48 | 19.20% | 59 | 23.60% | 50 | 20% | 69 | 250 | 100% | |

A total of 30% respondents indicated that they do not agree to the inventory management and 20% strongly indicated that they do not perform inventory management, to make a total of 50% respondents being half of the respondents. This is a signal of poor management skills in SMEs. 24% agreed and 26% were neutral. The findings agree with Maketwire (2014) who indicated that more than 50% of small businesses do not have inventory control systems to track the movement of their inventory. The results from the interviews carried out in this research concurred with the findings of Marketwire (2014) which indicated that 32% of small businesses used manual system that is pen and paper to track inventory movements in their businesses. Through the interviews undertaken by the researchers, it was discovered that small businesses views inventory management as expensive since it requires the use of software and an expert this then agreed with Reddy (2017) who stated that inventory management software is expensive to buy and maintain hence small businesses do not afford it. However, the results do not support the research results by Narayanapillai (2014) who discovered that 14% and below of small businesses do not have inventory management in their business.

A little more than two thirds of respondents (64%) indicated that they do not perform cash gap analysis in their businesses which is a strong signal of poor cash flow management in small businesses. 18% apply it and another 18% are neutral. The results agreed with the findings of Smith (2017) who discovered that 62% of small businesses do not perform cash gap analysis in their businesses. From the interviews undertaken, it was discovered that small businesses owners lack the knowledge of how cash gap analysis is done. The findings of this research however, clash with the results of a study carried by Business Wealth Educators (2015) who revealed that 50% of small businesses nowadays use cash gap analysis in their businesses.

An analysis on why some cash management practices are not being applied

The Table 9 above shows that 36% of respondents indicated that they do not have time for cash management 52% showed that they have time and 12% were neutral. This agreed with Wadesango & Makerevi (2018) who showed that 37% of small businesses do not perform cash management practices because they claim it takes more time. However, these results did not concur with the findings of Fleming (2014) who indicated that not more than 21% of small businesses do not perform cash management because of lack of time to do so. Some businesses have time to perform these practices but they are just reluctant to do so.

| Table 9: Cash Management Skills And Requirements | ||||||||||||

| Strongly | Agree | Neutral | Disagree | Strongly | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| agree | disagree | |||||||||||

| Business has time for cash management |

14 | 28% | 12 | 24% | 6 | 12% | 18 | 36% | 0 | 0% | 50 | 100% |

| There is an understanding of the importance of cash flow |

19 | 38% | 14 | 28% | 12 | 24% | 5 | 10% | 0 | 0% | 50 | 100% |

| Availability of sufficient skills for cash management |

0 | 0% | 25 | 50% | 6 | 12% | 12 | 24% | 7 | 14% | 50 | 100% |

| Major the creation of cash flow statements |

12 | 24% | 7 | 14% | 0 | 0% | 13 | 26% | 18 | 36% | 50 | 100% |

| Knowledge of what a cash budget is |

10 | 20% | 9 | 18% | 13 | 26% | 0 | 0% | 18 | 36% | 50 | 100% |

| Total | 55 | 22% | 67 | 26.80% | 37 | 14.80% | 48 | 19.20% | 43 | 17.20% | 250 | 100% |

A more than a third of respondents (38%), indicated that they strongly understand the importance of cash management towards the success of a business. 28% respondents also agreed that cash management is important but this does not agree with the results of Table 8 which shows a percentage of 47.6 of respondents who are not applying cash management practices on their businesses hence it clearly shows that small business do willingly not exercise cash management practices. 24% were neutral and a 10% disagreed. These results agree with Franken (2015), who asserts that 65% of small businesses in Mexico closed down and their owners revealed that they willingly did not apply cash management practices although they understood their importance.

| Table 10: Internal Controls Over Cash | |||||||||||

| Strongly | Agree | neutral | Disagree | Strongly | Total | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| agree | disagree | ||||||||||

| Segregation of duties | 18 | 36% | 15 | 30% | 0 | 0% | 11 | 22% | 6 | 12% | 50 |

| Authorization and approval | 20 | 40% | 24 | 48% | 1 | 2% | 5 | 10% | 0 | 0% | 50 |

| Physical, mechanical and electronic controls |

9 | 18% | 8 | 16% | 19 | 38% | 12 | 24% | 2 | 4% | 50 |

| Serial numbering of documents | 17 | 34% | 12 | 24% | 16 | 32% | 2 | 4% | 3 | 6% | 50 |

| Total | 64 | 32% | 59 | 29.50% | 36 | 72% | 30 | 15% | 11 | 22% | 200 |

Half of the respondents (50%), indicated that they possess skills suitable for cash management. No one strongly agreed that she/he possesses these skills. 24% respondents revealed they do not have cash management skills and the other were not sure if they possess these skills or not and the other strongly indicated that they have no qualifications over cash management. Only 26% were neutral and this is shocking and it’s a sign that cash management is not well practices in small businesses. This agreed with Wadesango et al. (2018) who indicated that SMEs lack management skills in the management of cash, their motive of business is to earn more cash but they do not how to do it to ensure more cash inflows in their businesses. However, the results did not concur with the findings of Marketwire (2014) which indicated that more than 70% of small businesses do not possess any skill concerning cash management.

A more than a third of respondents indicated that they see the importance of creating cash flow statements in their businesses against 62% who were disagreed. This is a sign that financial statements are not being created to the fullest in small businesses and it’s again a sign that they are unaware of the exact cash flow figures transpiring in their businesses. These results supported Josh (2017) who discovered that 66% of small businesses do not create cash flow statements for their businesses but they failed to concur with Muthama (2016) who found that 25% of businesses do not create cash flow statement.

A total of 38% agreed that they possess knowledge of what a cash budget is, 26% were neutral and 36% disagreed. Referring to Table 3, given the 86% of respondents who showed that they do not create cash budgets it is definitely clear that they possess the knowledge of cash budgets but they do not utilize them in their businesses.

An analysis on the internal controls exercised by small businesses over cash

The Table 10 above shows that 36% respondents strongly agree and 30% just agreed that they perform segregation of duties making it a total of 66%. 22% disagreed and 12% strongly disagreed. This is quite pleasing since segregation of duties is important over management of cash flow. From the interviews undertaken, the researchers discovered that the reason why 34% of respondents did not perform this control is because they have few workers to assign these duties. These findings agreed with the research results of Mwisho (2015) which showed that 70% of small businesses apply segregation of duties over cash. However, they disputed with the research results of Njama (2014) which shows that only 28.1% of small businesses separate duties over cash in their businesses.

It can be noticed again from the table that 88% respondents agreed that they authorize and approve responsibilities of members, 2% were neutral and 10% do not exercise this control. By visiting the businesses personally and discussions held, the researchers observed that some businesses are only operated by the core owners hence there is no one to give authority and approval to perform certain duties. These findings agreed with the findings of Achiro (2017) which showed that 90% of small businesses do exercise authorization and approval of duties. However, they argued with Leonard (2014) who revealed that 52% of small businesses authorize and approve duties of workers.

A total of 38% of respondents indicated that they were neutral about the use of electronic, mechanical and physical internal controls and, 34%agreed that they use them and 28% disagreed that they use this type of control. Again 58% respondents agreed that they use serial numbers on their documentation. 32% were neutral and only 10% disagreed? These results concurred with Mwisho (2015) who revealed that about 60% of small businesses use serial numbers on their documentation, they however did not agree with Wolf who indicated that 95% of small businesses use serial numbers but hey finally agreed with the same author who pointed out that about 50% of SMEs use physical, mechanical and electronic controls over cash.

An analysis on the effects of cash flow on the profitability and sustainability of small businesses

28% and 24% of respondents indicated that their businesses have not been profitable for the past 3 months and this is a strong signal that cash flows are affecting the profitability of businesses extremely. Only 10% and 28% agreed that their businesses have been profitable for the past 3 months and another 10% were neutral. From the interviews undertaken, the researchers discovered that the main factor that is affecting the profitability of these firms is cash problems. These results corresponded with the results by Mungal (2014) that 65.2% of small businesses are experiencing losses due to cash problems. However, they disagreed with the results by Hunt (2017) which revealed that 75% of small businesses are being unprofitable due to discriminatory prices being charged by these businesses (Table 11).

| Table 11: Effects Of Cash Flow On Profitability And Sustainability Of Businesses | |||||||||||

| Strongly | Agree | Neutral | Disagree | Strongly | Total | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| agree | disagree | ||||||||||

| The business was profitable for the past 3 months |

5 | 10% | 14 | 28% | 5 | 10% | 14 | 28% | 12 | 24% | 50 |

| The big part of our sales is in cash |

7 | 14% | 1 | 2% | 26 | 52% | 15 | 30% | 1 | 2% | 50 |

| Big part of our inventory is paid in cash |

0 | 0% | 5 | 10% | 1 | 2% | 24 | 48% | 20 | 40% | 50 |

| Sometimes the business runs out of stock |

6 | 12% | 10 | 20% | 15 | 30% | 3 | 6% | 16 | 32% | 50 |

| The business has some goods which do not get sold |

0 | 0% | 14 | 28% | 1 | 2% | 17 | 34% | 18 | 36% | 50 |

| The business has some debtors who completely do not settle their accounts | 22 | 44%% | 6 | 12% | 5 | 10% | 3 | 6% | 14 | 28% | 50 |

| The business does not qualify for a loan |

2 | 4% | 8 | 16% | 7 | 14% | 29 | 58% | 4 | 8% | 50 |

| The business has sufficient cash to ensure survival without getting a loan |

1 | 2% | 4 | 8% | 12 | 24% | 17 | 34% | 16 | 32% | 50 |

| Total | 43 | 10.80% | 62 | 15.50% | 72 | 18% | 122 | 30.50% | 101 | 25% | 400 |

A total of (52%) respondents indicated that their sales are half cash and half credit and (32%) of respondents specified that their business’ goods are sold on credit basis. Another 16% agreed that they sell the bigger part of their goods on cash basis. In the interviews undertaken, the respondents showed that due to the hardships of cash faced in the Zimbabwean economy, they are forced to sell goods on credit. This came into agreement with Mungal (2014) who found in her study that 32.4% of small businesses sell goods on credit and she also asserts that most of small businesses’ sales are credit sales and they are increasing nowadays due to the cash crisis that the economy is facing. The results also concurred with an article in Newsday (2016) which indicated that due to cash crisis businesses are no longer earning 100% sales in cash but rather they are earning 50% of their sales revenue in cash and the other half in Eco-cash, swipes and credit transactions However, it did not agree with the study of Stuart (2016) which indicated that with the hard times that the economy is suffering from, about 74% of small businesses are selling their goods on credit since customers do not have cash to finance immediate purchases.

Since the big part of sales is credit, small businesses are facing high rate of bad debts. (56%) respondents indicated that they are suffering from bad debts, 10% were neutral and 34% indicated that they do not have debtors who fail to settle their accounts completely. These results agreed with the results found by Wadesango et al. (2017) that discovered in their research that small 46% of SMEs’ owners complained that customers they are facing problems of some of their customers who are completely failing to settle their accounts in full and they are forcing them to fail. These findings also concur with Stuart (2016) who stressed out that the increase in bad debts is increasing the revenue which is written off by small businesses and the results shows that it’s not only happening in developed countries but in developing countries like Zimbabwe. However, the results came into contrary with the findings of Mungal (2014) which shows that 76.7% of small businesses are suffering from debtors who do not settle their accounts. These results though exposed that there is a need to communicate knowledge concerning the effect of bad debts to ensure success of business.

From the discussions undertaken, respondents pointed out that bad debts are affecting their cash flows and their profitability as the big objective of the business and they were finding ways to curb this problem. This finding agrees with Kew & Watson (2016) who underlined that bad debts reduce sales revenue that the business was supposed to earn there by reducing the profitability of the business. However, the finding did not support the findings of Carbajo (2017) who stated that debtors’ management affects the customer loyalty through cash flows not profitability.

A total of 40% respondents disagreed that big part of their inventory is bought in cash and a total of 44% strongly disagreed giving a total of 88% disagreements. A total of 2% agreed and another 10% was neutral. These results strongly indicate that there is shortage of cash in small businesses and it is also a strong signal that businesses’ survival is limited. Through the interviews undertaken, the researcher discovered that the reason as to this problem, is that debtors are delaying their payments hence it becomes difficult to make immediate payment for purchases. This supports the results of a research carried out by Cohen (2015) which pointed out that 90% of small businesses are buying their goods on credit. However, these results dispute with the findings of Chitiga & Choga (2016) which revealed that 73% of small businesses pay their purchases immediately in cash.

32% of respondents indicated that they run out of inventory, 30% were neutral and 42% revealed that they never run out of stock. From the general discussions undertaken, the researchers found that these businesses store a variety of products hence it’s only a certain line of product which runs out of stock not the whole storeroom. These findings concurred with Sprague and Wacker (2015) who discovered that 37% of small businesses run out of stock but some businesses never run out of inventory because they do not focus on only one line of product. However, the findings argue with Mungal (2014) who discovered that 81.2% of small businesses run out of stock. The researchers also discovered that 70% of small business has some goods which remain on shelves and do not get sold. The goods will reach their expiry dates whilst on the shelves or they become too damaged to trade. 28% do not have this type of goods but 2% were neutral. This agrees with Mungal (2014) who found out that 81.2% of small business indicated that their products do not get sold.

A total of 66% respondents proved that their businesses do not have sufficient cash to ensure their business’ survival. 10% agreed that they have sufficient money and 24% were neutral. This clearly shows that the sustainability of small businesses is hindered and this support the findings by Mungal (2014) who discovered that 75% of the businesses admit that there isn’t sufficient money available to run their business without obtaining or having access to external funding such as a loan. However, this research did not support Zimmerer and Scarborough (2017) who discovered that only 12% of small businesses have chance of surviving since the researchers discovered that only 34% of small businesses had a chance of surviving.

Test of hypothesis

A significant result is indicated with p<0.05. These values in Table 12 are highlighted in bold. The insignificant values with p>0.05 are indicated with a star*. The p-value defines the smallest value of alpha for which the null hypothesis can be rejected.

The results are shown in Table 12.

| Table 12: Chi Square Test Results | |||

| Chi square | Df | Significance | |

|---|---|---|---|

| Application of debtors management | 43.58 | 4 | 0 |

| Application of inventory management | 4.38 | 4 | 0.357* |

| Application of creditors management | 6.295 | 4 | 0.178* |

| Use of cash budgets | 24.214 | 3 | 0 |

| Use of cash gap analysis | 10.843 | 3 | 0.013 |

| the business has enough time for cash management | 18.466 | 3 | 0 |

| There is an understanding of importance of cash flow | 19.75 | 3 | 0 |

| Availability of sufficient skills for cash management | 17.111 | 3 | 0 |

| 0Major the creation of cash flow statements | 23.917 | 3 | 0 |

| Knowledge of what a cash budget is | 27.32 | 3 | 0 |

| Apply segregation of duties | 15.728 | 3 | 0.001 |

| Authorization and approval | 17.494 | 3 | 0.002 |

| Physical, electronic and mechanical controls | 17.079 | 4 | 0.002 |

| Serial numbering of documents | 10.076 | 4 | 0.039 |

| The business was profitable for the past 3 months | 10.93 | 4 | 0.027 |

| Big part of sales revenue is in form of cash | 49.177 | 4 | 0 |

| Purchases of new revenue are always paid in cash | 19.547 | 3 | 0 |

| Sometimes the business runs out of stock | 12.74 | 3 | 0.005 |

| Business has some goods which do not get sold | 22.443 | 3 | 0.002 |

| There are more customers who fail to settle their accounts completely | 83.892 | 4 | 0 |

| The business does not qualify for a loan to assist its survival | 18.45 | 4 | 0.001 |

| The business has insufficient money to ensure survival without getting a loan | 5.884 | 4 | 0 |

| * insignificant values which are of greater than the significant level 0.05 | |||

Expected frequency = Row total x column total

Grand total Chi square formula=

DF=(C-1) (R-1)

Where C represents the number of columns; and R represents the number of rows (Table 12):

The greater part of the values is less than 0.05 which means that the differences in the scoring patterns are significant (where applicable). This test revealed that the respondents have strong opinions for all the significant values because the responses either incline towards agree or disagree. The values highlighted in bold were significant with values less than 0.05 and the values with a star* are insignificant values which are of greater than the significant level 0.05. The chi square results indicate that there is a greatest significant effect of cash flow management on the profitability and sustainability of small businesses.

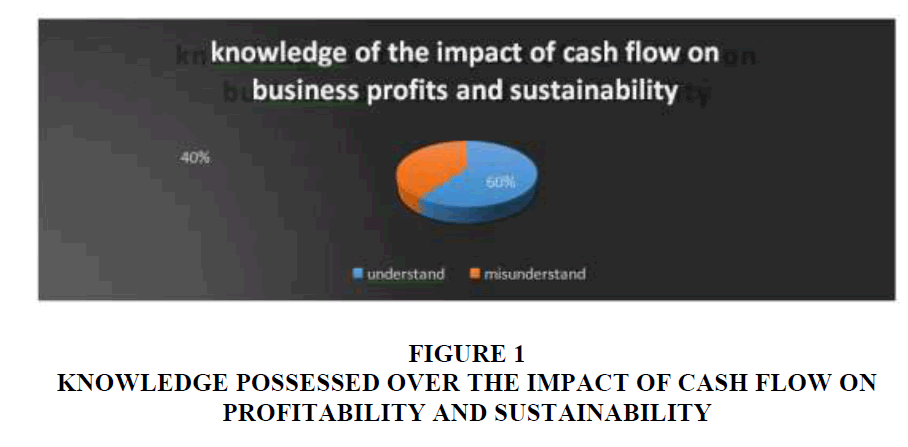

Small businesses understanding of the impact of cash flow on the profitability and sustainability of businesses

A third of respondents revealed that they do understand the impact of cash flow on the profitability and sustainability of their businesses while two thirds explained that they do not understand the impact (Figure 1). From the explanations they gave, two thirds of the respondents confessed that they think that profit and cash flow is all the same thing. They explained that if a business sells its goods and receive cash it is being profitable but in reality, that’s not correct. Some witnessed that even though they realize profits in their financial statements, they still could not have enough cash to finance purchases and if the cash crisis continue they would realize losses and they did not understand the reason behind this criterion. The other one third who claimed to understand the impact of cash flow on profitability explained that cash flows drives profits high and that if cash is improved through increasing cash sales would increase both cash and profits. This agreed with Kakuru (2015) who revealed that businesses must focus on collecting cash receipts to improve sales revenue so as to improve profitability of the businesses. These findings agreed with Mungal (2014) who discovered in her research that 65% of respondents do not understand the effects of cash flow on the profitability of business. However, the findings came to an argue with the results of a research carried by Mukandi (2014) which revealed that 12% of businesses do not understand effects of cash flow on the financial performance of businesses.

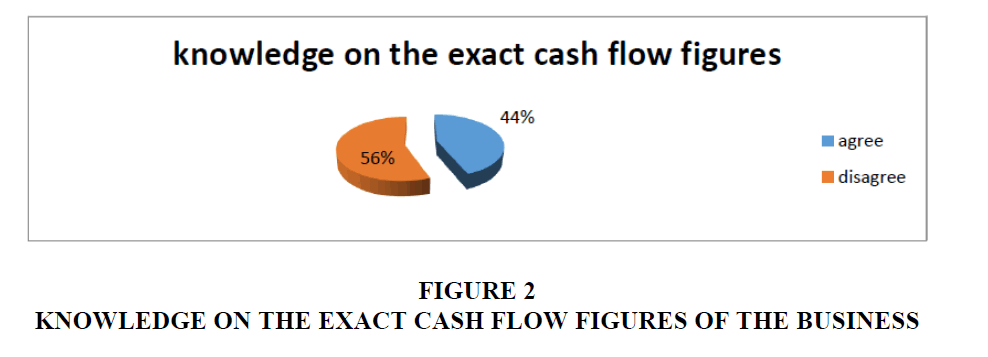

Knowledge on the exact cash flow figures of the business

56% of the respondents indicated that they are not aware of the cash flow movements in the business while a 44% indicated they are aware of every cent that comes into the business and moves out of the business. The high rate of those who disagree indicates that there is big room for fraud in small businesses. From the discussions, these respondents explained that they authorized the handling of cash to the sales persons or other employees hence they are not involved in analysing cash movements. Other explained that since they have no formal records to record every movement of cash, it is difficult for them to know exactly how much is coming and moving in and out of the business. This finding agrees with Meng (2018 who mentioned that small business owners do not track cash flows hence they end up not knowing the exact amount of cash which enters their businesses and move out (Figure 2).

Bad debts

A quite number of respondents revealed that some of their debtors take time to settle their accounts resulting in the businesses facing some difficulties to purchase new stock and continue with the business. Through the discussions, they explained that it was difficult not to offer credit facilities to their customers due to the cash crisis that our economy is facing. Other respondents indicated that they do not offer credit facilities at all hence they did not qualify to answer the question.

Interest Charged on Overdue Accounts

Of the respondents who offer credit facilities, none of them charge interest on overdue accounts because they think that this type of interest scares away customers which will result in the business suffering. This finding almost agrees with the findings of Mungal (2014) that 74.4% of small businesses do not charge interest on overdue accounts. Customers hence do not find the need for urgent payment since there is not effect of late payments.

Interview Responses

Question 1: Why are you facing difficulties to finance big part of your purchases in cash?

About 3 quarters of the 88% respondents who revealed that not big part of their purchases was in cash explained that they were having problems of customers who do not settle their accounts hence they are not able to buy more goods on cash basis. Others explained that cash limit offered in banks is not worth waiting for to gather enough money to purchase enough goods.

Question 2 what is the main challenge that you are facing in your business?

From the analysis undertaken, the researchers found that of the half of the respondents whose businesses were not profitable, the majority of them faced cash problems. Some of them are facing stiff competition from the competitors and the others are facing a challenge of low demand for the goods they sell.

Question 3: What hinders you from applying some of the internal controls over cash management?

More respondents revealed that they have few problems with other internal controls over cash except with the segregation of duties. They explained that their businesses have few employees hence it becomes so difficult for them to separate duties because it requires more labor. Other respondents gave reasons like they did not see the importance of using internal controls over the little money they earn.

Question 4: Have you ever tried to find in detail what gash gap analysis is?

A number of the respondents who indicated that they do not use cash gap analysis explained that they do not have any knowledge of what cash gap analysis and that they have not ever tried to find out what it was. They also explained that cash gap analysis seems like it is a very difficult practice hence it will add burden to the business and complicate things for their employees.

Question 5: If you do not have an inventory control system, what is the main reason behind that?

Of the few respondents who do not perform regular stock takes and who do not have any inventory control system in their business explained that inventory control system requires lots of money for the purchase of the software as well as the training costs or the wages for the expert who can use and maintain the software. They also explained that stock takes are good but they take time which swallows time for good incomes.

Question 6: If you got a loan to finance your business, were you or are you able to pay back the instalments in time?

Those respondents, who indicated that they got loans to finance their businesses, witnessed that they were having difficulties in paying back the money borrowed. Some have also stated that they ended found themselves in courts because of failure to pay back their instalments and the interests.

Conclusion

This study was carried out under the context of experiencing low profits, expansion and development of SMEs. It has been in the interest of the researchers to find if poor cash flow management is the greatest contributing factor towards the unprofitability and unsustainability of SMEs. This research indicated that this hypothesis was widespread and the knowledge gaining of cash flow management was of greatest importance in the SMEs success.

An investigation of the problem indicated that owners of SMEs who possess knowledge over cash flow management are the few who have businesses which are being profitable and they have sufficient money to ensure survival of their businesses in the future. The study also discovered that many small businesses are reluctant in performing cash management practices in their businesses. Statistics carried out in this study indicated that many small businesses do not qualify to obtain loans from financial institutions which is a barrier to the survival of small businesses. The results and findings of this study could be helpful to potential owners of all kinds of businesses and those who are yet to start their own businesses since cash management has a significant effect on the profitability and sustainability of small business thus success.

Recommendations

The researchers suggested the following suggestions to improve cash flow management knowledge and practices based on the results and findings of the research.

Cash Flow Management Practices

Debtors

Businesses must use debtors’ payment period over every accounts receivable account. To ensure quick payments from debtors, they have to remind debtors of the amounts they owe them through phone calls, emails or letters. They also can offer discount allowed to customers and they can also develop a policy which hinders debtors to purchase more goods before previous debts are settled. Mungal (2014) also suggested that small businesses must offer incentives for early payments of their accounts receivables. The author also discovered that 34.15 of SMEs have implemented this procedure to enhance debtor repayments by offering a discount.

Inventory

Regular stock takes must be performed by small businesses on regular basis. They must also set reorder levels as a way to guarantee no stock outs of highly liquid items. These stock make it possible to identify less liquid items which takes time to get sold. The researchers also support Marketwire (2014) who recommended small businesses to always ensure that the older items on the shelf are sold before the newer stock is put onto the shelf to prevent products from becoming expired or obsolete. Small business must research on the preparation and utilization of cash budgets. They must also find more about cash gap analysis and apply it in their businesses.

References

- Abanis, T., Sunday, T., Burani, A., & Eliabu, B. (2017). Financial management practices in small and medium enterprises in selected districts in Western Uganda. Research of Finance and accounting, 4(2), 29-43.

- Achiro, S. (2017). Tips on internal control over cash and SMEs. Blegscope Business Blog.

- Agrawal, R., Eskeem, A., & Desai, N. (2014). Small and medium enterprises in agriculture value chain. Oxfam

- Aren, A.O., & Sibindi, A.B. (2014). Cash flow management practices: An empirical study of small businesses operating in the S.A retail sector. Financial markets institutions, 4(2) 87-98.

- Business Wealth Educators. (2015). Do you know your cash gap? inside small Business Wealth Educators.

- Carbajo, M. (2017). The pros and cons of account receivable financing.

- Chitiga, R., & Choga, F. (2016). Inventory management of SMEs. Journal of environmental Science, 5(3) 207-213.

- Chivasa, S. (2014). Entrepreneurship culture among SMEs in Zimbabwe: A case of Bulawayo SMEs. International journals of economics, commerce and management, 2(9) 1-3.

- Cohen, K. (2015). Inventory control can make, break small businesses in South Florida. Tribune Business News, 10-11.

- Franken, V. (2015). Sustainability of SMEs: A case study of SMEs in the Mexican auto parts industry. Department of Economics and finance. Copenhagen business school.

- Ghalandari, K. (2012). Investigation of the effects of management skills on the cash flow. World Applied Sciences Journals, 20(3), 476-480.

- Kakuru, J. (2015). Finance decisions and the business, 3rd ed. Kampala International Publishers: Kampla, Uganda.

- Kew, J. & Watson, A. (2016). Financial accounting: An introduction. 4th ed. Cape town: Oxford University Press.

- Makaudze, E.O. (2018). An investigation into the financial management practices of new micro-enterprises in Zimbabwe. Journal of Social Service, 33(2), 179-188.

- Marfo-Yiadom, E., Asante, S., & Darkwa, P. (2014). Management accounting, Cap Coast: CCE Publications.

- Marketwire, G. (2014). Why walmart has the upper hand: Survey suggests 50% of small businesses have no inventory control systems. Archon Systems.

- McMahon, P. (2016). Know the cash flow: Cash is critical to small business survival.

- Meng, M.K. (2018). Overcoming the cash drought. The Business Times. From.

- Mong, D. (2015). Follow the cash: Lessons for capstone business courses. Journal of business & Economics research, 9(12), 33-44.

- Moore, J., William, P., & Longenecker, J. (2015). Managing a small business Small business Management, 11, 67-69.

- Mugano, G. (2015). Zimbabwe needs SME export, promotion agency.

- Mungal. A. (2014). The impact of cash management practices on the profitability and sustainability of small businesses, Department of management accounting, University of Technology: South Africa.

- Muthama, R.A. (2016). Effects of cash management practices on operational performance of selected public hospitals in Kiisi country, Department of Business Administration, University of Agriculture and Technology: Kenya

- Mwisho, A., (2015). The basic of auditing. Navision Financials Manuals, 11, 23-25.

- Narayanapillai, R. (2014). Factors discriminating inventory Management Performance in SMEs. Journal of Industrial Engineering and Management, 7(3) 605-621.

- Njama, G.A. (2014). Evaluation of internal control system over cash management. Mzumbe University.

- Nyoni, S. (2017). SMEs contribute 20% of tax revenue.

- Reddy, C. (2017). Inventory Management: Features, Objectives, Pros and Cons.

- Rust, R.T., & Moorman, C. (2018). The role of marketing in SMEs. Journal of Marketing, 63(special issue), 180-197.

- Sibanda, B. (2016). Sustainability of small businesses in Zimbabwe during the first five years. USA: Walden University Press

- Smith, E. (2017). How accountants and small businesses tackle the cash flow gap together.

- Sprague, L.G., & Wacker, J.G. (2015). Macroeconomic analysis of inventories: Learning from practices. International journal of production economics, 4(5) 231-237.

- Statistics South Africa, (2016). Development of SMMEs (online). South Africa, Statistics South Africa.

- Stuart, H.W. (2016). The profitability tests: Does your strategy makes sense, London: The MIT press.

- Storey, D.J. & Westhead, P. (2014). Management training in small firms: A case of Market Failure. Human Resource Management, 7, 61-71.

- Tinarwo, R. (2016). An investigation into the challenges faced by small to medium enterprises in Zimbabwe. Journal of Business Management (IOSR-JBM), 1-5.

- Wadesango, N., & Makerevi, C. (2018). Investigating the value creation of internal audit and its impact on company performance. Academy of Entrepreneurship, 24(3), 1-21.

- Wadesango, N., & Mwandambira, N. (2018). Evaluating the impact of tax knowledge on tax compliance among small medium enterprises in a developing country. Academy of Accounting and Financial Studies Journal, 22(6), 1-14.

- Wadesango, N., Nani, L., & Mhaka, C. (2017). A literature review on the effects of liquidity constraints on new financial product development. Academy of Accounting and Financial Studies Journal, 21(3), 1-11.

- Wadesango, N., & Mhaka, C. (2017). The effectiveness of enterprise risk management and internal audit function on quality of financial reporting in universities. Journal of Economics and Behavioral Studies, 9(4), 230-241.

- Wadesango, N., & Wadesango, O. (2016). The need for financial statements to disclose true business performance to stakeholders. Corporate Board: Role, duties and composition, 12(2), 77-84.

- Wadesango, N., Mutema, A., Mhaka, C., & Wadesango, V.O. (2018). Tax compliance of small and medium enterprises through self-assessment system: Issues and challenges. Academy of Accounting and Financial Studies Journal, 22(2), 1-15.

- Zimmerer, T.W., Scarborough, N.M., & Wilson, D. (2018). Entrepreneurship and small business management, 5th ed., Upper Saddle River, New Jersey: Pearson/Prentice Hall.