Research Article: 2021 Vol: 25 Issue: 2

The Influence Of Dynamic Capabilities On Performance Of Small And Medium Firms: The Case Of Thai SMES

Kulachet Mongkol, Srinakharinwirot University

Citation Information: Kulachet Mongkol. (2021). The Influence of Dynamic Capabilities on Performance of Small and Medium Firms: The Case of Thai SMES. International Journal of Entrepreneurship, 25(7), 1-11.

Abstract

Traditional research demonstrates that enhancing capabilities enables firms to gain a competitive advantage while also improving performance. Nevertheless, none of them places a strong emphasis on dynamic capabilities, and small and medium-sized enterprises (SMEs) especially in the South East Asia region have not been studied extensively in this area. As such, this paper will examine the impact of dynamic capabilities (innovative capability, absorptive capability and adaptive capability) on the performance of SMEs. The responses of 322 SMEs in Thailand were analyzed quantitatively using simple regressions. The findings indicated that all of them have a significant positive impact on the performance of SMEs. However, SMEs should prioritize innovative capability by investing and paying more attention to innovation and creativity, and then followed by the adaptation and absorption abilities of firms.

Keywords

Dynamic Capabilities, Innovative Capability, Absorptive Capability, Adaptive Capability, Small and Medium Enterprise (SMEs).

Introduction

Thailand is a country whose economy is heavily reliant on goods and service exports. Industrial products have accounted for more than 70% of total export revenues over the last two decades. Since then, the industrial sector has revitalized the country, aided by domestic support industries. Small and medium-sized enterprises (or SMEs) are critical components of supporting industries. Thai SMEs have evolved in response to national development plans and the global economy's development (Sumipol, 2018). At the moment, it is widely accepted that SMEs are critical to the country's economy. Kamunge, Njeru and Tirimba (2014) point out that SMEs are becoming increasingly important in terms of employment, wealth creation, and the development of innovation. They play a key role in national economies around the world, generating employment and income, contributing to innovation and knowledge diffusion, reponding to new or niched demands and social needs, and enhancing social inclusion (OECD, 2017).

Moreover, they are regarded as the most effective engines of economic growth. Additionally, SMEs generate the highest profit margins for the country when compared to larger scale enterprises, which spend a large portion of their revenue on imported machinery, technologies, and materials. Furthermore, SMEs also contribute to the development of wealth and prosperity in rural areas of the country. According to a recent study conducted by the Ministry of Industry's Office of Small and Medium-Sized Enterprises Promotion (OSMEP), Thailand has 2.9 million SMEs, accounting for 99 percent of the country's total number of enterprises. This resulted in the creation of 9.7 million jobs and an additional 3.4 trillion baht in revenue. They contributed 37.2 percent to the country's GDP and generated 1.59 trillion baht in exports. OSMEP also reported that in 2020, micro enterprises as well as small and medium enterprises (MSMEs) generated 5,963,156 million baht in GDP in 2019, accounting for 35.3 percent of the national GDP. It increased by 34.6 percent at a rate of 3.0 percent, down from a rate of 5.5 percent in the previous year. When the GDP was broken down by enterprise size, micro enterprises (Micro) contributed 496,187 million baht (2.9 percent), small enterprises (SE) contributed 2,575,443 million baht (15.3 percent), and medium enterprises (ME) contributed 2,891,526 million baht (17.1 percent). Their growth rates were 8.6 percent, 0.7 percent, and 3.9 percent, respectively (The office of SMEs Promotion, 2021).

Nowadays, the dynamic business environment in Thailand has resulted in fierce competition among SMEs, necessitating active engagement by entrepreneurs and owners due to a variety of factors. For instance, external factors such as socio-culture, technology, the economy, politics, and law have an unavoidable impact on SME performance, whereas internal factors such as organizational infrastructure and strategy undoubtedly have an enormous impact on SMEs performance. According to Aas and Breunig (2017) and Yoo and Kim (2015), organizations must be able to manage change effectively in increasingly volatile and complex service eco-systems in order to thrive in today's globalized and hyper-speed business environment (Crossan & Apaydin, 2010; Francis and Bessant, 2005). Nevertheless, Arinaitwe (2002) points out that SMEs typically face numerous obstacles that limit their long-term survival and development. Interestingly, small business development research has revealed that the failure rate in developing countries is significantly higher than in the developed world. Additionally, Kamunge, Njeru, and Tirimba (2014) confirm that SMEs are increasingly facing competition not only from direct competitors but also from large firms operating in niche markets that were previously considered exclusive to small businesses. According to Amyx (2005), one of the most significant obstacles is the negative perception of small and mediumsized businesses. Small businesses are perceived by prospective clients as lacking the ability to provide high-quality services and being incapable of completing multiple critical projects concurrently. Frequently, larger firms are chosen and awarded business solely on the basis of their brand recognition (Bowen, Morara and Mureithi, 2009). Lack of planning, insufficient financing, and ineffective management have been cited as the primary causes of small business failure (Longenecker, 2006).

As a result, creating a competitive advantage is critical for SME success. Concentrating on strategic management, numerous traditional studies confirm that firms can achieve both competitive advantage and performance improvement by strengthening capabilities (Rothaermel, 2018; Wheelen and Hunger, 2018; Mongkol, 2021). Nevertheless, very few of them prioritize dynamic capabilities, and they have not been thoroughly studied in SMEs, especially in the South East Asia region. Additionally, the relationship between dynamic capabilities and SMEs has received scant attention in the literature. As such, this study seeks to demonstrate the importance of dynamic capabilities in terms of SME competitive advantage and to determine whether dynamic capabilities have an effect on the SMEs performance, focusing on Thailand. To accomplish the research objectives, the author structured the paper as follows. To begin, the study discusses key concepts and theories pertaining to the performance and dynamic capabilities of SMEs. Second, it discusses the methodology of research, including the research framework and variable definitions. Thirdly, it summarizes and discusses the major findings of the statistical analysis. Finally, the most significant findings and recommendations for additional research are also discussed.

Literature Review

Small and Medium Enterprises (SMEs) in Thailand

Different countries define SME differently. In Thailand, the definition of small and medium enterprises is contented by the Ministry of Industry (The office of SMEs Promotion, 2021). To illustrate the point, Thai SMEs are classified as seen in the table 1.

| Table 1 Small and Medium Enterprises Classification | |

| Medium-sized Enterprises | Small-sized Enterprises |

| 51-200 person/< BHT 200 million | < 50 person/< BHT 50 million |

However, according to the characteristics of Thai SMEs, Carson (1990) confirmed that they have unique characteristics which differentiate them from large firms. In addition, Intrapairot and Srivihok (2003) also confirm that Thai SMEs generally have many specific characters. Firstly, Thai SMEs are able to initiate their business with low investment. Secondly, Thai SME are flexible and able to change product lines and production processes which help to adapt themselves well to customers’ demand. Thirdly, they use skill, mainly manual, in production. Fourthly, their products are high quality and unique. Lastly, they perform an active part in their communities, using local resources such as materials and people.

Small and Medium Enterprises (SMEs) Performance

Due to the importance of SMEs in the new economy, numerous studies have been conducted on SMEs performance and critical success factors. However, studies demonstrate that historical financial data alone is insufficient to accurately measure the performance of SMEs in the new economy, owing to the increasing complexity of organizations and the markets in which they compete (Kennerley & Neely, 2002). Additionally, it is because financial reports are a poor predictor of shareholder value. Cumby and Conrod (2001) argue that non-financial factors such as customer loyalty, internal processes, employee satisfaction, and organizational innovation drive sustainable shareholder value. Thus, rather than focusing exclusively on financial factors, a firm's performance can generally be evaluated using a variety of metrics, including market share and employee growth. Additionally, numerous scholars (Ankrah, Mensah, 2015; Thompson, Peteraf, Gamble, and Strickland, 2019) emphasize that while return on investment (ROI) is an efficient way to evaluate a firm's performance in terms of finance, the ability of SMEs to grow and achieve their strategic objectives is critical in terms of strategy.

Capability and Dynamic Capabilities

Organizational capabilities are critical for achieving a sustainable competitive advantage that results in increased performance (Mongkol, 2021). To illustrate the point, organizational capabilities are defined as the collective skills, expertise, and alignment of a company's employees. While competencies are typically at the individual level, capabilities span across an organization. Organizational capabilities are critical but non-duplicable intangible assets. These assets are even more critical than any other when it comes to strategy implementation (Hawkins, 2016). They are viewed as a company's primary intangible asset. They encompass an organization's collective skills, abilities, and expertise. In addition, Smallwood and Ulrich (2004) confirm that organizational capabilities are the means by which people and resources are combined to accomplish work. They shape the organization's identity and personality by defining what it excels at and, ultimately, what it is. They are more resistant to copying than capital market access, product strategy, or technology.

Nonetheless, the strategic literature differentiates capabilities from dynamic capabilities, defining the latter as the "firm's ability to integrate, build, and reconfigure internal and external competencies in response to rapidly changing environments" (Teece, Pisano, and Shuen, 1997). Dynamic capabilities are distinct from operational capabilities, which are concerned with an organization's current operations. By contrast, dynamic capabilities refer to an organization's ability to purposefully create, extend, or modify its resource base (Helfat and Peteraf 2007). Teece, Pisano, and Shuen (1997) define dynamic adaptability as an organization's inherent capacity to adapt its resource base optimally and purposefully. It focuses on the company's ability to develop, integrate, and reconfigure internal and external competencies in response to a dynamic and volatile business environment. Most businesses strive to improve their dynamic capabilities because they enable them to achieve and sustain a competitive advantage while also carving out a distinct identity in the industry and posing a stiff challenge to their rivals in the industry. In addition, the concept of dynamic capabilities focuses on the organization's internal strengths, such as its workforce and capital investments, rather than on external forces such as government policies and market trends, in order to maintain the market's dynamic nature and gain a competitive advantage. However, Wang and Ahmed (2007) assert that dynamic capabilities include three components: innovative capability, absorbtive capability, and adaptive capability. As a result, this research paper focuses on these three components, incorporating them into the research framework.

Innovative Capability

Innovation capability is defined as a firm's ability to identify new ideas and transform them into new/improved products, services or processes that benefit the firm. It refers to a business's ability to pursue novel ideas, designs, technologies, and creative processes (Lumpkin and Dess, 1996). According to Lawson and Samson (2001), innovation capabilities are referred to as higher-order capabilities, or the capacity to shape and manage multiple capabilities. Firms that possess these capabilities have the ability to successfully integrate their firm's critical capabilities and resources in order to stimulate innovation (Othman and Sohaib, 2016; Sudolska and Lapinska, 2020). Additionally, highly innovative firms enjoy demonstrable increases in market share, product success, returns on investment, and long-term returns, in comparison to less innovative firms (Allocca and Kessler, 2006). It can be confirmed that innovative capability acts as a moderator between strategic goals and financial performance (Donkor, Donkor, Kankam- Kwarteng, and Aidoo, 2018).

Absorptive Capability

Currently, absorptive capacity is primarily conceptualized as a dynamic capability, and it is grounded in macroeconomics, which defines it as an economy's ability to effectively utilize its capital resources. Cohen and Levinthal (1990) are credited with coining the absorptive concept, defining it as a business's capacity to recognize the value of new information, assimilate it, and apply it commercially.

While Cohen and Levinthal placed a premium on research and development investments to enhance an organization's absorptive capacity, subsequent research by Zahra and George (2002) demonstrated that several other areas could be explored to enhance an organization's absorptive capacity. Their concepts reformulate and expand the previous definition of absorptive capability, defining it as being composed of two distinct absorptive capacities: potential absorptive capacity and realized absorptive capacity. Their revised definition of absorptive capacity is as follows: a collection of organizational routines and processes through which firms acquire, assimilate, transform, and exploit knowledge in order to generate a dynamic organizational capability. At this point, it can be concluded that absorptive capability is the capacity of a business to absorb external knowledge from its environment, or the capacity of a business to acquire, assimilate, transform, and exploit external knowledge (Jimenez-Barrionuevo, Molina and Garcia-Morales, 2019; Zahra and George, 2002), and it is one of the primary determinants of corporate capacity in businesses, as it can significantly increase the capacity for exploring new opportunities (Zahra et al., 2009). Nonetheless, some researchers have discovered positive correlations between absorptive capacity and organizational performance, both direct and indirect (Wales, Parida and Patel, 2013), while other researchers assert that absorptive capacity has no significant impact on organizational performance, arguing that simple acquisition and assimilation of external knowledge without effective transformation and commercialization via specific innovation outputs cannot result in performance improvement (Da Costa, Camargo, Toaldo, and Didonet, 2018).

Adaptive Capability

Adaptive capability measures a firm's ability to identify and seize emerging market opportunities, as well as its ability to align its resources and routines with changing external market conditions (Alvarez & Merino, 2003). It is inextricably linked to an organization's strategic plan, which includes identifying and nurturing key capabilities, resources, and other organizational processes in order to respond to changing business requirements (Teece, Pisano, and Shuen) (1997). Paliokaite (2012) suggested that adaptive capability provides a competitive advantage, particularly in dynamic environments. The concept of adaptive capability is defined as taking into account three dimensions: horizon scanning, change management, and resilience. To begin, horizon scanning is the continuous process of gathering information about customers, suppliers, competitors, society, and technology and then using that information to make informed decisions (Ali, Sun and Ali, 2017). Second, change management is associated with modifications to objectives, plans, structures, and governance systems in response to horizon-scanning information ( Rathgeber and Kotter, 2006). The magnitude of adaptive capability is determined by changes in market/product expectations (McKee, Varadarajan, and Pride, 1989), as well as the firm's ability to meet those expectations using its existing resources and capabilities (McKee, Varadarajan, and Pride, 1989). (Ali, Sun and Ali, 2017). Thirdly, resilience refers to a business's capacity to withstand various types of disruptions (Sheffi and Rice, 2005; Ponomarove and Holcomb, 2009). It could be defined as adaptability, responsiveness, and the capacity to alter business operations and strategies in the face of disruption.

Additionally, Wang and Ahmed (2007) contend that adaptive capability is an action of response, with reaction centered on balancing exploration and exploitation strategies via resource modification, application, and renewal. In conclusion, according to Eshima & Anderson (2017), the transition of adaptive capability is related to the firm's capacity to meet changing market and product assumptions with its available resources. The central component of adaptive capability influences the development of strategies, which serve as mechanisms for managers to improve performance (Wang & Ahmed, 2007). Businesses that are adaptable to the development process will be able to achieve their objectives (Clarke, O’Connor, Leavy and Yilmaz (2015).

Research Methodology

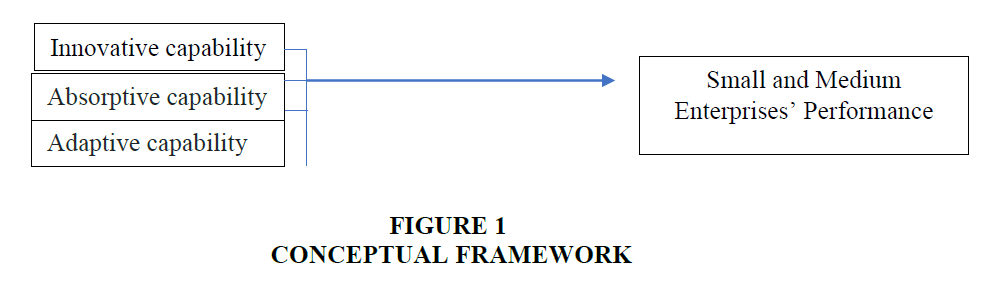

The research methods include a review of various national and international literatures, and a questionnaire survey was also performed. Figure 1 illustrates the conceptual research framework. According to secondary research, the framework includes three elements of dynamic capabilities that influence the performance of SMEs.

The study hypotheses the following:

H1: Innovative capability has a significant impact on SMEs performance

H2: Absorptive capability has a significant impact on SMEs performance

H3: Adaptive capability has a significant impact on SMEs performance

According to variables, independent variables were identified as follows:

The study developed the research model based on Wang and Ahmed’s definition (2007), who claimed that dynamic capabilities consist of three elements, namely innovative capability, absorptive capability, and adaptive capability.

1. Innovative capability: a firm's ability to identify new ideas and creative processes and transform them into new/improved products, services or processes that benefit the firm.

2. Absorptive capability: a firm’s ability to recognize the value of new information as well as the ability to absorb external knowledge from the business environment and assimilate it and apply it to commercial ends.

3. Adaptive capability: a firm’s ability to identify and capitalize on emerging market opportunities and the ability to align its resources and routines to the changing external market.

In addition, dependent variables were also identified as follows: SMEs performance is measured by the capability of the business to grow in a dynamic environment (Ankrah, Mensah, 2015; Thompson, Peteraf, Gamble, and Strickland, 2019).

The study population consisted of 344,118 Thai SMEs (The Office of SMEs Promotion, 2020). According to the Krejcie and Morgan table (1970), a proportional stratified sampling method was used to select 322 companies in four different industries, including service, commerce, production, and agriculture (as seen in Table 2).

| Table 2 Classification of Respondents | ||

| Business Sector | Population | Sample size |

| Service Sector | 160,377 | 150 |

| Commercial Sector | 127,038 | 119 |

| Manufacturing Sector | 54,691 | 51 |

| Agricultural Sector | 2,012 | 2 |

| Total | 344,118 | 322 |

A survey questionnaire was developed to collect primary data for this study. It consisted of three parts, which were 1) the characteristics of SMEs 2) three elements of dynamic capabilities and 3) performance of SMEs. In relation to the second and the third parts, 24 questions were collected to measure all study variables. All constructs were measured with a multiple-item 5- point Likert scale (1=strongly disagree; 5 = strongly agree). Cronbach alpha was used to measure the internal consistency and reliability of each construct. This study's reliability is acceptable because, according to Sekaran and Bougie (2016), cronbach alphas greater than 0.80 are considered good, as shown in table 3.

| Table 3 Cronbach’s Reliability Tests | ||||

| Variables | Means | Std. deviation | Alpha | No. of items |

| Innovative Capability | 4.234 | 0.776 | 0.879 | 6 |

| Absorptive Capability | 4.136 | 0.742 | 0.882 | 6 |

| Adaptive Capability | 4.094 | 0.711 | 0.8957 | 6 |

| SMEs Performance | 4.214 | 0.694 | 0.793 | 6 |

Results and Discussion

Simple Regression analysis was used to test three hypotheses suggested in this paper (H1, H2, and H3). For innovative capability, the results showed (Table 4) that innovative capability has a significant impact on the dependent variable, (t= 4.234, P<0.05). Hence the H1 was supported.

| Table 4 Simple Regression Analysis: The Impact of Innovative Capability on Performance | |||||||||

| Dependent Variable | Model Summary | ANOVA | Coefficients | ||||||

| R | R2 | Adjusted R2 | F | DF | Sig* | β | T | Sig* | |

| Performance | 0.896 | 0.803 | 0.796 | 14.855 | 2 | 0.00 | 0.535 | 4.234 | 0.00 |

| 319 | |||||||||

| 321 | |||||||||

For absorptive capability, the results indicated (Table 5) that absorptive capability has a significant impact on the dependent variable, (t=3.020, P<0.05). Thus, H2 was support.

| Table 5 Simple Regression Analysis: The Impact of Absorptive Capability on Performance | |||||||||

| Dependent | Model Summary | ANOVA | Coefficients | ||||||

| Variable | R | R2 | Adjusted R2 | F | DF | Sig* | β | T | Sig* |

| Performance | 0.705 | 0.497 | 0.493 | 12.041 | 2 | 0.00 | 0.393 | 3.020 | 0.00 |

| 319 | |||||||||

| 321 | |||||||||

Finally, according to the adaptive capability, the results (Table 6) indicated that adaptive capability has a significant impact on the dependent variable (t=4.039, P<0.05). Therefore, H3 was also accepted.

| Table 6 Simple Regression Analysis: The Impact of Adaptive Capability on Performance | |||||||||

| Dependent Variable | Model Summary | ANOVA | Coefficients | ||||||

| R | R2 | Adjusted R2 | F | DF | Sig* | β | T | Sig* | |

| Performance | 0.802 | 0.643 | 0.640 | 13.423 | 2 | 0.00 | 0.438 | 4.039 | 0.00 |

| 319 | |||||||||

| 321 | |||||||||

Conclusion

Because the construction of dynamic capabilities has received considerable attention in strategic management research, but little research has been devoted to studying dynamic capabilities in SMEs, particularly in South East Asia, this paper has shed some light on the impact of dynamic capabilities on SME performance. The importance of the paper stems from the fact that it brings new empirical research into the Thai SMEs' dynamic capabilities and issues related to performance, utilizing statistical analyses that have rarely been performed. The research findings support H1 (innovative capability has a significant impact on SMEs' performance). This is in line with Weismeier-Sammer (2014), who found that highly innovative firms have definitely increased market share, high product success, greater returns on investment and long-term returns, unlike less innovative firms. This view is also applicable to Thai SMEs, which are characterized by a high level of competition. In relation to H2, absorptive capability has a significant positive impact on the dependent variable, and this aligns with the literature of Zahra and George (2002) and Wales, Parida, and Patel (2013), who have discovered positive correlations between absorptive capacity and organizational performance, both direct and indirect. Finally, H3 (adaptive capability positively influences SMEs’ performance) is also supported. Since the current business situation is seen as a VUCA (volatile, uncertain, complex, ambiguous) world, This is in line with Kaehler, Busatto, Becker, Hansen and Santos (2013), who define adaptive capability as an organization’s strategic ability to maintain competitive advantage by modifying, reconfiguring or interconnecting resources, capabilities and competences, and seeking to increase the number of options or available strategic reactions in order to adapt quickly to environmental changes. It also reflects the ability of a firm to align its resources and routines to the changing external market (Alvarez and Merino, 2003), and this view is aligned with the Thai context. In conclusion, dynamic capabilities are essential. Enhancing innovative capability, absorptive capability and adaptive capability would enable SMEs to gain a sustainable competitive advantage and increase their performance. However, the results show that the beta (β) of innovative capability is the highest (β = 0.535), while the betas of adaptive and absorptive capability are 0.438 and 0.393, respectively. Therefore, SMEs should prioritize innovative capability by investing and paying more attention to innovation and creativity, and then followed by the adaptation and absorption abilities of firms.

Study Limitations and Future Studies

Although this paper has offered some contributions to SMEs literature, it also has limitations since Thailand represents only one of the South East Asian countries. So, the researcher recommends more comprehensive studies on dynamic capability elements related to SMEs performance to be conducted in other South East Asian countries.

Acknowledgement

The author is supported by the Faculty of Business Administration for Society, Srinakharinwirot University. This research is a part of the proposal number SWUEC/E- 089/2563, approved by the Ethics Committee of the Strategic Wisdom and Research Institute, Srinakharinwirot University.

References

- Aas, H.T., & Breunig, J.K. (2017). Conceptualizing innovation capabilities: A contingency perspective. Journal of Entrepreneurship, Management and Innovation, 13(1), 7-24.

- Ali, Z., Sun, H., & Ali, M. (2017). The impact of managerial and adaptive capabilities to stimulate organizational innovation in SMEs: A complementary PLS-SME approach. Sustainability, 9(12), 1-23.

- Allocca, M.A., & Kessler, E.H. (2006). Innovation speed in small and medium-sized enterprises. Creativity and Innovation Management, 15(3), 279-295.

- Alvarez, V.S., & Merino, T.G. (2003). The history of organizational renewal: Evolutionary models of Spanish savings and loans institutions. Organizational Studies, 24(9), 1437-1461.

- Amyx, C. (2005). Small business challenges – The perception problem: Size doesn’t matter?. Washington Business Jouranl, 3(4), 1-45.

- Ankrah, E., & Mensah, Y.C.C. (2015). Measuring performance in small and medium scale enterprises in the manufacturing industry in Ghana. International Journal of Research in Business Studies and Management, 2(12), 34-43.

- Arinaitwe, A. and Mwesigwa, R. (2015). Improving credit accessibility among SME’s in Uganda. Global Journal of Commerce and Management Perspective, 4(6), 22-30.

- Bowen, M., Murara, M., and Muriithi, S. (2009). Management of business challenges among small and micro enterprises in Nairobi-Kenya. KCA Journal of Business Management, 2 (1), 16-31.

- Carson, D. (1990). Some exploratory models for assessing small firms’ marketing performance, European Journal of Marketing, 24(11). 8-51

- Clarke, P., O’Connor, R.V., Leavy, B., & Yilmaz, M. (2015). Exploring the relationship between software process adaptive capability and organisational performance. IEEE Transactions on Software Engineering, 41(12), 1169-1183.

- Cohen, W.M., & Levinthal, D.A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 128-152.

- Crossan, M.M., & Apaydin, M. (2010). A multi-dimensional framework of organizational innovation: A systematic review of the literature. Journal of Management Studies, 47(6), 1154-1191.

- Cumby, J. and Conrod, J. (2001). Non-financial performance measures in the Canadian biotechnology industry. Journal of Intellectual Capital, 2(3), 261-272.

- Da Costa, J.C.N., Camargo, S.M., Toaldo, A.M.M., & Didonet, S.R. (2018). The role of marketing capabilities, absorptive capacity, and innovation performance. Marketing Intelligence & Planning.

- Donkor, J., Donkor, G.N.A., Kankam-Kwarteng, C., & Aidoo, E. (2018). Innovative capability, strategic goals and financial performance of SMEs in Ghana. Asia Pacific Journal of Innovation and Entrepreneurship, 2(2), 238-253.

- Eshima, Y., & Anderson, B.S. (2017). Firm growth, adaptive capability, and entrepreneurial orientation. Strategic Management Journal, 38(3), 770-779.

- Francis, D., & Bessant, J. (2005). Targeting innovation and implications for capability development. Technovation, 25(3), 171-183.

- Hamel, G., & Välikangas, L. (2003). The quest for resilience. Harvard Business Review, 81, 52–65.

- Hawkins, D. (2016). What are your Organization Capabilities?. Retrieved January 6, 2021, from https://www.summitleadership.com/what-are-your-organization-capabilities

- Helfat, E.C., & Peteraf, A.M. (2009). Understand dynamic capabilities: Progress along a developmental path. Strategic Organization, 7(1), 91-102.

- Intrapairot, A. and Srivihok, A. (2003). The e-commerce of SMEs in Thailand. In e-commerce and cultural values, 199-219, U.S.A. GI Publishing

- Jimenez-Barrionuevo, M.M., Molina, M.L., & Garcia-Morales, J.V. (2019). Combined influence of absorptive capacity and corporate entrepreneurship on performance. Sustainability, 11(11), 1-26.

- Kaehler, C., Busatto, F., Becker, V.G., Hansen, B.P., & Santos, S.L.J. (2013). Relationship between adaptive capability and strategic orientation: An empirial study in a Brazilian company. iBusiness, 6, 1-9.

- Kamunge, S.M, Njeru, A. and Tirimba, I.O.A. (2014). Factors affecting the performance of small and micro enterprises in Limuru town market of Kiambu county, Kenya. International Journal of Scientific and Research Publications, 4(12), 1-20.

- Kennerley, M., & Neely, A. (2002). A Framework of the Factors Affecting the Evolution of Performance Measurement Systems. International Journal of Operations & Production Management, 22, 1222-1245.

- Krejcie, R.V., & Morgan, D.W. (1970). Determining sample size for research activities. Educational and psychological measurement, 30, 607-610.

- Lawson, B., & Samson, A.D. (2001). Developing innovation capability in organisations: A dynamic capabilities approach. International Journal of Innovation Management, 5(3), 377-400.

- Longenecker, G.J., Moore, W.C., Petty, W., Palich, E.L. and McKinney, A.J. (2006). Ethical attitudes in small business and large corporations: Theory and empirical findings from a tracking study spanning three decade. Journal of Small Business Management, 44(2), 167-183.

- McKee, D.O., Varadarajan, P.R., & Pride, W.M. (1989). Strategic adaptability and firm performance: a market- contingent perspective. Journal of Marketing, 53(3), 21-35.

- Mongkol, K. (2021). A comparative study of a single competitive strategy and a combination approach for enterprise performance, Polish Journal of Management Studies, 23(2), 321-334.

- Mongkol, K. (2021). Strategic Management Practices in Thailand, Academy of Strategic Management Journal, 20(4), 1-11.

- OECD. (2017). Small, medium, strong. Trends in SME performance and business conditions. Paris: OECD Publishing.

- Othman, A.A.F., & Sohaib, O. (2016). Enhancing innovative capability and sustainability of Saudi firms. Sustainability, 8(12), 1-16.

- Paliokaite, A. (2012). The relationship between organisational foresight and product innovation in small and medium enterprises. In Proceedings of the 8th International Ph.D. School on National Systems of Innovation and Economic Development, Globelics Academy, Rio de Janeiro, Brazil, 20–31 August 2012.

- Ponomarov, S.Y., & Holcomb, M.C. (2009). Understanding the concept of supply chain resilience. International Journal of Logistics Management, 20, 124–143.

- Rathgeber, H., & Kotter, J. (2006). Our Iceberg Is Melting: Changing and Succeeding under Any Conditions. New York: St. Martin’s Press.

- Rothaermel, T. F. (2018). Strategic Management. Irwin: McGraw-Hill.

- Sheffi, Y., & Rice, J.B. (2005). A supply chain view of the resilient enterprise. MIT Sloan Management Review, 47, 41–48.

- Smallwood, N., & Ulrich, D. (2001). Capitalizing on capabilities. Harvard Business Review. Retrieved March 11, 2021, from https://hbr.org/2004/06/capitalizing-on-capabilities

- Sudolska, A., & Lapinska, J. (2020). Exploring determinants of innovation capability in manufacturing companies operating in Poland. Sustainability, 12(17), 1-20.

- Sumipol. (2018). SMEs the real backbone of Thai economy. Retrieved March 27, 2021, from https://www.sumipol.com/en/about-us/our-value/

- Teece, D.J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic management journal, 18(7), 509-533.

- The office of SMEs Promotion. (2021). Definition of MSMEs. Retrieved April 20, 2021, from https://www.sme.go.th/en/page.php?modulekey=363

- Wales, W.J., Parida, V., & Patel, P.C. (2013). Too much of a good thing? Absorptive capacity, firm performance, and the moderating role of entrepreneurial orientation. Strategic Management Journal, 34(5), 622-633.

- Wang, C.L., & Ahmed, P.K. (2007). Dynamic capabilities: A review and research agenda. International Journal of Management Reviews, 9(1), 31-51.

- Weismeier-Sammer, D. (2014). The role of familiness for family business innovativeness. International Journal of Entrepreneurial Venturing, 6(2), 101-117.

- Wheelen, L. T., & Hunger D. J. (2018). Strategic Management and Business Policy. New Jersey: Pearson Education, Inc.

- Yoo, Y., & Kim, K. (2015). How Samsung became a design powerhouse. Harvard Business Review, 93(9), 72-12. Zahra, A.S., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185-203.

- Zahra, A.S., Filatotchev, I., & Wright, M. (2009). How do threshold firms sustain corporate entrepreneurship? The role of boards and absorptive capacity. Journal of Business Venturing, 24(3), 248-260.